Professional Documents

Culture Documents

SOLON, DOnnie Ray O - TAxation2 - Seatwork 3

Uploaded by

DONNIE RAY SOLONOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SOLON, DOnnie Ray O - TAxation2 - Seatwork 3

Uploaded by

DONNIE RAY SOLONCopyright:

Available Formats

SOLON, Donnie Ray O Taxation 2

20-1-01343 Atty Dela Rosa

Seatwork No. 3

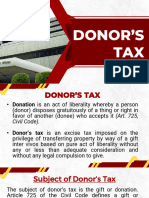

1. The Concept of Donation for donor’s Tax purposes is broader in scope that

its civil law concept because the provisions of the civil code in terms of

donation only cover’s the act of liberality whereby a person disposes

gratuitously of a thing or right in favour of another who accepts it. As

compared to the Donation for Donor’s Tax purposes which considered as

supplement the estate tax by preventing the avoidance of the latter through

the device of donating the property during the lifetime of the deceased

(donor). In Addition, donor’s tax also prevent the avoidance of income taxes.

Without donor’s tax, the donor may escape the progressive rates of income

taxation through the simple expedient of splitting his income among

numerous donees.

2. Donor’s Tax, being a tax being imposed on the privilege of the donor to give

a property as a way of gift, and can only be imposed when such gift was

received, is an excise tax that was imposed upon the right of a person to

transfer property gratuitously during his lifetime.

3. a tax on the privilege of the donor to

give; it is not a property tax but is a tax

4. imposed on the transfer of property by

way of gift during the life time of the donor.

The donor’s tax shall

5. not apply unless and until there is a

completed gift. It is an excise tax imposed

upon the right of a person

6. to transfer property gratuitously during

his lifeti

3. No, the condonation made by Mr Y on the debt of Mr. X cannot be

considered as a donation or gift. For a condonation of debt to be subjected

to donor’s tax, any consideration should not exist between the creditor and

SOLON, Donnie Ray O Taxation 2

20-1-01343 Atty Dela Rosa

Seatwork No. 3

the debtor. Considering that the condonation was wade after Mr X repaired

the Car of Mr Y, there is a service rendered on the part of Mr X, thus the

condonation is made as a consideration and not gratuitously given

If there will be a tax imposed on this case, Mr X will be subjected to income

tax and not of a donor’s tax.

4. The general renunciation by an heir, in this case the surviving spouse, of

his share in the hereditary estate left by the deceased is not subject to

donor’s tax. Because of this renunciation, right of accretion arises and, the

heir who renounces or cannot receive his share is added or incorporated to

that of his co-heirs, co-devisees or co-legatees. His share accrues to his co-

heirs in the same proportion that they inherit. Consequently, the heir can

never be considered to have owned his share in the inheritance that he

renounced. He could not donate a property that he never owned. As a

result, the heir who renounces his inheritance is not subject to donor’s tax

5. No. the property of a non-resident alien located outside the Philippines is

not subject to donor’s Tax

6. Even if donation and inheritance has same tax rates, donation is considered

to be a more efficient means to transfer the property. Donation has a wider

range of individuals it can transfer property to, and also the quicker in

terms of process considering that inheritance still go through the needed

court proceedings to probate the will.

You might also like

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Lecture Donors TaxDocument9 pagesLecture Donors TaxOtis MelbournNo ratings yet

- Donor Tax Rules for GiftsDocument16 pagesDonor Tax Rules for GiftsJohn Russel PacunNo ratings yet

- Donor S TaxDocument68 pagesDonor S TaxLuna CakesNo ratings yet

- Adsum Notes - Tax Transcript (Donor's Tax)Document23 pagesAdsum Notes - Tax Transcript (Donor's Tax)Raz SP100% (3)

- B. Donor's (Gift) Tax Definition and NatureDocument12 pagesB. Donor's (Gift) Tax Definition and Naturemariyha PalangganaNo ratings yet

- Donor's Tax - LMDocument9 pagesDonor's Tax - LMLouis MalaybalayNo ratings yet

- NotesDocument1 pageNotesprintzee.101No ratings yet

- Estate TaxDocument26 pagesEstate Taxkitayroselyn4No ratings yet

- DONOR ReviewerDocument2 pagesDONOR ReviewerKath ONo ratings yet

- Module 3 Donor's Tax (Part 1)Document39 pagesModule 3 Donor's Tax (Part 1)Venice Marie ArroyoNo ratings yet

- DONORDocument5 pagesDONORJN CNo ratings yet

- Donation Tax BasicsDocument44 pagesDonation Tax Basicsaehy lznuscrfbjNo ratings yet

- Donors Tax Under NircDocument8 pagesDonors Tax Under NircEinstein SalcedoNo ratings yet

- Donors Tax 2023Document34 pagesDonors Tax 2023Stephanie AlindoganNo ratings yet

- Ampongan Chap 1Document2 pagesAmpongan Chap 1iamjan_101No ratings yet

- ACT26 - Ch02 Donors TaxDocument7 pagesACT26 - Ch02 Donors TaxMark BajacanNo ratings yet

- Donor's Tax PDFDocument16 pagesDonor's Tax PDFJewel Francine PUDESNo ratings yet

- Donor's Tax Basics, Exemptions and AdviceDocument5 pagesDonor's Tax Basics, Exemptions and AdviceJunivenReyUmadhayNo ratings yet

- CHAPTER 6 - Donor's Tax ReportDocument58 pagesCHAPTER 6 - Donor's Tax ReportheyheyNo ratings yet

- Donor's Tax GuideDocument23 pagesDonor's Tax GuideJohn Paulo CalubNo ratings yet

- Transfer Taxes on Donation Chapter 3Document1 pageTransfer Taxes on Donation Chapter 3Kitem Kadatuan Jr.No ratings yet

- Transfer Taxation (CH 6 Donor's Tax)Document10 pagesTransfer Taxation (CH 6 Donor's Tax)Dahyun DahyunNo ratings yet

- Nature of DonationDocument19 pagesNature of DonationMarta MeaNo ratings yet

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- Reaction Paper On Article On Donors Tax Valencia, Reginald GDocument1 pageReaction Paper On Article On Donors Tax Valencia, Reginald GReginald ValenciaNo ratings yet

- Donor's Tax HandoutDocument14 pagesDonor's Tax HandoutJamesiversonNo ratings yet

- Bam 208 Acc 123 B5Document15 pagesBam 208 Acc 123 B5zoba.padama.upNo ratings yet

- Donor's TaxDocument48 pagesDonor's TaxCHARLOTTE THALININo ratings yet

- chapter 6_donors tax (28)Document59 pageschapter 6_donors tax (28)argene.malubayNo ratings yet

- Taxation 1 Mod 3Document45 pagesTaxation 1 Mod 3Harui Hani-31No ratings yet

- Module 1 - Lesson 1 - Administrative Provisions and Fundamental Concepts of Donor's TaxationDocument4 pagesModule 1 - Lesson 1 - Administrative Provisions and Fundamental Concepts of Donor's Taxationohmyme sungjaeNo ratings yet

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinNo ratings yet

- Tax Notes: Donor's Tax and Gift TaxDocument6 pagesTax Notes: Donor's Tax and Gift TaxMaria Victoria75% (4)

- Donor PDFDocument5 pagesDonor PDFHyun SeonNo ratings yet

- Donation ReviewerDocument6 pagesDonation ReviewerronaldNo ratings yet

- Donor's Tax Explained: Key Elements, Purposes and ClassificationsDocument3 pagesDonor's Tax Explained: Key Elements, Purposes and ClassificationsJohn Lexter MacalberNo ratings yet

- Donors Tax in The Philippines Under TRAINDocument4 pagesDonors Tax in The Philippines Under TRAINAnna Dominique VillanuevaNo ratings yet

- Donor's TaxDocument4 pagesDonor's TaxEunice ParraNo ratings yet

- Module 1 Lesson 5Document6 pagesModule 1 Lesson 5Rich Ann Redondo VillanuevaNo ratings yet

- Business Taxation Part 1Document5 pagesBusiness Taxation Part 1Rich Ann Redondo VillanuevaNo ratings yet

- Tax 2 Reviewer LectureDocument12 pagesTax 2 Reviewer LectureAnonymous aRheeMNo ratings yet

- UntitledDocument4 pagesUntitledKayla sofia AsturiasNo ratings yet

- TAXATION 2 Chapter 1 Introduction To Transfer TaxationDocument5 pagesTAXATION 2 Chapter 1 Introduction To Transfer TaxationKim Cristian MaañoNo ratings yet

- Tax2 TRAIN 8.5x13Document64 pagesTax2 TRAIN 8.5x13Kim EstalNo ratings yet

- Donors TaxDocument4 pagesDonors TaxTrisha Nicole FloresNo ratings yet

- Tax FinalsDocument30 pagesTax FinalsJennie KimNo ratings yet

- Donor's Tax: Understanding the Key ConceptsDocument8 pagesDonor's Tax: Understanding the Key ConceptsAngela Denisse FranciscoNo ratings yet

- Understanding DonationsDocument34 pagesUnderstanding DonationsToman BenkeiNo ratings yet

- Ch10 Donor's TaxDocument9 pagesCh10 Donor's TaxRenelyn FiloteoNo ratings yet

- Based On Who CollectsDocument3 pagesBased On Who CollectsRujean Salar AltejarNo ratings yet

- Condonation or Cancellation of IndebtednessDocument4 pagesCondonation or Cancellation of IndebtednessArceño, Advrelyn Frances C.No ratings yet

- Pates - Article 725-759Document46 pagesPates - Article 725-759hiltonbraiseNo ratings yet

- Name: Napoleon C. Lomotan Professor: Dean Cordova Year and Section: BSA-4A Date: January 23, 2019Document6 pagesName: Napoleon C. Lomotan Professor: Dean Cordova Year and Section: BSA-4A Date: January 23, 2019JenniferFajutnaoArcosNo ratings yet

- Association of Taxation and Law Students Donation and Donor's Tax ConceptDocument13 pagesAssociation of Taxation and Law Students Donation and Donor's Tax ConceptShiela May Agustin MacarayanNo ratings yet

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemFrom EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemRating: 4 out of 5 stars4/5 (16)

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Supreme CourtDocument4 pagesSupreme CourtDONNIE RAY SOLONNo ratings yet

- Deed of Conditional SaleDocument4 pagesDeed of Conditional SaleDONNIE RAY SOLONNo ratings yet

- Ient VS TulletDocument2 pagesIent VS TulletDonnie Ray Olivarez SolonNo ratings yet

- Transportation Law ReviewerDocument29 pagesTransportation Law ReviewerDONNIE RAY SOLONNo ratings yet

- G.R. No. L-4811 Woodhouse v. Halili 93 Phil. 526 (1953)Document5 pagesG.R. No. L-4811 Woodhouse v. Halili 93 Phil. 526 (1953)DONNIE RAY SOLONNo ratings yet

- G.R. No. 83377 de Vera v. AguilarDocument4 pagesG.R. No. 83377 de Vera v. AguilarDONNIE RAY SOLONNo ratings yet

- Supreme Court: Beaumont, Tenney and Ferrier For Plaintiff. Buencamino and Lontok For DefendantDocument3 pagesSupreme Court: Beaumont, Tenney and Ferrier For Plaintiff. Buencamino and Lontok For DefendantDONNIE RAY SOLONNo ratings yet

- Supreme Court: R. M. Calvo For Appellant. Jose Arnaiz For AppelleesDocument7 pagesSupreme Court: R. M. Calvo For Appellant. Jose Arnaiz For AppelleesDONNIE RAY SOLONNo ratings yet

- UntitledDocument10 pagesUntitledDONNIE RAY SOLONNo ratings yet

- UntitledDocument9 pagesUntitledDONNIE RAY SOLONNo ratings yet

- G.R. No. L-4388 PNB v. Seeto 91 Phil. 756 (1952)Document3 pagesG.R. No. L-4388 PNB v. Seeto 91 Phil. 756 (1952)DONNIE RAY SOLONNo ratings yet

- Supreme Court Rules on Parol Evidence in Land Contract DisputeDocument2 pagesSupreme Court Rules on Parol Evidence in Land Contract DisputeDONNIE RAY SOLONNo ratings yet

- Fillable BFP Operational Standards FormDocument9 pagesFillable BFP Operational Standards FormDONNIE RAY SOLONNo ratings yet

- G.R. No. 96405 Inciong v. CA, 257 SCRA 578 (1996)Document5 pagesG.R. No. 96405 Inciong v. CA, 257 SCRA 578 (1996)DONNIE RAY SOLONNo ratings yet

- 07 E. Michael & Co. v. EnriquezDocument2 pages07 E. Michael & Co. v. EnriquezShannon Gail MaongsongNo ratings yet

- 24griffin v. California 380 SCRA 853 1965 PDFDocument9 pages24griffin v. California 380 SCRA 853 1965 PDFDONNIE RAY SOLONNo ratings yet

- Document PDFDocument29 pagesDocument PDFDONNIE RAY SOLONNo ratings yet

- Philippine Supreme Court upholds oral agreement extending deadline to repurchase landDocument2 pagesPhilippine Supreme Court upholds oral agreement extending deadline to repurchase landDONNIE RAY SOLONNo ratings yet

- People Vs AlegreDocument8 pagesPeople Vs AlegreBernadetteNo ratings yet

- 19matter of Farber A.B. 394 A.2d 330 1978 PDFDocument35 pages19matter of Farber A.B. 394 A.2d 330 1978 PDFDONNIE RAY SOLONNo ratings yet

- 20viacrucis v. CA 44 SCRA 176 1972 PDFDocument8 pages20viacrucis v. CA 44 SCRA 176 1972 PDFDONNIE RAY SOLONNo ratings yet

- SOLON, DOnnie Ray O - TAxation2 - Seatwork 3Document2 pagesSOLON, DOnnie Ray O - TAxation2 - Seatwork 3DONNIE RAY SOLONNo ratings yet

- Rape Case Decision Analyzes Evidence and CredibilityDocument22 pagesRape Case Decision Analyzes Evidence and CredibilityDONNIE RAY SOLONNo ratings yet

- People v. PublicoDocument2 pagesPeople v. Publicolouis jansenNo ratings yet

- Uy Chico v. Union Life, 29 Phil 163 (1915)Document2 pagesUy Chico v. Union Life, 29 Phil 163 (1915)DONNIE RAY SOLONNo ratings yet

- Rosete Vs CA - SOLONDocument2 pagesRosete Vs CA - SOLONDONNIE RAY SOLONNo ratings yet

- Supreme Court Rules on Marketing Distributor Liability Based on Sales Agreements and Admissions of DebtDocument5 pagesSupreme Court Rules on Marketing Distributor Liability Based on Sales Agreements and Admissions of DebtBernadetteNo ratings yet

- SOLON, Donnie Ray O. - Legal OpinionDocument3 pagesSOLON, Donnie Ray O. - Legal OpinionDONNIE RAY SOLONNo ratings yet

- Lawyer's OathDocument1 pageLawyer's OathKukoy PaktoyNo ratings yet

- Uganda court rules on jurisdiction in cargo disputeDocument14 pagesUganda court rules on jurisdiction in cargo disputeKellyNo ratings yet

- Undertaking RevisedDocument3 pagesUndertaking RevisedPatrick Erica Antonio Lazo50% (2)

- Understanding Your EIN PUB 1635Document44 pagesUnderstanding Your EIN PUB 1635company22100% (3)

- BPI - Secretary's Certificate TemplateDocument3 pagesBPI - Secretary's Certificate TemplatemaureenNo ratings yet

- Insular Life Assurance Company, Ltd. vs. Asset Builders CorporationDocument25 pagesInsular Life Assurance Company, Ltd. vs. Asset Builders CorporationChaNo ratings yet

- Coastwise Lighterage Vs CADocument3 pagesCoastwise Lighterage Vs CAMikee RañolaNo ratings yet

- Insurance Claims BCOM 1ST YEARDocument7 pagesInsurance Claims BCOM 1ST YEARsewebib431No ratings yet

- LAND REGISTRATION LAW ReviewerDocument9 pagesLAND REGISTRATION LAW ReviewerAshley CaoNo ratings yet

- Redemption of Preference ShareDocument16 pagesRedemption of Preference ShareRohithNo ratings yet

- Revenue Sharing AgreementDocument4 pagesRevenue Sharing AgreementManokaran Chandhni100% (1)

- Practicing Company SecretaryDocument2 pagesPracticing Company SecretaryNishant OvhalNo ratings yet

- Motor Claim FormDocument3 pagesMotor Claim FormYCMOUNo ratings yet

- NLIU BHOPAL PROJECT ON ABSOLUTE LIABILITYDocument24 pagesNLIU BHOPAL PROJECT ON ABSOLUTE LIABILITYJatin MeenaNo ratings yet

- Fidic White BookDocument28 pagesFidic White BookAhmad MusthofaNo ratings yet

- Sps. Pio Dato Vs BPI, G.R. No. 181873, November 27, 2013Document2 pagesSps. Pio Dato Vs BPI, G.R. No. 181873, November 27, 2013Rizchelle Sampang-ManaogNo ratings yet

- OFFER - TO - PURCHASE sAMPLEDocument2 pagesOFFER - TO - PURCHASE sAMPLELeiNo ratings yet

- Tiu vs Arriesgado Case Digest on Common Carrier LiabilityDocument2 pagesTiu vs Arriesgado Case Digest on Common Carrier Liabilitymario navalezNo ratings yet

- Évangile Selon Jean by AnonymousDocument10 pagesÉvangile Selon Jean by AnonymousGutenberg.orgNo ratings yet

- De Jesus vs. The City of ManilaDocument2 pagesDe Jesus vs. The City of ManilaCarissa Cruz100% (1)

- Talobatib HS receives donation for educationDocument1 pageTalobatib HS receives donation for educationeulogio m. abantoNo ratings yet

- Gift Deed PradeepDocument4 pagesGift Deed PradeepMuni ReddyNo ratings yet

- Millado Dan - Affidavit of Adverse ClaimDocument2 pagesMillado Dan - Affidavit of Adverse ClaimDan MilladoNo ratings yet

- CasesDocument3 pagesCasesamyr felipeNo ratings yet

- Special Power of Attorney TransferDocument2 pagesSpecial Power of Attorney TransferAlfred BryanNo ratings yet

- Property Mortgaged, While in The Name of Edgar Omengan, Is Owned in Co-Ownership by All The Children of The Late Roberto and Elnora OmenganDocument8 pagesProperty Mortgaged, While in The Name of Edgar Omengan, Is Owned in Co-Ownership by All The Children of The Late Roberto and Elnora OmenganNiajhan PalattaoNo ratings yet

- Alex Remick Fraud Case, KHDocument34 pagesAlex Remick Fraud Case, KHWait What?100% (1)

- Partnership at WillDocument11 pagesPartnership at WillmyaccountofScribd100% (3)

- ATP - Villanueva (2018)Document385 pagesATP - Villanueva (2018)Ronald Z. RayaNo ratings yet

- Jimenez v. City of Manila GR No. 71049 May 29 1987Document3 pagesJimenez v. City of Manila GR No. 71049 May 29 1987Ren MagallonNo ratings yet

- Rental Deed CompressedDocument10 pagesRental Deed Compressedalnuman.techparkNo ratings yet