Professional Documents

Culture Documents

BBM Paper 3 2014

Uploaded by

Kanha KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBM Paper 3 2014

Uploaded by

Kanha KumarCopyright:

Available Formats

Financial Management &Business Accounting XEV (H-II) – BBM (3)

2014

Time : 3 Hours

Candidates are required to give their answers

In their own words as far as practicable

The questions are of equal value

Answer any five question selecting

At least two from each group

Group A

1. What is financial management? Discuss the objective and goals of financial management.

2. What do you mean by Financial Planning? Discuss the basic elements of Financial

Planning.

3. Define share capital. Explain the classification of share capital in details.

4. What is ratio analysis? Discuss the object and importance of ratio analysis.

5. From the following information, prepare a cash flow statement:

Rs.

Opening Cash Balance 15,000

Closing Cash Balance 17,000

Decrease in stock 8,000

Increase in Bills payable 12,000

Sale of Fixed Assets 30,000

Repayment of long term loan 50,000

Net profit for the year 2,000

Group B

6. Define accounting. Discuss the nature and importance of accounting.

7. What is receipt and payment account? Differentiate it from income and expenditure

account.

8. What do you mean by Depreciation? Explain the different methods of charging

depreciation.

9. Hari, Ravi and Kavi were partners in a firm sharing profit in the ratio 3:2:1. They admitted

Guru As a new partner for 1/7th the sharing in the profits. The new profit sharing ratio will

be 2:2:2:1Respectively. Guru brought Rs. 3,00,000 for his capital and Rs. 45,000 for his 1/7th

share of Goodwill. Showing your working clearly, pass necessary journal entries in the

book of the firm For the above mentioned transactions.

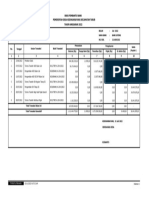

10. Prepare trading and profit & loss A/c for the year ending 31st March 2013 and a Balance

sheet as On that date after taking into account the following adjustments :

i) Closing stock Rs. 9800

ii) A plant which stock in the books at Rs. 6,000 on 1st April 2012 was sold for Rs.2,000

in exchange for a new machine costing Rs. 5,550. The net invoice of Rs. 3,500 was

passed through the purchase book.

iii) Bills receivable include a dishonored Bill of Rs. 450.

iv) Sundry debtors include an item of Rs. 350 for the goods supplied to the proprietor.

v) Write off Building, Machinery and Patents by 10%

vi) Make a provision for doubtful debts at 5%.

You might also like

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- 1 Assignment BBA 101Document10 pages1 Assignment BBA 101Farhana78% (9)

- MRC Catalog V18.2Document30 pagesMRC Catalog V18.2Arden PoncioNo ratings yet

- Chapter 9-Profit Planning: Multiple ChoiceDocument26 pagesChapter 9-Profit Planning: Multiple ChoiceRodNo ratings yet

- 001305012941Document3 pages001305012941RAJEEV MAHESHWARINo ratings yet

- Class 11 AccoutancyDocument5 pagesClass 11 AccoutancyRavikumar BalasubramanianNo ratings yet

- BA 99.1 Rodriguez LE 1 SamplexDocument6 pagesBA 99.1 Rodriguez LE 1 SamplexYsabella Beatriz SamsonNo ratings yet

- What Is Consecutive Interpretation?: A Few Hints On Consecutive InterpretingDocument18 pagesWhat Is Consecutive Interpretation?: A Few Hints On Consecutive InterpretingcacatuareaNo ratings yet

- Fabm2 Law q1 Week 1 To 9Document21 pagesFabm2 Law q1 Week 1 To 9Karen, Togeno CabusNo ratings yet

- 2015 Specialized Force Electrical Catalogue FullDocument428 pages2015 Specialized Force Electrical Catalogue FullRizwan Ahmed RafiqNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- 5125 - BR - Financial AccounitingDocument14 pages5125 - BR - Financial AccounitingjestinaNo ratings yet

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- Paper12 SolutionDocument21 pagesPaper12 SolutionTW ALWINNo ratings yet

- EP60010 - Financing New Ventures PDFDocument2 pagesEP60010 - Financing New Ventures PDFRajat AgrawalNo ratings yet

- MAA AssignmentDocument2 pagesMAA AssignmentVineela PathapatiNo ratings yet

- Financial Statements - II: 360 AccountancyDocument65 pagesFinancial Statements - II: 360 AccountancyshantX100% (1)

- Solutions Totutorial 1-Fall 2022Document8 pagesSolutions Totutorial 1-Fall 2022chtiouirayyenNo ratings yet

- Assistant Professor Dept. of Commerce Shift - I ST - Thomas College of Arts and Science Koyambedu, Chennai-107Document87 pagesAssistant Professor Dept. of Commerce Shift - I ST - Thomas College of Arts and Science Koyambedu, Chennai-107123456No ratings yet

- Financial Statements 2Document65 pagesFinancial Statements 2srisrirockstarNo ratings yet

- MB0025 Financial and Management AccountingDocument4 pagesMB0025 Financial and Management AccountingsanthoshaliasNo ratings yet

- Sole Proprietorship Quiz Bee1Document5 pagesSole Proprietorship Quiz Bee1Dethzaida AsebuqueNo ratings yet

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- Assignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Document6 pagesAssignment DMBA104 MBA 1 Set-1 and 2 Jan-Feb 2023Nihar KambleNo ratings yet

- MS 04-Jan 2014Document3 pagesMS 04-Jan 2014Devendar SinghNo ratings yet

- Financial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Document3 pagesFinancial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Suraj GuptaNo ratings yet

- Unit 14, 15 and 16 - Corporate Valuation NumericalsDocument4 pagesUnit 14, 15 and 16 - Corporate Valuation NumericalsHemant bhanawatNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Class 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIDocument70 pagesClass 11 Accountancy NCERT Textbook Part-II Chapter 10 Financial Statements-IIPathan KausarNo ratings yet

- Accounting ProcessesDocument80 pagesAccounting ProcessesTikMoj Tube100% (1)

- Bca 121 Financial Accounting II NotesDocument27 pagesBca 121 Financial Accounting II NotesIsaac KiprotichNo ratings yet

- Financial Statements - II: 372 AccountancyDocument65 pagesFinancial Statements - II: 372 AccountancyBhartiNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- July 19,2017Document7 pagesJuly 19,2017April Joy Lascuña - CailoNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Framework - QB PDFDocument6 pagesFramework - QB PDFHindutav aryaNo ratings yet

- Accountancy em Iii RevisionDocument7 pagesAccountancy em Iii RevisionMalathi RajaNo ratings yet

- MAA AssignmentDocument8 pagesMAA AssignmentRaghavendra R BelurNo ratings yet

- M.S Patel Nstitute Faculty of Management Studies (M.S. University of Baroda)Document2 pagesM.S Patel Nstitute Faculty of Management Studies (M.S. University of Baroda)YadNo ratings yet

- Bca 2 Sem Financial Accounting and Management Bca 109 2018Document4 pagesBca 2 Sem Financial Accounting and Management Bca 109 2018behappy9336No ratings yet

- शिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiDocument4 pagesशिक्षा निदेिालय राष्ट्रीय राजधािी क्षेत्र ददल्ली Directorate of Education, GNCT of DelhiAshish ChNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- Abm Fabm1 Airs LM q4-m9Document18 pagesAbm Fabm1 Airs LM q4-m9MEDILEN O. BORRESNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocument4 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNo ratings yet

- Bcom 2 Sem Financial Accounting 2 20101139 Nov 2020Document5 pagesBcom 2 Sem Financial Accounting 2 20101139 Nov 2020Akhil AbrahamNo ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- Half Yearly Examination (2015 - 16) Class - XII General InstructionsDocument5 pagesHalf Yearly Examination (2015 - 16) Class - XII General Instructionsmarudev nathawatNo ratings yet

- Capslet: Capsulized Self - Learning Empowerment ToolkitDocument12 pagesCapslet: Capsulized Self - Learning Empowerment Toolkitun knownNo ratings yet

- Single Entry SystemDocument13 pagesSingle Entry SystemDr.M.PREMANANTHAMNo ratings yet

- Class 12 - Quarterly Examination Q FINALDocument11 pagesClass 12 - Quarterly Examination Q FINALsubbuNo ratings yet

- CP 123 PDFDocument4 pagesCP 123 PDFJoshi DrcpNo ratings yet

- 1.2 Managerial AccountingDocument4 pages1.2 Managerial AccountingAshik PaulNo ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

- Bus. Finance W3-4 - C5 (Answer)Document5 pagesBus. Finance W3-4 - C5 (Answer)Rory GdLNo ratings yet

- Paper - 2 Accounting SyllabusDocument40 pagesPaper - 2 Accounting SyllabusNguyen Dac ThichNo ratings yet

- Chapter 16 - Accounts From Incomplete Records-Single Entry SystemDocument27 pagesChapter 16 - Accounts From Incomplete Records-Single Entry SystemTru eduzoneNo ratings yet

- CH - 2 (FM) PDFDocument5 pagesCH - 2 (FM) PDFKanha KumarNo ratings yet

- CH-1 (S, P, M) PDFDocument3 pagesCH-1 (S, P, M) PDFKanha KumarNo ratings yet

- CH - 1 (FM) PDFDocument8 pagesCH - 1 (FM) PDFKanha KumarNo ratings yet

- CH-4 (S, P, M)Document6 pagesCH-4 (S, P, M)Kanha KumarNo ratings yet

- MECLDocument3 pagesMECLVivek KumarNo ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- MMPC 003 Business EnvironmentDocument305 pagesMMPC 003 Business EnvironmentSangam PatariNo ratings yet

- Catalogue New Arteor LegrandDocument1 pageCatalogue New Arteor LegrandManh Ha NgoNo ratings yet

- National Monetization PipelineDocument4 pagesNational Monetization PipelinemouliNo ratings yet

- Bernard Q-Gun: Custom Select Ordering System For Bernard Q-GunsDocument13 pagesBernard Q-Gun: Custom Select Ordering System For Bernard Q-GunsJeffin JojimonNo ratings yet

- Article On The Gig EconomyDocument4 pagesArticle On The Gig Economyines alvaro feliuNo ratings yet

- Project: Jay FarmsDocument12 pagesProject: Jay FarmsSivanesan RamamoorthyNo ratings yet

- Stores LedgerDocument2 pagesStores LedgerM211110 ANVATHA.M100% (1)

- NeuroShell Forex SystemDocument8 pagesNeuroShell Forex SystemNuha IslamNo ratings yet

- History: DiscoveringDocument20 pagesHistory: DiscoveringDaniel Gabriel PunoNo ratings yet

- Dividend Discount Model (DDM) : A Study Based On Select Companies From IndiaDocument11 pagesDividend Discount Model (DDM) : A Study Based On Select Companies From IndiaRaihan RamadhaniNo ratings yet

- Distribution Management - CHAPTER 4Document43 pagesDistribution Management - CHAPTER 4Abhishek TiwariNo ratings yet

- Chap 1 - Portfolio Risk and Return Part1Document91 pagesChap 1 - Portfolio Risk and Return Part1eya feguiriNo ratings yet

- LifatDocument6 pagesLifatMehari TemesgenNo ratings yet

- Rpet UpgratedDocument11 pagesRpet UpgratedAdnan Sanzid Ali 211-23-999No ratings yet

- Parking Check (Table 7b) : Buildingwise Floor FSI DetailsDocument4 pagesParking Check (Table 7b) : Buildingwise Floor FSI Detailsahit1qNo ratings yet

- Compare BOQ BirsanagarDocument1 pageCompare BOQ BirsanagarMr XNo ratings yet

- Digital Banking and Alternative SystemsDocument31 pagesDigital Banking and Alternative SystemsRameen ZafarNo ratings yet

- Essay - DiademyDocument19 pagesEssay - DiademyPratyaksh Singh KachhwaahNo ratings yet

- Aeromexico AMXEES 2022 11 07 HUX-YVR ALLDocument4 pagesAeromexico AMXEES 2022 11 07 HUX-YVR ALLlina perezNo ratings yet

- Regulation of Insurance Companies & Irda, Features of Insurance ContractsDocument2 pagesRegulation of Insurance Companies & Irda, Features of Insurance Contractsvijayadarshini vNo ratings yet

- Buku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDocument1 pageBuku Pembantu Bank Tahun Anggaran 2022 Pemerintah Desa Kedokansayang Kecamatan TarubDanyep IdrisNo ratings yet

- Bba Sem Iv All AssignmentDocument5 pagesBba Sem Iv All AssignmentYogeshNo ratings yet

- Study Unit 2.1 Demand and Supply in Action: Ms. Precious MncayiDocument32 pagesStudy Unit 2.1 Demand and Supply in Action: Ms. Precious MncayiZiphelele VilakaziNo ratings yet