Professional Documents

Culture Documents

Coa 1

Uploaded by

Nefer PitouOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coa 1

Uploaded by

Nefer PitouCopyright:

Available Formats

Explaining the principles of cost volume behavior and cost volume analysis

Cost Volume Behavior refers to how a specific cost reacts to changes in activity levels. Fixed

costs are those that stay the same in total regardless of the number of units produced or sold. Fixed

costs per unit vary depending on whether fewer or more units are produced, even though total fixed

costs remain constant. Straight‐line depreciation is an example of a fixed expense. It does not matter if

the machine is used to manufacture 1,000 units or 10,000,000 units in a month, the depreciation

expenditure is the same since it is dependent on the number of years the equipment would be in

operation. Variable costs are those that change in total each time a new unit is manufactured or sold.

With a variable cost, the per unit cost stays the same, but the more units produced or sold, the higher

the total cost. Direct materials is a variable expense. If one yard of fabric costs P5 per yard and it costs

one yard to make one dress, the total cost of the materials is P5. The total cost for 10 dresses is P50 (10

dresses × P5 per dress) and the total cost for 100 dresses is P500 (100 dresses × P5 per dress). Mixed

costs, on the other hand, contain both fixed and variable costs. For example, a corporation pays a price

of P1,000 for the first 800 local phone calls in a month and P0.10 every local call made over 800. A

business made 2,000 local calls in March. It will have a P1,120 phone bill (P1,000 + (1,200 $0.10)).

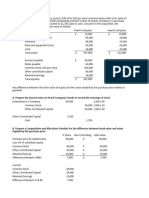

Cost Volume Profit or CVP analysis is an approach in determining how changes in variable and

fixed costs impact a company's profit. Companies can utilize CVP Analysis to determine how many units

they must sell to attain a specific minimum profit margin or break even. Breakeven point is the point

where an entity does not enjoy profit but does not incur a loss, which is when total contribution margin

equals total fixed costs. This is a determinant on how much sales or how much units to be sold to be

able to, at least, cover all operational costs. When employing CVP analysis, accountants often make the

following assumptions: fixed costs won't vary within the relevant range of activity; all costs can be

divided into fixed and variable costs; the selling price per unit won't change; and fixed costs won't

change. For example, if a company has P10,000 in fixed costs per month, and their product has an

average selling price of P100, and the variable cost is $20 for each product, that comes out to a

contribution margin per unit of $80 . Given and solution are stated below.

Fixed Costs per Month = P10,000

Average Selling Price (ASP) = P100.00

Variable Cost per Unit = P20.00

Contribution Margin = P80.00

Break-Even Point (BEP) in units = Fixed Costs ÷ Contribution margin per unit

= 10,000 ÷ 80

= 125 Units

You might also like

- An MBA in a Book: Everything You Need to Know to Master Business - In One Book!From EverandAn MBA in a Book: Everything You Need to Know to Master Business - In One Book!No ratings yet

- Dividends and Other PayoutsDocument29 pagesDividends and Other PayoutsArif AlamgirNo ratings yet

- Finance Lesson 3Document7 pagesFinance Lesson 3mhussainNo ratings yet

- Break Even AnalysisDocument77 pagesBreak Even AnalysisIshani GuptaNo ratings yet

- Management Accounting: Breakeven AnalysisDocument27 pagesManagement Accounting: Breakeven Analysislakshmi aparna yelganamoniNo ratings yet

- Exhibit 3 - Search Fund Formation - Private Placement Memorandum (Sample)Document21 pagesExhibit 3 - Search Fund Formation - Private Placement Memorandum (Sample)Lior100% (1)

- Module 2 - Financial Statements - Organized PDFDocument14 pagesModule 2 - Financial Statements - Organized PDFSandyNo ratings yet

- Cost Behavior Patterns & CVP Analysis: Chapter SixDocument9 pagesCost Behavior Patterns & CVP Analysis: Chapter Sixabraha gebruNo ratings yet

- Chapter 05 - Conceptual Framework Elements of Financial StatementsDocument5 pagesChapter 05 - Conceptual Framework Elements of Financial StatementsKimberly Claire AtienzaNo ratings yet

- Cost-Volume Profit AnalysisDocument26 pagesCost-Volume Profit AnalysisClarizza20% (5)

- Fixed Cost: Marginal CostingDocument6 pagesFixed Cost: Marginal CostingJebby VargheseNo ratings yet

- Share Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Document6 pagesShare Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Peri Babs100% (1)

- Solution Manual For Horngrens Financial Managerial Accounting 6th EditionDocument24 pagesSolution Manual For Horngrens Financial Managerial Accounting 6th EditionDanielleReevesnori100% (42)

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- HMCost3e SM Ch16Document35 pagesHMCost3e SM Ch16Bung Qomar100% (2)

- MBA 504 Ch4 SolutionsDocument25 pagesMBA 504 Ch4 SolutionsPiyush JainNo ratings yet

- CVP PDFDocument20 pagesCVP PDFChelsy SantosNo ratings yet

- Cvp-Bep AnalysisDocument13 pagesCvp-Bep AnalysisVeronica ApallaNo ratings yet

- What Is The Breakeven Point (BEP) ?Document4 pagesWhat Is The Breakeven Point (BEP) ?Muhammad NazmuddinNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and VolumeDocument19 pagesCost-Volume-Profit (CVP) Analysis Is Used To Determine How Changes in Costs and Volumelaur33nNo ratings yet

- 4 Operating LeverageDocument5 pages4 Operating LeverageSatyam KumarNo ratings yet

- Lesson 4 HND in Business Unit 5 Management AccountingDocument32 pagesLesson 4 HND in Business Unit 5 Management AccountingShan Wikoon LLB LLM100% (3)

- 1 Total Variable Costs and Unit Variable Costs Behave Differently With Changes in The Level of ActivityDocument2 pages1 Total Variable Costs and Unit Variable Costs Behave Differently With Changes in The Level of ActivityravenboifowlerNo ratings yet

- CostDocument3 pagesCostKMarshall06No ratings yet

- CVPDocument20 pagesCVPDen Potxsz100% (1)

- CVP & BEP Analysis - 1Document45 pagesCVP & BEP Analysis - 1nahi batanaNo ratings yet

- Cost Profit Volume AnalysisDocument28 pagesCost Profit Volume AnalysisClarice LangitNo ratings yet

- Break-Even AnalysisDocument2 pagesBreak-Even AnalysisMahadie HasanNo ratings yet

- Break-Even Point, Return On Investment and Return On SalesDocument8 pagesBreak-Even Point, Return On Investment and Return On SalesGaurav kumarNo ratings yet

- CH 04Document40 pagesCH 04thrust_xone100% (1)

- Presented By: Lutfi Ms Ananthakrishnan Malavika Sreekumar Manilal Kasera Mitesh KumarDocument14 pagesPresented By: Lutfi Ms Ananthakrishnan Malavika Sreekumar Manilal Kasera Mitesh KumarManilal kaseraNo ratings yet

- Contribution Margin Definition - InvestopediaDocument6 pagesContribution Margin Definition - InvestopediaBob KaneNo ratings yet

- Cost, Revenues and Profits Book-Chapter 13Document9 pagesCost, Revenues and Profits Book-Chapter 13Nikolai GaleaNo ratings yet

- Ma2 Examreport Aug19 Sept20Document6 pagesMa2 Examreport Aug19 Sept20tashiNo ratings yet

- Marginal Cost of ProductionDocument9 pagesMarginal Cost of ProductionJunayed MostafaNo ratings yet

- Managerial QuizDocument6 pagesManagerial QuizKezia SantosidadNo ratings yet

- ACC 2200 Milestone 1Document8 pagesACC 2200 Milestone 1Akhuetie IsraelNo ratings yet

- Cost II Chap 1Document10 pagesCost II Chap 1abelNo ratings yet

- Business & Finance Chapter-7 Part-02 PDFDocument12 pagesBusiness & Finance Chapter-7 Part-02 PDFRafidul IslamNo ratings yet

- Breakeven AnalysisDocument6 pagesBreakeven Analysisarbiepomarin84No ratings yet

- Strategic Cost Management - Semester SummaryDocument15 pagesStrategic Cost Management - Semester SummaryivandimaunahannnNo ratings yet

- Lesson 15 TextbookDocument24 pagesLesson 15 Textbookluo jamesNo ratings yet

- Variable Costing: VersusDocument22 pagesVariable Costing: VersusNathanaelNo ratings yet

- What Is Break Even Analysis?: Cost Accounting Total Revenue Fixed and Variable CostsDocument9 pagesWhat Is Break Even Analysis?: Cost Accounting Total Revenue Fixed and Variable CostsShuvro RahmanNo ratings yet

- CVP Analysis-1Document40 pagesCVP Analysis-1Gul Muhammad BalochNo ratings yet

- Cost Volume Profit AnalysisDocument16 pagesCost Volume Profit AnalysisAlthon JayNo ratings yet

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- Chapter 2 Types of Cost Data and Cost AnalysisDocument22 pagesChapter 2 Types of Cost Data and Cost AnalysisssinxxieNo ratings yet

- Break Even AnalysisDocument9 pagesBreak Even AnalysisBankatesh ChoudharyNo ratings yet

- Operating LeverageDocument4 pagesOperating Leveragetimothy454No ratings yet

- CVP AnalysisDocument33 pagesCVP AnalysisnamuNo ratings yet

- Cost and Management Accounting 93680Document16 pagesCost and Management Accounting 93680Vivek SharmaNo ratings yet

- Module 7 CVP Analysis SolutionsDocument12 pagesModule 7 CVP Analysis SolutionsChiran AdhikariNo ratings yet

- Break-Even 8.1&8.2Document23 pagesBreak-Even 8.1&8.2Jelian E. TangaroNo ratings yet

- 68 TermsDocument7 pages68 TermsakenemidNo ratings yet

- Presented By:: Group NoDocument14 pagesPresented By:: Group NoAbhinav SharmaNo ratings yet

- Cost Behaviour and Cost-Volume-Profit AnalysisDocument13 pagesCost Behaviour and Cost-Volume-Profit AnalysisMarife N. Cabajon100% (2)

- Application of Marginal CostingDocument18 pagesApplication of Marginal CostingKishor Nag0% (1)

- How Do You Find The Optimal Output AlgebraicallyDocument7 pagesHow Do You Find The Optimal Output AlgebraicallyasfawmNo ratings yet

- Chapter 4Document3 pagesChapter 4Amr AmrNo ratings yet

- Chapter 7 NotesDocument6 pagesChapter 7 NotesImadNo ratings yet

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- Unit 2Document7 pagesUnit 2Palak JainNo ratings yet

- In BusinessDocument6 pagesIn BusinessPhoebe LlameloNo ratings yet

- CPVDocument5 pagesCPVPrasetyo AdityaNo ratings yet

- Respected SirDocument1 pageRespected SirNefer PitouNo ratings yet

- ResearcherDocument1 pageResearcherNefer PitouNo ratings yet

- Research QuesDocument5 pagesResearch QuesNefer PitouNo ratings yet

- WilsonDocument1 pageWilsonNefer PitouNo ratings yet

- Kay RainierDocument3 pagesKay RainierNefer PitouNo ratings yet

- Kay Rainier LametDocument2 pagesKay Rainier LametNefer PitouNo ratings yet

- Impacts of The QuickDocument2 pagesImpacts of The QuickNefer PitouNo ratings yet

- InDocument1 pageInNefer PitouNo ratings yet

- Gov ReportDocument2 pagesGov ReportNefer PitouNo ratings yet

- In Previous Novels in TheDocument1 pageIn Previous Novels in TheNefer PitouNo ratings yet

- Assignment To Topic 1Document2 pagesAssignment To Topic 1Nefer PitouNo ratings yet

- Hahahhaha Ge For ThemDocument1 pageHahahhaha Ge For ThemNefer PitouNo ratings yet

- Jay LordDocument1 pageJay LordNefer PitouNo ratings yet

- Essay RubricDocument1 pageEssay RubricNefer PitouNo ratings yet

- First Learners ActivityDocument1 pageFirst Learners ActivityNefer PitouNo ratings yet

- At The Middle School LevelDocument1 pageAt The Middle School LevelNefer PitouNo ratings yet

- ActivityDocument3 pagesActivityNefer PitouNo ratings yet

- ConclusionDocument1 pageConclusionNefer PitouNo ratings yet

- Cenpelco OjtDocument23 pagesCenpelco OjtNefer PitouNo ratings yet

- Module 1. Corporate GovernanceDocument9 pagesModule 1. Corporate GovernanceNefer PitouNo ratings yet

- Assignment-Management Accounting 1 Module 1Document1 pageAssignment-Management Accounting 1 Module 1Nefer PitouNo ratings yet

- Course Outcomes Assesment No. 1 1. Discuss The History of Environmental ScienceDocument4 pagesCourse Outcomes Assesment No. 1 1. Discuss The History of Environmental ScienceNefer PitouNo ratings yet

- Chapter 5 ActivityDocument2 pagesChapter 5 ActivityMika MolinaNo ratings yet

- Financial Management Project: Presented byDocument16 pagesFinancial Management Project: Presented byAsif KhanNo ratings yet

- IntechDocument19 pagesIntechOnickul HaqueNo ratings yet

- Operating and Financial Leverage Operating and Financial LeverageDocument58 pagesOperating and Financial Leverage Operating and Financial LeverageFarzad TouhidNo ratings yet

- Dissertation On Credit Default SwapDocument6 pagesDissertation On Credit Default SwapBuyingPaperCanada100% (1)

- Total Benefit: An Example: Suppose PV0 - 0.7m, and We Have The Following Present ValuesDocument2 pagesTotal Benefit: An Example: Suppose PV0 - 0.7m, and We Have The Following Present ValuesHello FinesNo ratings yet

- Cash CA NCA CLDocument8 pagesCash CA NCA CL15vinayNo ratings yet

- NFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358Document2 pagesNFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358bitsthechampNo ratings yet

- This Study Resource Was: For The Next 6 ItemsDocument9 pagesThis Study Resource Was: For The Next 6 ItemsJames CastañedaNo ratings yet

- First Time Adoption of PFRSDocument5 pagesFirst Time Adoption of PFRSPia ArellanoNo ratings yet

- Fundamentals of Corporate Finance 7th Edition Brealey Test BankDocument54 pagesFundamentals of Corporate Finance 7th Edition Brealey Test BankEmilyJohnsonfnpgb100% (13)

- Accounts Ques (2 Files Merged)Document5 pagesAccounts Ques (2 Files Merged)Ishaan TandonNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Module 6 Investment PropertyDocument9 pagesModule 6 Investment PropertyMonica mangobaNo ratings yet

- Group 5 Case of Financial StatementDocument6 pagesGroup 5 Case of Financial StatementDhomas AgastyaNo ratings yet

- Horizontal and Vertical Analysis of Maruti SuzukiDocument31 pagesHorizontal and Vertical Analysis of Maruti SuzukiAnushka GuptaNo ratings yet

- Capital Structure: Limits To The Use of DebtDocument9 pagesCapital Structure: Limits To The Use of DebtTridha BajajNo ratings yet

- ResultDocument20 pagesResultPayal JainNo ratings yet

- CM Student GuideDocument62 pagesCM Student GuideASHUTOSH UPADHYAYNo ratings yet

- Ubs Sekuritas Indonesia Bilingual 31 Dec 2017 Released PDFDocument61 pagesUbs Sekuritas Indonesia Bilingual 31 Dec 2017 Released PDFCharles EdwardNo ratings yet

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet

- This Study Resource WasDocument5 pagesThis Study Resource WasadssdasdsadNo ratings yet

- An Intro To Bussiness AccountingDocument57 pagesAn Intro To Bussiness AccountingNadia AnuarNo ratings yet

- Financial Planning and BudgetingDocument45 pagesFinancial Planning and BudgetingRafael BensigNo ratings yet