Professional Documents

Culture Documents

APY 100 (1 +interest Earned Average Account Balance) - 1

APY 100 (1 +interest Earned Average Account Balance) - 1

Uploaded by

HussainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

APY 100 (1 +interest Earned Average Account Balance) - 1

APY 100 (1 +interest Earned Average Account Balance) - 1

Uploaded by

HussainCopyright:

Available Formats

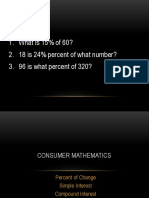

Q1. Use the APY formula required by the Truth in Savings Act for the following calculation.

Suppose that a customer holds a savings deposit in a savings bank for a year. The balance in the

account stood at $2,000 for 180 days and $100 for the remaining days in the year. If the Savings

bank paid this depositor $8.50 in interest earnings for the year, what APY did this customer

receive?

The correct formula is:

[ ]

365

Interest Earned Days in Period

APY = 100 ( 1 + ) -1

Average Account Balance

Q2. Monica Lane maintains a savings deposit with Monarch Credit Union. This past year

Monica received $10.75 in interest earnings from her savings account. Her savings deposit had

the following average balance each month:

January $400 July $350

February 250 August 425

March 300 September 550

April 150 October 600

May 225 November 625

June 300 December 300

What was the annual percentage yield (APY) earned on Monica’s savings account?

Q3. The National Bank of Mayville quotes an APY of 3.5 percent on a one-year money market

CD sold to one of the small businesses in town. The firm posted a balance of $2,500 for the first

90 days of the year, $3,000 over the next 180 days, and $4,500 for the remainder of the year.

How much in total interest earnings did this small business customer receive for the year?

Using the APY formula:

APY = 100

[ (1+

Interest Earnings 365/365

Average Balance

) −1

]

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Quiz 021612Document2 pagesQuiz 021612Gen Israel Miguel100% (2)

- Methods of Distributing Profits Based On PartnersDocument8 pagesMethods of Distributing Profits Based On PartnersChristian PaulNo ratings yet

- Tugas 2 Akuntansi ManajemenDocument3 pagesTugas 2 Akuntansi ManajemenSherlin KhuNo ratings yet

- Accounting EquationDocument6 pagesAccounting EquationShiny NatividadNo ratings yet

- Week 8 Class Exercises (Answers)Document4 pagesWeek 8 Class Exercises (Answers)Chinhoong OngNo ratings yet

- Banking and Insurance Chapter Seven Solution (4-10)Document5 pagesBanking and Insurance Chapter Seven Solution (4-10)MD. Hasan Al Mamun100% (1)

- Mcqs Capital Structure and Finance Costs 3-1 A Company Has Issued 50,000 Ordinary Shares of 25c Each at A Premium of 50c Per Share. The CashDocument15 pagesMcqs Capital Structure and Finance Costs 3-1 A Company Has Issued 50,000 Ordinary Shares of 25c Each at A Premium of 50c Per Share. The CashNguyen HienNo ratings yet

- Mid-Exam Pre-TestDocument36 pagesMid-Exam Pre-TestRizki RamdaniNo ratings yet

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- Correct Response Answer ChoicesDocument11 pagesCorrect Response Answer ChoicesArjay Dela PenaNo ratings yet

- Chapter 7 Practice ProblemsDocument12 pagesChapter 7 Practice ProblemsFarjana Hossain DharaNo ratings yet

- A01 Introduction To AccountingDocument50 pagesA01 Introduction To AccountingG JhaNo ratings yet

- Fa I MidDocument7 pagesFa I MidFãhâd Õró ÂhmédNo ratings yet

- Individual Assignment (Assosa) MBADocument3 pagesIndividual Assignment (Assosa) MBAaterefemelaku29No ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- P8 Consumer MathDocument39 pagesP8 Consumer MathRussel Beramo TolosaNo ratings yet

- Adjustment of Financial StatementDocument33 pagesAdjustment of Financial StatementAlish BaNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- Group Project - Finance For Supply ChainDocument3 pagesGroup Project - Finance For Supply ChainArmin SibrianNo ratings yet

- Adjusting EntriesDocument38 pagesAdjusting EntriesKae Abegail GarciaNo ratings yet

- Alternative Example 8Document4 pagesAlternative Example 8attiqueNo ratings yet

- ACC1701X Mock Exam 2 SolutionDocument13 pagesACC1701X Mock Exam 2 SolutionShaunny Bravo100% (1)

- CF Tutorial 9 - SolutionsDocument9 pagesCF Tutorial 9 - SolutionschewNo ratings yet

- Time Vale of Money ProblemDocument17 pagesTime Vale of Money ProblemEhab M. Abdel HadyNo ratings yet

- Answer The Following Questions Very CarefullyDocument2 pagesAnswer The Following Questions Very CarefullyMaham ImtiazNo ratings yet

- FIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Document6 pagesFIN 4003 FWA Problem Solving Revision 2020 10 Key Answers1Nourhan KhaterNo ratings yet

- 2011-02-09 035108 Finance 14Document4 pages2011-02-09 035108 Finance 14SamNo ratings yet

- 3 Midterm A - AnswerDocument12 pages3 Midterm A - AnswerAllison0% (1)

- W06-Financial Mathematics - LILYDocument38 pagesW06-Financial Mathematics - LILYHon FelixNo ratings yet

- Showaibs Financial Mathematics AssignmentDocument10 pagesShowaibs Financial Mathematics Assignmentapi-450894902No ratings yet

- Soal Latihan 2Document4 pagesSoal Latihan 2Fradila Ayu NabilaNo ratings yet

- Instructions: Date Apr-01Document4 pagesInstructions: Date Apr-01mohitgaba19No ratings yet

- Answer: Using A Financial Calculator or Excel The YTM Is Determined To Be 10.68%Document3 pagesAnswer: Using A Financial Calculator or Excel The YTM Is Determined To Be 10.68%rifat AlamNo ratings yet

- The Role of Working Capital: SalesDocument23 pagesThe Role of Working Capital: SalesFahim Ashab ChowdhuryNo ratings yet

- Quiz Ni Receivable Financing For BSA221CDocument2 pagesQuiz Ni Receivable Financing For BSA221CTrisha VillegasNo ratings yet

- AC1025 Mock Commentary 2018 PDFDocument13 pagesAC1025 Mock Commentary 2018 PDFNghia Tuan NghiaNo ratings yet

- Financial Accounting ProblemsDocument20 pagesFinancial Accounting Problemsmobinil1No ratings yet

- Exercise - 4Document2 pagesExercise - 4Wajiha NadeemNo ratings yet

- The Role of Working Capital: Bordenk@unk - EduDocument7 pagesThe Role of Working Capital: Bordenk@unk - EduAntonio FrancoNo ratings yet

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroNo ratings yet

- The Role of Working Capital: SalesDocument25 pagesThe Role of Working Capital: SalesMT NoowinNo ratings yet

- Question On Budget A LevelDocument3 pagesQuestion On Budget A LevelMUSTHARI KHANNo ratings yet

- Account ReceivableDocument3 pagesAccount ReceivableKartikasari GunawanNo ratings yet

- Soal Indirect N MutualDocument6 pagesSoal Indirect N MutualGerry Neka KantakiNo ratings yet

- Limited Companies - Capital Structure & Finance Costs HandoutDocument11 pagesLimited Companies - Capital Structure & Finance Costs HandoutKiri chrisNo ratings yet

- Cash Budgets 2Document2 pagesCash Budgets 2Prince TshepoNo ratings yet

- P2 Workbook Q PDFDocument91 pagesP2 Workbook Q PDFShelley ThompsonNo ratings yet

- A. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareDocument109 pagesA. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareChris Jay LatibanNo ratings yet

- Soal Latihan 2 AKL 2ADocument3 pagesSoal Latihan 2 AKL 2ARyza Dyandra100% (1)

- Answers 1Document2 pagesAnswers 1Julrick Cubio EgbusNo ratings yet

- Advanced Entrepreneurial Finance ExerciseDocument3 pagesAdvanced Entrepreneurial Finance Exercisesidi abdellahiNo ratings yet

- SS4-5 Chapter 03 v0Document32 pagesSS4-5 Chapter 03 v0Diệp Diệu ĐồngNo ratings yet

- Dwi Suci Indah S - 472026 - W5 Easy ProblemDocument5 pagesDwi Suci Indah S - 472026 - W5 Easy ProblemucyNo ratings yet

- QS13 - Class Exercises SolutionDocument2 pagesQS13 - Class Exercises Solutionlyk0texNo ratings yet

- Finman Q2Document14 pagesFinman Q2Rhn SbdNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Lahore School of Economics Financial Management II Distributions To Shareholders: Dividends and Share Repurchases - 1 Assignment 19Document1 pageLahore School of Economics Financial Management II Distributions To Shareholders: Dividends and Share Repurchases - 1 Assignment 19HussainNo ratings yet

- Literature Review MistakesDocument3 pagesLiterature Review MistakesHussainNo ratings yet

- Exam 4 Review Finance 335Document5 pagesExam 4 Review Finance 335HussainNo ratings yet

- ch1 SmeDocument1 pagech1 SmeHussainNo ratings yet

- CH 2 SmeDocument1 pageCH 2 SmeHussainNo ratings yet

- CH 1 BankingDocument10 pagesCH 1 BankingHussainNo ratings yet

- CH 4Document1 pageCH 4HussainNo ratings yet

- CH 3 SCMDocument1 pageCH 3 SCMHussainNo ratings yet

- Films To Watch Over The Holidays (PLZ Check PG Rating!) : Film & Release Date SubjectDocument5 pagesFilms To Watch Over The Holidays (PLZ Check PG Rating!) : Film & Release Date SubjectHussainNo ratings yet

- Ob & HRM ProjectDocument15 pagesOb & HRM ProjectHussainNo ratings yet

- Evaluation SkillsDocument3 pagesEvaluation SkillsHussainNo ratings yet

- Revision Worksheets Final Examination 2022: Grade 6Document30 pagesRevision Worksheets Final Examination 2022: Grade 6HussainNo ratings yet

- Exam TipsDocument2 pagesExam TipsHussainNo ratings yet

- Week 01 - Graphic DesignDocument1 pageWeek 01 - Graphic DesignHussainNo ratings yet