Professional Documents

Culture Documents

Cashflow Forecats Exercise - Good Books

Uploaded by

Georgios MilitsisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cashflow Forecats Exercise - Good Books

Uploaded by

Georgios MilitsisCopyright:

Available Formats

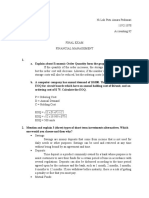

Name: Date:

Business Management( Studies) Worksheet

Cash Flow Forecasts

Good Books ( GB)

Jay Roy runs mini book shop Good Books (GB) specializing in IB diploma and Cambridge

IGCSE books and examination resources. Good Books ( GB) runs as a sole trader. To take

advantage of its good reputation, Roy is planning to open a second shop about 12

kilometers away from the current book shop.

Though GB has internal funds, Roy thinks that borrowing funds from a bank is a good

option to finance. Roy has approached his banker for the partial finance. The bank manager

has insisted Roy to produce cash flow forecasts for three months starting from April 2022.

Roy forecasts revenue and expenses for the first three months of the new book shop as

follows:

Personal or internal funds $ 8 000.

Bank loan at the start of the shop $ 10,000.

Startup expenses (April 2022) $ 6 000.

Monthly rent $ 1 200.

Shop employees’ wages $ 800 per month.

Monthly loan repayment $ 800 starting from June 2022

One-time promotional expenses $ 600( April)

Estimated monthly revenue $ 10 000 ( increases by 5 percent every month)

Questions:

(a) Explain two differences between cash and profit [ 4 marks] [4 marks]

(b) Prepare a monthly cash flow forecast for the first 3 months of operation

of the new shop. Comment on the projected cash flow forecast of the

new shop. [6 marks]

( c) Identify and explain two benefits of cash flow forecast as a planning tool

for Good Books. [4 marks]

Your Learning Partner | ©https://teacherrk.com/ |Page 1 of

Name: Date:

Suggested answers

(a) Explain two differences between cash and profit [ 4 marks]

Cash and profit are two different things that every business owner should know

well. The better you understand them under the broad umbrella of cash

management, the more successful your business will be. Mistaking cash for profit,

and vice versa, could be a serious misstep; a business can be highly profitable while

having a poor cash flow, while a healthy cash flow is not necessarily an indicator of

profitability

The difference between cash and profit is that cash is the money that a company

has in its bank account or in hand, while profit is the revenue of a company minus

the cost of goods sold and expenses (there are two types: Gross profit and net

profit)

Cash is what you need to run your business, while profit is what you can use to grow

your business.

From the accounting point of view, cash is considered as current asset while profit is

a liability.

Ultimately, cash and net profit measure different things. While profit is the goal –

and an indicator of financial health – cash is the lifeblood of an organisation,

keeping operations ticking over on a day-to-day basis.

(b) Prepare a monthly cash flow forecast for the first 3 months of operation [ 6 marks]

of the new shop. Comment on the projected cash flow forecast of the

new shop.

Answer is on the following page

Your Learning Partner | ©https://teacherrk.com/ |Page 2 of

Name: Date:

Good Books

Cash flow forecast for 3 months ( April, May and June)

Details April ($) May ($) June ($)

Opening bank balance (A) 8 000 19 400 27 900

Cash inflows:

Revenue 10 000 10 500 11 025

Bank loan 10 000 - -

Total cash inflows (B) 20 000 10 500 11 025

Cash outflows:

Startup expenses 6 000 - -

Monthly rent 1 200 1 200 1 200

Wages 800 800 800

Loan repayment - - 800

Promotional expenses 600 - -

Total cash outflows (C) 8 600 2 000 2 800

Net cash flow (D = B-C) 11 400 8 500 8 225

Closing balance (E= A+ D) 19 400 27 900 36 125

Forecast cashflow looks positive. Closing cash balance has been increasing month by month.

Hence, Good Books will not have any major cash flow or liquidity problems.

Your Learning Partner | ©https://teacherrk.com/ |Page 3 of

Name: Date:

(c ) Identify and explain two benefits of cash flow forecast as a planning tool [ 4 marks]

for Good Books.

A cashflow forecast is a financial forecast that predicts the future cash flows of a

business. It is an important tool for companies to analyze their performance and

identify potential risks.

With reference to Good Books (GB), two benefits are

Helps in planning

A cashflow forecast helps in planning for the future by providing a clear picture of

Good Book’s cash flow. It is a financial projection that helps in making decisions

about which assets to invest in, how much to spend on start-up expenses, wages,

shop rent, repayment of loan, etc. By forecasting these outflows and as well as

inflows from sales revenue, cash flow forecast helps Jay Roy to deal with any cash

surplus and cash shortages.

Good support document for financial assistance ( loan)

Cash flow forecast provides a good support for business like GB, where planning to

borrow loan from banks or financial institutions. This document enables the banker

to check on the possible cash inflows and outflows of the proposed new store and

check on the solvency and creditworthiness of the business.

Hence, a well-prepared cash flow forecast is a key to the success of a business. It

helps business owners to anticipate and plan for any potential changes in business

finances. A forecast can be used as a tool for financial planning, budgeting, and all

managerial decision making.

===========================================================

For more resources:

✅ https://teacherrk.com/

✅ https://www.youtube.com/c/TeacherRK

Your Learning Partner | ©https://teacherrk.com/ |Page 4 of

You might also like

- CH 6Document16 pagesCH 6Miftahudin Miftahudin100% (3)

- ACIB Past Questions PDFDocument208 pagesACIB Past Questions PDFdamola2real100% (1)

- Financial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesDocument8 pagesFinancial Analysis - Molycorp, Inc. Produces Rare Earth Minerals. the Company Produces Rare Earth Products, Including Oxides, Metals, Alloys and Magnets for a Variety of Applications Including Clean Energy TechnologiesQ.M.S Advisors LLCNo ratings yet

- Assignment 1 - Back Bay Battery Simulation - Shreya Gupta (Final)Document10 pagesAssignment 1 - Back Bay Battery Simulation - Shreya Gupta (Final)Shreya Gupta100% (3)

- Cape Chemical Cash ManagementDocument11 pagesCape Chemical Cash ManagementSeno Patih0% (2)

- 2011 Aug Tutorial 10 Working Capital ManagementDocument10 pages2011 Aug Tutorial 10 Working Capital ManagementHarmony TeeNo ratings yet

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- Short Term Financial PlanningDocument8 pagesShort Term Financial PlanningHassan MohsinNo ratings yet

- Syndicated Leveraged Loans During and After The CrisisDocument25 pagesSyndicated Leveraged Loans During and After The Crisisresat gürNo ratings yet

- Cash Flow Forecast - MEH With AnswersDocument4 pagesCash Flow Forecast - MEH With AnswersPriya IBDPexternalNo ratings yet

- 3.7 ExercisesDocument6 pages3.7 ExercisesGeorgios MilitsisNo ratings yet

- Revision Question BankDocument15 pagesRevision Question BankPuneet SharmaNo ratings yet

- How to Project Business FinancesDocument12 pagesHow to Project Business FinancesLenny Ithau100% (1)

- Collier 1ce Solutions Ch04Document10 pagesCollier 1ce Solutions Ch04Oluwasola OluwafemiNo ratings yet

- Cash Budget:: (A) Receipts & Payments MethodDocument6 pagesCash Budget:: (A) Receipts & Payments MethodGabriel BelmonteNo ratings yet

- T10 Managing Finance Notes by SeahDocument43 pagesT10 Managing Finance Notes by SeahSeah Chooi KhengNo ratings yet

- Topic 3 7 Cash FlowDocument16 pagesTopic 3 7 Cash FlowEren BarlasNo ratings yet

- Working Capital and Cashflows Assignment BECDocument8 pagesWorking Capital and Cashflows Assignment BECWalter tawanda MusosaNo ratings yet

- TC Questions and Answers Part 7 Bank ReconciliationDocument4 pagesTC Questions and Answers Part 7 Bank ReconciliationJayvee Ramos RuedaNo ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingJIMS VK IINo ratings yet

- Dr. (CA) Sanjib Kumar Basu: CA Final Paper 5 Advanced Management Accounting Chapter4Document37 pagesDr. (CA) Sanjib Kumar Basu: CA Final Paper 5 Advanced Management Accounting Chapter4Rah EelNo ratings yet

- How To Make Cash Flow Projections - 0Document6 pagesHow To Make Cash Flow Projections - 0Kyll MarcosNo ratings yet

- Accountancy Class 12 Project On Ratio AnalysisDocument11 pagesAccountancy Class 12 Project On Ratio Analysisaarav100% (1)

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- Cash FlowDocument15 pagesCash Flowvicmuwanga639No ratings yet

- T10 Managing Finance NotesDocument46 pagesT10 Managing Finance NotesNargis Habib MukatyNo ratings yet

- Lecture 9B - Financial BudgetsDocument22 pagesLecture 9B - Financial BudgetsSamuel Addo OseiNo ratings yet

- Working Capital Management TechniquesDocument21 pagesWorking Capital Management TechniquessbsNo ratings yet

- Understanding Cash Flow ProjectionsDocument4 pagesUnderstanding Cash Flow ProjectionsLaxman Zagge100% (2)

- Working Capital Management TechniquesDocument23 pagesWorking Capital Management TechniquessbsNo ratings yet

- Assignment BBA 2008Document32 pagesAssignment BBA 2008ChaiNo ratings yet

- Capital-Budgeting (Managerial Accounting)Document12 pagesCapital-Budgeting (Managerial Accounting)Dawn Juliana AranNo ratings yet

- Unit 5 Topic 4Document5 pagesUnit 5 Topic 4Ibrahim AbidNo ratings yet

- Corporate Finance Tutorial 3 - SolutionsDocument16 pagesCorporate Finance Tutorial 3 - Solutionsandy033003No ratings yet

- How to Prepare a Cash Flow ForecastDocument3 pagesHow to Prepare a Cash Flow Forecastkanika_0711No ratings yet

- Cash Budgeting and Fraud Management: Topic 4Document16 pagesCash Budgeting and Fraud Management: Topic 4sv03No ratings yet

- Investment Appraisal With Solved ExamplesDocument29 pagesInvestment Appraisal With Solved Examplesnot toothlessNo ratings yet

- Amara Prabasari 119211078 (Final Exam - Financial Statement)Document3 pagesAmara Prabasari 119211078 (Final Exam - Financial Statement)Amara PrabasariNo ratings yet

- Bibi Mohamed (Cosmetics Shop) Business Plan 2023 Completed.Document13 pagesBibi Mohamed (Cosmetics Shop) Business Plan 2023 Completed.Stephen FrancisNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Task 4 CompletedDocument13 pagesTask 4 CompletedTan ChongEeNo ratings yet

- 3.8 ExercisesDocument8 pages3.8 ExercisesGeorgios Militsis50% (2)

- Cash Flow PlanningDocument8 pagesCash Flow PlanningababsenNo ratings yet

- Chapter 7 - Capital BudgetingDocument38 pagesChapter 7 - Capital Budgetingnurfatimah473No ratings yet

- Week 5 - Sept 26-30 - AcctgDocument13 pagesWeek 5 - Sept 26-30 - Acctgmaria teresa aparreNo ratings yet

- Intro to Accounting Set 1Document8 pagesIntro to Accounting Set 1David WongNo ratings yet

- Business Finance: Formula and Budget PreparationDocument15 pagesBusiness Finance: Formula and Budget PreparationJims OlanoNo ratings yet

- Google Form Model A.A University 1Document96 pagesGoogle Form Model A.A University 1Tesfu HettoNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument83 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont Collegesma pgriNo ratings yet

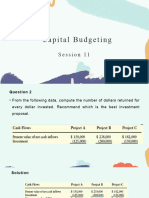

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Financial Ratio Analysis-LiquidityDocument30 pagesFinancial Ratio Analysis-LiquidityZybel RosalesNo ratings yet

- IGNOU MCA MCS-35 Solved Question Papers June 2009Document14 pagesIGNOU MCA MCS-35 Solved Question Papers June 2009Pankaj BassiNo ratings yet

- Cash Budgeting Notes and QuestionsDocument39 pagesCash Budgeting Notes and Questions邹尧No ratings yet

- The Cash-Trust Nexus AssessmentDocument13 pagesThe Cash-Trust Nexus AssessmentAnshik BansalNo ratings yet

- Manual For Finance QuestionsDocument55 pagesManual For Finance QuestionsMShoaibUsmani100% (1)

- Weekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)Document3 pagesWeekly Summary For Self Study - Week 4 (Ch7-Receivables) (Rev F23)That kid 246No ratings yet

- Cu 7en L¿?o Ne: Ti? P Yauc UyteDocument5 pagesCu 7en L¿?o Ne: Ti? P Yauc UyteIan BurnieNo ratings yet

- Chapter 16 Forecasting and Managing Cash FlowDocument43 pagesChapter 16 Forecasting and Managing Cash Flowapi-358995037100% (1)

- Senior High School Department: LessonDocument10 pagesSenior High School Department: LessonJane Decenine CativoNo ratings yet

- Understanding Cash Flow Problems and SolutionsDocument14 pagesUnderstanding Cash Flow Problems and SolutionsAlka DwivediNo ratings yet

- Funding Your Future Beyond Banks: Creative Alternatives to Funding Your Startup or Business InitiativeFrom EverandFunding Your Future Beyond Banks: Creative Alternatives to Funding Your Startup or Business InitiativeNo ratings yet

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessFrom EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNo ratings yet

- 3.8 ExercisesDocument8 pages3.8 ExercisesGeorgios Militsis50% (2)

- 3.9 ExercisesDocument8 pages3.9 ExercisesGeorgios MilitsisNo ratings yet

- 3.6 ExercisesDocument8 pages3.6 ExercisesGeorgios MilitsisNo ratings yet

- 3.1 ExercisesDocument3 pages3.1 ExercisesGeorgios MilitsisNo ratings yet

- 3.5 ExercisesDocument13 pages3.5 ExercisesGeorgios MilitsisNo ratings yet

- 3.2 ExercisesDocument6 pages3.2 ExercisesGeorgios MilitsisNo ratings yet

- 3.3 ExercisesDocument7 pages3.3 ExercisesGeorgios MilitsisNo ratings yet

- What You Should Know: Course 1.3Document22 pagesWhat You Should Know: Course 1.3Georgios MilitsisNo ratings yet

- Course 1.2: What You Should KnowDocument27 pagesCourse 1.2: What You Should KnowGeorgios MilitsisNo ratings yet

- Course 3.3: What You Should KnowDocument18 pagesCourse 3.3: What You Should KnowGeorgios MilitsisNo ratings yet

- How Samsung Can Become More Sustainable Through Reducing Waste And Investing In RenewablesDocument1 pageHow Samsung Can Become More Sustainable Through Reducing Waste And Investing In RenewablesGeorgios MilitsisNo ratings yet

- UntitledDocument1 pageUntitledGeorgios MilitsisNo ratings yet

- Stakeholder Analysis: Understanding Internal and External GroupsDocument24 pagesStakeholder Analysis: Understanding Internal and External GroupsGeorgios MilitsisNo ratings yet

- British GRI 2011 BrochureDocument16 pagesBritish GRI 2011 BrochureGlobal Real Estate InstituteNo ratings yet

- The Yale Endowment Model of Investing Is Not DeadDocument8 pagesThe Yale Endowment Model of Investing Is Not DeadkeatingcapitalNo ratings yet

- Barclays A Guide To MBS ReportsDocument33 pagesBarclays A Guide To MBS ReportsguliguruNo ratings yet

- ÔN THI CUỐI KÌ TCDN 1-MS TRANGDocument6 pagesÔN THI CUỐI KÌ TCDN 1-MS TRANGHoàng Việt VũNo ratings yet

- INVESTMENT MEANING AND FACTORSDocument18 pagesINVESTMENT MEANING AND FACTORSGrasselda SharenNo ratings yet

- National HighwayDocument12 pagesNational Highwayanuj19iitNo ratings yet

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariNo ratings yet

- Review Jurnal Psikologi The LONG MEMORYDocument4 pagesReview Jurnal Psikologi The LONG MEMORYDiah Dwi Putri IriantoNo ratings yet

- The Indian Financial SystemDocument5 pagesThe Indian Financial SystemBala SubramanianNo ratings yet

- Illustration of FIFO, LIFO and Weighted Average Methods of Stock ValuationDocument6 pagesIllustration of FIFO, LIFO and Weighted Average Methods of Stock Valuationneondust1123456No ratings yet

- Capstone Partners Industrials Industry Middle Market Deal Activity Outlook - 2021 1Document27 pagesCapstone Partners Industrials Industry Middle Market Deal Activity Outlook - 2021 1Eric PhanNo ratings yet

- RbiDocument25 pagesRbiShubham SaxenaNo ratings yet

- Certified Tax Adviser (CTA) Qualifying Examination: Paper 1 - Accounting and FinanceDocument4 pagesCertified Tax Adviser (CTA) Qualifying Examination: Paper 1 - Accounting and FinancesamNo ratings yet

- OZ Funds Real Estate EbookDocument29 pagesOZ Funds Real Estate EbookMark PolitiNo ratings yet

- Global Industry Classification StandardDocument52 pagesGlobal Industry Classification StandardAshwin GoelNo ratings yet

- Elevated Complete Bus Plan 1.2Document15 pagesElevated Complete Bus Plan 1.2ee sNo ratings yet

- Renunciation of POA PowersDocument2 pagesRenunciation of POA PowersJatin SharanNo ratings yet

- Depreciation ChartDocument2 pagesDepreciation ChartRakesh DangiNo ratings yet

- Unit Trust Account Opening Form 13.12.2019 1Document4 pagesUnit Trust Account Opening Form 13.12.2019 1henrykibe01No ratings yet

- Investment Risk and Return ChapterDocument10 pagesInvestment Risk and Return ChapterAmbachew MotbaynorNo ratings yet

- Chap Two Risk and ReturenDocument12 pagesChap Two Risk and ReturenAdugna KeneaNo ratings yet

- Corporate Fin. Chapter 10 - Leasing (SLIDE)Document10 pagesCorporate Fin. Chapter 10 - Leasing (SLIDE)nguyenngockhaihoan811No ratings yet

- ForexDocument1 pageForexUMAK Juris DoctorsNo ratings yet

- 3 PDFDocument15 pages3 PDFnorierawatiNo ratings yet

- Chapter 7 Consolidated FS - Part 4Document8 pagesChapter 7 Consolidated FS - Part 4Shane KimNo ratings yet

- PDF 1Document151 pagesPDF 1Nana GandaNo ratings yet

- NPA Loans Report of Udiayankulangara BranchDocument23 pagesNPA Loans Report of Udiayankulangara BranchSUNIL KUMAR TSNo ratings yet