Professional Documents

Culture Documents

Exercice - Saturne Solution Corrected

Uploaded by

Sabrina LaganàOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercice - Saturne Solution Corrected

Uploaded by

Sabrina LaganàCopyright:

Available Formats

SATURNE: A MANUFACTURER OF KITCHEN EQUIPMENT

Purchases and Sales

Purchase of cast iron 12000 kg at € 24 / kg

Direct labour : melting working 0,5 hour per saucepan and 1 hours per frying pan

Direct labour is paid : € 20 / hours

Direct labour : finishing 1 hour per saucepan and 1,5 hours per frying pan.

Direct labour is paid : € 22,40 per hour

Consumption of cast iron 1 kg per saucepan and 2,2 kg per frying pan.

Sales rep. commission € 1,5 per article sold.

Production and Sales in May 2014

Sauce Pans Frying Pans

Production in May 4 000 3 000

Sales in May 3 850 3 000

Unit sales price € 80 € 100

Allocation Table for Overhead in May 2014

Operating Centres

Purchasing Melting Finishing Distribution

Total Secondary

3 000 20 000 10 000 15 000

Allocation (€)

Allocation (or Kg of cast iron N° of units

Direct labour hours € of sales

expenses) base purchase produced

QUESTIONS

i) Complete the allocation table above

ii) Calculate the fully allocated cost of raw materials purchased and comment

iii) Calculate the cost of production of finished goods and comment on the stock

iv) Calculate the fully allocated cost of goods manufactured

v) Calculate the fully allocated cost of goods sold

vi) Prepare the income statement for the month and give a conclusion. Don’t forget to

include the distribution allocation in your final income statement. Calculate the sales

price per unit, the full cost per unit (‘cout de revient’) and the profit per unit.

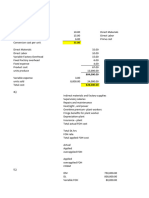

ALLOCATION TABLE

Operating Centres

Purchasing Melting Finishing Distribution

Total Secondary

3 000 20 000 10 000 15 000

Allocation (€)

Allocation (or Kg of cast iron N° of units

Direct labour hours € of sales

expenses) base purchase produced

Allocation base

units 12 000 kgs 5 000 hrs 7 000 units 608 000 €

€ 0,25 per Kg cast € 4 per hour of € 1,428 per unit € 0,02467 per € of

Allocation

iron purchased direct labour produced sales

melting

Did you see how I calculated : I used the allocation (or expense) base as the rule, looked back to

the data to find the underlying figure and then made the allocation calculation by a simple division

eg. € 3000 of overhead in purchasing, rule to share it out is according to how many kgs of cast

iron are bought : total purchase of cast iron is 12 000 – so 3000 / 12000 = € 0,25. This means, of

course, that I will include an extra € 0,25 per kg as a cost of raw materials in the next step !.

Notice also that the rule for melting shop overhead was ‘split according to the hours of direct

labour’. I did this – but I only looked at direct labour hours in the melting shop itself ! There was,

of course, some direct labour in finishing – but I am using a different allocation rule there.

STEP 2 : FULLY ALLOCATED COST OF RAW MATERIALS PURCHASED.

Only thing to remember here is to include the allocation from the table above !.

- full cost of purchase of raw materials : cast iron 12 000 x (24 + 0,25) = € 291 000

Notice that the allocation is just included as another layer of cost.

STEP 3 : STOCK TABLE : RAW MATERIALS AVCO METHOD

We know how much raw materials we purchased in May. We can work out how much is cast iron

is consumed from the production data above

4000 saucepans produced x 1 kg per saucepan = 4 000

3000 frying pans produced x 2,2 kg per frying pan = 6 600

TOTAL CAST IRON CONSUMED 10 600

CAST IRON Units Unit price Total

Beginning Stock 0 0 0

Purchased 12 000 24,25 291 000

TOTAL AVAILABLE 12 000 24,25 291 000

Consumed 10 600 24,25 257 050

End Stock 1 400 24,25 33 950

Conclusion from this table :

Cost of raw materials consumed : cast iron : € 257 050

Stock on balance sheet : cast iron : € 33 950

Of course, we can split this per product as follows :

Saucepans : 4 000 kg consumed at € 24,25/ kg € 97 000

Frying pans : 6 600 kg consumed at € 24,25/ kg € 160 050

Concerning the stocks on the balance sheet, they have increased to 1 400 tonnes.

STEP 3 ; Fully Allocated Cost of Goods Manufactured

I decided to calculate the cost of goods manufactured product by product – so I’m going to split

between saucepans and frying pans. This is not strictly necessary – but it’s a good exercice.

SAUCEPANS

Cost of raw materials consumed € 97 000

Direct labour melting 2 000 hours x (€ 20) € 40 000

Allocation overhead labour 2 000 hours x (€ 4) € 8 000

Direct labour Finishing 4 000 x € 22,40 € 89 600

Overhead allocation Finishing 4 000 units produced x 1,43 € 5 714

TOTAL € 240 314

FRYING PANS

Cost of raw materials consumed : € 160 050

Direct labour melting 3 000 hours x (€ 20) € 60 000

Allocation overhead melting 3 000 hours x € 4 € 12 000

Direct labour finishing 4 500 hours x € 22,40 € 100 800

Overhead allocation Finishing 3 000 units produced x 1,43 € 4 286

TOTAL € 337 136

Total cost of goods manufactured is € 577 450 representing a unit cost of goods manufactured of :

For saucepans : € 240 314 / 4000 = € 60,08 per unit for saucepans

For frying pans : € 337 136 / 3000 = € 112,38 per unit for frying pans.

I think they already have a problem : cost of good manufactured for frying pans is higher than

their sales price ! This company must be making losses. This cost of goods manufactured is the

figure used for the final allocation in the allocation table.

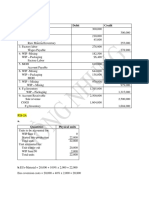

STEP 4 : Fully allocated cost of goods sold.

STOCK TABLE : FINISHED GOODS (AVCO METHOD)

SAUCE PANS Units Unit price Total

Beginning Stock 0 0 0

Purchased 4 000 60,08 240 314

TOTAL AVAILABLE 4 000 60,08 240 314

Consumed 3 850 60,08 231 303

End Stock 150 60,08 9 012

FRYING PANS Units Unit price Total

Beginning Stock 0 0 0

Purchased 3 000 112,38 337 136

TOTAL AVAILABLE 3 000 112,38 337 136

Consumed 3 000 112,38 337 136

End Stock 0 0 0

Note that for frying pans : since there is no variation of stock (stock at 0 at the beginning and at

the end) the cost of goods manufactured and the cost of goods sold must be the same/

Fully allocated cost of goods sold : Saucepans : € 231 303

Frying pans : € 337 136

TOTAL COST OF GOODS SOLD € 568 438

This cost of goods sold includes all of the allocation that correspond to manufacturing overhead.

Note, however, that we have not yet included the allocation for distribution – nor the sales rep.

commission. These will be included in the final income statement.

STEP 5 : Draw up an income statement for the month.

All we need to do now is calculate a sales figure, include our cost of goods sold and, of course, not

forget the last allocation expense : the admin expense added calculated on the allocation base of

the cost of goods manufactured and the sales rep commission.

So our income statement is as follows :

Saucepans :

Sales 3 850 units x € 80 € 308 000

Fully Allocated COGS (from the stock table) (€ 231 302)

Allocation admin 308 000 x 0,02467 (€ 7 599)

Sales commission 3 850 x 1,5 (€ 5 775)

Profit € 63 323

Profit margin (in % of sales) 20,56%

Frying Pan

Sales 3 000 units x € 100 € 300 000

Fully Allocated COGS (from the stock table) (€ 337 136)

Allocation admin 300 000 x 0,002467 (€ 7 401)

Sales commission 3 000 x 1,5 (€ 4 500)

Profit / (loss) (€ 49 037)

Profit margin (in % of sales) - 16,3%

In conclusion, as we noted before, this company has a real problem with the frying pan product

which is generating a loss on a fully allocated basis. I think they need to do some serious work

looking at the sales price and the cost structure of the frying pan line – and perhaps even start to

think about abandoning frying pan production.

You might also like

- Neptune Solution CorrectedDocument6 pagesNeptune Solution CorrectedSabrina LaganàNo ratings yet

- Venus - Solution FULL-CORRECTEDDocument7 pagesVenus - Solution FULL-CORRECTEDSabrina LaganàNo ratings yet

- Case 10 CLAUS StatementDocument6 pagesCase 10 CLAUS StatementClaudia AgüeraNo ratings yet

- FManAcc Teaching Week 11 Seminar Answers Part 2 2023 - 2024 - TaggedDocument2 pagesFManAcc Teaching Week 11 Seminar Answers Part 2 2023 - 2024 - Taggedredwaanmo19No ratings yet

- Kelompok 3 - Tugas 3 - Bab 'Persediaan'Document3 pagesKelompok 3 - Tugas 3 - Bab 'Persediaan'Elsi NonnyNo ratings yet

- BUS239 2018 Main Marking SchemeDocument13 pagesBUS239 2018 Main Marking SchemerahimNo ratings yet

- CH 6 - HomeworkDocument6 pagesCH 6 - HomeworkAxel OngNo ratings yet

- TOPIC Practice Questions: Question: MayDocument13 pagesTOPIC Practice Questions: Question: MayPines MacapagalNo ratings yet

- Exercise 1 and 2Document7 pagesExercise 1 and 2Nigussie BerhanuNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Muhammad Nabil Faid - Kelompok 1 - Latihan Soal AKMENDocument11 pagesMuhammad Nabil Faid - Kelompok 1 - Latihan Soal AKMENdcwd9yryjhNo ratings yet

- Hardhat LTD Projected Income Statement 2000/2001Document12 pagesHardhat LTD Projected Income Statement 2000/2001Rajeshkumar NayakNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- Illustration Ex. 1Document7 pagesIllustration Ex. 1Nigussie BerhanuNo ratings yet

- 2managerial Accounting & Control: 5 Registration Number: 2058131Document3 pages2managerial Accounting & Control: 5 Registration Number: 2058131Muhammad Ali KhanNo ratings yet

- PK VCDocument16 pagesPK VClidiawuNo ratings yet

- P 41085Document16 pagesP 41085Sandeep PeddadaNo ratings yet

- Case 9 BEMICE StatementDocument7 pagesCase 9 BEMICE StatementClaudia AgüeraNo ratings yet

- DocxDocument5 pagesDocxainun nisaNo ratings yet

- GADGET CoDocument5 pagesGADGET CoSabrina LaganàNo ratings yet

- PK Shirts Case Study - DataDocument9 pagesPK Shirts Case Study - Datamaria.aninoNo ratings yet

- Absorption Variable Costing Examples - XLSBDocument6 pagesAbsorption Variable Costing Examples - XLSBPaola OrpellaNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- Step 3: Calculate The VarianceDocument4 pagesStep 3: Calculate The VarianceteddyNo ratings yet

- Supply Chain 7, 8, 9Document10 pagesSupply Chain 7, 8, 9Mei XinNo ratings yet

- Assignment 4 - Variances - 50140Document9 pagesAssignment 4 - Variances - 50140Hafsa HayatNo ratings yet

- Hardhat Case - Rajesh Kumar NayakDocument12 pagesHardhat Case - Rajesh Kumar NayakSandeep RawatNo ratings yet

- Chapter 1-3Document21 pagesChapter 1-3Alexsandra GarciaNo ratings yet

- Calculation of The Main Cost VariancesDocument5 pagesCalculation of The Main Cost Variancesphuc waytoodankNo ratings yet

- Jawaban Soal ExerciseDocument13 pagesJawaban Soal Exerciseqinthara alfarisiNo ratings yet

- Answer c21Document8 pagesAnswer c21Võ Huỳnh BăngNo ratings yet

- 2403-0609-3932 - Client BOQ - Refurbishment ProjectDocument4 pages2403-0609-3932 - Client BOQ - Refurbishment Projectdarrenbeard1989No ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Latihan AKM 1 TM 4Document5 pagesLatihan AKM 1 TM 4chyntia susantoNo ratings yet

- Latihan AKM 1 CH 08Document5 pagesLatihan AKM 1 CH 08chyntia susantoNo ratings yet

- LAL03 TaskDocument3 pagesLAL03 TaskScribdTranslationsNo ratings yet

- PoN Servcie Container - WARTSILADocument5 pagesPoN Servcie Container - WARTSILAIgnacio BartchNo ratings yet

- Drury ADocument77 pagesDrury ATauraab50% (2)

- 2.1. For Process A What Is The Scrap Value of The Normal Loss?Document19 pages2.1. For Process A What Is The Scrap Value of The Normal Loss?Yến Nguyễn100% (1)

- Total Investment For The ProjectDocument2 pagesTotal Investment For The ProjectPham Van Phung - K15 FUG CTNo ratings yet

- Questions Fifo AverageDocument4 pagesQuestions Fifo AverageClaire BarbaNo ratings yet

- Activity - Based - Costing Case SolutionDocument5 pagesActivity - Based - Costing Case SolutionRienk HeegsmaNo ratings yet

- PIS - Coco Charcoal Briquette - 1 Page PresentationDocument1 pagePIS - Coco Charcoal Briquette - 1 Page PresentationNiemar AbaloNo ratings yet

- Steel Structure PricingDocument1 pageSteel Structure PricingberktorNo ratings yet

- FManAcc Teaching Week 11 Seminar Answers Part 1 2023 - 2024 - TaggedDocument5 pagesFManAcc Teaching Week 11 Seminar Answers Part 1 2023 - 2024 - Taggedredwaanmo19No ratings yet

- SINGH007 Ans Homework Lec 14 To 21Document47 pagesSINGH007 Ans Homework Lec 14 To 21Lau Chun GuiNo ratings yet

- Cost Accounting Quiz 3Document4 pagesCost Accounting Quiz 3Tayyaba KhalidNo ratings yet

- Quiz Learning Task Group Work PDFDocument5 pagesQuiz Learning Task Group Work PDFEric Kevin LecarosNo ratings yet

- 704966Document6 pages704966Alison JcNo ratings yet

- Ch2 - Cost Accounting - Horngren'sDocument16 pagesCh2 - Cost Accounting - Horngren'svipinkala1No ratings yet

- RCA Solutions Mod3 PDFDocument13 pagesRCA Solutions Mod3 PDFdiane camansagNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- 2 Standard Costing Case StudyDocument4 pages2 Standard Costing Case StudyLolAnonNo ratings yet

- Formative Assessment On Relative CostDocument8 pagesFormative Assessment On Relative CostChai MarapaoNo ratings yet

- Module Title: Accounting Information For Business Module Number: Umad5H-15-2Document13 pagesModule Title: Accounting Information For Business Module Number: Umad5H-15-2Shubham AggarwalNo ratings yet

- AccountingDocument16 pagesAccountingKieu Anh NguyenNo ratings yet

- UntitledDocument14 pagesUntitledJomar PenaNo ratings yet

- Accounting Assignment Unit 2Document4 pagesAccounting Assignment Unit 2Mike Kaboyo AbookieNo ratings yet

- Amazon Marketing MixDocument5 pagesAmazon Marketing MixKaran Sachdev100% (1)

- Jawaban Soal InventoryDocument4 pagesJawaban Soal InventorywlseptiaraNo ratings yet

- Comprehesive Exam - ID 19222167Document24 pagesComprehesive Exam - ID 19222167abdelrahman.hashem.20No ratings yet

- The Seven Centers of Management Attention HTTH e Hese en ...Document3 pagesThe Seven Centers of Management Attention HTTH e Hese en ...Marquise GinesNo ratings yet

- Kunci JWB Soal B 2015 PDFDocument29 pagesKunci JWB Soal B 2015 PDFAnisaa Okta100% (5)

- Advertising EffectivenessDocument9 pagesAdvertising EffectivenessUmer KhanNo ratings yet

- Ultimate Binary Options e BookDocument45 pagesUltimate Binary Options e BookJayNo ratings yet

- Environmental Scanning Part 1Document24 pagesEnvironmental Scanning Part 1Cora GonzalesNo ratings yet

- Name: Vishwas Jadav (0718773) Case Study #2: Homeshare International Qualitative Analysis Subject: IBM 201 005Document1 pageName: Vishwas Jadav (0718773) Case Study #2: Homeshare International Qualitative Analysis Subject: IBM 201 005Vishwas JadavNo ratings yet

- IT & Retail ReplenishmentDocument17 pagesIT & Retail ReplenishmentKristian TarucNo ratings yet

- Britannia S Marketing StrategyDocument39 pagesBritannia S Marketing StrategyPrasadSawant100% (1)

- IFRS Framework-Based Case Study - Barrick Gold Corporation-Goodwill For GoldDocument17 pagesIFRS Framework-Based Case Study - Barrick Gold Corporation-Goodwill For GoldJulio Marcos GansoNo ratings yet

- Forex Bermuda Trading Strategy SystemDocument20 pagesForex Bermuda Trading Strategy SystemMichael Selim75% (8)

- Chap 7 - Media Planning and StrategyDocument26 pagesChap 7 - Media Planning and StrategyAli Bukhari ShahNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- The Time Value MoneyDocument4 pagesThe Time Value Moneycamilafernanda85No ratings yet

- PSP ProjectsDocument474 pagesPSP ProjectsVishal BansalNo ratings yet

- Management Advisory Services QuestionnaireDocument12 pagesManagement Advisory Services QuestionnaireSteven Mark MananguNo ratings yet

- Nomer 8 Ujian MKDocument5 pagesNomer 8 Ujian MKnoortiaNo ratings yet

- WACC Workout FullDocument29 pagesWACC Workout Fulldevilcaeser2010No ratings yet

- Quizlet Econ 303Document29 pagesQuizlet Econ 303Kim TaehyungNo ratings yet

- Report-Picic & NibDocument18 pagesReport-Picic & NibPrincely TravelNo ratings yet

- 11Document6 pages11Jasmeet Kaur100% (3)

- Skans Schools of Accountancy: Cost & Management Accounting - Caf-8Document2 pagesSkans Schools of Accountancy: Cost & Management Accounting - Caf-8maryNo ratings yet

- Sales Variance & Operating StatementDocument12 pagesSales Variance & Operating StatementEjaz AhmadNo ratings yet

- MRS Abel Project LatestDocument71 pagesMRS Abel Project LatestKoledafe YusufNo ratings yet

- TutorialDocument3 pagesTutorialEliciaNo ratings yet

- Purchase Order Freight Terms: Revision # Date: Buyer: Ship ToDocument2 pagesPurchase Order Freight Terms: Revision # Date: Buyer: Ship ToMohammed Abdul FaheemNo ratings yet

- Operating CostingDocument39 pagesOperating CostingMishkaCDedhia100% (1)