Professional Documents

Culture Documents

2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214

Uploaded by

FelipeWeissOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2022 Full Year Results presentationCCHBC-FY-2022-presentation-20230214

Uploaded by

FelipeWeissCopyright:

Available Formats

01 02

Growth story priorities Winning in

driving strong a growing market

performance

03 04

Enabling our Delivering strong

customers’ success financial results, while

through our people navigating inflation

05

Investing to become

the leading 24/7

beverage partner

3 Coca-Cola HBC 2022 Full Year Results

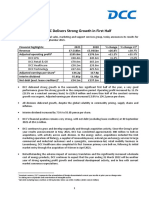

Strong financial progress

Organic revenue growth Comparable EBIT Returns

+14.2% €929.7 million €645 million fcf

+22.7% Ex Russia

& Ukraine 1.3% organic growth 14.1% ROIC

Financial indicators on a comparable basis exclude the recognition of restructuring costs, unrealised

commodity hedging results and non-recurring items. Organic financial indicators exclude the impact from

foreign currency translation and consolidation perimeter, i.e. acquisitions, divestments and reorganisations

resulting in equity method accounting. Certain differences in calculations are due to rounding.

4 Coca-Cola HBC 2022 Full Year Results

Sparkling gaining Sparkling and Energy Flexible plans, Consumer

share versus resilient and capabilities and tools behaviour resilient

branded and private continue to be to adapt to every across a majority of

label1 drivers of growth environment markets

1. Source: Nielsen

5 Coca-Cola HBC 2022 Full Year Results

Volume momentum

continues in Sparkling

• Sparkling largest driver of growth and profitability

− Trademark Coca-Cola grew by 9.1%1

− Successful activations in Coke, Fanta and Sprite

• Low/ no sugar fastest growing subcategory

− Volumes up double digit SPARKLING1 LOW / ADULT

NO SUGAR1 SPARKLING1

− Coke Zero Sugar Zero Caffeine launches +7.7% +14.3% +9.5%

• Adult Sparkling gained share

1. Organic volume growth ex Russia and Ukraine

6 Coca-Cola HBC 2022 Full Year Results

Energy remains energised

• Fastest growing category in NARTD

− consistent value share gains

− innovative activations yielding good results,

especially in gaming

• Revenue per case accretive ORGANIC % GROUP NEW

• Ample opportunity to continue growing per-capita VOLUME1 REVENUE2 LAUNCHES

consumption +32% 7% 15

1. Organic volume ex Russia and Ukraine 2. On an organic basis

7 Coca-Cola HBC 2022 Full Year Results

Coffee gaining scale

• Costa Coffee saw strong out-of-home recruitment

− number of outlets doubling vs. 2021

• Developing our super-premium offering with Caffè

Vergnano

• Investing in capabilities for the future ORGANIC # COSTA OOH # CAFFÈ

VOLUME1 OUTLETS VERGNANO

LAUNCHES

+45% 8,000

13

1. Organic volume ex Russia and Ukraine

8 Coca-Cola HBC 2022 Full Year Results

Opportunities to drive

revenue per case further

→ MIX

Category, package and channel all

positive contributors to mix

ORGANIC

NSR PER CASE

SPARKLING

VALUE SHARE

#1

→ PRICING FMCG VALUE

+15.9% +170 bps CONTRIBUTOR

Pricing decisions are data-driven, TO RETAILERS1

proactive and agile

1 Excluding

1. Source: Nielsen

Russia and Ukraine

9 Coca-Cola HBC 2022 Full Year Results

Digital commerce driving

incremental revenues

→ ROUTE-TO-CONSUMER

59% growth1 in e-retail & food

delivery apps

→ ROUTE-TO-CUSTOMER

Customer Portal B2B

− 34% of orders in Czech &

Slovakia

− 36% of orders in Ireland

Launch of HoReCa-focused B2B

platform, Sirvis, in Italy

1. Excluding Russia and Ukraine

10 Coca-Cola HBC 2022 Full Year Results

Data capabilities enhance

customer segmentation

Strengthening RGM and RTM

ENHANCING SEGMENTED EXECUTION

• Micro segmentation live in 10 markets with further

roll-outs to come in 2023

• Optimising our marketing activity at a granular level

• Targeting outlets for certain packs and products

• Personalising visits and optimising frequency

• Improving cooler placement and productivity

LAUNCHED Data & Analytics ACADEMY

11 Coca-Cola HBC 2022 Full Year Results

Progress in Egypt

Building a stronger business

Improving Integrating teams

capabilities Improving efficiency

Expanding portfolio Incorporating ESG

Adapting to short-term realities

Increasing price to Returnable glass

manage inflation and portfolio offers Growing Opportunity Opportunity

FX weakness affordability population to increase to become

per-capita market leader

100+ million consumption

12 Coca-Cola HBC 2022 Full Year Results

Leading in sustainability

• Ranked world’s most sustainable beverage Converted disused plant to recycling

company by Dow Jones Sustainability Index technology at Gaglianico, Italy

2022 for 6th time

→ transforms up to 30,000 tonnes of PET p.a.

• PACKAGING AND CLIMATE

→ 100% renewable electricity

− Progressed transition to 100% rPET in

selected markets → emissions reductions up to 70%

− Launched label-free bottle for Valser

− Investment in in-house rPET capability in

Italy, Poland and Romania

− €45 million investment in recycling

technologies to date

• €500 million green bond issued in September

13 Coca-Cola HBC 2022 Full Year Results

Consistently strong

top-line performance

Organic growth

20.6%

excluding RU & UKR | 2022

14.2% 25.2%

5.8% 22.7%

12.1%

15.9%

14.0% 13.4%

-1.5%

-4.6% 11.6%

8.1%

-4.1%

Revenue Volume Price/mix H1 FY

-8.5%

Organic financial indicators exclude the impact from foreign currency translation and consolidation

perimeter, i.e. acquisitions, divestments and reorganisations resulting in equity method accounting.

Certain differences in calculations are due to rounding.

15 Coca-Cola HBC 2022 Full Year Results

Managing significant cost inflation in 2022

How we are managing:

3%

Pricing and other RGM actions

21% 31%

COGS/ UC

+18% Long term contracts with

suppliers and hedging

45%

Concentrate

Raw materials, packaging & finished goods Productivity and

Overheads & haulage operational efficiencies

Depreciation

16 Coca-Cola HBC 2022 Full Year Results

Organic EBIT up 1.3%

despite cost inflation

Organic EBIT

growth

+1.3%

Comparable

EBIT growth

+11.9%

929.7

831.0

831.0

ex. Cyprus

asset sale 808.0 OPEX AS MARKETING

% OF SALES EXPENSES

24.6% +11.5%

-50 bps vs 2021 Ex Russia and Ukraine

FY 2021 FY 2022

Financial indicators on a comparable basis exclude the recognition of restructuring costs, unrealised

commodity hedging results and non-recurring items. Organic financial indicators exclude the impact from

foreign currency translation and consolidation perimeter, i.e. acquisitions, divestments and reorganisations

resulting in equity method accounting. Certain differences in calculations are due to rounding.

17 Coca-Cola HBC 2022 Full Year Results

Established markets

Well-balanced revenue growth

• High-single digit volume growth across all main

markets

• Price/mix driven by price increases in all markets, and

positive package, category and channel mix

• Single-serve mix +4.5pp benefitting from out-of-

home activations and growth in premium glass

portfolio

• Organic EBIT growth despite cost pressures and Volume Price / mix Revenue

cycling one-off €23 million real estate disposal in 2021

+9.1% +8.6% +18.6%

Comparable EBIT margin Organic EBIT

10.3% +1.3%

Financial indicators on a comparable basis exclude the recognition of restructuring costs, unrealised

commodity hedging results and non-recurring items. Organic financial indicators exclude the impact from

foreign currency translation and consolidation perimeter, i.e. acquisitions, divestments and reorganisations

resulting in equity method accounting. Certain differences in calculations are due to rounding.

18 Coca-Cola HBC 2022 Full Year Results

Developing markets

Strong volume growth

• Double-digit volume growth across main markets

• Price/mix driven by pricing actions in all markets,

positive package, category and channel mix

• In Poland, category recovery after sugar tax

complemented by strong share gains

• Organic EBIT growth despite COGS pressures

Volume Price / mix Revenue

+15.2% +11.9% +29.0%

Comparable EBIT margin Organic EBIT

6.7% +12.7%

Financial indicators on a comparable basis exclude the recognition of restructuring costs, unrealised

commodity hedging results and non-recurring items. Organic financial indicators exclude the impact from

foreign currency translation and consolidation perimeter, i.e. acquisitions, divestments and reorganisations

resulting in equity method accounting. Certain differences in calculations are due to rounding.

19 Coca-Cola HBC 2022 Full Year Results

Emerging markets

Resilient performance despite headwinds

• Growth negatively impacted by

performance in Russia & Ukraine

• Organic revenue grew by 23.5% and

organic volumes by 4.3% when excluding

Russia & Ukraine

• Strong price/mix development to help

offset inflation and FX weakness

• Egypt will be incorporated into organic Volume Price / mix Revenue

performance from January 2023

-10.9% +18.4% +5.5%

Comparable EBIT margin Organic EBIT

11.3% -1.1%

Financial indicators on a comparable basis exclude the recognition of restructuring costs, unrealised

commodity hedging results and non-recurring items. Organic financial indicators exclude the impact from

foreign currency translation and consolidation perimeter, i.e. acquisitions, divestments and reorganisations

resulting in equity method accounting. Certain differences in calculations are due to rounding.

20 Coca-Cola HBC 2022 Full Year Results

EPS up 7.7%

• Another year of robust EPS progress

EPS Payout ratio

• Finance costs increased €15.1 million due to

consolidation of Egypt +7.7% 46%

• Comparable tax rate of 26%, at the mid point Comparable net profit Dividend per share

of our guidance 25% to 27% €m €

Earnings

1.706 per share

• Dividend recommended at €0.78 per share, +10%

up 10% year on year 0.78

624.9

0.71

1.584

578.1

FY 2021 FY 2022 FY 2021 FY 2022

Organic financial indicators exclude the impact from foreign currency translation and consolidation

perimeter, i.e. acquisitions, divestments and reorganisations resulting in equity method accounting.

Certain differences in calculations are due to rounding.

21 Coca-Cola HBC 2022 Full Year Results

Another year of investment

and record FCF generation

• Capex up €49 million year on year with investments

across: Capex FCF

− capacity expansion in growth markets and on +€49m +€44m

targeted package formats

Capital expenditure % Free cash flow

− cooler expansions to drive single-serve

€m

consumption

14%

− digital commerce investments 20% 645

− rPET facility in Italy

13%

• Capex as % of NSR ended at 6.4%, in the lower end of

our range 53% 601

• Free cash flow up €44 million year on year driven

mostly by higher profitability Coolers & Marketing

FY 2021 FY 2022

Digital

• Net debt to EBITDA 1.2x Production

Other

22 Coca-Cola HBC 2022 Full Year Results

Continued ROIC expansion

• ROIC at 14.1%, or 15.8% excluding Egypt

acquisition ROIC

− increased profitability vs 2021 +100bps (ex Egypt)

− improved capital turnover

Ex. Cyprus Ex.

− cycling the Cyprus property sale which added asset sale 15.8% Egypt

14.4% 14.8%

40bps in prior year ROIC 13.7%

14.2% 14.1%

11.1%

2018 2019 2020 2021 2022

23 Coca-Cola HBC 2022 Full Year Results

Organic revenue Organic EBIT

growth above 5% growth in the

to 6% average range +3% to -3%

target range

COGS per case

increase by low

teens

24 Coca-Cola HBC 2022 Full Year Results

Leader in an 24/7 portfolio and

attractive, growing execution capabilities

industry to win share

Diversified Relentless cost

geographies with efficiency and strong

exposure to growth balance sheet

Engaged team with Determined to remain

a winning mindset a leader in

sustainability

25 Coca-Cola HBC 2022 Full Year Results

Join us for our

INVESTOR DAY

25 May in ROME

For further information on Coca-Cola HBC please visit our website at:

www.coca-colahellenic.com

Or contact our investor relations team:

Joanna Kennedy Marios Matar

Head of Investor Relations Investor Relations Manager

joanna.kennedy@cchellenic.com marios.matar@cchellenic.com

+44 (0)7802 427505 +30 697 444 3335

Jemima Benstead Virginia Phillips

Investor Relations Manager Investor Relations Manager

jemima.benstead@cchellenic.com virginia.phillips@cchellenic.com

+44 (0)7740 535130 +44 (0)7864 686582

26 Coca-Cola HBC 2022 Full Year Results

Forward-looking statement

Unless otherwise indicated, the condensed consolidated interim financial statements and the financial and operating data or other information included

herein relate to Coca-Cola HBC AG and its subsidiaries (“Coca-Cola HBC” or the “Company” or “we” or the “Group”).

This document contains forward looking statements that involve risks and uncertainties. These statements may generally, but not always, be identified

by the use of words such as “believe”, “outlook”, “guidance”, “intend”, “expect”, “anticipate”, “plan”, “target” and similar expressions to identify forward

looking statements. All statements other than statements of historical facts, including, among others, statements regarding our future financial position

and results, our outlook for 2022 and future years, business strategy and the effects of the global economic slowdown, the impact of the sovereign debt

crisis, currency volatility, our recent acquisitions, and restructuring initiatives on our business and financial condition, our future dealings with The Coca-

Cola Company, budgets, projected levels of consumption and production, projected raw material and other costs, estimates of capital expenditure, free

cash flow, effective tax rates and plans and objectives of management for future operations, are forward looking statements. By their nature, forward

looking statements involve risk and uncertainty because they reflect our current expectations and assumptions as to future events and circumstances

that may not prove accurate. Our actual results and events could differ materially from those anticipated in the forward-looking statements for many

reasons, including the risks described in the 2021 Integrated Annual Report for Coca-Cola HBC AG and its subsidiaries.

Although we believe that, as of the date of this document, the expectations reflected in the forward-looking statements are reasonable, we cannot

assure you that our future results, level of activity, performance or achievements will meet these expectations. Moreover, neither we, nor our directors,

employees, advisors nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. After the date

of the condensed consolidated interim financial statements included in this document, unless we are required by law or the rules of the UK Financial

Conduct Authority to update these forward-looking statements, we will not necessarily update any of these forward-looking statements to conform

them either to actual results or to changes in our expectations.

27 Coca-Cola HBC 2022 Full Year Results

You might also like

- Official CFA Revision Spreadsheet 3.22.22Document109 pagesOfficial CFA Revision Spreadsheet 3.22.22Do Minh Gia AnNo ratings yet

- SQL FunDocument155 pagesSQL FunjnmanivannanmechNo ratings yet

- AC Sample Paper 3 Unsolved-1Document10 pagesAC Sample Paper 3 Unsolved-1Appharnha Rs0% (1)

- Strong Execution Drives Growth MomentumDocument32 pagesStrong Execution Drives Growth MomentumSamir HassanNo ratings yet

- Edenred - 2023 02 21 Fy 2022 Results Presentation VdefDocument70 pagesEdenred - 2023 02 21 Fy 2022 Results Presentation VdefaugustocestariraizenNo ratings yet

- Coca Cola ReportDocument112 pagesCoca Cola ReportPraveen undruNo ratings yet

- AGM Presentation 28 April 2022Document22 pagesAGM Presentation 28 April 2022YukiNo ratings yet

- Bekaert 2023 May Investor PresentationDocument38 pagesBekaert 2023 May Investor PresentationmailprasanaNo ratings yet

- Annual ReportDocument153 pagesAnnual ReportMohan SellappaNo ratings yet

- 23-251 Crimson Wine Group (18115) Annual Report - BookmarkedDocument86 pages23-251 Crimson Wine Group (18115) Annual Report - BookmarkednguyenanleybNo ratings yet

- Presentation FY 2017Document70 pagesPresentation FY 2017David GachetNo ratings yet

- Lucas Bols, 2021-2022 PRESS RELEASEDocument17 pagesLucas Bols, 2021-2022 PRESS RELEASEjasper laarmansNo ratings yet

- DCC Delivers Strong Growth in First HalfDocument39 pagesDCC Delivers Strong Growth in First HalfPriya ShindeNo ratings yet

- KDP Annual Report 2018Document152 pagesKDP Annual Report 2018iwefiNo ratings yet

- 2022 Ampol Australia Annual Report PDFDocument174 pages2022 Ampol Australia Annual Report PDFM LYFNo ratings yet

- Annual Report 2019-ComDocument64 pagesAnnual Report 2019-ComFilipe BenjamimNo ratings yet

- RIL 1Q FY24 Analyst Presentation 21july23Document58 pagesRIL 1Q FY24 Analyst Presentation 21july23Sudeep RNo ratings yet

- Result Presentation - November 2021: Bulk Alcohol - Value Segment - Franchise Bottling - Premium SegmentDocument31 pagesResult Presentation - November 2021: Bulk Alcohol - Value Segment - Franchise Bottling - Premium SegmentstockengageNo ratings yet

- Baldwin Company Annual Report Fy 2021 PDFDocument26 pagesBaldwin Company Annual Report Fy 2021 PDFMOHAMED JALEEL MOHAMED SIDDEEK100% (1)

- CM20220429 5abae 1adc1Document116 pagesCM20220429 5abae 1adc1Liora Vanessa DopacioNo ratings yet

- Larfarge-22 ArDocument302 pagesLarfarge-22 ArLou VreNo ratings yet

- CarbonatadasDocument3 pagesCarbonatadasMAFE RAMIREZ BERNALNo ratings yet

- 2016 Agm - Ceo PresentationDocument13 pages2016 Agm - Ceo PresentationNandar KhaingNo ratings yet

- Presentacion Trimestral para Conference CallDocument23 pagesPresentacion Trimestral para Conference CallSANDRO LUIS GUEVARA CONDENo ratings yet

- CCK Shareholder Presentation 4 28 22Document12 pagesCCK Shareholder Presentation 4 28 22Ridoy RiNo ratings yet

- Borouge Annual Report 2022 Final 3Document1 pageBorouge Annual Report 2022 Final 3hissballsNo ratings yet

- RIL 1Q FY23 Analyst Presentation 22july22Document58 pagesRIL 1Q FY23 Analyst Presentation 22july22Akshay SawhneyNo ratings yet

- Conference Call Presentation 2021Document36 pagesConference Call Presentation 2021suedtNo ratings yet

- Coca-Cola Financial Analysis and ForecastDocument15 pagesCoca-Cola Financial Analysis and ForecastSHAYNo ratings yet

- Q4 2021 Investor Presentation HighlightsDocument19 pagesQ4 2021 Investor Presentation HighlightsShivanandNo ratings yet

- CAGNY 2019: Mondelēz outlines strategy to drive growthDocument64 pagesCAGNY 2019: Mondelēz outlines strategy to drive growthTim JoyceNo ratings yet

- IntroductionDocument4 pagesIntroductionadriancanlas243No ratings yet

- XOM Q4 2021 PresentationDocument37 pagesXOM Q4 2021 PresentationZerohedgeNo ratings yet

- FY22 Performance: Opportunity DayDocument21 pagesFY22 Performance: Opportunity DaysozodaaaNo ratings yet

- Minimalist Modern Annual ReportDocument9 pagesMinimalist Modern Annual Report2021-108960No ratings yet

- Coca-Cola Fourth Quarter and Full Year 2022 Full Earnings Release-2.14.23 FINALDocument33 pagesCoca-Cola Fourth Quarter and Full Year 2022 Full Earnings Release-2.14.23 FINALraki090No ratings yet

- Letter To ShareholdersDocument3 pagesLetter To ShareholdersMku MkuNo ratings yet

- CCHBC FY 2022 Script - Pdf.downloadassetDocument17 pagesCCHBC FY 2022 Script - Pdf.downloadassetSahar FrankNo ratings yet

- 1Q FY 2021-22 Financial ResultsDocument54 pages1Q FY 2021-22 Financial Resultsaditya tripathiNo ratings yet

- Annual Management Report 2022Document132 pagesAnnual Management Report 2022arslansheikh0000069No ratings yet

- Shareholder Deck Q1 2023 FINALDocument34 pagesShareholder Deck Q1 2023 FINALBrandon Gonzalez cNo ratings yet

- Annual - Report TemplateDocument140 pagesAnnual - Report TemplateXyz AbcNo ratings yet

- 2022 Ampol Australia Annual ReportDocument174 pages2022 Ampol Australia Annual ReportFarrell WihandoyoNo ratings yet

- HTTPSWWW - bharatpetroleum.inpdfOurFinancialBPCL20Annual20Report Final 05-08-22.PDF 3Document436 pagesHTTPSWWW - bharatpetroleum.inpdfOurFinancialBPCL20Annual20Report Final 05-08-22.PDF 3Rudransh narangNo ratings yet

- Cluey Ltd 2022 Annual Report Key AchievementsDocument49 pagesCluey Ltd 2022 Annual Report Key AchievementsNick WatsonNo ratings yet

- RELIANCE - Investor Presentation - 22-Jul-22 - TickertapeDocument59 pagesRELIANCE - Investor Presentation - 22-Jul-22 - TickertapeAhaana guptaNo ratings yet

- Vivo Energy Annual Report and Accounts 2022Document107 pagesVivo Energy Annual Report and Accounts 2022sujonaraf111No ratings yet

- RIL 4Q FY22 Analyst Presentation 6may22Document69 pagesRIL 4Q FY22 Analyst Presentation 6may22aditya tripathiNo ratings yet

- Group E - PepsiCoDocument10 pagesGroup E - PepsiCoVatsal MaheshwariNo ratings yet

- 51 - Unilever's Path To Growth StrategyDocument33 pages51 - Unilever's Path To Growth StrategyMonali PardeshiNo ratings yet

- 2019 Annual ReportDocument151 pages2019 Annual ReportSculeac Constantin100% (1)

- BPCL Annual Report Final 05-08-22Document436 pagesBPCL Annual Report Final 05-08-22Shrikant BudholiaNo ratings yet

- 2021 Annual Report (1) (Repaired)Document175 pages2021 Annual Report (1) (Repaired)Jobin JoseNo ratings yet

- Delivering Better Nutrition: Glanbia PLCDocument321 pagesDelivering Better Nutrition: Glanbia PLCVarun jajalNo ratings yet

- Repsol Strategic Plan 2021 2025Document75 pagesRepsol Strategic Plan 2021 2025pdurog2007No ratings yet

- RBI investment brief highlights long-term growth potential despite near-term headwindsDocument4 pagesRBI investment brief highlights long-term growth potential despite near-term headwindsrickescherNo ratings yet

- Cott Mission StatementDocument35 pagesCott Mission StatementKiran KrishnaNo ratings yet

- Sales and Results FY23Document61 pagesSales and Results FY23JoaoNo ratings yet

- TAP Molson Coors Boston Sept 2017 SlidesDocument27 pagesTAP Molson Coors Boston Sept 2017 SlidesAla BasterNo ratings yet

- RELIANCE - Investor Presentation - 06-May-22 - TickertapeDocument70 pagesRELIANCE - Investor Presentation - 06-May-22 - TickertapeAhaana guptaNo ratings yet

- Crompton Greaves Consumer Annual Report Highlights ResilienceDocument296 pagesCrompton Greaves Consumer Annual Report Highlights ResiliencePrabhatNo ratings yet

- TINE Annual Report 2022Document142 pagesTINE Annual Report 2022sowmya.mvs99No ratings yet

- Boosting Productivity in Kazakhstan with Micro-Level Tools: Analysis and Policy LessonsFrom EverandBoosting Productivity in Kazakhstan with Micro-Level Tools: Analysis and Policy LessonsNo ratings yet

- TUM SoM Course CatalogDocument2 pagesTUM SoM Course CatalogFelipeWeissNo ratings yet

- D MUNCHEN02 School of Management Fact Sheet 2022 2023Document6 pagesD MUNCHEN02 School of Management Fact Sheet 2022 2023FelipeWeissNo ratings yet

- Plan IOGE 2022-2023Document1 pagePlan IOGE 2022-2023FelipeWeissNo ratings yet

- AttractiveGeographyStrongCashGenerationDiverseMarketsDocument2 pagesAttractiveGeographyStrongCashGenerationDiverseMarketsFelipeWeissNo ratings yet

- Coca-Cola HBC Delivers Strong Growth in 2022Document48 pagesCoca-Cola HBC Delivers Strong Growth in 2022FelipeWeissNo ratings yet

- MA Mock Exam 2021 SolutionsDocument17 pagesMA Mock Exam 2021 Solutionsnissa.dawson18No ratings yet

- HUAWEIDocument18 pagesHUAWEIAswini Kumar BhuyanNo ratings yet

- Truth in Lending Act-PDIC-FRIADocument14 pagesTruth in Lending Act-PDIC-FRIAKyla DabalmatNo ratings yet

- Shareholders' Equity and Retained EarningsDocument7 pagesShareholders' Equity and Retained EarningszhutilNo ratings yet

- Quizzes - Topic 2 - Xem L I Bài LàmDocument6 pagesQuizzes - Topic 2 - Xem L I Bài Làmnhunghuyen159No ratings yet

- Delta Partners Corporate BrochureDocument8 pagesDelta Partners Corporate BrochurejamesoksNo ratings yet

- Subsidairy BooksDocument15 pagesSubsidairy BooksAtul Kumar SamalNo ratings yet

- JHT's SuperMud Tire Project EvaluationDocument1 pageJHT's SuperMud Tire Project EvaluationNavya AgrawalNo ratings yet

- 676254Document89 pages676254Shofiana IfadaNo ratings yet

- Prysor Co ExcelDocument4 pagesPrysor Co Excelsanjay gautamNo ratings yet

- Sahand Lali Cover LetterDocument1 pageSahand Lali Cover LetterSahand LaliNo ratings yet

- Balance Sheet and Financials of Grasim IndustriesDocument7 pagesBalance Sheet and Financials of Grasim IndustriesHiren KariyaNo ratings yet

- 3.CFA财报分析 Financial Statement AnalysisDocument408 pages3.CFA财报分析 Financial Statement AnalysisliujinxinljxNo ratings yet

- Chapter10 Management Control in DecentraDocument48 pagesChapter10 Management Control in DecentraВероника КулякNo ratings yet

- Clemente Ronaliza Auditing ProblemsDocument9 pagesClemente Ronaliza Auditing ProblemsEsse ValdezNo ratings yet

- The Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsDocument17 pagesThe Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsIka NurjanahNo ratings yet

- C04_Instr_PPT_Mowen4CeDocument83 pagesC04_Instr_PPT_Mowen4Cepiker.trance.0uNo ratings yet

- UAE Business Plan 2024Document5 pagesUAE Business Plan 2024abdulmatindip07No ratings yet

- Corporate AccountingDocument749 pagesCorporate AccountingDr. Mohammad Noor Alam71% (7)

- Contoh Review JurnalDocument14 pagesContoh Review JurnalariNo ratings yet

- Current & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiDocument26 pagesCurrent & Saving Account Statement: Arun J Plot No 366 13Th Street Astalakshmi Nagar 3Rd Main RD Alapakkam ChennaiArun Jayaprakash NarayananNo ratings yet

- International Financial Management: Bapuji B-Schools Lake View Campus, SS Layout Davangere-577004Document3 pagesInternational Financial Management: Bapuji B-Schools Lake View Campus, SS Layout Davangere-577004Arun NijaguliNo ratings yet

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- Doug BrienDocument2 pagesDoug BrienGoddy WashingtonNo ratings yet

- Accounting and Finance Exit Model Exam Attempt Review11 1Document41 pagesAccounting and Finance Exit Model Exam Attempt Review11 1Ayana Giragn AÿøNo ratings yet

- Acctg 2.2 Journal Entries - Cs TransactionsDocument4 pagesAcctg 2.2 Journal Entries - Cs Transactionskim TammyNo ratings yet

- Vadero Inc Accounting ExerciseDocument3 pagesVadero Inc Accounting ExerciseMalik Afzaal AwanNo ratings yet