Professional Documents

Culture Documents

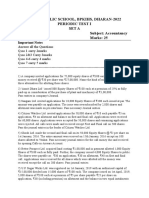

CBSE Class 12 Accountancy - Issue of Shares

Uploaded by

SahyogCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBSE Class 12 Accountancy - Issue of Shares

Uploaded by

SahyogCopyright:

Available Formats

Downloaded from www.studiestoday.

com

Chapter - Issue Of Shares

1. S Ltd. offers 1,00,000 equity shares of Rs.10 each payable Rs.3 on application, Rs.3 on

allotment(including premium Rs.2), Rs.4 on first call three months after allotment and Rs.2 on final call

three months after first call. Applications were received for 1,58,500 shares and allotment was made as

under:

Shares Allotted

Allotment in full 19,000

(Mr. D paid in full on allotment in respect

of 4,000 shares)

Allotment of 2/3 of shares applied for 80,000

Allotment of 1/2 of shares applied for 1,000

Application money of Rs.52,500 in respect of 17,500 shares upon which no allotment was made was

returned to applicants. All amounts were received except final call on 100 shares which were forfeited

and reissued later on Rs.9 each. Interest on call in advance is paid @ 12% p.a.(capital reserve Rs.700)

2. Rajesh Ltd. issued a prospectus inviting applications for 3,00,000 shares of Rs.10 each at a premium of

Rs.4 per share, payable as follows:

On Application Rs.4(including Rs.1 premium)

On Allotment Rs.3(including Rs.1 premium)

On First Call Rs.4(including Rs.1 premium)

On Second and Final call Rs.3(including Rs.1 premium)

Applications were received for 3,80,000 shares and pro-rata allotment was made on the applications for

3,50,000 shares. It was decided to utilise excess application money towards the sums due on allotment.

X, to whom 6,000 shares were allotted, failed to pay the allotment money and his shares were

forfeited after allotment.

Y, who applied for 10,500 shares failed to pay the two calls and on his such failure, his shares were

forfeited.

Z, who was allotted 3,000 shares did not pay the final call.

Of the shares forfeited, 11,000 shares were reissued as fully paid up for Rs.9 per share, the whole of Y's

share being included. Prepare Cash Book, Journal and show the Share Capital in the Balance

Sheet.(capital reserve Rs.41,333)

3. Journalise the following(only forfeiture and reissue):

(A) A limited company for forfeited 300 shares of Mr.X who had applied for 500 shares on account of

non-payment of allotment money Rs.3+2(premium) and first call Rs.2. Only Rs.3 per share was received

with application. Out of these, 200 shares were reissued to Mr. Y as fully paid shares for Rs.8 per

share.(capital reserve Rs.600)

(B) A company forfeited 200 shares of Rs.10 each fully called up issued at 10% discount on which Rs.3

per share was received with application. Amount required to be paid was Rs.2 on allotment, Rs.2 on

First call and Rs.2 on final call. Out of these, 100 shares were reissued to Mr. M as fully paid shares at

Rs.8 per share.(capital reserve Rs.200)

Downloaded from www.studiestoday.com

Downloaded from www.studiestoday.com

4. Jain Ltd. invited applications for issuing 35,000 shares of Rs.10 each at a discount of 10%. The amount

was payable as follows:

On application - Rs.5 per share; On allotment - Rs.3 per share; On First and Final call-Balance

Applications for 50,000 shares were received. Applications for 8,000 shares were rejected and the

money of these applicants was refunded. Shares were allotted on pro-rata basis to the remaining

applicants and the excess money received with applications from these applicants was adjusred towards

sums due on allotment. Jeevan, who had applied for 600 shares failed to pay allotment and first and

final call money. Naveen, the holder of 400 shares failed to pay first and final call money. Shares of

Jeevan and Naveen, were forfeited. Out of these forfeited shares, 800 shares were reissued @Rs.15 per

share fully paid up. The reissued shares included all the shares of Naveen.

Pass the necessary journal entries for the above transactions in the books of Jain Ltd.(capital

reserve Rs.5,600)

5. Sonam Ltd. issued 20,000 shares of Rs.10 each at a discount of rs.1 per share(to be adjusted on

allotment) payable as follows:

Rs.2.50 per share on Application

Rs.4 on per share on Allotment

Rs.2.50 per share on Ist and final call

Subscription list was closed on Ist January, 2012 by which applications for 45,000 shares had been

received. Allotment was made as follows:

List A - Applicants for 5,000 shares were allotted in full

List B - Applicants for 10,000 shares wee allotted 5,000 shares on pro-rata basis

List C - Applicants for 30,000 shares were allotted 10,000 shares on pro-rata basis.

Application money in excess of that required on allotment could be utilised for calls.

All the shareholders paid the amounts due on allotment and call except Y (who was allotted 400 shares

under List B) and Z(who was allotted 200 shares under List C). Both of these shareholders paid only the

application money.

Their shares were duly forfeited and were reissued @Rs.7 per share full paid up.

Pass necessary journal entries to record the above transactions.(capital reserve Rs.2,300)

6. Sudarshan Ltd. invited applications for 1,00,000 equity shares of Rs.10 each. The shares were issued

at a premium of Rs.5 per share. The amount was payable as follows:

On Application and allotment Rs.8 per share(including premium Rs.3)

Balance including premium on the first and final call.

Applications for 1,50,000 shares were received. Applications for 10,000 shares were rejected and pro-

rata allotment was made to the remaining applicants on the following basis:

(I) Applicants for 80,000 shares were allotted 60,000 shares; and

(2) Applicants for 60,000 shares were allotted 40,000 shares.

Excess application and allotment money could be utilized for calls.

X, who belonged to the first category and was allotted 300 shares, failed to pay the first call money.

Y, who belonged to the second category and was allotted 200 shares also failed to pay the first call

money. These shares were forfeited. the forfeited shares were reissued @ Rs.12 per share fully paid-up.

Pass the necessary journal entries and prepare Cash Book.( capital reserve Rs.4,100).

7. Fresco Ltd. invited applications for issuing 3,00,000 Equity shares of Rs.10 each at a discount of 3%.

The amount was payable as follows:

On Application - Rs.2 per share

Downloaded from www.studiestoday.com

Downloaded from www.studiestoday.com

On Allotment - Rs.4 per share

On First and Final call - the balance amount

The issue was fully subscribed. Shares were allotted to all the applicants. 'A' to whom 4,000 shares were

allotted paid the entire amount of his share money at the timeof allotment. 'B' to whom 1,800 shares

were allotted failed to pay the allotment money and his shares were immediately forfeited. Afterwards

the first and final call was made. 'C' did not pay the first and final call on hid 750 shares and his shares

were also forfeited. All the forfeited shares of 'B' and 500 shares of 'C' were reissued for Rs.8 per share

fully paid up.

Pass necessary journal entries in the books of Fresco Ltd. for the above transactions.(C/R Rs.2,690)

VALUE BASED QUESTIONS

8. Green Valley Ltd. offered 5,00,000 shares to public for subscription. Applications were received for

7,50,000 shares and pro-rata allotment was made to the applicants of 6,00,000 shares. Arushi applied for

4,800 shares and Navya was allotted 3,000 shares.

(A) How many applications have been rejected altogether?

(B) What is the pro-rata ratio?

(C) Which value has been affected by rejecting the applications. Suggest a better alternative for the

same.

9. Chirag Ltd. forfeited 3,000 shares of Rs.10 each, Rs.7 called up, issued at a premium of 20%( to be

paid at the time of allotment) for non-payment of a first call of Rs.2 per share. Out of these 1,800 shares

were reissued @Rs.7 paid up for Rs.4 per share.Which value has been affected by forfeiting above

mentioned 3,000 shares just after first call. Suggest a better alternative.

10.(A) Amrit Ltd. has a paid up share capital of Rs.10 Crore and a balance of Rs.2 Crore in securities

premium account. The company management do not want to carry over this balance.State the purposes

for which this balance can be utilized.

(B) Amrit Ltd. made a provision of 2% of its profits or Rs.20 Lac, whichever is higher, for the

medical care, social security and recreation of its employees. State the values served by this decision.

Downloaded from www.studiestoday.com

You might also like

- Capacity Management in Service FirmsDocument10 pagesCapacity Management in Service FirmsJussie BatistilNo ratings yet

- Book Business HandbookDocument57 pagesBook Business HandbookJashith100% (3)

- Price Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruDocument8 pagesPrice Summary Owner: PT Nadayu Marsar Indonesia Project: Epc of Transmart & Ibis Hotel Pekan BaruBandono JnrNo ratings yet

- Arihant Economics Class 12 Term 1 - WWW - jeebOOKS.inDocument161 pagesArihant Economics Class 12 Term 1 - WWW - jeebOOKS.inSahyog69% (85)

- Accounting of Issue of SharesDocument17 pagesAccounting of Issue of SharesAnkit Tiwari0% (1)

- Worksheet-Issue of SharesDocument4 pagesWorksheet-Issue of SharesBhavika LargotraNo ratings yet

- Questions For My GirlDocument11 pagesQuestions For My Girladhishreesinghal24No ratings yet

- CompanyDocument11 pagesCompanyBijendra DasNo ratings yet

- Accounting For Share Capital Extra Questions Part 2Document2 pagesAccounting For Share Capital Extra Questions Part 2NICOLANo ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Revision 2 Share CapitalDocument3 pagesRevision 2 Share CapitalGopika BaburajNo ratings yet

- Share CapitalDocument10 pagesShare CapitalShreyas PremiumNo ratings yet

- SHARESDocument5 pagesSHARESMohammad Tariq AnsariNo ratings yet

- Numerical QuestionsDocument3 pagesNumerical QuestionsArchi JainNo ratings yet

- Company Accounts RevisionDocument4 pagesCompany Accounts RevisionAnu SoniNo ratings yet

- Issue of Shares Cbse Question BankDocument7 pagesIssue of Shares Cbse Question Bankabhayku1689No ratings yet

- Accountancy XiiDocument3 pagesAccountancy XiiRusken CH MominNo ratings yet

- Worksheet - Accounting For Share CapitalDocument6 pagesWorksheet - Accounting For Share CapitalPrisha SharmaNo ratings yet

- SharesDocument2 pagesSharesHannah Ann JacobNo ratings yet

- Issue of Shares Comprehensive Sums Part IIDocument5 pagesIssue of Shares Comprehensive Sums Part IIHamza MudassirNo ratings yet

- Practice Sheet Issue of SharesDocument5 pagesPractice Sheet Issue of SharesAryan VermaNo ratings yet

- Share Capital Assignment PDFDocument6 pagesShare Capital Assignment PDFBHUMIKA JAINNo ratings yet

- Share Comprehensive QuestionsDocument1 pageShare Comprehensive QuestionsLaxmi Kant Sahani0% (2)

- Accounting For Shares - Notes 2Document9 pagesAccounting For Shares - Notes 2AviNo ratings yet

- 21 March Live Most Imp Questions Shares To Debent 240321 230837Document3 pages21 March Live Most Imp Questions Shares To Debent 240321 230837seemaanil029No ratings yet

- Corporate AccountingDocument32 pagesCorporate AccountingSaran Ranny100% (1)

- 5th Account Gobind Kumar Jha 9874411552Document69 pages5th Account Gobind Kumar Jha 9874411552binay chaudharyNo ratings yet

- Shares - HTPDocument2 pagesShares - HTPPavithra AnupNo ratings yet

- Shivaraj Corrporeting Acconting 3rd SemDocument9 pagesShivaraj Corrporeting Acconting 3rd Semshivaraj gowdaNo ratings yet

- Chapter 1 - Company Account - Accounting For Share CapitalDocument143 pagesChapter 1 - Company Account - Accounting For Share CapitalAvi yadavNo ratings yet

- Company Accounts-Issue of Shares - (Module 8)Document2 pagesCompany Accounts-Issue of Shares - (Module 8)Manshi GolchhaNo ratings yet

- PT I Acc Xii - 2023Document3 pagesPT I Acc Xii - 2023sindhuNo ratings yet

- Accounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsDocument9 pagesAccounting of Share Capital: CA Navaraj Lamichhane CAP-II, "Dec-2020" Ca, MbsbinuNo ratings yet

- Assignment Unit 1Document4 pagesAssignment Unit 1vsraviNo ratings yet

- Issue of SharesDocument3 pagesIssue of SharesPratiksha PatelNo ratings yet

- Issue of ShareDocument2 pagesIssue of ShareavtaranNo ratings yet

- CBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting For Share Capital and Debenture WorksheetJenneil CarmichaelNo ratings yet

- Issue of Shares Most Important Part 1Document25 pagesIssue of Shares Most Important Part 1mainikunal09No ratings yet

- Class XiithDocument11 pagesClass XiithSantvana ChaturvediNo ratings yet

- Worksheet For Issue of Share and DebentureDocument2 pagesWorksheet For Issue of Share and DebentureLaxmi Kant SahaniNo ratings yet

- Issue of Shares QuestionsDocument5 pagesIssue of Shares Questionsgson52310No ratings yet

- Worksheet 18 Company Issue of SharesDocument5 pagesWorksheet 18 Company Issue of SharesNishanth ChoudharyNo ratings yet

- Issue OF SHARE CAPITAL PRACTISE QUESTIONSDocument5 pagesIssue OF SHARE CAPITAL PRACTISE QUESTIONSCSCharlie GahlotNo ratings yet

- DR AKL Corporate Oct21 CIA 2021Document2 pagesDR AKL Corporate Oct21 CIA 2021Saif UddeenNo ratings yet

- Document 11Document2 pagesDocument 11KHUSHI PANDEYNo ratings yet

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityDocument13 pagesAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Company AccountsDocument105 pagesCompany AccountsKaustubh BasuNo ratings yet

- Company AccountsDocument3 pagesCompany AccountsYATTIN KHANNANo ratings yet

- Xii Mcqs CH - 9 Issue of SharesDocument7 pagesXii Mcqs CH - 9 Issue of SharesJoanna Garcia100% (1)

- Admsn ShareDocument2 pagesAdmsn Shareak99archana1999No ratings yet

- Accts PT 2 JK REVISED PDFDocument3 pagesAccts PT 2 JK REVISED PDFIshaan KanoiNo ratings yet

- Mathabit Smart Classes: Class - XII Accounts TestDocument2 pagesMathabit Smart Classes: Class - XII Accounts TestanoymousNo ratings yet

- Problems To StudentsDocument1 pageProblems To StudentsAJAIS BABUNo ratings yet

- Accounting Treatment of Forfeiture of SharesDocument18 pagesAccounting Treatment of Forfeiture of SharesMandy SinghNo ratings yet

- Chapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021Document18 pagesChapter - 7: Case/Source Based Questions:: Kvs Ziet Bhubaneswar 12/10/2021abiNo ratings yet

- Shares Short Cut Tricks by Sunil PandaDocument17 pagesShares Short Cut Tricks by Sunil Pandakawaljeetsingh121666No ratings yet

- DPP 05 Shares Sunil PandaDocument2 pagesDPP 05 Shares Sunil Pandaxrixn11No ratings yet

- Issue of Share - Q.1Document1 pageIssue of Share - Q.1divyafoundation040711No ratings yet

- Accounting For Share Capital (2019-20)Document20 pagesAccounting For Share Capital (2019-20)niyatiagarwal25No ratings yet

- Kami Export - Issue of Shares SQPDocument8 pagesKami Export - Issue of Shares SQPtawwabsayedNo ratings yet

- Writing Drills Part 2Document15 pagesWriting Drills Part 2SahyogNo ratings yet

- Reading Test: 65 Minutes, 52 QuestionsDocument56 pagesReading Test: 65 Minutes, 52 QuestionsSahyogNo ratings yet

- A. B. C. D.: Passport Part II (TWO) Practice TestDocument11 pagesA. B. C. D.: Passport Part II (TWO) Practice TestSahyogNo ratings yet

- Drill-6: Questions 1-9 Arebasedon Tbe FollowñsgpassageDocument16 pagesDrill-6: Questions 1-9 Arebasedon Tbe FollowñsgpassageSahyogNo ratings yet

- Drill-1: Questions 12-22 Are Based On The Following Passage. The Tyrannical and The TaciturnDocument12 pagesDrill-1: Questions 12-22 Are Based On The Following Passage. The Tyrannical and The TaciturnSahyogNo ratings yet

- Reading Test: 65 Minutes, 52 QuestionsDocument56 pagesReading Test: 65 Minutes, 52 QuestionsSahyogNo ratings yet

- Reading Test: 65 Minutes, 52 QuestionsDocument56 pagesReading Test: 65 Minutes, 52 QuestionsSahyogNo ratings yet

- 12 PF 1Document13 pages12 PF 1SahyogNo ratings yet

- Additional Topics Practice Test NewDocument11 pagesAdditional Topics Practice Test NewSahyogNo ratings yet

- This Question Paper Has II Parts and Both Parts Are CompulsoryDocument11 pagesThis Question Paper Has II Parts and Both Parts Are CompulsorySahyogNo ratings yet

- Xii MathsDocument115 pagesXii MathsAftab AliNo ratings yet

- WS - Cont - 2021-22Document2 pagesWS - Cont - 2021-22SahyogNo ratings yet

- Xii AccountancyDocument152 pagesXii AccountancySahyogNo ratings yet

- Business Studies Case Study Based QuestionsDocument7 pagesBusiness Studies Case Study Based QuestionsSahyog100% (1)

- CLASS 12 ACCOUNTS WORKSHEET ON FUNDAMENTALS OF PARTNERSHIP Mr. Md. MurtujaDocument1 pageCLASS 12 ACCOUNTS WORKSHEET ON FUNDAMENTALS OF PARTNERSHIP Mr. Md. MurtujaSahyogNo ratings yet

- Grade 11 Daily Lesson Log: ObjectivesDocument2 pagesGrade 11 Daily Lesson Log: ObjectivesKarla BangFerNo ratings yet

- Population GrowthDocument3 pagesPopulation GrowthJennybabe PetaNo ratings yet

- BES4-Assignment 3Document2 pagesBES4-Assignment 3look porrNo ratings yet

- Downtown Design ExhibitorsDocument21 pagesDowntown Design ExhibitorsIan DañgananNo ratings yet

- Steeple AnalysisDocument2 pagesSteeple AnalysisSamrahNo ratings yet

- Notice 11120 02 Apr 2024Document669 pagesNotice 11120 02 Apr 2024bhattacharya.devangana2No ratings yet

- Adobe Scan Apr 18, 2023Document6 pagesAdobe Scan Apr 18, 2023Yan PaingNo ratings yet

- Answers Governmental Accounting ExercisesDocument10 pagesAnswers Governmental Accounting Exerciseswerewolf2010No ratings yet

- WWW - Referat.ro England5093366fDocument13 pagesWWW - Referat.ro England5093366fJoanne LeeNo ratings yet

- Filt RosDocument6 pagesFilt RosSalva SalazarNo ratings yet

- Katalog Akitaka Opory Dvigatelya 2017-2018Document223 pagesKatalog Akitaka Opory Dvigatelya 2017-2018Alexey KolmakovNo ratings yet

- Unclaimed Deposit List 2008Document51 pagesUnclaimed Deposit List 2008Usman MajeedNo ratings yet

- Gmail - Your Booking Confirmation PDFDocument8 pagesGmail - Your Booking Confirmation PDFvillanuevamarkdNo ratings yet

- Chapter 6 MoodleDocument36 pagesChapter 6 MoodleMichael TheodricNo ratings yet

- Lista de Tablas GPDocument196 pagesLista de Tablas GPNatalia MoragaNo ratings yet

- Indirect Impact of GST On Income TaxDocument14 pagesIndirect Impact of GST On Income TaxNAMAN KANSALNo ratings yet

- Holly Tree 2015 990taxDocument21 pagesHolly Tree 2015 990taxstan rawlNo ratings yet

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocument41 pagesCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8No ratings yet

- The Affluent SocietyDocument189 pagesThe Affluent SocietyOtter1zNo ratings yet

- Eurocontrol European Aviation Overview 20230602Document20 pagesEurocontrol European Aviation Overview 20230602Neo PilNo ratings yet

- Worldwide Service Network: Middle EastDocument3 pagesWorldwide Service Network: Middle EastRavi ShankarNo ratings yet

- Thurstone Interest Test by Marie ReyDocument9 pagesThurstone Interest Test by Marie Reymarie annNo ratings yet

- Rallis India AR 2014-15 Page 25Document168 pagesRallis India AR 2014-15 Page 25bhomikjainNo ratings yet

- Invoice 5Document2 pagesInvoice 5PramodhNo ratings yet

- Feminist Trade PolicyDocument5 pagesFeminist Trade PolicyMerckensNo ratings yet

- Effects of Labor Standard Law in Regularization of EmployeesDocument4 pagesEffects of Labor Standard Law in Regularization of EmployeesNicole Ann MagistradoNo ratings yet

- Business Listing SitesDocument8 pagesBusiness Listing SitesMuhammad UmerNo ratings yet

- Lab Project On Procedure For Fixing and Revising Minimum Wages Our LawDocument13 pagesLab Project On Procedure For Fixing and Revising Minimum Wages Our LawSnigdha SharmaNo ratings yet