Professional Documents

Culture Documents

FM End Term 42

Uploaded by

Paras0 ratings0% found this document useful (0 votes)

9 views1 pageThe document is an end-term examination for a course in Financial Management. It contains 4 questions assessing students' understanding of portfolio analysis, capital budgeting techniques, stock valuation, capital structure theory, and leverage. Question 1 involves calculating the expected return and standard deviation of a portfolio and discussing limitations of IRR. Question 2 estimates systematic risk of a stock and analyzes how returns would change with beta and inflation. Question 3 explains Modigliani-Miller capital structure theorem with and without taxes and how financial leverage increases shareholder returns. Question 4 calculates operating and financial leverage at different sales levels for a company.

Original Description:

Original Title

Fm End term 42

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is an end-term examination for a course in Financial Management. It contains 4 questions assessing students' understanding of portfolio analysis, capital budgeting techniques, stock valuation, capital structure theory, and leverage. Question 1 involves calculating the expected return and standard deviation of a portfolio and discussing limitations of IRR. Question 2 estimates systematic risk of a stock and analyzes how returns would change with beta and inflation. Question 3 explains Modigliani-Miller capital structure theorem with and without taxes and how financial leverage increases shareholder returns. Question 4 calculates operating and financial leverage at different sales levels for a company.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageFM End Term 42

Uploaded by

ParasThe document is an end-term examination for a course in Financial Management. It contains 4 questions assessing students' understanding of portfolio analysis, capital budgeting techniques, stock valuation, capital structure theory, and leverage. Question 1 involves calculating the expected return and standard deviation of a portfolio and discussing limitations of IRR. Question 2 estimates systematic risk of a stock and analyzes how returns would change with beta and inflation. Question 3 explains Modigliani-Miller capital structure theorem with and without taxes and how financial leverage increases shareholder returns. Question 4 calculates operating and financial leverage at different sales levels for a company.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

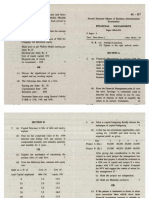

IRMA

Institute of Rural Management Anand

Course Name: Financial

Management Programme: PGDM-RM42

FPM-RM20

Date: 14.03.2022 Term Roll No.

End-Term Examination

Duration of Exam: 2 Hrs Weightage: 30% Total Marks: 40

1. Solve the followings: (5+5)

(a) A portfolio

consists of two securities A and in the proportion of 3:2. The correlation

between the two securities is (-)0.50. The expected returns (ER) and standard deviation

(SD) are as below:

A B

ER 20% 10%

SD 30% 20%

Calculate the expected return and SD of the portfolio.

(b) Discuss the limitations of the IRR technique of capital budgeting and the advantages of

the MIRR technique the IRR

over

technique.

2. Given risk-free rate (R;) 6%, expected market return 16% and expected return

=

on a stock

is 18%. Estimate the

systematic risk of the stock. (10)

i. Analyze the return on the stock if its beta

(market risk) falls to 0.80.

ii. Analyze the return on the stock if inflation increases

by 100 basis points.

3. Explain the following.

(5+5)

(a) Discuss the Modigliani and Miller theorem on the capital structure without and with

taxes

(b) Show that with financial leverage, expected return for shareholders increases.

4. Explain the following. (5+5)

(a) ABC Ltd sells a chair for Rs. 1,000. The variable costs (per unit) and fixed operating o

are Rs. 600 and Rs. 100,000, respectively. For interest expense of Rs. 80,000, calculate the

degree of operating and financial leverage when sales are 1,000 and 2,000 units.

(b) Compare the two degrees of operating and financial leverage at different levels of sales

and comment.

Page 1 of1

You might also like

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- Img 20200626 0001Document7 pagesImg 20200626 0001seyon sithamparanathanNo ratings yet

- Paper20A Set2Document8 pagesPaper20A Set2Ramanpreet KaurNo ratings yet

- Academic Session 2022 MAY 2022 Semester: AssignmentDocument6 pagesAcademic Session 2022 MAY 2022 Semester: AssignmentChristopher KipsangNo ratings yet

- Fe2305-0573 20230903121830Document9 pagesFe2305-0573 20230903121830broken swordNo ratings yet

- PRM41 - FM - End Term Question PaperDocument2 pagesPRM41 - FM - End Term Question PapershravaniNo ratings yet

- Financial-Planning-and-Budgeting-S-22 PaperDocument3 pagesFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985No ratings yet

- MN5207 Acounting and Financial Management 2019Document10 pagesMN5207 Acounting and Financial Management 2019Vimuth Chanaka PereraNo ratings yet

- Investment Planning and Portfolio ManagementDocument3 pagesInvestment Planning and Portfolio ManagementTark Raj BhattNo ratings yet

- Portfolio Management and Invesrment AnalysisDocument3 pagesPortfolio Management and Invesrment AnalysisGyan PokhrelNo ratings yet

- BCM 4206 Corporate Finance PDFDocument4 pagesBCM 4206 Corporate Finance PDFSimon silaNo ratings yet

- f9 2018 Marjun QDocument6 pagesf9 2018 Marjun QDilawar HayatNo ratings yet

- BFC 3379 Investment Analysis and Portfolio Management PDFDocument3 pagesBFC 3379 Investment Analysis and Portfolio Management PDFdouglas kimaniNo ratings yet

- New Format Exam Q Maf620 - Oct 2009Document5 pagesNew Format Exam Q Maf620 - Oct 2009kkNo ratings yet

- BEAM038J-Exam Paper BEAM038J-22AUGDocument6 pagesBEAM038J-Exam Paper BEAM038J-22AUGHoàng TrầnNo ratings yet

- Fe 202009 BBCF1013Document8 pagesFe 202009 BBCF1013Wan Muhamad ShariffNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversitySaR aSNo ratings yet

- Module - 4 Problem On Portfolio Risk & Return-IIDocument4 pagesModule - 4 Problem On Portfolio Risk & Return-IIgaurav supadeNo ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- PST FM 2015 2023Document92 pagesPST FM 2015 2023PhilipNo ratings yet

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDocument9 pagesModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- Assignment DMBA202 MBA 2 Set-1 and 2 Nov 2022Document2 pagesAssignment DMBA202 MBA 2 Set-1 and 2 Nov 2022Solve AssignmentNo ratings yet

- Adfm Iii 2015-17Document3 pagesAdfm Iii 2015-17Nithyananda PatelNo ratings yet

- Portfolio TheoryDocument9 pagesPortfolio TheorytoabhishekpalNo ratings yet

- Bos 43771 QDocument6 pagesBos 43771 QSunil KumarNo ratings yet

- Sd16 Hybrid p4 QDocument12 pagesSd16 Hybrid p4 QQasim AliNo ratings yet

- December 2016 QDocument7 pagesDecember 2016 QNirmal ShresthaNo ratings yet

- FM 15-16Document3 pagesFM 15-16BrijmohanNo ratings yet

- FM Assignment 5Document2 pagesFM Assignment 5Vundi RohitNo ratings yet

- SAPMDocument10 pagesSAPMadisontakke_31792263No ratings yet

- PGDM D - Corp ValDocument2 pagesPGDM D - Corp Valsanket patilNo ratings yet

- Section A - Answer Question One (Compulsory Question)Document5 pagesSection A - Answer Question One (Compulsory Question)Adeel KhalidNo ratings yet

- 2013MBA Sem II Financial Management - pdf2013Document3 pages2013MBA Sem II Financial Management - pdf2013Riya AgrawalNo ratings yet

- Dfa6233 2017 2 PT PDFDocument6 pagesDfa6233 2017 2 PT PDFmy pcNo ratings yet

- BMMF5103 QuestionDocument7 pagesBMMF5103 QuestionAbdurahman Isse IgalNo ratings yet

- IPMDocument6 pagesIPMPOOJAN DANIDHARIYANo ratings yet

- Question Paper Unsolved - Special Study in FinanceDocument18 pagesQuestion Paper Unsolved - Special Study in FinanceAbhijeet KulshreshthaNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument120 pagesPaper - 2: Strategic Financial Management Questions Security ValuationKeshav SethiNo ratings yet

- Paper - 2: Strategic Financial Management Questions Security ValuationDocument21 pagesPaper - 2: Strategic Financial Management Questions Security ValuationItikaa TiwariNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerAyushi GuptaNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- MTP 17 53 Questions 1710507531Document9 pagesMTP 17 53 Questions 1710507531janasenalogNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- Question Paper of FMDocument3 pagesQuestion Paper of FMsrijana pathakNo ratings yet

- Faculty Accountancy 2021 Session 1 - Degree Maf603 2Document12 pagesFaculty Accountancy 2021 Session 1 - Degree Maf603 2Hadi DahalanNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- Bba - 17ubn05 - 01.02.2022 - FN PDFDocument3 pagesBba - 17ubn05 - 01.02.2022 - FN PDFBdhs HdhdNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Assignment 1Document2 pagesAssignment 1chanus19No ratings yet

- Ba Fin430finalDocument4 pagesBa Fin430finalIzzy BbyNo ratings yet

- Acc202 (Q) - Online Exam (Both Campus) (Mock Exam)Document8 pagesAcc202 (Q) - Online Exam (Both Campus) (Mock Exam)Rishiaendra CoolNo ratings yet

- BFC 3379 Investment Analysis and Portfolio MNGTDocument4 pagesBFC 3379 Investment Analysis and Portfolio MNGTsumeya.abdi4No ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- MB 207 PDFDocument8 pagesMB 207 PDFdeep dasNo ratings yet

- CH 4 - Portfolio Management (2024) - HandoutDocument21 pagesCH 4 - Portfolio Management (2024) - HandoutMayibongwe MpofuNo ratings yet

- BComDocument3 pagesBComChristy jamesNo ratings yet

- Spreadsheet ModellingDocument12 pagesSpreadsheet ModellingParasNo ratings yet

- OR End Term 42Document3 pagesOR End Term 42ParasNo ratings yet

- Macro End TermDocument3 pagesMacro End TermParasNo ratings yet

- Operation ManagementDocument2 pagesOperation ManagementParasNo ratings yet

- OR End Term 42Document5 pagesOR End Term 42ParasNo ratings yet