Professional Documents

Culture Documents

Course No. Com 672 Corporate Finance

Uploaded by

Mir MusadiqOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Course No. Com 672 Corporate Finance

Uploaded by

Mir MusadiqCopyright:

Available Formats

Course No.

CORPORATE FINANCE Credit Hours 3

Com 672

Semester VII Pre- Requisite NONE

Objectives Apply theory to application, Demonstrating an understanding of the

theoretical knowledge base of organizational behavior

Analyze how individual and group behaviors act as building blocks to

organizational behavior

Research and analyze aspects of organizational behavior

Analyze team behavior and its effect on productivity

Communicate and interact with team members

CORPORATE FINANCE

1. Introduction to Corporate Finance

Financial decision making in corporations

Types of finances

Financial instruments and markets

Short and long term financing

Valuation principles

Required Rates of Return and risk

Internal & external financing

Spontaneous financing

Short term financing tools.

2. Financial statements and cash flows

The cash flow statement

The income statement and statement of retained earnings

The balance sheet

Relationship between book value and market value

3. Understanding the Interest Rates.

General level of interest rates.

Foreign Borrowing and lending

Purchasing power parity

Structure of interest rate

4. Valuing Debt and Equity

Value debt and preferred stock

Pure-discount instruments

Coupon bonds, zero coupon, perpetual & reserve bonds

Amortized instruments

Preferred stock, their types and valuation.

Valuing equity

A single period common stock

A multi-period common stock

The constant growth dividend & growth in stages.

Implications for managers.

5. Lease and loan financing, Introduction to financing decisions

Description of financial instruments

Private Sources of financing

Commercial banks and other financial intermediaries

Ventures capitalists

Issuing securities to the public.

6. Long-term financial policy: Dividends Policy.

How companies distribute value to the owners

Cash dividends

Share repurchases

Stock dividends and stock splits

When dividend policy is irrelevant

The effect of financial market imperfections

The effect of asymmetric imperfections

Establishing a dividend payout-earnings retention policy.

7. Capital structure theory

Operating & Financial leverage

Cost of Capital,

8. Restructuring

Restructuring company’s assets and claims

Mergers, Acquisitions, divestitures and buy-outs

BOOKS RECOMMENDED (Latest Editions)

Gary W. Emery, Corporate Finance; Principles and Practice

Van Horne, Financial Management and policy.

Gitman, Principles of Managerial Finance.

Brealey and Byers, Corporate Finance, McGraw Hill Rose, Corporate Finance.

You might also like

- Mergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and SolutionsFrom EverandMergers, Acquisitions, and Other Restructuring Activities: An Integrated Approach to Process, Tools, Cases, and SolutionsNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Revised OultlineDocument4 pagesRevised OultlineSarose ThapaNo ratings yet

- Corporate Finance ManagementDocument9 pagesCorporate Finance Managementtrustmakamba23No ratings yet

- Dividend Policy ProposalDocument22 pagesDividend Policy Proposalroman50% (4)

- Corporatte Finance OutlineDocument7 pagesCorporatte Finance OutlinemehwishNo ratings yet

- Dividend Policy of Everest Bank Limited: A Thesis Proposal byDocument9 pagesDividend Policy of Everest Bank Limited: A Thesis Proposal byRam khadkaNo ratings yet

- Special Topics Lesson 1 6Document31 pagesSpecial Topics Lesson 1 6Sharmaine JunioNo ratings yet

- Questions OadsDocument12 pagesQuestions OadsMuhammad ShaheerNo ratings yet

- 2 - Introduction To FinanceDocument30 pages2 - Introduction To FinanceMacNo ratings yet

- Warner Body WorksDocument35 pagesWarner Body WorksPadam Shrestha50% (4)

- Institute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementDocument4 pagesInstitute of Management Sciences Bahauddin Zakariya University (Multan) Course Outline: Strategic Financial ManagementJarhan AzeemNo ratings yet

- Introduction To FM45Document10 pagesIntroduction To FM45Sandeep AgarwalNo ratings yet

- Corporate Finance - UoJDocument63 pagesCorporate Finance - UoJAbraham KuolNo ratings yet

- FM1 IntroDocument27 pagesFM1 IntroZenedel De JesusNo ratings yet

- Chapter 1 Financial ManagementDocument16 pagesChapter 1 Financial ManagementRossyNo ratings yet

- 1.1 BackgroundDocument11 pages1.1 BackgroundBayalkotee ReshamNo ratings yet

- Inventry ProjectDocument92 pagesInventry Projectboidapu kanakarajuNo ratings yet

- Advanced Corporate Finance PartDocument73 pagesAdvanced Corporate Finance PartYidnekachew AwekeNo ratings yet

- Afin209 FPD 1 2017 1Document3 pagesAfin209 FPD 1 2017 1Daniel Daka100% (1)

- FM BBC CourseoutlineDocument6 pagesFM BBC CourseoutlineReagan SsebbaaleNo ratings yet

- Study Guide Final MGMT 449 Fall 2015 Ch1-10Document6 pagesStudy Guide Final MGMT 449 Fall 2015 Ch1-10jay bao0% (1)

- Course Outline - Fin 223Document3 pagesCourse Outline - Fin 223DenisNo ratings yet

- Course Outline - FinanceDocument2 pagesCourse Outline - FinanceAnnabelle BuenaflorNo ratings yet

- Accounting: Training: 1.1. DividendsDocument40 pagesAccounting: Training: 1.1. DividendsNeha ChoudharyNo ratings yet

- CF - Section A - DR - Sudhindra BhatDocument5 pagesCF - Section A - DR - Sudhindra BhatAbarna LoganathanNo ratings yet

- Behavioral Finance Course OutlineDocument3 pagesBehavioral Finance Course OutlineInocent Angel100% (1)

- Dividend Analysis at India Bulls: Project Report ON " "Document77 pagesDividend Analysis at India Bulls: Project Report ON " "Sankar BukkapatnamNo ratings yet

- 208 - F - Icici-Technical Analysis On Equity Stocks at Icici BankDocument90 pages208 - F - Icici-Technical Analysis On Equity Stocks at Icici BankPeacock Live ProjectsNo ratings yet

- Course OutlineDocument10 pagesCourse OutlineasjadNo ratings yet

- Introcuction To Finance - HandoutsDocument20 pagesIntrocuction To Finance - HandoutsChristos007No ratings yet

- FM Course Outline & Materials-Thappar UnivDocument74 pagesFM Course Outline & Materials-Thappar Univharsimranjitsidhu661No ratings yet

- Dividend Decision Analysis at Zen MoneyDocument100 pagesDividend Decision Analysis at Zen MoneyRoji0% (1)

- SFM Theory Booklet by CA Gaurav Jain SirDocument194 pagesSFM Theory Booklet by CA Gaurav Jain Sircajainrishabh99No ratings yet

- Orporate Inance S: Vii & Ix BA - LL.B. (H .) S: J N 2016: D - Y. P RDocument5 pagesOrporate Inance S: Vii & Ix BA - LL.B. (H .) S: J N 2016: D - Y. P RNaveen SihareNo ratings yet

- CH 17Document18 pagesCH 17monel_24671No ratings yet

- Corporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisDocument9 pagesCorporate Finance and Model of Financial Control - Substantiate Enterprise Controlling: Descriptive AnalysisPuttu Guru PrasadNo ratings yet

- 224 23 BS BF 224Document3 pages224 23 BS BF 224D'zite JereNo ratings yet

- The Handbook of Financing GrowthDocument6 pagesThe Handbook of Financing GrowthJeahMaureenDominguezNo ratings yet

- CourseOutline - Corporate FinanceDocument10 pagesCourseOutline - Corporate FinanceYaarbaileeNo ratings yet

- Advanced Corporate Finance Course OutlineDocument3 pagesAdvanced Corporate Finance Course OutlineYidnekachew AwekeNo ratings yet

- The Foundations: "It's All Corporate Finance" My Unbiased View of The WorldDocument10 pagesThe Foundations: "It's All Corporate Finance" My Unbiased View of The Worldapi-19731569No ratings yet

- Fundamentals of Corporate Finance: Introduction - Session One Ajay ShahDocument12 pagesFundamentals of Corporate Finance: Introduction - Session One Ajay ShahAjay ShahNo ratings yet

- Nahid's Thesis PaperDocument44 pagesNahid's Thesis PaperDipak SarkerNo ratings yet

- (Credit Hours 3) Corporate Financing Decisions: Text BooksDocument1 page(Credit Hours 3) Corporate Financing Decisions: Text Booksshraddha amatyaNo ratings yet

- BBM 206 Principles of FinanceDocument46 pagesBBM 206 Principles of FinanceMzee KodiaNo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Study of Debt Market & Corporate Financial Market AnalysisDocument18 pagesStudy of Debt Market & Corporate Financial Market AnalysisMadhuri WaghmareNo ratings yet

- The Study of Dividend Policies of Indian CompaniesDocument41 pagesThe Study of Dividend Policies of Indian CompaniesKushaal Chaudhary67% (3)

- Advanced Corporate FinanceDocument8 pagesAdvanced Corporate Financenargis aliNo ratings yet

- Strategy NotesDocument4 pagesStrategy NotesSoumya SharmaNo ratings yet

- Unit 1 Introduction To Financial ManagementDocument2 pagesUnit 1 Introduction To Financial ManagementCarmina 'ria' de Jesus100% (3)

- Consolidated FM NotesDocument227 pagesConsolidated FM NotesTitus GachuhiNo ratings yet

- COMPARATIVE EQUITY ANALYSIS OF BANKING AND IT SECTOR - INDIABULLS - Plega NewDocument97 pagesCOMPARATIVE EQUITY ANALYSIS OF BANKING AND IT SECTOR - INDIABULLS - Plega NewMohmmedKhayyumNo ratings yet

- Corporate Governance: John Paul Ragandap Lyka Mia QuitorianoDocument26 pagesCorporate Governance: John Paul Ragandap Lyka Mia QuitorianoLyka Mia QuitorianoNo ratings yet

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- Business Finance Course Outline & NotesDocument173 pagesBusiness Finance Course Outline & NotesramboNo ratings yet

- FM Lesson PlanDocument3 pagesFM Lesson PlanashwiniNo ratings yet

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocument16 pagesAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- 01 Fin - Introduction To Financial ManagementDocument19 pages01 Fin - Introduction To Financial Managementshahin shekhNo ratings yet

- Business Research and Report 2k20 BF 30 2k20 BF 83 2k20 BF 56-1Document20 pagesBusiness Research and Report 2k20 BF 30 2k20 BF 83 2k20 BF 56-1Mir MusadiqNo ratings yet

- AutomobileDocument15 pagesAutomobileMir MusadiqNo ratings yet

- Institute of CommerceDocument1 pageInstitute of CommerceMir MusadiqNo ratings yet

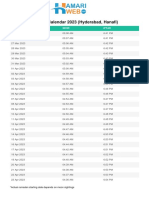

- Hyderabad Ramadan Calendar 2023 HamariwebDocument1 pageHyderabad Ramadan Calendar 2023 HamariwebMir MusadiqNo ratings yet

- Long-Term FinancingDocument15 pagesLong-Term FinancingMir MusadiqNo ratings yet

- The Role of Financial ManagementDocument17 pagesThe Role of Financial ManagementMir MusadiqNo ratings yet

- Educators ESE SESE SSE Science MCQs PDFDocument66 pagesEducators ESE SESE SSE Science MCQs PDFMir MusadiqNo ratings yet

- Netflix Fit: Case Analysis: Aswath DamodaranDocument22 pagesNetflix Fit: Case Analysis: Aswath DamodaranMir MusadiqNo ratings yet