Professional Documents

Culture Documents

Accured Expense

Uploaded by

Sameer AliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accured Expense

Uploaded by

Sameer AliCopyright:

Available Formats

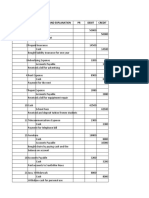

ACCURED EXPENSE

Question No 1

A person has appointed in a job at ABC & Co on 1st Jan 2018 Salary per month was agreed Rs 20,000.

Salary is required to be paid in arrears after the end of the month. Accounting period ends on 31

Dec.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

Question No 2

A person has appointed in a job at ABC & Co on 1st July 2018 Salary per month was agreed Rs 30,000.

Salary is required to be paid quarterly in arrears after the end of each Quarter. Accounting period

ends on 31 Dec.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

Question No 3

A person has appointed in a job at ABC & Co on 1st Jan 2018 Salary per month was agreed Rs 20,000.

Salary is required to be paid in arrears after the end of the month. Accounting period ends on 31

Dec. Salary is subject to increase at the rate @25% after the end of 1 year agreement.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

Question No 4

A person has appointed in a job at ABC & Co on 1st July 2018 Salary per month was agreed Rs 30,000.

Salary is required to be paid quarterly in arrears after the end of each Quarter. Accounting period

ends on 31 Dec. Salary is subject to increase at the rate @20% after the end of 1 year agreement.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

Question No 5

A person has appointed in a job at ABC & Co on 1st May 2018 Salary per month was agreed Rs

30,000. Salary is required to be paid quarterly in arrears after the end of each Quarter. Accounting

period ends on 31 Dec.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

1|Page By Abdul Rehman Mirza

0347-3806858

Question No 6

A person has appointed in a job at ABC & Co on 1st May 2019 Salary per month was agreed Rs

30,000. Salary is required to be paid quarterly in arrears after the end of each Quarter. Accounting

period ends on 31 Dec. Salary is subject to increase at the rate @20% after the end of 1 year

agreement.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Expense Account

3. Salaries Payable

ACCURED INCOME

Question No 1

A person has appointed in a job at ABC & Co on 1st Jan 2018 Salary per month was agreed Rs 20,000.

Salary is required to be received in arrears after the end of the month. Accounting period ends on 31

Dec.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

Question No 2

A person has appointed in a job at ABC & Co on 1st July 2018 Salary per month was agreed Rs 30,000.

Salary is required to be received quarterly in arrears after the end of each Quarter. Accounting

period ends on 31 Dec.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

Question No 3

A person has appointed in a job at ABC & Co on 1st Jan 2018 Salary per month was agreed Rs 20,000.

Salary is required to be received in arrears after the end of the month. Accounting period ends on 31

Dec. Salary is subject to increase at the rate @25% after the end of 1 year agreement.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

2|Page By Abdul Rehman Mirza

0347-3806858

Question No 4

A person has appointed in a job at ABC & Co on 1st July 2018 Salary per month was agreed Rs 30,000.

Salary is required to be received quarterly in arrears after the end of each Quarter. Accounting

period ends on 31 Dec. Salary is subject to increase at the rate @20% after the end of 1 year

agreement.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

Question No 5

A person has appointed in a job at ABC & Co on 1st May 2018 Salary per month was agreed Rs

30,000. Salary is required to be received quarterly in arrears after the end of each Quarter.

Accounting period ends on 31 Dec.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

Question No 6

A person has appointed in a job at ABC & Co on 1st May 2019 Salary per month was agreed Rs

30,000. Salary is required to be received quarterly in arrears after the end of each Quarter.

Accounting period ends on 31 Dec. Salary is subject to increase at the rate @20% after the end of 1

year agreement.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Salaries Income Account

6. Salaries Receivable

Question No 7

A person has appointed in a job at ABC & Co on 1st May 2019 Salary per month was agreed Rs

30,000. Salary is required to be received quarterly in arrears after the end of each Quarter.

Accounting period ends on 30 June. Salary is subject to increase at the rate @20% at the start of the

year agreement.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Salaries Income Account

3. Salaries Receivable

Prepaid Expenses:

Question No 1

Insurance premium paid for the 12 month ended 31 march 2019 was paid on 1 April 2018 amounting

Rs 120,000 year end for the business is 31 December

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Insurance Expense Account

3|Page By Abdul Rehman Mirza

0347-3806858

3. Prepaid Insurance

Question No 2

Rent agreement was signed on 1st June 2018 and rent per month agrees was Rs 30,000, Required to

be paid quarterly in advance at the start of each quarter, year ended is 31 December.

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Insurance Expense Account

3. Prepaid Insurance

Question No 3

Rent agreement was signed on 1st June 2018 and rent per month agrees was Rs 30,000, Required to

be paid quarterly in advance at the start of each quarter, year ended is 31 December. Rent is subject

to increase at the rate @20% after the end of 1 year agreement

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Rent Expense Account

3. Prepaid Rent

Unearned Income:

Question No 1

Insurance premium Received for the 12 month ended 31 march 2019 was received on 1 April 2018

amounting Rs 120,000 year end for the business is 31 December

Required:

1. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

2. Insurance income Account

3. Unearned Insurance Premium

Question No 2

Rent agreement was signed on 1st June 2018 and rent per month agrees was Rs 30,000, Required to

be Received quarterly in advance at the start of each quarter, year ended is 31 December.

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Rent Income Account

6. Unearned Rent Income

Question No 3

Rent agreement was signed on 1st June 2018 and rent per month agrees was Rs 30,000, Required to

be paid quarterly in advance at the start of each quarter, year ended is 31 December. Rent is subject

to increase at the rate @20% after the end of 1 year agreement

Required:

4. Journal Entries including adjustment for the year ended 31 Dec 2018 and 31 Dec 2019

5. Rent income Account

6. Unearned Rent Income.

4|Page By Abdul Rehman Mirza

0347-3806858

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Activity: Notes PayableDocument3 pagesActivity: Notes PayablePiaNo ratings yet

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeDocument5 pagesIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoNo ratings yet

- Borrowing Cost ProbDocument10 pagesBorrowing Cost ProbYoite MiharuNo ratings yet

- Intermediate Accounting 2Document23 pagesIntermediate Accounting 2hsjhsNo ratings yet

- Appropriation Accounts AndyDocument26 pagesAppropriation Accounts AndyAndrew MwingaNo ratings yet

- Income Taxation Chap-3-6Document48 pagesIncome Taxation Chap-3-6ouia iooNo ratings yet

- ACC402 2023 IFRS 2 TutorialsDocument3 pagesACC402 2023 IFRS 2 TutorialsBilliee ButccherNo ratings yet

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaNo ratings yet

- Chapter 7 AssignmentDocument27 pagesChapter 7 Assignmentsanskritishukla2020No ratings yet

- AP 300Q Quizzer On Audit of Liabilities ResaDocument13 pagesAP 300Q Quizzer On Audit of Liabilities Resaryan rosalesNo ratings yet

- TQ U6 Salaries 4 2019 PDFDocument3 pagesTQ U6 Salaries 4 2019 PDFhelenNo ratings yet

- ACC315A JAN 2023 Taxation CAT 1Document2 pagesACC315A JAN 2023 Taxation CAT 1Abuk AyulNo ratings yet

- Mpetsi Traders 25 MARKSDocument4 pagesMpetsi Traders 25 MARKSNkatekoNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Document1 pageINTERMEDIATE ACCOUNTING Vol. 2, Empleo and Robles 2006 Ed, Pp. 123-124Ronn Robby RosalesNo ratings yet

- S - Adjusting Entry ProblemsDocument4 pagesS - Adjusting Entry ProblemsYusra PangandamanNo ratings yet

- CA Exam Preparatory Question AnswersDocument4 pagesCA Exam Preparatory Question AnswersBhavye GuptaNo ratings yet

- Adjusting Entries Problems and SolutionsDocument3 pagesAdjusting Entries Problems and SolutionsUpcycWithMe GNo ratings yet

- AE-O-A - Quiz QuestionnaireDocument1 pageAE-O-A - Quiz QuestionnaireUSD 654No ratings yet

- Adjusting Journal Entries Are Entries Used To Update The Accounts Prior To The Preparation of Financial StatementsDocument4 pagesAdjusting Journal Entries Are Entries Used To Update The Accounts Prior To The Preparation of Financial Statementsjemima manzanoNo ratings yet

- CIA3001 Pilot PaperDocument12 pagesCIA3001 Pilot PaperThiya Thiviya100% (1)

- Exercise in Ac6 OnlineDocument2 pagesExercise in Ac6 OnlinePaul GarciaNo ratings yet

- 1645195113green Joanna 407 AssignmentDocument6 pages1645195113green Joanna 407 AssignmentFawziyyah AgboolaNo ratings yet

- Acca Tx-Mys 2019 JuneDocument14 pagesAcca Tx-Mys 2019 JuneChoo LeeNo ratings yet

- Franchise AccountingDocument2 pagesFranchise AccountingChristopher NogotNo ratings yet

- Adjusting Entries: Prepaid Expenses (Its An Assets)Document3 pagesAdjusting Entries: Prepaid Expenses (Its An Assets)Hira SialNo ratings yet

- AC3202 - 20202021B - Exam PaperDocument9 pagesAC3202 - 20202021B - Exam PaperlawlokyiNo ratings yet

- Acca TX Mys DEC 2019 Sample QuestionsDocument24 pagesAcca TX Mys DEC 2019 Sample QuestionsShazwanieSazaliNo ratings yet

- FE QuestionsDocument2 pagesFE Questionsviedereen12No ratings yet

- Chapter 7 Inclass Problems Day 2Document2 pagesChapter 7 Inclass Problems Day 2Abdullah alhamaadNo ratings yet

- MODULE 2 (Assignment 3) - PDFDocument2 pagesMODULE 2 (Assignment 3) - PDFRene LopezNo ratings yet

- Accruals & PrepaymentsDocument7 pagesAccruals & PrepaymentsClaudiu OaieNo ratings yet

- Financial LiabilitiesDocument4 pagesFinancial LiabilitiesNicah AcojonNo ratings yet

- 6-Interest Payable by The TaxpayerDocument13 pages6-Interest Payable by The TaxpayerRakshit VoraNo ratings yet

- Franchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFDocument1 pageFranchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFAllyssa ThalliaNo ratings yet

- E3 Adjusting Entries - QuestionsDocument3 pagesE3 Adjusting Entries - QuestionsHuzaifanadeemNo ratings yet

- IFRS-15-Problem-Set 2Document4 pagesIFRS-15-Problem-Set 2FayehAmantilloBingcangNo ratings yet

- AE 101 Module 2 Lesson 3 1Document30 pagesAE 101 Module 2 Lesson 3 1Arly Kurt TorresNo ratings yet

- Problem 1: Problem 2Document1 pageProblem 1: Problem 2Von Kirby RagasaNo ratings yet

- Problem Set ADocument14 pagesProblem Set ADyenNo ratings yet

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsDocument7 pagesChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietNo ratings yet

- Specific Financial Reporting Ac413 May19bDocument5 pagesSpecific Financial Reporting Ac413 May19bAnishahNo ratings yet

- Lecture 3 - Accounting Period and Methods of AccountingDocument21 pagesLecture 3 - Accounting Period and Methods of AccountingSKEETER BRITNEY COSTANo ratings yet

- IA 2 Quiz #1 - Investment in BondsDocument2 pagesIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNo ratings yet

- Adjusting Entries Exercises - EditedDocument4 pagesAdjusting Entries Exercises - EditedCINDY LIAN CABILLON100% (2)

- Practice Set (Questions) - IAS 19 PDFDocument3 pagesPractice Set (Questions) - IAS 19 PDFAli HaiderNo ratings yet

- Adjusting EntriesDocument22 pagesAdjusting EntriesShakir IsmailNo ratings yet

- Prac 1 Tua LiabilitiesDocument7 pagesPrac 1 Tua LiabilitiesKrisan Rivera0% (1)

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocument6 pages02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNo ratings yet

- 6-Interest Payable by The TaxpayerDocument13 pages6-Interest Payable by The Taxpayerabhay9411No ratings yet

- Accounting For The EntrepreneDocument19 pagesAccounting For The EntrepreneBreannaNo ratings yet

- Borrowing CostsDocument1 pageBorrowing CostsMark Angelo BustosNo ratings yet

- Reversing EntriesDocument5 pagesReversing EntriesRizky AjiNo ratings yet

- LESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTDocument14 pagesLESSON 13 Tax PAYMENT AND PROCEDURES and ASSESSEMTOctavius MuyungiNo ratings yet

- Borrowing CostDocument2 pagesBorrowing CostKyla Mae OrquijoNo ratings yet

- Basic ConceptsDocument4 pagesBasic ConceptsHarry IcwaNo ratings yet

- Far 2 LQDocument14 pagesFar 2 LQJennifer AdvientoNo ratings yet

- Tax Payment Procedure by Installments Host Samson (Autosaved)Document8 pagesTax Payment Procedure by Installments Host Samson (Autosaved)Samson KilatuNo ratings yet

- Finacc 334Document1 pageFinacc 334Pogi Kyle Sta. RosaNo ratings yet

- CPA Taxation Part 1 Section 3 QuestionsDocument5 pagesCPA Taxation Part 1 Section 3 QuestionsVictory NyamburaNo ratings yet

- LeeeeeDocument5 pagesLeeeeebd053188No ratings yet

- QUICKBOOKS ONLINE 2024 BEGINNERS GUIDE-MLPT E-BookDocument43 pagesQUICKBOOKS ONLINE 2024 BEGINNERS GUIDE-MLPT E-Bookjonalee740304No ratings yet

- MasDocument14 pagesMasgnim1520100% (1)

- Cfas SummarizeDocument26 pagesCfas SummarizeLEIGHANNE ZYRIL SANTOSNo ratings yet

- Final Exammm 3Document10 pagesFinal Exammm 3Marianne Adalid MadrigalNo ratings yet

- Chapter 12 - Job-Order-Process and Hybrid Costing SystemsDocument52 pagesChapter 12 - Job-Order-Process and Hybrid Costing Systems朱潇妤100% (2)

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- E NTREPVSe MPLOYMENTDocument9 pagesE NTREPVSe MPLOYMENTMa Melissa Nacario SanPedroNo ratings yet

- Corporate Tax Planning and ManagemantDocument11 pagesCorporate Tax Planning and ManagemantVijay KumarNo ratings yet

- PT Global Indonesia Neraca Saldo Per 30 November 2020: No. Akun Account Title November 30, 2020 Debit CreditDocument32 pagesPT Global Indonesia Neraca Saldo Per 30 November 2020: No. Akun Account Title November 30, 2020 Debit Credit02Adinda NurNo ratings yet

- Financial Statements: Income Statement & Balance SheetDocument21 pagesFinancial Statements: Income Statement & Balance SheetNingtoulung Gangmei100% (1)

- CASE STUDYCapital BudgetingDocument4 pagesCASE STUDYCapital BudgetingSumit KhilariNo ratings yet

- Project APT2043 Sem1 - 2023Document2 pagesProject APT2043 Sem1 - 2023a22a0203No ratings yet

- Tax PlanningDocument3 pagesTax Planningjoseph_gopu17919No ratings yet

- Create LawDocument47 pagesCreate LawRen Mar CruzNo ratings yet

- 1965 10 The Provincial Employees Social Security Ordinance 1965Document36 pages1965 10 The Provincial Employees Social Security Ordinance 1965Anwar ul Haq ShahNo ratings yet

- Ch4 SmithvilleDocument7 pagesCh4 SmithvilleLica Dapitilla Perin33% (3)

- North Carolina Outward Bound School Annual Report 2013Document16 pagesNorth Carolina Outward Bound School Annual Report 2013Siti Nur Khadijah JamulidinNo ratings yet

- 12 Acc c3 Prelim Exam p1 2023 QP AbDocument26 pages12 Acc c3 Prelim Exam p1 2023 QP AbPax AminiNo ratings yet

- P.O.A Paper 02. 27 May 2003Document11 pagesP.O.A Paper 02. 27 May 2003Jerilee SoCute Watts0% (2)

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- Ej 2 Cap 3 Mayers CanvasDocument2 pagesEj 2 Cap 3 Mayers CanvasAlvaro LopezNo ratings yet

- Special Journal Example-Basic AccountingDocument62 pagesSpecial Journal Example-Basic AccountingJaynel LoveNo ratings yet

- Larson12e 04Document60 pagesLarson12e 04samas7480No ratings yet

- Foundation Acc AssignmentDocument4 pagesFoundation Acc AssignmentJOEY LEONG KAH JIENo ratings yet

- Joanna Java Review SchoolDocument6 pagesJoanna Java Review SchoolYanaiza Irisari Alvarez75% (4)

- Government GrantsDocument9 pagesGovernment Grantssorin8488100% (1)

- Chapter 2 Opportunity Seeking Screening and SeizingDocument4 pagesChapter 2 Opportunity Seeking Screening and SeizingMaica A. Agliam100% (1)

- Intermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerDocument27 pagesIntermediate - Accounting - Spiceland - Sepe - Nelson - 8th - Ed - CHPT - 01 - Exercises AnswerMelissaNo ratings yet