Professional Documents

Culture Documents

Accounting NOTES

Uploaded by

Kisumi ShiginoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting NOTES

Uploaded by

Kisumi ShiginoCopyright:

Available Formats

HANDOUT

ACCOUNTING

Media- banking terminology that refers to the basis of the transaction as in posting media.

BRS- an accounting tool used by the businesses and individuals to know the true balance of cash in the bank account

Two types of Discounts

Trade Discount

- reductions in the list price to entice customers to buy in bulk.

- is not recorded in books of accounts.

- gives you the invoice price

Cash Discount

- Computed as reductions in the invoice price so that customers will pay earlier than the due date.

- These are recorded in the books of accounts as sales discounts or purchase discounts.

TAX AND TAXATION

Tax- an imposition by the government upon person, property, or right exercised within its jurisdiction.

Taxation- refers to the power of the state by which the sovereign raises revenue to defray the necessary expenses of the

government.

Rationale of Taxation

PRINCIPLES OF TAXATION

Fiscal adequacy- means that sources of revenue are sufficient to meet the government expenditures

Equality or Theoretical Justice- requires that the tax imposed must me proportionate to taxpayer’s ability to pay.

Administrative feasibility- demands that the law must be capable of convenient, just and effective administration

PURPOSES OF TAXATION

Primary purposes/fiscal purpose

- to take care of the basic needs of the citizens of the areas of health, education, safety, and protection

- to provide infrastructure for the conduct of commerce and industry.

Ex. Construction of schools, roads, bridges, public markets and hospitals.

Secondary purposes

- Regulatory – conveys that taxation is employed as a device od regulation or control by means of which certain

effects or conditions envisioned by the government may be achieved.

- Compensatory – signifies imposition or levying of taxes to attain some social and economic ends, irrespective of

whether the revenue is actually raised or not.

GENERAL PROCESS OF TAXATION

Tax Identification Number (TIN)- assigned to the business entity upon registration with BIR.

BIR Form 1903- accomplished by the business, which shall be supported by (a) securities and exchange commission

(SEC) and (b) a mayor’s business permit

Certificate of registration- must be renewed annually before 31 January

BIR Form 1902- fills up by an individual taxpayer deriving income from compensation and supported by his/her birth

certificate certified by (NSO) or National Statistics Office and declared dependents.

e- Services- taxpayer’s can-do electronic filing.

INCOME AND BUSINESS TAXATION

Income taxation- the levying of taxes on income of the tax payer based on his/her residence, citizenship, or place where

the income was earned.

Taxation – the imposition of taxes on an individual or business entity based on the place where the business is being

operated.

PRINCIPLES OF INCOME TAXATION

Income – the metric of the taxpayer’s capability to pay tax.

Gross income- is any flow of wealth to the taxpayer that increases net worth from any source legal or illegal.

Compensation income- all remuneration received under an employment.

Business income- arises from a regular conduct of any commercial activity resulting in regular sales of goods or services

by an individual or a business organization.

Income from profession- income from the sale of services, the income earned due to the skill you possess.

Income from properties- include rental income and forms of passive income which earned with very little amount of

involvement by the taxpayer.

Gain on sale dispositions of real property in the Philippines

Gain on sale dispositions of domestic directly to buyer

Gains from the other capital assets

TYPES OF INCOME TAX PAYERS

Resident citizen- refers to a Filipino citizen residing in the Philippines.

Non- resident citizen- a citizen of the Philippines who satisfactorily proves that he/she resides abroad intentionally

during the taxable year.

Resident alien- pertains to an individual who is residing in the Philippines but is not a citizen.

Non- resident aliens- are of two types; nonresident alien engaged in trade or business in the Philippines and

nonresident alien not engaged in trade or business (NRA- NETB)

Special aliens- refer to aliens, including qualified Filipinos, employed by a regional or area headquarters or regional

operating headquarters of multinational companies, offshore banking units and petroleum services contractors or

subcontractors.

Domestic corporation- is one that organized in accordance with Philippine laws.

Situs of income- is another principle of income taxation. It determines whether or not an income is taxable in the

Philippines.

PROCESS OF INCOME TAXATION

Final income taxation- a system whereby the person making the income payments is responsible to withhold the tax.

Passive income- are enumerated in inclusions in gross income. Different investments made by the individual

Interest income- from foreign currency deposits under the foreign system or expanded foreign currency deposit system

(EFCDS) under the local banking system.

Dividends- refer to distribution of a corporation’s profits to its shareholders.

Creditable withholding tax- is imposed on most items of regular income and is withheld at source by customers or

clients, but is not the final tax.

Regular income tax- is computed based on taxable income.

PRINCIPLES OF BUSINESS TAXATION

Excise tax- is imposed only on manufacturers or importers. Excise taxes are of two kinds: a) specific tax and b) ad

valorem tax. These two are differentiated in terms of tax basis. Specific tax is based on weight or volume capacity or the

physical unit of measurement. On the other hand, ad valorem tax is based on the selling price or other specified value of

the article.

VAT- is a tax on consumption, levied on the sale, barter, exchange or lease of goods or properties and services in the

Philippines and the importation of goods

into the Philippines.

DISTINCTION BETWEEN INDIVIDUAL AND BUSINESS TAXATION

Personal exemptions- refer to the theoretical personal, Irving, and family expenses of an individual allowed to be

deducted from gross income. The types of personal exemptions are basic personal additional personal exemption, and

premium for health and hospitalization insurance.

Basic personal exemptions- are 50 000.00 each for (a) single, including separated spouse without a dependent, widow,

or widower, (b) head of the family, and (c) married.

THREE INTENENT POWER OF THE GOVERNMENT

1. Eminent domain- the power of the government to take private property, upon payment of just compensation to

be used for public purposes.

2. Police power- the power f government to make laws that will promote public health, morals, safety, and welfare

of the people.

3. Taxation – pwer of government to collect taxes that will be used to finance different projects needed by the

people.

INCOME TAXATION

Two biggest classification of income taxpayers

a. Individuals

b. Corporation

RATE TO COMPUTE

Basic over Not over Tax Plus Of excess over

10,000 5%

10,000 30,000 5,000 10% 10,000

30,000 70,000 2,000 15% 30,000

70,000 140,000 8,500 20% 70,000

140,000 250,000 22,500 25% 140,000

250,000 500,000 50,000 30% 250,000

500,000 125,000 32% 500,000

QUALIFICATIONS FOR DEPENDENT

A. Must be legitimate, illegitimate or legally adopted child of the tax payer

B. Must be chiefly dependent upon the taxpayer and still living with them

C. Must not be more than 21 years old, unmarried and not gainfully employed.

D. Though more than 21 years old

TYPES OF BANK DEPOSITS

1. DEMAND DEPOSIT- demand anytime

2. SAVINGS DEPOSIT- long process

3. TIME DEPOSITS- limited withdrawal

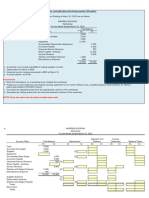

Bank reconciliation

- A statement which brings into agreement, the cash balance per book and cash balance per bank

Book reconciliation items

1. Credit memos (CM)

- notes receivable collected by the bank in favor of the depositor

- process of bank loan

- matured time deposits transferred by the bank to the current account

2. Debit memos (DM)

- refers to the item not representing checks paid by the bank which are charged on debited by the bank to the

account of the depositor

- not yet recorded by the depositor as cash disbursement

- NSF or no sufficient fund checks, these are checks deposited but returned by the bank because of insufficient

fund

- technically defective checks, these are checks deposited but returned by the bank because of technical defect

-bank service charge

- reduction of loan

3. Errors

Bank reconciliation items

1. Outstanding check (OC)

2. Deposit in transit (DIT)

3. Errors

Purpose of BRS

- To monitor bank accounts/ bank transactions

Bank statement

- Monthly report of the bank of the depositor showing the cash balance per bank at the

TAXATION beginning BRS

You might also like

- Multiple Choice: Chapter 9: Responsibility Accounting and DecentralizationDocument43 pagesMultiple Choice: Chapter 9: Responsibility Accounting and Decentralizationquanghuymc100% (2)

- Botswana Tax Lecture Slides, SydneyDocument84 pagesBotswana Tax Lecture Slides, Sydneysmedupe100% (1)

- p2 - Guerrero Ch11Document24 pagesp2 - Guerrero Ch11JerichoPedragosa100% (2)

- PharmacyclicsDocument2 pagesPharmacyclicsanupam2401840% (1)

- Module 8 - CASH FLOW STATEMENTDocument17 pagesModule 8 - CASH FLOW STATEMENTmsjoyceroxane100% (1)

- Income, Tax Treatment and Mode of Filing 2020Document2 pagesIncome, Tax Treatment and Mode of Filing 2020francis dungcaNo ratings yet

- Income Tax ComplianceDocument4 pagesIncome Tax ComplianceJusefNo ratings yet

- TaxationDocument38 pagesTaxationEphraim LopezNo ratings yet

- Withholding Taxes: Carlo P. Divedor 19 October 2017Document20 pagesWithholding Taxes: Carlo P. Divedor 19 October 2017Melanie Grace Ulgasan LuceroNo ratings yet

- Withholding Tax 101Document82 pagesWithholding Tax 101Loy Bals100% (1)

- Withholding Taxes 2Document20 pagesWithholding Taxes 2hildaNo ratings yet

- Fabm 2 ReviewerDocument3 pagesFabm 2 ReviewermurzkieplayzNo ratings yet

- Taxation Interest Income and Its Effect On SavingsDocument25 pagesTaxation Interest Income and Its Effect On SavingsTimothy AngeloNo ratings yet

- Interview QuestionsDocument12 pagesInterview QuestionsnadeemNo ratings yet

- Ngas & NposDocument7 pagesNgas & NposRenalyn MadeloNo ratings yet

- Taxation Principles and PracticesDocument16 pagesTaxation Principles and PracticesAmira NajjarNo ratings yet

- UP 2008 Taxation Law (Taxation 1)Document63 pagesUP 2008 Taxation Law (Taxation 1)Gol LumNo ratings yet

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- To 10,000 Taxpayers To Be Expanded To 20,000Document1 pageTo 10,000 Taxpayers To Be Expanded To 20,000macyaelNo ratings yet

- Accounting For Disbursement and Related TransactionsDocument16 pagesAccounting For Disbursement and Related TransactionsKattNo ratings yet

- Frequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?Document9 pagesFrequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?vanguardNo ratings yet

- Effective Tax ManagementDocument19 pagesEffective Tax ManagementMary Kathe Rachel ReyesNo ratings yet

- Reviewer in Accounting 2Document5 pagesReviewer in Accounting 2kim natividadNo ratings yet

- Tax 1 Unit 1. Chapter 4Document5 pagesTax 1 Unit 1. Chapter 4angelika dijamcoNo ratings yet

- CTP 22 QuestionsDocument31 pagesCTP 22 QuestionsNitin MalikNo ratings yet

- in Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideDocument6 pagesin Regards To The Offshore Registration and Please Know That A GBC 2 Conducts Business OutsideChille Nchimunya BwalyaNo ratings yet

- TAX LAW and ADMINISTRATIONDocument11 pagesTAX LAW and ADMINISTRATIONReStyleNo ratings yet

- Bureau of Internal Revenue Quezon CityDocument6 pagesBureau of Internal Revenue Quezon CityPeggy SalazarNo ratings yet

- Agnpo - FinalsDocument14 pagesAgnpo - FinalsMiraflor Sanchez BiñasNo ratings yet

- The Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationDocument8 pagesThe Economic Impacts of Taxation: The Effects of Direct Taxation, The Effects of Indirect TaxationBiniamNo ratings yet

- Income TaxationDocument22 pagesIncome TaxationMorano, Angeline G.No ratings yet

- 1 Quiz ChapterDocument7 pages1 Quiz ChapterJoebet DebuyanNo ratings yet

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezNo ratings yet

- Revenue and Other Receipts: Revenue From Exchange TransactionsDocument6 pagesRevenue and Other Receipts: Revenue From Exchange TransactionsMaria Cecilia ReyesNo ratings yet

- TAX1 ReviewerDocument97 pagesTAX1 ReviewerAbdulwahid MadumNo ratings yet

- DYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Document14 pagesDYBSAAgn313 - Accounting For Government & Non-Profit Organizations (SEMI-FINAL MODULE)Jonnafe Almendralejo IntanoNo ratings yet

- Q1. What Is Tax Administration?Document10 pagesQ1. What Is Tax Administration?Joyce Ann RepanaNo ratings yet

- Final Answers For Taxation!Document11 pagesFinal Answers For Taxation!jerald delloro100% (1)

- Wa0011.Document106 pagesWa0011.SHIVAM BHATTACHARYANo ratings yet

- Tax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeDocument7 pagesTax-Free Exchanges That Are Not Subject To Income Tax, Capital Gains Tax, Documentary Stamp Tax And/or Value-Added Tax, As The Case May BeJouhara ObeñitaNo ratings yet

- Department of Finance v. Asia United BankDocument19 pagesDepartment of Finance v. Asia United BankMarj BaquialNo ratings yet

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsJustine GuilingNo ratings yet

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- BIR Tax Briefing - RR 11-2018Document3 pagesBIR Tax Briefing - RR 11-2018Jeff BulasaNo ratings yet

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- Government Accounting DiscussionDocument8 pagesGovernment Accounting DiscussionSamantha Alice LysanderNo ratings yet

- Gov Acc 2019 JaaDocument9 pagesGov Acc 2019 JaaGlaiza Lerio100% (1)

- Abm - Income and Business TaxationDocument44 pagesAbm - Income and Business Taxationmeg100% (1)

- Taxation Law: Asia Pacific College of Advanced StudiesDocument14 pagesTaxation Law: Asia Pacific College of Advanced StudiesIsabelita PavettNo ratings yet

- W3 Module 3 - Tax Administration Part IIDocument14 pagesW3 Module 3 - Tax Administration Part IIElmeerajh JudavarNo ratings yet

- Simply Cleaning: Taxation IssuesDocument10 pagesSimply Cleaning: Taxation IssuesadeelmuzaffaralamNo ratings yet

- TDS - TCSDocument55 pagesTDS - TCSBeing HumaneNo ratings yet

- CHAPTER 5 - DisbursementDocument25 pagesCHAPTER 5 - DisbursementMohammadNo ratings yet

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- Government Accounting MidtermDocument10 pagesGovernment Accounting MidtermJerichoPedragosaNo ratings yet

- PFTP PostMidsemDocument236 pagesPFTP PostMidsemMS ArshaqNo ratings yet

- Fabm2 TaxationDocument4 pagesFabm2 TaxationFrancine Joy AvenidoNo ratings yet

- Introduction To Income TaxDocument80 pagesIntroduction To Income Taxkana lahotiNo ratings yet

- Government Accounting ReviewerDocument8 pagesGovernment Accounting ReviewerJoana loize CapistranoNo ratings yet

- NGAS - NPOS - With AnswersDocument10 pagesNGAS - NPOS - With AnswersDardar Alcantara100% (1)

- Basic Concepts of TaxationDocument9 pagesBasic Concepts of TaxationAyush BholeNo ratings yet

- Government AccountingDocument17 pagesGovernment AccountingJaniña Natividad100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Etech NOTESDocument2 pagesEtech NOTESKisumi ShiginoNo ratings yet

- Economics NOTESDocument2 pagesEconomics NOTESKisumi ShiginoNo ratings yet

- Business Ethics NotesDocument1 pageBusiness Ethics NotesKisumi ShiginoNo ratings yet

- EntrepreneurshipDocument3 pagesEntrepreneurshipKisumi ShiginoNo ratings yet

- PRDocument1 pagePRKisumi ShiginoNo ratings yet

- A-Z BucketlistDocument4 pagesA-Z BucketlistKisumi ShiginoNo ratings yet

- Mock Test 7 Suggested SolutionDocument10 pagesMock Test 7 Suggested SolutionHung SarahNo ratings yet

- Frankline OchiengDocument30 pagesFrankline OchiengOscar KipchumbaNo ratings yet

- Project: Prepare A Worksheet, Financial Statements, and Adjusting and Closing Entries (15 Marks)Document5 pagesProject: Prepare A Worksheet, Financial Statements, and Adjusting and Closing Entries (15 Marks)jonialbadri1000No ratings yet

- Final FsDocument35 pagesFinal FsJykyll PaulNo ratings yet

- Chapter 1 NumericalsDocument10 pagesChapter 1 NumericalsPradeep GautamNo ratings yet

- Deductions From House Property IncomeDocument6 pagesDeductions From House Property Incomedinesh babuNo ratings yet

- Unit-I-Introduction To Macro Economics & National IncomeDocument2 pagesUnit-I-Introduction To Macro Economics & National IncomeShubhamNo ratings yet

- JU-BA-SEM-V-Development EconomicsDocument219 pagesJU-BA-SEM-V-Development EconomicsRiya Gupte100% (1)

- Jawaban Silus Adijaya 2015Document15 pagesJawaban Silus Adijaya 2015natsu dragnelNo ratings yet

- Week 9.1 - Welfare Policy and Income DistributionDocument30 pagesWeek 9.1 - Welfare Policy and Income DistributionPedro Almeida LoureiroNo ratings yet

- 01 03 Accretion Dilution AfterDocument3 pages01 03 Accretion Dilution AfterДоминик КоббNo ratings yet

- Activity Sheets in Fundamentals of Accountanc2Document5 pagesActivity Sheets in Fundamentals of Accountanc2Irish NicolasNo ratings yet

- Summary Rules of Prizes and Winnings For Individual TaxpayersDocument2 pagesSummary Rules of Prizes and Winnings For Individual TaxpayersAllia AntalanNo ratings yet

- Comprehensive Example of Interperiod TAX ALLOCATIONDocument9 pagesComprehensive Example of Interperiod TAX ALLOCATIONarsykeiwayNo ratings yet

- Income Determination & MultiplierDocument23 pagesIncome Determination & MultiplierPrabhneetNo ratings yet

- DuPont Analysis Excel TemplateDocument3 pagesDuPont Analysis Excel TemplateMovil MathiasNo ratings yet

- CH 4 In-Class ExerciseDocument4 pagesCH 4 In-Class ExerciseAbdullah alhamaadNo ratings yet

- Cambridge Assessment International Education: Economics 0455/21 October/November 2019Document21 pagesCambridge Assessment International Education: Economics 0455/21 October/November 2019shrutisonibkn18No ratings yet

- Income Elasticity DemandDocument14 pagesIncome Elasticity DemandShreiyas SarafNo ratings yet

- MID EXAM Yustinus Samuel - 29120512 - YP64CDocument12 pagesMID EXAM Yustinus Samuel - 29120512 - YP64CyustinusNo ratings yet

- Business Model Case Study - Fintech Part IDocument28 pagesBusiness Model Case Study - Fintech Part IRaj KumarNo ratings yet

- A Tale of Prudence IASBDocument6 pagesA Tale of Prudence IASBChrizii SalzNo ratings yet

- Leac 203Document27 pagesLeac 203Ranveer SinghNo ratings yet

- Project I - Reading Note For StudentsDocument38 pagesProject I - Reading Note For StudentsTesfaye GutaNo ratings yet

- Punjab Small Industries Corporation Lahore (PSIC)Document42 pagesPunjab Small Industries Corporation Lahore (PSIC)Mueenhasan100% (1)

- 1, 2Document94 pages1, 2Gopi NathNo ratings yet

- EnjeuxDocument16 pagesEnjeuxAnouar OueslatiNo ratings yet