Professional Documents

Culture Documents

032 35 Bond Discount & Interest

Uploaded by

Zin Min Htet0 ratings0% found this document useful (0 votes)

8 views2 pages1. The document shows the calculation of straight line amortization of bonds payable over 15 years.

2. Bonds were issued for $198,484 with a face value of $240,000 and pay 6% interest semiannually.

3. Every 6 months, journal entries are made to record bond interest expense and amortize the discount on bonds payable.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document shows the calculation of straight line amortization of bonds payable over 15 years.

2. Bonds were issued for $198,484 with a face value of $240,000 and pay 6% interest semiannually.

3. Every 6 months, journal entries are made to record bond interest expense and amortize the discount on bonds payable.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pages032 35 Bond Discount & Interest

Uploaded by

Zin Min Htet1. The document shows the calculation of straight line amortization of bonds payable over 15 years.

2. Bonds were issued for $198,484 with a face value of $240,000 and pay 6% interest semiannually.

3. Every 6 months, journal entries are made to record bond interest expense and amortize the discount on bonds payable.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

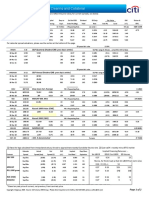

Calculation of straight line amortization

Trial Bal Amortized Unamortized Carrying

Date Account Debit (Credit) Acount Trial Bal Beg ADJ Ending Date amount Discount Value

Recorded journal entries and post to the 6/30 Cash 918,484 918,484 1/1 41,516 198,484

trail balance Accounts receivable 250,000 250,000 6/30 1,384 40,132 199,868 1

1/1 Issued bonds which pay Accounts Payable (20,000) (20,000) 12/31 1,384 38,748 201,252 2

interest semiannually Bonds Payable (240,000) (240,000) 6/30 1,384 37,364 202,636 3

Number of years 15 12/1 Discount on Bonds Payable 41,516 41,516 12/31 1,384 35,981 204,019 4

Face value 240,000 Common Dividend payable 0 0 6/30 1,384 34,597 205,403 5

Issue price 198,484 Retained Earnings (250,000) (250,000) 12/31 1,384 33,213 206,787 6

Interest rate on bond 6% Sales (700,000) (700,000) 6/30 1,384 31,829 208,171 7

Market rate 8% Cost of goods sold 0 0 12/31 1,384 30,445 209,555 8

6/30 Record bond interest and Bond interest expense 0 0 6/30 1,384 29,061 210,939 9

straight line amortization Wages Expense 0 0 12/31 1,384 27,677 212,323 10

of interest 0 0 0 6/30 1,384 26,293 213,707 11

12/31 Record bond interest and Net income (700,000) 0 (700,000) 12/31 1,384 24,910 215,090 12

straight line amortization

6/30 1,384 23,526 216,474 13

of interest

12/31 1,384 22,142 217,858 14

6/30 1,384 20,758 219,242 15

12/31 1,384 19,374 220,626 16

6/30 1,384 17,990 222,010 17

12/31 1,384 16,606 223,394 18

6/30 1,384 15,223 224,777 19

12/31 1,384 13,839 226,161 20

6/30 1,384 12,455 227,545 21

12/31 1,384 11,071 228,929 22

6/30 1,384 9,687 230,313 23

12/31 1,384 8,303 231,697 24

6/30 1,384 6,919 233,081 25

12/31 1,384 5,535 234,465 26

6/30 1,384 4,152 235,848 27

12/31 1,384 2,768 237,232 28

6/30 1,384 1,384 238,616 29

12/31 1,384 0 240,000 30

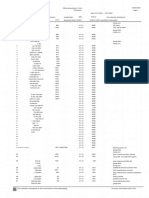

Calculation of straight line amortization

Trial Bal Amortized Unamortized Carrying

Date Account Debit (Credit) Acount Trial Bal Beg ADJ Ending Date amount Discount Value

Recorded journal entries and post to the 6/30 Cash 918,484 918,484 1/1

trail balance Accounts receivable 250,000 250,000 6/30 1

1/1 Issued bonds which pay Accounts Payable (20,000) (20,000) 12/31 2

interest semiannually Bonds Payable (240,000) (240,000) 6/30 3

Number of years 15 12/1 Discount on Bonds Payable 41,516 41,516 12/31 4

Face value 240,000 Common Dividend payable 0 0 6/30 5

Issue price 198,484 Retained Earnings (250,000) (250,000) 12/31 6

Interest rate on bond 6% Sales (700,000) (700,000) 6/30 7

Market rate 8% Cost of goods sold 0 0 12/31 8

6/30 Record bond interest and Bond interest expense 0 0 6/30 9

straight line amortization Wages Expense 0 0 12/31 10

of interest 0 0 0 6/30 11

12/31 Record bond interest and Net income (700,000) 0 (700,000) 12/31 12

straight line amortization

6/30 13

of interest

12/31 14

6/30 15

12/31 16

6/30 17

12/31 18

6/30 19

12/31 20

6/30 21

12/31 22

6/30 23

12/31 24

6/30 25

12/31 26

6/30 27

12/31 28

6/30 29

12/31 30

You might also like

- Cusip Identifier PDFDocument7 pagesCusip Identifier PDFJeromeKmt100% (1)

- Affidavit of Notary PresentmentDocument7 pagesAffidavit of Notary Presentmentpreston_402003100% (7)

- Citibank - Basics of Corporate FinanceDocument417 pagesCitibank - Basics of Corporate Financevikash100% (2)

- MS11 - Business ScienceDocument44 pagesMS11 - Business ScienceTaeJun YiNo ratings yet

- Financial Planning For Individual InvestorDocument83 pagesFinancial Planning For Individual Investorrathodsantosh101100% (2)

- File 0001Document1 pageFile 0001bhakarbalaNo ratings yet

- Karvak Mei 2021Document1 pageKarvak Mei 2021hunter gonNo ratings yet

- Solution 3Document6 pagesSolution 3Bunbun 221No ratings yet

- Fin Acc MBADocument7 pagesFin Acc MBAdavit kavtaradzeNo ratings yet

- Loan AmortizationDocument3 pagesLoan AmortizationMiskatul ArafatNo ratings yet

- P 14 - 8 - Titania - PracticeDocument5 pagesP 14 - 8 - Titania - PracticePinnPiyapatNo ratings yet

- 0400003620865dec 2023 1Document2 pages0400003620865dec 2023 1Munira Nasreen AnsariNo ratings yet

- Crude Oil Storage TankDocument5 pagesCrude Oil Storage TankBISWAJIT DASNo ratings yet

- Bản sao của Check căn - bảng giá phân khu RubyDocument8 pagesBản sao của Check căn - bảng giá phân khu RubyNguyễn Hà MyNo ratings yet

- Grand Total Premium: 1,32,614.00 Commission: 6,772.01Document1 pageGrand Total Premium: 1,32,614.00 Commission: 6,772.01TEJASHWI RAJNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)saifrahmanNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)tarun lahotiNo ratings yet

- Vi.7. Pembayaran Pokok Dan Bunga Pinjaman Luar Negeri (Juta USD)Document2 pagesVi.7. Pembayaran Pokok Dan Bunga Pinjaman Luar Negeri (Juta USD)Izzuddin AbdurrahmanNo ratings yet

- Investor Services - Futures, Clearing and Collateral: PX Close 1D PX Last Open IntDocument3 pagesInvestor Services - Futures, Clearing and Collateral: PX Close 1D PX Last Open IntsirdquantsNo ratings yet

- September 2019 Valuation Year Surat-Dahisar Tumkur Idaa Jaipur MVRDocument3 pagesSeptember 2019 Valuation Year Surat-Dahisar Tumkur Idaa Jaipur MVRslohariNo ratings yet

- 079 140 Note Payable Payments Journal EntryDocument2 pages079 140 Note Payable Payments Journal EntryZin Min HtetNo ratings yet

- 292 - 2021 - Primanota 2Document6 pages292 - 2021 - Primanota 2Abhishek GuptaNo ratings yet

- 260 Units: MR Manzoor HussainDocument2 pages260 Units: MR Manzoor HussainawahmaNo ratings yet

- Housing - PandL PDFDocument1 pageHousing - PandL PDFAbdul Khaliq ChoudharyNo ratings yet

- 614 Units: Saima Drive InnDocument2 pages614 Units: Saima Drive Innalihassan23starNo ratings yet

- VAluation Dample DataDocument8 pagesVAluation Dample DatavenkatNo ratings yet

- Bài tập về nhà - Trang tính1Document4 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- 701 Units: Fazal HussainDocument2 pages701 Units: Fazal HussainSyed Usama AliNo ratings yet

- Sre Bank-1Document10 pagesSre Bank-1max financeNo ratings yet

- Tire City Company Case StudyDocument1 pageTire City Company Case StudySo goodNo ratings yet

- 904 Units: Mrs. Nasreen BegumDocument2 pages904 Units: Mrs. Nasreen BegumTalal ArshadNo ratings yet

- Partial-Report-for-TY-TISOY-Northern-Samar-as of Dec18Document1 pagePartial-Report-for-TY-TISOY-Northern-Samar-as of Dec18The A CoachNo ratings yet

- 249 Units: Nusra Mushtaq AhmedDocument2 pages249 Units: Nusra Mushtaq AhmedDeputy ManagerNo ratings yet

- 662 Units Rs. 13,627.56: Saima ArifDocument2 pages662 Units Rs. 13,627.56: Saima ArifMark XNo ratings yet

- Data SM Kirim MeiDocument1 pageData SM Kirim MeiRisal Pahlewi Z. SaluNo ratings yet

- 563 Units: Mirza Nasir Ali BaigDocument2 pages563 Units: Mirza Nasir Ali Baigmussawer hasnainNo ratings yet

- Paket Toyota NovemberDocument3 pagesPaket Toyota NovembertonymuzioNo ratings yet

- Financial (Rs Million) Mar-20 Mar-19 Mar-18 Mar-17 Mar-16 Y-O-Y Change (%) Y-O-Y Change (%)Document1 pageFinancial (Rs Million) Mar-20 Mar-19 Mar-18 Mar-17 Mar-16 Y-O-Y Change (%) Y-O-Y Change (%)saifrahmanNo ratings yet

- Emami PNLDocument1 pageEmami PNLsZCCSZcNo ratings yet

- Loan Details: Ilustrative Loan Repayment CalculatorDocument6 pagesLoan Details: Ilustrative Loan Repayment CalculatorMuhammad ShahzadNo ratings yet

- ڈپلیکیٹ بل - Jul-2023 - 0400024512876Document2 pagesڈپلیکیٹ بل - Jul-2023 - 0400024512876Adnan Ahmed KidwaiNo ratings yet

- 126 Units Rs. 1,344.09: Syed Gohar Ali ShahDocument2 pages126 Units Rs. 1,344.09: Syed Gohar Ali ShahHaris RizwanNo ratings yet

- FSA AssignmentDocument4 pagesFSA AssignmentDharmil OzaNo ratings yet

- 353 Units: Muhammad ShabbirDocument2 pages353 Units: Muhammad ShabbirWajahat KhanNo ratings yet

- 2312 Mandiri Statement Dec23Document2 pages2312 Mandiri Statement Dec23mhartiriniNo ratings yet

- UID Top N Secondary Sales Report 14 15 19Document1 pageUID Top N Secondary Sales Report 14 15 19ratiozNo ratings yet

- 243 Units: MR Iqbal HussainDocument2 pages243 Units: MR Iqbal HussainediealiNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document17 pagesFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Berkshire Hathway coldNo ratings yet

- 823 Units: Sabir HussainDocument2 pages823 Units: Sabir HussainAsharf AliNo ratings yet

- 170 Units: Nusra Mushtaq AhmedDocument2 pages170 Units: Nusra Mushtaq AhmedDeputy ManagerNo ratings yet

- Downloads0400036703391 700013113383 PDFDocument2 pagesDownloads0400036703391 700013113383 PDFAllah MuhammadNo ratings yet

- 433 Units: Muhammad Faisal Zakaria.Document2 pages433 Units: Muhammad Faisal Zakaria.baylandrizwanNo ratings yet

- PAHW Monthly Statistics 20190530Document5 pagesPAHW Monthly Statistics 20190530Calvin PintoNo ratings yet

- Financials Plaza Del PradoDocument14 pagesFinancials Plaza Del PradoSteve WilliamNo ratings yet

- 171 Units Rs. 4,319.96: MR Mohammad Mushtaq Ke 230Document2 pages171 Units Rs. 4,319.96: MR Mohammad Mushtaq Ke 230Play GameNo ratings yet

- Listado Plan de Pagos Original: Datos GeneralesDocument2 pagesListado Plan de Pagos Original: Datos GeneralesMilagros MtNo ratings yet

- CheggDocument75 pagesCheggKaranNo ratings yet

- Company Info - Print Financials - P&LDocument1 pageCompany Info - Print Financials - P&LUtkarshNo ratings yet

- CM 807 20220901 00544807 PDFDocument3 pagesCM 807 20220901 00544807 PDFAsokan MadathilNo ratings yet

- KotakDocument3 pagesKotak41 lavanya NairNo ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- 370 Units Rs. 5,131.96: Muhammad AfzalDocument2 pages370 Units Rs. 5,131.96: Muhammad AfzalStudents LinkNo ratings yet

- Anand Rathi Share and Stock Brokers Limited Holding-MF-Normal-ReportDocument2 pagesAnand Rathi Share and Stock Brokers Limited Holding-MF-Normal-ReportAnonymous dvFDqqNo ratings yet

- M/S. Anika Enterprise: Alamin PackagingDocument2 pagesM/S. Anika Enterprise: Alamin PackagingAl-Amin Packaging Ind.No ratings yet

- 101 200 Financial STMT ST 1 ST 1 LT AccDocument2 pages101 200 Financial STMT ST 1 ST 1 LT AccZin Min HtetNo ratings yet

- 079 140 Note Payable Payments Journal EntryDocument2 pages079 140 Note Payable Payments Journal EntryZin Min HtetNo ratings yet

- 034 1400 Bond Issued at DiscountDocument2 pages034 1400 Bond Issued at DiscountZin Min HtetNo ratings yet

- Sidheswari - Annual Report GarmentDocument44 pagesSidheswari - Annual Report GarmentZin Min HtetNo ratings yet

- Notepad LinksDocument2 pagesNotepad LinksZin Min HtetNo ratings yet

- NotepadDocument1 pageNotepadZin Min HtetNo ratings yet

- Quickguide Jes Extender English 1 PDFDocument12 pagesQuickguide Jes Extender English 1 PDFZin Min HtetNo ratings yet

- CH 06Document19 pagesCH 06Zahid HussainNo ratings yet

- Chapter 4 Parity Conditions in InternatiDocument21 pagesChapter 4 Parity Conditions in InternatiShavi KhanNo ratings yet

- BondAnalytics GlossaryDocument4 pagesBondAnalytics GlossaryNaveen KumarNo ratings yet

- Multiple Choices For Corporate FinanceDocument11 pagesMultiple Choices For Corporate FinanceNhi Mập Ú100% (1)

- 51-bài-dịch-báoDocument221 pages51-bài-dịch-báoduyanh011286No ratings yet

- ACY4001 Advanced Accounting 1 - Individual Assignment 2 - Ch17Document2 pagesACY4001 Advanced Accounting 1 - Individual Assignment 2 - Ch17Morris LoNo ratings yet

- RevisedACFNModelExam - 2023Document15 pagesRevisedACFNModelExam - 2023Eyuel SintayehuNo ratings yet

- Acca f9 and p4 Answers To Reinforcing Questions p4Document80 pagesAcca f9 and p4 Answers To Reinforcing Questions p4Calvince OumaNo ratings yet

- My Project On UlipsDocument83 pagesMy Project On UlipsAlok KumarNo ratings yet

- Review Unit TestDocument7 pagesReview Unit TestJeane Mae BooNo ratings yet

- Cost of Capital - PracticalDocument9 pagesCost of Capital - PracticalKhushi RaniNo ratings yet

- FAR Noel B. Summary of Lectures With PWDDocument4 pagesFAR Noel B. Summary of Lectures With PWDFatima AndresNo ratings yet

- Stanbic Uganda - SBU - Ug 1H09Document9 pagesStanbic Uganda - SBU - Ug 1H09MukarangaNo ratings yet

- Chapter 2: Statement of Financial Position Statement of Financial PositionDocument16 pagesChapter 2: Statement of Financial Position Statement of Financial PositionDaniella Mae ElipNo ratings yet

- 09 Zutter Smart PMF 16e ch09Document59 pages09 Zutter Smart PMF 16e ch09Hafez QawasmiNo ratings yet

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupNo ratings yet

- Project Report On A Study of Performance of Mutual Funds of SbiDocument59 pagesProject Report On A Study of Performance of Mutual Funds of SbiSimran GuptaNo ratings yet

- Study of Investments in Bonds PDFDocument67 pagesStudy of Investments in Bonds PDFMkingNo ratings yet

- Executive Summary: Industry SnapshotDocument105 pagesExecutive Summary: Industry SnapshotRajveer SinghNo ratings yet

- Blue Bond: 1. Facilitating Climate Adaptation-Since Fiji Is Affected by Floods and Cyclones, Blue BondsDocument2 pagesBlue Bond: 1. Facilitating Climate Adaptation-Since Fiji Is Affected by Floods and Cyclones, Blue BondsShaniaNo ratings yet

- Sample Midterm PDFDocument4 pagesSample Midterm PDFVaibhav MittalNo ratings yet

- Prepare Adjusting Entry For The Following:: Entry Made by The Entity Should Be Entry 1Document3 pagesPrepare Adjusting Entry For The Following:: Entry Made by The Entity Should Be Entry 1Ma Teresa B. CerezoNo ratings yet

- Quiz 2 Ue Liabilities UnlockedDocument8 pagesQuiz 2 Ue Liabilities UnlockedPatrick SalvadorNo ratings yet

- Case 3,4 & 5Document11 pagesCase 3,4 & 5Karen Kaye Pasamonte0% (1)

- RHB China High Yield FundDocument2 pagesRHB China High Yield FundTAN CHONG HUINo ratings yet