Professional Documents

Culture Documents

GetNotice PDF

Uploaded by

Mabeke NdlelaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GetNotice PDF

Uploaded by

Mabeke NdlelaCopyright:

Available Formats

INCOME TAX ITSA

Statement of Account: Assessed Tax

Enquiries should be addressed to SARS:

Contact Centre

ALBERTON

1528

T BHEJANI Tel: 0800007277 Website: www.sars.gov.za

8076 15 DR THAMBO STREET

Details

EXTENSION 17

EMALAHLENI Reference number: 0637490186 Always quote this reference

1039 Date: 2023-03-11

number when contacting SARS

Statement period: 2021-03-11 to 2023-03-11

Account summary information

Balance brought forward: 0.00

Assessment: -2805.34

Refunds: 0.00

Balance: -2805.34

Transaction details

Transaction Transaction allocation information Account

Date Transaction description Transaction value

reference Tax Penalty Interest balance

2021-03-11 Balance brought forward 0.00 0.00 0.00 0.00

2021-10-01 20 Original assessment 2021 -7848.64 -7848.64 0.00 0.00 -7848.64

2021-10-01 21 Original assessment 2019 -2618.26 -2618.26 0.00 0.00 -10466.90

2022-06-01 22 Additional assessment 2021 7848.36 7848.36 0.00 0.00 -2618.54

2022-06-01 23 Additional assessment 2019 2617.92 2617.92 0.00 0.00 -0.62

2022-08-01 24 Estimated assessment 2022 -2804.72 -2804.72 0.00 0.00 -2805.34

2022-07-07 25 Electronic refund 2805.34 2805.34 0.00 0.00 0.00

2022-07-07 26 Electronic refund reversal -2805.34 -2805.34 0.00 0.00 -2805.34

2023-01-12 27 Electronic refund 2805.34 2805.34 0.00 0.00 0.00

2023-01-12 28 Electronic refund reversal -2805.34 -2805.34 0.00 0.00 -2805.34

2023-03-11 Closing balance -2805.34 0.00 0.00 -2805.34

Ageing - Transactions are aged according to the original due date, including all related interest and penalties.

Current 30 Days 60 Days 90 Days 120 Days Total

0.00 0.00 -2804.72 0.00 -0.62 -2805.34

Compliance information

Unprocessed payments 0.00 Registered provisional taxpayer No

Selected for audit or

No

verification

Outstanding returns

Please note that the interest as reflected in your account has been adjusted to reflect the rate of interest referred to in the General Information.

INCOME TAX ITSA

Refund Advice

Name T BHEJANI

Reference Number 0637490186

Note:

Refunds will be made electronically using the latest valid bank account details

provided to SARS. Refunds may be delayed where a taxpayer is selected for Refund amount -2805.34

audit, has outstanding returns or invalid bank account details.

Reference no.: 0637490186 ITSA_RO 2022.03.00 01/02

INCOME TAX ITSA

Statement of Account

Statement of Account - General Information

1. All assessments may be subject to verification and/or audit which could result in an additional or reduced assessment being issued.

2. This statement of account includes all transactions up to and including the date of issue.

3. An amount reflected as temporarily written off does not affect your liability to pay the amount at all, and SARS may institute proceedings to

recover the amount.

4. Interest is calculated at the rate determined by the Minister of Finance in terms of the Public Finance Management Act, of 1999.

4.1 Section 89(2) - Unless the amount shown under 'Due by you' is paid on or before the 'Second Date' appearing on this

assessment, interest at the prescribed rate calculated from the first 'Due Date' will be payable. According to section 89ter(1A),

payments will be allocated to your account in the following manner: first penalties, second interest and lastly tax.

4.2 Section 89quat(2) interest on underpayment of provisional tax has been calculated up until the first 'Due Date' of this assessment,

but becomes immediately due for payment.

4.3 Section 89quat(4) interest on overpayment of provisional tax has been calculated up until the processing date of the original

assessment.

5. When you make a payment, please use the payment reference number (PRN) reflected on the payment advice. The following payment

methods are available to you:

· Via SARS eFiling (www.sarsefiling .co.za)

· Electronically using internet banking (EFT - electronic fund transfer)

· At a branch of one of the following banking institutions: ABSA, FNB, Nedbank or Standard Bank

6. Refunds are made electronically into valid cheque, transmission or savings accounts held in the name of the taxpayer at a South African

registered bank. For more information regarding change of banking details go to www.sars.gov.za. Cheques are only

issued in exceptional circumstances.

7. Change of registered particulars may be updated within 21 business days of any such change via:

.

· Electronically via eFiling or the MobiApp (if you are registered as an eFiler),

· At your nearest SARS branch by appointment. To book an appointment visit the SARS website.

8. Any amount representing a credit balance is followed by a minus (-) sign.

9. Tax debt or a refund amounting to R100 or less need not be settled or refunded, but will remain on your account. However, interest resulting

from this amount will be calculated per note 4 above.

10. As there is an unavoidable delay between the date of payment and the date of processing of the payment to your account, any receipts

issued to you after the issue date of this statement of account have not been taken into account.

11. Obligation to pay any amount due is not suspended by any objection or appeal. However, SARS will consider a motivated application for the

suspension of payment pending the finalisation of an objection or appeal as stipulated in the Tax Administration Act.

12. Compliance information

12.1 Unprocessed payment indicates payments for income tax, provisional tax, secondary tax on companies (STC) or dividend tax

received which have not been allocated to your account due to insufficient information or incorrect payment referencing details.

12.2 Outstanding returns indicates returns that are currently outstanding and administrative penalties may be imposed. Please ensure

that such returns are filed urgently. No refund will be released where returns are outstanding.

12.3 Provisional taxpayer indicates if the taxpayer is registered as a provisional taxpayer or has been registered as a provisional

taxpayer due to information declared.

12.4. Selected for audit or verification indicates if the taxpayer is selected for audit or verification. No refund will be released where an

audit or verification has not been finalised.

12.5. Taxpayers receiving refunds while certain tax periods are still under audit/verification need to note:- These refunds are

calculatedby using the assessment credits only, excluding interest. These refunds will be limited to the net credit balance of the

account excluding any interest and assessment credits for tax periods still under audit/verification. Interest will be paid once all

the audit/verifications are finalised.

Reference no.: 0637490186 ITSA_RO 2022.03.00 02/02

You might also like

- Invoice 1Document1 pageInvoice 1Subham AgarwalNo ratings yet

- Balance Summary: Monthly Statement For March 2020Document4 pagesBalance Summary: Monthly Statement For March 2020Jeetendra ChavateNo ratings yet

- Utility Bill InternetDocument4 pagesUtility Bill InternetAsad HussainNo ratings yet

- LIC CREDIT CARD STATEMENTDocument1 pageLIC CREDIT CARD STATEMENTArun ShindeNo ratings yet

- Ufone statement for mobile number 03352433275 details usage and charges for August 2020Document11 pagesUfone statement for mobile number 03352433275 details usage and charges for August 2020Syed Shariq HassanNo ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- TelkomDocument4 pagesTelkomaduratejuNo ratings yet

- CDB ReportDocument9 pagesCDB ReportBruce FerreiraNo ratings yet

- Statement Tax Invoice: MR M Mphosi 38 Van Beek Street Johannesburg 2001Document2 pagesStatement Tax Invoice: MR M Mphosi 38 Van Beek Street Johannesburg 2001MA SHNo ratings yet

- PreviewDocument9 pagesPreviewjames.gardner1310No ratings yet

- 08-29-2012Document4 pages08-29-2012gingersnap6No ratings yet

- Tax Invoice: MAHESHWARA INDANE (0000190023)Document2 pagesTax Invoice: MAHESHWARA INDANE (0000190023)Sathish DavulaNo ratings yet

- TAX - TranscibedDocument14 pagesTAX - TranscibedPriscilla DawnNo ratings yet

- TSE S.R.O. Karpatské Námestie 10A 831 06 Bratislava SlovakiaDocument2 pagesTSE S.R.O. Karpatské Námestie 10A 831 06 Bratislava SlovakiaIronko Pepe100% (1)

- 653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542Document1 page653MakroProductFinanceLoansEmailPostSmart E-Statement Apr2023 542judithkhosaNo ratings yet

- 18 Jun 2020 To 02 Jul 2020 FCMB StatementDocument1 page18 Jun 2020 To 02 Jul 2020 FCMB StatementAdesola AfeezNo ratings yet

- Statement4568 9394 2665 80140 PDFDocument4 pagesStatement4568 9394 2665 80140 PDFMouhammad AboshahinNo ratings yet

- Screenshot 2022-12-11 at 18.17.13 PDFDocument1 pageScreenshot 2022-12-11 at 18.17.13 PDFLihle ShongweNo ratings yet

- Master CardDocument22 pagesMaster CardAsef KhademiNo ratings yet

- Nedbank Investment Statement - 28 Oct 2021Document2 pagesNedbank Investment Statement - 28 Oct 2021Janice MkhizeNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument5 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisAlan MathewNo ratings yet

- Pulana Martha Malatji - 2023 - 06 - 27Document2 pagesPulana Martha Malatji - 2023 - 06 - 27Vee-kay Vicky KatekaniNo ratings yet

- Your Personal Loan Statement: Mev J BernhardtDocument2 pagesYour Personal Loan Statement: Mev J BernhardtJeannine BernhardtNo ratings yet

- Account Statement: VAT Registration No.: 121221Document2 pagesAccount Statement: VAT Registration No.: 121221Victor Alejandro Alfonzo MarcanoNo ratings yet

- Account For Stand No. Township DaysDocument2 pagesAccount For Stand No. Township DaysMandlakayise MabizelaNo ratings yet

- View your account statement onlineDocument1 pageView your account statement onlineossamamhelmyNo ratings yet

- Account Number: 552944907 PIN CODE: 219293: Tax InvoiceDocument2 pagesAccount Number: 552944907 PIN CODE: 219293: Tax InvoiceRashaad SheikNo ratings yet

- Statement 63472253 2019 03 18 03 13 48 PDFDocument1 pageStatement 63472253 2019 03 18 03 13 48 PDFPortiaG38 PortiaG38No ratings yet

- Implications of BRICS and Population Growth for KIRIZA Chicken BusinessDocument1 pageImplications of BRICS and Population Growth for KIRIZA Chicken BusinessMabeke NdlelaNo ratings yet

- January Postpay BillDocument4 pagesJanuary Postpay BillestrobetceoNo ratings yet

- Hetzner 2021-02-04 R0012764148Document1 pageHetzner 2021-02-04 R0012764148Ольга СувороваNo ratings yet

- Project Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Document59 pagesProject Report On INCOME TAX PLANNING IN CASE OF INDIVIDUAL ASSESSEE 1Muzammil Sawant80% (5)

- Account Statement 230628 065759Document6 pagesAccount Statement 230628 065759Lesiba NeozaNo ratings yet

- PDF 1Document4 pagesPDF 1sheryl maeNo ratings yet

- xmlp13503143tmp 002312878099 2860 PDFDocument6 pagesxmlp13503143tmp 002312878099 2860 PDFLuqman SuhaimiNo ratings yet

- Salman Khoirudin: Account SummaryDocument3 pagesSalman Khoirudin: Account SummarySalman KhoirudinNo ratings yet

- Electricity BillDocument1 pageElectricity BillARPIT TELECOMNo ratings yet

- Deutsche Bank €2 Billion Payment to Standard CharteredDocument1 pageDeutsche Bank €2 Billion Payment to Standard Charteredpejman mashhadianNo ratings yet

- Celcom JanDocument2 pagesCelcom JanThee Suh ShyanNo ratings yet

- Cust 1-480215865754 723514580 20231101Document12 pagesCust 1-480215865754 723514580 20231101Raphael obasoNo ratings yet

- Date Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)Document2 pagesDate Details (R) AMOUNT (Excl. Vat) (R) Vat (R) AMOUNT (Incl. Vat)keorapetseNo ratings yet

- Mr. Subramanian Alagappan bank account statementDocument1 pageMr. Subramanian Alagappan bank account statementmanianNo ratings yet

- JTL WifiDocument1 pageJTL WifiRowlan NyagaNo ratings yet

- Consolidated Tax Invoice: Recipient Details Registrant DetailsDocument2 pagesConsolidated Tax Invoice: Recipient Details Registrant DetailsAccounts SkyHawkNo ratings yet

- Invoice 1139421221 I0136P2000267596Document1 pageInvoice 1139421221 I0136P2000267596Thanish GattuNo ratings yet

- Joubert 20 Caledon Statement 03 January 2022Document1 pageJoubert 20 Caledon Statement 03 January 2022Wynand van den BergNo ratings yet

- Invoice 1605-23-S-726Document1 pageInvoice 1605-23-S-726Chintada Netaji PraneethNo ratings yet

- This Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is RequiredDocument1 pageThis Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is Requiredtapas kumar biswalNo ratings yet

- Statement Letter12302019153646 2 PDFDocument1 pageStatement Letter12302019153646 2 PDFTracy deebNo ratings yet

- Invoice Balance Paid in FullDocument1 pageInvoice Balance Paid in FullmirkoNo ratings yet

- 2Document6 pages2nelson_tan71No ratings yet

- Summary DetailsDocument1 pageSummary DetailsAnk BasharNo ratings yet

- Banca CoinbaseDocument2 pagesBanca CoinbaseGeorge TimusNo ratings yet

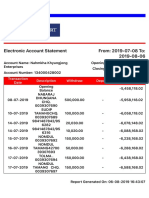

- Electronic Account Statement From: 2019-07-08 To: 2019-08-06Document2 pagesElectronic Account Statement From: 2019-07-08 To: 2019-08-06Namdrol Khyungkar LamaNo ratings yet

- Sman 1 Lumbis: NO Description AmountDocument4 pagesSman 1 Lumbis: NO Description AmounthaerilNo ratings yet

- Miss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260Document1 pageMiss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260nonkumbuloshabaneNo ratings yet

- Get optimized mobile services title under 40 charsDocument27 pagesGet optimized mobile services title under 40 charsAlankar GuptaNo ratings yet

- B1 48125378 PDFDocument2 pagesB1 48125378 PDFShashi0% (1)

- Date Transaction Description Amount (In RS.)Document1 pageDate Transaction Description Amount (In RS.)shashi singhNo ratings yet

- 5 Feb'23Document16 pages5 Feb'23Zia Ur Rahman Sabir100% (1)

- Inv TN B1 39515781 103417948939 October 20202Document2 pagesInv TN B1 39515781 103417948939 October 20202IndiaNo ratings yet

- Procap Financial Services Pvt. LTDDocument9 pagesProcap Financial Services Pvt. LTDDekrouf SysNo ratings yet

- IBBL Bank Statement (FY 2022-2023)Document1 pageIBBL Bank Statement (FY 2022-2023)Naeem HasanNo ratings yet

- My - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Document5 pagesMy - Statement - 12 Jan, 2022 - 18 Jan, 2022 - 9880560175Sunanda BidariNo ratings yet

- ABST4205 230903 0153501 UnlockedDocument2 pagesABST4205 230903 0153501 UnlockedFarhan SadikNo ratings yet

- Et Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408Document2 pagesEt Monkwe 0067 Zone 6 (Blackrock Section) Ngobi Hammanskraal 0408EstherNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Statement of Account: Assessed TaxDocument2 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Statement of Account: Assessed Taxbra9tee9tiniNo ratings yet

- HRM2605 - Assignment 03 - 2022 - Assessment Info LetterDocument5 pagesHRM2605 - Assignment 03 - 2022 - Assessment Info LetterMabeke Ndlela100% (1)

- MNG2602 TL102 1 2023Document8 pagesMNG2602 TL102 1 2023Mabeke NdlelaNo ratings yet

- A Case Study of Consumer Satisfaction of KentuckyDocument15 pagesA Case Study of Consumer Satisfaction of KentuckyMuqadas JunejoNo ratings yet

- IDFCFIRSTBankstatement 10113289794 111916567 09052023Document5 pagesIDFCFIRSTBankstatement 10113289794 111916567 09052023vikas jainNo ratings yet

- Estatement20220811 000518428Document4 pagesEstatement20220811 000518428Kim ZainurNo ratings yet

- India: Type of Transactions CoveredDocument20 pagesIndia: Type of Transactions Coveredss_scribdNo ratings yet

- Niel Ivan Alliosada Quimbo: Statement of AccountDocument4 pagesNiel Ivan Alliosada Quimbo: Statement of AccountNiel Ivan Alliosada QuimboNo ratings yet

- TAX01 Basic PrinciplesDocument10 pagesTAX01 Basic Principlesanon_812164091No ratings yet

- Annexure-B For Excise AuditDocument4 pagesAnnexure-B For Excise AuditNikhil KasatNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- About Card Payments Regulation - Questions & Answers RBADocument12 pagesAbout Card Payments Regulation - Questions & Answers RBASamNo ratings yet

- Christopher Driskell - MATH 12 (10.1) the US Tax SystemDocument3 pagesChristopher Driskell - MATH 12 (10.1) the US Tax SystemdriskelltopherNo ratings yet

- Examples PayrollDocument10 pagesExamples PayrollAlliana Nicole Masalta TorrefrancaNo ratings yet

- TCS Service Agreement FormDocument2 pagesTCS Service Agreement FormrobertchandleraccNo ratings yet

- Oing Business in GuatemalaDocument16 pagesOing Business in GuatemalaJorge Luis Can MonroyNo ratings yet

- Stamp Act and ImpoundingDocument2 pagesStamp Act and ImpoundingAnkit TewariNo ratings yet

- UnknownDocument2 pagesUnknownveersingh5521No ratings yet

- Sample I MCQs On Negotiable Instruments ActDocument2 pagesSample I MCQs On Negotiable Instruments ActLokesh RathiNo ratings yet

- Fee Challan 10 Nov 2021Document1 pageFee Challan 10 Nov 2021Choudary UmerNo ratings yet

- 22681/chennai Express Sleeper Class (SL)Document2 pages22681/chennai Express Sleeper Class (SL)Nithin Kumar B CNo ratings yet

- Caltex v COA: No offsetting of taxes against claimsDocument1 pageCaltex v COA: No offsetting of taxes against claimsHarvey Leo RomanoNo ratings yet

- Example of Sale Mix PS OfficeDocument3 pagesExample of Sale Mix PS OfficeMa. Kristine GarciaNo ratings yet

- InvoiceDocument1 pageInvoiceAbhijeet KumarNo ratings yet

- Taxation Theory QuestionsDocument7 pagesTaxation Theory QuestionsPrince kumarNo ratings yet

- Tutorial TupanDocument6 pagesTutorial TupanAbidNo ratings yet

- Part II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationDocument67 pagesPart II Extended Purchase Specification Based On Contactless Low-Value Payment ApplicationMai Nam ThangNo ratings yet

- SingleWindow Annex C1 C2 C3Document3 pagesSingleWindow Annex C1 C2 C3Jesus Inno Jaime LoretoNo ratings yet