Professional Documents

Culture Documents

What Drives a Trend-Follower's Trading Activity

Uploaded by

Riccardo RoncoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Drives a Trend-Follower's Trading Activity

Uploaded by

Riccardo RoncoCopyright:

Available Formats

FOR MARKETING PURPOSES ONLY

QUARTERLY

INSIGHTS

WHAT DRIVES A TREND-FOLLOWER’S TRADING ACTIVITY?

Understanding the key drivers behind trend-following exposure changes

#10 | 11 MAY 2022

Past performance is not necessarily indicative of future results quantica-capital.com 1

Executive summary

In this note, we show that the buying and selling Furthermore, we illustrate how changes in

of any market by a trend-following strategy is trend-signals, individual market volatilities, and

driven by changes in three key complementary the portfolio-scaling factor have each

factors: its signal or trend-strength, its risk or contributed to the overall portfolio turnover of a

volatility, and a “portfolio-scaling factor” that generic trend-following strategy since 2005.

reflects adjustments due to the applied portfolio

We conclude this note by highlighting that in the

construction or risk management methodology.

long-run, changes in individual market trend-

This portfolio-scaling factor is driven by

signals only account for little more than half, or

changing cross-asset correlations (or more

on average 60%, of a typical trend-follower’s

generally by the cross-signal correlations) and is

portfolio turnover. The remaining trading

used to actively manage the overall portfolio risk

activity is driven by risk-management and

exposure.

portfolio construction. Over shorter periods,

We introduce a simple analytical formula that risk-management factors, e.g., driven by a

attributes the change in an instrument’s dollar sudden volatility spike or correlation shifts

exposure to the change in each of the three across one or more asset-classes, may even

factors across time in a generic trend-following explain up to 80% of the turnover of a medium-

context. This approach allows us to identify and to-long-term trend-following portfolio.

quantify the key drivers behind any noticeable

increase or reduction in exposure to a single

instrument, a group of instruments, an entire

asset-class, or the full portfolio across time.

We take a closer look at the relative contribution

of these three factors during the most recent

period between January and March 2022, which

has been characterized by a substantial

expansion of trend opportunities, coupled with

a sharp rise in volatilities across fixed-income

and commodity markets.

Past performance is not necessarily indicative of future results quantica-capital.com 2

A trend-follower’s exposure to WTI Oil in month WTI Oil, while increasing continuously

Q1 2022 throughout January, already peaked on February

3rd, when the contract was trading at around $85

Against a backdrop of escalating geopolitical “only”. Between February 25 and March 9, despite

tensions and generally tight global supply chains, a sharp move higher in oil prices, our generic

the first quarter of 2022 saw some dramatic price trend-following strategy more than halved its

moves across most commodity markets. Such a notional exposure to WTI from 2% to 0.8% of its

market environment translated into a number of NAV!

powerful trends that directly impacted a trend-

follower’s positioning. By way of illustration, 12 90%

11

Figure 1 displays the allocated net notional 80%

1-day Value-at-Risk [bps]

10

exposure to the WTI Oil futures contract of a 9 70%

Volatility p.a.

generic trend-following strategy1 across this 8 60%

year’s first quarter compared to the price history 7

6 50%

of this contract over that period.

5 40%

4

3.0% 120 30%

3

2 20%

2.5% 110 Jan-2022 Feb-2022 Mar-2022

Net exposure [% of NAV]

WTI Oil future position Value-at-Risk

Front-month WTI Oil future volatility (rhs)

Price [USD]

2.0% 100

Figure 2: Rolling exponentially weighted volatility of front-

month WTI Oil futures and rolling 1-day 99% Value-at-Risk

1.5% 90 of the WTI Oil position of a generic trend-following strategy

during the first quarter of 2022. Source: Quantica,

Bloomberg.

1.0% 80

While the underlying trend-signal is a natural

0.5% 70 driver of building up exposure to WTI Oil in a

Jan-22 Feb-22 Mar-22

WTI Oil future net exposure market environment like the one observed during

Front-month WTI Oil future price (rhs)

the first quarter of 2022, the spike in volatility

Figure 1: Net notional exposure (as a percent of NAV) of the observed in late February and early March (as

WTI Oil future contract in a generic trend-following strategy

and corresponding contract price during the first quarter of depicted in Figure 2) led the trend-following

2022. Source: Quantica, Bloomberg. strategy to reduce exposure to maintain its risk

budget. At constant trend-strength, the doubling

The price of WTI Oil started the year by rising

of an instrument’s volatility leads to a reduction

steadily until February 24. The rise then

in half of its notional exposure in the portfolio.

continued subsequently on much higher

The overall risk allocated to the instrument,

volatility to reach a price of around $100 (or a

however, remains unaffected in such case, as can

40% increase from the start of the year) at the

be further seen from Figure 2. The above simple

end of the first quarter after peaking at $119 on

case study is the most recent real-world

March 8. Interestingly, the weight allocated by

illustration on how signal and risk interact to

the generic trend-following strategy to front-

1 Quantica’s generic trend-following model has been designed to closely track the SG Trend Index, an industry benchmark composed of

the ten biggest trend-following programs and can be viewed as a realistic reflection of a typical trend-following approach. Its correlation

with the SG Trend Index amounts to 0.89 since 2005. The strategy is applied to a universe of 83 of the most liquid futures markets across

equities, fixed-income, interest rates, currencies, and commodities and its portfolio is scaled to target a long-term volatility of 12% per

annum.

Past performance is not necessarily indicative of future results quantica-capital.com 3

influence the positioning of a trend-follower. It the required dollar exposure to meet its

also provides a compelling example of a trend- risk allocation target.

follower selling a market despite the rise in the

• A portfolio-scaling factor, which scales

underlying price.

all positions up or down according to the

So far, we have illustrated how two factors – specific portfolio construction rules in

signal and volatility – do affect the positioning of order to meet and actively manage the

a trend-following strategy in an isolated market portfolio’s overall risk target. It is a direct

context. In the next section, we derive a simple reflection of (1) the cross-instrument

mathematical formula to decompose the correlation structure and (2) the overall

portfolio turnover of all instruments in a generic trend-opportunity set of the underlying

trend-following strategy into the changes of investment universe. Indeed, higher

three factors: trend-signal, volatility, and cross- (lower) average cross-correlations lead

correlations. to a higher (lower) portfolio volatility (all

else being equal), which results in a lower

Trend-following exposures are driven by

(higher) portfolio-scaling factor to

three main factors control the portfolio volatility. A greater

Systematic trend-following relies on the trend-opportunity set (i.e., a greater

assumption that persistent trends are recurring number of concomitant trends) across

events in all types of financial market universe constituents will also lead to a

environments and across all asset classes. In higher average risk exposure across

order to capitalize on such trends, a trend- individual instruments, which implies a

following strategy takes long and short positions higher portfolio volatility. In turn, this

across a diversified set of markets. In most trend- results in a lower portfolio-scaling factor.

following approaches, the weight or dollar The above three variables may be combined into

exposure of each instrument2 is typically a the below mathematical formulation of the

function of the following three key variables: weight of an instrument in a trend-following

• The instrument’s trend-signal or trend- strategy:

strength, which captures the direction

signal ⋅ portfolio-scaling factor

(long or short) and conviction level in the weight =

trend. The trend-signal is a function of volatility

the trend-following model being used as

Put differently, an instrument’s notional-weight

part of the investment strategy. For

exposure 𝑤𝑡 in a trend-following portfolio at time

instance, the chosen set of lookback

𝑡 is the product of three distinct and

windows to measure trends will impact

complementary factors

the speed at which the model will react

to new or fading trends3. 1

𝑤𝑡 = 𝑠𝑡 ⋅ ⋅𝜆 ,

• The instrument’s estimated risk or 𝜎𝑡 𝑡

volatility. The higher (lower) the

instrument’s volatility, the lower (higher)

2The weight of an instrument in a portfolio is defined as the dollar exposure of that instrument divided by the portfolio’s net asset value.

3For more information on the relationship of lookback windows and reaction speed please refer to Quantica Capital, “Why speed matters”,

Quantica Quarterly Insights, April 2020.

Past performance is not necessarily indicative of future results quantica-capital.com 4

where: 1 1

𝑤𝑡 − 𝑤𝑡−1 = 𝛼𝑡 (𝑠𝑡 − 𝑠𝑡−1 ) + 𝛽𝑡 ( − )

𝜎𝑡 𝜎𝑡−1

• 𝑠𝑡 is the instrument’s trend-strength at

+ 𝛾𝑡 (𝜆𝑡 − 𝜆𝑡−1 ) ,

time 𝑡, which may be positive (long

position) or negative (short position) for suitable 𝛼𝑡 , 𝛽𝑡 and 𝛾𝑡 , which are the

1

sensitivities of the weight to the trend-strength,

• 𝜎𝑡

is the instrument’s inverse volatility at inverse volatility, and portfolio-scaling factor,

time 𝑡 respectively. The precise definition of 𝛼𝑡 , 𝛽𝑡 and

𝛾𝑡 , including the derivation of the formula may be

• 𝜆𝑡 is the portfolio-scaling factor at time 𝑡

found in Appendix 1.

(i.e., a function of the cross-instrument

correlation structure and the overall trend Using the above formula, we show in the

opportunity set), which works in subsequent sections how the three factors have

combination with a portfolio risk-target recently contributed to the overall portfolio

(e.g., 12% p.a.). turnover of a generic trend-following strategy.

Whilst the first factor reflects the conviction of Trend-following turnover implications

the model in the trend that a given instrument from rising energy prices during Q1 2022

exhibits, the other two factors represent the risk-

management portion of the strategy. The second Returning to our initial example, we first look at

factor will for instance lead to a reduction (an how recent changes in trend-signals and

increase) in an instrument’s exposure if its volatilities of individual instruments, as well as

volatility increases (decreases). The third factor changes in the portfolio-scaling factor, have

may lead to a similar reduction (increase) if (1) the contributed to impacting the net aggregate

average correlation or if (2) the average trend- Energy exposure of our generic trend-following

strength in absolute terms across all universe strategy during the first quarter of 20225.

constituents increases (decreases). Note that the 25%

changes attribution [% of NAV]

first two factors are instrument-specific, while

Net exposure and cumulative

20%

the last factor is mostly dependent on the entire

15%

set of instruments composing the strategy’s

investment universe4. 10%

5%

A formula for explaining the change in

trend-following exposures 0%

-5%

The previous weight decomposition formula may Jan-2022 Feb-2022 Mar-2022

be used to obtain the following mathematical Trend-Strength

Portfolio-Scaling Factor

Volatility

Energy Net Exposure

formula explaining the change of an instrument’s Figure 3: Energy overall net notional exposure attribution by

weight in a trend-following strategy in terms of cumulative changes in instrument trend-strength,

changes of the three factors: instrument volatility, and portfolio-scaling factor in a

generic trend-following strategy with a long-term 12%

annualized volatility target during the first quarter of 2022.

The sum of the three factor’s cumulative changes equals the

change in net notional exposure at any point in time.

Source: Quantica Capital.

4 In practice, other factors additionally impact the instrument weight such as trading costs, liquidity, exposure, and risk allocation constraints.

5 Energy includes the following highly liquid futures markets: WTI Crude Oil, Brent Crude Oil, Gasoil, Heating Oil and Gasoline.

Past performance is not necessarily indicative of future results quantica-capital.com 5

As Figure 3 shows, during January and until following strategy would have – assuming

February 3, the increase in Energy exposure from constant instrument volatilities and a constant

5% to 17% was mostly signal-driven, as the portfolio-scaling factor – more than quadrupled

volatility and the portfolio-scaling factor this exposure to -227% by February 17, driven by

contributions were relatively small and offsetting an increasingly aggregate negative trend-

each other. From February 3 to February 10, the strength. However, overall net aggregate short

further rise in the overall Energy trend-strength fixed-income exposure never exceeded -152% in

got offset by a decline of the portfolio-scaling the first quarter of 2022, as an expanding

factor, leading to a stabilization of the weight commodities opportunity set (i.e., declining

allocated to Energy at around 17% until February portfolio-scaling factor) has offset any further

25. The declining portfolio-scaling factor, leading fixed-income trend-strengthening between

to an Energy exposure reduction of around 7% mid-January and mid-February, as is shown in

until February 10, is the reflection of an Figure 4.

expanding trend opportunity set, characterized

50% 2%

Net exposure and cumulative changes

at that time by a general increase in the average

0% 0%

trend-strength across multiple commodity

attribution [% of NAV]

Cumulative return

markets (not just Energy)6. The subsequent -50% -2%

reduction of the Energy exposure from 17% to -100% -4%

less than 7% between February 25 and March 9,

-150% -6%

was entirely driven by the spike in volatility

witnessed across all underlying instruments -200% -8%

during that period. The remainder of the quarter -250% -10%

saw no further trading activity from the strategy Jan-2022 Feb-2022 Mar-2022

Trend-Strength

in the underlying instruments, as the three Volatility

Portfolio-Scaling Factor

factors remained mostly constant. Fixed-Income Net Exposure

10-year US Treasury future cumulative return (rhs)

Trend-following turnover implications Figure 4: Fixed-Income net notional exposure attribution by

cumulative changes in instrument trend-strength,

from rising global yields during Q1 2022 instrument volatility, and portfolio-scaling factor in a

generic trend-following strategy with a long-term 12%

The rise in energy prices witnessed during the annualized volatility target during the first quarter of 2022.

first quarter of 2022 was accompanied by a The sum of the three factor’s cumulative changes equals the

changes in net notional exposure at any point in time.

general rise in global government bond yields Source: Quantica Capital, Bloomberg.

across the duration spectrum. Both the front-

and the long-end rose sharply, with 2-year US On February 25, the sudden safe-haven

Treasury yields increasing from 0.73% to 2.33%, government bond rally translated into a general

and 30-year US Treasury yields increasing from spike in bond volatility across the duration

1.9% to 2.45%. spectrum. This spike in volatility resulted in an

immediate sharp reduction in fixed-income net

Starting the year with an already negative net short exposure in the generic trend-following

aggregate 10-year duration equivalent exposure strategy, from -150% to -114% at the beginning

to fixed-income7 of -51%, our generic trend- of March. The bond rally had only a marginal

6 As the number of investment opportunities increases, but the overall portfolio risk budget remains at 12% p.a., the average exposure

allocated to each investment opportunity decreases by construction.

7 All subsequent fixed-income exposures are expressed in 10-year duration equivalents. The strategy’s underlying fixed-income universe is

composed of 15 global government bond futures spanning durations from 2 to 30 years.

Past performance is not necessarily indicative of future results quantica-capital.com 6

impact on trend-signal contributions, and like 1 1

∑|Δ𝑖𝑡 | = ∑ 𝛼̃𝑡𝑖 (𝑠𝑡𝑖 − 𝑠𝑡−1

𝑖

) + ∑ 𝛽̃𝑡𝑖 ( − )

the energy exposure, the strategy's aggregate 𝜎𝑡𝑖 𝑖

𝜎𝑡−1

𝑖 𝑖 𝑖

fixed-income weight stabilized towards -100% at

the end of the quarter. Notably, the general + ∑ 𝛾̃𝑡𝑖 (𝜆𝑡 − 𝜆𝑡−1 ) ,

𝑖

build-up in long commodity exposure between

mid-January and mid-February8 (i.e., expanding for suitable 𝛼̃𝑡𝑖 , 𝛽̃𝑡𝑖 and 𝛾̃𝑡𝑖 , which have the same

commodity opportunity set) accounts for an absolute value as 𝛼𝑡 , 𝛽𝑡 and 𝛾𝑡 for instrument 𝑖,

equivalent -70% of foregone short fixed-income respectively, but might differ in their sign. As a

exposure at the end of March 2022. reminder, these variables denote the sensitivities

of the weight to the trend-strength, inverse

We provide a further illustrative example in

volatility, and portfolio-scaling factor,

Appendix 2, covering the first quarter of 2020,

respectively. We provide a detailed mathematical

which was characterized by the sudden and

derivation of this formula, including the definition

significant spike in equity volatility following the

of the three accompanying constants in

outbreak of the COVID-19 pandemic.

Appendix 3.

A three-factor attribution formula of

Trend-following turnover attribution

overall trend-following portfolio

dynamics in Q1 2022

turnover

Based on the above formula, Figures 5a and 5b

Our previous observations naturally lead us to ask outline how changes in the trend-signal, the

the following question: what portion of a trend- individual instrument volatilities and the

follower’s portfolio turnover is explained by each portfolio-scaling factor have contributed on a

of the three factors previously listed this year so relative and absolute basis to the overall portfolio

far, or over a much longer period, such as the turnover (across all asset-classes) of a typical

past 17 years? trend-following strategy since the beginning of

The turnover of a portfolio between two this year.

consecutive periods 𝑡 − 1 and 𝑡 is equal to the 100%

8%

sum of the absolute changes in weights of its

Contribution to total portfolio

80%

individual constituents 𝑖 between the two 36%

periods: ∑𝑖|𝑤𝑡𝑖 − 𝑤𝑡−1𝑖

|. Please note that such 60%

turnover

definition does not account for any turnover due

40%

to the rolling of futures positions from one expiry

56%

to the next. As it is purely operational in nature, 20%

we ignore it in the context of this note.

0%

Jan-2022 Feb-2022 Mar-2022 Average

From the previous formula expressing the Trend-Strength Volatility Portfolio-Scaling Factor

change in weight of an instrument Δ𝑖𝑡 = 𝑤𝑡𝑖 − 𝑤𝑡−1

𝑖

Figure 5a: Rolling average one-month contributions to the

as a function of the three factors, we can infer an portfolio turnover (measured as the sum of the changes in

analytical expression that attributes the turnover weight of its individual components in absolute terms) of a

generic trend-following strategy of changes in instrument

of a generic trend-following portfolio ∑𝑖|Δ𝑖𝑡 | to signals, in instrument volatilities, and changes in the

each of the three factors: portfolio-scaling factor, respectively. Source: Quantica

Capital.

8 Note that the overall portfolio net exposure of equities and currencies were mostly stable over the period.

Past performance is not necessarily indicative of future results quantica-capital.com 7

450 100%

9%

Contribution to total portfolio turnover

400

350 80%

Round-turns per million

27 32%

300

60%

250 111

200

40%

150

59%

100 192 20%

50

0 0%

Jan-2022 Feb-2022 Mar-2022 Average Jan-05 Jan-08 Jan-11 Jan-14 Jan-17 Jan-20 Average

Trend-Strength Volatility Portfolio-Scaling Factor Trend-Strength Volatility Portfolio-Scaling Factor

Figure 5b: Rolling average one-month round-turns per Figure 6a: Rolling average one-month contributions to the

million (number of contracts traded per million of notional) portfolio turnover of a generic trend-following strategy of

traded by a generic trend-following strategy (excluding any changes in instrument signals, in instrument volatilities, and

roll trades) due to changes in instrument signals, in changes in the portfolio-scaling factor, respectively. Source:

Quantica Capital.

instrument volatilities, and changes in the portfolio-scaling

factor, respectively. Source: Quantica Capital. 1200

Consistent with our previous observations on the 1000

drivers of energy and fixed-income exposure

Round-turns per million

800

changes this year, Figure 5a outlines a majority

contribution from signal changes of up to 70% 600

during January. However, in February the relative 40

400

contribution of instrument volatility changes to 159

portfolio turnover increased and in March on 200

276

average around 55% of the strategy's trading

0

activity was driven by risk management rather Jan-05 Jan-08 Jan-11 Jan-14 Jan-17 Jan-20 Average

than changes in individual trend dynamics. For Trend-Strength Volatility Portfolio-Scaling Factor

the entire quarter, more than half of the overall Figure 6b: Rolling average one-month round-turns per

portfolio turnover was driven by changes in million traded by a generic trend-following strategy

signals on the underlying universe constituents, (excluding any roll trades) due to changes in instrument

signals, in instrument volatilities, and changes in the

and 36% of it was driven by changes in their portfolio-scaling factor, respectively. Source: Quantica

underlying volatilities. The portfolio-scaling Capital.

factor, i.e., cross-instrument correlation and

In late 2008 for instance, 77% of a trend-

overall trend opportunity dynamics, accounted

follower’s exposure changes were primarily

for 9% of the total portfolio turnover in Q1 2022.

driven by changes in the underlying instruments’

Long-term trend-following turnover volatilities. A similar pattern could be observed in

attribution dynamics since 2005 March 2020 around the outbreak of the COVID-

19 pandemic. More generally, in any period of

If we look beyond the last quarter, going back to heightened volatility, risk-management factors

2005, the relative contribution of each factor has rather than changes in trends are the dominant

displayed significant variation over time, as can drivers of a trend-follower’s changes in

be seen in Figures 6a and 6b, in combination with underlying instrument exposures.

Table 1.

Past performance is not necessarily indicative of future results quantica-capital.com 8

Inversely, changes in the trend-strength of

individual instruments may at times explain up to

90% of the overall turnover of a trend-following

portfolio (such as in April 2017, early 2020 and

more recently during the second half of 2021).

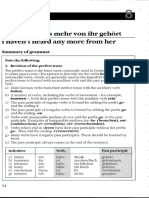

Finally, changes in the portfolio-scaling factor

never accounted for more than 60% (achieved in

June 2012) of overall portfolio turnover in the

past 17 years. It is by far the factor that has the

least amount of impact on strategy turnover.

Average

Maximum Date Minimum Date

'05 - '22

Trend-

91.7% Apr-17 17.7% Jan-09 58.8%

Strength

Volatility 76.7% Dec-08 6.4% Apr-17 32.6%

Portfolio-

59.1% Jun-12 0.0% Apr-07 8.6%

Scaling

Table 1: Maximum, minimum, and average one-month

contributions to portfolio turnover of a generic trend-

following strategy of changes in instrument signals, in

instrument volatilities, and changes in the portfolio-scaling

factor, respectively. Period: 2005 – 2022. Source: Quantica

Capital.

Over the entire period, on average, changes in

the trend-strength of individual instruments

account for approximately 59% of the total

portfolio turnover of a trend-follower, as can be

seen in Table 1. Put differently, in the long-run,

less than two-thirds of a trend-follower’s trading

activity is the result of trend-signal changes in the

underlying markets traded.

Complementarily, risk-management accounts

for the remaining 41% of such trading activity

(with 33% of the latter driven by individual

instrument volatility changes and 8% by

portfolio-scaling).

In the short-run, however, risk-management

factors (driven for instance by a volatility or

correlation spike across one or more asset-

classes) may account for up to 80% of the

positioning changes of such a trend-following

strategy.

Past performance is not necessarily indicative of future results quantica-capital.com 9

Conclusion

We have introduced a simple analytical formula Our decomposition approach also allowed us to

that decomposes the dollar exposure of any derive an analytical expression for the total

trade of a generic trend-following strategy into portfolio turnover based on the same three

the relative contribution of the following three factors. We have highlighted how changes in

key factors: trend-signals, in individual market volatilities, and

in the portfolio-scaling factor each have

• Single instrument trend-signal

contributed to the overall portfolio turnover of a

• Single instrument market risk or volatility

generic trend-following strategy.

• Portfolio-scaling factor, depending on

cross-correlations and overall trend We find that on average over the past 17 years,

opportunity set across the whole changes in individual market trend-signals

investment universe account for close to 60% of a medium-to-long-

term trend-follower’s total portfolio turnover.

Sharply rising commodity prices and global

The remaining 40% can be attributed to active

interest rates have profoundly impacted the

risk management.

positioning of trend-following portfolios in the

first quarter of 2022. Applying the derived Over shorter periods, e.g., during times of

turnover attribution formula, we have illustrated elevated market stress (such as 2008, March

how these three factors have contributed to the 2020 or Q1 2022), risk-management may

change in a trend-follower’s overall energy and account for up to 80% of the trading activity of a

fixed-income exposures over that period. In trend-follower. More generally, in any period of

particular, we have provided two examples when heightened volatility or cross-correlation

a trend-following strategy significantly reduced dynamics, risk-management factors rather than

its exposure to a group of instruments despite its changes in trends are the dominant drivers of a

increase in the underlying price trend. trend-follower’s portfolio trading activity.

Past performance is not necessarily indicative of future results quantica-capital.com 10

Appendix 1: Derivation of the instrument 1

𝛽𝑡 = (2𝑠𝑡 𝜆𝑡 + 𝑠𝑡 𝜆𝑡−1 + 𝑠𝑡−1 𝜆𝑡 + 2𝑠𝑡−1 𝜆𝑡−1 ) ,

weight change attribution formula 6

1 𝑠𝑡 𝑠𝑡 𝑠𝑡−1 𝑠𝑡−1

Assuming very generally that the weight 𝑤𝑡 of an 𝛾𝑡 = (2 + + +2 ).

6 𝜎𝑡 𝜎𝑡−1 𝜎𝑡 𝜎𝑡−1

instrument at time 𝑡 is a product of 𝑛 factors 𝑤𝑡 =

∏𝑛𝑘=1 𝑥𝑡𝑘 , we can apply the framework of Shapley

Appendix 2: Trend-following turnover

values (Shapley, 1953) to obtain the following

weight change decomposition:

implications from the COVID-19 induced

equity crash in March 2020

𝑛

𝑤𝑡 − 𝑤𝑡−1 = ∑ 𝜙𝑡𝑘 (𝑥𝑡𝑘 − 𝑥𝑡−1

𝑘

), Looking at the period corresponding to the

𝑘=1

outbreak of the COVID-19 crisis in the first

quarter of 2020, the generic trend-following

where the 𝜙𝑡𝑘 are given by program reduced its overall equity exposure

from 115% to 30%, or 85% in just the last week of

(|𝑆| − 1)! (𝑛 − |𝑆|)!

𝜙𝑡𝑘 = ∑ ∏ 𝑥𝑡𝑙 ∏ 𝑙

𝑥𝑡−1 . February 2020, as shown in Figure 7. Most

𝑛!

𝑆⊆{1,…,𝑛} 𝑙∈𝑆∖{𝑘} 𝑙∈{1,…,𝑛}∖𝑆 notably, two-thirds of this reduction is to be

𝑆∋𝑘

attributed to pure risk-management, while a

While the usual appeal of Shapley values is that change in trend-strength accounted for the

they can be used to obtain an attribution of the remaining exposure reduction. Conversely, the

change of any function of some number of subsequent reduction in equity exposure to a

variables to those variables, their application is slight net short exposure on March 12 was

particularly appealing in our case of a simple entirely due to a continuous decline in the

product of 𝑛 variables, since the resulting program’s aggregated equity trend-strength.

attribution is very close to the usual linearization

200% 6%

Net exposure and cumulative changes

obtained in the differentiable continuous-time

setting: 160% 0%

attribution [% of NAV]

Cumulative return

120% -6%

𝑛

80% -12%

𝑑𝑤𝑡 = ∑ (∏ 𝑥𝑡𝑙 ) 𝑑𝑥𝑡𝑘 .

𝑘=1 𝑙≠𝑘 40% -18%

0% -24%

For the purpose of decomposing the weight

change in a trend-following setting we apply the -40%

Jan-2020 Feb-2020 Mar-2020

-30%

1

𝑛 = 3 case of the formula with 𝑥𝑡1 = 𝑠𝑡 , 𝑥𝑡2 = 𝜎𝑡

Trend-Strength

Volatility

Portfolio-Scaling Factor

and 𝑥𝑡3 = 𝜆𝑡 to obtain: Equity Net Exposure

S&P 500 TR Index cumulative return (rhs)

Figure 7: Equity net notional exposure attribution by

1 1

𝑤𝑡 − 𝑤𝑡−1 = 𝛼𝑡 (𝑠𝑡 − 𝑠𝑡−1 ) + 𝛽𝑡 ( − ) cumulative changes in instrument signal, instrument

𝜎𝑡 𝜎𝑡−1 volatility, and portfolio-scaling factor in a generic trend-

+ 𝛾𝑡 (𝜆𝑡 − 𝜆𝑡−1 ) , following strategy with a long-term 12% annualized volatility

target during the first quarter of 2020 and corresponding

where cumulative return of S&P 500 TR Index over the same

period. The sum of the three factor’s cumulative changes

1 𝜆𝑡 𝜆𝑡 𝜆𝑡−1 𝜆𝑡−1 equals the changes in net notional exposure at any point in

𝛼𝑡 = (2 + + +2 ), time. Source: Quantica Capital, Bloomberg.

6 𝜎𝑡 𝜎𝑡−1 𝜎𝑡 𝜎𝑡−1

Past performance is not necessarily indicative of future results quantica-capital.com 11

Appendix 3: Derivation of the portfolio References

turnover attribution formula Shapley, L. S. (1953). 17. A Value for n-Person

Given the additive decomposition of an Games. In H. W. Kuhn, & A. W. Tucker (Eds.),

instrument’s 𝑖 weight change Δ𝑖𝑡 = 𝑤𝑡𝑖 − 𝑤𝑡−1

𝑖

into Contributions to the Theory of Games (AM-28),

𝑛 components Volume II (pp. 307–318). Princeton University

Press.

𝑛

Δ𝑖𝑡 = ∑ Δ𝑖𝑘

𝑡 ,

𝑘=1

we obtain a decomposition of the total portfolio

turnover ∑𝑖|Δ𝑖𝑡 | as follows:

∑|Δ𝑖𝑡 | = ∑ sgn(Δ𝑖𝑡 )Δ𝑖𝑡 = ∑ ∑ sgn(Δ𝑖𝑡 )Δ𝑖𝑘

𝑡

𝑖 𝑖 𝑖 𝑘=1

𝑛

= ∑ ∑ sgn(Δ𝑖𝑡 )Δ𝑖𝑘

𝑡 .

𝑘=1 𝑖

Here the sign of Δ𝑖𝑡 is used to rewrite its absolute

value, leading to an interpretable attribution

where factors moving in the same (opposite)

direction as the overall weight change contribute

positively (negatively) to the instrument’s

turnover.

We apply the above to the case of generic trend-

following:

1 1

Δ𝑖𝑡 = 𝛼𝑡𝑖 (𝑠𝑡𝑖 − 𝑠𝑡−1

𝑖

) + 𝛽𝑡𝑖 ( − )

𝜎𝑡𝑖 𝑖

𝜎𝑡−1

+ 𝛾𝑡𝑖 (𝜆𝑡 − 𝜆𝑡−1 )

and thus end up with the following turnover

decomposition:

∑|Δ𝑖𝑡 | = ∑ sgn(Δ𝑖𝑡 )𝛼𝑡𝑖 (𝑠𝑡𝑖 − 𝑠𝑡−1

𝑖

)

𝑖 𝑖

1 1

+ ∑ sgn(Δ𝑖𝑡 )𝛽𝑡𝑖 ( − )

𝜎𝑡𝑖 𝑖

𝜎𝑡−1

𝑖

+ ∑ sgn(Δ𝑖𝑡 )𝛾𝑡𝑖 (𝜆𝑡 − 𝜆𝑡−1 ) .

𝑖

Past performance is not necessarily indicative of future results quantica-capital.com 12

Since 2003, Quantica Capital’s mission has been to design and implement the

best possible systematic trend-following investment products in highly liquid,

global markets. To the benefit of our investors and all our stakeholders.

DISCLAIMER

This document is provided by Quantica Capital AG. The information and opinions contained herein have been compiled or

arrived at in good faith based upon information obtained from sources believed to be reliable. However, such information

has not been independently verified and no guarantee, representation or warranty, express or implied, is made as to its

accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions

of entities and securities mentioned herein are not intended to be complete. This document is for information purposes

only. This document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities

or other financial instruments. The investment strategy described herein is offered solely on the basis of the information and

representations expressly set forth in the relevant offering circulars, and no other information or representations may be

relied upon in connection with the offering of the investment strategy. The investment strategy is only available to

institutional and other qualified investors. Performance information is not a measure of return to the investor, is not based

on audited financial statements, and is dated; return may have decreased since the issuance of this report. Past performance

is not necessarily indicative of future results. Alternative Investments by their nature involve a substantial degree of risk and

performance may be volatile which can lead to a partial or total loss of the invested capital.

CONTACT US Licensed asset manager with FINMA

Registered CTA and CPO with the CFTC

Tel: +41 (44) 556 69 00 Quantica Capital AG

info@quantica-capital.com Zurich Branch, Bärengasse 29

www.quantica-capital.com CH-8001 Zurich

Switzerland

Past performance is not necessarily indicative of future results quantica-capital.com 13

You might also like

- Understanding Managed FuturesDocument12 pagesUnderstanding Managed FuturesJohnNo ratings yet

- Dispersion and Its Effect On Manager Selection 1603837160Document6 pagesDispersion and Its Effect On Manager Selection 1603837160Andrea ComiNo ratings yet

- Bridgewater ReportDocument12 pagesBridgewater Reportw_fibNo ratings yet

- Has The Fed Tightened Enough Guideposts To ConsiderDocument10 pagesHas The Fed Tightened Enough Guideposts To ConsiderCheah Ken ShernNo ratings yet

- 2022Q3 QuanticaQuarterlyInsightsDocument13 pages2022Q3 QuanticaQuarterlyInsightsRiccardo RoncoNo ratings yet

- Sip Presentation - May 2020Document40 pagesSip Presentation - May 2020DBCGNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- U.S. Equity Index Fund (TDAM) : As at June 30, 2021Document1 pageU.S. Equity Index Fund (TDAM) : As at June 30, 2021Tony ParkNo ratings yet

- Quarterly Update Provides Insights Into RW Investment StrategyDocument6 pagesQuarterly Update Provides Insights Into RW Investment StrategyChaitanya JagarlapudiNo ratings yet

- UTI Aggressive Hybrid Fund (Formerly UTI Hybrid Equity Fund)Document28 pagesUTI Aggressive Hybrid Fund (Formerly UTI Hybrid Equity Fund)rinkuparekh13No ratings yet

- PRSN CNMDocument77 pagesPRSN CNMBradGourdoNo ratings yet

- Trading Index Dividends: Junhua Lu, Phd. CFADocument19 pagesTrading Index Dividends: Junhua Lu, Phd. CFAMatthew BurkeNo ratings yet

- Trend Following in Focus - September 2018Document8 pagesTrend Following in Focus - September 2018Clement VitaliNo ratings yet

- Quarter 2 Market Report: The Big PictureDocument9 pagesQuarter 2 Market Report: The Big PictureMridul SharmaNo ratings yet

- 12.max Life Diversified Equity FundDocument1 page12.max Life Diversified Equity Fundgourab.1996paulNo ratings yet

- 4.6. Reinsurance Cash Flow Patterns 4.6.1. Using The Timing of Gross Payments For Reinsurance Cash FlowsDocument7 pages4.6. Reinsurance Cash Flow Patterns 4.6.1. Using The Timing of Gross Payments For Reinsurance Cash FlowsSarah NyamakiNo ratings yet

- Uti Equity Fund: Why Multi Cap Funds?Document2 pagesUti Equity Fund: Why Multi Cap Funds?Suresh DhanasekarNo ratings yet

- Product Snapshot: DSP 10Y G-Sec FundDocument2 pagesProduct Snapshot: DSP 10Y G-Sec FundManoj SharmaNo ratings yet

- PI-PLANNING-PERFOMANCE-ASIA-PACIFIC v3Document6 pagesPI-PLANNING-PERFOMANCE-ASIA-PACIFIC v3Anh NguyenNo ratings yet

- CitiGroup On TrendFollowingDocument49 pagesCitiGroup On TrendFollowingGabNo ratings yet

- Dividen Investing S& PDocument10 pagesDividen Investing S& PromangrasNo ratings yet

- Indonesia - Jakarta - Landed Residential 1H23Document4 pagesIndonesia - Jakarta - Landed Residential 1H23herry prasetyoNo ratings yet

- Invest in Mid Cap Fund - UTI Equity Mutual FundsDocument2 pagesInvest in Mid Cap Fund - UTI Equity Mutual FundsRinku MishraNo ratings yet

- BCG Global Asset Management 2023 May 2023Document28 pagesBCG Global Asset Management 2023 May 2023VickoNo ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- Investor Presentation Highlights Triton's Market LeadershipDocument22 pagesInvestor Presentation Highlights Triton's Market LeadershipsarahNo ratings yet

- ARM Factsheets JanuaryDocument10 pagesARM Factsheets JanuaryJon RolexNo ratings yet

- Factsheet - 20 October 2023Document2 pagesFactsheet - 20 October 2023Shivani NirmalNo ratings yet

- 01 - M&A Conference - 2023 Year of The DealDocument25 pages01 - M&A Conference - 2023 Year of The Dealjm petitNo ratings yet

- Invest in quality bond fund with average maturity of 6.88 yearsDocument14 pagesInvest in quality bond fund with average maturity of 6.88 yearsDeepak Singh PundirNo ratings yet

- Commodity Trading Goes Back To The FutureDocument10 pagesCommodity Trading Goes Back To The FutureIshan SaneNo ratings yet

- DownloadDocument2 pagesDownloadewfnewfNo ratings yet

- HDFC BlueChip FundDocument1 pageHDFC BlueChip FundKaran ShambharkarNo ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Nykaa Investor PresentationDocument54 pagesNykaa Investor PresentationNaishadhNo ratings yet

- 1.1 Dao Nga Exchange RateDocument15 pages1.1 Dao Nga Exchange RatecomnguoiNo ratings yet

- PIATAFDocument1 pagePIATAFEileen LauNo ratings yet

- US Stock Bond CorrelationDocument24 pagesUS Stock Bond CorrelationSabyasachi MukherjeeNo ratings yet

- FX Composite InstitutionalDocument1 pageFX Composite InstitutionalDanger AlvarezNo ratings yet

- Cincinnatii Southern Railway Investment Advisor Presentation SummaryDocument4 pagesCincinnatii Southern Railway Investment Advisor Presentation SummarySACoolidgeNo ratings yet

- Canara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsDocument25 pagesCanara Robeco Equity Tax Saver Fund - ELSS with 3-year lock-in & tax benefitsmayankNo ratings yet

- Kempen Global Small Cap Review Q1Document35 pagesKempen Global Small Cap Review Q1Andrei FirteNo ratings yet

- Trend Following Why Now A Macro PerspectiveDocument17 pagesTrend Following Why Now A Macro PerspectiveAnna Kogan NasserNo ratings yet

- SSRN Id2488552Document34 pagesSSRN Id2488552Eric John JutaNo ratings yet

- Market Haven Monthly 2011 JanuaryDocument10 pagesMarket Haven Monthly 2011 JanuaryMarketHavenNo ratings yet

- AQR Alternative Thinking - The Stock-Bond Correlation 2Q 2022Document18 pagesAQR Alternative Thinking - The Stock-Bond Correlation 2Q 2022Cristian WaschburgerNo ratings yet

- Liquidity Paper FinalDocument13 pagesLiquidity Paper Finalnick ragoneNo ratings yet

- Capital Growth FundDocument1 pageCapital Growth FundHimanshu AgrawalNo ratings yet

- Sbi PPTDocument59 pagesSbi PPTmisfitmedicoNo ratings yet

- PB RGB FR OB mIG en 20230131Document2 pagesPB RGB FR OB mIG en 20230131matthieu massieNo ratings yet

- Quarterly Update - June 2021Document5 pagesQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- MDC Group Assignment 30 PDFDocument124 pagesMDC Group Assignment 30 PDFMelvina GodivaNo ratings yet

- Valuation Exercise For FOS ENERGYDocument6 pagesValuation Exercise For FOS ENERGYAmr YehiaNo ratings yet

- Blu Putnam Dynamics of Volatility and Correlations in The Commodity SpaceDocument49 pagesBlu Putnam Dynamics of Volatility and Correlations in The Commodity SpacesebaNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Predictingvolatility LazardresearchDocument9 pagesPredictingvolatility Lazardresearchhc87No ratings yet

- Vietnam Ho Chi Minh City Office Q2 2019 PDFDocument2 pagesVietnam Ho Chi Minh City Office Q2 2019 PDFNguyen Quang MinhNo ratings yet

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSFrom EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNo ratings yet

- Transparency in Financial Reporting: A concise comparison of IFRS and US GAAPFrom EverandTransparency in Financial Reporting: A concise comparison of IFRS and US GAAPRating: 4.5 out of 5 stars4.5/5 (3)

- Financial Derivative and Energy Market Valuation: Theory and Implementation in MATLABFrom EverandFinancial Derivative and Energy Market Valuation: Theory and Implementation in MATLABRating: 3.5 out of 5 stars3.5/5 (1)

- Magic Formula Investment Strategy Back Test (2022 Update) - Quant InvestingDocument13 pagesMagic Formula Investment Strategy Back Test (2022 Update) - Quant InvestingRiccardo RoncoNo ratings yet

- Don't Look Back: The Role of Instrument Selection in Trend-FollowingDocument11 pagesDon't Look Back: The Role of Instrument Selection in Trend-FollowingRiccardo RoncoNo ratings yet

- Research Review - 23 June 2023 - Forecasting Equity Returns - The Capital SpectatorDocument3 pagesResearch Review - 23 June 2023 - Forecasting Equity Returns - The Capital SpectatorRiccardo RoncoNo ratings yet

- AmiBroker Community ForumDocument3 pagesAmiBroker Community ForumRiccardo RoncoNo ratings yet

- Algebra and Differential Calculus For Data Science - CourseraDocument10 pagesAlgebra and Differential Calculus For Data Science - CourseraRiccardo RoncoNo ratings yet

- WN 3-08Document6 pagesWN 3-08Riccardo RoncoNo ratings yet

- Essential Linear Algebra For Data Science - CourseraDocument10 pagesEssential Linear Algebra For Data Science - CourseraRiccardo RoncoNo ratings yet

- How Much Can CTAs Really Move the MarketDocument22 pagesHow Much Can CTAs Really Move the MarketRiccardo RoncoNo ratings yet

- Trend-following strategies perform differently with and without volatility scalingDocument4 pagesTrend-following strategies perform differently with and without volatility scalingRiccardo RoncoNo ratings yet

- WN 3-19Document5 pagesWN 3-19Riccardo RoncoNo ratings yet

- Expressway To Data Science - Essential Math - CourseraDocument10 pagesExpressway To Data Science - Essential Math - CourseraRiccardo RoncoNo ratings yet

- Translations of The Dialogues PDFDocument23 pagesTranslations of The Dialogues PDFRiccardo RoncoNo ratings yet

- WN 3-18Document6 pagesWN 3-18Riccardo RoncoNo ratings yet

- WN 3-25Document5 pagesWN 3-25Riccardo RoncoNo ratings yet

- Alphabetical List of Vocabulary PDFDocument16 pagesAlphabetical List of Vocabulary PDFRiccardo RoncoNo ratings yet

- BeoGram 4002 6000 Turntable Restoration RepairDocument12 pagesBeoGram 4002 6000 Turntable Restoration RepairRiccardo Ronco0% (1)

- Key To The Exercises PDFDocument18 pagesKey To The Exercises PDFRiccardo RoncoNo ratings yet

- WN 3-24Document3 pagesWN 3-24Riccardo RoncoNo ratings yet

- Level 33Document69 pagesLevel 33Gezim BytyqiNo ratings yet

- Liyc German Level 2 PDFDocument59 pagesLiyc German Level 2 PDFSun JavaNo ratings yet

- DML-522W100: 22" / 56 CM LCD MONITORDocument2 pagesDML-522W100: 22" / 56 CM LCD MONITORRiccardo RoncoNo ratings yet

- Learn in Your Car German - Book 1Document72 pagesLearn in Your Car German - Book 1Patrícia Da Silva PinheiroNo ratings yet

- Beocom6000 Userguide EnglishDocument56 pagesBeocom6000 Userguide EnglishRiccardo RoncoNo ratings yet

- Kelly Portfolio OptimizationDocument19 pagesKelly Portfolio OptimizationRiccardo RoncoNo ratings yet

- Panasonic Home Phones 6411 ManualDocument48 pagesPanasonic Home Phones 6411 ManualRiccardo RoncoNo ratings yet

- Kelly Portfolio OptimizationDocument19 pagesKelly Portfolio OptimizationRiccardo RoncoNo ratings yet

- Powder FlowDocument15 pagesPowder FlowSteven SastradiNo ratings yet

- Seminar On Building Analysis On Staad With Raft FoundationsDocument4 pagesSeminar On Building Analysis On Staad With Raft FoundationsAWOUNANGNo ratings yet

- ASTM D70 DensityDocument4 pagesASTM D70 DensityPedro AlvelaisNo ratings yet

- Silver Recovery From Waste X-Ray Photographic Films Collected From Hospitals in Addis AbabaDocument7 pagesSilver Recovery From Waste X-Ray Photographic Films Collected From Hospitals in Addis Ababamuftah76No ratings yet

- Reported To Another Basis ToleranceDocument15 pagesReported To Another Basis ToleranceYuliyanti YuliyantiNo ratings yet

- Paper Lncs PDFDocument57 pagesPaper Lncs PDFNeilNo ratings yet

- Halton-Pressure Relief DamperDocument4 pagesHalton-Pressure Relief Damperramkumar_meNo ratings yet

- Chapter7 Powerfeed SystemDocument27 pagesChapter7 Powerfeed SystemYAKUBU A. AROGENo ratings yet

- Shree MetriDocument18 pagesShree Metrivireshsa789No ratings yet

- Lac Operon - Genetics-Essentials-Concepts-and-ConnectionsDocument15 pagesLac Operon - Genetics-Essentials-Concepts-and-ConnectionsDiandra AnnisaNo ratings yet

- Unirub Techno India PVT 7Document7 pagesUnirub Techno India PVT 7BalajiYachawadNo ratings yet

- Tachyhydrite Camg CL 12H O: Crystal Data: Physical PropertiesDocument1 pageTachyhydrite Camg CL 12H O: Crystal Data: Physical Propertieskittipun khamprasoetNo ratings yet

- Wk4 Formulating HypothesisDocument19 pagesWk4 Formulating HypothesisChaela GonzagaNo ratings yet

- DM200094_Marts 3000_DK400041_ENDocument28 pagesDM200094_Marts 3000_DK400041_ENipasrl.guestNo ratings yet

- Varisoft Eq 100 Ti c0920 CosmotecDocument3 pagesVarisoft Eq 100 Ti c0920 CosmotecHayala MotaNo ratings yet

- 4720.00080A01 S22 Series Service ManualDocument138 pages4720.00080A01 S22 Series Service ManualSIM MOVAR86% (7)

- Engineering Graphics Exam Drawing ProblemsDocument2 pagesEngineering Graphics Exam Drawing ProblemsSalim Saifudeen SaifudeenNo ratings yet

- 2023 2024 S1 SB Assignment CorrectedDocument3 pages2023 2024 S1 SB Assignment Corrected31231022022No ratings yet

- Boolean String WriteupDocument2 pagesBoolean String Writeuphr.indiaNo ratings yet

- RRB Clerk Prelims Day - 13 e (1) 168804293277Document27 pagesRRB Clerk Prelims Day - 13 e (1) 168804293277sahilNo ratings yet

- ArchModels Volume - 126 PDFDocument40 pagesArchModels Volume - 126 PDFgombestralalaNo ratings yet

- Artigo Fator de PotênciaDocument4 pagesArtigo Fator de PotênciaDiego FaenelloNo ratings yet

- 10 5923 J Ajsp 20110102 07Document6 pages10 5923 J Ajsp 20110102 07markuleNo ratings yet

- Vibrational Numbers (FAQ) PDFDocument4 pagesVibrational Numbers (FAQ) PDFJcpathak100% (1)

- Subject Content Clarification Guide A LevelDocument24 pagesSubject Content Clarification Guide A LevelKhan SaibNo ratings yet

- GPIB Communication and Hardware SpecificationsDocument5 pagesGPIB Communication and Hardware Specificationsshofika SelvarajNo ratings yet

- SPM Unit 3 NotesDocument13 pagesSPM Unit 3 Notes20kd1a05c1No ratings yet

- Design and Analysis of Algorithms Unit IIDocument20 pagesDesign and Analysis of Algorithms Unit IIAyman AymanNo ratings yet

- Short Questions... DbmsDocument10 pagesShort Questions... DbmsMuhammad Jamal ShahNo ratings yet

- Optical and Near-Infrared Spectroscopy of The Black Hole Transient 4U 1543-47 During Its 2021 Ultra-Luminous StateDocument12 pagesOptical and Near-Infrared Spectroscopy of The Black Hole Transient 4U 1543-47 During Its 2021 Ultra-Luminous StateAndrea HermosaNo ratings yet