Professional Documents

Culture Documents

Polytechnic University of The Philippines Sto. Tomas Branch AY 2021 - 2022 Financial Accounting and Reporting 1 Assignment Name: Jenebeth R. Nieva

Uploaded by

Nana LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Polytechnic University of The Philippines Sto. Tomas Branch AY 2021 - 2022 Financial Accounting and Reporting 1 Assignment Name: Jenebeth R. Nieva

Uploaded by

Nana LeeCopyright:

Available Formats

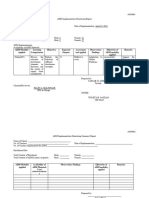

Polytechnic University of the Philippines

Sto. Tomas Branch

AY 2021 – 2022

Financial Accounting and Reporting 1

Assignment

Name: Jenebeth R. Nieva

I. Partnership Formation

Problem 1. A, B and C formed a partnership on January 1, 2021 by contributing the following assets and

liabilities:

Cash Inventory PPE Account Notes Mortgage

s Payable payable

payable

Partner Face value Cost Fair value Book value Fair value

A 10,000 20,00 30,000 10,000 40,000 20,000

0

B 20,000 40,00 20,000 50,000 20,000 10,000

0

C 30,000 50,00 40,000 30,000 50,000 70,000

0

Required:

1. Determine the capital balance of each partner assuming the partners agreed that the contributed

capital of each partner is the amount to be credited as his capital.

Answer:

A P 60,000

B P 50,000

C P 50,000

Solution:

Partnershi

A B C p

Cash 10,000 20,000 30,000 60,000

Inventory 30,000 20,000 40,000 90,000

PPE 40,000 20,000 50,000 110,000

Accounts

Payable (40,000) (20,000)

Notes

Payable (10,000) (10,000)

Mortgage

Payable (70,000) (70,000)

Capital

Balance ₱60,000 ₱50,000 ₱50,000 ₱160,000

2. Who among the partners receive bonus assuming the partners agreed that they will have equal interest

in the partnership after the formation?

Answer: B and C

Solution:

Actual Contribution Bonus Method

Partner A ₱60,000 (P160,000/3) ₱53,334

Partner B ₱50,000 (P160,000/3) ₱53,333

Partner C ₱50,000 (P160,000/3) ₱53,333

Total ₱160,000 ₱160,000

B and C shall receive bonus.

3. Assuming the partners agreed that A will have 20% capital interest and B will have 30% capital interest,

how much is the amount of bonus to C?

Answer: P 30,000

Solution:

Actual Contribution Bonus Method

Partner A ₱60,000 (P160,000x20%) ₱32,000

Partner B ₱50,000 (P160,000x30%) ₱48,000

Partner C ₱50,000 (P160,000x50%) ₱80,000

Total ₱160,000 ₱160,000

P 80,000 – P 50,000 = P 30,000

The amount of bonus to C is P 30,000.

4. Assuming the partners agreed that A will have 50% capital interest, how much bonus is received by A

from B and C?

Answer: P 20,000

Solution:

Actual Contribution Bonus Method

Partner A ₱60,000 (P160,000x50%) ₱80,000

P 80,000 – P 60,000 = P 20,000

The amount of bonus A shall receive from B and C is P 20,000.

5. Assuming the partners agreed that A will have 10% capital interest and C will have 10% capital

interest, how much is the amount of bonus to B?

Answer: P 78,000

Solution:

Actual Contribution Bonus Method

Partner A ₱60,000 (P160,000x10%) ₱16,000

Partner B ₱50,000 (P160,000x80%) ₱128,000

Partner C ₱50,000 (P160,000x10%) ₱16,000

Total ₱160,000 ₱160,000

P 128,000 – P 50,000 = P 78,000

The amount of bonus to B is P 78,000.

Problem 2. On January 1, 2021, A, B and C formed a partnership. A contributed P50,000 cash. B

contributed inventory with a cost of P100,000 and fair value of P150,000. C contributed a land with

historical cost of P50,000 and assessed value of P200,000. The land is mortgaged for P100,000. On

January 3, 2021, the land was sold for P250,000. How much is the amount to be credited to C assuming

there will be no bonus?

Answer: P 150,000

Solution:

P 250,000 – P 100,000 = P 150,000

The amount to be credited to C is P 150,000.

Problem 3. On January 1, 2021, A, owner of a sole proprietorship business, B and C decided to form a

partnership. B contributed a building with a cost of P100,000 and accumulated depreciation of P20,000.

The fair value of the building is P130,000. The building is mortgaged for P30,000. The statement of

financial position of A’s business shows the following balances on December 31, 2020 with the

corresponding fair values:

Book value Fair value

Cash P100,000 P100,000

Accounts Receivable 200,000 125,000

Allowance for bad debts (50,000)

Inventory 50,000 70,000

PPE, gross 150,000 150,000

Acc. Depreciation (50,000)

Accounts Payable 100,000 105,000

Notes Payable 50,000 50,000

How much is the amount of cash to be contributed by C to have a 20% ownership in the business?

Answer: P 97,500

Solution:

A B Partnership

Cash P100,000 P100,000

Accounts Receivable 125,000 125,000

Inventory 70,000 70,000

PPE, gross 150,000 150,000

Land P130,000 P130,000

Accounts Payable (105,000) (105,000)

Notes Payable (50,000) (50,000)

Mortgage Payable (30,000) (30,000)

Total P290,000 P100,000 P390,000

P 390,000 x 20/80 = P97,500

The amount of cash to be contributed by C is P 97,500.

II. Partnership Operation

Problem 1. On January 1, 2021, Angel and Bea formed a partnership with an investment of P40,000 by

Angel and P60,000 by Bea. On December 31,2021, after closing all income and expense accounts, the

Income Summary account showed a credit balance of P60,000, representing the profit for the year 2021.

Changes in the capital accounts during 2021 are summarized as follows:

Transactions Angel Bea

Capital balances, January 1,2021 40,000 60,000

Additional investments, March 1 20,000 50,000

Additional investments, August 1 20,000 40,000

Withdrawal, October 1 (20,000) -

Withdrawal, November 1 (50,000)

Capital balances, December 31,2021 60,000 100,000

Required: Determine the profit share of Angel and Bea under the following profit or loss arrangement:

a. The profit or loss will be divided equally.

b. The profit or loss will be divided in the ratio of 60:40 to Angel and Bea.

c. The profit or loss will be divided based on the beginning capital balance ratio.

d. The profit or loss will be divided based on the ending capital balance ratio.

e. The profit or loss will be divided based on the weighted average capital balance ratio.

f. The profit or loss will be divided based on the following terms:

a. Salaries to Angel and Bea of P20,000 and P30,000 respectively.

b. Interest of 10% on ending capital balance.

d. Remaining profit or loss after salaries, interest and bonus, equally.

g. Assuming there is net loss of P60,000 and the profit or loss will be divided based on the following

terms:

a. Salaries to Angel and Bea of P20,000 and P30,000 respectively.

b. Interest of 10% on ending capital balance.

d. Remaining profit or loss after salaries, interest and bonus, equally.

h. The profit or loss will be divided based on the following terms:

a. Salaries to Angel and Bea of P5,000 and P10,000 respectively.

b. Interest of 10% on beginning capital balance.

c. Bonus to Bea, 20% of net income before salaries, interest and bonus.

d. Remaining profit or loss after salaries, interest and bonus, equally.

i. The profit or loss will be divided based on the following terms:

a. Salaries to Angel and Bea of P5,000 and P10,000 respectively.

b. Interest of 10% ending capital balance.

c. Bonus to Bea, 20% of net income before salaries and interest but after deduction of bonus.

d. Remaining profit or loss after salaries, interest and bonus, equally.

j. The profit or loss will be divided based on the following terms:

a. Salaries to Angel and Bea of P5,000 and P10,000 respectively.

b. Interest of 10% weighted average capital balance.

c. Bonus to Bea, 20% of net income after salaries and interest but before deduction of bonus.

d. Remaining profit or loss after salaries, interest and bonus, equally.

l. The profit or loss will be divided based on the following terms:

a. Salaries to Angel and Bea of P5,000 and P10,000 respectively.

b. Interest of 10% weighted average capital balance.

c. Bonus to Bea, 20% of net income after deduction of salaries, interest and bonus.

d. Remaining profit or loss after salaries, interest and bonus, equally.

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- p1 Quiz With TheoryDocument15 pagesp1 Quiz With TheoryGrace CorpoNo ratings yet

- Corporate LiquidationDocument16 pagesCorporate LiquidationMidas Troy Victor100% (1)

- 5 6185807922006589566Document4 pages5 6185807922006589566ChawNo ratings yet

- Performance Management System at HBLDocument36 pagesPerformance Management System at HBLArslan Ali80% (5)

- Employee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanDocument1 pageEmployee Movement Form.v01 - Recg - Mohamed Adam Izhar Bin Mohamed RidzwanXiao Minn NeohNo ratings yet

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Partnership Formation: Name: Date: Professor: Section: Score: QuizDocument5 pagesPartnership Formation: Name: Date: Professor: Section: Score: QuizWenjun100% (3)

- RESA MCQsDocument56 pagesRESA MCQsWendelyn Tutor100% (1)

- Env SPV DR B 001 QC Manual Rev.ADocument92 pagesEnv SPV DR B 001 QC Manual Rev.AyoeyNo ratings yet

- Partnership DissolutionDocument15 pagesPartnership DissolutionAbc xyzNo ratings yet

- 1.4 Partnership Liquidation - 1Document4 pages1.4 Partnership Liquidation - 1Leane Marcoleta100% (2)

- Kpi Scorecard TemplateDocument2 pagesKpi Scorecard TemplatePersonalia HC JBSPNo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionYam SondayNo ratings yet

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Document15 pagesAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroNo ratings yet

- ACC 110 RemedialDocument11 pagesACC 110 RemedialGiner Mabale StevenNo ratings yet

- Toaz - Info Partnership Dissolution PRDocument16 pagesToaz - Info Partnership Dissolution PRNil Justeen GarciaNo ratings yet

- Final Grading Exam Key Answers PDFDocument35 pagesFinal Grading Exam Key Answers PDFLeslie Mae Vargas ZafeNo ratings yet

- IMS Checklist 3 - Mod 2Document10 pagesIMS Checklist 3 - Mod 2Febin C.S.100% (1)

- PartnershipDocument7 pagesPartnershipShane Nayah100% (2)

- Long QuizDocument5 pagesLong QuizMitch Tokong MinglanaNo ratings yet

- Acctg301 PartnershipDissolutionDocument16 pagesAcctg301 PartnershipDissolutionTiu Voughn ImmanuelNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Division of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsDocument7 pagesDivision of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsJuliana Cheng100% (3)

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- ANSWER Assessment ExamDocument21 pagesANSWER Assessment ExamJazzy Mercado100% (1)

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Quiz - Chapter 1 - Partnership Formation - 2021 EditionDocument5 pagesQuiz - Chapter 1 - Partnership Formation - 2021 EditionNahwi KimpaNo ratings yet

- AFAR Quiz 1 (B42)Document12 pagesAFAR Quiz 1 (B42)Edma Glory MacadaagNo ratings yet

- B.) CC, P25,000: PP, P21,000 Aa, P38,000Document22 pagesB.) CC, P25,000: PP, P21,000 Aa, P38,000Wendelyn TutorNo ratings yet

- Quiz 1 Partnership AnswersDocument4 pagesQuiz 1 Partnership Answersdianel villarico100% (2)

- RIBAAppointmentAgreements20102012revision AdrianDobson PDFDocument65 pagesRIBAAppointmentAgreements20102012revision AdrianDobson PDFTash Sous100% (1)

- Partnership AcctgDocument4 pagesPartnership Acctgcessbright100% (1)

- Partnership ExercisesDocument17 pagesPartnership ExercisesDan RyanNo ratings yet

- Partnership Operation Quiz 2Document2 pagesPartnership Operation Quiz 2cabbigatcrisanta04No ratings yet

- Partnership DissolutionDocument5 pagesPartnership DissolutionJae Nathaniel Arroyo OronanNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- ILLUSTRATIVE PROBLEMS - Methods of Dividing Profits of LossesDocument7 pagesILLUSTRATIVE PROBLEMS - Methods of Dividing Profits of LossesMathew LumapasNo ratings yet

- ILLUSTRATIVE PROBLEMS - Methods of Dividing Profits or LossesDocument7 pagesILLUSTRATIVE PROBLEMS - Methods of Dividing Profits or LossesAntoniete OpladoNo ratings yet

- Answer Key POD Cup Jr. Final RoundDocument6 pagesAnswer Key POD Cup Jr. Final RoundRitsNo ratings yet

- BAM 201 p2 Quiz 2 With AnswersDocument9 pagesBAM 201 p2 Quiz 2 With AnswersPascua, Colleene Faye DG.No ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationAbc xyzNo ratings yet

- Partnership OperationsDocument27 pagesPartnership OperationsAbc xyzNo ratings yet

- Activity 1Document1 pageActivity 1Cris TineNo ratings yet

- Partnership RequirementDocument6 pagesPartnership RequirementAlyssa Marie Miguel100% (1)

- AfarDocument14 pagesAfarPaulo MiguelNo ratings yet

- Quiz 2 Problem 1Document4 pagesQuiz 2 Problem 1Mitch Tokong MinglanaNo ratings yet

- Partnership Operations - AssignmentDocument6 pagesPartnership Operations - AssignmentRosmar AbanerraNo ratings yet

- Lesson 2. Partnership FormationDocument6 pagesLesson 2. Partnership Formationangelinelucastoquero548No ratings yet

- Review: Financial Accounting and Reporting II Midterm Examination ReviewDocument11 pagesReview: Financial Accounting and Reporting II Midterm Examination ReviewJohn Kenneth Jarce CaminoNo ratings yet

- ACC 311 Ass#2Document7 pagesACC 311 Ass#2Justine Reine CornicoNo ratings yet

- Solution-Dissolution and LiquidationDocument8 pagesSolution-Dissolution and LiquidationRejay VillamorNo ratings yet

- Asynchronous 3Document35 pagesAsynchronous 3Mark Anthony CondaNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership LiquidationMonica MangobaNo ratings yet

- Business CombinationDocument8 pagesBusiness CombinationCharla SuanNo ratings yet

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- Fernandez Acctg 14N Finals ExamDocument5 pagesFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONo ratings yet

- Exam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)Document29 pagesExam in Taxation Exam in Taxation: Business Tax (Naga College Foundation) Business Tax (Naga College Foundation)jhean dabatosNo ratings yet

- Advanced Accounting 1 1Document11 pagesAdvanced Accounting 1 1zeline petallanoNo ratings yet

- Activity 1 Partnership Formation and OperationDocument8 pagesActivity 1 Partnership Formation and OperationRoyceNo ratings yet

- Advact PrelimDocument10 pagesAdvact PrelimSano ManjiroNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationMa Teresa B. CerezoNo ratings yet

- Final Grading Examination Key AnswersDocument22 pagesFinal Grading Examination Key AnswersKimNo ratings yet

- SHS Investigative ReportDocument1 pageSHS Investigative ReportNana LeeNo ratings yet

- Eapp 111Document9 pagesEapp 111Nana LeeNo ratings yet

- DocumentDocument3 pagesDocumentNana LeeNo ratings yet

- Applied Economics ExamDocument9 pagesApplied Economics ExamNana LeeNo ratings yet

- BENSDocument7 pagesBENSNana LeeNo ratings yet

- Report in I.TDocument14 pagesReport in I.TNana LeeNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsNana LeeNo ratings yet

- Reviewer TCWDocument2 pagesReviewer TCWNana LeeNo ratings yet

- Colleen 2125000 5 Change - 870 180 1Document3 pagesColleen 2125000 5 Change - 870 180 1Nana LeeNo ratings yet

- STS LESSONs 1 4Document21 pagesSTS LESSONs 1 4Nana LeeNo ratings yet

- ACCO 20033 FAR 1 Departmental MidtermsDocument5 pagesACCO 20033 FAR 1 Departmental MidtermsNana LeeNo ratings yet

- Metag Catalog 2021Document108 pagesMetag Catalog 2021atssbcNo ratings yet

- Abtt Preliminary Exam ReviewerDocument5 pagesAbtt Preliminary Exam ReviewerDENNIS BELGIRA JR.No ratings yet

- BD Leather Industry 2022Document11 pagesBD Leather Industry 2022shamira haqueNo ratings yet

- SC Syariahcompliant 2505-2023Document39 pagesSC Syariahcompliant 2505-2023Fatimah TarmiziNo ratings yet

- Berkowitz Designer BookDocument27 pagesBerkowitz Designer BookNoah BerkowitzNo ratings yet

- Suspicious Letter - ResponseDocument3 pagesSuspicious Letter - ResponseShannonNo ratings yet

- Nigel Slack Chapter 16 Project Planning and ControlDocument28 pagesNigel Slack Chapter 16 Project Planning and ControladisopNo ratings yet

- Sumit Rawat: Experience Federal Mogul Goetze India LTDDocument4 pagesSumit Rawat: Experience Federal Mogul Goetze India LTDAnup PandeyNo ratings yet

- CH 01 (The Nature of CRM)Document12 pagesCH 01 (The Nature of CRM)Razbir RayhanNo ratings yet

- Dr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial EconomicsDocument7 pagesDr. Filemon C. Aguilar Memorial College of Las Piñas: Aced 4 - Managerial Economicsmaelyn calindongNo ratings yet

- Soal Pas KLS XiiDocument10 pagesSoal Pas KLS XiiRetnomairinaNo ratings yet

- Csm-Form SchoolDocument2 pagesCsm-Form SchoolLove MaribaoNo ratings yet

- Management CommunicationDocument8 pagesManagement CommunicationJohn Carlo DinglasanNo ratings yet

- Expert Q&A: Up Next in Your CoursesDocument1 pageExpert Q&A: Up Next in Your CoursesHassaan AftabNo ratings yet

- Group II RTP Dec 2012Document173 pagesGroup II RTP Dec 2012Prekshit KalashdharNo ratings yet

- ADM-Implementation-Monitoring-Tool-as-discussed-withthe-CID-group PMDocument3 pagesADM-Implementation-Monitoring-Tool-as-discussed-withthe-CID-group PMcaesar.amigoNo ratings yet

- HB Quiz 2020Document4 pagesHB Quiz 2020Allyssa Kassandra LucesNo ratings yet

- New Checklist For TradingDocument8 pagesNew Checklist For TradingADC VentureNo ratings yet

- Other MCQ CH 1 To 6Document90 pagesOther MCQ CH 1 To 6EmmaNo ratings yet

- Contemporary Strategy Analysis 10th Edition Grant Test BankDocument8 pagesContemporary Strategy Analysis 10th Edition Grant Test BankChristopherDayasptr100% (10)

- Class 1 Project Management An OverviewDocument31 pagesClass 1 Project Management An OverviewAbdul FasiehNo ratings yet

- Certificado Material Yugo de AmarreDocument8 pagesCertificado Material Yugo de AmarrePaola CardenasNo ratings yet

- Six Sigma Green Belt Roadmap - Lynda PDFDocument4 pagesSix Sigma Green Belt Roadmap - Lynda PDFKanchan KrishanNo ratings yet

- Plant LayoutDocument5 pagesPlant LayoutSasmita SahooNo ratings yet