Professional Documents

Culture Documents

6 Additional Q in 5th Edition Book PDF

Uploaded by

Bikash KandelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 Additional Q in 5th Edition Book PDF

Uploaded by

Bikash KandelCopyright:

Available Formats

Additional Questions and

th

Answers in 5 Edition book

[CA Nagendra Sah]

Stay connected on YouTube and Telegram for future updates:

Telegram: Search @fmguru on Telegram Apps and join "SFM Gyan (CA Nagendra)"

Channel

YouTube: www.youtube.com/canagendrasah

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 2 Additional Q in 5th Edition Book

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 3

Chapter - 2

FOREIGN EXCHANGE EXPOSURE

AND RISK MANAGEMENT

PREMIUM/DISCOUNT, LOSS/GAIN, FORWARD CONTRACT HEDGE

Question No. 2J [July-2021-New-8M]

XP Pharma Ltd., has acquired an export order for 10 million for formulations to a European company. The Company

has also planned to import bulk drugs worth 5 million from a company in UK. The proceeds of exports will be

realized in 3 months from now and the payments for imports will be due after 6 months from now. The invoicing

of these exports and imports can be done in any currency i.e. Dollar, Euro or Pounds sterling at company's choice.

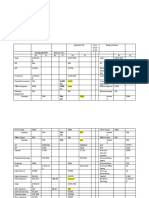

The following market quotes are available.

Spot Rate j

Annualized Premium

/$ 67.10/67.20 $ - 7%

/Euro 63.15/63.20 Euro – 6%

/Pound 88.65/88.75 Pound – 5%

Advice XP Pharma Ltd. about invoicing in which currency.

(Calculation should be upto three decimal places).

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 4 Additional Q in 5th Edition Book

(ii)

CROSS RATE

Question No. 6I [MTP-May-2021-New/Old-10M]

On 1st February 2020, XYZ Ltd. a laptop manufacturer imported a particular type of Memory Chips from SKH

Semiconductor of South Korea. The payment is due in one month from the date of Invoice, amounting to 1190

Million South Korean Won (SKW).

Following Spot Exchange Rates (1st February) are quoted in two different markets:

USD/ INR 75.00/ 75.50 in Mumbai

USD/ SKW 1190.00/ 1190.75 in New York

Since hedging of Foreign Exchange Risk was part of company’s strategic policy and no contract for hedging in

SKW was available at any in-shore market, it approached an off-shore Non- Deliverable Forward (NDF) Market

for hedging the same risk.

In NDF Market a dealer quoted one-month USD/ SKW at 1190.00/1190.50 for notional amount of USD 100,000

to be settled at reference rate declared by Bank of Korea.

After 1 month (1st March 2020) the dealer agreed for SKW 1185/ USD as rate for settlement and on the same day

the Spot Rates in the above markets were as follows:

USD/ INR 75.50/ 75.75 in Mumbai

USD/ SKW 1188.00/ 1188.50 in New York

Analyze the position of company under each of the following cases, comparing with Spot Position of 1st February:

(i) Do Nothing.

(ii) Opting for NDF Contract.

Note: Both Rs./ SKW Rate and final payment (to be computed in Rs. Lakh) to be rounded off upto 4 decimal

points.

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 5

(ii)

RETURN FROM FOREIGN SECURITY

Question No. 9.3 [July-2021-Old-6M]

Mr. Mammen, an Indian investor invests in a listed bond in USA. If the price of the bond at the beginning of the

year is USD 100 and it is USD 103 at the end of the year. The coupon rate is 3% payable annually.

Find the return on investment in terms of home country currency if:

(i) USD is Flat.

(ii) USD appreciates during the year by 3%.

(iii) USD depreciates during the year by 3%.

(iv) Indian Rupee appreciates during the year by 5%.

(v) Will your answer differ if Mr. Mammen invests in the bond just before the interest payable.

Solution:

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 6 Additional Q in 5th Edition Book

EARLY DELIVERY/EXECUTION OF FORWARD CONTRACT

Question No. 18.1 [July-May-2021-Old-10M] [Same as Q.No. 18A-only point (ii) is extra]

On 1st October, 2020 Mr. Guru, an exporter, enters into a forward contract with the Bank to sell USD 1,00,000 on

31st December 2020 at INR/USD 75.40. However, at the request of the importer, Mr. Guru received the amount

on 30th November, 2020. Mr. Guru requested the bank take delivery of the remittance on 30th November, 2020

i.e., before due date.

The inter-bank rate on 30th November 2020 was as follows:

Spot INR/USD 75.22-75.27

One Month Premium 10/15

Assume 365 days in a year.

(i) If bank agrees to take early delivery, then what will be net inflow to Mr. Guru assuming that the

prevailing prime lending rate is 18%. Per annum.

(ii) If Mr. Guru can deploy these funds in USD, he gets return at the rate of 3% per annum. Which is better?

Why?

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 7

(ii)

Question No. 18.2 [MTP-May-2021-New-8M]

On 1 October 2019 Mr. X an exporter enters into a forward contract with a BNP Bank to sell US$ 1,00,000 on 31

December 2019 at Rs. 70.40/$ and bank simultaneously entered into a cover deal at Rs. 70.60/$. However, due to

the request of the importer, Mr. X received amount on 28 November 2019. Mr. X requested the bank to take delivery

of the remittance on 30 November 2019 i.e., before due date. The inter-banking rates on 28 November 2019 were

as follows:

Spot 70.22/70.27

One Month Swap Points 15/10

If bank agrees to take early delivery, then determine the net inflow to Mr. X assuming that the prevailing prime

lending rate is 10% and deposit rate is 5%.

Note:

(i) While exchange rates to be considered up to two decimal points the amount to be rounded off to Rupees

i.e., no paisa shall be involved in computation of any amount.

(ii) Assume 365 days a year

Solution: Bank will buy from customer at the agreed rate of Rs. 70.40. In addition to the same if bank will

charge/ pay swap difference and interest on outlay/inlay in funds.

(i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 8 Additional Q in 5th Edition Book

(ii)

(iii)

(iv)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 9

Chapter - 3

MUTUAL FUND

RETURN FROM DIVIDEND REINVESTMENT PLAN

Question No. 3B [July-2021-Old-5M]

The Asset Management Company of the mutual fund (MF) has declared a dividend of 9.98% on the units under

the dividend reinvestment plan for the year ended 31 st March, 2021. The investors are issued additional units

for the dividend at the rate of closing Net Asset Value (NAV) for the year as per the conditions of the scheme.

The closing NAV was 24.95 as on 31st March, 2021. An investor Mr. X who is having 20,800 units at the

year-end has made an investment in the units before the declaration of the dividend and at the rate of opening

NAV plus an entry load of 0.04. The NAV has appreciated by 25% during the year.

Assume the face value of the unit as 10.00.

You are required to calculate:

(i) Opening NAV; (ii) Number of the units purchased; (iii) Original amount of the investment.

Solution: (i)

(ii)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 10 Additional Q in 5th Edition Book

(iii)

NAV AND RETURN

Question No. 5.7 [July-2021-Old-4M] [Same as bonus plan of Q. 5.6]

M/s. Strong an AMC has floated a dividend bonus plan on 1 st April, 2016 at a certain net asset value (NAV).

The fund has a robust growth and has declared a bonus of 1:5 (1 bonus unit for 5 right units held) on 30 th

September, 2017 and a second bonus of 1:4 (1 bonus unit for 4 right units held) on 30 th September 2019. The

fund, as on 31st March 2021, has generated an average yield of 17.5%.

Mr. Optimistic has made an investment of 16 lakhs in the plan before the declaration of the first bonus and

remain invested thereafter.

The following information is also available:

Date 01.04.2016 30.09.2017 30.09.2019 31.03.2021

NAV () ? 85 92 100

You are required to advise to Mr. Optimistic the opening NAV, which is required by him to calculate the

capital appreciation.

Solution:

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 11

Chapter - 4

Derivative Analysis and Valuation

No New Question Added

Chapter - 5

PORTFOLIO MANAGEMENT

CAPITAL ASSETS PRICING MODEL

Question No. 6AA [July-2021-Old-10M]

Mr. X is having 1 lakh shares of M/s. Kannyaka Ltd. The beta of the company is 1.40.

Mr. Y a financial advisor has suggested having the following portfolio:

Security Beta % Holding

S 1.20 10

K 0.75 10

P 0.40 30

D 1.40 50

100

Market Return is 12%

Risk free rate is 8%

You are required to calculate the following for the present investment and suggested portfolio:

(i) What is the expected return based on CAPM and also

(1) If the market goes up by 2.5%?

(2) If the market goes down by 2.5%

(3) If the market gives Negative Returns of 2.5%

(ii) If the probability of market giving negative return is more, please advise Mr. X whether to continue the

holdings of M/s. Kannyaka Ltd. or to buy the portfolio as per the suggestion of Mr. Y. If so, why?

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 12 Additional Q in 5th Edition Book

Solution:

Portfolio Beta is 1.015

(i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 13

(iii) If the probability of market giving negative return is more, It is advisable to Mr. X to buy the

portfolio suggested by Mr. Y because Beta of the porrtfolio is less than of Kannayaka Ltd.

CONSTRUCTION OF PORTFOLIO AS PER INVESTMENT OBJECTIVE

Question No. 13E [RTP-May-2021-New]

The Following data relate to A Ltd.’s Portfolio:

Shares X ltd Y ltd Z ltd

No. of Shares (lakh) 6 8 4

Price per share () 1000 1500 500

Beta 1.50 1.30 1.70

The CEO is of opinion that the portfolio is carrying a very high risk as compared to the market risk and hence

interested to reduce the portfolio’s systematic risk to 0.95. Treasury Manager has suggested two below mentioned

alternative strategies:

(i) Dispose off a part of his existing portfolio to acquire risk free securities, or

(ii) Take appropriate position on Nifty Futures, currently trading at 8250 and each Nifty points

multiplier is 210.

You are required to:

(a) Interpret the opinion of CEO, whether it is correct or not.

(b) Calculate the existing systematic risk of the portfolio

(c) Advise the value of risk-free securities to be acquired,

(d) Advise the number of shares of each company to be disposed off,

(e) Advise the position to be taken in Nifty Futures and determine the number of Nifty contracts to be

bought/sold; and

(f) Calculate the new systematic risk of portfolio if the company has taken position in Nifty Futures and there is

2% rise in Nifty.

Note: Make calculations in lakh and upto 2 decimal points.

Solution: Yes, the apprehension of CEO is correct as the current portfolio is more riskier than market as

(a) the beta (Systematic Risk) of market portfolio is as computed as follows:

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 14 Additional Q in 5th Edition Book

(b) Since the Beta of existing portfolio is 1.40, the systematic risk of the current portfolio is 1.40.

(c)

Shares to be disposed off to reduce beta (20000 × 32%) 6,400 lakh and Risk Free securities

to be acquired for the same amount.

(d)

(e)

(f)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 15

Chapter – 6

SECURITY VALUATION

BOND DURATION, BOND VOLATILITY & BOND CONVEXITY

Question No. 13.7 [July-2021-Old-8M]

An investor has recently purchased substantial number of 7 year 6.75%, 1,000 bond with 5% premium payable

on maturity at a required Yield to Maturity (YTM) of 9%. However, due to a financial crunch he is looking to sell

these bonds and has got a proposal from another investor, who is willing to purchase these bonds by shelling out a

maximum amount of 897 per bond. Investors follow intrinsic value method for valuation of bonds.

(i) You are required to determine

(1) The Market Price, Duration and Volatility of the bond and

(2) Required YTM of the new investor

(ii) What is relationship between the price of the bond and YTM?

Period (t) 1 2 3 4 5 6 7

PVIF (9%, t) 0.917 0.842 0.772 0.708 0.650 0.596 0.547

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 16 Additional Q in 5th Edition Book

(ii) Relationship between the price of the bond & YTM is opposite or inverse.

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 17

VALUE OF EQUITY SHARE [CONSTANT DIV GROWTH, PE MULTIPLE APPROACH]

Question No. 20Q [July-2021-Old-5M]

NM Ltd. (NML) is aspiring to enter the capital market in a three years' time. The Board wants to attain the target

price of 70 for its shares at the end of three years. The present value of its shares is 52.03. The dividend is

expected to grow at a rate of 15% for the next three years. NML uses dividend growth model for its projections.

The required rate of return is 15%.

You are required to calculate the amount of dividend to be declared by the board in the base year so as to achieve

the target price.

Period (t) 1 2 3

PVIF (15%, t) 0.8696 0.7561 0.6575

Solution:

Question No. 20.12 [MTP-May-2021-New-8M]

You are interested in buying some equity stocks of RK Ltd. The company has 3 divisions operating in different

industries. Division A captures 10% of its industries sales which is forecasted to be Rs. 50 crores for the industry.

Division B and C captures 30% and 2% of their respective industry's sales, which are expected to be Rs. 20 crore

and Rs. 8.5 crore respectively. Division A traditionally had a 5% net income margin, whereas divisions B and C

had 8% and 10% net income margin respectively. RK Ltd. has 3,00,000 shares of equity stock outstanding, which

sell at Rs. 250.

The company has not paid dividend since it started its business 10 years ago. However, from the market sources

you come to know that RK Ltd. will start paying dividend in 3 years’ time and the pay-out ratio is 30%. Expecting

this dividend, you would like to hold the stock for 5 years. By analysing the past financial statements, you have

determined that RK Ltd.'s required rate of return is 18% and that P/E ratio of 10 for the next year and on ending P/E

ratio of 20 at the end of the fifth year are appropriate.

Evaluate:

(i) Whether you will be in purchasing RK Ltd. equity at this time based on your one-year forecast?

(ii) Price you will like to pay for the stock of RK Ltd if you expect earnings to grow @ 15% continuously.

Ignore taxation.

PV factors are given below:

Years 1 2 3 4 5

PVIF@ 18% 0.847 0.718 0.609 0.516 0.437

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 18 Additional Q in 5th Edition Book

Solution:

(i)

(ii)

SHARE PRICE AFTER BUYBACK AND BONUS ISSUE

Question No. 22.2 [July-2021-Old-12M]

SM Limited has a market capitalization of 3,000 crore and the current earnings per share (EPS) is 200 with a

price earnings ratio (PER) of 15. The Board of directors is considering a proposal to buy back 20% of the shares

at a premium which can be supported by the financials of the company. The Boards expects post buy back market

price per share (MPS) of 3057. Post buy back PER will remain same. The company proposes to fund the buy

back by availing 8% bank loan since available resources are committed for expansion plans.

Applicable income tax rate is 30%.

You are required to calculate:

(i) The interest amount which can be paid for availing the bank loan,

(ii) The loan amount to be raised and

(iii) The premium per share and percentage premium paid over the current MPS.

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 19

Solution:

COST OF GDR

Question No. 24.1 [July-2021-Old-6M]

M/s. Raghu Ltd. is interested in expanding its operation and planning to. install manufacturing plant at US. It

requires 8.82 million USD (net of issue expenses/ floatation cost) to fund the proposed project. GDRs are

proposed to be issued to finance this project. The estimated floatation cost of GDRs is 2%.

Additional information:

(i) Expected market price of share at the time of issue of GDR is 360 (Face Value 100)

(ii) Each GDR will represent two underlying Shares.

(iii) The issue shall be priced at 10% discount to the market price.

(iv) Expected exchange rate is 1NR/USD 72.

(v) Dividend is expected to be paid at the rate of 20% with growth rate of 12%.

(1) You, as a financial consultant, are required to compute the number of GDRs to be issued and cost of

the GDR.

(2) What is your suggestion if the company receives an offer from a US Bank willing to provide an

equivalent loan with an interest rate of 12%?

(3) How much company can save by choosing the option as recommended by you?

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 20 Additional Q in 5th Edition Book

Solution:

EARNING BASED MODEL (GORDON’S MODEL, WALTER MODEL)

Question No. 25.8 [RTP-May-2021-Old] [Similar to Q.25A]

The following information pertains to Golden Ltd:

Profit before tax 75 Crore

Tax rate 30%

Equity Capitalization Rate 15%

Return on investment (ROI) 18%

Retention ratio 80%

Number of shares outstanding 75,00,000

The market price of the share of the company in the bull market was somewhere around 2100 per share. Advice,

whether the share of the Golden Ltd. should be purchased or not. Further, also suggest the form of Market prevalent

as per EMH Theory.

Note: Use Gordon’s Growth Model.

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 21

Solution:

RIGHT ISSUE

Question No. 27C [July-2021-Old-4M]

Aggressive Ltd., is proposing to fund its expansion plan of 12 crore by making a rights issue. The current

market price (CMP) is 40. The Board is willing to offer a discount of 20% on the CMP for the rights issue. The

Board is also desirous that the fall in Ex - right price of the shares be restricted to 10% of CMP.

You are required to calculate:

(i) The number of new equity shares to be offered for each rights held,

(ii) Theoretical value of right and

(iii) The total number of equity shares to be issued.

Solution: (i)

(ii) Theoretical Value of Right = 36 - 32 = 4

(iii) No. of equity share to be issued = 12 𝐶𝑟𝑜𝑟𝑒 = 37,50,000 or 0.375 shares

32

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 22 Additional Q in 5th Edition Book

Chapter-6 [Unit-III]

MONEY MARKET INSTRUMENTS

MONEY MARKET INSTRUMENTS

Question No – 32K [July-2021-Old-5M]

The Bank BK enters into a Repo for 9 days with Bank NE in 6% Government bonds 2022 for an amount of 2

crores. The other relevant details are as follows:

First Leg Payment (Start Proceed) 2,00,06,750

Second Leg Payment (Repayment Proceed) 2,00,31,759

Initial Margin 1.25%

Days of accrued interest 240

Assume 360 days in a year.

You are required to calculate:

(i) Repo Rate

(ii) Dirty Price and

(iii) Clean Price.

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 23

(ii)

(iii)

Chapter - 7

MERGERS, ACQUISITIONS &

CORPORATE RESTRUCTURING

Question No. 41 [July-2021-New-8M]

Long Ltd., is planning to acquire Tall Ltd., with the following data available for both the companies:

Long Ltd Tall Ltd

Expected EPS 12 5

Expected DPS 10 3

No. of Shares 30,00,000 18,00,000

Current Market Price of Share 180 50

As per an estimate Tall Ltd., is expected to have steady growth of earnings and dividends to the tune of 6% per

annum. However, under the new management the growth rate is likely to be enhanced to 8% per annum without

additional investment.

You are required to:

(i) Calculate the net cost of acquisition by Long Ltd., if 60 is paid for each share of Tall Ltd.

(ii) If the agreed exchange ratio is one share of Long Ltd., for every three shares of Tall Ltd., in lieu of

the cash acquisition as per (i) above, what will be the net cost of acquisition?

(iii) Calculate Gain from acquisition.

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 24 Additional Q in 5th Edition Book

Solution: (i)

(ii)

(iii)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 25

Chapter - 8

INTEREST RATE RISK MANAGEMENT

CALCULATION OF FORWARD INTEREST RATE

Question No. 1.4 (Similar to 1B) [MTP-May-2021-New/Old-8M]

ABC Ltd. wants to issue 9% Bonds redeemable in 5 years at its face value of Rs. 1,000 each.

The annual spot yield curve for similar risk class of Bond is as follows:

Year Interest Rate

1 12%

2 11.62%

3 11.33%

4 11.06%

5 10.80%

(i) Evaluate the expected market price of the Bond if it has a Beta value of 1.10 due to its popularity because

of lesser risk.

(ii) Interpret the nature of the above yield curve and reasons for the same.

Note: Use PV Factors upto 4 decimal points and value in Rs. upto 2 decimal points.

Solution: (i)

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 26 Additional Q in 5th Edition Book

(ii) The given yield curve is inverted yield curve.

The main reason for this shape of curve is expectation for forthcoming recession when investors

are more interested in Short-term rates over the long term.

INTEREST RATE FUTURE

Question No. 4B [MTP-May-2021-New-8M]

In March 2020, XYZ Bank sold some 7% Interest Rate Futures underlying Notional 7.50% Coupon Bonds. The

exchange provides following details of eligible securities that can be delivered:

Security Quoted Price of Bonds Conversion Factor

7.96 GOI 2023 1037.40 1.0370

6.55 GOI 2025 926.40 0.9060

6.80 GOI 2029 877.50 0.9195

6.85 GOI 2026 972.30 0.9643

8.44 GOI 2027 1146.30 1.1734

8.85 GOI 2028 1201.70 1.2428

Recommend the Security that should be delivered by the XYZ Bank if Future Settlement Price is 1000.

Solution: The XYZ Bank shall choose those CTD (Cheapest-to-Deliver) Bonds from the basket of

deliverable Bonds which gives maximum profit computed as follows:

Profit = Future Settlement Price × Conversion Factor – Quoted Spot Price of Deliverable Bond

Accordingly, the profit of each bond shall be computed as follows:

Since maximum profit to the Bank is in case of 6.80 GOI 2029, same should be opted for.

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Additional Q in 5th Edition book Page 27

Chapter - 9

CORPORATE VALUATION

VALUE OF COMPANY/SHARE

Question No. 1I [RTP-May-2021-New/Old]

Sun Ltd. recently made a profit of 200 crore and paid out 80 crores (slightly higher than the average paid in

the industry to which it pertains). The average PE ratio of this industry is 9. The estimated beta of Sun Ltd. is 1.2.

As per Balance Sheet of Sun Ltd., the shareholder’s fund is 450 crore and number of shares is 10 crores. In case

the company is liquidated, building would fetch 200 crores more than book value and stock would realize 50

crores less.

The other data for the industry is as follows:

Projected Dividend Growth 4%

Risk Free Rate of Return 6%

Market Rate of Return 11%

Calculate the valuation of Sun Ltd. using

(a) P/E Ratio

(b) Dividend Growth Model

(c) Book Value

(d) Net Realizable Value

Solution:

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

Page 28 Additional Q in 5th Edition Book

Chapter - 10

INTERNATIONAL FINANCIAL

MANAGEMENT

No New Question Added

Chapter - 11

SECURITY ANALYSIS

No New Question Added

Chapter - 12

RISK MANAGEMENT

No New Question Added

// CA NAGENDRA SAH // WWW.NAGENDRASAH.COM

You might also like

- 5 Additional Q in 4th Edition Book PDFDocument76 pages5 Additional Q in 4th Edition Book PDFBikash KandelNo ratings yet

- ForexDocument20 pagesForexmail2piyush0% (2)

- 01B Forex QuestionDocument48 pages01B Forex QuestionrishavNo ratings yet

- Paper - 2: Strategic Financial Management Questions Index FuturesDocument26 pagesPaper - 2: Strategic Financial Management Questions Index FutureskaranNo ratings yet

- B1 Free Solving (May 2019) - Set 1Document5 pagesB1 Free Solving (May 2019) - Set 1paul sagudaNo ratings yet

- CA Final SFM RTP For May 2023Document18 pagesCA Final SFM RTP For May 2023remoratilemothekheNo ratings yet

- Interest Rate Risk ManagementDocument8 pagesInterest Rate Risk ManagementEdga WariobaNo ratings yet

- Assignment Chapter 17 18 20Document7 pagesAssignment Chapter 17 18 20Amarjit SinghNo ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- FM212 2018 PaperDocument5 pagesFM212 2018 PaperSam HanNo ratings yet

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014SajidZiaNo ratings yet

- Fm202 Exam Questions 2013Document12 pagesFm202 Exam Questions 2013Grace VersoniNo ratings yet

- Additional QuestionsDocument3 pagesAdditional QuestionsHotel Bảo LongNo ratings yet

- 20081MSMK Ibs535Document9 pages20081MSMK Ibs535anuragrp1988@gmail.comNo ratings yet

- P2 Financial Management June 2012Document9 pagesP2 Financial Management June 2012Subramaniam KrishnamoorthiNo ratings yet

- Test Paper -1: Derivatives, IRRM, Forex and IFMDocument7 pagesTest Paper -1: Derivatives, IRRM, Forex and IFMAbhu ArNo ratings yet

- 2 - Forex Questions M19 To J21Document30 pages2 - Forex Questions M19 To J21Kanchana SubbaramNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument4 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- MGMT2023 Individual Assignment Units 7-8Document2 pagesMGMT2023 Individual Assignment Units 7-8Joann PierreNo ratings yet

- Assessment Paper and Instructions To CandidatesDocument3 pagesAssessment Paper and Instructions To CandidatesJohn DoeNo ratings yet

- Financial Management: Thursday 9 June 2011Document9 pagesFinancial Management: Thursday 9 June 2011catcat1122No ratings yet

- 3 Additional Q in 2nd Edition Revised BookDocument29 pages3 Additional Q in 2nd Edition Revised BookVishal AgarwalNo ratings yet

- Ac413 Supp Feb20Document5 pagesAc413 Supp Feb20AnishahNo ratings yet

- Final Exam f02Document13 pagesFinal Exam f02Omar Ahmed ElkhalilNo ratings yet

- Invest or Not in Oil & Gas Based on WACCDocument10 pagesInvest or Not in Oil & Gas Based on WACCKaso MuseNo ratings yet

- FRM Assgn Case StudyDocument16 pagesFRM Assgn Case StudyShravan Kumar100% (1)

- International Financial Management V1Document13 pagesInternational Financial Management V1solvedcareNo ratings yet

- CASH BUDGETS AND BUDGETING FOR SOLE TRADERS AND COMPANIESDocument23 pagesCASH BUDGETS AND BUDGETING FOR SOLE TRADERS AND COMPANIESfongNo ratings yet

- Exam 2022 SeptemberDocument11 pagesExam 2022 Septembergio040700No ratings yet

- Project Finance Question PaperDocument3 pagesProject Finance Question PaperBhavna0% (1)

- Specific Financial Reporting Ac413 May19aDocument4 pagesSpecific Financial Reporting Ac413 May19aAnishahNo ratings yet

- Chapter - 2: Foreign Exchange Exposure and Risk ManagementDocument32 pagesChapter - 2: Foreign Exchange Exposure and Risk ManagementPrabhakar Sharma100% (1)

- Financial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988Document7 pagesFinancial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988EshanMishraNo ratings yet

- DD The Superior College Lahore: InstructionsDocument3 pagesDD The Superior College Lahore: Instructionsmehzil haseebNo ratings yet

- Gaf 520 Dist Assign 1Document9 pagesGaf 520 Dist Assign 1Tawanda ZimbiziNo ratings yet

- 20081MS Ibs535Document12 pages20081MS Ibs535anuragrp1988@gmail.comNo ratings yet

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- Mock Question I II III IV VDocument24 pagesMock Question I II III IV Vapi-381455783% (6)

- SFM QDocument4 pagesSFM QriyaNo ratings yet

- STRATEGIC FINANCIAL MANAGEMENT EXAMDocument19 pagesSTRATEGIC FINANCIAL MANAGEMENT EXAMCLIVENo ratings yet

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014sarirahmadNo ratings yet

- Cash Flow 2022Document23 pagesCash Flow 2022Omar El-BourinyNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- FIN2001 Exam - 2021feb - FormoodleDocument7 pagesFIN2001 Exam - 2021feb - Formoodletanren010727No ratings yet

- Ca-Final SFM Question Paper Nov 13Document11 pagesCa-Final SFM Question Paper Nov 13Pravinn_MahajanNo ratings yet

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- b1 Free Solving (May 2019) - Set 3Document5 pagesb1 Free Solving (May 2019) - Set 3paul sagudaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaamitmdeshpandeNo ratings yet

- MGF633 Assignment 4 - Fall 2010Document2 pagesMGF633 Assignment 4 - Fall 2010Mahmoud TaabodiNo ratings yet

- ARM SolDocument32 pagesARM SolRizwan AhmadNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- Financial Management Problem SolvingDocument5 pagesFinancial Management Problem Solvingpaul sagudaNo ratings yet

- Assignment - FinalDocument5 pagesAssignment - FinalapoorvkrNo ratings yet

- Investment ManagementDocument19 pagesInvestment ManagementMichael VuhaNo ratings yet

- Assignment May2011 ADocument6 pagesAssignment May2011 AZyn Wann HoNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume I: Country and Regional ReviewsNo ratings yet

- Unit 11 ImmunizationDocument45 pagesUnit 11 ImmunizationBikash Kandel100% (1)

- SFM Summary Notes Last Minute Revision by Satish Jalan STUDYNOTES365Document69 pagesSFM Summary Notes Last Minute Revision by Satish Jalan STUDYNOTES365Bikash KandelNo ratings yet

- What does "XDDocument1 pageWhat does "XDBikash KandelNo ratings yet

- Unit 12 Family PlanningDocument147 pagesUnit 12 Family PlanningBikash KandelNo ratings yet

- Sample Size CalculationDocument3 pagesSample Size CalculationBikash KandelNo ratings yet

- Community Health Nursing 2Document140 pagesCommunity Health Nursing 2Bikash KandelNo ratings yet

- Security Valuation Chapter GuideDocument46 pagesSecurity Valuation Chapter GuideBikash KandelNo ratings yet

- Modified Radcal MastectomyDocument76 pagesModified Radcal MastectomyBikash KandelNo ratings yet

- 6 Additional Q in 5th Edition Book PDFDocument28 pages6 Additional Q in 5th Edition Book PDFBikash KandelNo ratings yet

- 8A IRRM-Summary PDFDocument24 pages8A IRRM-Summary PDFBikash KandelNo ratings yet

- Derivative Call OptionDocument7 pagesDerivative Call OptionTanmayananda ChattarajNo ratings yet

- This Study Resource Was: No. Account Title Debit CreditDocument7 pagesThis Study Resource Was: No. Account Title Debit CreditLoiz Santos Trinidad100% (2)

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- Depreciation Methods for Engineering AssetsDocument10 pagesDepreciation Methods for Engineering AssetsDiane Gutierrez100% (1)

- Financial Performance of Hatsun Agro Product LimitedDocument51 pagesFinancial Performance of Hatsun Agro Product LimitedMukesh GuptaNo ratings yet

- Capital-Structure-and-Long-term-Financing-Decisions Quick NotesDocument6 pagesCapital-Structure-and-Long-term-Financing-Decisions Quick NotesAlliah Mae ArbastoNo ratings yet

- FNDACT1 - H-04 - Adjusting Process Illustrative ProblemDocument6 pagesFNDACT1 - H-04 - Adjusting Process Illustrative ProblemKing BelicarioNo ratings yet

- ch05 Accounting For Merchandising Operations Test BankDocument58 pagesch05 Accounting For Merchandising Operations Test BankSTEM1 LOPEZNo ratings yet

- Week 7 Homework Lisa ChandlerDocument13 pagesWeek 7 Homework Lisa ChandlerShopno ChuraNo ratings yet

- 330 S12 IndSty MT AMongelluzzoDocument8 pages330 S12 IndSty MT AMongelluzzomongo9279No ratings yet

- Accounting 25th Edition Warren Test Bank 1Document104 pagesAccounting 25th Edition Warren Test Bank 1clyde100% (33)

- Overview Slides GLFMCO 27072017 V2 UPPDocument61 pagesOverview Slides GLFMCO 27072017 V2 UPPSiti Habsah AbdullahNo ratings yet

- Kordia Interim Report 2012Document11 pagesKordia Interim Report 2012kordiaNZNo ratings yet

- Survey of Accounting 4Th Edition Edmonds Solutions Manual Full Chapter PDFDocument51 pagesSurvey of Accounting 4Th Edition Edmonds Solutions Manual Full Chapter PDFzanewilliamhzkbr100% (5)

- Retained Earnings Sample QuizDocument9 pagesRetained Earnings Sample QuizGali jizNo ratings yet

- Working With Financial StatementsDocument33 pagesWorking With Financial StatementsAssad Hayat Niazi100% (1)

- CatrionaDocument4 pagesCatrionaShyrine EjemNo ratings yet

- Annual Report 2013 PDFDocument75 pagesAnnual Report 2013 PDFsururyNo ratings yet

- ACC101 T222 FinalExam MarkingGuideDocument18 pagesACC101 T222 FinalExam MarkingGuideTan IrisNo ratings yet

- Past Paper Questions Up To Winter 2015 PDFDocument99 pagesPast Paper Questions Up To Winter 2015 PDFsamit shresthaNo ratings yet

- Accounting For CorporationDocument7 pagesAccounting For CorporationPrincess AlegreNo ratings yet

- IAS38 - Accounting for Intangible AssetsDocument13 pagesIAS38 - Accounting for Intangible AssetsJehPoyNo ratings yet

- 02 Cost Terms, Concepts and Behavior ANSWER KEYDocument4 pages02 Cost Terms, Concepts and Behavior ANSWER KEYJemNo ratings yet

- Understanding Government Accounting Updates and DevelopmentsDocument96 pagesUnderstanding Government Accounting Updates and DevelopmentsMary Ann A. Belasa100% (2)

- Financial Management MCQ MergedDocument59 pagesFinancial Management MCQ Mergedvenkatesh vNo ratings yet

- Acca FR s20 NotesDocument152 pagesAcca FR s20 NotesFreakin Q100% (1)

- Chapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEDocument3 pagesChapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEGelle PascualNo ratings yet

- ACC213 QUIZ SOLUTIONSDocument4 pagesACC213 QUIZ SOLUTIONSAlexx DianneNo ratings yet

- Financial Ratios: Arab British Academy For Higher EducationDocument6 pagesFinancial Ratios: Arab British Academy For Higher EducationhirenpadaliaNo ratings yet

- Nas 33 EpsDocument61 pagesNas 33 EpsbinuNo ratings yet

- Common Size Statements: ParticularsDocument3 pagesCommon Size Statements: ParticularsChandan GuptaNo ratings yet