Professional Documents

Culture Documents

Bca 2 Sem Financial Accounting and Management Bca 109 2018

Uploaded by

behappy93360 ratings0% found this document useful (0 votes)

5 views4 pagesAmazing how you do it for

Original Title

bca-2-sem-financial-accounting-and-management-bca-109-2018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAmazing how you do it for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views4 pagesBca 2 Sem Financial Accounting and Management Bca 109 2018

Uploaded by

behappy9336Amazing how you do it for

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

C.S.J.M.

University, Kanpur

B.C.A. Second Semester Examination - 2018

Financial Accounting & Management (BCA 109)

Section-A (Short Answer Type Questions)

Note: Attempt all questions. Each question carries 3 marks.

1. Explain the following:

(A) Purpose of Accounting Information

(B) Revenue nature items

(C) Provision for doubtful debts

(D) Fund flow statement

(E) Objectives of financial management

(F) Application of computer in Accounting

(G) Owned capital and Borrowed capital

(H) Economic Order Quantity

(I) Cost of debts

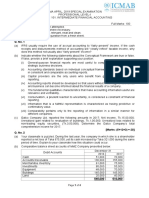

Section-B (Long Answer Type Questions)

Note: Attempt any two questions. Each question carries 12 marks.

2. Explian the following:

(a) Cost concept (b) Dual Aspect concept

(c) Revenue Recognition concept (d) Accounting period concept

(e) Consistency convention (D) Conservation convention.

3. The Balance Sheet of ABC Ltd. as on 31st March, 2017 was as follows:

Liabilities Amount (रु) Assets Amount (रु)

Share Capital 6,00,000 Goodwill 3,00,000

Surplus 1,00,000 Plant 6,00,000

Debentures 3,00,000 Stock 1,00,000

Creditors 80,000 Debtors 80,000

B/P 70,000 Cash 70,000

Other Current 50,000 Misc. Assets 50,000

Liabilities

12,00,000 12,00,000

4,19,0300 4,19,300

Sales for the year रु 10,0000

Cost of Sales रु 6,80,000

You are required to calculate:

(i) Current ratio (ii) Quick ratio

(iii) Inventory turnover ratio

(iv) Average collection period

(v) Proprietor's liabilities ratio.

4. The trial Balance of a business as at 31st March. 2016 is given below:

Prepare the Trading and Profit & Loss Account for the ended year 31st March, 2016 and

Balance Sheet as on that date taking into account the following adjustments:

(i) Closing Stock values रु 7,000

(ii) Outstanding wages रु 600 and Salaries रु 1,400.

(iii) Depreciation is to be provided @ 5% on all fixed assets.

(iv) Insurance premium paid in advance रु 200.

5. Analyse the following transactions. State the nature of accounts and state which

account will be debited and which will be credited according to the traditional approach:

(i) Dinesh started Business with cash रु 2,00,000.

(ii) Purchase furniture for cash रु 50,000.

(iii) Purchase goods from Mahesh रु 30,000

(iv) Sold good to Shyam on credit रु 50,000

(v) Deposited cash into Bank रु 50,000 for opening an account

(vi) Withdraw cash for personal use रु 8,000.

(vii) Paid Mahesh by cheque रु 10,000.

(viii) Withdrew cash from Bank for office use रु 10,000.

(ix) Paid Salary रु 20,000.

(x) Paid Interest on loan रु 5,000

(xi) Borrowed from Mahesh रु 1,00,000

(xii) Deposited cash रु 750,000 directly to Business Bank A/c.

Section C

(Long Answer Type Questions)

Note: Attempt any two questions. Each question carries 12 marks.

6. What is meant by Capitalization? Explain the causes and consequences of

overcapitalization and undercapitalization.

7. What do you understand by Receivable Management? How is it important for a

company? Explain the factors affecting the size of receivables.

8. What do you mean by Working Capital? Describe those factors which influence the

composition of working capital.

9. Write notes the following:

(a) Capital Gearing (b) Debentures

(c) Cost of Capital (d) Object of Cash Management

You might also like

- Suntrust Statement Template PDFDocument2 pagesSuntrust Statement Template PDFJustin Mason54% (13)

- Rich Dad Financial Statement TemplateDocument10 pagesRich Dad Financial Statement TemplateJoseph Cloyd L. Lamberte83% (6)

- Wells Fargo Statement - Oct 2022Document6 pagesWells Fargo Statement - Oct 2022pradeep yadavNo ratings yet

- Accountancy and Business Statistics Second Paper: Management AccountingDocument10 pagesAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONo ratings yet

- A Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in IndiaDocument56 pagesA Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in Indiasohailsam100% (1)

- Managenet AC - Question Bank SSDocument18 pagesManagenet AC - Question Bank SSDharshanNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- M.S Patel Nstitute Faculty of Management Studies (M.S. University of Baroda)Document2 pagesM.S Patel Nstitute Faculty of Management Studies (M.S. University of Baroda)YadNo ratings yet

- Corporate Accounting Ii 2020Document4 pagesCorporate Accounting Ii 2020joe josephNo ratings yet

- AccountsDocument5 pagesAccountsvenessaNo ratings yet

- 12TH Acc QPDocument9 pages12TH Acc QPLOHITHNo ratings yet

- Entrepreneurship P230pp2Document5 pagesEntrepreneurship P230pp2nasasiraluke861No ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Section B&CDocument3 pagesSection B&CTanmay ChopraNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- Assignment For AccountancyDocument3 pagesAssignment For AccountancyKamlesh PandeyNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Accountancy June 2008 EngDocument8 pagesAccountancy June 2008 EngPrasad C MNo ratings yet

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- B.SC & Bca Degree Examination: Fourth SemesterDocument11 pagesB.SC & Bca Degree Examination: Fourth SemesterStudents Xerox ChidambaramNo ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- FA (1st) Dec2017Document3 pagesFA (1st) Dec2017dkdjfNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Ii Puc AccountsDocument3 pagesIi Puc AccountsShekarKrishnappaNo ratings yet

- Accounts Mock Test May 2019Document18 pagesAccounts Mock Test May 2019poojitha reddyNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- Introductions To Accounting Set 1 Part A: Multiple Choice Question (40 Marks) Answer ALL QuestionsDocument8 pagesIntroductions To Accounting Set 1 Part A: Multiple Choice Question (40 Marks) Answer ALL QuestionsDavid WongNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- KseebDocument12 pagesKseebArif ShaikhNo ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- Must Do Sample Paper Solved and Un Solved With Pre Board PaperDocument47 pagesMust Do Sample Paper Solved and Un Solved With Pre Board PaperBhangu PreetNo ratings yet

- Question Bank - Management AccountingDocument7 pagesQuestion Bank - Management Accountingprahalakash Reg 113No ratings yet

- RatioanalysisanswersDocument5 pagesRatioanalysisanswersAnu PriyaNo ratings yet

- 2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Document4 pages2018-06 ICMAB FL 001 PAC Year Question JUNE 2018Mohammad ShahidNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2017Document13 pagesSAMPLE PAPER - (Solved) : For Examination March 2017ankush yadavNo ratings yet

- Account - 1Document6 pagesAccount - 1kakajumaNo ratings yet

- Gradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanDocument4 pagesGradable Assignment (30 Marks) : Subject: MAA Marks: 30 Prof. Lakshmi NarasimhanNaveen KumarNo ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Question CMA April 2019 SP Exam.Document4 pagesQuestion CMA April 2019 SP Exam.F A Saffat RahmanNo ratings yet

- Alliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Document5 pagesAlliance Ascent College: Master of Business Administration: Financial Reporting and Cost Control (MGT 521)Rahul RavindranathanNo ratings yet

- FM QPDocument18 pagesFM QPjpkassociates2019No ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- Intro. To Accounting July 2013Document4 pagesIntro. To Accounting July 2013adv.erumfatimaNo ratings yet

- Class 11th Final TestDocument7 pagesClass 11th Final TestmenekyakiaNo ratings yet

- Corporate Accounting II (T)Document6 pagesCorporate Accounting II (T)BISLY MARIAM BINSONNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- 8.cash Flow StatementDocument16 pages8.cash Flow Statementnarangdiya602No ratings yet

- Class Xii Accountancy 8.cash Flow Statement Competency - Based Test ItemsDocument27 pagesClass Xii Accountancy 8.cash Flow Statement Competency - Based Test ItemsjashanjeetNo ratings yet

- Bank Record Storage Using BlockchainDocument8 pagesBank Record Storage Using BlockchainIJRASETPublicationsNo ratings yet

- Case Digest Compendium LABOR LAW IDocument16 pagesCase Digest Compendium LABOR LAW IRonn PetittNo ratings yet

- FSU FIN 4324 Syllabus-Spring 2022Document5 pagesFSU FIN 4324 Syllabus-Spring 2022Eduardo VillarrealNo ratings yet

- Corporate Board ResolutionDocument2 pagesCorporate Board ResolutionkimitiNo ratings yet

- 095 Philippine Savings Bank V ChowkingDocument2 pages095 Philippine Savings Bank V ChowkingArnold Rosario ManzanoNo ratings yet

- Kalyani Black BookDocument100 pagesKalyani Black BookUjjwal Joseph fernanded100% (1)

- 2 NEGO Digest and AnalysisDocument82 pages2 NEGO Digest and AnalysisJustin EnriquezNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- NC 079-80-264 Interest RatesDocument3 pagesNC 079-80-264 Interest RatesSaddam AliNo ratings yet

- The Eternal ZeroDocument4 pagesThe Eternal ZeroThuy NguyenNo ratings yet

- Leading Experts in Islamic FinanceDocument238 pagesLeading Experts in Islamic FinanceZX Lee100% (1)

- Chap8 PDFDocument63 pagesChap8 PDFFathinus SyafrizalNo ratings yet

- Registration Confirmation Mail SCBDocument4 pagesRegistration Confirmation Mail SCBKrishna MNo ratings yet

- NadiyaDocument61 pagesNadiyaAnonymous 22GBLsme1No ratings yet

- International BankingDocument10 pagesInternational BankingVinod AroraNo ratings yet

- Finmar Q2Document18 pagesFinmar Q2Tatyanna KaliahNo ratings yet

- Vietnam Ebook enDocument155 pagesVietnam Ebook enIsaac HernandezNo ratings yet

- Bharat Credit CardDocument2 pagesBharat Credit Cardrizanaqvi0% (1)

- Finance Translation Test - ENDocument2 pagesFinance Translation Test - ENJai RNo ratings yet

- HSBC Expat Tariff of ChargesDocument9 pagesHSBC Expat Tariff of ChargesDougNo ratings yet

- Principle of AccountsDocument153 pagesPrinciple of AccountsAndrea MalubaNo ratings yet

- CRM Six Strategies For Loan Portfolio Growth During A Recession - CU ManagementDocument6 pagesCRM Six Strategies For Loan Portfolio Growth During A Recession - CU ManagementIstiaque AhmedNo ratings yet

- Internal Debt in Nepal: An Analysis of Trend and Structure: Chapter One: IntroductionDocument85 pagesInternal Debt in Nepal: An Analysis of Trend and Structure: Chapter One: IntroductionChistosoIceisNo ratings yet

- ChallanDocument1 pageChallankasiseerapuNo ratings yet

- Integrated GramDocument6 pagesIntegrated GramSuramaNo ratings yet

- Integrated Treasury in A BankDocument7 pagesIntegrated Treasury in A BankKrishi JainNo ratings yet