Professional Documents

Culture Documents

09

09

Uploaded by

RAMKESH DIWAKAROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09

09

Uploaded by

RAMKESH DIWAKARCopyright:

Available Formats

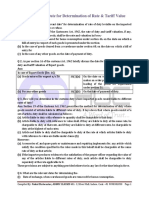

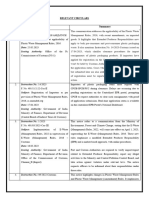

The Importer M/s. A&S TRADERS filed Bill of Entry no. 2425319 dated 13.09.

2022, for

clearance of goods imported from the supplier M/s. PT. YAN TRADING & LOGISTICS,

Samples were forwarded to get clearance from FSSAI, PQ as per Single Window Interface for

Trade (SWIFT). Further, the said Bill of Entry was examined and reported fssai sample taken for

test and vide fssai test report (rejection report of food import) ncc no: ncc202200081170 dt

20.09.2022 & rncc202200000641 dt 04.11.2022, sample do not confirm to specifications under

fss act, 2016 and was rejected for import

"The sample DRIED COCOA BEANS does not conform to the standards laid down under

Clause 2.3.54 of Food Safety ft Standards (Food Products standards and Food additives)

Regulations, 2011 with respect to the above tested parameter." Importer had applied a review

application with FSSAI and the same has been rejected vide NCC no RNCC202200000641

dated 04.11.2022 with following remarks: "As per referral lab analysis report, the sample

COCOA BEANS does not conforms to the standard as per Regulation No 2.3.54 of Food Safety

ft Standards (Food Products standards and Food additives) Regulations, 2011, as the sample

shows moldy beans and salty beans above the maximum prescribed limit. The sample also

shows the presence of visible fungus and abnormal smell in it. The sample is thus substandard

under section 3(1)(zz)(x) of FSS ACT 2006."

Hence the goods namely "COCOA BEANS (433 BAGS)" imported vide Bill of Entry no. 2425319

dated 13.09.2022, is liable for confiscation under section 111(d) of the Customs Act, 1962, by

importing unsafe goods, the importer has committed an act which rendered the goods liable for

confiscation. Hence, the importer is liable for penal action under Section 112(a) of the Customs

Act, 1962.

Accordingly, AA confiscated the goods namely "COCOA BEANS (433 BAGS)" imported vide Bill

of Entry no. 2425319 dated 13.09.2022 with Total assessable value of Rs . 24,70,459/- under

Section 111(d) of the Customs Act, 1962 with an option to the Importer to redeem the goods on

payment of redemption fine of Rs.1,50,000/- under Sec-125 of the Customs Act, 1962 for the

purpose of re-export only and imposed penalty of Rs. 50,000/- on M/s. A&S TRADERS under

Section 112(a) (i) of Customs Act 1962 for having rendered the goods liable for confiscation.

and ordered for consignment of the impugned goods namely "COCOA BEANS (433 BAGS)" to

be re-exported to the country of export within 30 days from the date of receipt of this order.

You might also like

- Syllabus: Prefix & Code HRMT 622 3 Credits Course Name Talent Management Term / Year Winter 2022Document8 pagesSyllabus: Prefix & Code HRMT 622 3 Credits Course Name Talent Management Term / Year Winter 2022CL-A-11 KUNAL BHOSALENo ratings yet

- Chem 145.1 FR 2Document8 pagesChem 145.1 FR 2Shaina CerveraNo ratings yet

- C3 Differentiation Topic AssessmentDocument6 pagesC3 Differentiation Topic AssessmentFaddy OrahaNo ratings yet

- Science Investigatory Project: Group#3 Banana Peel As Shoe PolishDocument11 pagesScience Investigatory Project: Group#3 Banana Peel As Shoe PolishGMae Lim100% (4)

- Assessment & Date For Determination of Rate & Tariff ValueDocument18 pagesAssessment & Date For Determination of Rate & Tariff ValueMegha0% (1)

- Foreign Trade ASSIGNMENTDocument7 pagesForeign Trade ASSIGNMENTJaya VatsNo ratings yet

- Circular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButDocument18 pagesCircular No. 38 /2016-Customs: - (1) Notwithstanding Anything Contained in This Act ButAnshNo ratings yet

- BLR CestatDocument9 pagesBLR CestatS kameshNo ratings yet

- CDP Day 1Document8 pagesCDP Day 1Asnifah AlinorNo ratings yet

- Revised Circular 38 2016Document17 pagesRevised Circular 38 2016akash1824No ratings yet

- Export Restrictions and Prohibitions Under Customs Act, 1962 - Taxguru - inDocument15 pagesExport Restrictions and Prohibitions Under Customs Act, 1962 - Taxguru - inSnigdha DubeyNo ratings yet

- 2011 v2 PiiiDocument142 pages2011 v2 PiiiRamakrishnan VishwanathanNo ratings yet

- 06 V643 - Sukhdev Exports OverseasDocument6 pages06 V643 - Sukhdev Exports OverseasVivek SharmaNo ratings yet

- Documents Availing For Export IncentivesDocument13 pagesDocuments Availing For Export IncentivesArun MannaNo ratings yet

- Ocean Freight SC Decision 19.05.2022Document153 pagesOcean Freight SC Decision 19.05.2022Poltu GhoshNo ratings yet

- The Solicitor General For Petitioner. Jorge G. Macapagal Counsel For Respondent. Aurea Aragon-Casiano For Bagong Buhay TradingDocument4 pagesThe Solicitor General For Petitioner. Jorge G. Macapagal Counsel For Respondent. Aurea Aragon-Casiano For Bagong Buhay TradingZachary BañezNo ratings yet

- Gujarat Advance Ruling 102 2020Document11 pagesGujarat Advance Ruling 102 2020gsgenterprizeNo ratings yet

- Food Safety & Standards (Import) Regulations, 2017Document29 pagesFood Safety & Standards (Import) Regulations, 2017Ayush AryanNo ratings yet

- Circular No. 36 /2020-CustomsDocument16 pagesCircular No. 36 /2020-CustomsAshok KumarNo ratings yet

- Decision of 121st Meeting of Expert CommitteeDocument20 pagesDecision of 121st Meeting of Expert CommitteeShuaib MalikNo ratings yet

- Circular No. 11 /2009-CusDocument6 pagesCircular No. 11 /2009-CusrpadmakrishnanNo ratings yet

- Foreign Trade AssignmentDocument7 pagesForeign Trade AssignmentJaya VatsNo ratings yet

- Icai CustomsDocument130 pagesIcai CustomsP LAVANYANo ratings yet

- Court OrderDocument7 pagesCourt Ordertarique.jahangirNo ratings yet

- PN No 78Document7 pagesPN No 78saurabhNo ratings yet

- Activity No. 2 Ass Sec. 807-813Document4 pagesActivity No. 2 Ass Sec. 807-813ALAJID, KIM EMMANUELNo ratings yet

- 012 CELAJE Oriondo v. COA NON-KATAYDocument2 pages012 CELAJE Oriondo v. COA NON-KATAYJosh CelajeNo ratings yet

- Circular No 38 2020Document6 pagesCircular No 38 2020Ruchir KumarNo ratings yet

- Asturias Sugar Central, Inc. vs. Commissioner of Customs and Court of Tax Appeals (1969) Penned by CastroDocument9 pagesAsturias Sugar Central, Inc. vs. Commissioner of Customs and Court of Tax Appeals (1969) Penned by CastroFelicia AllenNo ratings yet

- Circular No 10 2021Document5 pagesCircular No 10 2021Sarika JainNo ratings yet

- Procedure For Clearance of Imported and Export GoodsDocument26 pagesProcedure For Clearance of Imported and Export GoodsSaranya VillaNo ratings yet

- 2022 P T D 1059Document7 pages2022 P T D 1059Muhammad Wisal AhmedNo ratings yet

- VBHN02 23022023BNN (E)Document46 pagesVBHN02 23022023BNN (E)Thanh Tâm TrầnNo ratings yet

- Union of India & Ors Vs M-S. Indo-Afghan Agencies LTD On 22 November, 1967Document18 pagesUnion of India & Ors Vs M-S. Indo-Afghan Agencies LTD On 22 November, 1967Rajesh TandonNo ratings yet

- 2014 P T D 525Document4 pages2014 P T D 525Muhammad Wisal AhmedNo ratings yet

- Asturias Sugar V Commissioenr Fo CustomsDocument2 pagesAsturias Sugar V Commissioenr Fo CustomsJenifferRimandoNo ratings yet

- Tax 2 Four CasesDocument20 pagesTax 2 Four CasesMaryBalezaNo ratings yet

- Note On DGOV Observations Dt. 13042022Document6 pagesNote On DGOV Observations Dt. 13042022Sujit SrikantanNo ratings yet

- Farolan v. CTA (1993)Document5 pagesFarolan v. CTA (1993)Carlo MercadoNo ratings yet

- DBK AnxDocument2 pagesDBK AnxrsmajodNo ratings yet

- Sro 565-2006Document44 pagesSro 565-2006Abdullah Jathol100% (1)

- 03Document1 page03RAMKESH DIWAKARNo ratings yet

- Circular 22Document1 pageCircular 22ravivarmahyd8173No ratings yet

- Assessment of Goods - Unit IIIDocument30 pagesAssessment of Goods - Unit IIIanshuNo ratings yet

- DBK and DeecDocument3 pagesDBK and DeecManik RajNo ratings yet

- 3215.1990 Tariff & SROsDocument3 pages3215.1990 Tariff & SROsONLINE COMPUTER COURSESNo ratings yet

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jNo ratings yet

- Judicial Snippets: /idt /customsDocument4 pagesJudicial Snippets: /idt /customsdev_glaNo ratings yet

- Appeal v1Document12 pagesAppeal v1Sheldon Dsouza100% (1)

- Hon'ble High Court of New Delhi Order in Great NutsDocument14 pagesHon'ble High Court of New Delhi Order in Great Nutsksvv prasadNo ratings yet

- Farolan V CADocument11 pagesFarolan V CAJoy NavalesNo ratings yet

- Cs Manual2013Document505 pagesCs Manual2013SatishBhadraNo ratings yet

- Relevant CircularsDocument2 pagesRelevant CircularsChetanya KapoorNo ratings yet

- CA Final Custom Question Bank PDFDocument128 pagesCA Final Custom Question Bank PDFJitendra ChauhanNo ratings yet

- Case LawDocument21 pagesCase LawRam SskNo ratings yet

- Customs Clearance Procedures For Export: Prescribed Bill of Entry and Bill of Export Form Order, 2001Document5 pagesCustoms Clearance Procedures For Export: Prescribed Bill of Entry and Bill of Export Form Order, 2001AmirNo ratings yet

- Excise ManualDocument134 pagesExcise ManualRavi MolasariaNo ratings yet

- 03-Commissioner of Customs v. Marina Sales, Inc. GR No 183868Document9 pages03-Commissioner of Customs v. Marina Sales, Inc. GR No 183868ryanmeinNo ratings yet

- Coffee Day Global LTD in 1Document4 pagesCoffee Day Global LTD in 1radhakrishnaNo ratings yet

- Chapter-2 Part-I Registration and E.C.C. Number 1Document8 pagesChapter-2 Part-I Registration and E.C.C. Number 1ChetanNo ratings yet

- MarinaDocument4 pagesMarinaellaNo ratings yet

- Customs Manual 2012Document21 pagesCustoms Manual 2012Shanky RanaNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- 10 Multicast Zone Routing Protocol For Mobile Ad Hoc NetworksDocument6 pages10 Multicast Zone Routing Protocol For Mobile Ad Hoc NetworksakshusvgNo ratings yet

- New PODocument9 pagesNew POredz00No ratings yet

- Unit 2Document7 pagesUnit 2Hind HindouNo ratings yet

- Acrylic SecretsDocument92 pagesAcrylic SecretsMihaela Toma100% (2)

- Ultrasound-Guided Ilioinguinal and Iliohypogastric BlockDocument5 pagesUltrasound-Guided Ilioinguinal and Iliohypogastric BlockaksinuNo ratings yet

- MFM 23 - Impact of Inflaction and GDP On Stock Market Returns in IndiaDocument28 pagesMFM 23 - Impact of Inflaction and GDP On Stock Market Returns in IndiaCyril Chettiar0% (1)

- Arts 6 Module 1Document18 pagesArts 6 Module 1Elexthéo JoseNo ratings yet

- Bella Pro Series 5.3 Qt. Digital Air Fryer 90065Document32 pagesBella Pro Series 5.3 Qt. Digital Air Fryer 90065مصطفى الأصفرNo ratings yet

- MTTM 2nd Year 2019-2 PDFDocument11 pagesMTTM 2nd Year 2019-2 PDFRajnish PathaniaNo ratings yet

- Help For The W3C Markup Validation ServiceDocument10 pagesHelp For The W3C Markup Validation ServicetsbgyywaedmqNo ratings yet

- Agriculture4 0-IEEETIIDocument13 pagesAgriculture4 0-IEEETIIAmanda FNo ratings yet

- PM Fellowship Call For ProposalDocument36 pagesPM Fellowship Call For ProposalShivashankar HiremathNo ratings yet

- Agricultural Revolution - Industrial RevolutionDocument2 pagesAgricultural Revolution - Industrial RevolutionJenni SilvaNo ratings yet

- Math4 q2 Mod6 FindingtheLCM v3 - For MergeDocument21 pagesMath4 q2 Mod6 FindingtheLCM v3 - For MergeJoanna GarciaNo ratings yet

- Short User Manual: More User Manuals OnDocument10 pagesShort User Manual: More User Manuals OnChristiane Qra PorpiglioNo ratings yet

- Fairview Terminal PhaseII Expansion Project Report - Oct2012Document436 pagesFairview Terminal PhaseII Expansion Project Report - Oct2012NewsroomNo ratings yet

- STAT2001 HomeWork#2 ActualDocument2 pagesSTAT2001 HomeWork#2 ActualKenya LevyNo ratings yet

- Control Systems Prof. C. S. Shankar Ram Department of Engineering Design Indian Institute of Technology, Madras Lecture - 40 Root Locus 4 Part-2Document7 pagesControl Systems Prof. C. S. Shankar Ram Department of Engineering Design Indian Institute of Technology, Madras Lecture - 40 Root Locus 4 Part-2HgNo ratings yet

- WA 05 Unit Test 01 Listening ScriptsDocument1 pageWA 05 Unit Test 01 Listening ScriptsEden GamaNo ratings yet

- Summative Test-Quarter 2Document19 pagesSummative Test-Quarter 2JocelynNo ratings yet

- Mitsubishi Forklift Edr13n 24v Esr18n 24v Esr20n 24v Ess15n 24v Ess20n 24v Operation Maintenance Manual enDocument23 pagesMitsubishi Forklift Edr13n 24v Esr18n 24v Esr20n 24v Ess15n 24v Ess20n 24v Operation Maintenance Manual enmichellejackson130187gcq100% (125)

- Chemical Kinetics AssignmentDocument15 pagesChemical Kinetics AssignmentVanshdip RawatNo ratings yet

- 9037HG32LZ20: Product DatasheetDocument2 pages9037HG32LZ20: Product DatasheetNarcisse AhiantaNo ratings yet

- The Days of Creation in The Thought of Nasir KhusrawDocument10 pagesThe Days of Creation in The Thought of Nasir KhusrawShahid.Khan1982No ratings yet

- Factsheet 2022Document1 pageFactsheet 2022Kagiso Arthur JonahNo ratings yet

- UntitledDocument336 pagesUntitledChristine CagunanNo ratings yet