Professional Documents

Culture Documents

2020 IRR of RA 11256

Uploaded by

Karla Elaine Umali0 ratings0% found this document useful (0 votes)

11 views4 pages2020 IRR of RA 11256

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document2020 IRR of RA 11256

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pages2020 IRR of RA 11256

Uploaded by

Karla Elaine Umali2020 IRR of RA 11256

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

March 6, 2020

SUBJECT : Implementing Rules and Regulations of Republic Act

No. 11256, Also Known as "An Act to Strengthen the

Country's Gross International Reserves, Amending for

the Purpose Sections 32 and 151 of the National Internal

Revenue Code, as Amended, and for Other Purposes"

SECTION 1. Declaration of Policy. — Republic Act ("R.A.") No. 11256

seeks (1) to enable the Bangko Sentral ng Pilipinas ("BSP") to build up the

country's gross international reserves ("GIR") by buying domestically

produced gold from small-scale mining operations using pesos, (2) to ensure

that small-scale miners ("SSMs") will receive a fair price for their gold, and

(3) to return to the formal sector the sale of gold from small-scale mining

operations. Towards this end, as envisioned under R.A. No. 7076 (the

People's Small-Scale Mining Act of 1991) and R.A. No. 11256, all gold

produced from small-scale mining operations and sold to the BSP by

registered SSMs and accredited traders shall be exempt from taxation.

SECTION 2. Scope. — Pursuant to the provisions of Section 5 of R.A.

No. 11256, this Implementing Rules and Regulations ("IRR") is hereby

promulgated, to implement the provisions on the exemption from payment

of income and excise taxes imposed under the National Internal Revenue

Code ("NIRC") of 1997, as amended, on the sale of gold to BSP by registered

SSMs and accredited traders and to provide guidelines for the registration of

SSMs and accreditation of traders who will qualify and enjoy the exemptions.

SECTION 3. Coverage. — This IRR shall cover sale of gold with the

BSP of registered SSMs and accredited traders, as well as sale of gold by

SSMs to accredited traders for eventual sale to the BSP. Registration of SSMs

and accreditation of traders shall be in accordance with the provisions on

registration and accreditation.

SECTION 4. Definition of Terms . — As used in this IRR, the following

terms shall mean or be understood as follows:

a) Accredited Traders — persons and/or entities engaged in the

business of buying and selling gold that have complied with the

BSP's gold trader accreditation procedures.

b) Department of Environment and Natural Resources

Department Administrative Order ("DENR DAO") No. 2015-

03 — the Revised Implementing Rules and Regulations of R.A.

No. 7076 ("People's Small-Scale Mining Act") which provides,

among others, the registration, licensing, declaration of Minahang

Bayan, and Awarding of Small-Scale Mining Contracts.

c) Mines and Geosciences Bureau ("MGB") — primary

government agency under the DENR responsible for the

conservation, management, development, and proper use of the

country's mineral resources including those in reservations and

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

lands of public domains.

d) Registered SSMs — refer to Filipino citizens who have

organized themselves as an individual miner or cooperative duly

licensed by the MGB to engage in the extraction of minerals or

ore-bearing materials from the ground under the terms of a

small-scale mining contract, as defined under DENR DAO No.

2015-03, or any subsequent administrative issuance/s of the

relevant government agency governing the registration of SSMs.

e) Small-Scale Mining Contract — refers to the co-production,

joint venture, or mineral production sharing agreement between

the government and a small-scale mining contractor for the

small-scale utilization of a plot of mineral inside a Small-Scale

Mining Area or Minahang Bayan, as defined under DENR DAO No.

2015-03, or any subsequent administrative issuance/s of the

relevant government agency governing the registration of SSMs.

SECTION 5. Tax Exemptions. — Transactions as provided hereunder

shall be exempt from taxes, as follows:

a) Income derived from the following sale of gold are excluded in

the gross income and shall be exempt from income tax, and

consequently from withholding taxes:

1) The sale of gold to the BSP by registered SSMs and

accredited traders; and

2) The sale of gold by registered SSMs to accredited traders

for eventual sale to the BSP.

b) Excise tax shall not be levied, assessed and collected on the

following:

1) The sale of gold to the BSP by registered SSMs and

accredited traders; and

2) The sale of gold by registered SSMs to accredited traders

for eventual sale to the BSP.

If an excise tax has been otherwise paid prior to the sale of gold to the

BSP, the taxpayer may file a claim for refund or credit with the Commissioner

of Internal Revenue for the excise tax paid.

SECTION 6. Issuance of Tax Identification Number. — The Bureau of

Internal Revenue ("BIR") shall issue a Tax Identification Number ("TIN") to

SSMs and traders to serve as a tag for the income and excise tax exemption

of their sale, or eventual sale, of gold to BSP. The details of the sales

transaction from registered SSMs and accredited traders shall be reported by

the BSP on a monthly basis to the BIR.

SECTION 7. Registration of SSMs. — The registration of SSMs shall

be governed by Chapter III of DENR DAO No. 2015-03 or by any subsequent

administrative issuance/s of the relevant government agency governing the

registration of SSMs.

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

SECTION 8. Accreditation of Traders . — The accreditation of traders

shall be governed by the guidelines on the accreditation of gold traders, or

any subsequent administrative issuance/s governing the accreditation of

traders to be issued by the BSP.

For purposes of validating the sale to accredited traders, SSMs shall

issue Acknowledgment of Gold Delivery and Sale, stating therein their TIN, to

such accredited traders. This, in turn, shall be submitted to BSP by

accredited traders upon eventual sale of the gold to the BSP.

In any case, all gold sold to the BSP by accredited traders shall be

presumed to have been purchased by said accredited traders from SSMs.

SECTION 9. Certification. — The BSP shall issue a certification to

registered SSMs upon receipt of a certified copy of a valid and effective

Small-Scale Mining Contract from the relevant agency, and to accredited

traders upon submission of the complete accreditation requirements,

respectively, subject to renewal upon expiration. The BSP certification shall

be the basis for the tax exemptions and non-withholding/collection of taxes

under R.A. No. 11256.

SECTION 10. Sale of Gold to the BSP. — Registered SSMs and

accredited traders shall sell gold to the BSP in accordance with the BSP Gold-

Buying Program Guidelines, or any subsequent issuance/s of the BSP

governing its purchase of gold.

For purposes of applying the tax exemptions and non-

withholding/collection of taxes under R.A. No. 11256, no further proof shall

be required by BSP from registered SSMs or accredited traders, other than

the documents mentioned under Sections 9 and 12, hereof. In the event that

the tax exemption is found by the BIR as not applicable to a BSP transaction

with a person or entity purporting to be a registered SSM and/or accredited

trader, such person or entity shall be primarily and solely liable for any

deficiency taxes that may be assessed by the BIR.

SECTION 11. Exchange of Information. — The MGB, or any

applicable government entity, shall, for purposes of determining the validity

of the registration of SSMs, ensure that a list of registered SSMs is readily

made available to the BSP.

SECTION 12. Transitory Provision . — Notwithstanding Sections 7, 8,

and 9 of this IRR, SSMs and traders shall be given a period of one (1) year,

which may be extended for a period not exceeding three (3) years, from the

effectivity of this IRR to comply with the registration and accreditation

requirements to avail of the tax exemption under R.A. No. 11256, as

implemented under Section 5 of this IRR.

During this transitory period, BSP shall issue a temporary certification

to SSMs and traders; in the case of SSMs, upon submission of proof of their

pending application for registration with the relevant agency, and in the case

of traders, upon submission of proof of their pending application for

accreditation with the BSP. SSMs and traders holding such temporary

certification shall enjoy the tax exemptions and non-withholding/collection of

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

taxes, provided, that they comply with the procedure for the sale of gold to

BSP under Section 10 of this IRR.

Upon the lapse of the said transitory period, all sale of gold to the BSP

by non-registered SSMs and/or non-accredited traders shall be subject to the

applicable taxes under the NIRC of 1997, as amended.

SECTION 13. Repealing Clause. — All government issuances that are

inconsistent with the provisions of this IRR are hereby amended, modified, or

repealed accordingly.

SECTION 14. Effectivity. — This IRR shall take effect fifteen (15)

days following its complete publication in two (2) newspapers of general

circulation and from filing of three (3) certified copies in the University of the

Philippines Law Center.

(SGD.) CARLOS G. DOMINGUEZ

Secretary of Finance

Recommending Approval:

(SGD.) BENJAMIN E. DIOKNO

Bangko Sentral ng Pilipinas

(SGD.) CAESAR R. DULAY

Commissioner of Internal Revenue

(SGD.) ROY A. CIMATU

Department of Environment and Natural Resources

(SGD.) EDUARDO M. AÑO

Department of the Interior and Local Government

CD Technologies Asia, Inc. © 2021 cdasiaonline.com

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- IRR of RA 7652Document9 pagesIRR of RA 7652Juan Edmundo ReyesNo ratings yet

- DOF - Department Order No. 17 - 04Document12 pagesDOF - Department Order No. 17 - 04jjvii8No ratings yet

- Ruling On LendingDocument3 pagesRuling On LendingRheneir MoraNo ratings yet

- Level 1 - Access - WorkbookDocument272 pagesLevel 1 - Access - Workbookkavinah5785100% (1)

- Covid 19 Proof Multibagger StocksDocument20 pagesCovid 19 Proof Multibagger StocksKarambir Singh DhayalNo ratings yet

- IRR of RA 10066Document31 pagesIRR of RA 10066Karla Elaine UmaliNo ratings yet

- 2016 Guide To RA 9178 BMBEs Act of 2002 PDFDocument97 pages2016 Guide To RA 9178 BMBEs Act of 2002 PDFjealousmistress100% (2)

- Sarfaesi Act PPT-1Document21 pagesSarfaesi Act PPT-1Vironika Reddy100% (1)

- The Travel & Tourism Competitiveness Report 2015Document519 pagesThe Travel & Tourism Competitiveness Report 2015pavelbtNo ratings yet

- Financial Reporting and AnalysisDocument34 pagesFinancial Reporting and AnalysisNatasha AzzariennaNo ratings yet

- Special Commercial Law: New Central Bank ActDocument34 pagesSpecial Commercial Law: New Central Bank ActMasterboleroNo ratings yet

- 2020 Walmart Annual ReportDocument88 pages2020 Walmart Annual ReportPruthviraj DhinganiNo ratings yet

- Tech Talk Food Safety CultureDocument2 pagesTech Talk Food Safety CulturePrerna Dingal RathoreNo ratings yet

- RFBT-13 (Banking Laws)Document10 pagesRFBT-13 (Banking Laws)Alliah Mae ArbastoNo ratings yet

- RR No. 6-2012Document5 pagesRR No. 6-2012fatmaaleahNo ratings yet

- RA 9178 - Barangay Micro Business EnterprisesDocument4 pagesRA 9178 - Barangay Micro Business EnterprisesAgust DyllNo ratings yet

- Pa Tax Brief - March 2020Document13 pagesPa Tax Brief - March 2020Teresita TibayanNo ratings yet

- Brangay MicroBsiness EntrprisesDocument4 pagesBrangay MicroBsiness EntrprisesJMarcNo ratings yet

- BMBEs (RA 9178), IRRDocument5 pagesBMBEs (RA 9178), IRRtagabantayNo ratings yet

- NBFC ALM RBI GuidelinesDocument115 pagesNBFC ALM RBI GuidelinessrirammaliNo ratings yet

- RR 1996Document57 pagesRR 1996Maisie Rose VilladolidNo ratings yet

- Dti Ao No 01 S of 2003Document4 pagesDti Ao No 01 S of 2003RaymondNo ratings yet

- Circular 26.09.2023Document2 pagesCircular 26.09.2023riteshskcoNo ratings yet

- Ra9178 BmbeDocument5 pagesRa9178 BmbeJanMarkMontedeRamosWongNo ratings yet

- Cralaw Virtua1aw LibraryDocument143 pagesCralaw Virtua1aw LibraryJon SnowNo ratings yet

- Amended Capital Market Authority RegulationsDocument4 pagesAmended Capital Market Authority RegulationsabdurrahmanNo ratings yet

- Reserve Bank of India Department of Banking Regulation Central Office Mumbai-400 001Document17 pagesReserve Bank of India Department of Banking Regulation Central Office Mumbai-400 001santhosh prabhuNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJen AnchetaNo ratings yet

- Group Aisyah Pyq June 2014, Dec 2016, July 2017Document25 pagesGroup Aisyah Pyq June 2014, Dec 2016, July 2017NursafirahNo ratings yet

- S.I. 103A of 2022 Securities (Registration, Licensing and Corporate Governance) NomDocument6 pagesS.I. 103A of 2022 Securities (Registration, Licensing and Corporate Governance) NomaddyNo ratings yet

- 2009 RulingsDocument525 pages2009 RulingsAtty Rester John NonatoNo ratings yet

- Currency LawDocument4 pagesCurrency LawAzhar HassanNo ratings yet

- Modaraba Companies Modaraba Floatation Control Ordinance, 1980Document17 pagesModaraba Companies Modaraba Floatation Control Ordinance, 1980tahahussainNo ratings yet

- RR 04-99 PDFDocument3 pagesRR 04-99 PDFPeter Joshua OrtegaNo ratings yet

- Dof Order No. 17-04Document10 pagesDof Order No. 17-04matinikkiNo ratings yet

- IRR of SRCDocument24 pagesIRR of SRCCedric VanguardiaNo ratings yet

- Alpex Solar 123 Limited - GidDocument40 pagesAlpex Solar 123 Limited - GidxvhotyNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- Module 3 Tax Preferences Available For Sole Proprietorship BusinessDocument7 pagesModule 3 Tax Preferences Available For Sole Proprietorship Businessangclaire47No ratings yet

- Int Exchange Banl vs. CIRDocument16 pagesInt Exchange Banl vs. CIRRomeo de la CruzNo ratings yet

- Bir 363-14Document5 pagesBir 363-14msdivergentNo ratings yet

- BMBEs (RA 9178)Document5 pagesBMBEs (RA 9178)tagabantayNo ratings yet

- Micro - Finance - Act - SRi LAnka 2016Document31 pagesMicro - Finance - Act - SRi LAnka 2016Hashan De AlwisNo ratings yet

- Taxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesDocument1 pageTaxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesBryan Christian MaragragNo ratings yet

- 262962-2020-Amendments To Certain Provisions of The 201820210526-11-Rko1kkDocument6 pages262962-2020-Amendments To Certain Provisions of The 201820210526-11-Rko1kkRavenclaws91No ratings yet

- Form2a Irfc NRDocument8 pagesForm2a Irfc NRShop ArunNo ratings yet

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument5 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaKajarathan SubramaniamNo ratings yet

- GST Guide On Exemption of Investment Precious MetalsDocument23 pagesGST Guide On Exemption of Investment Precious MetalsLuigi MoralesNo ratings yet

- The Foreign Exchange Management (Permissible Capital Account Transactions) Regulations, 2000Document4 pagesThe Foreign Exchange Management (Permissible Capital Account Transactions) Regulations, 2000ChandanNo ratings yet

- SEBI - To Brokers - Ban On Creation of BGDocument3 pagesSEBI - To Brokers - Ban On Creation of BGgarbage DumpNo ratings yet

- Act 001 - Law Islamic Banking Act 1983Document36 pagesAct 001 - Law Islamic Banking Act 1983Master EmoNo ratings yet

- Diamond Cutting and Polishing Act 2007Document12 pagesDiamond Cutting and Polishing Act 2007lugardsunNo ratings yet

- Tax Laws DT Revsion Notes For Dec 22Document176 pagesTax Laws DT Revsion Notes For Dec 22anushkamohanan0No ratings yet

- Ra 9178 BmbeDocument5 pagesRa 9178 BmbeBrian James RubioNo ratings yet

- Clark Investor V Secretary of Finance and CIRDocument10 pagesClark Investor V Secretary of Finance and CIRChrissyNo ratings yet

- Deed of ContinunityDocument7 pagesDeed of Continunitymnassociates.legalNo ratings yet

- Monetary & Banking Operations in Free Trade - Industrial Zones (FTZS) .As AmendedDocument14 pagesMonetary & Banking Operations in Free Trade - Industrial Zones (FTZS) .As AmendedHossein DavaniNo ratings yet

- Circular Limited Purpose Trading Members Qualified Suppliers18082022120108Document6 pagesCircular Limited Purpose Trading Members Qualified Suppliers18082022120108Abhishek JainNo ratings yet

- Updated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Document120 pagesUpdated Operational Circular For Issue and Listing of Commercial Paper - April 13 2022Vani PattnaikNo ratings yet

- BMBE Law, IRR and Forms - Document TranscriptDocument8 pagesBMBE Law, IRR and Forms - Document TranscriptLansingNo ratings yet

- Finance Current Affairs January Week IiDocument24 pagesFinance Current Affairs January Week IiBhav MathurNo ratings yet

- Sebi Circ 300903Document2 pagesSebi Circ 300903kadam.jayendraNo ratings yet

- The Tax Administrationregistration of Small Vendors and Service Providers Regulations 2020Document5 pagesThe Tax Administrationregistration of Small Vendors and Service Providers Regulations 2020Andrey PavlovskiyNo ratings yet

- BIR Ruling No. 113-94Document1 pageBIR Ruling No. 113-94Chynah Marie MonzonNo ratings yet

- IRR of RA 10697Document327 pagesIRR of RA 10697Karla Elaine UmaliNo ratings yet

- IRR of RA 10625Document28 pagesIRR of RA 10625Karla Elaine UmaliNo ratings yet

- IRR of RA 7916Document51 pagesIRR of RA 7916Karla Elaine UmaliNo ratings yet

- Philippine - Mining - Act - of - 199520210719-11-1couod6Document28 pagesPhilippine - Mining - Act - of - 199520210719-11-1couod6chan.aNo ratings yet

- Epira Law 2001Document35 pagesEpira Law 2001euroaccessNo ratings yet

- Ncip PPT Presentation Sustainability 1 1 PDFDocument37 pagesNcip PPT Presentation Sustainability 1 1 PDFBenjie PangosfianNo ratings yet

- Dao 2000-98 PDFDocument179 pagesDao 2000-98 PDFJohnKevinVillarNo ratings yet

- Thesis RA 8713Document25 pagesThesis RA 8713Mike23456No ratings yet

- D:/Desktop/scanned/Circular No. 2012-001/circular-Without Number - JPG 2012-001Document11 pagesD:/Desktop/scanned/Circular No. 2012-001/circular-Without Number - JPG 2012-001barcelonnaNo ratings yet

- TOPIK 1 - IntroductionDocument66 pagesTOPIK 1 - IntroductionkanasanNo ratings yet

- ResearchDocument6 pagesResearchEthanNo ratings yet

- Assignment 1 BriefDocument5 pagesAssignment 1 BriefViet NguyenNo ratings yet

- Oct 2011: Qualitative Evaluation To Determine The Necessity of Step 1 of The Goodwill Impairment TestDocument3 pagesOct 2011: Qualitative Evaluation To Determine The Necessity of Step 1 of The Goodwill Impairment TestSingerLewakNo ratings yet

- Innovation: Innovated by Professor Vijay Govindarajan, Tuck School of Business, Dartmouth CollegeDocument13 pagesInnovation: Innovated by Professor Vijay Govindarajan, Tuck School of Business, Dartmouth CollegeManikandan SuriyanarayananNo ratings yet

- JD - Analyst Opex NLPDocument9 pagesJD - Analyst Opex NLPLakshmidevi pmNo ratings yet

- Lean Validation BoardDocument1 pageLean Validation BoardLadipo AilaraNo ratings yet

- Pert and CPM: Projecct Management ToolsDocument98 pagesPert and CPM: Projecct Management Toolslakshmi dileepNo ratings yet

- MBA Finance (Production Functions: CH 3) MBS (Production and Cost Analysis: CH 3) MBM (Theory of Production and Cost: Ch3)Document48 pagesMBA Finance (Production Functions: CH 3) MBS (Production and Cost Analysis: CH 3) MBM (Theory of Production and Cost: Ch3)Saru Regmi100% (1)

- The State Bank of IndiaDocument4 pagesThe State Bank of IndiaHimanshu JainNo ratings yet

- Summary of Case: Page:-1Document7 pagesSummary of Case: Page:-1devi ghimireNo ratings yet

- Case Study On Building Data Warehouse/Data MartDocument6 pagesCase Study On Building Data Warehouse/Data MartCandida NoronhaNo ratings yet

- Training Talf06 Aviation Fuel ManagementDocument2 pagesTraining Talf06 Aviation Fuel ManagementegemNo ratings yet

- Resale Price Lor Lew LianDocument2 pagesResale Price Lor Lew LianAlex Ng W HNo ratings yet

- Angel OneDocument139 pagesAngel OneReTHINK INDIANo ratings yet

- Cost Sheet Practical ProblemsDocument2 pagesCost Sheet Practical Problemssameer_kini100% (1)

- Director VP Marketing in Boston MA Resume Jeffrey LawsonDocument2 pagesDirector VP Marketing in Boston MA Resume Jeffrey LawsonJeffreyLawsonNo ratings yet

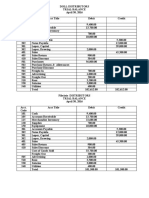

- 5.preliminary Trial Balance PhilAsia and DoleDocument1 page5.preliminary Trial Balance PhilAsia and DoleRodolfo CorpuzNo ratings yet

- Centre For Innovation, Incubation and Entrepreneurship (CIIE)Document13 pagesCentre For Innovation, Incubation and Entrepreneurship (CIIE)Manish Singh RathorNo ratings yet

- Microfridge 1for DTNDocument2 pagesMicrofridge 1for DTNNimmi PandeyNo ratings yet

- PornHub.com.docxDocument9 pagesPornHub.com.docxLouise RanzNo ratings yet

- Loris ResumeDocument3 pagesLoris Resumeapi-219457720No ratings yet

- TRE8X10 Road Transport Costing and Distribution Assignment - Aug 2021Document5 pagesTRE8X10 Road Transport Costing and Distribution Assignment - Aug 2021percyNo ratings yet