Professional Documents

Culture Documents

Faculty - Accountancy - 2022 - Session 2 - Diploma - Tax317

Uploaded by

Lyana InaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Faculty - Accountancy - 2022 - Session 2 - Diploma - Tax317

Uploaded by

Lyana InaniCopyright:

Available Formats

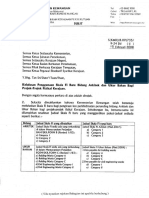

CONFIDENTIAL AC/JUL2022H"AX317

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE TAXATION 2

COURSE CODE TAX317

EXAMINATION JULY 2022

TIME 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of six (6) questions.

2. Answer ALL questions in the Answer Booklet. Start each answer on a new page.

3. Do not bring any materials into the examination room unless permission is given by the

invigilator.

4. Please check to make sure that this examination pack consists of:

i) the Question Paper

ii) a four-page Appendix 1

iii) an Answer Booklet - provided by the Faculty

5. Answer ALL questions in English.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 8 printed pages

> Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1 (2) AC/JUL 2022H"AX317

g) Resident individuals

Chargeable Income Rate Cumulative Tax

RM RM

0 - 2,500 0% 0

2,501 - 5,000 0% 0

5,001 - 10,000 1% 50

10,001 - 20,000 1% 150

20,001 - 35,000 3% 600

35,001 - 50,000 8% 1,800

50,001 - 70,000 14% 4,600

70,001 - 100,000 21% 10,900

100,001 - 150,000 24% 22,900

150,001 - 250,000 24% 46,900

250,001 - 400,000 24.5% 83,650

400,001 - 600,000 25% 133,650

600,001 - 1,000,000 26% 237,650

1,000,001 - 2,000,000 28% 517,650

Above 2,000,000 30%

h) Non-resident individuals 30%

• Benefits-in-kind (BIK) scale rates as per Inland Revenue Board (IRB) guidelines

Cost of car Prescribed annual Prescribed annual

(when new) value of private usage value of private

RM of car petrol

RM RM

Up to 50,000 1,200 600

50,001 75,000 2,400 900

75,001 100,000 3,600 1,200

100,001 150,000 5,000 1,500

150,001 200,000 7,000 1,800

200,001 250,000 9,000 2,100

250,001 350,000 15,000 2,400

350,001 500,000 21,250 2,700

500,001 and above 25,000 3,000

The value of the car benefit equivalent to half of the above rates is taken if the car

provided is more than five years old.

Where a driver is provided, the value benefit is fixed at RM600 per month.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1 (3) AC/JUL2022H"AX317

Household furnishing, apparatus and appliances

Types of BIK Annual value of BIK

RM

Semi-furnished with furniture in lounge,

dining room or bedroom 840

Plus one or more of the following:

Air-conditioners, curtains, carpets 1,680

Plus one or more of the following:

Kitchen equipment, crockery, utensils, appliances

i.e fully furnished 3,360

Rate of Capital Allowances

Motor Heavy General Computers Others Building

Vehicles Plant & Plant &

Machinery Machinery

Initial 20% 20% 20% 20% 20% 10%

allowance

Annual 20% 20% 14% 20% 10% 3%

allowance

Rate of Real Property Gains Tax Rates

For the period of 1 January 2020 and onward

Category of disposal RPGT rate

Companies Individual Individual

incorporated in (citizen / (non-citizen /

Malaysia or a permanent non-permanent

Trustee of a resident) resident) or a

Trust Company not

incorporated in

Malaysia

Within 3 years after the date 30% 30% 30%

of acquisition

In the 4th year after the date of 20% 20% 30%

acquisition

In the 5th year after the date of 15% 15% 30%

acquisition

In the 6th year after the date of 10% 5% 10%

acquisition or thereafter

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1 (4) AC/JUL 2022/TAX317

Sales Tax and Service Tax

For the period from 1 September 2018 and onwards

Sales tax rate for taxable goods 5%, 10%

Service tax rate for taxable services 6%

Stamp Duty

Rates of duty under the First Schedule

Conveyance, assignment, transfer or absolute bill of sale

Rate

%

Sale of property from 1 January 2019 - 30 June 2019

For every RM100 or fractional part thereof:

On the first RM100,000 1%

RM100,001 to RM500,000 2%

On the excess over RM500,000 3%

Rate

%

Sale of property from 1 July 2019 onwards

For every RM100 or fractional part thereof:

On the first RM100,000 1%

RM100,001 to RM500,000 2%

RM500,001 to RM1,000,000 3%

On the excess over RM1,000,000 4%

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC/JUL2022flTAX317

QUESTION 1

Happy Lappy Sdn Bhd is a Malaysian resident company with a financial year ending on 31

March each year. The paid-up capital of the company is RM4 million and the estimated tax

payable for the year of assessment 2020 is RM3.6 million. The company seeks your advice

on matters relating to tax.

Required:

a. Explain to Happy Lappy Sdn Bhd the due date for the first instalment payment and

submission of the tax return to the Inland Revenue Board of Malaysia (IRBM) for the

year of assessment 2021.

(4 marks)

b. Estimate the amount of tax payable of Happy Lappy Sdn Bhd for the year of assessment

2021.

(2 marks)

(Total: 6 marks)

QUESTION 2

Alam Makmur Sdn Bhd (ALSB) manufactures and sells a shoe product known as Product

GXZ in Klang Valley. As at 1 January 2021, it had a paid-up capital of RM3 million and closes

the account on 31 December each year. The company's statement of profit or loss for the

financial year ended 31 December 2021 is as follows:

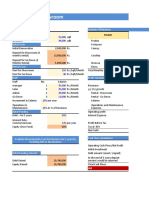

Alam Makmur Sdn Bhd

Statement of Profit or Loss for the year ended 31 December 2021

Note RM RM

Sales 1 5,576,000

Less: Cost of sales 2 (1,576,000)

Gross Profit 4,000,000

Less: Operating expenses

Remuneration 3 340,600

Selling and distribution 4 42,000

Professional fees 5 17,000

Repair and maintenance 6 91,000

Bad and doubtful debts 7 53,100

Depreciation 48,200

Contributions 8 60,000

Transport and travelling 9 47,120

Entertainment expenses 10 10,000

Training 11 3,600 (712,620)

Net Profit 3,287,380

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 AC/JUL 2022/TAX317

Notes:

1. Sales include compensation received from an insurance company for damaged office

equipment amounted to RM10,000.

2. Cost of sales includes:

RM

Written-off stock obsolescence 10,000

Provision for stock obsolescence 30,000

3. Remuneration comprises:

RM

Salary inclusive salary of a disabled executive (eyesight problem) at

RM2,000 per month 270,000

EPF contribution 60,000

Travelling allowance for company's sales executives 10,600

Selling and distribution include:

RM

Participation in a Virtual International Trade Fair in Taiwan which

was approved by the Ministry of International Trade and Industry 20,000

(MITI)

Local advertisement 8,000

Freight charges 14,000

5. Professional fees include:

RM

Accounting and secretarial fees 8,000

Consultation fees paid to Meriah Packaging for designing and

packaging the product for the company 2,000

Fees for owner's personal loan 7,000

6. Repairs and maintenance include:

RM

Upgrading the factory's floors 20,000

Resurfacing of car park 40,000

Renovation of business premise air-conditioning systems for

customers' convenience (the company claims capital allowance) 31,000

7. Bad and doubtful debts include:

RM

Bad debts written off during the year 21,400

Net increase in general provision 31,200

Net increase in specific provision 19,500

Bad debts recovered during the year (debts were written off last (19,000)

year)

All the debts are trade debts except for a sum of RM8,000 written off

which is in respect of a loan made to an ex-accountant

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 AC/JUL2022/TAX317

8. Contributions include:

RM

Cash donation to Tabung Covid-19 under section 44(6) 20,000

Gift of artefact to Kedah State Government 10,000

Cash contribution to an approved research and development 10,000

company

Business zakat 20,000

9. Transport and travelling comprise:

RM

Marine insurance premium paid to Moriko Marine Insurance (M)

Bhd for import of goods 10,600

Leave passage to Japan for the finance manager and family 10,000

Lease rental for company lorry 26,520

10. Entertainment expense includes:

RM

Annual dinner for employees 3,000

Hari Gawai dinner for employees with the presence of some clients 5,000

Refreshment for clients during 'Bonanza Sales Day' 2,000

11. A sum of RM3.600 incurred in sending the employees to attend courses conducted by

the Malaysian Productivity Centre (MPC). A certificate from the institution for the

attendance is available.

Additional Information:

Business adjusted losses brought forward from the previous year of assessment amounting

to RM10,000 and total capital allowance for the year of assessment 2021 amounting to

RM20,000 and balancing charge amounting to RM15,000.

Required:

a. Calculate the income tax payable by Alam Makmur Sdn Bhd for the year of assessment

2021. Indicate 'Nil' for any item that does not require any adjustment.

(22 marks)

b. Explain any TWO (2) circumstances in determining business income is deemed derived

from Malaysia.

(2 marks)

(Total: 24 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 AC/JUL2022/TAX317

QUESTION 3

Aroma Sdn Bhd (ASB), a resident company located in Samarahan, Sarawak, manufactures

two (2) products, namely Arbe X and Berz Y. Arbe X is a promoted product under the

Promotion Investment Act 1986 which is eligible for consideration of pioneer status or

investment tax allowance. ASB is uncertain whether to apply for pioneer status or an

investment tax allowance incentive.

The summarized adjusted income/(losses), capital allowances and capital expenditures of

Arbe X and Berz Y for the years ended 31 December are as follow:

ArbeX 2022 2023

RM RM

Adjusted income/loss 700,000 (80,000)

Capital allowances for the year 200,000 20,000

Capital Expenditures:

Plant and machinery 100,000 100,000

Office equipment 40,000

Motor vehicle for directors 120,000

Buildings 600,000

Land 1,000,000

BerzY 2022 2023

RM RM

Adjusted income/loss (140,000) 150,000

Capital allowances for the year 20,000 70,000

Rental income 60,000 20,000

Donation to state government 20,000 20,000

Required:

a. Calculate the company's chargeable income and the amount to be credited to the

exempt income account for the year of assessment 2022 to 2023 under the following

tax incentives:

i. Pioneer status

ii. Investment tax allowance

(18 marks)

b. Analyse the more efficient tax incentives for Aroma Sdn Bhd.

(2 marks)

c. Explain FOUR (4) criteria to be eligible for the reinvestment allowance if Aroma Sdn Bhd

wishes to apply for reinvestment allowance under Schedule 7A of the Income Tax Act

1967.

(4 marks)

(Total: 24 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 6 AC/JUL 2022/TAX317

QUESTION 4

Lanang Sdn Bhd, a Malaysian resident company, purchased a machine from Seol Pte Ltd, a

company from South Korea. Seol Pte Ltd also provides technical assistance and training to

Lanang Sdn Bhd to operate the machine. Seol Pte Ltd sent its employees to Malaysia to install

the machine and to provide technical assistance on the operation of the machine.

To expand its business, Lanang Sdn Bhd made a mortgage loan from Bank BCB, in

Singapore. The amount of loan is RM30 million and payable within 20 years.

On 30 June 2021, Lanang Sdn Bhd made the following payments to its contractors and

suppliers:

1. RM750,000 for the purchase of high-tech machinery from Seol Pte Ltd.

2. RM50,000 for the fees charges on the technical assistance provided by Seol Pte Ltd.

3. RM650,000 for interest on a mortgage loan from Bank BCB for the construction of Lanang

Sdn Bhd branch in Penang.

4. RM25,000 for the installation fee of machine paid to Seol Pte Ltd.

Required:

a. Explain with reasons whether each transaction incurred by Lanang Sdn Bhd is subjected

to withholding tax.

(6 marks)

b. Calculate the amount to be paid by Lanang Sdn Bhd to Seol Pte Ltd.

(4 marks)

c. Explain the consequences to Lanang Sdn Bhd if the company remitted the withholding

tax to the Inland Revenue Board Malaysia (IRBM) on 3 August 2021.

(2 marks)

(Total: 12 marks)

QUESTION 5

Marwa, a Malaysian citizen, intended to sell his double-storey terrace house in Sepang,

Selangor to Safa for RM600.000. Safa paid a 5% deposit on 12 April 2021 but decided to

withdraw the deal one week later. The deposit was forfeited.

The house was a gift from Marwa's mother, Puan Lily who is a Malaysian citizen. The transfer

took place on 14 August 2016 and the market value at the time of transfer was RM480,000.

Puan Lily had purchased the house from a private developer on 2 January 2011 at the price

of RM320.000. Puan Lily incurred a minor renovation cost of RM100,000 and legal fees of

RM8.500. Puan Lily also received an insurance compensation of RM5,000 due to flood.

On 1 December 2021, Marwa sold the house to Ali via a Sales and Purchase Agreement for

RM650,000. He incurred brokerage fees of RM650, valuation fees of RM2,500 and an

advertisement to seek a buyer of RM850.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 7 AC/JUL2022/TAX317

Marwa, together with his siblings, Zulaikha and Zahirah who are Malaysian citizens,

incorporated AZA Sdn Bhd (ASB) on 11 May 2018. Each of them held 200,000 units of shares

of RM1.00 each in ASB. ASB was not a real property company at the date of incorporation.

However, ASB became a real property company on 5 January 2021. The defined value of real

property for ASB on that date was RM2,500,000.

Marwa inherited a piece of land from his grandmother on 11 January 2020 and transferred the

land to ASB on 5 October 2021 for a total consideration of RM1,050,000, consisting of 230,000

shares valued at RM4.00 each and the balance in cash. The market value of the land was

RM680,000 at the date of transfer. The land was purchased by her grandmother in March

2012 for RM380,000. On 1 December 2021, Marwa sold all the shares he acquired on 5

October 2021 in ASB for RM1,200,000.

Required:

a. Explain any FOUR (4) situations which give rise to real property gains tax exemption for

individuals.

(4 marks)

b. Calculate the real property gains tax (if any) on the:

i. transfer of the double-storey terrace house from Puan Lily to Marwa; and

ii. disposal of the double-storey terrace house from Marwa to Ali.

(10 marks)

c. Determine the implication of real property gains tax (if any) on the:

i. disposal of land by Marwa to ASB on 5 October 2021; and

ii. disposal of 230,000 shares by Marwa on 1 December 2021.

(10 marks)

(Total: 24 marks)

QUESTION 6

Dew Sdn Bhd is a Malaysian tax resident company. The company converts organic materials

to become organic-based products such as soaps, shampoos, aromatherapy and candles in

Tangkak, Johor. The company commenced its business on 1 April 2019 and closes its

accounts on every 31 December. The company sells its products to customers within

Malaysia. The company achieved its threshold limit for sales tax purposes in July 2021.

On 3 December 2021, the company made the following sales to Sparkle Sdn Bhd in Klang,

Selangor:

Transactions RM

(exclusive sales tax)

Organic soaps 250,000

Organic shampoos 300,000

Organic aromatherapy 110,000

Organic candles 390,000

Organic materials 10,000

Transportation charges 300

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 8 AC/JUL2022/TAX317

Required :

a. Show to Dew Sdn Bhd:

i. Whether the activities of the company fall within the scope of sales tax.

ii. When the company is required to become sales tax registrant and issue sales tax

invoice to its customer.

(4 marks)

b. Illustrate the sales tax invoice issued to Sparkle Sdn Bhd according to the Sales Tax Act

2018 (Assume sales tax rate is at 10%).

(6 marks)

(Total: 10 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL APPENDIX 1(1) AC/JUL 2022/TAX317

The following tax rates are to be used in answering the questions.

Income tax

rates

a) Resident company with paid-up capital of RM2.5 million and below

(at the beginning of the YA) AND having gross income from source

or sources consisting of a business of not more than RM50 million

for the basis period for a YA:

On the first RM600,000 chargeable income 17%

On the subsequent chargeable income 24%

b) Resident company with paid-up capital above RM2.5 million (at the

beginning of the YA) OR having gross income from source or

sources consisting of a business of more than RM50 million for the

basis period for a YA 24%

c) Non-resident company/branch 24%

d) Resident limited liability partnership with a capital contribution of

RM2.5 million and below (at the beginning of the YA) AND having

gross income from source or sources consisting of a business of

more than RM50 million for the basis period for a YA AND the

resident limited liability partnership is not controlled by or does not

control another company with a capital contribution (whether in

cash or in-kind) and paid-up share capital of more than RM2.5

million:

On the first RM600,000 chargeable income 17%

On the subsequent chargeable income 24%

e) Resident limited liability partnership with capital contribution above

RM2.5 million (at the beginning of the YA) OR having gross income

from source or sources consisting of a business of more than RM50

million for the basis period for a YA 24%

f) Non-resident limited liability partnership 24%

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Malaysian tax rates and reliefsDocument4 pagesMalaysian tax rates and reliefsJasne OczyNo ratings yet

- ACCA F6 Taxation Solved Past PapersDocument235 pagesACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- Test 2Document7 pagesTest 2khowcatherine2000No ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 Other Than SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 Other Than Salariedsyed aamir shahNo ratings yet

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDocument5 pagesInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNo ratings yet

- Test 1Document6 pagesTest 1khowcatherine2000No ratings yet

- Set up car showroom business planDocument14 pagesSet up car showroom business planshrish guptaNo ratings yet

- Taxation Question 2019 MarchDocument13 pagesTaxation Question 2019 MarchAlice DesiraeeNo ratings yet

- StoqnamadruateDocument4 pagesStoqnamadruateDela cruz, Hainrich (Hain)No ratings yet

- Cost Sheet - GenX - Team 4 .2Document7 pagesCost Sheet - GenX - Team 4 .2sanketmistry32No ratings yet

- 2008 09 e Line Bota Training LevyDocument4 pages2008 09 e Line Bota Training LevySanjay ThakkarNo ratings yet

- FM AssignmentDocument23 pagesFM AssignmentMuskan NagarNo ratings yet

- Emergency Response Master Budget FormatDocument51 pagesEmergency Response Master Budget FormatNaveed UllahNo ratings yet

- Income Statement For 3 YearsDocument5 pagesIncome Statement For 3 YearsATticFistNo ratings yet

- Bank ManagementDocument14 pagesBank ManagementAreeba MalikNo ratings yet

- FINMAN Decision AnalysisDocument5 pagesFINMAN Decision AnalysisTrish GarridoNo ratings yet

- I Recommended Audit Fees in MalaysiaDocument2 pagesI Recommended Audit Fees in MalaysiaSelva Bavani SelwaduraiNo ratings yet

- Muskan Nagar - FM AssignmentDocument33 pagesMuskan Nagar - FM AssignmentMuskan NagarNo ratings yet

- Group Activities Income StatmentDocument3 pagesGroup Activities Income StatmentMarwin NavarreteNo ratings yet

- Note On Tax Rebate On Takaful Contribution 2019 20 SalariedDocument1 pageNote On Tax Rebate On Takaful Contribution 2019 20 SalariedRoy Estate (Sajila Roy)No ratings yet

- Income Statement: New Customers Average OrderDocument11 pagesIncome Statement: New Customers Average OrderSheena Rose AbadNo ratings yet

- MIAQE Tax Rates and AllowancesDocument16 pagesMIAQE Tax Rates and Allowanceszezu zazaNo ratings yet

- Regulation Amendment Notification 15 August 2019Document3 pagesRegulation Amendment Notification 15 August 2019Shiran MahadeoNo ratings yet

- Expressway Project Finance Task 4A (Avinash Singh)Document9 pagesExpressway Project Finance Task 4A (Avinash Singh)avinash singh100% (2)

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather Saleemabdul_348No ratings yet

- Corporate Finance Case Study WorkingDocument11 pagesCorporate Finance Case Study WorkingS.H. Rustam16% (19)

- No 1Document3 pagesNo 1North KSDNo ratings yet

- Sail Pay RevisionDocument4 pagesSail Pay Revisionhimanshu2010swNo ratings yet

- Taxavvy: Budget 2023 EditionDocument37 pagesTaxavvy: Budget 2023 EditionFar Ha NaNo ratings yet

- PWC Taxavvy Budget 2023 EditionDocument37 pagesPWC Taxavvy Budget 2023 Editionlpamgt_674780425No ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- LCC Without Petrol Saving KitDocument4 pagesLCC Without Petrol Saving KitPratik WalimbeNo ratings yet

- Quiz No 3Document5 pagesQuiz No 3KristiNo ratings yet

- Scale of Fees for Consulting Quantity Surveyor and Architect (Revised 2004-2007Document18 pagesScale of Fees for Consulting Quantity Surveyor and Architect (Revised 2004-2007larysubNo ratings yet

- Taxation Question 2018 MarchDocument17 pagesTaxation Question 2018 MarchNg GraceNo ratings yet

- 2020 Indian income tax slab ratesDocument2 pages2020 Indian income tax slab ratessarwar raziNo ratings yet

- F6mys 2009 Dec QDocument10 pagesF6mys 2009 Dec QDave Loh Chong HowNo ratings yet

- Edited FSDocument40 pagesEdited FShello kitty black and whiteNo ratings yet

- Financial PlanDocument10 pagesFinancial Planapi-25978665No ratings yet

- Projected Broiler Farm (20,000)Document1 pageProjected Broiler Farm (20,000)Eean KicapNo ratings yet

- Pakistan Salary Tax Calculator FY 2019-20Document2 pagesPakistan Salary Tax Calculator FY 2019-20Usman HabibNo ratings yet

- Lastname Firstname Initial FullnameDocument11 pagesLastname Firstname Initial Fullnamemuhammad harisNo ratings yet

- Pakistan Salary Income Tax Calculator Tax Year 2021 2022Document4 pagesPakistan Salary Income Tax Calculator Tax Year 2021 2022Kashif NiaziNo ratings yet

- Financial Projection Master DistributorDocument3 pagesFinancial Projection Master DistributorArié WibowoNo ratings yet

- Indah Water Portal - Charges CommercialDocument2 pagesIndah Water Portal - Charges CommercialHafidzul ZakariaNo ratings yet

- Operation Expenses and Sales Analysis for Stationery Business Over 5 YearsDocument31 pagesOperation Expenses and Sales Analysis for Stationery Business Over 5 YearsJanine PadillaNo ratings yet

- Candy Live Policy-2.05Document5 pagesCandy Live Policy-2.05Gesang FirmansyahNo ratings yet

- Calculate New Salary Tax by Ather SaleemDocument2 pagesCalculate New Salary Tax by Ather SaleemMalikKamranAsifNo ratings yet

- Chicago SaharsaDocument6 pagesChicago SaharsaShail DokaniaNo ratings yet

- Business PlanDocument12 pagesBusiness PlanPapa HarjaiNo ratings yet

- V6 After Budget 2023 New Tax Regime Vs Old Tax RegimeDocument20 pagesV6 After Budget 2023 New Tax Regime Vs Old Tax RegimegunagaliNo ratings yet

- Property Plant and Equipment Schedule TemplateDocument3 pagesProperty Plant and Equipment Schedule TemplateKabile MwitaNo ratings yet

- TaxationDocument11 pagesTaxationkhowcatherine2000No ratings yet

- 07 DEC QuestionDocument9 pages07 DEC QuestionkhengmaiNo ratings yet

- F6-Dec 2007 PYQDocument16 pagesF6-Dec 2007 PYQTan Wan ChingNo ratings yet

- Annexures For BlockchainDocument6 pagesAnnexures For BlockchainDannyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Ac110 24032023Document4 pagesAc110 24032023Lyana InaniNo ratings yet

- Ac110 24032023Document4 pagesAc110 24032023Lyana InaniNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Aud339Document8 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Aud339Lyana InaniNo ratings yet

- Strategic Management Lesson Plan MARA UniversityDocument10 pagesStrategic Management Lesson Plan MARA UniversityLyana InaniNo ratings yet

- Analyzing The External Environment of The Firm: Creating Competitive AdvantagesDocument34 pagesAnalyzing The External Environment of The Firm: Creating Competitive AdvantagesHazim HafizNo ratings yet

- Dess10 C03 FinalDocument38 pagesDess10 C03 FinalLyana InaniNo ratings yet

- Basis PeriodDocument11 pagesBasis PeriodLyana InaniNo ratings yet

- Instruction and Rubric ASSIGNMENT MAF661 Mar23-Aug23Document10 pagesInstruction and Rubric ASSIGNMENT MAF661 Mar23-Aug23Lyana InaniNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Document13 pagesFaculty - Accountancy - 2022 - Session 1 - Diploma - Tax317Lyana InaniNo ratings yet

- Activity Hazards Analysis: MD485B Tower Assembly AHADocument6 pagesActivity Hazards Analysis: MD485B Tower Assembly AHAJaycee PagadorNo ratings yet

- Squatting LawsDocument3 pagesSquatting LawsRyan AcostaNo ratings yet

- GGGI - Procurement Rules (2018) PDFDocument25 pagesGGGI - Procurement Rules (2018) PDFFerry MarkotopNo ratings yet

- STRATEGIC RESPONSE TO NEW COMPETITIONDocument6 pagesSTRATEGIC RESPONSE TO NEW COMPETITIONANANTHA BHAIRAVI M100% (1)

- Who Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkDocument4 pagesWho Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkElph Music ProductionNo ratings yet

- Accounting Chapter 11Document69 pagesAccounting Chapter 11Brisa MasiniNo ratings yet

- 2014 WASSCE ECONOMICS THEORYDocument3 pages2014 WASSCE ECONOMICS THEORYBernard ChrillynNo ratings yet

- Class XI (As Per CBSE Board) : Informatics PracticesDocument11 pagesClass XI (As Per CBSE Board) : Informatics PracticesprithiksNo ratings yet

- The Recruitment Process: CoverDocument19 pagesThe Recruitment Process: Coveradhitiya pNo ratings yet

- Download ebook Marketing 5Th Edition 2021 Pdf full chapter pdfDocument67 pagesDownload ebook Marketing 5Th Edition 2021 Pdf full chapter pdfbrian.williams904100% (21)

- Topic 6 - ADS 404 Chapter 6 2018Document25 pagesTopic 6 - ADS 404 Chapter 6 2018Nabil Azeem JehanNo ratings yet

- Restaurant Accounting With Quic - Doug Sleeter-4Document21 pagesRestaurant Accounting With Quic - Doug Sleeter-4ADELALHTBANINo ratings yet

- Prelim QuizDocument5 pagesPrelim QuizShania Liwanag100% (2)

- The 3 Certainties: Comiskey V Bowring-HanburyDocument6 pagesThe 3 Certainties: Comiskey V Bowring-HanburySyasya FatehaNo ratings yet

- CIF Delta Report - Error 152 For Planned OrdersDocument10 pagesCIF Delta Report - Error 152 For Planned OrderskfcheonNo ratings yet

- Factors Affecting Teachers' Knowledge Sharing Behaviors and Motivation: System Functions That WorkDocument8 pagesFactors Affecting Teachers' Knowledge Sharing Behaviors and Motivation: System Functions That Worksaeed h.gholizadehNo ratings yet

- Design Thinking IntroductionDocument26 pagesDesign Thinking IntroductionEduardo MucajiNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Strategic and Tactical Marketing ProcessDocument106 pagesStrategic and Tactical Marketing ProcessFadilla Wanda NaseroNo ratings yet

- GTU Syllabus for MBA 1st Sem Economics for Managers SubjectDocument4 pagesGTU Syllabus for MBA 1st Sem Economics for Managers SubjectPRINCE PATELNo ratings yet

- Capitalism Vs Socialism: Key DifferencesDocument5 pagesCapitalism Vs Socialism: Key DifferencesSheran HamidNo ratings yet

- final report. (1)Document48 pagesfinal report. (1)Arjun Singh ANo ratings yet

- 05 Define+ProjectDocument5 pages05 Define+ProjectrawbeanNo ratings yet

- Manage Customer Relationships Through Quality ServiceDocument10 pagesManage Customer Relationships Through Quality ServiceEzrella ValeriaNo ratings yet

- Central Bank - Annual Report - 2018Document76 pagesCentral Bank - Annual Report - 2018olhNo ratings yet

- Sistem Informasi Manajemen Presensi Siswa Berbasis MobileDocument6 pagesSistem Informasi Manajemen Presensi Siswa Berbasis Mobilefahmi nur baihaqiNo ratings yet

- Insular Life Assurance Co LTD Vs NLRC, 179 Scra 439Document2 pagesInsular Life Assurance Co LTD Vs NLRC, 179 Scra 439Earvin Joseph BaraceNo ratings yet

- Handwork Issue 4Document89 pagesHandwork Issue 4andrew_phelps100% (1)

- Experience is a Hard TeacherDocument8 pagesExperience is a Hard Teacherxiu yingNo ratings yet

- Unit 4 TdsDocument18 pagesUnit 4 TdsAnshu kumarNo ratings yet