Professional Documents

Culture Documents

Consent Form-Corporate NPS

Uploaded by

Anto RejoyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consent Form-Corporate NPS

Uploaded by

Anto RejoyCopyright:

Available Formats

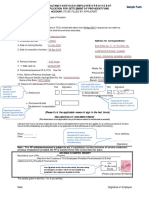

CONSENT FORM FOR CORPORATE NPS

Date:

To,

Corporate Human Resources,

Mumbai.

Sub.: Consent to contribute Employers Contribution to National Pension System (NPS) from monthly salary.

Dear Sir/Madam,

I, Mr/Ms……………………………………………………………………………………………………………………………authorised you to

Contribute……………………% of my basic from my monthly salary towards Employers Contribution to NPS

w.e.f. Month……………………Year…………… and remit the same to my following mentioned NPS Account (PRAN).

I hereby confirm that my PRAN :………………………………………………………………………………. is active and any other

charges applicable to the said NPS transactions will be borne by me.

Thanking you,

Yours faithfully,

Signature of Employee

Name:

Emp. Code:

Disclaimer

“The Company is offering an investment option, to its employees in the National Pension Scheme (NPS) as an Employers

Contribution to NPS, which is purely voluntary. The investment is subject to market risks and the Company does not guarantee

and/or make any commitment whatsoever in respect of the returns on such investment. The exemptions presently applicable under

the Income Tax Act, 1961 in relation to investment in NPS are subject to change in the applicable laws from time to time. As per

proposed union budget 2020 i.e. from April 2020, employee will get maximum deduction u/s 80CCD(2) up to Rs. 7.5 lac in a year

(cumulative of Employers Contribution to EPF and NPS).The employee acknowledges that the decision of investing in NPS (if opted

for) will be purely of the employee and the Company has no liability of whatsoever nature in relation to the investment decision of

the employee. The FAQs and/or any other material should be used for information purpose only. Employees should consult and

seek independent professional advice before taking any investment decision.”

Signature of Employee

Note: Kindly submit consent form along with self-attested PRAN Copy.

You might also like

- What Is The National Pension System (NPS) ?Document9 pagesWhat Is The National Pension System (NPS) ?Avinash singhNo ratings yet

- The Payment of Bonus Act, 1965Document15 pagesThe Payment of Bonus Act, 1965Raman GhaiNo ratings yet

- Annexure - Iv Information Sheet Name: Candidate ID:: 1. Role and Competency Based OrganizationDocument3 pagesAnnexure - Iv Information Sheet Name: Candidate ID:: 1. Role and Competency Based OrganizationdfsdfNo ratings yet

- Performa For Joint Request Under Paragraph 26 (Final)Document2 pagesPerforma For Joint Request Under Paragraph 26 (Final)Nihar Ranjan TripathyNo ratings yet

- Debajyoti BBSRDocument5 pagesDebajyoti BBSRjawedaman123No ratings yet

- Appointment As Marketing ManagerDocument3 pagesAppointment As Marketing ManagershivarajapyuNo ratings yet

- RanjitDocument5 pagesRanjitjawedaman123No ratings yet

- Payment of Bonus Act Quick RevisionDocument9 pagesPayment of Bonus Act Quick Revisionshanky631No ratings yet

- Debajyoti JoiningDocument5 pagesDebajyoti Joiningjawedaman123No ratings yet

- CW P 3405602Document12 pagesCW P 3405602satish_CJ100% (1)

- c3175492 Pavan Kumarvasudha Signed OfferletterDocument6 pagesc3175492 Pavan Kumarvasudha Signed OfferletterPavan Kumar Vasudha100% (1)

- SIP Registration RenewalForm Dec15Document2 pagesSIP Registration RenewalForm Dec15singenaadamNo ratings yet

- Information SheetDocument5 pagesInformation SheetShrishNo ratings yet

- Raghavendra Nayak S Signed OfferLetterDocument6 pagesRaghavendra Nayak S Signed OfferLetterVikram DNo ratings yet

- Format For Solvency CertificateDocument8 pagesFormat For Solvency CertificateneethanNo ratings yet

- Personal Details: Application No: TFS/PB/BE/ / ..Document4 pagesPersonal Details: Application No: TFS/PB/BE/ / ..Shishir SaxenaNo ratings yet

- PRMS FAQsDocument3 pagesPRMS FAQsfriendbceNo ratings yet

- PFDocument18 pagesPFPredhivrajNo ratings yet

- Every Contractor Shall Issue Employment-Cum-Wage Card in Proforma XIVDocument10 pagesEvery Contractor Shall Issue Employment-Cum-Wage Card in Proforma XIVstellalaurenNo ratings yet

- Declaration Form (Employee Pension Scheme) - Form 9Document4 pagesDeclaration Form (Employee Pension Scheme) - Form 9Anand Bisht67% (3)

- National Pension Scheme FAQsDocument5 pagesNational Pension Scheme FAQsvaierNo ratings yet

- Provident Fund Act SummaryDocument10 pagesProvident Fund Act SummaryhemlatauNo ratings yet

- Very ImportantDocument5 pagesVery Importantkaran100% (3)

- Deed of Partnership 01Document11 pagesDeed of Partnership 01SunilsabatNo ratings yet

- NCL Industries Annual Report 14Document57 pagesNCL Industries Annual Report 14rajan10_kumar_805053No ratings yet

- Provident Fund - SynopsisDocument9 pagesProvident Fund - SynopsisSIDDHANT MOHAPATRANo ratings yet

- C3892637 - RAKSHITHK S - OfferLetter-1 PDFDocument6 pagesC3892637 - RAKSHITHK S - OfferLetter-1 PDFmithuncyNo ratings yet

- Membership Form SBOODocument2 pagesMembership Form SBOOrakesh9006No ratings yet

- FAQs - EricssonDocument15 pagesFAQs - EricssonManish SharmaNo ratings yet

- InstructionsDocument8 pagesInstructionssathyanarayana medaNo ratings yet

- Paymt of Bonus ActDocument4 pagesPaymt of Bonus ActPriscilla Sherene MBANo ratings yet

- Tax Savings Declarations GuidelinesDocument13 pagesTax Savings Declarations GuidelinesAditya DasNo ratings yet

- Note For PF PDFDocument3 pagesNote For PF PDFMilind MohapatraNo ratings yet

- Payment of Bonus ActDocument22 pagesPayment of Bonus ActpoohshahNo ratings yet

- Comm in Business EnvironDocument9 pagesComm in Business EnvironsasyedaNo ratings yet

- Income From SalaryDocument21 pagesIncome From SalaryAditya Avasare60% (10)

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSDocument3 pagesArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- Sarfaraj JoiningDocument5 pagesSarfaraj Joiningjawedaman123No ratings yet

- Provident FundDocument9 pagesProvident FundGopalakrishnan KuppuswamyNo ratings yet

- Annual Bonus Plan FY 16-17Document14 pagesAnnual Bonus Plan FY 16-17Ashutosh SaxenaNo ratings yet

- TaxDocument46 pagesTaxAkashTokeNo ratings yet

- Partnership DeedDocument8 pagesPartnership DeedSangita AcharyaNo ratings yet

- Frequently Asked Questions Provident FundDocument7 pagesFrequently Asked Questions Provident Fundpenusila6941No ratings yet

- National Pension Scheme - Process Note - v1Document11 pagesNational Pension Scheme - Process Note - v1Pratap ReddyNo ratings yet

- Capgemini OfferLetterDocument14 pagesCapgemini OfferLetterRAJASEKARANNo ratings yet

- Bonus ActDocument5 pagesBonus ActPriya SonuNo ratings yet

- Manali AR Notice 2016Document9 pagesManali AR Notice 2016Vaishnavo DeviNo ratings yet

- PRAKRUTHIDocument4 pagesPRAKRUTHIprakruthiry03No ratings yet

- Format of Joining LetterDocument1 pageFormat of Joining LetterGAGAN KANSAL100% (3)

- PPP Loan Forgiveness Application (Revised 6.16.2020)Document5 pagesPPP Loan Forgiveness Application (Revised 6.16.2020)LaurenNo ratings yet

- Offer Letter FPB14915Document3 pagesOffer Letter FPB14915Sagar GuptaNo ratings yet

- 12thannualreport16 17Document119 pages12thannualreport16 17RudraNo ratings yet

- CM Unit - VDocument23 pagesCM Unit - Vsunilkumarmswa22No ratings yet

- Offer LetterDocument6 pagesOffer LetterKennet AlphyNo ratings yet

- The Payment of Bonus & Gratuity Act. Bonus Act-1965 & Gratuity Act-1972Document34 pagesThe Payment of Bonus & Gratuity Act. Bonus Act-1965 & Gratuity Act-1972Dhruti AthaNo ratings yet

- Setting up, operating and maintaining Self-Managed Superannuation FundsFrom EverandSetting up, operating and maintaining Self-Managed Superannuation FundsNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- CommerzoneDocument16 pagesCommerzoneAnto RejoyNo ratings yet

- Mindspace - Maximus 2A Madhapur - 7 FloorDocument5 pagesMindspace - Maximus 2A Madhapur - 7 FloorAnto RejoyNo ratings yet

- Mindspace - Maximus 2B MadhapurDocument15 pagesMindspace - Maximus 2B MadhapurAnto RejoyNo ratings yet

- 2166 COC BookletDocument34 pages2166 COC BookletSamay MaraviNo ratings yet