Professional Documents

Culture Documents

Untitled

Uploaded by

ayra napayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

ayra napayCopyright:

Available Formats

Sample Problem with Solution:

The Smart Manufacturing Company has a cycle time of 3.0 days, uses a Raw and In Process

account and charges all conversion costs to the Cost of Goods Sold. At the end of each month,

all inventories are counted, their conversion cost components are estimated and inventory

account balances are adjusted. Raw material cost is backflushed from RIP to Finished Goods.

The following information is for the month of June.

Materials purchased on credit P146,000

RIP beginning, including P4,400 of conversion costs 15,000

RIP ending, including P7,800 of conversion costs 24,000

FG beginning, including P10,800 of conversion costs 36,000

FG ending, including P6,500 of conversion costs 18,000

Conversion cost - P80,000 direct labor and P100,000 overhead

Requirement:

Prepare the journal entries to record the above transactions.

Answers:

1. Raw and In Process P146,000

Accounts Payable P146,000

*To record materials purchased on credit.

2. Cost of Goods Sold P180,000

Accrued Payroll P80,000

FOH Applied P100,000

*To apply conversion costs.

*We record this entry because it is mentioned in the problem that all conversion

costs are charged directly to Cost of Goods Sold. In this entry, we assumed that

ALL conversion costs are sold even though it is obvious that there are still

conversion costs left in the inventory because we still have an ending balance of

Finished Goods which includes P6,500 OF CONVERSION COSTS. Because of

that ending balance, we will have an adjusting entry for Cost of Goods Sold

which is shown in journal entry #5.

3. Finished Goods P140,400

Raw and In Process P140,400

*To backflush the raw materials from RIP to FG.

*It is the RAW MATERIALS PORTION of Cost of Goods Manufactured.

*Computation for journal entry #3:

Raw materials in RIP beginning (15,000 - 4,400) P10,600

Raw materials purchased 146,000

Raw materials in RIP ending (24,000 - 7,800) (16,200)

Raw materials in Cost of Goods Manufactured P140,400

4. Cost of Goods Sold P154,100

Finished Goods P154,100

*To backflush the raw materials from FG to COGS

*It is the RAW MATERIALS PORTION of Cost of Goods Sold

*Computation for journal entry #4:

Raw materials in FG beginning (36,000 - 10,800) P25,200

Raw materials transferred from RIP to FG or the

raw materials in Cost of Goods Manufactured 140,400

Raw materials in FG ending (18,000 - 6,500) (11,500)

Raw materials that were sold P154,100

5. Cost of Goods Sold P900

Raw and In Process (7,800 - 4,400) 3,400

Finished Goods (10,800 - 6,500) P4,300

*To adjust the Cost of Goods Sold since the journal entry #2 is still unadjusted.

*Computation for journal entry #5:

Conversion Costs applied in journal entry #2 P180,000

Conversion cost in RIP beginning 4,400

Conversion cost RIP ending (7,800)

Conversion cost in Cost of Goods Manufactured P176,600

Conversion cost in FG beginning 10,800

Conversion cost in FG ending (6,500)

Conversion cost in Cost of Goods Sold (adjusted amount) P180,900

*Why debit COGS P900?

P180,900 should be the amount of Cost of Goods Sold but we recorded

P180,000 in journal entry #2, that’s why we have to adjust it by

DEBITING/adding P900.

*Why debit RIP P3,400?

CC in RIP beg 4,400 there is an INCREASE of 3,400 that’s

CC in RIP end 7,800 why we have to adjust RIP by

DEBITING/ adding 3,400

*Why credit FG P4,300?

CC in FG beg 10,800 there is a DECREASE of 4,300 that’s

CC in FG end 6,500 why we have to adjust FG by

CREDITING/ subtracting 4,300

You might also like

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankDocument32 pagesFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Test BankTest bank World0% (1)

- Backflush - Costing - System - and - Activity - Based - Costing Answer KeyDocument14 pagesBackflush - Costing - System - and - Activity - Based - Costing Answer KeyAbegail A. AraojoNo ratings yet

- Problem Solving Standard Costing and Variance AnalysisDocument6 pagesProblem Solving Standard Costing and Variance AnalysisFranklin Galope100% (5)

- Sample Church Audit ReportDocument5 pagesSample Church Audit Reportvrasshen580% (5)

- JIT and Backflush Costing - Sample Problems With SolutionsDocument2 pagesJIT and Backflush Costing - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Module 12 Just in Time and Backflush CostingDocument14 pagesModule 12 Just in Time and Backflush CostingMarjorie NepomucenoNo ratings yet

- Activity 1 Cost Concepts and Cost BehaviorDocument2 pagesActivity 1 Cost Concepts and Cost BehaviorLacie Hohenheim (Doraemon)No ratings yet

- Just in TimeDocument3 pagesJust in TimeHenry SeeNo ratings yet

- BCDocument3 pagesBCPrankyJelly0% (1)

- Just in Time and Backflush CostingDocument12 pagesJust in Time and Backflush Costings.gallur.gwynethNo ratings yet

- JIT Backflush CostingDocument5 pagesJIT Backflush Costingellamae ascanoNo ratings yet

- Cost Accounting BackflushingDocument5 pagesCost Accounting BackflushingCollete Guadalupe WPNo ratings yet

- Unit 8: Activity Based Costing and Back-FlushDocument5 pagesUnit 8: Activity Based Costing and Back-FlushCielo PulmaNo ratings yet

- Discussion of Assignment - Just in Time and Backflush CostingDocument4 pagesDiscussion of Assignment - Just in Time and Backflush CostingRoselyn Lumbao100% (1)

- Service Cost AllocationDocument2 pagesService Cost AllocationdamdamNo ratings yet

- Activity in JITDocument3 pagesActivity in JITEross Jacob SalduaNo ratings yet

- Cost Accounting de Leon Chapter 6 SUMMARYDocument3 pagesCost Accounting de Leon Chapter 6 SUMMARYHarrietNo ratings yet

- Cost Accounting Quiz 4Document4 pagesCost Accounting Quiz 4andreamrieNo ratings yet

- Cost Accounting and ControlDocument2 pagesCost Accounting and ControlAlly JeongNo ratings yet

- JIT-Backflush CostingDocument1 pageJIT-Backflush CostingArmina BagsicNo ratings yet

- Module in Management Accounting: Batangas State UniversityDocument4 pagesModule in Management Accounting: Batangas State Universityjustine reine cornicoNo ratings yet

- Manufacturing Systems: TraditionalDocument15 pagesManufacturing Systems: TraditionaljellNo ratings yet

- Chapter 6 ProjectDocument6 pagesChapter 6 Projectprmsusecgen.nfjpia2324No ratings yet

- Solution To Assignment 1Document3 pagesSolution To Assignment 1Khyla DivinagraciaNo ratings yet

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- Chapter5 JustinTimeandBackflushAccountingDocument21 pagesChapter5 JustinTimeandBackflushAccountingFaye Nepomuceno-Valencia0% (1)

- Cost Accounting & Control Final ExaminationDocument6 pagesCost Accounting & Control Final ExaminationAlexandra Nicole IsaacNo ratings yet

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Casibang ch5Document3 pagesCasibang ch5Krung KrungNo ratings yet

- AFAR Finals Dec 2017Document47 pagesAFAR Finals Dec 2017Dale Ponce0% (1)

- Chapter 6 AssignmentDocument4 pagesChapter 6 AssignmentJohnray ParanNo ratings yet

- Backflush CostingDocument2 pagesBackflush CostingsarahbeeNo ratings yet

- 09 JIT Backflush CostingDocument1 page09 JIT Backflush Costing202010461No ratings yet

- ACCO 20073 Backflush CostingDocument2 pagesACCO 20073 Backflush CostingMaria Kathreena Andrea AdevaNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- Soal Ab1 (Tm-1) Cost ConceptDocument5 pagesSoal Ab1 (Tm-1) Cost ConceptAntonius Sugi SuhartonoNo ratings yet

- Quiz 1 Cost Accounting FDocument5 pagesQuiz 1 Cost Accounting Fretchiel love calinogNo ratings yet

- Just in Time Backflush CostingDocument24 pagesJust in Time Backflush CostingAngel Alejo AcobaNo ratings yet

- Cost Accounting ExercisesDocument1 pageCost Accounting ExercisesJosephina Catipon BelenNo ratings yet

- AE 22 M TEST 3 With AnswersDocument6 pagesAE 22 M TEST 3 With AnswersJerome MonserratNo ratings yet

- Jit PDFDocument28 pagesJit PDFRona S. Pepino - AguirreNo ratings yet

- Variance ExercisesDocument5 pagesVariance ExercisesAntonette Marie LoonNo ratings yet

- Backflush Costing 1 - Lecture Notes 1, 2 Backflush Costing 1 - Lecture Notes 1, 2Document4 pagesBackflush Costing 1 - Lecture Notes 1, 2 Backflush Costing 1 - Lecture Notes 1, 2Prime MarquezNo ratings yet

- Chapter 6 7 TestDocument5 pagesChapter 6 7 TestYza GesmundoNo ratings yet

- AC&VCDocument6 pagesAC&VCjsus22No ratings yet

- JitDocument6 pagesJitJuanNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingretchiel love calinogNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Final Deptals COST.1 PDFDocument5 pagesFinal Deptals COST.1 PDFIllion IllionNo ratings yet

- 3 - Process CostingDocument30 pages3 - Process CostingCharisse Ahnne TosloladoNo ratings yet

- Cost Accounting Mastery - 1Document4 pagesCost Accounting Mastery - 1Mark RevarezNo ratings yet

- Standard CostingDocument7 pagesStandard CostingsarahbeeNo ratings yet

- 04 Standard Costing and Variance Analysis ANSWER KEYDocument4 pages04 Standard Costing and Variance Analysis ANSWER KEYJem100% (1)

- Process CostingDocument4 pagesProcess CostingKrizia Mae FloresNo ratings yet

- Absorption (Full Costing) Variable (Direct Costing)Document4 pagesAbsorption (Full Costing) Variable (Direct Costing)Leo Sandy Ambe CuisNo ratings yet

- Backflush Costing1Document3 pagesBackflush Costing1Mitzi EstelleroNo ratings yet

- Rona - Assignment Sep 20Document3 pagesRona - Assignment Sep 20John Ray RonaNo ratings yet

- Backflush Costing System and Activity Based Costing QuestionsDocument23 pagesBackflush Costing System and Activity Based Costing QuestionsMedalla NikkoNo ratings yet

- Engineering Service Revenues World Summary: Market Values & Financials by CountryFrom EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Antifreeze for Internal Combustion Engines World Summary: Market Values & Financials by CountryFrom EverandAntifreeze for Internal Combustion Engines World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Gases, Type World Summary: Market Values & Financials by CountryFrom EverandIndustrial Gases, Type World Summary: Market Values & Financials by CountryNo ratings yet

- Wiley P2 Sec-A FlashcardDocument29 pagesWiley P2 Sec-A FlashcardnaxahejNo ratings yet

- Midterm Exam Analysis of Financial StatementsDocument4 pagesMidterm Exam Analysis of Financial StatementsAlyssa TordesillasNo ratings yet

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Members and Firm 2018 2019 17 07 2018Document405 pagesMembers and Firm 2018 2019 17 07 2018Sajib Chandra Roy100% (1)

- Chapter08 Inventory Cost Other Basis Student Copy LectureDocument9 pagesChapter08 Inventory Cost Other Basis Student Copy LectureAngelo Christian B. OreñadaNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2014)Document238 pagesIFRS Illustrative Financial Statements (Dec 2014)Aayushi AroraNo ratings yet

- Chapter 13Document23 pagesChapter 13carlo knowsNo ratings yet

- Financial Reporting: © The Institute of Chartered Accountants of IndiaDocument5 pagesFinancial Reporting: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- Senior Auditor Complete BookDocument186 pagesSenior Auditor Complete BookSaeed Ahmed KiyaniNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionPrimosebastian TarrobagoNo ratings yet

- Chapter 2 - Framework For Preparation and Presentation of Financial StatementsDocument34 pagesChapter 2 - Framework For Preparation and Presentation of Financial StatementsSumit PattanaikNo ratings yet

- Accounts Receivable AuditingDocument2 pagesAccounts Receivable AuditingJohnNo ratings yet

- CH 01Document52 pagesCH 01choNo ratings yet

- Corprorate Restructuring Corporate Law Accounting Taxation PerspectiveDocument101 pagesCorprorate Restructuring Corporate Law Accounting Taxation Perspectiveharsh vasu guptaNo ratings yet

- BruuuDocument4 pagesBruuuMae ValenciaNo ratings yet

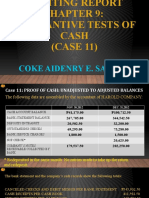

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Impact of Accounting Information System (Q4)Document14 pagesImpact of Accounting Information System (Q4)Indriani SuhardinNo ratings yet

- A-Introduction To NAMDocument15 pagesA-Introduction To NAMMukhtar AhmadNo ratings yet

- Case - 2 - 6 - Case#2.6 The Fund of Funds Independence IDocument12 pagesCase - 2 - 6 - Case#2.6 The Fund of Funds Independence IYismaw100% (1)

- History of AccountingDocument14 pagesHistory of AccountingAhmad YahyaNo ratings yet

- The Importance of Internal ControlsDocument16 pagesThe Importance of Internal ControlsPaulin Joy ArceNo ratings yet

- Accounting ExamDocument25 pagesAccounting ExamJohn Paul PolicarpioNo ratings yet

- Auditing Theory ReviewerDocument6 pagesAuditing Theory ReviewerHans Even Dela CruzNo ratings yet

- Bad News Message - ScriptDocument2 pagesBad News Message - ScriptSaadat ShaikhNo ratings yet

- Ndokwa Salale Resume - AccountantDocument5 pagesNdokwa Salale Resume - AccountantNdokwaNo ratings yet

- Unit of Competence Module Title LG Code: TTLM Code: Learning GuideDocument34 pagesUnit of Competence Module Title LG Code: TTLM Code: Learning GuideNigussie Berhanu100% (1)

- 05 Multinational OperationsDocument59 pages05 Multinational OperationsIan ChanNo ratings yet

- The Evolution of Auditing: An Analysis of The Historical DevelopmentDocument47 pagesThe Evolution of Auditing: An Analysis of The Historical DevelopmentthakurchiragNo ratings yet