Professional Documents

Culture Documents

Ca - Bcomph - 4th Sem - 2021

Uploaded by

Mandeep Kaur SahniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca - Bcomph - 4th Sem - 2021

Uploaded by

Mandeep Kaur SahniCopyright:

Available Formats

(c) Number of units to be sold for a profit of Exam.

Code : 108504

Rs. 2,000. Subject Code : 2054

Rs.

B.Com. 4th Semester

Selling price 5 per unit

COST ACCOUNTING

Variable cost 3 per unit

Paper–BCG-406

Fixed cost 3000

Time Allowed—2 Hours] [Maximum Marks—50

Total number of units sold = 2000 units

Show mathematical computations to verify your Note :—There are EIGHT questions of equal marks.

calculations. Candidates are required to attempt any FOUR

questions.

7. What are objectives of budgetary control ? Give its

advantages and disadvantages. 1. What is the need of Cost Accounting ? State its objectives.

8. Find out the following Material variances :

2. From the following particulars relating to the production

(a) Material Cost Variance and sales for the year ended 30th June 2013, prepare

(b) Material Price Variance Cost Sheet showing Prime Cost, Works Cost, Cost of

(c) Material Usage Variance Sales and Profit per unit :

(d) Material Mix Variance Particulars Rs.

(e) Material Yield Variance

Raw material purcahsed as on 1.7.2012 12,500

Standard Actual

Standard Mix Rs. Actual Mix Work in progress as on 1.7.2012 at

Material Material

X 60 kg @ Rs. 5 300 X 56 kg @ Rs. 8 prime cost = Rs. 15,000

Y 40 kg @ Rs. 10 400 Y 44 kg @ Rs. 9 Add manufacturing expenses = Rs. 3,000 18,000

100 kg 700 100 kg Finished goods at cost as on 1.7.2012

(8000 units) 60,000

Loss 30% 30 kg – Loss 25% 25 kg

70 kg 700 75 kg Raw material purchased 1,00,000

6517(2721)/II-6322 4 6517(2721)/II-6322 1 (Contd.)

Particulars Rs. year ending 31st January, 2013 from the following

particulars :

Freight on raw material purchased 5,000

1. Materials = Rs. 3,00,000

Loss of material by fire 5,000

2. Wages = Rs. 6,00,000

Factory expenses 70,000 3. Overhead charges = Rs. 1,20,000

Chargeable expenses 25,000 4. Special plant = Rs. 2,00,000

Direct labour 1,35,000 5. Work certified was for Rs. 16,00,000 and 80% of

Administrative expneses @ Rs. 2 — the same was received in cash.

6. Material lying on site as on 31.1.2013 was

Selling expenses @ Re. 1 —

Rs. 40,000.

Distribution expneses 15,000 7. Depreciate Plant by 10%.

Sale of finished goods (28000 units) 4,00,000 8. 5% of the value of material issued and 6% of

Raw material as on 30.6.2013 20,000 wages may be taken to have been incurred for the

portion of the work completed but not yet certified.

Work in progress as on 30.6.2013 at Overheads are charged as a percentage of direct

prime cost = Rs. 10,000 wages.

Add manufacruring expenses = Rs. 8,000 18,000 9. Ignore depreciaton of Plant for use on uncertified

Stock of finished goods as on 30.6.2013 portion of the work.

(10000 unts) ? 10. Ascertain the amount to be transferred to Profit

and Loss Account on basis of realised profit.

Assume sales are made on FIFO basis.

5. What is the need of Reconciliation ? What are the

3. Explain normal wastage, abnormal wastage and abnormal causes of disagreement of results shown by cost accounts

gain. Discuss their treatment in process accounts. and financial acounts ?

4. M/s. Promising Company undertook a contract for 6. From the following data plot a Break even chart

erecting a sewerage treatment plant for Prosperous showing :

Municipality for a total value of Rs. 24 lakhs. It was (a) Break-even point

estimated that the job would be completed by

(b) Margin of safety and profit

31st January, 2014. Prepare contract account for the

6517(2721)/II-6322 2 (Contd.) 6517(2721)/II-6322 3 (Contd.)

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- CHINESE RESTAURANT Marketing Plan 1Document18 pagesCHINESE RESTAURANT Marketing Plan 1Bilal100% (4)

- Cost AccountingDocument43 pagesCost AccountingAmina QamarNo ratings yet

- CHP 9 Ob Test Bank Chapter 9 Organizational BehaviourDocument10 pagesCHP 9 Ob Test Bank Chapter 9 Organizational BehaviourAr KhNo ratings yet

- Globalization, Slobalization and LocalizationDocument2 pagesGlobalization, Slobalization and LocalizationSadiq NaseerNo ratings yet

- Change Management at Dell CorporationDocument21 pagesChange Management at Dell CorporationimuffysNo ratings yet

- Inventory Management For Amazon IndiaDocument21 pagesInventory Management For Amazon IndiaAnjney Bhardwaj50% (2)

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Practical Problems: Fybsc - Semester Ii - Management Accounting - Extra QuestionsDocument4 pagesPractical Problems: Fybsc - Semester Ii - Management Accounting - Extra QuestionsRahul SinghNo ratings yet

- 1 Cost Sheet TexbookDocument6 pages1 Cost Sheet TexbookVishal Kumar 5504No ratings yet

- Costing (New) MTP Question Paper Mar2021Document8 pagesCosting (New) MTP Question Paper Mar2021ADITYA JAINNo ratings yet

- 3) CostingDocument19 pages3) CostingKrushna MateNo ratings yet

- 51624bos41275inter QDocument5 pages51624bos41275inter QvarunNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- COMSATS University Islamabad, Lahore Campus Terminal Examination –Fall 2020Document3 pagesCOMSATS University Islamabad, Lahore Campus Terminal Examination –Fall 2020Ibrahim IbrahimchNo ratings yet

- CAF-3 CMAModelpaperDocument5 pagesCAF-3 CMAModelpaperAsad ZahidNo ratings yet

- II Internal Test - Accounting For Management - Important QuestionsDocument3 pagesII Internal Test - Accounting For Management - Important QuestionsSTARBOYNo ratings yet

- 4 2 Sma 2018Document5 pages4 2 Sma 2018Nawoda SamarasingheNo ratings yet

- First Time Login Guide MsDocument6 pagesFirst Time Login Guide MskonosubaNo ratings yet

- MA-MP Management AccountingDocument5 pagesMA-MP Management AccountingAhmed RazaNo ratings yet

- ICAP Cost Accounting FE-2 & Modular Paper D12Document4 pagesICAP Cost Accounting FE-2 & Modular Paper D12ShehrozSTNo ratings yet

- END Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Document2 pagesEND Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Lavi LakhotiaNo ratings yet

- Certificate in Accounting and Finance Stage Examination Cost and Management Accounting QuestionsDocument6 pagesCertificate in Accounting and Finance Stage Examination Cost and Management Accounting QuestionsNadir IshaqNo ratings yet

- Variance QuestionsDocument11 pagesVariance QuestionskajaleNo ratings yet

- Test Cost SheetDocument3 pagesTest Cost SheetIt's MeNo ratings yet

- IAS 2 Inventory ValuationDocument4 pagesIAS 2 Inventory ValuationSultanNo ratings yet

- 4 2 Sma 2017Document5 pages4 2 Sma 2017Nawoda SamarasingheNo ratings yet

- Inter Cost 2Document27 pagesInter Cost 2Anirudha SatheNo ratings yet

- BFC 3227 Cost Accounting 2Document5 pagesBFC 3227 Cost Accounting 2peterkiamaw492No ratings yet

- ICAP COST ACCOUNTING EXAM 2003Document3 pagesICAP COST ACCOUNTING EXAM 2003ShehrozSTNo ratings yet

- Paper 1 CA Inter CostingDocument8 pagesPaper 1 CA Inter CostingtchargeipatchNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- Variance QuestionsDocument3 pagesVariance QuestionsHadeed HafeezNo ratings yet

- Test Paper 2 CA Inter CostingDocument8 pagesTest Paper 2 CA Inter CostingtchargeipatchNo ratings yet

- Cost and Management Accounting Assignment Questions SolvedDocument2 pagesCost and Management Accounting Assignment Questions SolvedRahul Nishad100% (1)

- Acct 321 - Managerial AccountingDocument6 pagesAcct 321 - Managerial AccountingNodeh Deh SpartaNo ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Assignement 2Document8 pagesAssignement 2Jerome Moga100% (3)

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Pakistan’s Leading Accountancy Institute Certificate Exam Cost and Management Accounting QuestionsDocument4 pagesPakistan’s Leading Accountancy Institute Certificate Exam Cost and Management Accounting QuestionsNomiNo ratings yet

- Mentoring AB UTS 2015 GasalDocument10 pagesMentoring AB UTS 2015 GasalGilang Aji PradanaNo ratings yet

- Final CMAC (NA) Midterm Q.Paper Aut-23Document5 pagesFinal CMAC (NA) Midterm Q.Paper Aut-23Hassan TanveerNo ratings yet

- Imp 2203 - Costing - Question PaperDocument5 pagesImp 2203 - Costing - Question PaperAnshit BahediaNo ratings yet

- Gtu Mba Ma Winter 2018Document4 pagesGtu Mba Ma Winter 2018umangrathod613No ratings yet

- Cost Attemptwise PPDocument317 pagesCost Attemptwise PPHassnain SardarNo ratings yet

- Cma Past PapersDocument437 pagesCma Past PapersTooba MaqboolNo ratings yet

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanDocument4 pagesT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTNo ratings yet

- Cost Mock Test Paper 2Document7 pagesCost Mock Test Paper 2Soul of honeyNo ratings yet

- Dec 21Document26 pagesDec 21Prabhat Kumar GuptaNo ratings yet

- Costing methods and techniques assessmentDocument3 pagesCosting methods and techniques assessmentAishwarya SundararajNo ratings yet

- C.A Cost Acc P.PDocument29 pagesC.A Cost Acc P.PRaja Ubaid100% (1)

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Final CMAC (SOL) Midterm Q.Paper Aut-23Document4 pagesFinal CMAC (SOL) Midterm Q.Paper Aut-23Anmoul ZahraNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)gulzar ahmadNo ratings yet

- Accountancy-I SubjectiveDocument2 pagesAccountancy-I SubjectiveAhmedNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayNo ratings yet

- Cost Accounting: T I C A PDocument4 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Standard costing analysis and variance calculationDocument16 pagesStandard costing analysis and variance calculationGurveer SNo ratings yet

- r5 NR 302 Mba Cost and Management AccountingDocument2 pagesr5 NR 302 Mba Cost and Management AccountingSrinivasa Rao GNo ratings yet

- Basic Costing Concepts QDocument4 pagesBasic Costing Concepts QUmair GOLDNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Practice MCQ 4Document5 pagesPractice MCQ 4business docNo ratings yet

- Bruin Dog Grooming Journals - Rev 15Document40 pagesBruin Dog Grooming Journals - Rev 15Rishab KhandelwalNo ratings yet

- Plant GM with 15+ Years Operations ExperienceDocument6 pagesPlant GM with 15+ Years Operations ExperiencemohammedNo ratings yet

- Retail Dealer AgreementDocument4 pagesRetail Dealer AgreementSunyazon Multipurpose CompanyNo ratings yet

- CHP 1 - GlobalizationDocument10 pagesCHP 1 - GlobalizationSITI0% (1)

- Assam Handicrafts ResearchDocument28 pagesAssam Handicrafts Researchdilraj singhNo ratings yet

- La La Land SongbookDocument74 pagesLa La Land SongbookNickNo ratings yet

- Fundamentals of Organizational Communication: A01 - SHOC0079 - 09 - SE - FM - Indd 1 08/04/14 4:27 PMDocument26 pagesFundamentals of Organizational Communication: A01 - SHOC0079 - 09 - SE - FM - Indd 1 08/04/14 4:27 PMDaniel PaloNo ratings yet

- Assessment (L4) : Case Analysis: Managerial EconomicsDocument4 pagesAssessment (L4) : Case Analysis: Managerial EconomicsRocel DomingoNo ratings yet

- Call Centre Investment ProposalDocument3 pagesCall Centre Investment ProposalPredueElleNo ratings yet

- MGT489 - Final ExamDocument5 pagesMGT489 - Final ExamNahida akter jannat 1712024630No ratings yet

- Chapter Production and Costs MCQ-1Document8 pagesChapter Production and Costs MCQ-1licab58347No ratings yet

- NOIDA 2021 HandbookDocument59 pagesNOIDA 2021 HandbookpremprakashtransportNo ratings yet

- Class 7 WorksheetDocument7 pagesClass 7 WorksheetPallav ThakurNo ratings yet

- BSBPMG518 Manage Project ProcurementDocument9 pagesBSBPMG518 Manage Project ProcurementPahn PanrutaiNo ratings yet

- AFOMA To Enable Social Impact With Decentralized E-CommerceDocument4 pagesAFOMA To Enable Social Impact With Decentralized E-CommercePR.comNo ratings yet

- DocJuris Contract Playbook Model v4.5 - Service AgreementDocument24 pagesDocJuris Contract Playbook Model v4.5 - Service AgreementvicentesuzukiNo ratings yet

- Class Notes 11 - Fractions & Percentages Practice QuestionsDocument11 pagesClass Notes 11 - Fractions & Percentages Practice Questions4H Boodram ArvindaNo ratings yet

- ANJU Major Project Front PagesDocument9 pagesANJU Major Project Front PagesKrijeshVtmNo ratings yet

- OPEC (Organization of The: Petroleum Exporting Countries)Document12 pagesOPEC (Organization of The: Petroleum Exporting Countries)AMAN DEEP KAURNo ratings yet

- Introduction To Research Methods A Hands On Approach 1st Edition Pajo Test BankDocument12 pagesIntroduction To Research Methods A Hands On Approach 1st Edition Pajo Test Bankethelbertsangffz100% (30)

- Strategy and Analysis in Using Net Present Value: Multiple Choice QuestionsDocument12 pagesStrategy and Analysis in Using Net Present Value: Multiple Choice Questionsphantom ceilNo ratings yet

- Case Study Analysis - Performance Management at Vitality Health Enterprises Inc - Syndicate 5Document15 pagesCase Study Analysis - Performance Management at Vitality Health Enterprises Inc - Syndicate 5Yocky Tegar HerdiansyahNo ratings yet

- Assignment: Financial Management Unit 1Document2 pagesAssignment: Financial Management Unit 1sachinNo ratings yet

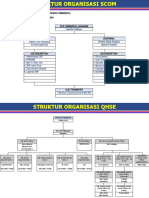

- Struktur Organisasi - Sem, Scarm, Som, Sam, SqhseDocument2 pagesStruktur Organisasi - Sem, Scarm, Som, Sam, SqhseOloyNo ratings yet