Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

Arya Roshan0 ratings0% found this document useful (0 votes)

15 views10 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views10 pagesUntitled

Untitled

Uploaded by

Arya RoshanCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

ILLUSTRATION 6 << company paid him

Mr. Ajay a Service Engineer of AB Ltd retires on 30/11/2020, o ee

gratuity of & $5,000 for 32 years and 10 months of service. His salaty details surement benefit

= Basic pay 7 4,500 p.m., D.A. 50% of Basic pay of which 25% enters £0 Fo 7

during 2019-20. ~ en

* Basic pay was ¢ 4,700 p.m., D.A. ¢ 1200 pan. during the previous year 2020-21.

" D.A. enters into retirement benefit at uniform rate.

(© Scanned with OKEN Scanner

ILLUSTRATION 9 : po

Mr. Kumar retired on 10th April 2020 after serv;

for 30 years and 7 months. He was

getting salary of € 15,000 p.m, won COT 0 zon thereafter 7 15,600 p.m. he

received D.A #@ %3,000 p.m (fornfing part of salary for retirement benefits) and 2%

commission on sales achieved by him. Turnover by him during 10 months (proceeding the month

in which he retired) is = 24,00,000. He received gratuity of € 4,68,000. Compute the exempted

amount of gratuity.( He is not covered under the Payment of Gratuity Act.) (BBM Nov. 2012)

© Scanned with OKEN Scanner

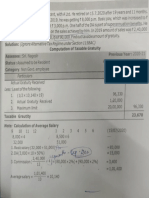

Hhbseaton- 16 (BBM, Nov. - 2002) (modified)

Mr. Anand Shankar (resident), retired from service in Mysore Minerals Ltd., on 31st December

2020. Inthis company, he has put in 33 years and 9 months of service. On retirement, the company paid

him a gratuity of ¥ 3,25,000. His monthly salary at the time of retirement (since 1-10-2015) was &

12,000, DA® 3,000 and H.R.A. % 2,000, Find out the exempted amount of Gratuity if he is: a) Covered

under the Paymentof Gratuity Act 1972.b) Not covered under the Payment of Gratuity Act 1972,

(Ignore Alternative Tax Regime under Section 115BAC)

Solution:

© Scanned with OKEN Scanner

Illustration - 17 (BBM, April- 1998,)(B.Com, Nov. - 2014) (modified) ee

Mr. Ganguly (resident), a marketing manager in Kolkata, retired from XYZ Ltd. on Dec. 15, 2029

after 28 years and 8 months of service and receives % 3,50,000 as death cum retirement gratuity. His

average basic salary for the preceding. 19 months ended on 30 Nov. 2020 was % 18,200 per month,

Besides, he has received % 1,000 per month as DA, 80% of which form part of the salary for the purpose

of computation of all retirement benefits and 6% commission on turnover achieved by him. Total

turnover achieved by him for 10 months ended on 30th Nov 2020 is ¥ 1,50,000. Assume he is not

covered under Payments of Gratuity Act. Compute the taxable gratuity for the A.Y. 2021-22. (Ignore

Altefnative Tax Regime under Section 115BAC)

Solution:

(© Scanned with OKEN Scanner

‘Aditri Co. & Asmita

Illustration ~ 22 nies — ti

Sri. Bhagavathi Prasad, Marketing Specialist is working with two poe ‘out of which © 20,000 is

Co. He retires from Aditri Co, on 30/11/2015 & receives ¢ 22,000 as grat OF ceryice and receives

ars & 8 moreceding 10 months ended

exempt. He also retires from Asmita Co. on 10/12/20 after 28 yea

%2,90,000 as gratuity. His average Basic salary drawn from Asmita Co. for PRS nich forms part of

on 30/11/2020 is ¢ 18,200. Besides, he has received & 1,000 p.m. as DA 809 ord by him during ten

salary & 6% commission on turn over achieved by him. Total turnover achiev" 0A, J901.99,

months ending on 30/11/2020 is % 2,00,000. Find out taxable amount of gratuity fo!

(Ignore Alternative Tax Regime under Section 115BAC)

(© Scanned with OKEN Scanner

joyee oe euveree =

illustration - 18 (B.Com, Dec. -2008, Nov.- 2017) (modified) ny for 32 Years and 19

Sri Veeresh (resident) retired on 31.3.2021 after serving ina COMPUT egiately precedi

months. He received % 1,78,000 as gratuity. His average monthly salary 720. 2994-22. (Gratuityig

10 months was € 28,000. Computer his exempted and taxable gratuity FOF Mion 11 5BAC)

not covered under Gratuity Act). (Ignore Alternative Tax Regime u”

Solution:

wo mented

© Scanned with OKEN Scanner

ition - 19

Mr. Arup Mukherjee (resident), a manager of a Limited Co., retires on 1-6-2020 after putting 40

jears of continuous service. He received a gratuity of & 1,00,000 in August 2019. His salary for the year

2019-20 was 4,000 p.m, and 2020-21 ¥ 6,000 p.m. Calculate his taxable gratuity for the A.Y. 2021-22.

(Ignore Alternative Tax Regime under Section 115BAC)

solution:

(© Scanned with OKEN Scanner

Iilustration - 20

Sri. Eshwar Mullick, who is not covered by the Payment of Gratuity Act receives gratuity of

onths and 23 days. His last

£3,88,000 when he retires on 23/06/2020, after a service on 34 years 9 mi

m., DA 6,600 p.m, Servant Allowance % 600

drawn emoluments are as follows: Basic Salary € 25,000 p.

pm. Annual increment of Basic Salary & 1,000 pm falls due on 1st January-of every. year. Compute

taxable amount of Gratuity for the A.Y. 2021-22. (Ignore Alternative Tax Regime)

© Scanned with OKEN Scanner

Illustration - 21 : ; 8

Sri. Neelakanta Maity, the Marketing Manager of Archita Ltd. retires on 30-11-2020 after service gf

22 years and 10 months. At the time of retirement he has been paid ® 2,80,000 as gratuity. Find out

taxable gratuity for A.Y. 2021-22 with the following available information. Salary and allowances: a,

Basic salary at the time of retirement %8,000 pm, b. Month from which increment is allowed - From the

salary payable for the month of July, c. Amount of last increment ¥ 1,000, d. DA (15% is

retiretnent benetit)-2-000 p.m €- commission (Fixed on per month basis since 2003% Besides,

he gets 0.5% commission on turn over achieved by him. Turnover for different month is as follows:

Jan. 20202 70,000; February ¢ 80,000; March @ 85,000; April to June 2,70,000; July to Oct € 3,70,000;

Nov % 95,000, Salary, allowances and commission become due on ist day of the next month. (Ignore

Alternative Tax Reaime under Section 115BAC)

(© Scanned with OKEN Scanner

.d on 15.7.2020 after 19 years and 11 months.

Hilustration - 23

Sri. Nagesh isa sales assistant, with A Ltd. He

He got gratuity of € 1,20,000. In 2019, he was getting ¢ 8,000 p.m. Basic pay, which was increased to €

‘One half of the DA Is part of superannuation benefits. He

n 2019 amount of sales was® 2,40,000__

8,500 p.m. in 2020. He gets DA at ¢ 3,000 p.

is entitled to commission at € 2% on the sales achieved by hi

‘ind out taxable amount of gratuity.

and during first six months of 2020, itis

© Scanned with OKEN Scanner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hra 2 (It)Document4 pagesHra 2 (It)Arya RoshanNo ratings yet

- (A Project Report, Submitted in Partial Fulfillment of The Requirements of The Bachelor of Business Administration Degree) Submitted ToDocument78 pages(A Project Report, Submitted in Partial Fulfillment of The Requirements of The Bachelor of Business Administration Degree) Submitted ToArya RoshanNo ratings yet

- IJCRT2207347Document7 pagesIJCRT2207347Arya RoshanNo ratings yet

- UntitledDocument2,074 pagesUntitledArya RoshanNo ratings yet

- Benefits. by of Sales: 2020. SuperannuationDocument1 pageBenefits. by of Sales: 2020. SuperannuationArya RoshanNo ratings yet

- UntitledjahshdhDocument1 pageUntitledjahshdhArya RoshanNo ratings yet

- Sregno NameDocument12 pagesSregno NameArya RoshanNo ratings yet

- 20sje866 BRM PresentationDocument6 pages20sje866 BRM PresentationArya RoshanNo ratings yet