Professional Documents

Culture Documents

Unit I Activity Part 1 Preparation of Financial Statements

Unit I Activity Part 1 Preparation of Financial Statements

Uploaded by

Windie SisodOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit I Activity Part 1 Preparation of Financial Statements

Unit I Activity Part 1 Preparation of Financial Statements

Uploaded by

Windie SisodCopyright:

Available Formats

Updates in Philippine Accounting and Financial Reporting Standards

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards

Learning Activities

Name:

Class Schedule:

Directions: Read and analyze the following activity and answer what is required. Submit

your work in the pigeon boxes which are provided in your department/college, or to

google class on or before the date as reflected in your study schedule. See Rubrics in

appendix. You may also access the rubrics in the classwork section in the google

classroom.

Activity 1

Loving Care Company provided the following balances on December 21, 2021:

Franchise 200,000

Goods in process 600,000

Building 4,000,000

Employees income tax payable 20,000

Prepaid insurance 20,000

Raw materials 200,000

Notes payable 100,000

Cash 420,000

Accounts receivable 500,000

Retained earnings 880,000

Finished goods 400,000

Accrued Expenses 30,000

Trading securities 250,000

Claim receivable 20,000

Machinery 2,000,000

Advance from customer 100,000

Tools 40,000

Goodwill 100,000

Accumulated Depreciation-Machinery 1,300,000

Allowance for doubtful account 50,000

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards

Plant expansion fund 500,000

Serial bonds payable (500,000 due 2,500,000

every) July 31 of each year

Accounts payable 300,000

Share capital 5,000,000

Accumulated Depreciation-Building 1,600,000

Income tax payable 60,000

Factory supplies 50,000

Share premium 500,000

Accrued interest on notes payable 10,000

Investment in bonds 1,500,000

Land 1,500,000

Notes Receivable 150,000

Required:

Prepare a properly classified statement of financial position on December 31, 2021

Thank you for completing the task. If you have

not completed, or have difficulty in accomplishing the

activity, please send me a message to our google class

or you may ask clarifications through a text message or

phone calls on the contact number included in your

course guide.

And now, you are ready for the assessment.

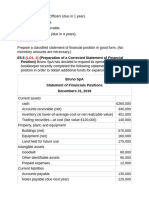

Loving Care Company

Statement of Financial Position

As of December 31,2021

Assets

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards

Current Assets: Note

Cash 420,000

Trading Securities 250,000

Trade and Other Receivables (1) 620,000

Inventories (2) 1,250,000

Prepaid Insurance 20,000

Total Current Assets 2,560,000

Noncurrent Assets:

Property, Plant and Equipment (3) 4,640,000

Long-Term Investments (4) 2,000,000

Intangible Assets (5) 300,000

Total noncurrent assets 6,940,000

Total Assets 9,500,000

Liabilities and Shareholders' Equity

Current Liabilities:

Trade and Other Payables (6) 620,000

Serial Bonds Payable - current portion 500,000

Total Current Liabilities 1,120,000

Noncurrent Liabilities:

Serial Bonds Payable - remaining portion 2,000,000

Shareholders' Equity:

Share Capital 5,000,000

Share Premium 500,000

Retained Earnings 880,000

Total Shareholders' Equity 6,380,000

Total Liabilities and Shareholders' Equity 9,500,000

Note 1 - Trade and Other Receivables

Accounts Receivable 500,000

Allowance for doubtful accounts (50,000)

Notes Receivable 150,000

Claim Receivable 20,000

Total Trade and Other Receivables 620,000

Note 2 - Inventories

Finished Goods 400,000

Goods in Process 600,000

Raw Materials 200,000

Factory Supplies 50,000

Total Inventories 1,250,000

Note 3 - Property , Plant and Equipment

Cost Accumulated Depreciation Carrying Amount

Land 1,500,000 1,500,000

Building 4,000,000 1,600,000 2,400,000

“Not intended for publication. For classroom instruction purposes only”.

Updates in Philippine Accounting and Financial Reporting Standards

Machinery 2,000,000 1,300,000 700,000

Tools 40,000 40,000

Total 7,540,000 2,900,000 4,640,000

Note 4 - Long-Term Investments

Investment in Bonds 1,500,000

Plant Expansion Fund 500,000

Total 2,000,000

Note 5 - Intangible Assets

Franchise 200,000

Goodwill 100,000

Total 300,000

Note 6 - Trade and Other Payables

Accounts Payable 300,000

Notes Payable 100,000

Income Tax Payable 60,000

Advances from Customers 100,000

Accrued Expenses 30,000

Accrued Interest on note payable 10,000

Employees' income tax payable 20,000

Total Trade and Other Payables 620,000

“Not intended for publication. For classroom instruction purposes only”.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial PositionElaine Fiona Villafuerte100% (2)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Cfas 2019 Ch.08 and Ch.09 Long Problems SolutionsDocument15 pagesCfas 2019 Ch.08 and Ch.09 Long Problems SolutionsNathalie GetinoNo ratings yet

- Chapter 8 CFAS Problem 8-1 Page 162Document6 pagesChapter 8 CFAS Problem 8-1 Page 162Rhoda Claire M. GansobinNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Cfas Problem 8 1 PDFDocument3 pagesCfas Problem 8 1 PDFAzuh Shi0% (1)

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- ACCA102Document3 pagesACCA102Nicole FidelsonNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- CfasDocument2 pagesCfassyramaebillones26No ratings yet

- Pas 1, Pas 2, Pas 7Document29 pagesPas 1, Pas 2, Pas 7MPCINo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Act 1 Simple Company (SFP)Document3 pagesAct 1 Simple Company (SFP)Reginald MundoNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- ACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationDocument2 pagesACC 221 - Intermediate Accounting 3 Exit Competency Exam: Additional InformationRyan PedroNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Acctg 601Document2 pagesAcctg 601Maria Regina Javier100% (1)

- Net Cash Flows From Operating ActivitiesDocument7 pagesNet Cash Flows From Operating ActivitiesShaneNiñaQuiñonezNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- Jessbel G. Mahilum - IA3-CD1 - Assignment4Document6 pagesJessbel G. Mahilum - IA3-CD1 - Assignment4Jessbel MahilumNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Review - SFP To Interim ReportingDocument3 pagesReview - SFP To Interim ReportingAna Marie IllutNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- Activity 01 PDFDocument5 pagesActivity 01 PDFJennifer AdvientoNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Chapter 1 11 IA3Document10 pagesChapter 1 11 IA3ZicoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- HW5.FT222004.Archit KumarDocument7 pagesHW5.FT222004.Archit KumarARCHIT KUMARNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)