Professional Documents

Culture Documents

Case 19 - Fonderia Del Piemonte

Case 19 - Fonderia Del Piemonte

Uploaded by

Voramon PolkertOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 19 - Fonderia Del Piemonte

Case 19 - Fonderia Del Piemonte

Uploaded by

Voramon PolkertCopyright:

Available Formats

Case 19

Fonderia del Piemonte S.p.A.

Synopsis and Objectives

The managing director of a specialty foundry must decide whether to approve a major

investment to automate part of her plant’s production process. The case presents information

sufficient to build cash flow forecasts of production costs incremental to this investment.

Discounted cash flow (DCF) analysis reveals that this investment project is attractive but that the

benefits hinge on important assumptions about the plant’s business volume, the manager’s

ability to lay off workers over the objections of a labor union, and the hurdle rate.

Suggested Questions

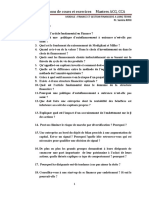

1. What is the basic nature of the problem in this case?

2. What are the cash flows associated with the Thor MM-9 investment?

3. What discount rate did you use? What DCF did you get?

4. Are you uncertain about any of the assumptions? What does a sensitivity analysis of those

assumptions reveal?

5. Are there qualitative issues that we should address but which are not reflected in the DCF

analysis?

6. What should Martina Bellucci recommend to her board of directors?

You might also like

- Financial Statement Analysis and Security Valuation: - October 26, 2022 Arnt VerriestDocument42 pagesFinancial Statement Analysis and Security Valuation: - October 26, 2022 Arnt VerriestfelipeNo ratings yet

- Chapter 1 - Multinational Financial Management - QuizDocument11 pagesChapter 1 - Multinational Financial Management - Quizhy_saingheng_7602609100% (1)

- Business Administration Past PapersDocument35 pagesBusiness Administration Past PapersBilal Hussain0% (3)

- TN19 Target CorporationDocument18 pagesTN19 Target CorporationStanisla Lee100% (4)

- Managerial EconomicsDocument16 pagesManagerial EconomicsIzwan YusofNo ratings yet

- Roland Berger - Diversification Out of Box 2008 PDFDocument54 pagesRoland Berger - Diversification Out of Box 2008 PDFmclaytonNo ratings yet

- CAPITAL BUDGETING Ultratech Cements 2015Document87 pagesCAPITAL BUDGETING Ultratech Cements 2015Nair D Sravan50% (2)

- SFM Theory Compiler - Bhavik ChokshiDocument54 pagesSFM Theory Compiler - Bhavik Chokshirajat100% (2)

- DupontDocument4 pagesDupontChanathip_Kupr_4289No ratings yet

- Business Technology and Finance - QuestionDocument13 pagesBusiness Technology and Finance - QuestionNghiêm Thị Mai Anh100% (1)

- Group B&D - Case 19 - Fonderia PresentationDocument24 pagesGroup B&D - Case 19 - Fonderia PresentationVinithi Thongkampala100% (2)

- 10 Steps Strategy For SME Success: Commissioned by Oracle CorporationDocument28 pages10 Steps Strategy For SME Success: Commissioned by Oracle CorporationNaveen PandeyNo ratings yet

- FINA 6092 Case QuestionsDocument7 pagesFINA 6092 Case QuestionsKenny HoNo ratings yet

- Week 2Document80 pagesWeek 2王振權No ratings yet

- FinMo 2019 CaseDocument33 pagesFinMo 2019 CaseTa Thi Minh ChauNo ratings yet

- 26.2.23 Ford Case.Document1 page26.2.23 Ford Case.ximena salasNo ratings yet

- Questions Azxcfor PreparationDocument2 pagesQuestions Azxcfor Preparationsomu9006No ratings yet

- Financial Consulting (8051F017) lGzdIPAY0bDocument4 pagesFinancial Consulting (8051F017) lGzdIPAY0bRishabh MishraNo ratings yet

- PM 302 Academic Penalty Questions2Document3 pagesPM 302 Academic Penalty Questions2Mansi VermaNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument16 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 Editionsamer abou saadNo ratings yet

- Chap 06Document32 pagesChap 06yakayuno4No ratings yet

- LM04 Capital InvestmentsDocument15 pagesLM04 Capital InvestmentsSYED HAIDER ABBAS KAZMINo ratings yet

- The Bulletin: Setting The 2020 Audit Committee AgendaDocument11 pagesThe Bulletin: Setting The 2020 Audit Committee Agenda范洁No ratings yet

- Summary Chapter 2 - 502865Document2 pagesSummary Chapter 2 - 502865maudynashira8No ratings yet

- Tapping Into New and International MarketsDocument31 pagesTapping Into New and International MarketsFahim KhanNo ratings yet

- OM Assignment - 1Document8 pagesOM Assignment - 1Soubhik HaldarNo ratings yet

- Gtum21ekm Coursework 2Document3 pagesGtum21ekm Coursework 2spencerbokor07No ratings yet

- Questions ACG, CCADocument6 pagesQuestions ACG, CCAHamza El MissouabNo ratings yet

- Case Questions Spring 2012Document2 pagesCase Questions Spring 2012Refika TetikNo ratings yet

- 2 - Generic Business Plan PDFDocument13 pages2 - Generic Business Plan PDFKamran SaleemNo ratings yet

- Managerial Economics in EngineeringDocument2 pagesManagerial Economics in Engineeringtanuias2009No ratings yet

- Developing A Business PlanDocument36 pagesDeveloping A Business PlanFloribeth MisaNo ratings yet

- 00 Theories Final Exam To Be PrintedDocument4 pages00 Theories Final Exam To Be PrintedPillos Jr., ElimarNo ratings yet

- Focused ManufacturingDocument10 pagesFocused Manufacturingniroshan24No ratings yet

- IB Bm2tr 1 Resources Answers3Document7 pagesIB Bm2tr 1 Resources Answers3Dương Ngọc HuyềnNo ratings yet

- Advance Performance ManagementDocument53 pagesAdvance Performance ManagementAyesha HamidNo ratings yet

- CbmecDocument3 pagesCbmecFrancisco AssisiNo ratings yet

- SFM Theory Compiler by CA - Bhavik ChokshiDocument82 pagesSFM Theory Compiler by CA - Bhavik ChokshiNithya StephenNo ratings yet

- FAB/F1: Accountant in Business: Final Assessment 8Document14 pagesFAB/F1: Accountant in Business: Final Assessment 8sajid newaz khanNo ratings yet

- Managerial Economics: Applications, Strategy, and Tactics, 12 EditionDocument24 pagesManagerial Economics: Applications, Strategy, and Tactics, 12 EditionWilliam DC RiveraNo ratings yet

- Why Start-Ups Fail: Cases, Challenges, and SolutionsDocument5 pagesWhy Start-Ups Fail: Cases, Challenges, and SolutionsChandraNo ratings yet

- Corporate Financial Planning - Reference To Asset Liability Management in Banking SectorDocument10 pagesCorporate Financial Planning - Reference To Asset Liability Management in Banking SectorPavan KumarNo ratings yet

- Unit 8 Capital Budgeting: StructureDocument34 pagesUnit 8 Capital Budgeting: StructureSamuel Dwumfour100% (1)

- Part 1-Overview of Strategic Financial Management: TOPIC 1: Business PlanningDocument24 pagesPart 1-Overview of Strategic Financial Management: TOPIC 1: Business PlanningCenith CheeNo ratings yet

- Project Evaluation and Planning: I) What Do You Understand by Capital Investment? Its Importance and DifficultiesDocument5 pagesProject Evaluation and Planning: I) What Do You Understand by Capital Investment? Its Importance and DifficultiesGãurãv SãndhãlNo ratings yet

- Seven Unidentified Philippine IndustriesDocument4 pagesSeven Unidentified Philippine Industriessi_roselynNo ratings yet

- (A Case Study of Nwokeji Urban Planning and Architectural Studio (NupasDocument23 pages(A Case Study of Nwokeji Urban Planning and Architectural Studio (NupasSweety RoyNo ratings yet

- Topic 1 SolutionDocument4 pagesTopic 1 Solutiontijopaulose00No ratings yet

- Exam Feb 7thDocument8 pagesExam Feb 7thOmer SalihNo ratings yet

- Financial Management 2Document159 pagesFinancial Management 2Ivani Katal0% (2)

- Financial Management June 2010 Marks PlanDocument7 pagesFinancial Management June 2010 Marks Plankarlr9No ratings yet

- Chapter 6Document65 pagesChapter 6እማሸንኮሮ በአማራNo ratings yet

- SFM Theory Notes - Addendum - Nov 20 To Dec 21 - New Ques - Bhavik ChokshiDocument32 pagesSFM Theory Notes - Addendum - Nov 20 To Dec 21 - New Ques - Bhavik ChokshiAswaniNo ratings yet

- AFM D22 Examiner ReportDocument20 pagesAFM D22 Examiner ReportBhumika BhardwajNo ratings yet

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- Case 12 - Analysis Guidance - C12 HJ HeinzDocument2 pagesCase 12 - Analysis Guidance - C12 HJ HeinzVoramon Polkert0% (1)

- Case 6 - Analysis Guidance - C6 Financial DetectiveDocument2 pagesCase 6 - Analysis Guidance - C6 Financial DetectiveVoramon PolkertNo ratings yet

- Case 26 - Analysis GuidanceDocument2 pagesCase 26 - Analysis GuidanceVoramon PolkertNo ratings yet

- Case 28 - Aanalysis Guidance - Autozone, Inc PDFDocument1 pageCase 28 - Aanalysis Guidance - Autozone, Inc PDFVoramon PolkertNo ratings yet

- Case 32 - Analysis GuidanceDocument1 pageCase 32 - Analysis GuidanceVoramon PolkertNo ratings yet