Professional Documents

Culture Documents

ECO - Module 3

ECO - Module 3

Uploaded by

Kartik Puranik0 ratings0% found this document useful (0 votes)

11 views76 pagesOriginal Title

ECO- Module 3 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views76 pagesECO - Module 3

ECO - Module 3

Uploaded by

Kartik PuranikCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 76

qi

AN TS eee PE

INDIAN MONEY MARKET

Meaning

The Money Market is a market for lending and borrowing of short-term funds. It deals in funds and

financial instruments having a maturity period of one day to one year. It covers money and financial

assets that are close substitutes for money. The instruments in the money market are of short term

nature and highly liquid.

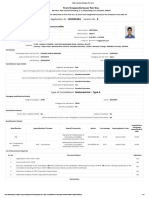

Discuss the structure (OR) components of Indian money market.

The Indian money market consists of two segments, namely organized sector and unorganized

sector. The RBI is the most important constituents of Indian money market. The organized sector is

within the direct purview of RBI regulation, The unorganized sector comprises of indigenous

bankers, money lenders and unregulated non-banking financial institutions.

The structure or components of Indian money market is depicted in the chart 5.1.

Svar

NU

IS)

cr

Calll and Notice Money Market

Treasury Bills Market

Commercial Bills Market Unregulated Non-Bank Financia

Market for Certificates of Deposits (CDs) Intermediaries (Chit Funds, Nidhis and

Market for Commercial Papers (CPs) Loan Companies)

Repos Market * Finance Brokers

Money Market Mutual Funds (MMMFs)

Discount & Finance House of India (DFHI)

Indigenous Bankers

Money Lenders

awww ewes

(A) Organized Money Market Instruments and Features.

1. Call and Notice Money Market: Under call money market, funds are transacted on overnight basis.

Under notice money market funds are transacted for the period between 2 days and 14 days. The

funds lent in the notice money market do not have a specified repayment date when the deal is

made. The lender issues a notice to the borrower 2-3 days before the funds are to be paid. On

receipt of this notice, the borrower will have to repay the funds within the given time. Generally,

banks rely on the call money market where they raise funds for a single day

The main participants in the call money market are commercial banks (excluding RRBs), co-

‘operative banks and primary dealers. Discount and Finance House of India (DFHI), Non-banking

financial institutions such as LIC, GIC, UTI, NABARD etc. are allowed to participate in the call

money market as lenders,

2. Treasury Bills (T-Bills): Treasury bills are short-term securities issued by RBI on behalf of

Government of India. They are the main instruments of short term borrowing by the Government.

They are useful in managing short-term liquidity, At present, the Government of India issues three

types of treasury bills through auctions, namely - 91 days, 182-day and 364-day treasury bills.

There are no treasury bills issued by state governments. With the introduction of the auction system,

interest rates on all types of TBs are being determined by the market forces.

3. Commercial Bills: Commercial bill is a short-term, negotiable, and self-liquidating instrument with

low risk, They are negotiable instruments drawn by a seller on the buyer for the value of goods

delivered by him. Such bills are called trade bills. When trade bills are accepted by commercial

banks, they are called commercial bills. f the seller gives some time for payment, the bill is payable

at future date (i.e. usance bill). Generally the maturity period is upto 90 days. During the usance

period, if the seller is in need of funds, he may approach his bank for discounting the bill

Commercial banks can provide credit to customers by discounting commercial bills. The banks can

rediscount the commercial bills any number of times during the usance period of bill and get money.

4. Certificates of Deposits (CDs): CDs are unsecured, negotiable promissory notes issued at a

discount to the face value. They are issued by commercial banks and development financial

institutions. CDs are marketable receipts of funds deposited in a bank for a fixed period at a

specified rate of interest

CDs were introduced in India in June 1989, The main purpose of the scheme was to enable

commercial banks to raise funds from the market through CDs. According to the original scheme,

CDs were issued in multiples of Rs.25 lakh subject to minimum size of an issue being Rs.1 crore.

They had the maturity period of 3 months to one year. They are freely transferable but only after the

lock in period of 45 days after the date of issue.

5. Commercial Papers (CPs): Commercial Paper (CP) is an unsecured money market instrument

issued in the form of a promissory note with fixed maturity. They indicate the short-term obligation of

an issuer. They are quite safe and highly liquid. They are generally issued by the leading, nationally

reputed, highly rates and credit worthy large manufacturing and finance companies is the public as

well as private sector. CPs were introduced in India January 1990. CPs were launched in India with

a view to enable highly rated corporate borrowers to diversify their sources of short-term borrowings

and also to provide an additional instrument to investors. RBI has modified its original scheme in

order to widen the market for CPs.

Corporates and primary dealers (PDs) and the all India financial institutions can issue CPs. A

corporate can issue CPs provided they fulfil the following conditions:

(a) The tangible net worth of the company is not less than Rs.4 crore.

(b) The company has been sanctioned working capital limit by banks or all India financial institutions,

and

(©) The borrowed account of the company is classified as a standard asset by the financing institution

or bank

6. Repos: A repo or reverse repo is a transaction in which two parties agree to sell and repurchase

the same security. Under repo, the seller gets immediate funds by selling specified securities with

an agreement to repurchase the same at a mutually decided future date and price. Similarly, the

buyer purchases the securities with an agreement to resell the same to the seller at an agreed date

and price. The repos in government securities were first introduced in India since December 1992

Since November 1996, RBI has introduced "Reverse Repos", ie. to sell government securities

through auction

7. Discount and Finance House of India (DFH)): It was set up by RBI in April 1988 with the objective

of deepening and activating money market. It is jointly owned by RBI, public sector banks and all

India financial institutions which have contributed to its paid up capital.

The DFHI deals in treasury bills, commercial bills, CDs, CPs, short-term deposits, call money

market and government securities. The presence of DFHI as an intermediary in the money market

has helped the corporate entities, banks, and financial institutions to invest their short-term

surpluses in money market instruments,

Q2

8 Money Market Mutual Funds (MMMFs): RBI introduced MMMFs in April 1992 to enable small

investors to participate in the money market. MMMFs mobilizes savings from small investors and

invest them in short-term debt instruments or money market instruments such as call money, repos,

treasury bills, CDs and CPs. These instruments are forms of debt that mature in less than a year.

(8) UNORGANIZED SECTOR OF INDIAN MONEY MARKET

The unorganized Indian money market is largely made up of indigenous bankers, money lenders

and unregulated non-bank financial intermediaries. They do operate in urban centers but their

activities are largely confined to the rural sector. This market is unorganized because it's activities

are not systematically coordinated by the RBI

The main components of unorganized money market are:

1. Indigenous Bankers: They are financial intermediaries which operate as banks, receive deposits

and give loans and deals in hundies. The hundi is a short term credit instrument. It is the indigenous

bill of exchange. The rate of interest differs from one market to another and from one bank to

another. They do not depend on deposits entirely, they may use their own funds,

2. Money Lenders: They are those whose primary business is money lending. Money lenders

predominate in villages. However, they are also found in urban areas, interest rates are generally

high. Large amount of loans are given for unproductive purposes. The borrowers are generally

agricultural labourers, marginal and small farmers, artisans, factory workers, small traders, etc.

3. Unregulated non-bank Financial Intermediaries: Theconsist of Chit Funds, Nithis, Loan

companies and others.

(@) Chit Funds: They are saving institutions. The members make regular contribution to the fund, The

collected funds is given to some member based on previously agreed criterion (by bids or by

draws). Chit Fund is more famous in Kerala and Tamilnadu.

(©) Nidhis: They deal with members and act as mutual benefit funds. The deposits from the members

are the major source of funds and they make loans to members at reasonable rate of interest for the

purposes like house construction or repairs. They are highly localized and peculiar to South India.

Both chit funds and Nidhis are unregulated.

4. Finance Brokers: They are found in all major urban markets specially in cloth markets, grain

markets and commodity markets. They are middlemen between lenders and borrowers.

What are the features of Indian Money Market? oR

Examine the defects of Money Market in Indi

Several steps were taken in the 1980s and 1990s to reform and develop the Indian money market.

Despite these efforts, Indian money market continues to remain lopsided, thin and extremely

volatile. Indian money market is relatively underdeveloped when compared to advanced markets

like London and New York money markets. ts main defects are explained below:

1. Existence of Unorganized Money Market:This is one of the major defects of Indian money

market. It does not distinguish between short term and long term finance, and also between the

purposes of finance. Since it is outside the control and supervision of RBI, it limits the RBI's control

of over money market.

‘sjoyew AQUOW #0, MON PUE LOPUCT Se YaNs sJOYeW

Rouow padojanap ywa paseduios 2q youues y! ‘snyy “inpim pue yydap yuaroyjns ounboe oy yA sey

pue padojanap ssa Ajaanejas si y jeu) aye21pur Ayea|s yaysew Aauow ueipul jo sjzajap eroge ayy

“EIpU] Ul a1e1S pedojenapsopun ave sOWN|SU!

SAY ‘Sd PUR SCD ‘SiIIq Kinsean Aep-p9¢ ‘siliq Ainsean Kep-zgi se yons sjuawingsul 1p:

aU P2oNpoMU! Sey [GY “9B-SB6L Jeyy Jeyew Asuow ay ui Buyeap siayoug pue siajeap ysier:

Ou alam a1aU] ACGIOW “S}QWeW |!q pue AauoW Yeo Ajuo ao O1OY| “9B-SBBL IN SaWNASUL

4eded ws} Woys eyenbepe eney jou pip jaysew Aouow ueipul oy | :sUaWNASU] ypesD ayenbepeu *,

“239 ‘ijiq eouesn uo Aanp duieys yBiy pe. yseo Buisn Jo sonoesd peardsapim

‘yayjoue 9uo UO siey”ueq snouebipul jo sauepuedep Bununossip uey) Jeujes Bumouoq

Jo} aauasajaid ‘sasodind Aypinby Jo) yseo yo yunowe abe; e Guidaay syueq jo aanoeid ayy

se yons suojoey Auew jo yunoa9e uo padojanap ye Jou Si JaYLeW [JIG BU) “1Ge 0) AjaAnaaya saiouebe

ypes snouen dn Bulyuy soy Asessadeu si yexsew jg paziuebio jjam Y :y RI IIIg JO aoUesqy *

‘uosees yoe|s ayy Buuinp spun ety Bumespyym pue uosees Ksnq

ein Buunp rayew Keuow au) ow) Asuow Buippe Aq 1eyseu Aeuow aup ul suonenjony Yyons plore 0.

seunseeul snouen Bulye) ueeq Sey {gy “JeyIOUE 0} UOSeAS eUO WO) SeyeI yseJO UI By} UI SUONENJONY

@pim are asa ‘yeyeW Keuow ueIpU] Jo eimeey BulyLNs es! (@uNS 0) JaquIaAON) UOseas Asnq eu)

Buunp ysavequl jo aye YBjy pue Aeuow jo AouaBul.ys |euoseas oy) :Aeuoy jo AouaBuins jeuosees *

“sueaX 1U9984 Ol) Ul 1UAIXe BWOS 0} SPUN} Jo UONeZI|/GoW at peroudwut

sey ‘uojsuedxa ysueig Apeynoed quauidojaaap Burjueq ayy ‘ianamoy ‘o1@ ‘Awouode jaijeled

Jo aoue)sixe ‘syiqey Burjueg jo yor] ‘sBulnes Mo| ‘saniioey Burjueq ayenbapeu! ay|} Ssoyey snoUeA

jo qunovoe uo YeyeW Aeuow uelpul Ul} spuny jo eBevoYs si eel Ayjeseued ispun4 aenbepeul *

“suonmynsut jueseyIp £q

qua] SUONeINP @WeS JO SPUN} JO} JEYIP Sered BY “JeYLOUB 0} JeyJeL KeuOW ey) JO UONDES BUD Woy

puny Jo Ayyiqow Jo 49e| 0} aNp SI SIU ‘¥8 ‘sUOAMNSUI JeIUeUY Jo SaVe1 BuIpUD| ’syUeg JeIDJALWIOD

pue arnessdoos jo sayes Guipue| pue sysodep ‘jwewuseaob jo ayes Buimoliog ay) se yons

Joyrew Kovow uepul By) ul Saou! Jo sayes KueWH 00} SISIKO Bla :saeY ISezayU] UL Ayo!

“saueuonouny Jo Ayoydnynu s| a4aua pue saonoeid

un uy AyuOYUN OU Ss} 104 “Ie 's!puB] Kau ‘salueduIOD UEO} ‘sOYUEG snoUDBipul soIMNSUOD

41 JS) UI snoU@BOWOY jou si Jo}es paye|nBouun oy,1 ‘BuDoM siaun seyeInBes kpoq xade ue se Igy

“SUOAMNSU! [eIOURLY PUe Syue erneiedood ‘syUeg JeIDFAUNUOD ‘eIPU] JO YUE aI ‘Iga Se Yons

SuONMSUI JeFAANS SOyMNSUOD FR!eW poziueBI oY JOY!eU! pozueBioun oy) pue jxeW AOUCW

paziueBio aip ‘sioias ony ow! papiaip Kipeoaq s| Yew KauowW UeIpUL ay, :YOResBAIU] Jo 49E7 ~

Qi

CAPITAL MARKET IN INDIA

Capital market is the market for medium and long term funds. It refers to all the facilities and the

institutional arrangements for borrowing and lending term funds (medium-term and long-term funds).

‘The demand for long-term funds comes mainly from industry, trade, agriculture and government.

The central and state governments invest not only on economic overheads such as transport,

irrigation, and power supply but also an basic and consumer goods industries and hence require

large sums from capital market. The supply of funds comes largely from individual savers, corporate

savings, banks, insurance companies, specialized financial institutions and government.

Explain the role (OR) Significance of Capital Market in economic development.

Capital market has a crucial significance to capital formation, Adequate capital formation is

indispensable for a speedy economic development. The main function of capital market is the

collection of savings and their distribution for industrial development, This stimulates capital

formation and hence, accelerates the process of economic development.

‘A sound and efficient capital market facilitates the process of capital formation and thus contributes.

to economic development. The significance of capital market in economic development is explained

below.

1. Mobilisation of Savings: Capital market is an organized institutional network of financial

organizations, which not only mobilizes savings through various instruments but also channelizes

them into productive avenues. By making available various types of financial assets, the capital

market encourages savings. By providing liquidity to these financial assets through the secondary

markets capital market is able to mobilize large amount of savings from various sections of the

people such as individuals, families, and associations. Thus, capital market mobilizes these savings

and make the same available for meeting the large capital needs of industry, trade and business.

2. Channelization of Funds into Investments: Capital market plays a crucial role in the economic

development by channelizing funds in accordance with development priorities. The financial

intermediaries in the capital market are better placed than individuals to channel the funds into

investments which are more favourable for economic development.

3. Industrial Development: Capital market contributes to industrial development in the following

ways:

(a) It provides adequate, cheap and diversified finance to the industrial sector for various purposes.

(b) It provides funds for diversified purposes such as for expansion, modernization, upgradation of

technology, establishment of new units etc.

(©) It provides a variety of services to entrepreneurs such as provision of underwriting facilities,

participating in equity capital, credit rating, consultancy services, etc. This helps to stimulate

industrial entrepreneurship.

4. Modernization and Rehabilitation of Industries: Capital market can contribute towards

modernization, rationalization and rehabilitation of industries. For example, the setting up of

development financial institutions in India such as IFCI, ICICI, IDBI and so on has helped the

existing industries in the country to adopt modernization and replacement of obsolete machinery by

providing adequate finance.

5. Technical Assistance: An important bottleneck faced by entrepreneurs in developing countries is

technical assistance. By offering advisory services relating to the preparation of feasibility reports,

identifying growth potential and training entrepreneurs in project management, the financial

intermediaries in the capital market play an important role in stimulating industrial entrepreneurship.

This helps to stimulate industrial investment and thus promotes economic development.

6. Encourage Investors to invest in Industrial Securities: Secondary market in securities

encourage investors to invest in industrial securities by making them liquid. It provides facilities for

6

continuous, regular and ready buying and selling of securities. Thus, industries are able to raise

substantial amount of funds from various segments of the economy.

7. Reliable Guide to Performance: The capital market serves as a reliable guide to the performance

and financial position of corporate, and thereby promotes efficiency. It values companies accurately

and toes up manager compensation to stock values. This gives incentives to managers to maximize

the value of companies. This stimulates efficient resource allocation and growth.

Q.2 What is capital market? Explain the structure (OR) composition of capital market in India.

In the financial market all those institutions and organizations which provide medium term and long-

term funds to business enterprises and public authorities, constitute the capital market. In simple

words, the market which lends long-term funds is called the capital market.

The capital market is composed of those who demand funds and those who supply funds. Thus, the

borrowers and lenders in the financial market for medium-term and long-term funds constitute the

capital market.

The Indian Capital Market is broadly divided into two categories:

1). The securities market consisting of

(a) The git-edged market and (b) The industrial securities market; and

2), The financial institutions (Development Financial Institutions) (DFs). Thus, the Indian capital market

is composed of

(@) The gilt-edged market or the market for government securities and industrial securities or corporate

securities market.

(b) Capital market includes Development Financial Institutions (DFls) such as IFCI, SFC, LIC, IDBI,

UTI, ICICI, etc. They provide medium-term and long-term funds for business enterprises and public

authorities.

(©) Apart from the above, there are financial intermediaries in the capital market such as merchant

bankers, mutual funds, leasing companies, venture capital companies etc. They help in mobilizing

savings and supplying funds to investors.

THE CAPITAL MARKET IN INDIA IS SHOWN BY CHART

Chart 1 : Capital Market in India

+

+

Government Industrial Securities Development Financial Financial

Securities (gilt-edged market Institutions Intermediaries

market) JN

New le Market (A) @)

Primary Secondary

Market Market

yoy oy eee

IFC ICICl SFCs IDBI IRBI UTI

Merchant Mutual Leasing =—-Venture. = Others

Banks Funds Companies _ Capital

Companies

“Awouose uerpuy ety jo Yosb ayy buyjesipur paylssenip

usaq sey Guluonouny sy ‘sapisag ‘Ajjenueisqns paseesou! sey suonsesuen joyew jeyded jo

@WN|ON ayy ‘sapedep OM ySe] AY) Ul ‘1OB) U] UeWeroJdWW! ;eUeWOUeYd UMOYs eneY WeWUYSeAU! pue

Burnes Jo awinjon ayy ynog ‘yymo.6 pides passaunim sey yayJew jeyded ‘suejq Jea,-anly ayy GuLing

"LS6| Jaye yuewerosdu Apears umoys sey yee jeyded ueIpu| oy) :saueIpeeyuy eIoUeULY (py)

poyeo ose suonnt

uplyM suoNMysul je!ueuy jeIseds ose oxoY Jey) PaUONUOW oney oM:sUONMNSU] jeIoUeUTY (2)

“senuinoas u! Buljeep pue Buljes

“Burkng ut sseursng Gurjo.quoo pue Bune;nBes 40) yeysew peziuebio Ajybiy e si y ‘SenuNoas persi| JO

payonb jo ajes pue aseysund ayy jo jeyJewW e si Jaye AJepuoses ayy JO jaye SHueYyoxe yOo\s oY)

Heysew Asepuoes (g)

“Kaun aup jo yymosB sCUODe UO yeduUI

Sy Jo esneseq Wepodu!! si JeyseW anssI Mau Oty Je4) PayoU eq AE yj “ssauISNg Jie BuIpuedxe

pue spuog ‘saJeys jo Woy au) ides mau jo Buises au) YM pauiJeou02 S| JexJeW aNssi MAU ey)

Jeu Ksepuoras aL) payed “yeysew 490) Jo afueysxe yo0)s

se umoUy AjuoWWUOD ‘JoxeW anss! pjo (q) pue yoyew Arewud ou pajles JoyJew anss! mau ay,

neque; Arewiiid (v)

2sa0697e9 ony Oy! papiaip si Faye SITY)

-fyo24y pls pue yyGnog aq uee YoIyM spuog pue SaMUAgap 'sexeYs Jo JEW e SII}

y@xJEWW SaNLINdag JeLNSMPUl a4 (Z)

“syuauunaysut gap pinby sow! ay) ese SenUNoes ueLUWeROB ‘sny |

“suonesado jayew uado sy yBnoy yeyew pabpa-16 euy ul aos jueuIWop e sAeyd |gy

“sumone pig pajeas panss! Apsow usaq

aney saqunoes juaWienoB ‘266L auNr eoulg “seadns jo Sa10s9 paspuny ara 40 Salo! [elanas

ow! uns Kew uonpesuen yeq ‘Abie Kian ase JayJEU SAnUNIAS TWOLULIAADB aup Ul SUONDeSUEH au

“spuny uapjoud ayy pue ‘919 ‘Or ‘Sveq

JeoJ9WWOD apNoUl SUoAMASUI esey) ‘SenUNZES esau) UI SpUNY JleLy Jo UOMOd UleYaD e JSeAUI

0) mej Aq pauinbas ase Keys “suonnyysu! Ajueuiwopeid ee yeysew pabpa-y6 ay) UI sioyseau! ey

“sanlinoas Ayyjenb yseq aup ‘a’! pabpa-y6 se umouy ave Koy ‘soy

YSU ae SeUNIGS ay] Sy JeYeW senUNIes JUaWUUeACD ay) Se UMOUY OS] SI JaxJeW pabpa-yID,

ye veW pebpy

“ssaooud quaLujo}|e

au sasimadns jg¥4s jo aaneqasaides e ‘aseys Jo juauNOye aly ul aoejd sexe) eonoesdjew ou

@INSUA OJ ’SJOISAAU! JO S]SaJaIU! Bt) Ja}O/d 0) SasNseaW SNOLeEA PednpoNu! Sey |gFS “SenuNdes ul

SJOJSOAU! JO JSAZaYul UON}Ia}0Id 9) SI [GAS JO ajou JUeLOdUI UY :S10]SAAU] JO JSAJA}U] JO UONIO}OJd

“syeysew Asepuoses pue

Ayewiid 0} adsas ym suuiou ‘saujapin6 ‘saanoaup ‘suone;nBai ‘soins anssi 40 awey UeD |gAS ayL

“eIpuy ul Syaysew Andes au jo uoNejnBas ayy si {g@3S Jo ajo1 JUeUOdW JeYJOUY :ajoy AsoyeinBay

"S}oy JEU [eyded jo uawdojanep Ayyeay ayy Joy JUBA

ase seinseaw Auojejnies sy ‘seonoeidjew Bulpey syueneid 3) ‘ssoyseaul jenpiipul ayy Ayersadse

‘SIOJSAAU! JO S\SosaqU pue SIYyBU ayy syajoud y “yeyJeW jeyded ayy Jo wawdojenap pue UONOWOd

aul SI [GaS JO |JOl yueYOdWw! aL) jo suC:;eyIeW |eWdeg jo yUauUIdojaA|aq pue UOnOWOIg

“Aysiuly @DuUeU!4 a4) Jo jo.NUOD

Wes9A0 ayy JapUN Ss! |G3S eyL “eIpul UI YomaWeY A1oye;nBas jeIueUy aLy Jo jUaN|NSUOD yeLOdWUI

Aiea e awi0deq MoU Sey yj “G66L Auenuer ul paseeJoul asem [gas Jo Siamod AuojejnBas ayy ‘smyeys

Asoymeys papsooze sem }!'Z66L Arenuer pue gg6L u! pieog A10ynje}s-uou e se paysiiqeise sem |gaS

‘Waa Jo eouroyiu

7 80y ayy aulLUeXy

vo

“suoneaouu! BuiBesnooue

pue uonjedwos Bunjejnuiys exe senyinses ey) YBnosyy sedounosed Jo uoNed0||e2 pue UONeZ|IIGoLW

yo Ue Bunewioe ul ajos Jueyoduu! Ue sAejd |g34S eu, :seounosay jo UONe:

“spuny Jenynw aySaWOp pue sj] 4 jo BuLoyuoWwW pue uoNeinBas

‘uonensibai rye syoo) osje y “(S||4) SiOySaAU] ;eEUOANMIASU] UBlel04 pue spuny jennwW InsSewWop

0) yadsas yum Aaijod yuaujsanu! jeuonMSU! Jaye yoo) [GIS ‘Aco yeuUNsanu] jeuoNNASU]

“Bulpen 49) pue sjuawanow eoud

jo Buyoyuow pue sabueyoxe yoors ay jo awos Jo uONeAsiuIWpe ‘sabueyoxe yooIs Jo SiequiaW

jo Buyoyuow pue uojensibes 40) ajqisuodsai osje si y ‘s}onpoid queunsenu! mau puke jayJeW

Asepuosas 10) sanss! Aioyejnfias pue Aayjod ye 10) ajqisuodsai si |gas :Aoog yeyxsey Asepuosas

“S@URIPSWWAjU! payejes anssi jo Buoyuow

pue uonejnBes ‘uonensibe: 40) ‘Aoyod yaxsew Asewid ayy ym Buneuipso-09 10) ‘senssi yybu

pue dI\qGNnd Joj JaYJo Jo Sioa) pue sasmoadsoid sup |e jo Buman Joy ajqisuodsai si 3 “jeysew Auewid

0) Wadsau YM senss! AsoyejnBai pue syayew Aatjod at) Wye Jaye SyOo| |Gas :AdIoq yyey ewig

‘sajuedwios paysi jsuleBe |g4s 0) sjurejdwios aye

0} JUEM OYM SIO}SAAU! SjSISSe [GAS JO UOISIAIG a2UePIND pue jesselpay SaDUeAaLID 4JO}SAAU| OY

“squrejdwos Jo}saau! YM jeap 0} wWaysKs Guypuey sjurejdwos payewoyne ue pesnpoqui sey |gaS

“saouenali6 ssoysenu! aly Guissaupas Jo ajos seyjoue sAeid jQ3s ‘Jesseupay SaoueAeUD S,10}SaAU]

“salpawias pue syyBu soup JO pue JayJewW Sanlinoas

BU} 0} parejas SENSs! SNOUEA UO SJO\SAAU! ALN UAIYBI|US 0} Eun O} SU] WOY s|UeWesNeApe Senss!

¥ Jaye sanunsas ayy jnoge siojsaAu! ety BuNeonpa jo ajol e sey |G@AS :uOneINpy S,JO}SAAU]

39

Module 2

MONETARY ECONOMICS

Unit Structure

4.0 Objectives

4.1. Concept of Money Supply

42. Constituents of Money Supply

4.3. Determinants of Money Supply

4.4. Velocity of Circulation of Money

45 Summary

4.6 Questions

4.0 OBJECTIVES

+ To study the concept of money supply

* To understand the constituents of money supply

+ To study various determinants of money supply

‘* To study the concept of velocity of circulation of money and

its factor determinants

4.1 CONCEPT OF MONEY SUPPLY

Money supply refers to the amount of money which is in

circulation in an economy at any given time. It is the total

stock of money held by the people consisting of individuals,

firms, State and its constituent bodies except the State

treasury, Central Bank and Commercial Banks. The cash

balances held by the Federal and federating governments with the

Central Bank and in treasuries are not considered as part of money

supply because they are created through the administrative and

non-commercial operations of the government. Further money

supply refers to the disposable stock of money. Therefore money

supply is stock of money in circulation. Money supply can be

looked at from two points of views, namely, money supply as a

stock and money supply as a flow. Thus at a given point of time,

the total stock of money and the total supply of money is different.

40

Money supply viewed at a point of point is the stock of money held

by the people on a given day whereas money supply viewed

overtime is viewed as a flow. Units of money are spent and re-

spent several times during a given period. The average number

of times a unit of money circulates amongst the people in a

given year is known as Velocity of Circulation of Money, The

flow of money is measured by multiplying the stock of money with

the coefficient of velocity of circulation of money.

4.2__CONSTITUENTS OF MONEY SUPPLY

There are two approaches to the constituents of money supply.

They are the traditional and the modern approaches.

1. Traditional Approach: According to the traditional approach,

the money supply consists of currency money consisting of

coins and notes and bank money consisting of checkable

demand deposits with commercial banks. The currency money

is considered high powered money because of the legal backing

of the State, The Central Bank of a country issues currency

notes and coins because it has the monopoly of note and coin

issue. The supply of money in a country depends upon the

system of note issue adopted by the country. For instance,

India adopted the Minimum Reserve System in 1957, Under

this system, the Reserve Bank of India has to maintain a

minimum reserve of *.200 Crores consisting of gold and foreign

securities. Out of this, the value of gold should not be less than

*.116 Crores. With this reserve, the Reserve Bank of India has

the power to issue unlimited amount of currency in the country.

Checkable demand deposits of commercial banks are used in

the settlement of debt. Payments made through checks change

the volume of demand deposits by creating derivative deposits.

The creation of demand deposits is determined by the credit

creation activities of the commercial banks. Bank money is

considered as secondary money whereas cash money is known

as high powered money. Thus according to the traditional

approach, the total supply of money is the sum of high powered

money and secondary money or currency and bank money.

The ratio of bank money to currency money depends upon the

extent of monetization, banking habits and banking

development in a country. In advanced countries, ratio of bank

money to currency money is high whereas in poor countries the

ratio of currency money to bank money is high.

2, The Modern Approach: According to the modern approach,

money supply includes currency money and near money.

Money supply therefore consists of coins, currency notes,

a

demand deposits of commercial banks, time deposits of

commercial banks, financial assets, treasury bills and

commercial bills of exchange, bonds and equities.

RESERVE BANK OF INDIA'S APPROACH TO THE

MEASUEMENT OF MONEY SUPPLY:

According to the Reserve Bank of India since its inception in

1935, money supply in the narrow sense of the term was the sum

of currency with the people and demand deposits with the

commercial banking system. Narrow money was denoted by the

RBI by Mj, In 1964-65, the concept of broad money or aggregate

monetary resources was introduced. Broad money was considered

equal to Mi + Time deposits with commercial banks. In March,

1970 the RBI accepted the report of the Second Working Group on

Money Supply. This report was published in the year 1977 and it

gave a broad definition of money supply. Accordingly, four

measures of money supply were brought into effect.

These four measures are as follows:

1. My = Currency with the public + Demand deposits with the

commercial Banks + Other deposits with the RBI.

2. Ma -M; + Post Office Savings Bank Deposits.

3. Ms -My, Time deposits with the commercial banks.

4, Mg -Ms + Total Post Office Deposits (excluding NSCs).

The Reserve Bank of India gives importance to narrow

money (M;) and broad money (M3). Narrow money excludes time

deposits because they are not liquid and are income earning assets

while broad money includes time deposits because some liquidity is

involved in it as these assets earns interest income in future. Since

time deposits have become convertible in recent times, they have

become more liquid than what they were before. The Mz and My

measures of money supply include post office savings and other

deposits with the post offices.

The third working group on money supply recommended the

following measures of monetary aggregates through th

report submitted in 1998:

1, Mo =Currency in circulation + Bankers’ deposits with the RBI +

Other deposits with the RBI. (Mo is compiled on weekly

basis).

2. M, =Currency with the public + Demand deposits with the

bankingSystem + Other deposits with the RBI = Currency

42

with the public + Current deposits with the banking system

+ Demand liabilities Portion of Savings Deposits with the

banking system + other Deposits with the RBI

3, Mz = My + Time liabilities portion of saving deposits with the

banking System + Certificates of deposits issued by the

banks + Term Deposits [excluding FCNR (B) deposits] with

a contractual maturity of up to and including one year with

the banking system =Currency with the public + current

deposits with the banking System + Savings deposits with

the banking system + CertificatesOf Deposits issued by the

banks + Term deposits [excluding

FCNR (B) deposits] with a contractual maturity up to and Including

‘one year with the banking system + other deposits with the RBI.

4. M3 = Mz + Term deposits [excluding FCNR (B) deposits]

with a Contractual maturity of over one year with the

banking system +Call borrowings from Non-depository

financial corporations by the — Banking system. (Ms, Mz

& Mare compiled every fortnight).

In addition to the monetary measures stated above, the

following liquidity aggregates to be compiled on monthly basis were

also recommended by the working group:

1. Ly =Ms + All deposits with the Post Office Savings Banks

(excluding National Savings Certificates).

2. Le = Ly + Term deposits with Term lending institutions and

refinancing Institutions (Fis) + Term borrowing by Fis + Certificates

of Deposits issued by Fis.

3. Ls =L2+ Public deposits of Non-banking Financial Companies.

(Lsis compiled on quarterly basis).

4.3 DETERMINANTS OF MONEY SUPPLY

Currency in circulation and demand deposits are the main

constituents of money supply. While the demand deposits are

created by the commercial banks, currency is issued by the Central

Bank and the Government. The supply of money is determined by

the following factors:

1. Size of the Monetary Base: Money supply depends upon the

size of the monetary base. The monetary base refers to the

group of assets which empowers the monetary authorities to

issue currency money. Money supply changes with changes in

43

the monetary base. The monetary base of an economy consists

of monetary gold stock, reserve assets such as government

securities, bonds and bullion, foreign exchange reserve with the

central bank and the amount of central bank's credit

outstanding. In the present times, gold stock is not considered

as part of the monetary base.

. Community's Choice: The relative amount of cash and

demand deposits held by the people also influences the supply

of money. If the people prefer to make check payments much

more than cash payments, the total money supply maintained

by a given monetary base would be larger and vice versa

Since money deposited in commercial banks generates

derivative deposits and expand the supply of bank money

through the credit multiplier, people's preference of bank money

to cash would increase the supply of money. However, the

choice of the community is determined by factors such as

banking habits, per capita income, availability of banking

facilities and the level of economic development. If these

factors are developed, the money supply would be larger and

vice versa

. Extent of Monetization: Monetization refers to the use of

|. Cash Reserve Rati

money as a medium of exchange. The choice of the community

for money as a liquid asset depends upon the extent of

monetization of the economy. If monetization is high, demand

for money would be high and vice versa

The Cash Reserve Ratio refers to the

ratio of a bank's cash holdings to its total deposit liabilities. It

determines the coefficient of the credit multiplier. The CRR is

determined by the Central Bank of a country. The credit

multiplier (m) is determined as the reciprocal of the CRR ().

Therefore m = 1/r. Excess funds with the commercial banks

multiplied by the credit multiplier will give us the extent of credit

creation by the commercial banks. Lower the CRR, greater will

be value of the credit multiplier and therefore greater will be the

‘supply of bank money and vice versa.

. Monetary Policy of the Central Bank: Monetary policy is

defined as the policy of the Central Bank with regard to the cost

and availability of credit in the economy, The monetary policy of

the Central Bank of any country will be according to the macro-

economic conditions. Thus under inflationary conditions, the

Central Bank may follow restrictive monetary policy and thereby

reduce the supply of bank money by pursuing both qualitative

and quantitative measures of controlling money supply.

Similarly under recessionary conditions the Central Bank may

follow expansionary monetary policy and thereby raise the

supply of money in the economy.

44

6. Fiscal Policy of the Government: Fiscal Policy is defined as a

Policy concerning the income and expenditure of the

government. While the government raises revenue through

various sources like different types of taxes, borrowing and

through deficit financing, it spends the money raised for various

developmental and non-developmental purposes. When the

government raises revenue by imposing fresh taxes or by

raising the existing level of taxes, it helps to reduce money

supply. Similarly, market borrowing by the government reduces

money supply and raises the market interest rates. This is

known as the crowding out effect of government borrowing

When the government spends the money so raised, money

supply increases. However, when the government runs a

deficit budget, it adds to the existing stock of money supply and

thus raises the supply of money in the economy. The opposite

will be the impact of a surplus budget but surplus budgets are a

rarity in modern times.

7. Velocity of Circulation of Money: Velocity of circulation of

money refers to the average number of times a unit of money as

a medium of exchange changes hands during a given year.

Money supply is measured as total money in circulation

multiplied by the velocity of circulation (MxV). Thus higher the

velocity of circulation of money, higher will be the money supply

and vice versa.

4.4 VELOCITY OF CIRCULATION OF MONEY

The velocity of circulation of money determines the flow of

money supply in an economy in a given period of time, normally

such a period is one year. The average number of times a unit of

money changes hands is known as the velocity of circulation of

money. The supply of money in a given period is obtained by

multiplying the money in circulation with the coefficient of velocity of

circulation i.e., M x V where M refers to the total amount of money

in circulation and V refer to the velocity of circulation of money in

the given period.

Factors Determining Velocity of Circulation of Money: The

velocity of circulation of money is determined by the following

factors:

1. Time Unit of Income Receipts: The more frequently people

receive income, the shorter will be the average time period of

holding money and greater will be the velocity of circulation of

money. Thus if in a given society large number of people

receive income on daily basis, the velocity of circulation of

money would be higher than the one in which people receive

income on weekly, fortnightly or monthly basis.

45

Method and Habits of Payment: The velocity of circulation

of money would be high if large number of people prefers to

make payment on installment basis. As a result, the same unit

of money will change hands more often than when payments

are made in full

Regularity of Income Receipts: If in a society people receive

income on a regular basis, they will spend their current income

without bothering about future and hence the velocity of

circulation of money would be high. However, if future income

receipts are uncertain, people will not spend more money in

the present and hence the velocity will be less

Saving Habits of the People: If the marginal propensity to

save is high in a society, then the people will be spending less

in the present and hence the velocity will be less. Similarly, if

the marginal propensity to consume is high the people will

spend more and the velocity of circulation of money will be

high:

Income Distribution: Income distribution may be more equal

or more unequal in a society. If inequalities of income are high

in a society with the top 20 % taking away a major portion of

the national income, velocity of circulation of money would be

low because the richer sections of the society will be holding

more idle cash balances. However, if income distribution is

more equal or less unequal, the bottom 40% of the people will

receive more incomes and spend more thereby increasing the

velocity of circulation of money.

Development of Banking and Financial System: If the

banking and financial institutions in a country are well

developed, mobilization of savings can be effectively carried

out and more credit made available to the needy. This not

only prevents hoarding of cash balances but also increases

the velocity of circulation of both currency and bank money.

Business Cycle: During the prosperity phase of the business

cycle, investment, output, income, employment and prices

rise. Thus the velocity of circulation of money would be high

during the prosperity phase. However, during the downturn of

the business cycle, investment, output, income, employment

and prices begin to decline thereby reducing the velocity of

circulation of money.

Liquidity Preference of the People: If the liquidity preference

of the people is high ie., if they wish to hold a greater part of

their income in the form of idle cash balances, the velocity of

circulation of money would be low and vice versa

46

9, Speedy Clearance of Checks and Transfer of Funds: A

more advanced banking system would help speedy clearance

of checks and transfer of funds from one account to another

account, thereby increasing the velocity of circulation of

money.

SUMMARY

1. Money supply refers to the amount of money which is in

circulation in an economy at any given time. It is the total stock

of money held by the people consisting of individuals, firms,

State and its constituent bodies except the State treasury,

Central Bank and Commercial Banks.

2. There are two approaches to the constituents of money supply.

They are the traditional and the modern approaches.

3. The supply of money is determined by the following factors: Size

of monetary base, Community's choice, Extent of monetization,

Cash Reserve Ratio, Monetary policy of the Central Bank,

Fiscal policy of the Government, Velocity of circulation of

money.

4, The velocity of circulation of money determines the flow of

money supply in an economy in a given period of time, normally

such a period is one year.

5. Factors determining velocity of circulation of money: Time unit

of income receipts, Method and habits of payment, Regularity of

income receipts, Saving habits of the people, Income

distribution, Development of banking and financial system,

Business cycle, Liquidity preference of the people, Speedy

clearance of cheques and transfer of funds.

4.6 QUESTIONS

1. What is Money Supply?

Explain the approaches to the constituents of money supply.

Explain the determinants of money supply.

What is Velocity of Circulation of Money and explain the

determinants of velocity of circulation of money?

RON

POSS

FISCAL POLICY

ing to Arthur Smithies, the term ‘fiscal polic

to ae which government uses its expenditine

revenue programmes to produce desirable effects ang avoid

undesirable effects on the national income, production a

employment." Thus, fiscal policy may be defined as that part Ps

government’s economic policy which deals with taxation

expenditure, borrowing and the management of public debt in an

economy for purposes of stabilization or development.

The significance of fiscal policy as an instrument of ¢

control was first emphasised by Keynes. The Keynesian

of fiscal policy is applicable to advanced economies. Thi

fiscal policy in advanced economies is to stabilize the rate of

growth. But, in the context of an under-developed economy, the

role of fiscal policy is to accelerate the rate of capital formation,

Fiscal policy as a means of providing economic development aims

at achieving the following objectives :

Conomic

analysis

role of

Objectives of fiscal policy in under-developed countries

@i) To increase the rate of investment.—Fiscal policy

aims at the promotion and acceleration of the rate of

investment in the private and public sectors of the

economy. This can be achieved by checking actual and

Potential consumption and by raising the saving ratio.

(ii) To encourage socially optional investment.—fiscal

policy should encourage the flow of investment into the

channels which are considered socially desirable. This

relates to the optimum pattern of investment and it 1s

the responsibility of the State to promote investment

in social and economic overheads to achieve economie

development. Investment in transport, communicatien,

Power development and soil conservation fall unde

economic overheads. Investment in education, PU’ a :

health and technical training facilities come

( 472 )

social overheads,

(ii) To increase employment opportunities.—Fiscal

policy should aim at increasing employment

opportunities and reducing unemployment and

under-employment. For this, the State expenditure

should be directed towards Providing social and

economic overheads, Such expenditure creates more

employment and increases the productive efficiency of

the economy in the long-run.

(iv) To promote economic stability in the face of

international _instability—Fiscal policy should

promote the maintenance of reasonable economic

stability in the face of short-run international cyclical

fluctuations. An under-developed country is prone to the

effects of international cyclical fluctuations due to the

very nature of its economy.

(v) To counteract inflation.—Fiscal policy should aim at

counteracting inflationary tendencies inherent in a

developing economy.

(vi) To increase and_ redistribute national

income.—Fiscal policy should increase national income

and redistribute it in such a manner that the extreme

inequalities of income and wealth are reduced in the

economy.

(vii) To remove the regional imbalances in the

economy.—Fiscal policy should-aim to develop all the

regions equally in the economy.

(viii) To estimate sectorial imbalances.—Fiscal policy

should be to estimate, as far as possible, sectorial

imbalances arising in the economy from time to time.

The success of fiscal policy in achieving these objectives

depends on taxation,. public spending, public borrowing and deficit

financing.

TAXATION

axes are compulsory payments to the government without

expectation of, definite return or benefit to the tax-payer. Dalton

says; "A tax is a compulsory contribution imposed by a public

authority, irrespective of the exact amount of service rendered to

taxpayer in return and not imposed as a penalty for any

offence." According to Prof. Seligman, "A tax is a compulsory

contribution from the person to the government to defray the

expenses incurred in the common interests of all, without

reference to special benefits conferred." Bastable defines a tax as

compulsory contribution of the wealth of a person or a body of

persons for the service of public power. W. Taussig says that the

essence of a tax, as distinguished from other charges by

government, is the absence of a direct quid pro quo between the

tax payer and the public authority. Thus, a tax is generally levied

to augment the public revenue which is utilised for public benefit

and it cannot be predicted as to what extent the amounts paid

by an individual to the State. come back to him in the form of

services rendered by the authority or State.

Characteristics of taxes.—From the above definitions, the

following elements of taxes are visible :—

(1) Taxes are imposed by the government only.

(2) A tax is compulsory. contribution of the tax payer.

(3) In the payment of a tax, the element of sacrifice is

involved.

(4) Payment of a tax is the personal obligation of the tax

payer.

(5) The aim of taxation is the welfare of the community

as a whole.

(6) A tax is a legal collection.

(7) An element of force is there.

( 441)

PRINCIPLES OF ECONOMICS FOR Law STUg

NTS

(8) A tax is not imposed to realise the cost of benef,

(9 aes may be assed out of income.” Py

0) At a ey are actly eld by inde

(1) The tax dows Oe public authority. between th

e tax is raising public revenue,

(12) The purpose of the ts

(13) Tax is used for public purpose or common benefit of

all.

(14) Tax involves appropriati

CANONS OF TAXATION

dam Smith in his "An Inquiry into the Nat

and Gecass 6 ee Wealth of Nations" (Book V, chapter (2), rat

II) enunciated four famous maxims. They oe a

(1) Canon of equality—'The subjects of every State

ought to contribute towards the support of the

government, as nearly as possible, in proportion to their

respective abilities, that is, in proportion to the revenue

which they respectively enjoy under the protection of

the State. In the observation or neglect of the maxim

consists what is called the equality or inequality of

taxation." In other words, every person will pay taxes

to the government in proportion to his ‘ability to pay’.

The richer a person is, the more is his ability to pay

towards the running of the government. The ability to

pay may be judged on the basis of wealth or income

or expenditure. The maxim implies that the income

which a person enjoys under the protection of the State,

should be taxed on the proportional rate of taxation.

Though, at another place, he pointed out that richer

citizens should not pay in proportion to their wealth,

but more than in proportion, he proposed here

. proportional taxes for equality.

a) —'The tax which each individual

er to pay oughi\to be certain, and not arbitrary.

e time of payment,\the manner of payment, the

ceeded be paid oughtto be clear and plain to the

ee fs ive faked 0 person." The canon 0

tax payer by the tax to prevent the exploitation of the

ax collector or the State. Uncertainty

ion of private property,

AND FISCAL POLICY 443

yf in taxation encourages insolence or corruption. The

annon of certainty demands that there should be no

element of arbitrariness in a tax. The tax payer should

be able to see for himself why he is called upon to pay

a particular sum as taxation. Certainty is needed not

only from the point of view of the tax-payer, but also

from that of the State. The government should be able

to estimate the proceeds of the various taxes and the

time when they are expected to flow in.

Canon of convenience.—'Every tax ought to be

levied at the time or in the manner in which it is most

likely to be convenient for the contributor to pay it."

The canon of convenience says that the time of payment

and the manner of payment should be convenient. It

implies that taxes should be imposed in such a manner

and at the time which is most convenient for the

tax-payer. Adam Smith also pointed out the reasons and

the taxes which can conveniently be collected, ie., taxes

on articles of luxuries, "taxes upon such consumable

goods as articles of luxury, are finally paid by the

consumer and generally in a manner that is very

convenient for him." The payment of these taxes is

convenient to consumer because he pays them little by

| little and whenever he likes as he has the freedom to

| buy them at the most convenient time or not to buy

them at all.

Canon of economy.—"Every tax ought to be contrived

as both to take out and keep out of the pockets of the

people as little as possible over and above what it

brings into the public treasury of the State." This canon

indicates that taxes should not be imposed unless the

revenue from them is considerable and, at the same

time, the collection charges should not be too much and

too high a proportion of the total tax revenue.

, Adam Smith pointed out the conditions under which, a tax

4y either take-out or keep-out of the pockets of the people more

: 4 ings into treasury in the following four ways :

@® The levying of it may require a great number of officers,

whose salaries may eat up the greater part of the

Produce of the tax, and whose pre-requisites may

impose another additional tax upon the people. Hence,

the administration cost should be minimum.

3

rr

4

(ii)

PRINCIPLES OF ECONOMICS FOR LAW STUDENTS

It may obstruct the industry of the people, and |

discourage them from applying to certain branches of

business which might give maintenance and

employment to great multitudes. Hence, the taxes

should not be levied so heavily as to discourage

production.

(iii) The forfeitures and other penalties which these

unfortunate individuals incur, who attempt

unsuccessfully to evade the tax may frequently ruin

them, and thereby put an end to the benefit which the

community might have received from the employment

of their capital. An injudicious tax offers a great

temptation to smuggling. Hence, the tax should not be

so heavy as to offer great temptation for evasion or

smuggling and tax-payer may not be put under

unnecessary extra cost.

(iv) By subjecting to the frequent visits and the odious

examination of the tax-getters it may expose them to

much unnecessary trouble, vexation and oppression.

The first canon of Adam Smith is ethical and the other three

are administrative in character.

(6)

(6)

Mm

(8)

Other Canons.—Some writers, like Bastable have

added a few more canons of taxation to Adam Smith's

four maxims.

Canon of productivity or fiscal adequacy.—

Bastable’s first canon of taxation is the canon of

productivity. The productivity of a tax may be observed

in two ways. In the first place, a tax should yield a

satisfactory amount for the maintenance of a

government. Secondly, the taxes should not obstruct

and discourage production in the short as well as in

the long run.

Canon of elasticity—Bastable also laid stress on the

principle of elasticity, ie, the yield of the taxes may

be increased or decreased according to the needs of the

government. Taxes on property and commodities are not

80 elastic as income tax.

Canon of diversity—There should be all types of

taxes, direct and indirect, so that every class of citizens

may be called upon to contribute something towards

the State revenue. The burden of taxation should be

widely distributed on the entire economy without

causing much harm to

anyone.

(@) Conon oulsimplicity emacs tha oe Gul

e : by the tax-payer, ie, its nature,

its aim, time of payment, method and basis of

i

{ —_

| estimation should all be easily followed by each tax

\ BANKING AND FISCAL POLicy wy

easily be understood

payer. Obviously th,

difficulties of the aeaeers may remove several

interest of his couventere and therefore, it is in the

| 40) Canon of neutrality,—: i

t ¢ the sense that they sbecld ant nrc oe meal a

production or distribution,

(11) Canon of expediency.—tt implies that the possibilit

of imposing a tax should be taken into acount from

different angles, i.e., its reaction upon the tax payers.

Sometimes, it is seen that a tax may be desirable and

may have most of the characteristics of a good tax but

the government may not find it expedient to impose it.

For example, progressive agriculture income tax is very

much desirable in India, but it has not been imposed

so far in the manner it should have been imposed.

Hence, this canon is of vital importance in democratic

countries.

(12) Canon of contribution to economic

stabilization.—It may be interpreted as to promote

full employment and if possible a stable financial level.

The stabilization of the balance of payments may be a

subsidiary objective of a well organised tax system.

(13) Canon of co-ordination.—In democratic countries,

taxes are imposed by federal and local governments. It

is therefore very much desirable that there must be

co-ordination between the different taxes that are

imposed by different tax authorities.

OBJECTIVES OF TAXATION

Normally, there is only one objective for the imposition of

tires, i.e, to collect revenue for the government. But in modern

8, social and economic justice is only the end in a Democratic

Socialist State. Hence, the following are regarded as the broad

“cial and economic objectives of taxation to achieve the above

Boal,

(1) Prevention of concentration of wealth.—Prof.

Musgrave provided the following devices to prevent the

PRINCIPLES OF ECONOMICS FOR LAW STUDENTS

concentration of wealth :

(i) A tax transfer scheme, combining progressive

income taxation of high income households with a

subsidy to low income households.

(ii) A combination of taxes on goods purchased largely

by high income consumers and subsidies to other

goods which are used ee

consumers. .

(2) To secure economic stability—The tool of taxation

may be used to secure economic stability or to remove

economic fluctuations. The economic fluctuation a

be due to changes in ployment,

prices and aggregate demand. The measures are:

(i) If involuntary unemployment

taxation should be reduced.

(ii) If inflation prevails, the level o!

increased. ‘ — 7

(ii) If full employment and price stability prevails,

then, there is no need to change the present level

of taxation~

(3) To secure adjustment in allocation of resources.—

All wants cannot be satisfied through the market.

Public sector is used to make provision of social wants

or collective wants, i.e., defence, justice, railways and

roads, social and cultural welfare, etc. As social life

became more complex and civil sense of the people

developed, the State found it necessary and possible. to

take upon itself some further obligations such as those

of protection against internal disorders, regulation of

trade and commerce, etc. To meet the expenditure. for

these functions revenue is to be raised through taxes.

(4) To accelerate economic growth.—For the purpose of

promoting a country’s economic development, taxation

may be used to achieve the following objectives :

(i) to curtail consumption and thus transfer resources

from consumption to investment;

a ‘0 increase me incentives to save and invest;

iii ransfer the resources from the hands of the

public to the hands of the government in order to

make public investment possible;

(iv) to modify the pattern of investment into socially

f taxation should be

“‘Buyqured

pue 3uny3eq ay} [oI}U09 04 yUSUNI}sUI UB se U0T}exXe}

ay} es Ue JUEUTUJEAOS OY, “WWeAdTeIIT are yt [jedosd

YoIyM saatjour 9y} yey} puE SMye[SIBa_ ayy. Jo 1amod

ou? UF St UoHexe, oy ‘onueAel Butster Jo aoInos 8

Ajazaul jou pue Joryu0 eL0s Jo JueuINIysul peztudo00e1

BS UOHEXeL—Jo1;U09 [B}o0s Jo yuournzysut uy (9)

'— ‘Aya08 ur yypeam JO WOLNQLYSIp atqeynbe

aye 0} puB satzTenbout o1WoUOIa ey} aeonpar 0} (A)

pus ‘1ouueur e[qeiisep

a 13"

in AQI10d THOSId NY ONIAN

4

om Jo 8U0 UT pazer}Ua0U0D Suraq Jo peaysur Peytsrearp

aq Pinoys we}sAs xe} OY, ‘sUI9z1 snotZeA UO Perse] ore

sexe} YOTYM UI WezShs xB} ay} 07 Si9jer xeq efdiyinur

y—me384s AISIOAIP 10 ute4shs uoMnexe,-yInW (g)

‘uoryexe} JO Ueping 4we18 B 1eaq Pinoys fay}

pue sexe} exou Awd prnoys jo 7oyV0q ere CYM asoyy

‘sf JUL ‘SeOUBISUMOTD eyTTUN ur suosied jo quourzear4

aanefer a[qBrISep 94} St UoTyexey ut AyTeNba jo podse

puoses oY, “UOHBxe} Jo Uepng oures oy} 1e9q P[noys

seouBISUNOITD IBIAS UT padstd ere oym suosiad asoyy

Iv ‘sfenbe jo yueury¥e13 [enba, st aseo ST} UT eyer oY,

‘seouBySUINOIID O¥YI] UI SsuOSsIed Jo yuourwe 1odoid eu}

st 381g eUL AyTenbe Jo ura;qord 94} 03 sjoedse omy ore

any —aopang XB}. Jo UOHNGLYySIp oy) Ur AyTENby (z)

‘requinu

qseye03 84} Jo pooS 4soqver9 94} eJ0WoI1d prnoys

wayshs xe} f10aq ‘aures ay} 8q plnoys sexe} yuereyIp

30 soytioes [eursreur ayy yey} Aem w& Yons ut etdoad

# suotjses yuarayyIp uo PeTA9] 8q Plnoys sexe} ay} ‘sty3

Ssaampe Q], ‘adequeape [etoos unurxeur jo afdroutid ay}

uo paseq st yorym 489q 94} SI UoTyexe} Jo uIeyshs yey}

“eC IC 04 Surproosy—syxyaueq TeIo0s umunrxey] (1)

: 5 ayeig Aue

# waysks xe, punos JO SostopoBIEYO oy} ore ButmoT[oy ayy,

WALSAS XV GOOD V JO SOLLSIUSLOVAVHO

NOLLVXVL 40 Sa TdIONINd

taxes. At the same time, care should be taken to avoid

oltiplicity of taxes, Arthur Young states, "If I were to

define @ good system of taxation, it shou!

ing light! of taxation, it should be that of

bearing “igntly on an infinite number of points, heavily

on none.

4) Productivity of the tax system—The term

‘productivity’ is interpreted in two senses. First, the

taxation system should be such as to provide adequate

income to the government to meet its expenditure. As

the needs of the public authorities increase continually,

the tax system should yield increased revenues.

Secondly, the tax system should be such as to produce

no adverse effect on the productive capacity of the

country. In other words, the tax system should give the

maximum possible encouragement to the productive

capacity of the country.

(5) Rights of tax-payers.—A sound tax system will have

to safeguard the interests of the tax payers. In a

democratic set-up, the rights of tax-payers have to be

continuously kept in mind. Besides, the present level

of taxation as well as the further prospects of taxation

necessitate that the interest and rights of tax-payers

should be given adequate recognition. The authority

should : (i) make efforts to broaden their

understanding of particular tax measures, (ii) provide

for prompt and fair treatment of his complaints, and

(iii) reduce the inconvenience to minimum.

(6) Universal application of taxes.—Each individual

should pay according to his ability to pay, and the

individuals possessing the same ability to pay should

contribute the same amount by way of taxes without

any discrimination. In India, income tax is lacking this

characteristic because income from agriculture is not

taxed to the extent the incomes have been taxed in the

non-agriculture sector.

(1) Elasticity.—The taxation system should provide to the

government increased income with the increase in the

national income of the country. The taxation system

should also yield more income when the government

expenditure goes up. Two things are essential to bring

about elasticity in the tax system. First, there should

be proper blending of direct and indirect taxes.

Secondly, certain sources of income should be

(8)

(9)

PRINCIPLES OF ECONOMICS FOR LAW STUDENTS

exclusively reserved for emergencies.

Convenience.—The government should keep in view

the convenience of the tax-payer while devising th,

taxation system of the country. Since the tax-payers

make sacrifices when they pay the taxes, it is essential

for the government to see that they are not put to any

avoidable inconvenience.

Absence of tax evasion.—The tax system of the

country should be so devised as to leave no scope for

tax evasion on the part of the tax-payers. To achieve

thié objective, there should be a proper blending of all

sorts of commodity and personal taxes. This will reduce

the scope for tax evasion to the minimum.

(10) Conducive to economic growth.—The tax system

must be so shaped as to accelerate economic

development. It should generate a healthy investment

climate and provide incentives to the entrepreneurial

classes to come forward and set up new business and

industrial enterprises in the country.

(11) Optimum allocation of resources.—The tax system

should be so framed. as to ensure that the productive

resources of the economy are optimally allocated and

utilised. For this purpose, it is essential that the tax

system should be economically neutral.

(12) Ensuring economic stability—The tax system

should provide for in-built measures to fight the demon

of inflation. Inflation not only erodes the real income

of the masses, but also perpetuates glaring inequalities

of income and wealth. From the point of view of

ensuring economic stability, it is necessary that the tax

system must be progressive in relation to changes in

the national income.

DIRECT AND INDIRECT TAXES

Taxes have been broadly categorised into direct taxes and

indirect taxes. Dalton made a distinction between direct and

indirect taxes as "that a direct tax is really paid by a person on

whom it is legally imposed, while an indirect tax is imposed on

one person, but paid partly or wholly by another owing to a

consequential charge in the terms of some contract or bargaining

between them."

J.S. Mill says," Direct tax is that which is demanded from

the persons who (it is intended or desired) should pay it. Indirect

taxes are those which are demanded from one person in the

expectation and intention that he shall indemnify himself at the

expense of another."

Bastable defined direct taxes as those "which are levied on

permanent and recurring occasions" and indirect taxes as

“charges on occasional and particular events.”

Prof. Shirras distinguished the direct and indirect taxes as

"Those taxes levied immediately on property and income of

Persons are called direct taxes, whereas those that are paid by

the consumers to the State indirectly are called indirect taxes."

‘hus, income tax, wealth tax, and corporate taxes which are

directly paid to the State may be called direct taxes, and customs

and excise duties and sales tax may be called indirect taxes.

The direct taxes involve a direct money burden and in the

‘ase of indirect taxes, the man who Pays the tax to the

8overnment is different from the person who bears it ultimately.

Direct v, Indirect taxes :

(1) Reverting to the contrast between direct and indirect

taxes, it will be appreciated that it is not possible to

introduce the principle of Progressive tax incidence in

indirect taxes, whereas the Progressive tax incidence ig

(2) Apart

(3)

PRINCIPLES OF ECONOMICS FOR LAW STUDENTs

: aa ah taxes. It would be impracticable fo

possible ae ‘0 enforce a system of central eecige

fa guvel trol whereby & higher rate be charged if it ig

on pet by av! i and lower rates from a

Ie 7 a the poor. Hence, indirect taxes are

sarily pro] ional. :

neces: from peers there is another one, namely,

ion of tax. There is possibility for evasion of income

eroranarens it is not possible to evade the excise duties

i customs duties. :

aan oa ‘equity’ is the very life of direct taxes. The

rinei le of equity is not observable in case of indirect

Pires. Let us compare the merits and demerits of both

direct and indirect taxes.

of Direct Taxes :—

ee inistrative cost of collecting these

qa) Economy.—The admi

(2)

(3)

(4)

(5)

©)

taxes is low because the same officers who assess small

income or properties can assess larger incomes ‘and

properties. Moreover, the tax payers make the payment

to the State and therefore, every

of these taxes direct

ise that is taken out of the pockets of the tax payer

paise :

is deposited in the State treasury.

Certainty.—These taxes also satisfy the canon of

certainty. The tax payer is certain as to how much he

is expected to pay, and similarly, the State is certain

as to how it has to receive income from direct taxes.

Equity.—Direct taxes are considered to be just and

equitable because they are generally based on the

principle of progression. Therefore, they fall more

heavily on the rich than on the poor.

Reduction in inequalities.—As the direct taxes are

Progressive, rich people are subjected to higher rates of

taxation. These taxes help to reduce inequalities in

incomes.

Elasticity—The taxes also satisfy f

ee atisfy the canon 0!

Sean as the government revenue may be increas

in ply e raising the rate of taxation. Moreover, the

income from direct taxes will also increase with the

couse in income of the people.

consciousness.—It is said that direct taxes

create civil consciousness among the tax-payers. The

oft BANKING AND FISCAL Poxigy

tax-payer May take j, “

: +, intelligent interest i

oaibed ia soenditure and observe whether ie arenes

| country, this Ci coed sae ny ®, democratic

the public expenditure, "e8® checks the wastage in

erits of Direct Taxes ;

(1) Unpopular.—The direct

A taxes

shifted, and thereft _ are generally not

Hence, such taxes re) they are painful to the tax payer.

are unpopular j

generally opposed by the faa cave in nature and are

; ers.

(2) Inconvenience.—These taxes

which | it. is derived, which is generally subject to

complications. Moreover, the payment of these taxes in

lump sum is not as convenient to the tax payer as the

frequent payment of small amounts of indirect taxes.

Possibility of injustice.—In practice it is difficult to

assess the income of all cases accurately. Hence, the

direct taxes may not fall with equal weight on all

classes. Moreover, the rates of direct taxes are

arbitrarily fixed by the government and they may not

be on the basis of ability to pay. .

Possibility of evasion.—A direct tax is said to be a

tax on honesty, it is not evaded only when the tax payer

is honest, otherwise it can be evaded through

fraudulent practices. The progressiveness of direct taxes

induces the tax payer to evade the payment of taxes.

(5) Exemption of low income group.—If only direct

taxation is resorted, the low income group people

cannot be approached by direct taxes, as they are

normally exempted from such taxes on the basis of

ability or equality.

Merits of Indirect Taxes :—

(1) Convenient.—They are imposed at the time of

purchase of a commodity or the enjoyment of a service

so that the tax-payer does not feel the burden of the

tax as it is hidden in the price of the commodity

bought. They are also convenient because they are paid

in small amounts and in intervals and not in one lump

sum.

(3)

4

» (2)

(3)

(4)

(6)

)

@

(8)

PRINCIPLES OF BUNS FOR LAW

STUbeis

Difficult to evade—Indirect taxes are genera

included in the price of commodities purchased. Eva,’

of an indirect tax will mean giving up the satisfac”

of a given want. ..

Elastic.—Taxes imposed on commodities with ing]

demand are elastic. A

le.—Indirect taxes enable everyone, even

ae, vations to contribute something towards -

expenses of the State. Since direct taxes leave lower

income groups from their scope, indirect taxes Take

them share in the financial burden of the State,

Can be progressive.—Indirect taxes can be Made

progressive by imposing heavy taxes on luxuries ang

exempting articles of common consumption.

Productive.—The income from indirect taxes can be

made highly productive by imposing few taxes each

yielding a substantial amount of revenue. .

Wide coverage.—Through indirect taxes every

member of the community can be taxed, so that

everyone may provide something to the government to

finance the services of public utilities.

Social welfare.—Heavy taxation on articles which are

lastic

* injurious to the health and efficiency of the people may

restrict their consumption.

Demerits of Indirect Taxes :—

qd)

(2)

(8)

(4)

(5)

Regressive.—The indirect taxes are generally

regressive in nature as they fall more heavily upon the

Poor than upon the rich.

Administrative cost——The administrative cost of

collecting such taxes is generally heavy because they

have to be collected from millions of individuals in

small amounts. Hence, they are uneconomical.

Reduction in savings.—Indirect taxes discourage

haves oar they are included in price and people

mor i iti are

ise Vesat nes © on essential commodities and

pncertainty.—The income from indirect taxes is said

aecesatencertain, because the taxing authority cannot

= y-estimate the total revenue from. indirect

No civil consciousness.— Indirect taxes are collected

je RING AND FISCAL PoUcy

451

acted wemen like traders and hence they have

Generally speaking, the burden of indirect taxes tends to

pal more foe on the Poorer sections of the community and

pat of direct taxes mainly on the richer sections of the

unity. They both are not competitive but are complementary.

at is why Gladstone, the great Victorian statesman, remarked

the direct and indirect taxes should be viewed as equally

attractive sisters, neither of whom. should be pursued too ardently.

PROPORTIONAL AND PROGRESSIVE TAXATION

Taxes may be divided into

Proportional and progressive,

| pased on the burden of taxation.

Proportional taxation :—

PE. Taylor says, "A schedule of Proportional tax rates is one

in which the rates of taxation remains constant as the tax base

changes." The amount of tax payable is calculated by multiplying

the tax base with the fixed rate. Thus, in proportional tax system

the multiplier, i.e., the rate remains constant with the change in

multiplicant (income).

Case for or Merits of the proportional taxation :—

(1) Proportional tax does not affect the relative position of

the tax payer.

(2) Proportional tax is simple to estimate and calculate and

the imposition is uniform.

The willingness to work more and save more of the tax

Payer is not adversely affected by the proportional

taxation.

(4) The principle of equality of justice is being followed in

Proportional taxation.

(5) Equality of sacrifice’ as between the rich and the poor

can be achieved by it.

Mc Culloch, a well-known supporter of proportional taxes

‘ys, "When you abandon the plain principle (of proportion) you

are at sea without rudder and compass and there is no amount

injustice you may not commit.”

against proportional taxation :

(1) A system of proportional taxation would not lead to