Professional Documents

Culture Documents

Unit Iii Assessment Problems

Uploaded by

Windie SisodOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

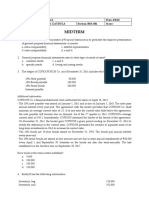

Unit Iii Assessment Problems

Uploaded by

Windie SisodCopyright:

Available Formats

Updates in Philippine Accounting and Financial Reporting Standards 1

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 2

Name: _____________________________

Class Schedule:_______________________

Assessment

Multiple Choice

Directions: Read and analyze each item. Encircle/Highlight the letter of the correct

answer. Please also provide solution for each item. You may also view this exam on

google class. Submit your work in the pigeon boxes which are provided in your

department/college, or to google class on or before the date as reflected in your study

schedule.

Problem:

Western Company has several contingent liabilities on December 31, 2020. The auditor

obtained the following brief description of each liability. In June 2020, Western Company

became involved in litigation. In December 2020, the court assessed a judgement for

P2,000,000 against Western Company. The entity is appealing the amount of the

judgement. The entity’s attorney believed it is probable that they can reduce the

assessment on appeal by 50%.

In August 2020, Pasig City brought action against Western Company for polluting the

river with its waste products. It is probable that Pasig City will be successful but the

amount of damages Western might have to pay should not exceed P3,000,000.

1. What total amount should be accrued as provision on December 31,2020?

a. 3,000,000

b. 5,000,000

c. 2,000,000

d. 4,000,000

P2,000,000 x 50% = P1,000,000 (it is probable to decrease the amount to

50%) It is probable that Pasig city will be successful with payment for

damage not exceeding P3,000,000

P1,000,000 + 3,000,000 = P4,000,000

Problem:

In August 2020, ABC Company filed suit against CBA Company seeking 4,000,000

damages for patent infringement. A court verdict in November 2020 awarded ABC

Company P2,000,000 in damages, bur CBA’s appeal is not expected to be decided

before 2021. ABC’s counsel believed it is probable that ABC will be successful against

CBA for an estimated amount in the range of 500,000 and 1,500,000, with 1,000,000

considered the most likely amount.

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 3

2. What amount should ABC record as income from the lawsuit for the year ended

December 31,2020?

a. Zero

b. 1,000,000

c. 2,000,000

d. 1,500,000

Problem:

Mercedes Company issued P 10,000,000 face value 12% convertible bonds at 110 on

January 1,2020, maturing on January 1, 2025 and paying interest semiannually on

January 1 and July 1. It is estimated the bonds would sell only 105 without the

conversion feature. Each P1,000 bond is convertible into 10 ordinary shares with P100

par value.

3. What is the increase in shareholders equity arising from the issuance of the

convertible bonds on January 1,2020?

a. 350,000

b. 500,000

c. 1,000,000

d. Zero

10,000,000 (110%) - 10,000,000(105%) = P500,000

4. What would be the entry to record the issuance of the bonds payable?

a. Cash 11,000,000

Bonds Payable 10,000,000

Premium bonds payable 500,000

Share premium-conversion privilege 500,000

b. Cash 11,000,000

Bonds Payable 10,000,000

Premium bonds payable 650,000

Share premium-conversion privilege 350,000

c. Cash 11,000,000

Bonds Payable 10,000,000

Premium bonds payable 350,000

Share premium-conversion privilege 650,000

d. Cash 11,000,000

Bonds Payable 10,000,000

Premium bonds payable 1,000,000

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 4

Problem:

Maryland Company purchased equipment for 2,000,000 on January 1,2020 with a useful

life of 5 years and a residual value of 500,000 using the straight-line method for financial

statement purposes. Depreciation was P300,000 for 2020 and P200,000 for 2021 for tax

purposes. Income before tax and depreciation was P3,000,000 during 2021 and the tax

rate was 25%. During 2021 the entity made an estimated tax payment of 200,000.

5. What is the income tax payable on December 31,2021?

a. 640,000

b. 500,000

c. 450,000

d. 675,000

3,000,000 - 200,000 ( DEPRECIATION FOR 2021) = 2,800,000

2,800,000 X 25% = 700,000

700,000 - 200,000 (ESTIMATED TAX PAYMENT)= P500,000

6. What would be the total amount of income tax expense that is reported in the 2021

income statement?

a. 675,000

b. 500,00

c. 475,000

d. 640,000

Problem:

The following are the balances related to a defined benefit plan of Sheraton Company on

January 1, 2020.

Projected benefit obligation 7,000,000

Fair value of plan asset 6,250,000

The actuary provided the following data for the current year:

Current service cost 600,000

Settlement discount rate 10%

Expected return on plan assets 8%

Actual return on plan asset 700,000

Contribution to the plan 900,000

Benefit paid to retirees 100,000

7. What is the employee benefit cost?

a. 675,000

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 5

b. 600,000

c. 700,000

d. 650,000

CURRENT SERVICE COST 600,000

INTEREST EXPENSE ON PBO (7,000,000 X 10%) 700,000

INTEREST INCOME ON FVPA (6,250,000 X 10%) (625,000)

EMPLOYEE BENEFIT COST P675,000

8. What is the remeasurement gain on plan assets?

a. 75,000

b. 700,000

c. 125,000

d. 240,000

700,000 - 625,000 =P75,000

9. What is the defined benefit cost?

a. 300,000

b. 600,000

c. 900,000

d. 675,000

675,000 - 75,000 = P600,000

10. What is the prepaid/accrued benefit cost on December 31?

a. 400,000 prepaid

b. 400,000 accrued

c. 450,000 prepaid

d. 450,000 accrued

6,250,000 - 7,000,000 = P750,000 ACCRUED BENEFIT COST

600,000 - 900,000 = P300,000 PREPAID BENEFIT COST

750,000 - 300,000 = P450,000 ACCRUED BENEFIT COST

Problem:

Globe Company reported profit before tax of P 6,000,000 and income tax expense of

P1,000,000 for the current year. In addition, the entity paid during the year an ordinary

dividend of P500,000 and a preference dividend of P500,000 on the redeemable

preference shares. The entity had P2,000,000 of P10 par value ordinary shares in issue.

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 6

11. What amount should be reported as basic earnings per share for the year?

a. 25

b. 21.50

c. 20

d. 23.5

6,000,000 - 1,000,000 = P5,000,000

2,000,000 / 10 = 200,000 ORDINARY SHARES

5,000,000/200,000 = P25

Problem:

Color Unite Company reported the following on December 31, 2020:

8% cumulative preference share capital, P50 par value 4,500,000

Ordinary share capital, P1 par, 10,000,000 shares 10,000,000

Share Premium 20,000,000

Retained earnings, January 1, 2020 132,000,000

Net Income for 2020 35,000,000

12. The net income included an expropriation loss of P8,000,000. What amount should

be reported as basic earnings per share?

a. 3.46

b. 4.04

c. 4.63

d. 3.67

4,500,000 X 8% =P360,000

35,000,000 - 360,000 = 34,640,000

34,640,000/10,000,000 = 3,46

Problem:

During 2020, Innovative Company had outstanding 500,000 ordinary shares and 30,000

cumulative preference shares with a P10 per share dividend. Each preference share is

convertible into four ordinary shares. The entity had a P 5,000,000 net loss for 2020. No

dividends were paid or declared.

13. What amount should be reported as basic loss per share?

a. 10.6

b. 10

c. 9.4

d. 8.06

30,000 X 10 = P300,000 PREFERENCE SHARE

5,000,000 + 300,000 = P5,300,000

5,300,000 / 500,000= 10.6

Problem:

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 7

Blossom Company reported the following liabilities in the statement

Accounts payable 1,000,000

Bonds payable 3,000,000

Accrued expense 500,000

Finance lease liability 4,000,000

Advances from customer 1,200,000

Unearned revenue 300,000

Deferred tax liability 400,000

Estimated warranty liability 200,000

14. In preparing financial statements in a hyperinflationary economy, what total amount

should be classified as monetary liabilities?

a. 8,500,000

b. 4,500,000

c. 8,900,000

d. 9,700,000

ACCOUNTS PAYABLE 1,000,000

BONDS PAYABLE 3,000,000

ACCRUED EXPENSE 500,000

FINANCE LEASE LIABILITY 4,000,000

TOTAL P8,500,000

Problem:

Alibaba Company reported the following assets in the statement of financial position:

Cash in bank 2,000,000

Patent 1,000,000

Accounts receivable 4,000,000

Advances to employees 200,000

Inventory 1,500,000

Advances to supplier 400,000

Financial asset at fair value 500,000

Prepaid expenses 100,000

15. In preparing financial statements in a hyperinflationary economy, what total amount

should be classified as monetary asset?

a. 6,200,000

b. 6,600,000

c. 6,700,000

d. 7,700,000

CASH IN BANK 2,000,000

ACCOUNTS RECEIVABLE 4,000,000

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards 8

ADVANCES TO EMPLOYEES 200,000

TOTAL P6,200,000

You did a great job! If you have not completed,

or have difficulty in accomplishing the activity, please

send me a message to our google class or you may ask

clarifications through a text message or phone calls on

the contact number included in your course guide.

You had just completed this unit. You are now ready to take

Unit 4.

“Not intended for publication. For classroom instruction purposes only”.

You might also like

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Accounting Review: Key Financial ConceptsDocument23 pagesAccounting Review: Key Financial Conceptsjoyce KimNo ratings yet

- Acctg 5Document6 pagesAcctg 5Charmane MatiasNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Accounting ReviewDocument74 pagesAccounting Reviewjoyce KimNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Accrued Expenses and Bonds Payable Problems (40Document8 pagesAccrued Expenses and Bonds Payable Problems (40Joelo De Vera100% (1)

- Financial Accounting and ReportingDocument15 pagesFinancial Accounting and Reportingjoyce KimNo ratings yet

- Self Test 9 - LiabilitiesDocument4 pagesSelf Test 9 - LiabilitiesLennier ArvinNo ratings yet

- Self Test 9 - LiabilitiesDocument4 pagesSelf Test 9 - LiabilitiesBasketball WorldNo ratings yet

- Acc 108 Emp Bene. Bonus Debt RestrDocument2 pagesAcc 108 Emp Bene. Bonus Debt Restrbrmo.amatorio.uiNo ratings yet

- Drill 3 AK FSUU AccountingDocument15 pagesDrill 3 AK FSUU AccountingRobert CastilloNo ratings yet

- AC13.1.4 Module 1 QuizDocument5 pagesAC13.1.4 Module 1 QuizDianaNo ratings yet

- AE 16 Prelims Problem SolvingDocument6 pagesAE 16 Prelims Problem SolvingJheally SeirNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Exam 2Document19 pagesExam 2SHE50% (2)

- Final Exam Analysis of FS and WCM 2Document6 pagesFinal Exam Analysis of FS and WCM 2Naia SNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Fin Acc 2 Review MaterialsDocument17 pagesFin Acc 2 Review Materialsmaria evangelistaNo ratings yet

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- Intermediate Accounting 3 Final Exam ReviewDocument19 pagesIntermediate Accounting 3 Final Exam ReviewMay Ramos100% (2)

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- On December 31 Ae 201 AccountingDocument4 pagesOn December 31 Ae 201 Accountingelsana philipNo ratings yet

- Cash Flow Statement AnalysisDocument22 pagesCash Flow Statement AnalysisJoyce LunaNo ratings yet

- Tutorial 1 - QSDocument6 pagesTutorial 1 - QSAzlinaZaidilNo ratings yet

- Intermediate Accounting 2 and 3 FinalDocument67 pagesIntermediate Accounting 2 and 3 FinalNah HamzaNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- Financial Accounting 2 - Liabilities MCQ (SolvingDocument16 pagesFinancial Accounting 2 - Liabilities MCQ (SolvingNicole Andrea TuazonNo ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- Quizzer 2 - Overall With AnswersDocument23 pagesQuizzer 2 - Overall With AnswersJan Elaine CalderonNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Ho2-Employee Benefits and Share-Based Compensation (Student's Copy)Document10 pagesHo2-Employee Benefits and Share-Based Compensation (Student's Copy)Alliah ArrozaNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Prelim Lecture 1 Assignment: Multiple ChoiceDocument4 pagesPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNo ratings yet

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionDJ NicartNo ratings yet

- Problems - Docx 1Document25 pagesProblems - Docx 1You Knock On My DoorNo ratings yet

- ACC 123 Quiz 1Document16 pagesACC 123 Quiz 1hwo50% (2)

- Financial Accounting and Reporting ReviewDocument17 pagesFinancial Accounting and Reporting ReviewAnonymousWriter34870% (10)

- IA2Document12 pagesIA2John FloresNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- FEU Diliman FAR Review Employee Benefits ProblemsDocument2 pagesFEU Diliman FAR Review Employee Benefits ProblemsSam FranciscoNo ratings yet

- Receivables Solution PDFDocument10 pagesReceivables Solution PDFbanannannaNo ratings yet

- Quizzer RETAINED EARNINGSDocument5 pagesQuizzer RETAINED EARNINGSPrincess Frean VillegasNo ratings yet

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Quiz Employee Benifits Income TaxDocument2 pagesQuiz Employee Benifits Income TaxMonica MonicaNo ratings yet

- Reviewer in Partnership Corporation MycDocument22 pagesReviewer in Partnership Corporation MycScwythle65% (20)

- Financial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreDocument18 pagesFinancial Accounting and Reporting Iii (Reviewer) : Name: Date: Professor: Section: ScoreAnirban Roy ChowdhuryNo ratings yet

- PSBA Refresher Course Single Entry and Error CorrectionDocument2 pagesPSBA Refresher Course Single Entry and Error CorrectionAna Marie IllutNo ratings yet

- AUDITING PROBLEMSDocument16 pagesAUDITING PROBLEMSJustin NoladaNo ratings yet

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Relax Company's current assets on Dec 31, 2019Document4 pagesRelax Company's current assets on Dec 31, 2019Glen JavellanaNo ratings yet

- Sia 1.bonds PayableDocument13 pagesSia 1.bonds PayableYasmin MamugayNo ratings yet

- CPA Review: Philippine NPO Financial Accounting QuestionsDocument3 pagesCPA Review: Philippine NPO Financial Accounting QuestionsAljur SalamedaNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Tax Finals ReviewerDocument52 pagesTax Finals ReviewerJezreel Y. ChanNo ratings yet

- Accounting For Treatment For MergerDocument6 pagesAccounting For Treatment For Mergergoel76vishalNo ratings yet

- Canapi 04 Activity 2Document2 pagesCanapi 04 Activity 2sora fpsNo ratings yet

- Business Plan FormatDocument3 pagesBusiness Plan FormatElaine ALdovinoNo ratings yet

- Depreciation, Depletion and ITC: 1 - Principles of AccountingDocument11 pagesDepreciation, Depletion and ITC: 1 - Principles of AccountingAthena Satria TumambingNo ratings yet

- J. Cacdac Capital Sewing Business Trial BalanceDocument15 pagesJ. Cacdac Capital Sewing Business Trial BalancejepsyutNo ratings yet

- Advanced Tutorials 2020Document19 pagesAdvanced Tutorials 2020ericacadagoNo ratings yet

- Assignment 2Document13 pagesAssignment 2Lyca Mae Cubangbang100% (2)

- Sriram com-PE CaseDocument12 pagesSriram com-PE CaseSuryansh SinghNo ratings yet

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- Property Plant and EquipmentDocument13 pagesProperty Plant and EquipmentWilsonNo ratings yet

- Elements of Financial StatementsDocument2 pagesElements of Financial StatementsHanifah AyuNo ratings yet

- Stock Analysis Excel Revised March 2017Document26 pagesStock Analysis Excel Revised March 2017Sangram Panda100% (1)

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxQuỳnh Anh NguyễnNo ratings yet

- Entrepreneurship ManagementDocument18 pagesEntrepreneurship Managementcandy lollipoNo ratings yet

- Depreciation: Salient FeaturesDocument12 pagesDepreciation: Salient FeaturesSudhir Kumar YadavNo ratings yet

- NSSCAS 2021 ExaminersDocument256 pagesNSSCAS 2021 ExaminersKatjiuapenga100% (1)

- Accounting Exercises On Cash FlowsDocument2 pagesAccounting Exercises On Cash FlowsMicaella GoNo ratings yet

- Adv. Accounts PMDocument427 pagesAdv. Accounts PMNor Hanna DanielNo ratings yet

- DBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018Document10 pagesDBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018barangay08 can-avidesamarNo ratings yet

- 04Document28 pages04Aaron Brooke100% (1)

- Oracle Applications - PA - Oracle R12 Project Billing Training ManualDocument43 pagesOracle Applications - PA - Oracle R12 Project Billing Training ManualRajendran SureshNo ratings yet

- Investments in Tax Saving Products FinaDocument64 pagesInvestments in Tax Saving Products FinaYagnesh Shah100% (1)

- Basic AccoDocument27 pagesBasic AccoJasmine ActaNo ratings yet

- Berjaya Financial Report PDFDocument108 pagesBerjaya Financial Report PDFRubanNo ratings yet

- Far Reviewer CompleteDocument87 pagesFar Reviewer CompleteAngelica NimerNo ratings yet

- Prepare Cost Sheet Any ProductDocument20 pagesPrepare Cost Sheet Any Productv adamNo ratings yet

- Governmental and Nonprofit Accounting 10th Edition Smith Solution ManualDocument27 pagesGovernmental and Nonprofit Accounting 10th Edition Smith Solution Manualconsuelo100% (21)

- Contract CostingDocument12 pagesContract Costingvivek rajakNo ratings yet

- Concept of Capital and Revenue TransactionsDocument5 pagesConcept of Capital and Revenue TransactionsYakkstar 21No ratings yet