Professional Documents

Culture Documents

10 4 Page 290 10 4 Mastery Problem SJ PDF

Uploaded by

Aidan JamesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 4 Page 290 10 4 Mastery Problem SJ PDF

Uploaded by

Aidan JamesCopyright:

Available Formats

10-4 Mastery Problem, p.

290

Journalizing sales and cash receipts transactions; proving and ruling journals

1., 2., 3.

SALES JOURNAL PAGE 19

1 2 3

ACCOUNTS SALES TAX

SALE POST. RECEIVABLE SALES PAYABLE

DATE ACCOUNT DEBITED NO. REF. DEBIT CREDIT CREDIT

2020

1 Oct 24 Brought Forward a (14,966.70) (14,521.55) ( 445.15) 1

2 27 County Hospital 443 ( 509.08) ( 489.50) ( 19.58) 2

3 30 Southeastern University 444 ( 3,643.50) ( 3,643.50) 3

4 Total (19,119.28) (18,654.55) ( 464.73) 4

5 5

6 6

7 7

8 8

9 9

10 10

11 11

12 12

13 10

14 11

15 12

16 13

17 14

18 15

8. Debit Credit

Column Title Totals Totals

Accounts Receivable Debit ( 19,119.28)

Sales Credit ( 18,654.55)

Sales Tax Payable Credit ( 464.73)

TOTALS ( 19,119.28)( 19,119.28)

This study source was downloaded by 100000807654533 from CourseHero.com on 04-10-2023 10:37:31 GMT -05:00

https://www.coursehero.com/file/67274258/10-4-page-290-10-4-Mastery-Problem-SJpdf/

Powered by TCPDF (www.tcpdf.org)

You might also like

- 17 - (GFCI) Inspection LogDocument1 page17 - (GFCI) Inspection LogSaudia Arabia JobsNo ratings yet

- The Toyota Kata Practice Guide: Practicing Scientific Thinking Skills for Superior Results in 20 Minutes a DayFrom EverandThe Toyota Kata Practice Guide: Practicing Scientific Thinking Skills for Superior Results in 20 Minutes a DayRating: 4.5 out of 5 stars4.5/5 (7)

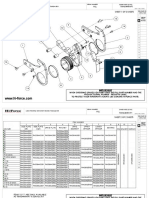

- Multifresh: User ManualDocument144 pagesMultifresh: User ManualAt Yugovic100% (4)

- Fap Dat 1044 Demonstrativo DebitoDocument1 pageFap Dat 1044 Demonstrativo Debitoconect brasilNo ratings yet

- Conta Blender 1250L LayoutDocument1 pageConta Blender 1250L LayoutBaioniNo ratings yet

- Tambahan KerjaDocument1 pageTambahan KerjaRiyan saputraNo ratings yet

- Tambahan KerjaDocument1 pageTambahan KerjaRiyan saputraNo ratings yet

- Mp-Badwaha-3.75 MLD Stp-Layout Drawing For STP-06-12-2019 PDFDocument1 pageMp-Badwaha-3.75 MLD Stp-Layout Drawing For STP-06-12-2019 PDFAkash PatilNo ratings yet

- MADRASA-AS-SABA (Exam) 2022-23Document1 pageMADRASA-AS-SABA (Exam) 2022-23Mohammed Adnan khanNo ratings yet

- TO: - and To All Tenants in PossessionDocument8 pagesTO: - and To All Tenants in PossessionHenry Jacob Baker JrNo ratings yet

- MADRASA-AS-SABA (Exam) - 1Document1 pageMADRASA-AS-SABA (Exam) - 1Mohammed Adnan khanNo ratings yet

- Chapter 8 Working PapersDocument9 pagesChapter 8 Working PapersYoussef MoustafaNo ratings yet

- Allison MT (B) 640, 643, 650, 653 Series On-Highway Transmissions Parts CatalogDocument10 pagesAllison MT (B) 640, 643, 650, 653 Series On-Highway Transmissions Parts CatalogMarcos LunaNo ratings yet

- Allison MT (B) 640, 643, 650, 653 Series On-Highway Transmissions Parts CatalogDocument38 pagesAllison MT (B) 640, 643, 650, 653 Series On-Highway Transmissions Parts CatalogMarcos LunaNo ratings yet

- 11 November and Dec - Cababat Only ActualDocument8 pages11 November and Dec - Cababat Only ActualBPH MaramagNo ratings yet

- BOOKKEEPINGDocument13 pagesBOOKKEEPINGBarayuga Justine Joy S.No ratings yet

- WFOAdult Billing CFormDocument1 pageWFOAdult Billing CFormisidNo ratings yet

- NLC Payroll EtcDocument8 pagesNLC Payroll EtcJessica CrisostomoNo ratings yet

- Cortes Enrega FinalDocument1 pageCortes Enrega FinalJohn Edison Perez GarciaNo ratings yet

- Dassault Systemes: XXX Dell X Product1 A0Document1 pageDassault Systemes: XXX Dell X Product1 A0DHANARAJ BASAVARAJ BHASKARNo ratings yet

- Gspublisherversion 0.18.100.100Document1 pageGspublisherversion 0.18.100.100Jose Luis TolosaNo ratings yet

- Vue ÉclatéesDocument17 pagesVue ÉclatéesLudovic BrasseurNo ratings yet

- 2-Motobomba A Diesel 10HP 4 Pol Auto Escorvante Partida Elãtrica2Document4 pages2-Motobomba A Diesel 10HP 4 Pol Auto Escorvante Partida Elãtrica2Jose Wellington Silva dos SantosNo ratings yet

- UntitledDocument18 pagesUntitledCarlo JayNo ratings yet

- Visitor Sign in Sheet (El Dorado Mining Noordsift Pan) : Date Name (Printed) Signature From Visiting Time in Time OutDocument1 pageVisitor Sign in Sheet (El Dorado Mining Noordsift Pan) : Date Name (Printed) Signature From Visiting Time in Time OutJaco EngelbrechtNo ratings yet

- National Learning Camp Payroll 2023Document2 pagesNational Learning Camp Payroll 2023Jessica CrisostomoNo ratings yet

- March MadnessDocument1 pageMarch MadnessD PatelNo ratings yet

- King Fahd University of Petroleum and Minerals College of Computing and MathematicsDocument2 pagesKing Fahd University of Petroleum and Minerals College of Computing and MathematicsAbdullah AlOmarNo ratings yet

- 10 4 Mastery Problem CRJ P. 290 10 4 Mastery Problem CRJ PDFDocument4 pages10 4 Mastery Problem CRJ P. 290 10 4 Mastery Problem CRJ PDFAidan JamesNo ratings yet

- Arc Flash Project: Qualified and AdvantageousDocument2 pagesArc Flash Project: Qualified and AdvantageousSalman FadillahNo ratings yet

- Brooklyn Community District 9: Total PopulationDocument40 pagesBrooklyn Community District 9: Total PopulationcouncilkNo ratings yet

- 11 November Aguirre, Ildemae MD & Co.Document8 pages11 November Aguirre, Ildemae MD & Co.BPH MaramagNo ratings yet

- First Aid ListsDocument1 pageFirst Aid ListsAnna Marie Filipinas RajilNo ratings yet

- Tinte Moa - 100yd - Mod3 PDFDocument1 pageTinte Moa - 100yd - Mod3 PDFCiprian OpreaNo ratings yet

- IMES Toshiba Aquilion Training Fall 18Document2 pagesIMES Toshiba Aquilion Training Fall 18Jawad SandhuNo ratings yet

- General Notes For Steel Structure 20231113Document3 pagesGeneral Notes For Steel Structure 20231113cmpeverpro2023No ratings yet

- Annex C - RMO NSNPDocument1 pageAnnex C - RMO NSNPLeonardo Jr SultanNo ratings yet

- 1 DayperpageundatedDocument1 page1 DayperpageundatedhavingtoregisterissuchbullshitNo ratings yet

- Attendance Sheet Name of Student Signature Course/ Year/ Section Name of Guardian SignatureDocument2 pagesAttendance Sheet Name of Student Signature Course/ Year/ Section Name of Guardian Signaturecredit analystNo ratings yet

- 12 December Aguirre, Pastor MD & Co. OBLIGATEDocument8 pages12 December Aguirre, Pastor MD & Co. OBLIGATEBPH MaramagNo ratings yet

- Simbologia Quant.: 06 Placa de Led de Embutir Cor 4000K 15Document1 pageSimbologia Quant.: 06 Placa de Led de Embutir Cor 4000K 15Helder MoraisNo ratings yet

- Loewe Pineapple Paper ToyDocument2 pagesLoewe Pineapple Paper ToyAndonny Leiva VegaNo ratings yet

- Ruler1 10mmDocument1 pageRuler1 10mmpipokin123.1No ratings yet

- AttendanceDocument1 pageAttendanceVineet SinghNo ratings yet

- Stair Section Plan (North Dagon) - 20bDocument1 pageStair Section Plan (North Dagon) - 20bKhup KhanNo ratings yet

- Plano 02 A PDFDocument1 pagePlano 02 A PDFwendyNo ratings yet

- Casa ProyectosDocument1 pageCasa ProyectospamelaNo ratings yet

- Planilha Funil de VendasPEÇAS (Version 2) .XLSBDocument8 pagesPlanilha Funil de VendasPEÇAS (Version 2) .XLSBRenata FernandesNo ratings yet

- Snell S Law - Stitch FiddleDocument3 pagesSnell S Law - Stitch FiddleIsaac MeyerNo ratings yet

- OL SMM-055-ODE - Requistion Form (Ver 04)Document1 pageOL SMM-055-ODE - Requistion Form (Ver 04)wendy pramonoNo ratings yet

- TWH54NRH Spare Parts Sheet942016221232Document2 pagesTWH54NRH Spare Parts Sheet942016221232Heitor RibeiroNo ratings yet

- Primer Nivel: Gspublisherversion 0.0.100.100Document1 pagePrimer Nivel: Gspublisherversion 0.0.100.100J Luis Quispe RoncallaNo ratings yet

- Show Title Studio: SC. Cont Action 6 5 4 3 2 1Document1 pageShow Title Studio: SC. Cont Action 6 5 4 3 2 1Sk BonillaNo ratings yet

- Aclan, Arlan P.-Back PageDocument1 pageAclan, Arlan P.-Back PageDon King DalusongNo ratings yet

- Plan Primul Nivel-ParcariDocument1 pagePlan Primul Nivel-ParcariArchitecture AdbiaNo ratings yet

- 89 TromboneDocument1 page89 TrombonePedro ViniciusNo ratings yet

- Weekdays: Weekdays Graphical Representation ScheduleDocument3 pagesWeekdays: Weekdays Graphical Representation ScheduleMavrix AgustinNo ratings yet

- Casa Proyectos11Document1 pageCasa Proyectos11pamelaNo ratings yet

- Secondary Calendar2022 23Document1 pageSecondary Calendar2022 23Trelaine ThompsonNo ratings yet

- One Bold Move a Day: Meaningful Actions Women Can Take to Fulfill Their Leadership and Career PotentialFrom EverandOne Bold Move a Day: Meaningful Actions Women Can Take to Fulfill Their Leadership and Career PotentialNo ratings yet

- Jones 2 - 27 QuestionsDocument1 pageJones 2 - 27 QuestionsAidan JamesNo ratings yet

- Athletics Registration ProcessDocument1 pageAthletics Registration ProcessAidan JamesNo ratings yet

- Economic ChoicesDocument13 pagesEconomic ChoicesAidan JamesNo ratings yet

- 10 4 Mastery Problem CRJ P. 290 10 4 Mastery Problem CRJ PDFDocument4 pages10 4 Mastery Problem CRJ P. 290 10 4 Mastery Problem CRJ PDFAidan JamesNo ratings yet