Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

Jyoti Meena0 ratings0% found this document useful (0 votes)

10 views4 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesUntitled

Untitled

Uploaded by

Jyoti MeenaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

Confidential

Time Barring Matter

&

Office of the

Dy. Director of Income Tax (Inv.), Unit-2(3)

Room No. 009, Ground Floor, C Block, Civic Centre, New Delhi - 110 002

F.No. DDIT (Inv/Unit-2(3/Enq. Rep/2018-19/ 1553 Dated: 07.03.2018

To,

The Income Tax Officer,

Ward-2(3), Amritsar

Subject- Enquiry report in the case of Vishal Gems & Jewels Private Limited

(PAN:AABCV2673G)-reg.

Please refer to the above.

Gist of Allegations

2. Information in possession of this office shows that Vishal Gems & Jewels Pvt

Ltd. is maintaining a current account no, 023805001596 with Amritsar-Hall

Bazar (Punjab) branch. PAN is AABCV2673G and account no. 050205000062

linked with same PAN. Alert is triggered under large value of cash transaction

in the account. Transaction pattern shows credits/debits by Cash, transfer,

RIGS and debits by cash withdrawal through self-paid cheques, RTGS,

Transfer of Rs. 10.55 crores out of which Rs.4.88 crores by cash and Rs. 3.61

crore through RTGS..

\quiries conducted

3. Vide order sheet dated 12.10.2018 approval was taken for open enquiry in the

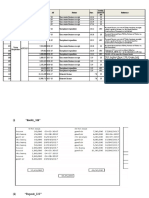

above case and Bank Account statements of bank account no, 023805001596 and

050205000062 were obtained. Summary of credit entries in aforesaid bank

accounts in FY 2011-12 and FY 2012-13 is as under:

Account No. Credit in FY 2011-12 | Credit in 2012-13

(ins GnRs) __|

023805001596 8,36,23,003. 5,00,28,777.

050205000062 | 2,93,90,000. 48,80,000

[Total 11,30,13,003 5,49,08,77,

x

Summons dated 17.10.2018 was sent to the assessee at his Delhi address to

confirm genuineness of the source of the credits. The summons was returned

by the postal department with remarks “no such firms at this address”, Field

enquiry was done to ascertain the identity of M/s Vishal Gems & Jewels

Private Limited. As per enquiry, no such company exists on the given address

at present, However, it was found that it had operated from Karol Bagh, Delhi

few years back,

Also, summons was sent to M/s Vishal Gems & Jewels Private Limited at its

Punjab address in Amritsar. In reply of the summon, which was received on

03.01.2019, Sh. Varinder Kumar - Director of the company, sought adjournment

on medical grounds as he had undergone heart surgery and doctor had

advised him bed rest. He had attached report of the doctor alongwith.

Subsequently he was contacted telephonically twice after reasonable gap to

submit books of accounts and other details so as to confirm genuineness of the

source of credits. He further, requested for more time citing his ill health, Later,

through email dated 28.02.2019, he had sent incomplete document set which

included:

() Some purchase bills for FY 2011-12 and FY 2012-13, which did not

match with the purchases as claimed in the ITR,

Ledger of bank account statements 023805001596 and 050205000062

during FY 2011-12 and FY 2012-13,

(iii) Ledger of M/s Ultimate Creations in its books for FY 2011-12 and FY

2012-13.

No details have been submitted hence after and the complete details have not

been verified.

Also, copy of account of M/s Vishal Gems & Jewels Private Limited in the

books of M/s Ultimate Creations was sought. The confirmation from M/s

Ultimate Creations along with its bank book was obtained and has been kept

on record.

In the STR, few other accounts (80) have also been mentioned regarding which

it has been indicated that “the subject entity has following additional bank

accounts in which substantial cash transactions have taken place”. On enquiry,

the details regarding many such accounts were obtained and 70 verified and it

has been found that these do not belong to M/s Vishal Gems & Private

Limited.

ITR profiling

10. ‘The company has filed ITR for AY 2012-13 and 2013-14 showing Turnover and

GTlas per following details.

[AY | TURNOVER | GTI |

2012-13 | 18,68,51,732_|_7,80,368_|

2013-14 | 12,15,52,656 780,893.

Outcome of Enquiry:

11. On the basis of enquiries, it has been found that the credits in the bank account

during AY 2012-13 and AY 2013-14 are Rs. 11,30,13,003 and Rs. 5,49,08,777.

Also, if the period as mentioned in the STR is considered which is from

25.05.2011 to 30.08.2012, the total credit amount is of Rs. 10.55 crore, which is

less than the sales declared in ITR. It is pertinent to mention here that the

Principal Officer has not submitted any books of accounts despite being

contacted through summons and telephone. In the absence of any submission

by the subject, the source of credits in the books remain unverified. Thus, the

total deposits in respective AYs remains unverified, which is Rs. 11,30,13,003

for AY 2012-13 and Rs. 5,49,08,777 for AY 2013-14 respectively and is

recommended for addition in relevant AYs.

Suggestions to Assessing Officer:

12. In view of above, you are advised to verify genuineness of the source of fund

and consider thereafter initiation of action under section 147 for escapement of

income from assessment to the tune of Rs. 11,30,13,008 for AY 2012-13 and Rs.

5,A49,08,777 for AY 2013-14. Any kind of bank fraud, money laundering

transaction or violation of any other law in force, is observed, you are

advised to write to appropriate authorities informing the same.

13. In case, jurisdiction over the case does not pertain to your office, the case may

be forwarded to correct jurisdiction under intimation to this office.

This issues with the approval of Pr.DIT(Inv.}-2, New Delhi.

Dy. Director of Income Tax(Inv.),

Unit-2(3), New Delhi

Encl: Bank Statement

Copy to:

(1) Pr.CIT-1, Amritsar as Se

(2) AddL.CIT, Range-2, Amritsar RA

Dy. Director of eas

Unit-2), New Delhi

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- OECD Conducting Financial Investigation PDFDocument7 pagesOECD Conducting Financial Investigation PDFJyoti MeenaNo ratings yet

- TDS CertificateDocument2 pagesTDS CertificateJyoti MeenaNo ratings yet

- UntitledDocument7 pagesUntitledJyoti MeenaNo ratings yet

- Account DetailsDocument3 pagesAccount DetailsJyoti MeenaNo ratings yet

- UntitledDocument7 pagesUntitledJyoti MeenaNo ratings yet

- SN Entity PAN Addition Amount AY Nature para Reference Section Under IT ActDocument5 pagesSN Entity PAN Addition Amount AY Nature para Reference Section Under IT ActJyoti MeenaNo ratings yet

- SN Entity PAN AY Addition AmountDocument105 pagesSN Entity PAN AY Addition AmountJyoti MeenaNo ratings yet

- Order Appealed Against 2Document27 pagesOrder Appealed Against 2Jyoti MeenaNo ratings yet

- Attachment-002 Plie - 1034344288Document1 pageAttachment-002 Plie - 1034344288Jyoti MeenaNo ratings yet

- 2020 08 08 16 32 44 678 - Aaecb8489p - 2019Document16 pages2020 08 08 16 32 44 678 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet

- 2020 08 08 16 54 23 843 - Aaecb8489p - 2019Document83 pages2020 08 08 16 54 23 843 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet