Professional Documents

Culture Documents

Chapter 1. Feasibility Study

Chapter 1. Feasibility Study

Uploaded by

Đăng Dương0 ratings0% found this document useful (0 votes)

0 views34 pagesasm 1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentasm 1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views34 pagesChapter 1. Feasibility Study

Chapter 1. Feasibility Study

Uploaded by

Đăng Dươngasm 1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 34

Feasibility Study

The Feasibility Study

▪ What is a feasibility study?

▪ What to study and conclude?

▪ Types of feasibility

▪ Technical

▪ Economic

▪ Schedule

▪ Operational

▪ Quantifying benefits and costs

▪ Payback analysis

▪ Net Present Value Analysis

▪ Return on Investment Analysis

▪ Comparing alternatives

Why a feasibility study?

▪ Objectives:

▪ To find out if an system development project can be done:

▪ ...is it possible?

▪ ...is it justified?

▪ To suggest possible alternative solutions.

▪ To provide management with enough information to know:

▪ Whether the project can be done

▪ Whether the final product will benefit its intended users

▪ What the alternatives are (so that a selection can be made in subsequent phases)

▪ Whether there is a preferred alternative

▪ A management-oriented activity:

▪ After a feasibility study, management makes a “go/no-go” decision.

▪ Need to examine the problem in the context of broader business strategy

Content of a feasibility study

▪ The present organizational system ▪ Possible alternatives

▪ Stakeholders, users, policies, functions, ▪ “Sticking with the current system” is always

objectives,... an alternative

▪ Problems with the present system ▪ Different business processes for solving the

problems

▪ inconsistencies, inadequacies in functionality,

performance,… ▪ Different levels/types of computerization for

the solutions

▪ Goals and other requirements for the new

system ▪ Advantages and disadvantages of the

alternatives

▪ Which problem(s) need to be solved?

▪ Things to conclude:

▪ What would the stakeholders like to achieve?

▪ Feasibility of the project

▪ Constraints

▪ The preferred alternative.

▪ including nonfunctional requirements on the

system (preliminary pass)

The “PIECES” framework

▪ Useful for identifying operational problems to be solved, and their

urgency

▪ Performance

▪ Is current throughput and response time adequate?

▪ Information

▪ Do end users and managers get timely, pertinent, accurate and usefully

formatted information?

▪ Economy

▪ Are services provided by the current system cost-effective?

▪ Could there be a reduction in costs and/or an increase in benefits?

The “PIECES” framework

▪ Control

▪ Are there effective controls to protect against fraud and to

guarantee information accuracy and security?

▪ Efficiency

▪ Does current system make good use of resources: people, time,

flow of forms,…?

▪ Services

▪ Are current services reliable? Are they flexible and expandable?

Four Types of feasibility

Technical feasibility Economic feasibility

▪ Is the project possible with ▪ Is the project possible, given

current technology? resource constraints?

▪ What technical risk is there? ▪ What are the benefits?

▪ Availability of the technology: ▪ Both tangible and intangible

▪ Is it available locally? ▪ Quantify them!

▪ Can it be obtained? ▪ What are the development

▪ Will it be compatible with and operational costs?

other systems?

Four Types of feasibility

Schedule feasibility Operational feasibility

▪ Is it possible to build a solution ▪ If the system is developed, will it

in time to be useful? be used?

▪ What are the consequences of ▪ Human and social issues…

delay?

▪ Potential labour objections?

▪ Any constraints on the schedule?

▪ Manager resistance?

▪ Can these constraints be met?

▪ Organizational conflicts and

policies?

▪ Social acceptability?

▪ legal aspects and government

regulations?

Technical Feasibility

▪ Is the proposed technology or solution practical?

▪ Do we currently possess the necessary technology?

▪ Do we possess the necessary technical expertise

▪ …and is the schedule reasonable for this team?

▪ Is relevant technology mature enough to be easily applied to our

problem?

▪ What kinds of technology will we need?

▪ Some organizations like to use state-of-the-art technology

▪ …but most prefer to use mature and proven technology.

▪ A mature technology has a larger customer base for obtaining advice

concerning problems and improvements.

Technical Feasibility

▪ Is the required technology available “in house”?

▪ If the technology is available:

▪ …does it have the capacity to handle the solution?

▪ If the technology is not available:

▪ …can it be acquired?

Economic Feasibility

▪ Can the bottom line be quantified yet?

▪ Very early in the project…

▪ a judgement of whether solving the problem is worthwhile.

▪ Once specific requirements and solutions have been identified…

▪ …the costs and benefits of each alternative can be calculated

Economic Feasibility

▪ Cost-benefit analysis

▪ Purpose - answer questions such as:

▪ Is the project justified (I.e. will benefits outweigh costs)?

▪ What is the minimal cost to attain a certain system?

▪ How soon will the benefits accrue?

▪ Which alternative offers the best return on investment?

▪ Examples of things to consider:

▪ Hardware/software selection

▪ Selection among alternative financing arrangements (rent/lease/purchase)

▪ Difficulties

▪ benefits and costs can both be intangible, hidden and/or hard to estimate

▪ ranking multi-criteria alternatives

Benefits

▪Tangible Benefits ▪Intangible benefits

▪ Readily quantified as $ values ▪ Difficult to quantify

▪ Examples: ▪ But maybe more important!

▪ increased sales ▪ business analysts help estimate $ values

▪ cost/error reductions ▪ Examples:

▪ increased throughput/efficiency ▪ increased flexibility of operation

▪ increased margin on sales ▪ higher quality products/services

▪ more effective use of staff time ▪ better customer relations

▪ improved staff morale

▪How will the benefits accrue?

▪ When - over what timescale?

▪ Where in the organization?

Costs

▪Development costs (OTO) ▪Operational costs (on-

▪ Development and purchasing costs: going)

▪ Cost of development team ▪ System Maintenance:

▪ Consultant fees ▪ hardware (repairs, lease, supplies,...),

▪ software used (buy or build)? ▪ software (licenses and contracts),

▪ hardware (what to buy, buy/lease)? ▪ facilities

▪ facilities (site, communications,

power,...) ▪ Personnel:

▪ For operation (data entry, backups,…)

▪ Installation and conversion costs:

▪ For support (user support, hardware

▪ installing the system, and software maintenance, supplies,…)

▪ training personnel, ▪ On-going training costs

▪ file conversion,....

Analyzing Costs vs. Benefits

▪ Identify costs and benefits

▪ Tangible and intangible, one-time and recurring

▪ Assign values to costs and benefits

▪ Determine Cash Flow

▪ Project the costs and benefits over time, e.g. 3-5 years

▪ Calculate Net Present Value for all future costs/benefits

▪ determines future costs/benefits of the project in terms of today's dollar

values

▪ A dollar earned today is worth more than a potential dollar earned next

year

Analyzing Costs vs. Benefits

▪ Do cost/benefit analysis

▪ Calculate Return on Investment:

▪ Allows comparison of lifetime profitability of alternative solutions.

▪ Calculate Break-Even point:

▪ how long will it take (in years) to pay back the accrued costs:

Calculating Present Value

▪ A dollar today is worth more than a dollar tomorrow…

▪ Your analysis should be normalized to “current year” dollar values.

▪ The discount rate

▪ measures opportunity cost:

▪ Money invested in this project means money not available for other

things

▪ Benefits expected in future years are more prone to risk

▪ This number is company- and industry-specific.

▪ “what is the average annual return for investments in this industry?”

Calculating Present Value

▪ Present Value:

▪ The “current year” dollar value for costs/benefits n years into the

future

▪ … for a given discount rate i

▪ E.g. if the discount rate is 12%, then

▪ Present_Value(1) = 1/(1 + 0.12) = 0.893

1

▪ Present_Value(2) = 1/(1 + 0.12) = 0.797

2

Net Present Value

▪ Measures the total value of the investment

▪ …with all figures adjusted to present dollar values

▪ NPV = Cumulative PV of all benefits - Cumulative PV of all costs

▪ Assuming subsequent years are like year 4…

▪ the net present value of this investment in the project will be:

▪ after 5 years, $13,652

▪ after 6 years, $36,168

Computing the payback period

▪ Can compute the break-even point:

▪ when does lifetime benefits overtake lifetime costs?

▪ Determine the fraction of a year when payback actually occurs:

▪ For our last example, 51,611 / (70,501 + 51,611) = 0.42

▪ Therefore, the payback period is approx 3.4 years

Return on Investment (ROI) analysis

▪ For comparing overall profitability

▪ Which alternative is the best investment?

▪ ROI measures the ratio of the value of an investment to its cost.

▪ ROI is calculated as follows:

For our example

▪ ROI = (795,440 - 488,692) / 488,692 63%,

▪ or ROI = 306,748 / 488,692 63%

▪ Solution with the highest ROI is the best alternative

▪ But need to know payback period too to get the full picture

▪ E.g. A lower ROI with earlier payback may be preferable in some circumstances

Schedule Feasibility

▪ How long will it take to get the technical expertise?

▪ We may have the technology, but that doesn't mean we have the skills

required to properly apply that technology.

▪ May need to hire new people

▪ Or re-train existing systems staff

▪ Whether hiring or training, it will impact the schedule.

▪ Assess the schedule risk:

▪ Given our technical expertise, are the project deadlines reasonable?

▪ If there are specific deadlines, are they mandatory or desirable?

▪ If the deadlines are not mandatory, the analyst can propose several alternative

schedules.

Schedule Feasibility

▪ What are the real constraints on project deadlines?

▪ If the project overruns, what are the consequences?

▪ Deliver a properly functioning information system two months late…

▪ …or deliver an error-prone, useless information system on time?

▪ Missed schedules are bad, but inadequate systems are worse!

Operational Feasibility

▪ How do end-users and managers feel about…

▪ …the problem you identified?

▪ …the alternative solutions you are exploring?

▪ You must evaluate:

▪ Not just whether a system can work…

▪ … but also whether a system will work.

Operational Feasibility

▪ Any solution might meet with resistance:

▪ Does management support the project?

▪ How do the end users feel about their role in the new system?

▪ Which users or managers may resist (or not use) the system?

▪ People tend to resist change.

▪ Can this problem be overcome? If so, how?

▪ How will the working environment of the end users change?

▪ Can or will end users and management adapt to the change?

Feasibility Study Contents

1. Purpose & scope of the study

5. Possible alternatives

▪ Objectives (of the study)

▪ …including ‘do nothing’.

▪ who commissioned it & who did it,

6. Criteria for comparison

▪ sources of information,

▪ definition of the criteria

▪ process used for the study,

7. Analysis of alternatives

▪ how long did it take,…

▪ description of each alternative

2. Description of present situation ▪ evaluation with respect to criteria

▪ organizational setting, current system(s). ▪ cost/benefit analysis and special implications.

▪ Related factors and constraints. 8. Recommendations

3. Problems and requirements ▪ what is recommended and implications

▪ What’s wrong with the present situation? ▪ what to do next;

▪ E.g. may recommend an interim solution and a permanent solution

▪ What changes are needed?

9. Appendices

4. Objectives of the new system.

▪ to include any supporting material.

▪ Goals and relationships between them

Comparing Alternatives

▪ How do we compare alternatives? ▪ Other evaluation criteria to include in the matrix

▪ When there are multiple selection criteria? ▪ quality of output

▪ ease of use

▪ When none of the alternatives is superior across the

▪ vendor support

board?

▪ cost of maintenance

▪ Use a Feasibility Analysis Matrix! ▪ load on system

▪ The columns correspond to the candidate solutions;

▪ The rows correspond to the feasibility criteria;

▪ The cells contain the feasibility assessment notes for

each candidate;

▪ Each row can be assigned a rank or score for each

criterion

▪ e.g., for operational feasibility, candidates can be ranked

1, 2, 3, etc.

▪ A final ranking or score is recorded in the last row.

Example matrix

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Unit 2 - Assignment BDTDocument83 pagesUnit 2 - Assignment BDTCục MuốiNo ratings yet

- Vedix-Prakriti Type Vata-PittaDocument20 pagesVedix-Prakriti Type Vata-PittaMunazir Hasan100% (3)

- 08 Topnotch Surgery SuperExam - NOHIGHLIGHTSDocument94 pages08 Topnotch Surgery SuperExam - NOHIGHLIGHTSFrancine LucasNo ratings yet

- Unit 5 - Assignment 2 BriefDocument3 pagesUnit 5 - Assignment 2 BriefCục MuốiNo ratings yet

- A Muslim - Hindu Dialogue, How To Defeat The MuslimsDocument2 pagesA Muslim - Hindu Dialogue, How To Defeat The MuslimsCA Vaibhav Maheshwari100% (1)

- Astm A860 A860m-18Document5 pagesAstm A860 A860m-18Zaida Isadora Torres Vera100% (2)

- Assignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DateDocument29 pagesAssignment 2 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DateCục MuốiNo ratings yet

- 1 - Unit 2 - Assignment Brief 1Document3 pages1 - Unit 2 - Assignment Brief 1Cục MuốiNo ratings yet

- 1 - Unit 2 - Assignment Brief 2Document3 pages1 - Unit 2 - Assignment Brief 2Cục MuốiNo ratings yet

- Unit 5 - Assignment 1 BriefDocument3 pagesUnit 5 - Assignment 1 BriefCục MuốiNo ratings yet

- Unit-9-Assignment 1 - BriefDocument5 pagesUnit-9-Assignment 1 - BriefCục MuốiNo ratings yet

- Unit 5 - Assignment 1 BriefDocument3 pagesUnit 5 - Assignment 1 BriefCục MuốiNo ratings yet

- HRM - EssayDocument17 pagesHRM - EssayvsnaveenkNo ratings yet

- The Knights Tale by Geoffrey ChaucerDocument2 pagesThe Knights Tale by Geoffrey Chaucerapi-222876920No ratings yet

- Good Food Org GuideDocument76 pagesGood Food Org GuideFood Tank100% (4)

- Llanbadarn Show 2018 ScheduleDocument40 pagesLlanbadarn Show 2018 ScheduleEmma HowellsNo ratings yet

- ETL Testing Interview Questions and AnswersDocument9 pagesETL Testing Interview Questions and AnswersKancharlaNo ratings yet

- Lesson Plan XiiDocument5 pagesLesson Plan XiiIon PopescuNo ratings yet

- GSM Mobile Based Speed Control of DC MotorDocument9 pagesGSM Mobile Based Speed Control of DC MotorRoshan Singh100% (1)

- Winn - The Quest For Spiritual OrgasmDocument22 pagesWinn - The Quest For Spiritual Orgasmawreeve100% (1)

- Eh TW5825Document2 pagesEh TW5825Lim Hendra Kurniawan Halim (Hendra)No ratings yet

- Cities - Re Imagining The Urban ReviewDocument2 pagesCities - Re Imagining The Urban ReviewlightwriterNo ratings yet

- PDFDocument595 pagesPDFKharisma PratamaNo ratings yet

- Some Medicinal Plants of JharkhandDocument2 pagesSome Medicinal Plants of Jharkhandniharikas1987No ratings yet

- Folowing Scheduletor The Rnaing O: Eeders Hail Be Ddopted For 10.7.218 11.7.21 OnlyDocument5 pagesFolowing Scheduletor The Rnaing O: Eeders Hail Be Ddopted For 10.7.218 11.7.21 OnlyPiyush ChughNo ratings yet

- 21st Century Skills - Rethinking How Students Learn (PDFDrive)Document102 pages21st Century Skills - Rethinking How Students Learn (PDFDrive)Claudia PulidoNo ratings yet

- Ecological InventoryDocument3 pagesEcological InventoryStephanie Hanson100% (1)

- Chapter 14. Intestinal GasDocument19 pagesChapter 14. Intestinal GasMonica CiorneiNo ratings yet

- Learning Packet: Practical Research 1Document9 pagesLearning Packet: Practical Research 1takamiya nahoNo ratings yet

- October 13, 2009 - The Adoption of IFRS ForDocument12 pagesOctober 13, 2009 - The Adoption of IFRS Formjay moredoNo ratings yet

- Sundaram Multi Pap LTD - 13 - 7 - 10Document3 pagesSundaram Multi Pap LTD - 13 - 7 - 10DarshanNo ratings yet

- ETSI TS 122 078: Technical SpecificationDocument96 pagesETSI TS 122 078: Technical SpecificationMichal JudaNo ratings yet

- Tips On How To Write A Better Narrative EssayDocument6 pagesTips On How To Write A Better Narrative EssayAjlia AzamNo ratings yet

- Assignment Chapter 9Document3 pagesAssignment Chapter 9Nur ArinahNo ratings yet

- Crush - Candy.corpse - Chapters1 2Document19 pagesCrush - Candy.corpse - Chapters1 2bibliocommons2012No ratings yet

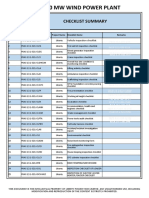

- Act02 50 MW Wind Power Plant: Checklist SummaryDocument54 pagesAct02 50 MW Wind Power Plant: Checklist SummaryRaza Muhammad SoomroNo ratings yet

- SÓP On SOPDocument3 pagesSÓP On SOPThien Doan ChiNo ratings yet

- CGI 2024 Version AnglaiseDocument550 pagesCGI 2024 Version AnglaiseKendra LeslyNo ratings yet