Professional Documents

Culture Documents

Pharmacyclics

Uploaded by

anupam240184Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pharmacyclics

Uploaded by

anupam240184Copyright:

Available Formats

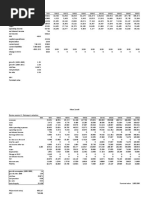

Projected Offering Expenses

2000 2001 2002 2003 2004

R&D expenses 27.5 42.5 38 44 54.5

SG&A 5 15 35 53 62

Total OE 32.5 57.5 73 97 116.5

income statement

2004 2003 2002 2001 2000 2000*

Licence & grant revenue 1000

contract revenue 303

total revenue 0 0 0 0 0 1303

research & development 54.5 44 38 42.5 27.5 10967

general & administration 62 53 35 15 5 1934

total operating expenses 116.5 97 73 73 32.5 12901

loss from operation -116.5 -97 -73 -73 -32.5 -11598

interest income 2557

interest expenses -8

interest net 0 0 0 0 0 2549

loss before income tax -9049

provision for income tax 0

net profit 0 0 0 0 0 -9049

assuming license n co

Revenue from Xcytrin 2005 2004 2003 2002

Revenue(USA) 680000000 442000000 289000000 34000000

COGS 136000000 88400000 57800000 6800000

Gross profit(USA) 544000000 353600000 231200000 27200000

Revenue(outside) 425000000 255000000 85000000

Gross Profit(outside) 127500000 76500000 25500000

total gross profit 671500000 430100000 256700000 27200000

Revenue From Lutrin

Contribution 20000000 9000000 3000000

Total revenue 451100000 266700000 31200000

total operating expenses 116000000 97000000 73000000

EBIT 335100000 169700000 -41800000

Add depreciation/amortization

· Why is Pharmacyclics considering an equity issue in March 2000?

· Forecast of after tax cash flows through 2002 assuming Xcytrin & Lutrin are approved, if not approved.

· As of March 2000 how many future years of funding does Pharmacyclics have?

· What funding strategy is apparent in Pharmacyclics pre-IPO financing? Why managers would want to follo

Assumption(Xcytrin)

radiation treatment for brain met 170000 used perce 0.2

cost per treatment 10000

COGS 2000

used in USA 0.02 0.17 0.26 0.4

used outside USA 0.05 0.15 0.25

1999 1998 1997 1996 1995

750 2700 25 301 79

1291 831 0 0 0

2041 3531 25 301 79

21889 13973 9632 7641 9330

2762 1987 1905 1515 996

24651 15960 11537 9156 10326

-22610 -12429 -11512 -8855 -10247

0 0 0 0 0

0 0 0 0 0

1000000

Cash and Cash Equivalent 2000 61.164

expenditure 2000 32.5

expenditure 2001 57.5

-28.836

till mid of 2001

are approved, if not approved.

Why managers would want to follow this strategy? Does it benefit the investors too?

You might also like

- Case 3 - Pharmacyclics Group 6Document3 pagesCase 3 - Pharmacyclics Group 6davidsison0% (1)

- Pharmacyclics: Financing Research and DevelopmentDocument2 pagesPharmacyclics: Financing Research and Developmentkaye0% (1)

- 3Document8 pages3YogeshPrakashNo ratings yet

- Case 8 - Pharmacyclics - Finance Research and DevelopmentDocument1 pageCase 8 - Pharmacyclics - Finance Research and DevelopmentYun Clare YangNo ratings yet

- Pharmacyclics Final Case StudyDocument6 pagesPharmacyclics Final Case StudyKrystal Osial100% (2)

- Individual AssignmentDocument10 pagesIndividual Assignmentparitosh nayakNo ratings yet

- American Chemical Corp EX NOTESDocument18 pagesAmerican Chemical Corp EX NOTESRex Jose50% (2)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Whether Merck Should Take Licensing of DavanrikrugDocument19 pagesWhether Merck Should Take Licensing of DavanrikrugratishmayankNo ratings yet

- Sealed Air's Leveraged Recapitalization Drives Improved PerformanceDocument3 pagesSealed Air's Leveraged Recapitalization Drives Improved Performancenishant kumarNo ratings yet

- Asset Beta AnalysisDocument13 pagesAsset Beta AnalysisamuakaNo ratings yet

- Sealed Air Co Case Study Queestions Why Did Sealed Air Undertake A LeveragDocument9 pagesSealed Air Co Case Study Queestions Why Did Sealed Air Undertake A Leveragvichenyu100% (1)

- Financial Accounting and Reporting: The Game of Financial RatiosDocument8 pagesFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNo ratings yet

- Interest (1 - (1+r) - N/R) + PV of The Principal AmountDocument2 pagesInterest (1 - (1+r) - N/R) + PV of The Principal AmountBellapu Durga vara prasadNo ratings yet

- Sealed Air CorporationDocument4 pagesSealed Air CorporationValdemar Miguel SilvaNo ratings yet

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccNo ratings yet

- JHT's SuperMud Four Year System Project Financial AnalysisDocument4 pagesJHT's SuperMud Four Year System Project Financial Analysisanup akasheNo ratings yet

- American Chemical Corp (ACC) Case Study Executive SummaryDocument1 pageAmerican Chemical Corp (ACC) Case Study Executive SummaryNatasha SuddhiNo ratings yet

- EC2101 Practice Problems 8 SolutionDocument3 pagesEC2101 Practice Problems 8 Solutiongravity_coreNo ratings yet

- Maria HernandezDocument2 pagesMaria HernandezUjwal Suri100% (1)

- The value of an unlevered firmDocument6 pagesThe value of an unlevered firmRahul SinhaNo ratings yet

- Merck & Company Product - Decision TreeDocument11 pagesMerck & Company Product - Decision TreeIgor SoaresNo ratings yet

- PlanetTran EvaluationDocument18 pagesPlanetTran EvaluationNATOEENo ratings yet

- FM-07 Valuations, Mergers Acquisitions Question PaperDocument4 pagesFM-07 Valuations, Mergers Acquisitions Question PaperSonu0% (1)

- Excel Spreadsheet Sampa VideoDocument5 pagesExcel Spreadsheet Sampa VideoFaith AllenNo ratings yet

- Year 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5Document30 pagesYear 1979 1980 1981 1982 1983 1984 Period 0 1 2 3 4 5shardullavande33% (3)

- Sealed Air Corporation's Leveraged Recapitalization (A)Document10 pagesSealed Air Corporation's Leveraged Recapitalization (A)Ramji100% (1)

- Radio OneDocument7 pagesRadio OneVvb Satyanarayana0% (1)

- Financial Management - Case - Sealed AirDocument7 pagesFinancial Management - Case - Sealed AirAryan AnandNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesNavinMohanNo ratings yet

- Radio OneDocument23 pagesRadio Onepsu0168100% (1)

- Sampa Case SolutionDocument4 pagesSampa Case SolutionOnal RautNo ratings yet

- Yell Case Exhibits Growth RatesDocument12 pagesYell Case Exhibits Growth RatesJames MorinNo ratings yet

- Dividend Decision at Linear TechnologyDocument8 pagesDividend Decision at Linear TechnologyNikhilaNo ratings yet

- Accounts Case StudyDocument9 pagesAccounts Case Studydhiraj agarwalNo ratings yet

- Sealed AirDocument7 pagesSealed AirAnju BabuNo ratings yet

- Problem Set 6: Option Pricing: One-Period Financial Market ModelDocument14 pagesProblem Set 6: Option Pricing: One-Period Financial Market ModelmariaNo ratings yet

- Corp Gov Group1 - Sealed AirDocument5 pagesCorp Gov Group1 - Sealed Airdmathur1234No ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Multi Tech Case AnalysisDocument1 pageMulti Tech Case AnalysisRit8No ratings yet

- Sealed Air Case StudyDocument8 pagesSealed Air Case StudyDo Ngoc Chau100% (4)

- Radio One AnswerDocument3 pagesRadio One AnswerAditya Consul50% (6)

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Airthread Connections Case Work SheetDocument45 pagesAirthread Connections Case Work SheetBhuvnesh Prakash100% (1)

- Annual Report 2001-2002: Godrej Industries Limited - Financial HighlightsDocument2 pagesAnnual Report 2001-2002: Godrej Industries Limited - Financial HighlightsRaakze MoviNo ratings yet

- NetscapeDocument3 pagesNetscapeulix1985No ratings yet

- 2006 CSL Income Statement Financial RatiosDocument15 pages2006 CSL Income Statement Financial RatiosUZAIR300No ratings yet

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDocument7 pagesInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNo ratings yet

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Financials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009Document2 pagesFinancials of NYSE For The Period Between Fys 2003-2005 and NYSE Euronext For The FY 2007-2009BasappaSarkarNo ratings yet

- Comparative Common-Size Statement AnalysisDocument8 pagesComparative Common-Size Statement AnalysisAparna Raji SunilNo ratings yet

- GCMMF Balance Sheet 1994 To 2009Document37 pagesGCMMF Balance Sheet 1994 To 2009Tapankhamar100% (1)

- Kohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Document54 pagesKohat Cement Company LTD: Profit and Loss Account For The Year Ended On . Rupees in (''000'') Gross Sales 1958321 2800130Sohail AdnanNo ratings yet

- Ceres Gardening Company Submission TemplateDocument8 pagesCeres Gardening Company Submission TemplateSmriti RahejaNo ratings yet

- Project Report Power UnsoiledDocument20 pagesProject Report Power Unsoiledshubham jagtapNo ratings yet

- Annual Report 2022Document512 pagesAnnual Report 2022JohnNo ratings yet

- KO Income Statement: Total RevenueDocument4 pagesKO Income Statement: Total RevenueSadiya Basheer Sadiya BasheerNo ratings yet

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- Team Titans FerarriDocument14 pagesTeam Titans FerarriAhmed Afridi Bin FerdousNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Key Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Document6 pagesKey Fact Statement Fincorp Limited (Formerly Known As Magma Fincorp Limited) (PFL)Ritu RajNo ratings yet

- University OF Lagos, Akoka: Postgraduate Past Questions AND AnswersDocument20 pagesUniversity OF Lagos, Akoka: Postgraduate Past Questions AND Answersokiwe tobechukwuNo ratings yet

- Problems and Prospects of Marketing in Developing Economies - The Nigerian Experience PDFDocument10 pagesProblems and Prospects of Marketing in Developing Economies - The Nigerian Experience PDFaliNo ratings yet

- Form 135Document4 pagesForm 135TechnetNo ratings yet

- Dell's Working Capital - RDocument23 pagesDell's Working Capital - REmaNo ratings yet

- Week 6-7 joint costs allocationDocument5 pagesWeek 6-7 joint costs allocationFebemay LindaNo ratings yet

- Business Models: Dr. Megha Chauhan Symbiosis Law School, NOIDADocument29 pagesBusiness Models: Dr. Megha Chauhan Symbiosis Law School, NOIDALsen IilkhusxNo ratings yet

- Indian Economy by Ramesh Singh 11 EditionDocument49 pagesIndian Economy by Ramesh Singh 11 Editionanon_726388494No ratings yet

- BF ASN InvestmentDocument1 pageBF ASN InvestmentkeuliseutinNo ratings yet

- Tim Hortons' Key Success Factors: Brand Recognition, Location, Customer SatisfactionDocument2 pagesTim Hortons' Key Success Factors: Brand Recognition, Location, Customer SatisfactionSong LiNo ratings yet

- The Contemporary World M6T4Document13 pagesThe Contemporary World M6T4joint accountNo ratings yet

- JP Morgan Top PicksDocument17 pagesJP Morgan Top PicksysnngncNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Southeast Asian Views On The United States - Perceptions Versus Objective Reality - FULCRUMDocument13 pagesSoutheast Asian Views On The United States - Perceptions Versus Objective Reality - FULCRUMshotatekenNo ratings yet

- Dropship Suspend AppealDocument10 pagesDropship Suspend AppealenesahvalekinciNo ratings yet

- Vat or NotDocument3 pagesVat or Notkim JinNo ratings yet

- TRUST RECEIPTS LAW: KEY CONCEPTS AND OBLIGATIONSDocument5 pagesTRUST RECEIPTS LAW: KEY CONCEPTS AND OBLIGATIONSStephany PolinarNo ratings yet

- Strategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo KartosapoetroDocument15 pagesStrategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo Kartosapoetrofour TeenNo ratings yet

- Corrugated Paper BoxDocument13 pagesCorrugated Paper BoxGulfCartonNo ratings yet

- Fundamentals of AccountingDocument2 pagesFundamentals of AccountingDiane SorianoNo ratings yet

- Lenders+Deck+Mar'23 IFSDocument18 pagesLenders+Deck+Mar'23 IFSGautam MehtaNo ratings yet

- 0.3 Case 3 - The Global Financial Crisis of 2008-The Role of Greed - Fear - and OligarchsDocument21 pages0.3 Case 3 - The Global Financial Crisis of 2008-The Role of Greed - Fear - and OligarchsDiego Miguel Aliaga GomezNo ratings yet

- 10.1108@ijpdlm 05 2013 0112Document22 pages10.1108@ijpdlm 05 2013 0112Tú Vũ QuangNo ratings yet

- Chapter 2 Exercises-TheMarketDocument7 pagesChapter 2 Exercises-TheMarketJan Maui VasquezNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, LagunaDocument4 pagesCertificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, Lagunaandrea mancaoNo ratings yet

- DevaluationDocument3 pagesDevaluationBibhuti Bhusan SenapatyNo ratings yet

- Toyota Announces 2023 Car Sales Along With 2024 Domestic Sales Projection at 800,000 Units and Toyota Sales Target at 277,000 UnitsDocument6 pagesToyota Announces 2023 Car Sales Along With 2024 Domestic Sales Projection at 800,000 Units and Toyota Sales Target at 277,000 Unitslethuhoai3003No ratings yet

- ReviewerDocument7 pagesReviewerKaye Mariz TolentinoNo ratings yet

- YPFB TransporteDocument3 pagesYPFB TransporteCarlos RodriguezNo ratings yet

- JURNAL Anggrenita Aulia (1810412620008) - RevisiDocument11 pagesJURNAL Anggrenita Aulia (1810412620008) - Revisipengetikan normansyahNo ratings yet