0% found this document useful (0 votes)

173 views4 pagesReal Estate Pro Forma

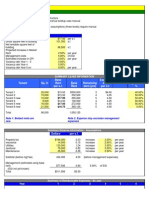

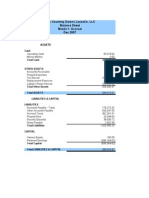

This document contains an investment analysis model for a real estate property. It includes operating assumptions such as management fees, taxes, insurance, utilities and capital expenditures. It also includes acquisition assumptions such as the purchase price, financing terms, equity contributions and sources and uses of funds. Additionally, it outlines rent roll assumptions and projected income and expenses for the property.

Uploaded by

John BanaskiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

173 views4 pagesReal Estate Pro Forma

This document contains an investment analysis model for a real estate property. It includes operating assumptions such as management fees, taxes, insurance, utilities and capital expenditures. It also includes acquisition assumptions such as the purchase price, financing terms, equity contributions and sources and uses of funds. Additionally, it outlines rent roll assumptions and projected income and expenses for the property.

Uploaded by

John BanaskiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd