Professional Documents

Culture Documents

Activity 6

Uploaded by

BC qpLAN CrOwOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 6

Uploaded by

BC qpLAN CrOwCopyright:

Available Formats

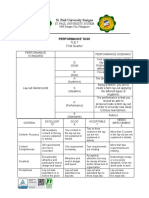

1. Analyze whether the transaction is accountable or not.

Then identify the accounts that are

affected, and the effects on such accounts.

Transaction Accounts affected Effect (increase

or decrease)

1. The owner withdrew cash from the OWNER’S DRAWING, EQUITY INCREASE

business. CASH, ASSETS DECREASE

2. The business obtained a loan from the LOAN PAYABLE, LIABILITIES INCRASE

bank. CASH, ASSETS DECREASE

3. Payment of the loan from the bank. CASH, ASSETS DECREASE

LOAN PAYABLE, LIABILITIES DECREASE

4. Sale on account. ACCOUNTS RECEIVABLE, ASSETS INCREASE

SALES, INCOME INCREASE

5. Purchase in cash. PERCHASE, EXPENSES INCREASE

CASH, ASSET DECREASE

6. Purchase on account. ACCOUNTS PAYABLE, LIABILITIES INCREASE

PURCHASES, EXPENSES INCREASE

7. Sale for cash. CASH, ASSETS INCREASE

SALES, INCOME INCREASE

8. Payment of salaries expense. SALARIES EXPENSES, EXPENSES INCREASE

CASH, ASSET DECREASE

9. Payment of accounts payable. CASH DECREASE

ACCOUNTS PAYABLE DECREASE

10. Purchase of inventory on account. PURCHASE, EXPENSES INCREASE

ACCOUNTS PAYABLE, LIABILITIES INCREASE

11. Purchase of inventory in cash. PURCHASES, EXPENSES INCREASE

CASH, ASSET DECREASE

12. Purchase of equipment on account. EQUIPMENT, ASSET INCREASE

ACCOUNTS PAYABLE, LIABILITIES INCREASE

13. Collection of receivables from customer. ACCOUNTS RECEIVABLE, LIABILITIES DECREASE

CASH, ASSET INCREASE

14. Payment of various small expenses. SMALL EXPENSES, EXPENSES INCREASE

CASH, ASSET DECREASE

15. The business posted a job hiring. ADVERTISING EXPENSES, EXPENSES INCREASE

CASH DECREASE

16. Sale partly in cash and on account. CASH INCREASE

ACCOUNTS RECEIVABLE INCREASE

SALE INCREASE

17. The dog of the owner won 2nd place in a NULL NULL

pet contest.

2. Provide the journal entries to record the transactions described below. You do not need to provide a

short description for the journal entries.

1. Owner contributes ₱600,000 to the business.

2. The business obtains a loan of ₱400,000.

3. Purchase of inventory worth ₱200,000 on cash basis.

4. Purchase of inventory worth ₱500,000 on account.

5. Sale of goods for ₱900,000, on account. The cost of the goods sold is ₱400,000.

6. Payment of ₱400,000 as settlement of accounts payable.

7. Collection of ₱500,000 on accounts receivable.

8. Purchase of equipment worth ₱480,000.

9. Drawings of owner amounting to ₱10,000.

10. Payment for interest expense of ₱5,000.

JOURNAL

NUMBER ACCOUNT TITLES DEBIT CREDIT

1 CASH 600,000

OWNERS, CAPITAL 600,000

To record owner’s contribution to the business

2 CASH 400,000

LOAN PAYABLE 400,000

To record obtained loan

3 CASH 200,000

PURCHASE 200,000

To record purchase of inventory on cash

4 ACCOUNTS PAYABLE 500,000

PURCHASE 500,000

To record purchase of inventory on account

5 CASH 900,000

COST OF GOODS SOLD 400,000

SALES 900,000

INVENTORY 400,000

To record Sale of goods with cost of the goods sold

6 ACCOUNTS PAYABLE 400,000

CASH 400,000

To record Payment of settlement of accounts payable

7 CASH 500,000

ACCOUNTS RECEIVABLE 500,000

To record Collection on accounts receivable.

8 EQUIPMENT 480,000

CASH 480,000

To record purchase of equipment

9 OWNER’S DRAWING 10,000

CASH 10,000

To record Drawings of owner

10 INTEREST EXPENSE 5,000

CASH 5,000

To record Payment for interest expense

3. Record the transactions in the journal provided below. Indicate the dates and provide a brief

description for each journal entry.

Dates Transactions

Nov. 1, 20x1 A business owner provides ₱2,000,000 cash as investment to the business.

Nov. 5, 20x1 The business obtains a ₱500,000 loan and issues a promissory note.

Nov. 8, 20x1 The business acquires equipment costing ₱1,000,000 on cash basis.

Nov. 16, 20x1 The business purchases inventory costing ₱200,000 on cash basis.

Nov. 30, 20x1 The business sells goods costing ₱135,000 for ₱300,000 on cash basis.

Dec. 1, 20x1 The business sells goods costing ₱180,000 for ₱400,000 on account.

Dec. 4, 20x1 The business purchases inventory costing ₱600,000 on account.

Dec. 9, 20x1 The business collects ₱100,000 accounts receivable.

Dec. 17, 20x1 The business pays ₱200,000 accounts payable.

Dec. 28, 20x1 The business owner made temporary withdrawal of ₱120,000 cash from

the business.

JOURNAL

DATE ACCOUNT TITLES DEBIT CREDIT

20X1

Nov. 1 CASH 2,000,000

OWNER’S CAPITAL 2,000,000

To record owner’s contribution to the business

Nov. 5 LOAN PAYABLE 500,000

CASH 500,000

To record obtained loan

Nov. 8 EQUIPMENT 1,000,000

CASH 1,000,000

To record purchase of equipment

Nov. 16 PURCHASES 200,000

CASH 200,000

To record purchase of inventory on cash

Nov. 30 CASH 300,000

COST OF GOODS SOLD 135,000

SALES 300,000

INVENTORY 135,000

To record Sale of goods with cost of the goods sold

Dec. 1 ACCOUNTS RECEIVABLE 400,000

COST OF GOODS SOLD 180,000

SALES 400,000

INVENTORY 180,000

To record Sale of goods with cost of the goods sold

Dec. 4 ACCOUNTS PAYABLE 600,000

PURCHASE 600,000

To record purchase of inventory on account

Dec. 9 CASH 100,000

ACCOUNTS RECEIVABLE 100,000

To record purchase of inventory on account

Dec. 17 ACCOUNTS PAYABLE 200,000

CASH 200,000

To record Payment of accounts payable

Dec. 28 OWNER’S DRAWING 120,000

CASH 120,000

To record owner’s temporary withdrawal

You might also like

- Tutorial Work With SolutionsDocument73 pagesTutorial Work With SolutionsAlison Mokla100% (1)

- Activity 6Document12 pagesActivity 6danica gomezNo ratings yet

- The General's Favorite Fishing Hole Chart of Accounts Assets RevenuesDocument4 pagesThe General's Favorite Fishing Hole Chart of Accounts Assets RevenuesJessamae MacasojotNo ratings yet

- Chapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Document16 pagesChapter 6 Answers Key Millan Financial Accounting and Reporting (3rd Edition)Terese PingolNo ratings yet

- Chapter 6 - Business Transactions & Their AnalysisDocument10 pagesChapter 6 - Business Transactions & Their AnalysisJaycel Yam-Yam VerancesNo ratings yet

- Topic 6.Document5 pagesTopic 6.Ernie AbeNo ratings yet

- Module 6 AccountingDocument2 pagesModule 6 AccountingJesther Nasa-anNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Document17 pagesSol. Man. - Chapter 6 - Business Transactions and Their Analysis 1Lableh Arpyah100% (3)

- Darantan, KC T. - FAR Module 6Document3 pagesDarantan, KC T. - FAR Module 6Li LiNo ratings yet

- Journalizing Transactions (Review) - 9.5.17Document13 pagesJournalizing Transactions (Review) - 9.5.17Jessa Beloy100% (1)

- Analysis of Business TransactionsDocument21 pagesAnalysis of Business TransactionsDan Gideon Cariaga100% (1)

- Recording of Business TransactionDocument34 pagesRecording of Business TransactionannegelieNo ratings yet

- TheoriesDocument11 pagesTheoriesNadzma Pawaki HashimNo ratings yet

- Accounting Non-Accountants Part 2Document37 pagesAccounting Non-Accountants Part 2Vanessa Gapas0% (1)

- Civic CompanyDocument5 pagesCivic CompanyJyasmine Aura V. AgustinNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- FAR - Module 6 - Act. 6 AnswerDocument15 pagesFAR - Module 6 - Act. 6 AnswerAngel Justine Bernardo100% (6)

- Topic 1.1.1 Additional NotesDocument6 pagesTopic 1.1.1 Additional NotesMei Yi YeoNo ratings yet

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesDocument3 pagesOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriNo ratings yet

- Exercises and Problem Debit 2-A May 2 CashDocument16 pagesExercises and Problem Debit 2-A May 2 CashRenz MoralesNo ratings yet

- Acc102 W1Document47 pagesAcc102 W1Moheb RefaatNo ratings yet

- Acc117-Chapter 4-1Document25 pagesAcc117-Chapter 4-1Fadilah JefriNo ratings yet

- Tally Ass2Document2 pagesTally Ass2charu bishtNo ratings yet

- Acctg ConstantinoDocument6 pagesAcctg ConstantinoKyla Lyn OclaritNo ratings yet

- Partnership FormationDocument8 pagesPartnership FormationWithDoctorWu100% (1)

- Midterm - Chapter 3Document28 pagesMidterm - Chapter 3JoshrylNo ratings yet

- Chapter 6 Accounting Equations: Short Answer QuestionDocument16 pagesChapter 6 Accounting Equations: Short Answer QuestionSaransh BattaNo ratings yet

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingAhrian BenaNo ratings yet

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Accounting and Finance Unit 2Document191 pagesAccounting and Finance Unit 2vasudha100% (1)

- Effects of Accounts Balance SheetDocument3 pagesEffects of Accounts Balance SheetDina Rose SardumaNo ratings yet

- Journalize Merchandise BusinessDocument2 pagesJournalize Merchandise BusinessEloise April G BalasabasNo ratings yet

- Merchandising Business - Sample Problem (Answers)Document4 pagesMerchandising Business - Sample Problem (Answers)Eana MabalotNo ratings yet

- BKP 9 Accounting EquationDocument13 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Department of Accountancy: Holy Angel UniversityDocument14 pagesDepartment of Accountancy: Holy Angel UniversityJohn Edwinson Jara0% (1)

- Group 1 Accounting 1Document14 pagesGroup 1 Accounting 1Mary Jessa Ubod TapiaNo ratings yet

- Oktay Urcan: Financial Accounting: FoundationsDocument52 pagesOktay Urcan: Financial Accounting: FoundationsSonali AgarwalNo ratings yet

- Activity 4 Quiz FABMDocument1 pageActivity 4 Quiz FABMJake SabilloNo ratings yet

- Acc 422Document20 pagesAcc 422Charles WilleNo ratings yet

- Ch07 - Account Receivable TayangDocument53 pagesCh07 - Account Receivable TayangAntolin Yudha DinataNo ratings yet

- Accounting EquationsDocument27 pagesAccounting EquationsSrijita ChatterjeeNo ratings yet

- Analysis of Business TransactionsDocument2 pagesAnalysis of Business Transactionskianna aquino100% (1)

- Bugal Atria Lenn V. Grade 12-Luca Pacioli Fundamentals of Accountancy, Business ManagementDocument2 pagesBugal Atria Lenn V. Grade 12-Luca Pacioli Fundamentals of Accountancy, Business ManagementAtria Lenn Villamiel BugalNo ratings yet

- Exercises AccountingTransactionsDocument4 pagesExercises AccountingTransactionsRuneet Kaur AroraBD21036No ratings yet

- BKP 9 Accounting EquationDocument16 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Debit and CreditDocument64 pagesDebit and CreditAngelita Capagalan100% (1)

- Department of Accountancy: Holy Angel UniversityDocument14 pagesDepartment of Accountancy: Holy Angel UniversityMichaella ManlapazNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument66 pagesAccounting For Receivables: Learning ObjectivesSamar BarakehNo ratings yet

- Accounting Chapter 4Document21 pagesAccounting Chapter 4MUHAMMAD ZULHAIRI BIN ROSLI STUDENTNo ratings yet

- Chapter 3-Accounting 101Document7 pagesChapter 3-Accounting 101Haidee SumampilNo ratings yet

- UntitledDocument17 pagesUntitledJoshua Arjay V. ToveraNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument63 pagesAccounting For Receivables: Learning ObjectivesBayaderNo ratings yet

- Practice Exam Answer KeyDocument4 pagesPractice Exam Answer KeyDavid Marion CatindinNo ratings yet

- Assignment - 11 Bilal Crockery Store 15 30092022 085712pm 20022023 022802pm 05032023 033130pmDocument1 pageAssignment - 11 Bilal Crockery Store 15 30092022 085712pm 20022023 022802pm 05032023 033130pmosama saleemNo ratings yet

- Jornal MerchandiseDocument12 pagesJornal MerchandiseHannah Jane Toribio100% (1)

- Debit and Credit Rules of AccountingDocument6 pagesDebit and Credit Rules of AccountingsbcluincNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- INVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESFrom EverandINVESTMENT PROJECTS TO GENERATE POSITIVE RATES OF RETURN in CONDITIONS OF NEAR ZERO or NEGATIVE INTEREST RATESNo ratings yet

- Unit 2 - Activity 1Document2 pagesUnit 2 - Activity 1BC qpLAN CrOwNo ratings yet

- Unit 2 - Activity 2Document3 pagesUnit 2 - Activity 2BC qpLAN CrOwNo ratings yet

- Unit 2 - Activity - 4Document2 pagesUnit 2 - Activity - 4BC qpLAN CrOwNo ratings yet

- Main Task Questions Module 4Document9 pagesMain Task Questions Module 4BC qpLAN CrOwNo ratings yet

- Unit 3 - Activity 2Document3 pagesUnit 3 - Activity 2BC qpLAN CrOwNo ratings yet

- Partnership Warm-Up ActiviyDocument1 pagePartnership Warm-Up ActiviyBC qpLAN CrOwNo ratings yet

- Main Task Questions Module 3Document6 pagesMain Task Questions Module 3BC qpLAN CrOwNo ratings yet

- Partnership Formation Do It YourselfDocument2 pagesPartnership Formation Do It YourselfBC qpLAN CrOwNo ratings yet

- Partnership Opration Do It YourselfDocument4 pagesPartnership Opration Do It YourselfBC qpLAN CrOwNo ratings yet

- Partnership Liquidation Do It YourselfDocument3 pagesPartnership Liquidation Do It YourselfBC qpLAN CrOwNo ratings yet

- Corporations Warm UpDocument2 pagesCorporations Warm UpBC qpLAN CrOwNo ratings yet

- Partnership Dissolution Do It YourselfDocument4 pagesPartnership Dissolution Do It YourselfBC qpLAN CrOwNo ratings yet

- Activity 9Document1 pageActivity 9BC qpLAN CrOwNo ratings yet

- Module 4 Main TaskDocument4 pagesModule 4 Main TaskBC qpLAN CrOwNo ratings yet

- Accounting For Dividends Do It YourselfDocument6 pagesAccounting For Dividends Do It YourselfBC qpLAN CrOwNo ratings yet

- Accounting For Corporations Do It YourselfDocument5 pagesAccounting For Corporations Do It YourselfBC qpLAN CrOwNo ratings yet

- Partnership Agreement Main TaskDocument2 pagesPartnership Agreement Main TaskBC qpLAN CrOwNo ratings yet

- Module 3 Main TaskDocument10 pagesModule 3 Main TaskBC qpLAN CrOwNo ratings yet

- Activity 8Document3 pagesActivity 8BC qpLAN CrOwNo ratings yet

- Forex Systems: Types of Forex Trading SystemDocument35 pagesForex Systems: Types of Forex Trading SystemalypatyNo ratings yet

- 2012 Water Distribution Bulk Water Filling Station Bid Doc - 201205301523587116Document7 pages2012 Water Distribution Bulk Water Filling Station Bid Doc - 201205301523587116ayaz hasanNo ratings yet

- Marks of A Successful EntrepreneurDocument4 pagesMarks of A Successful Entrepreneuremilio fer villaNo ratings yet

- EDP101 EntrepreneurshipDocument6 pagesEDP101 EntrepreneurshipLobzang DorjiNo ratings yet

- Management and Cost Accounting 6Th Edition Full ChapterDocument41 pagesManagement and Cost Accounting 6Th Edition Full Chapterjohn.thier767100% (21)

- Kyambogo University Provisional Diploma/ Certificate Entry Scheme Private Admission List 2019 2020Document7 pagesKyambogo University Provisional Diploma/ Certificate Entry Scheme Private Admission List 2019 2020The Campus Times0% (1)

- OECD Measure Productivity 2001Document44 pagesOECD Measure Productivity 2001Binh ThaiNo ratings yet

- Takele Abate 2405.14B.QA 01Document9 pagesTakele Abate 2405.14B.QA 01ከጎንደር አይከልNo ratings yet

- UntitledDocument10 pagesUntitledmehvishNo ratings yet

- Ethics Award Nomination DeaneDocument17 pagesEthics Award Nomination DeaneAndrew MoyaNo ratings yet

- Code For Interview: Amcat Reading Comprehension Previous Papers QuestionsDocument7 pagesCode For Interview: Amcat Reading Comprehension Previous Papers QuestionsPraneetNo ratings yet

- FY 2023 Release GuidelinesDocument41 pagesFY 2023 Release GuidelinesTsuhaarukinguKaesuterouReyaizuNo ratings yet

- Differential CostsDocument3 pagesDifferential Costskahit anoNo ratings yet

- Academic Writing Task (Diagrams) : How To Analyse A ProcessDocument7 pagesAcademic Writing Task (Diagrams) : How To Analyse A ProcessLogdi JamesNo ratings yet

- Customer Perceptions Towards The Service Quality: A Case Study of Bonchon Chicken Restaurant, Olongapo BranchDocument45 pagesCustomer Perceptions Towards The Service Quality: A Case Study of Bonchon Chicken Restaurant, Olongapo Branchmarichu apiladoNo ratings yet

- VrioDocument2 pagesVrioRoxana GabrielaNo ratings yet

- Civic Swat 1 & 2Document10 pagesCivic Swat 1 & 2Daniel GomaNo ratings yet

- Lindsey 2018Document27 pagesLindsey 2018arin ariniNo ratings yet

- St. Paul University Surigao: Performance TaskDocument2 pagesSt. Paul University Surigao: Performance TaskRoss Armyr Geli100% (1)

- JLN Pending, Kuching 1 30/11/22Document4 pagesJLN Pending, Kuching 1 30/11/22Jue tingsNo ratings yet

- Grills, Railings, Fence: Profile No.: 220 NIC Code:24109Document10 pagesGrills, Railings, Fence: Profile No.: 220 NIC Code:24109Sanyam BugateNo ratings yet

- List of Table and Figures: Outline Development Plan, AgraDocument12 pagesList of Table and Figures: Outline Development Plan, AgrageetNo ratings yet

- Chapter 12-Bond MarketDocument48 pagesChapter 12-Bond MarketIzat MrfNo ratings yet

- Inventories: By: Herbert B. SumalinogDocument30 pagesInventories: By: Herbert B. Sumalinogmarites yuNo ratings yet

- Shopping Experiences of Second Hand ClothesDocument19 pagesShopping Experiences of Second Hand ClothesThu Huyền BùiNo ratings yet

- Module 12. Cost Volume Profit Analysis 22.06.2012Document36 pagesModule 12. Cost Volume Profit Analysis 22.06.2012vini2710No ratings yet

- Negligent Misstatement StudentsDocument17 pagesNegligent Misstatement StudentsJasmine NabilaNo ratings yet

- Custom Software Development Pricing Strategies Ebook NewDocument136 pagesCustom Software Development Pricing Strategies Ebook NewEldiiar100% (1)

- Hotel Invoice TemplateDocument2 pagesHotel Invoice TemplateNik RajputNo ratings yet

- Loadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Document3 pagesLoadmasters Customs Services, Inc. v. Glodel Brokerage Corporation, G.R. No. 179446, 10 January 2011, (639 SCRA 69)Christian Talisay100% (1)