Professional Documents

Culture Documents

Larsen and Toubro LTD Vs DCIT Range 22 27072016 IU2016080816154650111COM127018

Uploaded by

MALKANI DISHA DEEPAK0 ratings0% found this document useful (0 votes)

13 views21 pagesOriginal Title

Larsen_and_Toubro_Ltd_vs_DCIT__Range_22_27072016__IU2016080816154650111COM127018

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views21 pagesLarsen and Toubro LTD Vs DCIT Range 22 27072016 IU2016080816154650111COM127018

Uploaded by

MALKANI DISHA DEEPAKCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 21

MANU/IU/0714/2016

IN THE ITAT, MUMBAI BENCH, MUMBAI

ITA No./4442/Mum/2010 and ITA No./4599/Mum/2013

Assessment Year: 1998-1999

Decided On: 27.07.2016

Appellants: Larsen & Toubro Ltd.

Vs.

Respondent: DCIT - Range 2(2)

Hon'ble Judges/Coram:

Joginder Singh, Member (J) and Rajendra, Member (A)

Counsels:

For Appellant/Petitioner/Plaintiff: J.D. Mistry

For Respondents/Defendant: Mukund Chate

Case Note:

Direct Taxation - Slump sale - Sale of unit - Commissioner held that Assessing

Officer (AO) was fully justified in rejecting claim of slum sale - Hence, present

appeal - Whether sale of earth moving manufacturing unit was slump sale -

Held, Assessee had sold going concern and joint venture had taken over all

assets and liabilities of Assessee for lumpsum price - It was not case of AO

that other units were not doing their businesses independently or they were

linked with unit sold by Assessee - Assessee had transferred business at

lumpsum consideration by way of slump sale - Thus, sale of earth moving

manufacturing unit was slump sale - Assessee would not be entitled to claim

loss for transaction in question - Appeal partly allowed. [4]

Facts:

During the assessment proceedings, the AO found that the assessee had

reduced the profit on sale of undertaking from the profit and loss account,

that it had claimed capital loss in its return, that construction equipment

manufacturing undertaking of the company was sold and transferred for a

lump sum consideration, as a going concern, to a joint-venture company, that

it had treated the undertaking itself was a non-depreciable capital asset and

had worked out the LTCL, that the LTCL was the difference between the slum

price and the indexed cost of the undertaking, that it had reduced from the

respective blocks the written down value of the assets forming part of the

undertaking which was transferred. The AO directed the Assessee to file

explanation with details of computation and treatment made the books of

accounts and the legal basis on which it had claimed the transaction was a

slump sale. The Assessee, stated that the works was transferred to a newly

incorporated joint-venture company, that the profit on sale and transfer of

undertaking was disclosed in the books of accounts. The AO held that where a

portion was attributable to plant, machinery and the stock, the difference

between the actual cost and returned and value of assets was assessable as

business income under Section 41(2) of Act, that the surplus over such

23-02-2023 (Page 1 of 21) www.manupatra.com Symbiosis University

difference was assessable as capital gains, that in the case under

consideration there was no sale of entire business, that the Assessee had sold

fixed assets and current assets, that the lump sum purchase consideration

was partly attributable to depreciable assets and party to land which was a

non -perishable fixed asset, that the consideration was specifically

attributable to net current assets. He referred to the provisions of Section

41(2), (2A) and 50 of the Act and held that the business activity of the

Assessee comprised manufacturing of cement, engineering and construction

including earthmoving equipments and heavy machinery electronic

equipments, that transfer of part of activity in form of sale of unit did not

constitute sale of the entire business as a going concern or a slump sale. On

appeal, the First Appellate Authority held that the AO was fully justified in

rejecting the claim of slum sale and considering the transaction as itemised

sale and applying the relevant provisions of the Act. Hence, present appeal.

Held:

Sale of unit treated as slump sale:

(i) It was clear that if ongoing concern was sold for a lump sum amount it has

to be treated a slump sale and had to be taxed as such. In such cases

itemised sale of the assets was not there-an amount was paid for transferring

an independent unit. The Assessee had sold a going concern and the joint

venture had taken over all the assets and liabilities of the Assessee for a

lumpsum price. Earth moving equipment manufacturing unit was an

independent unit and was sold to the JV without assigning any individual

value to either fixed assets or current assets, that it was sale of undertaking

as a whole. It was not the case of the AO that the other units were not doing

their businesses independently or they were inseparably linked with the unit

sold by the Assessee. In fact they were catering the need of all other

divisions. As an independent unit, earth moving manufacturing unit, was a

separate business having its own assets and liabilities. The Assessee had

transferred that division to JV for a lump sum amount. While doing so,

depreciation was not claimed on the assets transferred. It was also found that

the entire plot of land of the earth moving equipments manufacturing unit

was transferred to JV, none of the assets located at any other plant was

transferred by the Assessee. No value was assigned to plot of land and

building while transferring the assets to the JV and that the Assessee had

transferred the business at a lumpsum consideration by way of slump sale

without assigning any individual value to various assets and liabilities. There

was nothing on record to show that the value shown by the JV was the

itemized value of the assets owned by the Assessee. Thus, the sale of earth

moving manufacturing unit was a slump sale. The Assessee would not be

entitled to claim loss for the transaction in question.[4]

ORDER

Rajendra, Member (A)

1. Challenging the order dt. 26.03.2013 of the CIT(A)-5, Mumbai the Assessing Officer

(AO) and the assessee have filed cross-appeals for the year under consideration.

Assessee-company, engaged in the business of construction, manufacturing of heavy

machinery and cement, etc., filed it return of income on, 27.11.1998, declaring income

23-02-2023 (Page 2 of 21) www.manupatra.com Symbiosis University

of Rs. 37.20 crores. The AO completed the assessment, on 28.02.2001, under section

143(3) of the Act, determining the income of the assessee at Rs. 2,09,15,37,490/-.

ITA/4442/Mum/2010:

2. First ground of appeal is about confirming the disallowance of Rs. 3.15 crores, being

the commission paid to certain parties during the previous year. During the course of

hearing before us, the Authorised Representative (AR) and the Departmental

Representative (DR) agreed that the issue stands decided against the assessee by the

order of the Tribunal for the earlier years. We would like to reproduce relevant portion

of the order of the Tribunal for A.Y. 1997-98 and same reads as under:-

"5. Ground No. 3 relates to the disallowance of commission paid amounting to

Rs. 2,40,16,498/-. The Assessing Officer has considered this issue at para 13

on page 7 of his order and the grievance of the assessee was considered by the

CIT(A) at para 8 page 3 of his order. Similar disallowance has been considered

by the Tribunal at para 8 & 9 of its order in ITA No. 2200/M/2000, wherein it

has followed the Tribunal order for A.Y. 1994-95 in ITA Nos. 4265 &

4892/Mum/98. Facts being identical, respectfully following the decision of the

Tribunal in the assessee's own case in earlier years, finding of the CIT(A) are

confirmed. Ground No. 3 is accordingly dismissed."

Respectfully following the above order of the Tribunal, we decide the first ground of

appeal against the assessee.

3 . Second ground is about addition made under section 40A(9) in respect of

contribution to Marine Navy Officers Welfare Fund (Rs. 8.85 lakhs) and Utmal

Employees Welfare Fund (Rs. 1 lakh). Representatives of both the sides agreed that

identical issue was decided in favour of the assessee by the Tribunal, while adjudicating

the appeal for A.Y. 1997-98 as under:-

"6. Ground No. 4 relates to the disallowance of Rs. 6,32,725/- on account of

contribution to Marine Navy Officers Welfare Fund. This issue has been

discussed by the Assessing Officer at para 18 page 9 of his order and the same

has been considered by the CIT(A) at para 13 page 5 of his order, wherein the

CIT(A) has directed the Assessing Officer to allow deduction of Rs. 1,00,000/-.

Similar disallowance was considered by the Tribunal in ITA No.

2200/Mum/2000 at para 12 and 13 of its order at page 5 & 6, wherein the

Tribunal has followed its own decision in ITA No. 3943/Mum/98. Facts and

circumstances being identical, respectfully following the decision of the

Tribunal in the assessee's own case for earlier years, we direct the Assessing

Officer to delete the addition of Rs. 6,32,725/-. Ground No. 4 is accordingly

allowed."

Respectfully following the above, ground No. 2 is decided in favour of the assessee.

4. Third ground of appeal is about failure to treat the transfer of Bangalore undertaking

as slump sale and disallowing depreciation of Rs. 17.58 crores. During the assessment

proceedings, the AO found that the assessee had reduced the profit on sale of Bangalore

undertaking of Rs. 108.18 crores from the profit and loss account, that it had claimed

capital loss in its return, that construction equipment manufacturing undertaking of the

company at Bangalore was sold and transferred for a lump sum consideration, as a

going concern, to a joint-venture company, that it had treated the undertaking itself is a

non-depreciable capital asset and had worked out the LTCL of Rs. 47.29 crores, that the

23-02-2023 (Page 3 of 21) www.manupatra.com Symbiosis University

LTCL was the difference between the slum price and the indexed cost of the

undertaking, that it had reduced from the respective blocks the written down value of

the assets forming part of the undertaking which was transferred. The AO directed the

assessee to file explanation with details of computation and treatment made the books

of accounts and the legal basis on which it had claimed the transaction was a slump

sale. The assessee, vide its letter dated 13/01/2001, stated that the Bangalore works

was transferred to a newly incorporated joint-venture company, namely L & T Komatsu

Ltd. (LTK) for a lump sum consideration of Rs. 186.10 crores, that the profit on sale

and transfer of the above undertaking of Rs. 108.19 crores was disclosed in the books

of accounts. The assessee gave detailed breakup in its explanation and claimed that it

had treated the undertaking is a capital asset and had worked out long-term capital loss

as under. It was further argued that the decision was the difference between the slump

price and the indexed cost of acquisition and improvement of the undertaking, that the

written down value of the assets was transferred was reduced and no depreciation had

been claimed on such assets. It enclosed a certificate from the statutory auditors giving

detailed working of the cost of acquisition and improvement. It was argued that the

undertaking, a capital asset, was transferred as a whole along with all its rights and

privileges for a lump sum consideration, that no individual value to its assets and

liabilities was assigned, that the income arising from such transfer had to be taxed

under the head income from capital gains. The assessee referred to the provisions of

section 50B of the Act and the definition of slump sale, as provided in the section

2(42C) of the Act. It relied upon certain judgments delivered by various High Courts. In

its letter dated 22/02/2001, the assessee further argued that the assets transferred also

included certain items pertaining to research and development (R & D) facilities, that

since no part of the consideration would be attributable to such assets same were

included in the slum price, that the consideration was not separately offered to tax as

per the provisions of section 41(3) of the Act, that the about treatment in computing the

total income was in line with the mode of computation of capital gains stating the

undertaking is a capital asset and also in view of the fact that no part of consideration

could be attributed to specific assets and liabilities and subjected to tax under a

different head of income.

4.1. After considering the submission of the assessee, the AO referred to the case of

Artex Manufacturing Company (MANU/SC/0773/1997 : 227 ITR 260) and held that

where a portion was attributable to plant, machinery and the stock, the difference

between the actual cost and returned and value of assets was assessable as business

income u/s. 41(2), that the surplus over such difference was assessable as capital

gains, that in the case under consideration there was no sale of entire business, that the

assessee had sold fixed assets and current assets, that the lump sum purchase

consideration of Rs. 186 crores was partly attributable to depreciable assets and party

to land which was a non -perishable fixed asset, that the consideration of Rs. 39.10

crores was specifically attributable to net current assets. He referred to the provisions of

section 41(2), (2A) and 50 of the Act and held that the business activity of the assessee

comprised manufacturing of cement, engineering and construction including

earthmoving equipments and heavy machinery electronic equipments, that transfer of

part of activity in form of sale of Bangalore unit did not constitute sale of the entire

business as a going concern or a slump sale, that the transfer specifically excluded

engine division, marketing division, parts and service division, training Centre as per

the agreement entered into by the assessee with the JV-company, that entire business

was not transferred, that a part of the assets of winner one unit had been transferred,

that it was not a case of slum sale, that the assessee was maintaining separate books of

accounts for Bangalore division, that the details of plant and machinery, building, land,

current assets and liabilities were maintained separately, that the balance sheet and

23-02-2023 (Page 4 of 21) www.manupatra.com Symbiosis University

audit report was also prepared separately for that unit, that the balance sheet of

Bangalore unit as on 31/03/1998 showed that the entire unit was not transferred on

01/02/1998, that the assessee had separate and identifiable blocks of assets for each

unit, that the sale proceeds which were attributable to the blocks of assets of the

Bangalore unit could be better nine on some rational basis and any excess, as

determined in accordance with the provisions of section 50, could be brought to tax.

Referring to the provisions of section2(24), he held that the profits embedded in the

whole or portion of the lump sum price not attributable to the sale of stock in trade had

to be taxed under the head capital gains, that sale of stock in trade was to be taxed as

business income. Finally he held that there was no sale of business as a whole and that

only a part of a line of business was sold. He referred to the demarcation of the

consideration of Rs. 186.10 crores in the case of LTK Ltd. i.e. the purchaser and

observed that it had showed the allocation of various assets purchased by it. After

considering the valuation report in the books of accounts of the purchaser, he discussed

the allocation of fixed assets and deduction claim under section 35 of the Act. He held

that the valuation report prepared by LTK clearly mentioned the market price of the

assets transferred by the assessee, that value was allocated to the capital asset

pertaining to R & D work. The AO further observed that there was close connection

between the transfer and the acquirer of the business, that the argument of the assessee

that the allocation to the different assets and identification of the value was merely

done by the JV and it did not have any knowledge of the individual values attributable

to the different assets was not available, that in the valuation report of the JV a

reference had been made to the earlier valuation report given by the same value to the

assessee for land and building, that the value of individual assets were thereby clearly

in existence before the date of agreement and was duly considered for arriving at the

sales figure of 186.10 crores, that transaction could not be treated as slum sale is

claimed by the assessee, that the taxability would be determined in accordance with the

allocation two different assets which would be treated as values attributable to those

assets out of the sale price, that the value so apportion therefore would be credited to

the respective blocks was sale consideration in case of the assessee which would be

accordingly reduced the claim of depreciation, that in respect of non-depreciable asset

i.e. land, as LTCG would be attracted, that in respect of R & D assets for which the sale

consideration would be 4.5 crores provisions of section 41(3) of the Act would be

attracted, that as per the provisions of the said section the amount has to be treated as

profits under the head business income. He worked out the LTCG on sale of land and

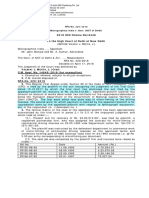

reduced the claim of depreciation as under:

4.2. During the appellate proceedings, the assessee made elaborate submission,

besides reiterating the arguments advanced before the FAA, before the FAA. After

considering the submissions of the assessee, the FAA held that the Bangalore division

had not been sold as a whole as going concern, that only certain assets had been

transferred, that the assessee had not been able to satisfactorily refute the finding of

the AO in that regard, that there was no sale of entire business, that it was sale of fixed

assets and current assets and the lump sum consideration of Rs. 186 corrodes was

partly attributable to depreciable assets and partly to land and partly to net current

assets, that it was all the more apparent from the fact that the said transfer excluded

engine division, marketing division etc., that it was claimed that transaction was made

for a lump sum consideration, that the books of accounts at the end of the purchases

contradicted the claim made by the assessee, that the AO had brought on record the

facts that prove that it was an itemised sale of the assets, that the facts of the case of

Artax Manufacturing Company (supra) were applicable to the facts of the case, that the

AO had assessed the JV company also, that he could attribute the values individually to

various assets, based on a location made in the books of the purchaser company, that

23-02-2023 (Page 5 of 21) www.manupatra.com Symbiosis University

the allocation was based on the valuation report dated 11/05/1998, that the assessee

had never disputed the facts regarding the valuation report, that the facts born from the

records of the purchaser were the clinching evidences with regard to the conclusion

drawn by the AO, that the assessee was maintaining separate books of accounts for

Bangalore division along with the details of plant and machinery, assets and liabilities,

that the balance sheet was separately prepared, that it had separate block of assets

which were identifiable, that the sale proceeds could be determined on some rational

basis, that taxes could be determined according the provisions of section 50 of the Act,

that the consideration attributable to fixed assets had been determined from valuation

report in the case of the purchasers, that it was improbable that the assessee was not

aware of such itemised valuation of the assets transferred, that entire amount of Rs.

186.10 corrodes had been duly demarcated and respective asset wise allocation was

available,, that even land and building was duly got valued as per report dated

8/08/1997, that the values attributable to different categories of assets was clearly

available, that the value of the current assets transferred that actual value was available

from the balance sheet of LTK. The FAA referred to the decision of Asia Brown Brevory

Ltd. (100 TTJ 502) and observed that mere recitals of the agreement would not be

sufficient to hold that transaction was slump sale or not, that though the recital in the

agreement indicated lump sum payment but the facts had to be seen in the context of

itemised valuation report in the case of the purchaser, that the contention raised by the

assessee was contradictory. Finally, he held that the AO was fully justified in rejecting

the claim of slum sale and considering the transaction as itemised sale and applying the

relevant provisions of the Act.

4.3. Before us, the AR stated that the AO/FAA had disregarded the transaction as a

slum-sale transaction and had proceeded in determining the tax liability by

hypothetically allocating the values attributable to individual assets by crediting the

values of block of respective assets, that the facts of the case of Artex Manufacturing

Company (supra) were not applicable to the facts of the case, that in the case under

consideration the undertaking was transferred as a whole along with all its rights and

privileges for a lump sum consideration without assigning any individual value to its

assets and liabilities, that the income arising from such transfer had to be taxed under

the head income from capital gains. Referring to the CBDT circular No. 63 :

MANU/DTCR/0010/1971, dated 16/08/1971, the AR argued that the amount of capital

gain had be ascertained by deducting, from the amount of compensation the aggregate

of cost of acquisition of undertaking and the cost of any improvements thereto, that

merely because the assessing officer had also assessed the LTK he could not attribute

the values individually to various assets based on the allocation made in the books of

the purchaser company, that the allocation was done in the books of the transferee

based on the valuation report dated 11/05/1998, that in the hands of the purchaser the

apportionment of purchase consideration among various types of assets had to be

made, that it had to book the assets and the liabilities, that the accounting treatment

given by LTK was in accordance with AS-10, that LTK had apportioned the consolidated

consideration among various fix and current assets based on the values report, that

there was no material available to the AO to draw the conclusion that assessee had sold

itemized assets, that the valuation report dated 11/05/1998 was obtained by LTK, that

merely because a valuation of landed building was done by the assessee it could not be

presumed that the same was considered for determining the sale price by the assessee,

that determination of sale consideration was a matter of negotiation between the buyer

and seller, that unilateral valuation of part of an asset by the buyer could not be the

basis of determining the sale price, that the AO had failed to appreciate the fact that the

market value of assets as per the valuation report dated 11/05/1998 and the value of

current assets did not match or even approximated the total consideration received by

23-02-2023 (Page 6 of 21) www.manupatra.com Symbiosis University

the assessee, that the reliance placed by the AO on the valuation report was totally

arbitrary, that the value of fixed assets had been arrived at by deducting book value of

current assets from the slum price, that same did not approximate the market value of

its assets nor it represented the market value of the current assets, that the assessee

had reduced the cost of current assets transferred to the purchaser to the tune of Rs.

45.51 corrodes, that the cost of material, tools and work in progress transfer to LTK

was reduced from manufacturing, construction and operating expenses, that it was

separately considered for determining the profits on sale/transfer of Bangalore works,

that the said cost could not be termed treated as market value of the current assets as

held by the AO, that the AO had wrongly presumed that there was no sale of entire

business but of only fixed assets and current assets, that the assessee had transferred

not only fixed and current assets but also the rights and obligations privileges and

charges and everything connected with the construction equipment manufacturing

undertaking, that the AO had totally ignored the aspect and concluded that lump sum

purchase consideration was specifically attributable to the depreciable and not the

appreciable assets, that the AO had wrongly concluded that since the assessee was in

various businesses transfer of any one of the business did not cost you transfer or sale

of entered business is going concern or slum sale, that the concept of business of an

undertaking could never be meant to be all the businesses of the company clubbed

together, that what was important was whether the particular business constituted

separate unit or an undertaking of the company, the Bangalore works which had been

sold constituted separate business and a separate accounting units/undertaking in

respect of which even the benefit under section 80-I had been allowed in the past, that

the AO had admittedly indicated that Bangalore unit was engaged in manufacture of

construction equipment and that was one of the businesses of the company, that it was

not necessary for the company to sell all its division forming part of manufacturing

business undertaking, that the sale of a going concern could legitimately relate to the

manufacturing facilities only, that in case of the assessee the marketing function was

always forming part of overall marketing activities of the company. He referred to the

pages 256-278 of the paper book and relied upon the cases of PNB Finance Ltd. (307

ITR 57), Electric Control Gear Manufacturing Company (MANU/SC/1245/1997 : 227 ITR

278) and Novartis India Ltd. (64 SOT 84). He fairly conceded that the loss claimed by

the assessee for with regard to slump sale was not allowable. The DR contended that

the whole unit was not sold as a going concern, that other units like marketing unit

remained with the assessee, that purchaser JV had the assessee as one of the partners,

that facts of the case Artex were clearly applicable, that it was a colorable device to

reduce the tax liability, that the JV had shown itemized value of all the assets purchased

by it.

4.4. We have heard the rival submissions and perused the material before us. We find

that the buyer-LTK-is a joint-venture with equal equity participation by the assessee and

Komatsu Asia-Pacific Singapore, that it has purchased the manufacturing division of

earth moving unit at Bangalore from the assessee during the year under consideration,

that the other divisions were not part of the sale, that the AO referred to the valuation

report prepared by LTK of the assets received by it in transfer and held that value of the

assets was available to the assessee, that he further held that it was a case of itemized

sale of the assets, that it was not a slump sale, that he finally taxed the transaction, that

the FAA upheld the order of the AO referring to the case of Artex Manufacturing Co.

(supra), that the assessee argued the it was a case of slump sale and the facts of Artex

were not applicable to the facts of the assessee. In our opinion, the short issue to be

decided in the matter is whether the transaction can be was slum sale i.e. sale of

proverbial lock stock and barrel. In the case of Polychem Ltd. (MANU/MH/0162/2012 :

343 ITR115) Hon'ble Bombay High Court has defined the word slump sale in following

23-02-2023 (Page 7 of 21) www.manupatra.com Symbiosis University

manner:

"When a transfer takes place of the whole business and undertaking of the

assessee and the transfer involves not only fixed assets such as land, building

and machinery but other component elements such as the benefit of existing

contracts, licences and approvals and intangibles including intellectual property

and transfer of the work force of the undertaking or business, it would be

impossible in such a case to attribute or allocate the sale consideration as

between the fixed assets on the one hand and the intangibles on the other."

In that matter it was found that the assessee, engaged in the business of manufacture

and sale of liquor, entered into an agreement on 24.03.1994, to sell to the purchaser

the undertaking/business together with its assets and liabilities as a running

business/going concern on as is where is basis. According to the assessee, the profit

arising on the transfer of the undertaking was not chargeable to tax. The AO deducted

from the total sale price of Rs. 10.38 crores the written down value of the fixed assets

and the value of the stores, raw materials and finished goods which was worked out at

Rs. 3.48 crores and held the difference of Rs. 6.90 crores chargeable as capital gains.

The FAA affirmed this holding that the net worth of the unit was ascertained by

evaluating each asset and liability and the sale price being determined on the basis of

each asset and liability it could not be asserted that the assets were not acquired at any

cost. The Tribunal held that this was not a sale of itemised assets and it was hence not

possible to compute any chargeable capital gain on the sale of the undertaking as a

going concern.

On appeal the Hon'ble Court held that the agreement in pursuance of which the

undertaking was transferred by the assessee made it clear that the assessee was

transferring to the purchaser the undertaking/business as a running business/going

concern together with its assets and liabilities, that the under-taking/business

comprised besides immovable property and movable property (including plant and

machinery), current assets including raw materials, stock-in-trade and book debts, the

benefits of all pending contracts, engagements and orders, all licences and other

permissions and approvals required from the State and the Central Government to carry

on liquor business, the distribution network, marketing strategies, plans, advertising

information and customer list and the use of intangible assets referable to the

undertaking/business including trademarks, that the agreement did not contain an

itemized valuation in respect of the land, building and fixed assets transferred, that the

total consideration of Rs. 10.6 crores determined under the agreement was for the

transfer of the business and undertaking as a whole comprising but not limited to the

land, building and fixed assets, that the transaction involved a slump sale, that there

was, therefore, fundamentally an error on the part of the AO when he proceeded to hold

that there was a profit of Rs. 6.90 crores being the difference between the sale price

and the deductions which he erroneously regarded as having emerged from the

agreement itself.

4.5. Here, would like to refer to the case of Agrosynth Chemicals (MANU/KA/0116/2010

: 327 ITR 135) of the Hon'ble Karnataka High Court wherein the Hon'ble Court has

discussed the cases referred to by the AO and assessee during the appellate

proceedings. In the matter of Argrosynth (supra) under an agreement, the entire land of

the assessee-firm, measuring 5 acres along with the factory buildings, plant and

machinery and the assets and liabilities were sold for a total consideration of Rs. 1.50

Crores. In reassessment proceedings for the assessment year 1995-96, applying the

provisions of section 41(2) of the Act, the difference between the sum of Rs. 1.50

23-02-2023 (Page 8 of 21) www.manupatra.com Symbiosis University

Crores and the written down value of the assets of Rs. 23,02,460 was brought to tax.

On appeal, the FAA came to the conclusion that it was a slump sale and that capital

gains were not attracted. The Tribunal dismissed the Department's appeal. On appeal to

the High Court, dismissing the appeal the Hon'ble Court held as under:

".......the agreement did not reflect the actual value of the land, building, plant

and machinery nor the actual liability of the assessee payable to different

persons. It was a composite agreement, agreeing to sell the entire going

concern of the factory, as it was. Therefore, the Assessing Officer was not

correct in bringing to tax the various assets sold by the assessee for a sum of

Rs. 1,50,00,000 shown in its books at a written down value of Rs.

23,02,460.......

9. Both the counsel have relied upon the judgment rendered by their Lordships

on the same day, viz., July 8, 1997. The judgment in Artex Manufacturing

Company MANU/SC/0773/1997 : [1997] 227 ITR 260 (SC) was delivered earlier

and later on, the same day, the judgment in Electric Control Gear Manufacturing

Company MANU/SC/1245/1997 : [1997] 227 ITR 278 has been delivered.

Based on the facts in each case, their Lordships have taken a view that section

41(2) is applicable in the case of Artex Manufacturing Company

MANU/SC/0773/1997 : [1997] 227 ITR 260 (SC) and similarly their Lordships

have held that the provisions of section 41(2) of the Act is not applicable to the

facts involved in Electric Control Gear Manufacturing Company

MANU/SC/1245/1997 : [1997] 227 ITR 278.

10. In view of these two judgments, we have to find out whether the facts in

the present case are similar to the case in Artex Manufacturing Company

MANU/SC/0773/1997 : [1997] 227 ITR 260 (SC) or Electric Control Gear

Manufacturing Company MANU/SC/1245/1997 : [1997] 227 ITR 278. If the case

in hand is similar to that of Artex Manufacturing Company MANU/SC/0773/1997

: [1997] 227 ITR 260 (SC), we have to reverse the finding of the Tribunal as

well as the Commissioner of Income-tax (Appeals), and if the judgment in

Electric Control Gear Manufacturing Company MANU/SC/1245/1997 : [1997]

227 ITR 278 could be made applicable to the present case based on the facts of

the case, then the appeal of the Revenue has to be dismissed, by answering the

questions of law. In order to appreciate the facts of this case, the agreement

entered into between the assessee and M/s. Agrosynth Chemicals Ltd., we have

to examine the nature of transactions. The learned counsel for the parties have

made available the copy of the agreement entered into between the assessee

and the purchaser, dated December 1, 1994. Under the agreement, the entire

land measuring 5 acres along with the factory buildings, plant and machinery

and the assets and liabilities are sold for a total consideration of Rs.

1,50,00,000 and the company which has purchased it had agreed to pay the

consideration of Rs. 1,50,00,000 by allotting 15 lakhs equity shares of Rs. 10

each in favour of the partners of the assessee. On going through the

documents, the agreement does not reflect the actual value of the land,

building, plant and machinery. It also does not reflect the actual liability of the

assessee payable to different persons. It is composite agreement, agreeing to

sell the entire going concern of the factory, as it is. But, in the case of Artex

Manufacturing Company MANU/SC/0773/1997 : [1997] 227 ITR 260 (SC),

during the course of assessment, the assessee had produced the document to

show the value of the articles sold by it. Therefore, the facts involved in Artex

Manufacturing Co. and the facts involved in the present case are different. But

23-02-2023 (Page 9 of 21) www.manupatra.com Symbiosis University

in the case of Electric Control Gear Manufacturing Company

MANU/SC/1245/1997 : [1997] 227 ITR 278, the agreement relied upon in the

said judgment and the agreement relied upon in the present case are more or

less same. Therefore, relying upon the judgment in Electric Control Gear

Manufacturing Company MANU/SC/1245/1997 : [1997] 227 ITR 278, we have

to answer the questions of law against the Revenue and in favour of the

assessee."

Finally, we would also like to refer to the case of Ece Industries Ltd.

(MANU/DE/4142/2010 : 344 ITR 382) of the Hon'ble Delhi High Court. In that matter

the assessee had sold its lamp division in the previous year relevant to the assessment

year 1999-2000 for a sum of Rs. 42.50 crores. In the computation of capital gains, the

assessee showed cost of the lamp division at Rs. 59.33 crores and declared the long

term capital loss at Rs. 16.83 crores to be adjusted against the profit for the current

year. The AO invoked the provisions of section 50 of the Act and issued a show-cause

notice to the assessee. The assessee submitted that no part of the price of Rs. 42. 50

crores was attributable to any particular asset including any depreciable asset and, so,

the provisions of section 50(2) were not attracted. It also contended that it was an old

concern for more than 36 months, its transfer would give long-term capital gain. The

AO held that the capital gains on the depreciable asset were to be treated as short-term

capital gains and required the assessee to quantify the consideration received by it for

sale of tangible and intangible assets but the assessee did not furnish the information.

Accordingly, he took the written down value of the assets of the lamp division at Rs.

5,15,75,131 as declared by the assessee out of which he segregated the value of land

and applied indexation. Consequently, he computed the short-term capital gains at Rs.

36,89,23,393. The FAA confirmed the order passed by the Assessing Officer holding that

the assessee had merely made a unit sale, i.e., sale of its lamp division which was a

part of its overall business concern and that the assessee still continued as a business

concern, that the assessee was not treating that unit as a separate and independent

business but was treating it as a part of the integrated whole business and, therefore,

the sale of the lamp division was not in the nature of a slump sale as a going concern.

The Tribunal held that the transaction of sale of the unit by the assessee was a

transaction in the nature of slump sale of a going concern as a whole, that since the

unit was a capital asset within the meaning of section 2(14) of the Act, the profits on

transfer of such capital asset were to be treated as long-term capital gains. Neither the

provisions of Sec. 50 nor the provisions of section 50B would be attracted but the

provisions of sections 45 and 48 would be applied. On appeal by the department, the

Hon'ble High Court held as under:

".....the Tribunal held that section 50 would not be applicable in the assessee's

case, as it was not a case of transfer of a depreciable asset, but for transfer of

the entire unit as a whole and the sale consideration settled between the parties

was not only for the depreciable assets but for all intangible or tangible assets

including goodwill, licences and liabilities. Even the stamp duty for transferring

the land and building was part of the sale consideration, as it was to borne by

the transferee. The sale of the unit was thus, a composite sale and, therefore, a

case of slump sale. When an undertaking was sold it was to be understood as a

whole of undertaking. Therefore, section 50 dealing with the depreciable assets

would not be applicable when the entire unit as a going undertaking was sold

by the assessee."

From the above discussion it is clear that if ongoing concern is sold for a lump sum

amount it has to be treated a slump sale and had to be taxed as such. In such cases

23-02-2023 (Page 10 of 21) www.manupatra.com Symbiosis University

itemised sale of the assets is not there-an amount is paid for transferring an

independent unit. To find out the facts of the case we would like to refer to the

agreement entered in to by the assessee with the JV company.

4.6. We have perused the Business Transfer Agreement (BTA), dated 01.02.1998 and

deed of transfer of land and building of Bangalore Works Undertaking dt. 11.3.1998. We

find that the agreement was entered in to between the parties on the following

understanding-

"Whereas, L & T desires to sell to JVC, and JVC desires to purchase from L & T,

a part of L & T's construction equipment manufacturing business alongwith

certain facilities and assets relating thereto at the Plant on the terms and

conditions set forth herein;"

The definitions provided in the BTA would be beneficial to resolve the issue. The

agreement has defined Benefit Plans, Business Transfer Approvals and Current Liabilities

as under:-

"Benefit Plans" means all superannuation, provident fund, gratuity, profit

sharing, retirement, deferred compensation, bonus, severance or termination

payment, disability, hospitalization, medical insurance, life insurance, life

insurance and other benefit plans, programs, policies or arrangements with

respect to the Transferred Employees.

"Business Transfer Approvals" shall mean all approvals, authorizations,

permission, consents and licenses from government authorities in India and L &

T's shareholders necessary to transfer the L & T Transferred Business to JVC.

"Current Liabilities" means the liabilities of L & T including but not limited to

credits, loans and advances payment, pre-payment (if any) which shall be

assumed by JVC on the Final Closing Date."

At page-283 of the PB L & T assets of L & T have been defined as under:-

"L & T Assets" means all of the assets used in or otherwise related to the L &

Tribunal Transferred business on the Final Closing Date, including without

limitation the following.....Excluding the manufacturing facilities belonging to

the Engine Division, the plant, machinery and office equipment belonging to the

Marketing Division, Parts & Service divisions and the Training Centre."

L & T transferred business has been defined at pg. 284 of the PB as under:

"L & T Transferred Business" means the business, as a going concern, of

manufacturing the construction equipment and component thereof as well as

various hydraulic equipment, including custom engineered systems and

applications thereof which L & T presently manufactures at the Plant, excluding

engines, vibratory compactors, wheel loaders, backhoe loaders and dump

trucks."

Clause 2 of the BTA is about transfer of business and liabilities. We are reproducing the

relevant portion:-

"2.1 Transfer of Business

Subject to the terms and conditions hereof, on the Final Closing Date L & T

23-02-2023 (Page 11 of 21) www.manupatra.com Symbiosis University

shall transfer, convey, assign, sell and deliver to JVC, and JVC shall acquire the

L & T Transferred Business and L & T Transferred Assets, free and clear of all

Liens.

2.2 Transfer of Liabilities

Except the L & T Assumed Liabilities and Current Liabilities which, subject to

the terms and conditions hereof, shall be assumed by JVC on the final Closing

Date, JVC does not assume, and shall not be deemed to have assumed at any

time, any obligations or liabilities of L & T, whether arising out of or relating to

the L & -T Transferred Business, or otherwise.

3. Purchase Price

3.1 Consideration

The total consideration to be paid to L & T by JVC for the L & T Transferred

Business shall be in an amount equal to the Effective Amount plus/minus

Adjustment Amount (the "Final Closing Amount").

As of the Effective Date, the Parties have agreed upon the Effective Amount as

set out in the Exhibit-A hereto, based upon the valuation confirmed by Komatsu

and mutually agreed."

A perusal of the above leaves no doubt that the assessee had sold a going concern and

the JV had taken over all the assets and liabilities of the assessee for a lumpsum price.

We further hold that earth moving equipment manufacturing unit was an independent

unit and was sold to the JV for Rs. 186.10 crores without assigning any individual value

to either fixed assets or current assets, that it was sale of undertaking as a whole. It is

found that the said unit was allowed 80I deduction in earlier years. It proves that it was

not dependent on other divisions located at Bangalore. It is not the case of the AO that

the other units were not doing their businesses independently or they were inseparably

linked with the unit sold by the assessee. In fact they were catering the need of all

other divisions. As an independent unit, earth moving manufacturing unit, was a

separate business having its own assets and liabilities. The assessee had transferred

that division to JV for a lump sum amount. While doing so, depreciation was not

claimed on the assets transferred.

It is also found that the entire plot of land of the earth moving equipments

manufacturing unit was transferred to JV, none of the assets located at any other plant

was transferred by the assessee. In our opinion, the transfer deed executed on 19.03.98

for transfer of land and building was only for the purpose of conveyance and

registration of immovable property, that the said transfer deed did not contain any

specific value for transfer of plot of land and building, that the value declared by it was

for the purpose of stamp duty and registration. We find that in the agreement the

assessee had specifically mentioned that the property was valued at Rs. 59.31 crores for

registration purposes. It is further found that in application made u/s. 230A of the Act,

the total sale consideration for transfer of construction manufacturing undertaking was

mentioned and no separate value for land and building was indicated. Considering the

above, we are of the opinion that no value was assigned to plot of land and building

while transferring the assets to the JV and that the assessee had transferred the

business at a lumpsum consideration by way of slump sale without assigning any

individual value to various assets and liabilities.

23-02-2023 (Page 12 of 21) www.manupatra.com Symbiosis University

4.7. We find that one of the reasons, given by the FAA, for not considering the

transaction a slump sale was that the purchaser had assigned cost to the assets

acquired by it. It is a coincidence that the AO for the assessee happened to be the AO

for the JV also and from the return of income of the JV he found that the purchaser had

shown exact cost of each of the assets. In our opinion, it cannot be the deciding factor.

A purchaser of a going concern has to assign cost to the assets received by it.

Accounting standard mandates that the entity acquiring a going concern has to get its

assets valued. But, valuation report obtained by the purchaser do not prove at all that

the assets had the same value for the seller. Once an assessee sells the lock stock and

barrel of a unit for that assessee individual items loose existence. In the case before us,

there is nothing on record to show that the value shown by the JV was the itemized

value of the assets owned by the assessee. Considering the above discussion, we hold

that the sale of earth moving manufacturing unit was a slump sale. Here, we want to

make it clear that the assessee would not be entitled to claim loss for the transaction in

question. Finally, reversing the order of the FAA, we decide ground No. 3 in favour of

the assessee, in part.

5. Fourth ground of appeal is about upholding the computation of deduction u/s. 80HHC

of the Act on following basis:-

i. total turnover was taken inclusive of unclaimed credit balance and scrap sale

ii. 90% gross interest received was reduced from the profits of business

iii. loss on export of trading goods was set off against profit on export of

manufacture goods

iv. 90% of miscellaneous income was reduced from the profits of business

During the course hearing before us, the AR and the DR stated that issue of inclusion on

scrap sales in the total turnover (Rs. 1701.62 lakhs) was decided in favour of the

assessee by the Tribunal in A.Y. 1997-98 as under:-

"7. Ground Nos. 5 & 6 relate to the claim of deduction u/s. 80HHC and 80HHE

of the Act. These grounds have three components:

a) Inclusion of scrap sales and other items of miscellaneous income in

the total turnover. Similar issue has been considered by the Tribunal in

ITA No. 2200/Mum/2000 at para 31 on page 11 of its order, wherein

the Tribunal has followed its own order in the assessee's own case for

A.Y. 1994-95 in ITA Nos. 4265 & 4892/Mum/98. Facts being identical,

respectfully following the decision of the Tribunal in assessee's own

case, we direct the Assessing Officer to give relief accordingly as

claimed under part (a) herein above.

b) Set off of loss of export of trading goods against profit on export of

manufactured goods. Similar issue has been considered by the Tribunal

in ITA No 2200/Mum/2000 at para 32 on page 11 of its order, wherein

the Tribunal has followed its own order in the assessee's own case for

A.Y. 1994-95 in ITA Nos. 4265 & 4892/Mum/98. Facts being identical,

respectfully following the decision of the Tribunal in assessee's own

case, findings of the CIT(A) are confirmed. Part (b) is accordingly

dismissed.

23-02-2023 (Page 13 of 21) www.manupatra.com Symbiosis University

c) This relates to computation of indirect cost attributable to trading

exports inclusive of sales and administration overheads, interest and

brokerages. This part has not been pressed before us by the learned

senior counsel and is therefore dismissed."

"22. Ground Nos. 13 to 15 relates to the claim of deduction u/s. 80HHC and

80HHE of the Act. The Assessing Officer has discussed this issue at para 26 on

page 21 of his order. The CIT(A) has allowed the appeal of the assessee vide

para 25 & 26 on page 15 of his order. We find that the Tribunal had an

occasion to consider similar grievance in assessee's own case in ITA No.

2200/M/2000. The Tribunal considered this issue at para 29 on page 10 of its

order. We find that the Tribunal has followed the earlier orders of the Tribunal

in assessee's own case in ITA No. 4265 & 4892/Mum/98 as also in ITA No.

987/Mum/98. Facts and issues being identical, respectfully following the

decision of the Tribunal in assessee's own case, ground No. 13, 14 & 15 are

accordingly dismissed."

Respectfully following the orders of the Tribunal in earlier years part of the issue, raised

by the assessee, is decided in its favour.

6 . The next item is with regard to unclaimed credit balance in the total turnover (Rs.

76.10 crores). While deciding the appeal, filed by the assessee, the first appellate

authority (FAA) followed the order of his predecessor of the earlier A.Y. and decided the

issue against the assessee. Before us, the AR relied upon the case of Jeyar Consultants

and Investments Pvt. Ltd. (46 ITD 71). The DR supported the order of the FAA. We have

heard the rival submissions and perused the material before us. We find that the issue

is covered in favour of the assessee by the decision of Jeyar Consultants (supra), relied

upon by it. Therefore, we decide issue in favour of the assessee.

7. Next ground is about the 80HHC calculation and reduction of 90% of gross interest

receipt (Rs. 6078 lakhs) from the profits of business disregarding interest paid of Rs.

13,512 lakhs by the assessee. During the course of hearing before us, AR and DR stated

that identical issue was deliberated upon by the Tribunal while deciding the issue for

A.Y. 1997-98. We find that at page 9 of the order (para 22), the Tribunal has decided

the issue as follows:

"22. Ground Nos. 13 to 15 relates to the claim of deduction u/s. 80HHC and

80HHE of the Act. The Assessing Officer has discussed this issue at para 26 on

page 21 of his order. The CIT(A) has allowed the appeal of the assessee vide

para 25 & 26 on page 15 of his order. We find that the Tribunal had an

occasion to consider similar grievance in assessee's own case in ITA No.

2200/M/2000. The Tribunal considered this issue at para 29 on page 10 of its

order. We find that the Tribunal has followed the earlier orders of the Tribunal

in assessee's own case in ITA No. 4265 & 4892/Mum/98 as also in ITA No.

987/Mum/98. Facts and issues being identical, respectfully following the

decision of the Tribunal in assessee's own case, ground No. 13, 14 & 15 are

accordingly dismissed."

Respectfully following the above order, part of the issue involved is allowed in favour of

the assessee.

8. The next item is set off of losses on export trading goods against profit on export of

manufactured goods. The AR of the assessee fairly conceded that the Tribunal has

dismissed the appeal of the assessee in that regard, while deciding the appeal for A.Y.

23-02-2023 (Page 14 of 21) www.manupatra.com Symbiosis University

1997-98. We are reproducing the relevant portion of that order.

"b) Set off of loss of export of trading goods against profit on export of

manufactured goods. Similar issue has been considered by the Tribunal in ITA

No 2200/Mum/2000 at para 32 on page 11 of its order, wherein the Tribunal

has followed its own order in the assessee's own case for A.Y. 1994-95 in ITA

Nos. 4265 & 4892/Mum/98. Facts being identical, respectfully following the

decision of the Tribunal in assessee's own case, findings of the CIT(A) are

confirmed. Part (b) is accordingly dismissed."

Considering the above, this issue is decided against the assessee.

9. Now, we would discuss the last item of the reduction 90% of miscellaneous income

received from profits of business (Rs. 3549.29 lakhs). We find that it included

Recoveries from S & A companies (Rs. 438.04 lakhs), Service fees (Rs. 354.54 lakhs)

Guest house recoveries (Rs. 20 lakhs), Training/tuition fees (Rs. 36.98 lakhs), Profit on

sale of stores/bunkers (Rs. 12. 14 lakhs), Provision no longer required (Rs. 209.72

lakhs), Verification charges (Rs. 10.37 lakhs), Recovery of damages from customers

(Rs. 34.03 lakhs), Issue of nursery plants (Rs. 8.66 lakhs), Royalty received (Rs. 36.06

lakhs), Sales promotion reimbursement-Cannon Singapore (Rs. 56.89 lakhs), Export

incentives (Rs. 1422.16 lakhs), Collection against outstanding (Rs. 72. 08lakhs), Other

miscellaneous income (Rs. 1041.422 lakhs), Less profit on sale of import licence (Rs.

184 lakhs) considered separately).

9.1. During the assessment proceedings, the AO, referring to the matter of K.K. Doshi

(MANU/MH/0679/2000 : 245 ITR 849) held that all the above mentioned receipts were

not directly derived out of the export activities of the assessee, that there was no nexus

between those receipts and the export business, that same were to be excluded to the

extent of 90% as per the provisions of section 80HHC expl. (bba) He recalculated the

profit of the business at page No. 31 of the assessment order.

9.2. In the appellate proceedings, the FAA held that there was no merit in the case of

the assessee, that the AO was justified in applying explanation (baa) and following the

decision of K.K. Doshi (supra).

9.3. Before us, the AR relied upon the orders of Sharda Gums and Chemicals Industrial

Area (76 ITD 282) and Honda Siel Power Products Ltd. (77 ITD 123). The DR supported

the order of FAA. We have heard the rival submission and material before us. We find

that the issue decided by the Tribunal in the case of Honda Seil Power Products (supra)

did not deal with the issue raised before us. We would like to reproduce the question

raised in the appeal and same reads as under:

"That, on the facts and in the circumstances of the case, the learned

Commissioner of Income Tax (Appeals)-IV, Calcutta erred in law as well as on

facts in holding that the Assessing Officer was not justified in adding back Rs.

90,80,314 under section 40A(3) while processing the return under section

143(1)(a) and in that view directed the Assessing Officer to delete the said

disallowances by passing order under section 154 of the Income-tax Act, 1961."

In our opinion, the above referred case is of no help to the assessee. In the case of

Sharda Gums (supra) issue of interest income has been decided. It does not deal with

the other items. Thus, the cases relied upon by the assessee are of little help to the

resolve the issue. But, on the other hand the stand taken by the departmental

authorities is also defective. We find that the AO and the FAA have relied upon the case

23-02-2023 (Page 15 of 21) www.manupatra.com Symbiosis University

of K.K. Doshi (supra) that stands reversed by the Hon'ble Apex Court

(MANU/SC/8246/2007 : 297 ITR 38). Therefore, we are of the opinion that the issue

needs a fresh adjudication at the level of the AO. In the interest of justice we are

remitting back the issue to the file to the FAA for fresh adjudication. He is directed to

consider all the items, mentioned at paragraph 9 of our order and decide the issue

afresh.

1 0 . Next ground of appeal is about reducing the amount claimed as exempt under

section 10(15) and 10(33) of the Act. During the assessment proceedings, the AO found

that the assessee has claimed exemption u/s. 10(15) and 10(33) respectively

amounting to Rs. 2.75 crores, being interest from tax free bonds and for dividend

receipts at Rs. 19.79 crores. The AO observed that income itself was exempt therefore

expenditure relating to such income had to be disallowed. He referred to the case of

Distributors Baroda Ltd. (MANU/SC/0146/1985 : 155 ITR 120) and the circular No. 780

dated 04.10.1988 issued by the CBDT. He directed the assessee to filed explanation in

this regard. After considering the submissions of assessee firm dated 13.02. 2010, the

AO stated that there was no case of indivisible business, that the business of the

assessee consisted of multifarious activities, that making of investment in shares and

tax free bonds was not the part of its business activities, that the investments were not

the part of stock-in-trade of the business carried out by it. Finally, he held and ad hoc

expenditure @ 5% under the head Establishment and Administrative Charges was to be

deducted. He worked out the disallowance at Rs. 12.85 lakhs out of the claim made

under section 10(15) and of Rs. 98.97 lakhs out of the claim made under section 10(33)

of the Act.

10.1. Aggrieved by the order of the AO the assessee filed an appeal before FAA. After

considering the assessment order and the submission of the assessee, the FAA held the

provisions of section 14A r.w. rule 8D of the Income Tax Rules, 1962 (Rules) were

clearly applicable to the facts of the case, that there was scope for making an estimated

disallowance of expenditure attributable to exempt income as per the direction of the

FAA, the assessee furnished a working of disallowance as per Rule 8D. The FAA found

that as per the working disallowance has to be made at Rs. 3.90 crores in place of Rs.

1.119 crores. It was contested that the provisions of section 14A r.w. Rule 8D could not

be applied retrospectively. Referring to the decision of the Daga Capital Investment Ltd.

(26 SOT 603), the FAA held Rule 8D as well as the provisions of sub-sections (2) and

(3) were retrospective in operation, that all direct and indirect expenses relatable to

exempted income. Accordingly he directed the AO to work out the disallowance after

examining the working submitted by the assessee.

10.2. Before us the AR started that in A.Y. 1997-98 the FAA has deleted the ad-hoc

addition of 5% made by the AO in respect of expenses related to dividend income and

interest on tax free bonds, that the Tribunal confirmed the deletion in respect of

expenses related to dividend income, that the Tribunal had disallowed the expenses

relating to interest on tax free bonds @ 2%, that strategic investments made by the

assessee, should be excluded for 14A disallowance. The DR relied upon the order of the

FAA.

10.3 We have heard the rival submissions and perused the material before us. We find

that while deciding the appeal for the A.Y. 1997-98, the Tribunal had disallowed the

expenses relating to interest on tax free bonds @ 2%, and had held that strategic

investments made by the assessee, should be excluded for 14A disallowance. Following

the same, ground raised by the assessee is allowed in its favour, in part.

23-02-2023 (Page 16 of 21) www.manupatra.com Symbiosis University

11. Next ground of appeal is about addition of Rs. 12.94 crores, in computing book

profit under section 115JA of the Act. The AR and DR stated that this issue stands

decided in light of the decisions delivered in the cases of Vijaya Bank (231 CTR 209),

TRF Limited (MANU/SC/0150/2010 : 323 ITR 397). The second item with regard to

computation under section 115JA is about disallowance made under section 14A of the

Act. Respectfully, following the judgment of Vijaya Bank (supra) and TRF Ltd. (supra)

we allow the appeal filed by the assessee. Second item being of consequential nature,

stands allowed for statistical purposes.

12. Ground seven deals with deduction of capital recovery portion embedded in lease

rental income. Before us, the AR stated that the ground being infructuous was not be

adjudicated. Same stands dismissed.

1 3 . Ground No. 8 deals with disallowance of professional fees for projects not

materialized, amounting to Rs. 10.65 lakhs. The AR conceded that identical issue was

decided against the assessee by the Tribunal while deciding the appeal for A.Y. 1990-91

and 1993-94 as under:-

"6.17 The tenth ground is regarding the disallowance of expenditure incurred

by the assessee in connection with the projects not materialized. The

disallowance amounts to Rs. 6,49,501. The expenses were incurred towards

professional fees, foreign travel, local travel and consultancy fees in respect of

proposed projects but ultimately not materialized. In support of the contention,

the learned Counsel has relied on various decisions including the decision of

the Andhra Pradesh High Court in the case of CIT Vs. Coromandel Fertilizers

[MANU/AP/0729/2001 : 247 ITR 417], Calcutta High Court in the case of CIT

VS. Graphite India Ltd. [MANU/WB/0079/1996 : 221 ITR 420] and that of

Gauhati High Court in the case of DCIT Vs. Assam Asbestos Limited

[MANU/GH/0107/2003 : 185 CTR 223]. This issue was considered by the

Tribunal in assessee's own case for the assessment year 1989-90 (mentioned

supra). The Tribunal after considering the facts and circumstances of the case

has confirmed the 50% disallowance made by the Assessing Authority. The

expenses were incurred for flat glass project, market survey for fruits and

vegetables, tyre project, bulk drugs etc. We agree with the CIT(A) that even

though the proposed projects may he intimately connected to the existing

business carried on by the assessee, the assessee-company was in fact

exploring the prospectus of new units. Those units were not ultimately

successful; we can say that they were all aborted projects. Therefore, those

expenses are to be treated in the nature of loss of capital instead of revenue

expenditure deductible in computing the income of the running business. Even

though the items of expenditure may be in the nature of revenue expenses per

se, those expenses were incurred not in connection with the business carried on

by the assessee-company but those expenses were incurred for the business

which were proposed by the assessee-company to commence and carry on. This

line of distinction cannot overlooked. Therefore, in the light of the statutory

provision governing the subject, we hold that this expenditure cannot be

allowed and the lower authorities have rightly disallowed the expenditure

incurred in connection with the projects not materialized. This ground is also

dismissed.

6.19 The twelfth ground raised by the assessee is against the disallowance

under Rule 6D on per employee per trip basis. The Bombay High Court in the

case CIT Vs. Acrow India Ltd. [MANU/MH/0186/1997 : 229 ITR 325] has upheld

23-02-2023 (Page 17 of 21) www.manupatra.com Symbiosis University

the principle of per employee per trip, and therefore, the ground of the

assessee is to be dismissed. The disallowance is, accordingly, confirmed.

11.7 The seventh ground raised by the assessee is against the disallowance of

foreign travel expenses of Rs. 73,575/-. The disallowance is confirmed and the

ground is dismissed in view of our decision for the assessment year. 1990-91.

17.8 The eighth ground is in respect of expenditure incurred on new project -

Dismissed.

17.9 The ninth ground is in respect of foreign travel expenditure - Dismissed."

Following the above, ground No. 8 is decided against the assessee.

14. The assessee has raised two additional grounds. The first is about calculation of

book profit for deduction under section 80HHC. It was argued that it should be on the

basis of profit as per P & L Account instead of normal book profit. The AR referred to

the case of Bahary Information Technology System Pvt. Ltd. (SLP No. 33750 of 2009)

and stated that suitable direction should be issued to the AO. Considering the facts of

the case we direct the AO to follow the decision of Bahary Information Technology

System Pvt. Ltd. (supra) while calculating the book profit for deduction u/s. 80HHC of

the Act. Additional ground No. 1 is allowed for statistical purposes.

15.1 With regard to second additional ground the AR stated that it was infructuous. So,

same stands dismissed.

ITA 4599/Mum/2010:

16. First ground of appeal, raised by the AO, is about disallowance of claim for loss in

computation of value of work-in-progress on construction contracts (Rs. 15,39,06,000/-

). The DR and the AR conceded before us that identical issue was decided in favour of

the assessee by the Tribunal, while deciding the appeal in ITA No. 4299/Mum/2001 for

A.Y. 1997-98 as under:

"14. Ground No. 5 with its sub grounds relate to deletion of the addition of Rs.

10,75,11,000/- on account of unforeseeable losses in computation of work-in-

progress on construction account. This issue has been considered by the

Assessing Officer at para 16 on page 9 of his order and the same has been

considered by the CIT(A) at para 11 on page 4 of his order. Similar issue was

considered by the Tribunal in ITA No. 2863/Mum/2000 at para 44 and 45 on

page 15 of its order, wherein the Tribunal has followed its findings for A.Y.

1994-95 in ITA No. 4264& 4982/Mum/98. Facts and issues being identical,

respectfully following the decision of the Tribunal in the assessee's own case,

findings of the CIT(A) are confirmed. Ground No. 5 with its sub ground is

accordingly dismissed."

Respectfully following the above, ground No. 1 is decided against the AO.

17. Next ground of appeal is about expenditure on construction of jetty. We find that

this issue stands decided in favour of the assessee by the Tribunal in ITA No.

4299/Mum/2001 for A.Y. 1997-98, wherein it was held as under:

"13. Ground No. 4 relates to the deletion of the addition made on account of

expenditure on construction of jetty at Gujarat Cement Plat Rs. 9,58,53,000/-.

This issue has been discussed by the Assessing Officer at para 15 of page 8 of

23-02-2023 (Page 18 of 21) www.manupatra.com Symbiosis University

his order and the same has been considered by the CIT(A) at para 10 page 4 of

his order. Similar disallowance was considered by the Tribunal in the assessee's

own case in ITA No. 2863/Mum/2000 at para 42 and 43 on pages 14 & 15 of its

order, wherein the Tribunal has followed its findings in assessee's own case for

A.Y. 1994-95 in ITA Nos. 4265 & 4892/Mum/98. Facts and issues being

identical, respectfully following the decision of the Tribunal, findings of the

CIT(A) are confirmed. Ground No. 4 is accordingly dismissed."

Respectfully following the above, ground No. 2 is decided against the AO.

18. Third ground of appeal is about expenses on cement plants (Rs. 34,44,57,820/-). It

is found that the issue has been decided in favour of the assessee by the Tribunal in

ITA/4299/Mum/2001 for A.Y. 1997-98 wherein it has held as under:

"15. Ground No. 6 is with its sub ground relates to the deletion of the addition

of Rs. 19,67,31,697/- on account of expenses on Cement Plants. This issue has

been considered by the Assessing Officer at para 21 on page 13 of his order

and the same has been considered by the CIT(A) at para 15 on page 6 of his

order. Similar issue came up for hearing before the Tribunal in the assessee's

own case in ITA No. 2200/Mum/2000, wherein the Tribunal has considered this

issue at para 17 to 21 of its order, wherein the Tribunal has followed its

decision in the assessee's own case for A.Y. 1982-83 and 1990-91 to 1994-95.

Facts and circumstances being identical, respectfully following the decision of

the Tribunal in the assessee's own case, the findings of the CIT(A) are

confirmed. Ground No. 6 with its sub ground is accordingly dismissed."

Respectfully following the above, ground No. 3 is decided against the AO.

19. Fourth ground of appeal is about expenses on cement plants (towards setting up of

new captive power section) depreciation (Rs. 5,71,69,219/-). We observe that the issue

before us has been decided by the Tribunal, in favour of the assessee, while

adjudicating the appeal for the A.Y. 1997-98 (supra). Respectfully following the above,

ground No. 4 stands dismissed.

2 0 . Fifth ground of appeal is about interest and commitment charges in respect of

borrowings made for cement projects (Rs. 1,59,85,43,981/-). It is found that the issue

has been deliberated upon and decided in favour of the assessee by the Tribunal in ITA

No. 4299/Mum/2001 (supra). The Tribunal has held as under:

"16. Ground No. 7 with its sub ground relates to the deletion of the addition of

Rs. 71,87,42,880/- on account of interest and commitment charges in respect

of borrowings made for Cement Projects. The disallowance has been made by

the Assessing Officer at para 22 on page 15 of his order and the CIT(A) has

deleted the additions as discussed at para 17 on page 12 of his order. Similar

disallowance was considered by the Tribunal in the assessee's own case in ITA

No. 2863/Mum/2000 at para 46 at page 15 of its order, wherein the Tribunal

has followed the findings in the assessee's own case for A.Y. 1994-95 in ITA

Nos. 4264 & 4892/Mum/98. Facts and issues being identical, respectfully

f9ollowng the decision of the Tribunal in these own case the findings of the

CIT(A) are confirmed. Ground 7 with its sub grounds is accordingly dismissed."

Respectfully following the above, ground No. 5 is decided against the AO.

21. Sixth ground of appeal is about charges, including commitment charges, in respect

23-02-2023 (Page 19 of 21) www.manupatra.com Symbiosis University

of borrowings made for cement projects (Rs. 5.61 crores). Representatives of both the

sides agreed that the issue stands decided against the AO by the Tribunal order for the

A.Y. 1997-98 (supra). We are reproducing the relevant portion of the order wherein it

was held as under:-

"16. Ground No. 7 with its sub ground relates to the deletion of the addition of

Rs. 71,87,42,880/- on account of interest and commitment charges in respect

of borrowings made for Cement Projects. The disallowance has been made by

the Assessing Officer at para 22 on page 15 of his order and the CIT(A) has

deleted the additions as discussed at para 17 on page 12 of his order. Similar

disallowance was considered by the Tribunal in the assessee's own case in ITA

No. 2863/Mum/2000 at para 46 at page 15 of its order, wherein the Tribunal

has followed the findings in the assessee's own case for A.Y. 1994-95 in ITA

Nos. 4264 & 4892/Mum/98. Facts and issues being identical, respectfully

following the decision of the Tribunal in these own case the findings of the

CIT(A) are confirmed. Ground 7 with its sub grounds is accordingly dismissed."

Respectfully following the above, ground No. 6 is decided against the AO.

22. Ground No. 7 of appeal is about Mining lease, Mining Development expenses (Rs.

1,34,86,433/-). During the course of hearing of the appeal it was found that this issue

is considered and decided in favour of the assessee by the Tribunal in

ITA/4299/Mum/2001 for A.Y. 1997-98 wherein it was held as under:

"20. Ground No. 11 relates to the deletion of the addition of Rs. 8,91,120/- on

account of expenditure incurred on mining lease. The Assessing Officer has

disallowed this amount as per the discussions at para 25 on page 20 of his

order. The CIT(A) has deleted the addition vide para 23 at page 15 of his order.

Similar findings of the CIT(A) was confirmed by the Tribunal in ITA No.

3533/Mum/2001 in assessee's own case for A.Y. 1996-97, vide para 97 on page

25 of its order, wherein the Tribunal followed its own findings in the case of the

assessee in earlier years. Facts and circumstances being identical, respectfully

following the decision of the Tribunal, ground No. 11 is dismissed."

2 1 . Ground No. 12 relates to the deletion of Rs. 1,00,65,540/- being

expenditure incurred on mining. This issue has been considered by the

Assessing Officer at para 25 of his order. The additions made by the Assessing

Officer has been deleted by the CIT(A) vide para 24 at page 15 of his order.

The Tribunal has dismissed a similar ground in ITA No. 2200/Mum/2000 vide

para 22 on page 8 of his order. We have no hesitation in following the findings

of the Tribunal in the assessee's own case. Ground No. 12 is accordingly

dismissed."

Respectfully following the above, ground No. 7 stands dismissed.

23. Ground No. 8 of appeal is about interest under section 244A of the Act. At the time

of hearing the AR for the assessee submitted that this issue is considered and decided

in favour of the assessee by the Tribunal for A.Y. 1997-98. The DR could not controvert

the claim made by the AR. Therefore, respectfully following the above order of the

Tribunal, last ground is decided against the AO.

As a result, appeal filed by the assessee stands partly allowed and appeal of the AO is

dismissed.

23-02-2023 (Page 20 of 21) www.manupatra.com Symbiosis University

Order pronounced in the open court on 27th July, 2016.

© Manupatra Information Solutions Pvt. Ltd.