Professional Documents

Culture Documents

02 gr5

02 gr5

Uploaded by

RAMKESH DIWAKAR0 ratings0% found this document useful (0 votes)

5 views2 pagesAn importer, M/s. S.M. International, misclassified goods described as "Lotion Pump for Hand Sanitizer" and "Mist Spray for Hand Sanitizer" under tariff codes with lower duty rates, resulting in a short payment of Rs. 11,71,128 in duties. An audit found the goods should have been classified under a code with higher duty rates. The importer did not respond to a notice seeking payment of the differential duties and interest owed. During an adjudication in the importer's absence, the goods were reclassified under the proper tariff code and the importer was ordered to pay the outstanding duties and interest, and penalties were imposed including seizure of the goods worth Rs. 72

Original Description:

Original Title

02-gr5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn importer, M/s. S.M. International, misclassified goods described as "Lotion Pump for Hand Sanitizer" and "Mist Spray for Hand Sanitizer" under tariff codes with lower duty rates, resulting in a short payment of Rs. 11,71,128 in duties. An audit found the goods should have been classified under a code with higher duty rates. The importer did not respond to a notice seeking payment of the differential duties and interest owed. During an adjudication in the importer's absence, the goods were reclassified under the proper tariff code and the importer was ordered to pay the outstanding duties and interest, and penalties were imposed including seizure of the goods worth Rs. 72

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pages02 gr5

02 gr5

Uploaded by

RAMKESH DIWAKARAn importer, M/s. S.M. International, misclassified goods described as "Lotion Pump for Hand Sanitizer" and "Mist Spray for Hand Sanitizer" under tariff codes with lower duty rates, resulting in a short payment of Rs. 11,71,128 in duties. An audit found the goods should have been classified under a code with higher duty rates. The importer did not respond to a notice seeking payment of the differential duties and interest owed. During an adjudication in the importer's absence, the goods were reclassified under the proper tariff code and the importer was ordered to pay the outstanding duties and interest, and penalties were imposed including seizure of the goods worth Rs. 72

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

M/s. S.M.

International, imported goods self-declared as "Lotion Pump

for Hand Sanitizer" and "Mist Spray for Hand Sanitizer". During a post-

clearance audit, it was found that the importer had misclassified the goods

and paid a lower duty rate. The goods should have been classified under CTH

96161010 with a BCD of 20%, SWS of 10% and IGST of 18% rather than

under CTH 84242000 and 84248990, where the BCD was 7.5% and the SWS

and IGST were the same. The misclassification resulted in a short payment of

duty of Rs.11,71,128/-. An audit letter was issued to the importer asking for

payment of the differential duty and interest, but no reply was received. The

company is in violation of Section 28 of the Customs Act, 1962.

Show Cause Notice was issued to M/s. S.M. INTERNATIONAL, an

importer, asking to show cause to the Additional Commissioner of Customs

(Group-5) as to why:

The classification of the impugned goods, described as "LOTION PUMP

FOR HAND SANITISER" and "Mist Spray for hand Sanitizer," should not be

rejected and reclassified under 96161010, for which BCD@20%, SWS@10%

and IGST@18% is payable.

The short levied duty of Rs. 11,71,128/- should not be demanded.

The interest on the short levied duty should not be demanded.

The goods valued at Rs. 72,18,046/- should not be held liable for

confiscation.

Penalty should not be imposed for rendering the goods liable for

confiscation.

The importer was given 30 days to reply and was offered a personal hearing

on 14.12.2022, but failed to appear. The adjudication was done in their

absence. The main issue was the correct classification of the impugned

imported goods, and the relevant heading was 8424 in the HS Code, used to

classify mechanical appliances for projecting, dispersing, or spraying liquids

or powders. The classification was based on the description and notes in the

HS Code, and after considering the available records, the adjudication was

done in their absence.

Accordingly AA rejected the assigned classification of goods imported

under Bills of Entry as per Annexure-I, which were declared as "Lotion Pump

for Hand Sanitizer" under CTH 84248990 and "Mist Spray for Hand Sanitizer"

under CTH 84242000 and reclassified them under CTH 96161010. AA

acknowledged the underpaid duty of Rs 11,71,128 and demanded interest as

per Section 28AA of the Customs Act, 1962. AA seized the goods with an

assessable value of Rs 72,18,046 under Section 111(m) of Customs Act, 1962

and offered redemption on payment of a redemption fine of Rs 7,00,000 as per

Section 125(1) of Customs Act, 1962. A penalty of Rs 3,00,000 was imposed

under Section 112(a) of Customs Act, 1962.

You might also like

- FDNY SuitDocument55 pagesFDNY SuitGregory PriceNo ratings yet

- Claire Wolfe - Don't Shoot The Bastards (Yet) - 101 More Ways To Salvage Freedom-Loompanics Unlimited (1999)Document260 pagesClaire Wolfe - Don't Shoot The Bastards (Yet) - 101 More Ways To Salvage Freedom-Loompanics Unlimited (1999)steved_43100% (1)

- Pinay Jurist: Suggested Answers To The 2017 Bar Examination Questions in Taxation Up Law ComplexDocument20 pagesPinay Jurist: Suggested Answers To The 2017 Bar Examination Questions in Taxation Up Law ComplexLogia LegisNo ratings yet

- Tax Case Digests MidtermsDocument47 pagesTax Case Digests MidtermsJulo R. TaleonNo ratings yet

- 2008 Digest-Sc Taxation CasesDocument19 pages2008 Digest-Sc Taxation Caseschiclets777100% (2)

- Casco Philippine Chemical Co vs. GimenezDocument2 pagesCasco Philippine Chemical Co vs. GimenezAnton MercadoNo ratings yet

- CIR vs. Pilipinas ShellDocument3 pagesCIR vs. Pilipinas ShellArchie Torres88% (8)

- TaxDocument7 pagesTaxArvi April NarzabalNo ratings yet

- Taxation Law Review Cases Digest IIDocument34 pagesTaxation Law Review Cases Digest IIJohney DoeNo ratings yet

- Guidote Vs BorjaDocument6 pagesGuidote Vs Borjayangkee_17No ratings yet

- TX Cs041119Document11 pagesTX Cs041119Morphues100% (1)

- Counter Affidavit: (NPS DOC NO. XII-07-INQ-19D-00095)Document2 pagesCounter Affidavit: (NPS DOC NO. XII-07-INQ-19D-00095)Bai Alefha Hannah Musa-AbubacarNo ratings yet

- AA SpecDocument1 pageAA SpecssvminNo ratings yet

- Manila Memorial Park Vs Sec. of DSWDDocument4 pagesManila Memorial Park Vs Sec. of DSWDChola CastilloNo ratings yet

- SPCL Case DigestDocument7 pagesSPCL Case DigestlawYearNo ratings yet

- July 18 - SPIT NotesDocument8 pagesJuly 18 - SPIT NotesMiggy CardenasNo ratings yet

- Cir Vs Central Luzon Drug CorporationDocument7 pagesCir Vs Central Luzon Drug CorporationErika Libberman HeinzNo ratings yet

- Finals Case Digest 3 (1) Crim LawDocument78 pagesFinals Case Digest 3 (1) Crim Lawjulie anne serraNo ratings yet

- Digest No. 1 - Casco V GimenezDocument2 pagesDigest No. 1 - Casco V GimenezRosalie Abatayo100% (1)

- Commissioner General Tra VS Mamujee & 2 Others Civil Appea No.10 of 2018 Hon - Mwarija, JDocument19 pagesCommissioner General Tra VS Mamujee & 2 Others Civil Appea No.10 of 2018 Hon - Mwarija, JMoud Khalfani0% (1)

- Ruling (Okuja V Ura)Document14 pagesRuling (Okuja V Ura)Joshua Kato KalibbalaNo ratings yet

- Casco Chemical V Gimenez GR L-17931Document3 pagesCasco Chemical V Gimenez GR L-17931Dorothy PuguonNo ratings yet

- Casco Phil Chemical Co. Vs Gimenez G.R. No. L-17931 February 28, 1963Document2 pagesCasco Phil Chemical Co. Vs Gimenez G.R. No. L-17931 February 28, 1963QQQQQQNo ratings yet

- Jalandoni & Jamir For Petitioner. Officer of The Solicitor General For RespondentsDocument2 pagesJalandoni & Jamir For Petitioner. Officer of The Solicitor General For RespondentsCarmel LouiseNo ratings yet

- MC Dowell & Company LimitedDocument3 pagesMC Dowell & Company Limitedsupriya.su07No ratings yet

- 15 Case DigestDocument17 pages15 Case DigestColeen Del RosarioNo ratings yet

- Cir VS Luzon DrugDocument9 pagesCir VS Luzon DrugYvon BaguioNo ratings yet

- 25 CIR Vs Bicolandia Drug Corp, G.R. No. 148083 July 21, 2006Document6 pages25 CIR Vs Bicolandia Drug Corp, G.R. No. 148083 July 21, 2006Perry YapNo ratings yet

- 2022 SLD 2274Document3 pages2022 SLD 2274Zayn ShaukatNo ratings yet

- Major Detections and RecoveriesDocument4 pagesMajor Detections and RecoveriessanNo ratings yet

- Petitioner vs. vs. Respondents Jalandoni & Jamir Solicitor GeneralDocument2 pagesPetitioner vs. vs. Respondents Jalandoni & Jamir Solicitor GeneralAlan Jay CariñoNo ratings yet

- Contex Corp Vs CirDocument7 pagesContex Corp Vs Ciractuarial_researcherNo ratings yet

- San Pablo Manufacturing Corporation To Chavez Vs JBCDocument4 pagesSan Pablo Manufacturing Corporation To Chavez Vs JBCShaira VerasNo ratings yet

- Illustrations 37 45Document4 pagesIllustrations 37 45Adelaine DizonNo ratings yet

- Cir V Gonzales FactsDocument6 pagesCir V Gonzales FactsDawn BarondaNo ratings yet

- Contex V CIRDocument2 pagesContex V CIRAj MangaliagNo ratings yet

- Ios ProjectDocument11 pagesIos Projectmahathi bokkasamNo ratings yet

- Tom Digest AcleoDocument15 pagesTom Digest AcleoGuilgamesh EmpireNo ratings yet

- GR L-17931Document2 pagesGR L-17931breech_16loveNo ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 16 Final Examination: Suggested Answers To QuestionsDocument17 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 16 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- CONTEX CORPORATION, Petitioner, vs. HON. Commissioner OF Internal REVENUE, RespondentDocument36 pagesCONTEX CORPORATION, Petitioner, vs. HON. Commissioner OF Internal REVENUE, RespondentHi Law SchoolNo ratings yet

- Office of The Solicitor General For Petitioner. Hilado and Hilado For RespondentDocument11 pagesOffice of The Solicitor General For Petitioner. Hilado and Hilado For RespondentellaNo ratings yet

- Office of The Solicitor General For Petitioner. Hilado and Hilado For RespondentDocument11 pagesOffice of The Solicitor General For Petitioner. Hilado and Hilado For RespondentellaNo ratings yet

- 09 CIR Vs Pilipinas ShellDocument14 pages09 CIR Vs Pilipinas ShellEMNo ratings yet

- Case CommentaryDocument7 pagesCase CommentaryHritik KashyapNo ratings yet

- Taxation Facts Ruling IssueDocument10 pagesTaxation Facts Ruling IssueWindylyn LalasNo ratings yet

- Iidt RTP Cases Nov 2015Document36 pagesIidt RTP Cases Nov 2015jesurajajosephNo ratings yet

- Taxation AssignmentDocument12 pagesTaxation Assignmentsuruchiba2049No ratings yet

- Tax Rev VAT CasesDocument196 pagesTax Rev VAT CasesJake MacTavishNo ratings yet

- Case Digest IIDocument9 pagesCase Digest IISansui Jusan Rochel100% (1)

- Casco v. GimenezDocument2 pagesCasco v. GimenezKelvin Jhones AligaNo ratings yet

- CIR Vs HawaianDocument2 pagesCIR Vs HawaianWonder WomanNo ratings yet

- Second DivisionDocument13 pagesSecond DivisionRam Migue SaintNo ratings yet

- Cir Vs Pilipinas ShellDocument13 pagesCir Vs Pilipinas ShellJeff GomezNo ratings yet

- 8.a. Full Contex Corp V CIRDocument4 pages8.a. Full Contex Corp V CIRWhoopi Jane MagdozaNo ratings yet

- TAX II CasesDocument2 pagesTAX II CasesSir Nino CaganapNo ratings yet

- Casco V GimenezDocument3 pagesCasco V GimenezAlandia GaspiNo ratings yet

- VAT CasesDocument138 pagesVAT CasesArvi CalaguiNo ratings yet

- Court OrderDocument7 pagesCourt Ordertarique.jahangirNo ratings yet

- Allowable DeductionsDocument18 pagesAllowable DeductionsZek AngelesNo ratings yet

- Case 2Document2 pagesCase 2Nadzlah BandilaNo ratings yet

- Q. Deduction: in GeneralDocument40 pagesQ. Deduction: in GeneralJen MoloNo ratings yet

- SILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Document7 pagesSILICON PHILIPPINES, INC Vs CIR G.R. No. 172378 January 17, 2011Francise Mae Montilla MordenoNo ratings yet

- English: Problem Solving Through Analytical ListeningDocument8 pagesEnglish: Problem Solving Through Analytical Listeningdonna geroleo100% (1)

- Foam-Water Sprinkler: Model F1 & HDocument4 pagesFoam-Water Sprinkler: Model F1 & HRANJITHNo ratings yet

- Flisfeder - Algorithmic ApparatusDocument29 pagesFlisfeder - Algorithmic ApparatusInés BaladaNo ratings yet

- Sons of The Godfather: "Mafia" in Contemporary Fiction Author(s) : DWIGHT C. SMITH JR. Source: Italian Americana, SPRING 1976, Vol. 2, No. 2 (SPRING 1976), Pp. 190-207 Published By: Italian AmericanaDocument19 pagesSons of The Godfather: "Mafia" in Contemporary Fiction Author(s) : DWIGHT C. SMITH JR. Source: Italian Americana, SPRING 1976, Vol. 2, No. 2 (SPRING 1976), Pp. 190-207 Published By: Italian AmericanaAONo ratings yet

- BOX: Henry Brown Mails Himself To Freedom Teachers GuideDocument3 pagesBOX: Henry Brown Mails Himself To Freedom Teachers GuideCandlewick PressNo ratings yet

- Sangguniang Bayan of San Adres, Et Al. v. Court of AppealsDocument7 pagesSangguniang Bayan of San Adres, Et Al. v. Court of AppealsJune Vincent FerrerNo ratings yet

- Triple Talaq CaseDocument3 pagesTriple Talaq CaseEnrique IglesiasNo ratings yet

- 1324 - Option Contract (Distinction Between Earnest Money and Option Money)Document1 page1324 - Option Contract (Distinction Between Earnest Money and Option Money)Sarah Jane UsopNo ratings yet

- QSC08 141Document238 pagesQSC08 141Jay Ryan SantosNo ratings yet

- Land Title 1Document11 pagesLand Title 1BJ AndresNo ratings yet

- 1995-Constitution of UgandaDocument141 pages1995-Constitution of UgandaAlvin KingNo ratings yet

- Mil Reflection PaperDocument2 pagesMil Reflection PaperCamelo Plaza PalingNo ratings yet

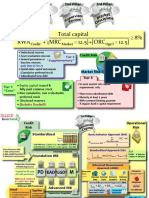

- Bionic Turtle - Basel-II-cheatsheetDocument8 pagesBionic Turtle - Basel-II-cheatsheetCFOCLOUD365No ratings yet

- PFR Case Digest - GR 180764 and 164703Document4 pagesPFR Case Digest - GR 180764 and 164703Princess AirellaNo ratings yet

- Company FNLDocument30 pagesCompany FNLpriyaNo ratings yet

- I. General InformationDocument6 pagesI. General InformationEdgardo RamaculaNo ratings yet

- Rizal 3aDocument2 pagesRizal 3aJayson ManoNo ratings yet

- Tugas 3 Bahasa InggrisDocument5 pagesTugas 3 Bahasa InggrisNabila Puspita0% (1)

- Resolution of The 49th Annual Celebration of The Rocky Mountain Conference of The United Church of ChristDocument2 pagesResolution of The 49th Annual Celebration of The Rocky Mountain Conference of The United Church of ChristCPR DigitalNo ratings yet

- Adobe Scan 21 Sep 2022Document2 pagesAdobe Scan 21 Sep 2022ACNo ratings yet

- Revision - Public FacilitiesDocument5 pagesRevision - Public FacilitiesonlymotieNo ratings yet

- Parte Order.: Assignments ProblemsDocument2 pagesParte Order.: Assignments ProblemsAnil kumarNo ratings yet

- Belfast ConfettiDocument18 pagesBelfast Confettipierrette1No ratings yet

- SEC Memorandum Circular 19 Series of 2016Document3 pagesSEC Memorandum Circular 19 Series of 2016Raya VacaroNo ratings yet

- Promising NicheDocument2 pagesPromising NicheFazrihan DuriatNo ratings yet

- At 04 Audit Evidence and Audit Documentation PDFDocument6 pagesAt 04 Audit Evidence and Audit Documentation PDFMadelyn Jane IgnacioNo ratings yet