Professional Documents

Culture Documents

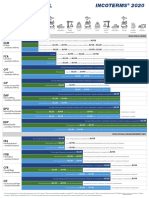

DELIVERY Transfer of Risk and Transfer of Title

Uploaded by

Karen TanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DELIVERY Transfer of Risk and Transfer of Title

Uploaded by

Karen TanCopyright:

Available Formats

Delivery, Transfer of Risk & Transfer of Title

The International Chamber of Commerce (ICC) created a generally accepted, readily understandable set of

terms called Incoterms 2010. These terms defines the responsibilities of both the buyer and seller in the

various transportation options. Incoterms 2010 is not a body of law. It is an internationally agreed upon

protocol for understanding who pays for what, when risk transfers, and where the goods are to be delivered.

Incoterms do not identify where the transfer of title occur. Incoterms cover the fundamentals terms of

the movement of the cargo: Documentation; who is to arrange for the documentation, Cost; who is

responsible for the various costs involved, Control; who possesses control of the goods at any point in the

journey and Liability; who is exposed to the economic loss if the cargo is damaged.

DELIVERY UNDER INCOTERMS

In global trade, "delivery" refers to the seller fulfilling the obligation of the terms of sale or to completing a

contractual obligation. "Delivery" can occur at any point in the physical movement of the cargo. Incoterms

describe the seller’s responsibility to “deliver the cargo to a specified or ‘named’ place”. When the cargo is

delivered to that ‘named’ place, responsibility for the cargo is on the buyer.

PASSING OF RISKS UNDER INCOTERMS

Incoterms provides that the risk of loss or damage to the goods, as well as the obligation to bear the costs

relating to the goods, passes from the seller to the buyer when the seller has fulfilled his obligation to

deliver the goods.

TRANSFER OF TITLE

Transfer of title occurs when the parties wish it to occur. A statement as to transfer of title should be

included in the body of the contract and commercial invoice. Transfer of title affects the parties' rights in the

event of total or partial loss and damage or destruction of the goods. Once transfer of title has occurred,

the buyer may be precluded from rejecting the goods despite valid complaints of quality, quantity or

description. When buyer acquires titles, the seller can sue the buyer for non-payment. Problems may arise

in commercial agreements if the contract does not specify when the transfer of title occurs. A good

example of this is what happens if “delivery” occurs but the buyer breaches the contract by not paying the

contract price. In such an example, problems may arise with regard to who is the legal owner of the goods.

Romalpa clause. A Romalpa clause is a title retention clause, which serves to separate the passing of

title, and risk of loss and which provides that until payment is received, title remains with the seller. An

example of a Romalpa clause; ‘Risk of loss and damage shall pass to the Buyer upon delivery. Title shall

pass to the buyer upon payment in full’.

INCOTERMS AND DOMESTIC FREIGHT TERMS

Incoterms should not be confused with domestic trade terms. The domestic terms are under the Uniform

Commercial Code adopted by each state. The following chart offers guidance as to the differences.

DOMESTIC INTERNATIONAL

Transfer of title to the goods presumed by use of term but Transfer of title not specified by use of the Incoterms; should be

can be negotiated by seller and buyer. stated separately.

Risk and title transfer are presumed to transfer Risk transfer based on Incoterms selected; title transfers based on

simultaneously but can be negotiated by seller and buyer agreement between seller and buyer.

Thirteen different terms are possible with specified locations stated,

Five different terms; F.O.B. is the most commonly used i.e. ex-works seller’s warehouse.

term with specified locations stated, and modifications.

Based on Uniform Commercial Code adopted by each An agreement adopted by the International Chamber of Commerce

state, becoming a state law then incorporated into seller and buyer AGREEMENTS

M.E. Dey & Co. ▪ connect@medey.com ▪ 414-747-7000 ▪ www.medey.com

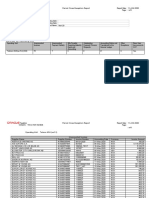

INCOTERMS

CARRIAGE RISK TRANSFER COSTS

EXW Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the buyer the goods are at the disposal of the buyer when the goods are at the disposal of the

buyer

FCA Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the buyer or the seller on the goods have been delivered to the carrier when the goods have been delivered to the

the buyer's behalf at the named place carrier at the named place

FAS Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the buyer the goods have been placed alongside the when the goods have been placed alongside

ship the ship

FOB Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the buyer the goods pass the ship's rail when the goods pass the ship's rail

CFR Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer at port of destination, buyer

the seller the goods pass the ship's rail paying such costs as are not for the seller's

account under the contract of carriage

CIF Carriage and insurance to Risk transfer from the seller to the buyer when Costs transfer at port of destination, buyer

be arranged by the seller the goods pass the ship's rail paying such costs as are not for the seller's

account under the contract of carriage

CPT Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer at port of destination, buyer

the seller the goods have been delivered to the carrier paying such costs as are not for the seller's

account under the contract of carriage

CIP carriage and insurance to Risk transfer from the seller to the buyer when Costs transfer at port of destination, buyer

be arranged by the seller the goods have been delivered to the carrier paying such costs as are not for the seller's

account under the contract of carriage

DAF Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the seller the goods have been delivered at the frontier when the goods have been delivered at the

frontier

DES Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the seller the goods are placed at the disposal of the when the goods are placed at the disposal of

buyer on board the ship the buyer on board the ship

DEQ Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the seller the goods are placed at the disposal of the when the goods are placed at the disposal of

buyer on the quay the buyer on the quay

DDU Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the seller the goods are placed at the disposal of the when the goods are placed at the disposal of

buyer the buyer

DDP Carriage to be arranged by Risk transfer from the seller to the buyer when Costs transfer from the seller to the buyer

the seller the goods are placed at the disposal of the when the goods are placed at the disposal of

buyer the buyer

Risk is often managed through using a Marine insurance policy. A Marine insurance policy usually includes a ‘Warehouse to

Warehouse clause’. The plain meaning is insurance coverage on cargo continues in force during the ordinary and customary course

of transit to the final destination. Transit does not begin until the goods are properly packed for export. Insurance remains in force for

15 days after discharge (30 days if the destination is outside the limits of the port of discharge while awaiting normal clearance for

transit to the final destination). Anyone who has an insurable interest in a cargo shipment (i.e., anyone who would suffer a loss if the

cargo were damaged or destroyed or who would benefit from the safe arrival of the cargo) may insure cargo. Marine Insurance

covers in the event of loss or damage to goods due to a covered peril insured against while at risk under the policy. Marine insurance

indemnifies the holder regardless of the carrier limits of liability (ocean carrier $500 per package, International air carriers, $9.07 per

pound, Domestic Air carriers $0.50 per pound). Incoterms, insurable interest and transfer of title all may not coincide with the

intended condition of the sales transaction. In addition, risk of non-payment of the invoice value is an important consideration.

Consider the following recommendations: Measurement and recognition of risk are vital steps in a supply chain. Incoterms must be

clearly stated within or on the sales invoice/contract. Keep in mind that some Incoterms are incompatible with the selected mode of

transportation. Insure your cargo. Our Cargo Insurance policy automatically covers approved goods under the so-called ‘warehouse

to warehouse clause’ to protect your investment all the way to destination. If you insure under your own policy, discuss the coverage

limitations with your insurance agent. We also recommend that the choice of Incoterms recognize this. The cargo is inspected at time

of delivery at destination to check for any obvious in-transit damage. That title transfer is specifically spelled out in the contract. That

consideration is given to credit insurance to protect lack of payment due to an unreasonable or unfair dispute with your customer. **

Letters of Credit can be quite useful in controlling your risk of payment. Discuss the incorporation of Letters of Credit into your Sales

order with your Banker. **This review of title, risk and delivery is not legal advice. M.E. Dey & Co., Inc understands the above to be

accurate. However, it represents only a summary of our understanding of three very complex issues. Contact your attorney for proper

legal guidance in this important issue.

M.E. Dey & Co. ▪ connect@medey.com ▪ 414-747-7000 ▪ www.medey.com

You might also like

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- IncoDocs Trade Guide Shipping Import Export IncoTerms Freight Forwarder Documents 2019 Small PDFDocument19 pagesIncoDocs Trade Guide Shipping Import Export IncoTerms Freight Forwarder Documents 2019 Small PDFWalter P100% (1)

- IncoDocs Trade Guide Shipping Import Export IncoTerms Freight Forwarder Documents 2019 SmallDocument19 pagesIncoDocs Trade Guide Shipping Import Export IncoTerms Freight Forwarder Documents 2019 Smallradovan barkerNo ratings yet

- Lesson 2:: Incoterms 2010 & 2020Document33 pagesLesson 2:: Incoterms 2010 & 2020Cathleen Drew TuazonNo ratings yet

- Delmar Incoterms2020Document1 pageDelmar Incoterms2020zeeshan zafarNo ratings yet

- Global Trade Guide: Learn Key Information About The Import / Export ProcessDocument26 pagesGlobal Trade Guide: Learn Key Information About The Import / Export ProcessOrkunErdemNo ratings yet

- Global Trade Guide: Learn Key Information About The Import / Export ProcessDocument25 pagesGlobal Trade Guide: Learn Key Information About The Import / Export ProcessElizabete FerreiraNo ratings yet

- Global Trade Guide: Learn Key Information About The Import / Export ProcessDocument24 pagesGlobal Trade Guide: Learn Key Information About The Import / Export ProcessUlrich Maria BaltzerNo ratings yet

- IncoDocs Trade Guide March 2020Document24 pagesIncoDocs Trade Guide March 2020Evgeniy TruniakovNo ratings yet

- IncotermsDocument5 pagesIncotermsZaid Ahmad KhanNo ratings yet

- Compare TTQTDocument28 pagesCompare TTQTnngocdung.1869No ratings yet

- 01 Icc CifDocument11 pages01 Icc CifJoselejoselito romoNo ratings yet

- Wine and Spirits Download Incoterms Download DataDocument1 pageWine and Spirits Download Incoterms Download DatawdavidchristopherNo ratings yet

- IncotermsDocument9 pagesIncotermsdrdmonzNo ratings yet

- Incoterms 2020: The Significance For Your Marine InsuranceDocument4 pagesIncoterms 2020: The Significance For Your Marine InsuranceZoran DimitrijevicNo ratings yet

- Common Incoterms 2020 Their MeaningsDocument3 pagesCommon Incoterms 2020 Their MeaningsDSB 444No ratings yet

- "Export Procedure and Documentation": Bba 5 Semester By: Dr. Madhvi KushDocument28 pages"Export Procedure and Documentation": Bba 5 Semester By: Dr. Madhvi Kushekta singhNo ratings yet

- Incoterms 2020: Anmol Kapuria Divya Verma Siddhartha KhandelwalDocument19 pagesIncoterms 2020: Anmol Kapuria Divya Verma Siddhartha KhandelwalBhanu Putra Kalyan MukkamulaNo ratings yet

- ICC Incoterms Rules 2020 GuideDocument3 pagesICC Incoterms Rules 2020 GuidemazinmaazNo ratings yet

- Incoterms2010 HolshipDocument1 pageIncoterms2010 HolshipAldiNo ratings yet

- Incoterms 2020Document1 pageIncoterms 2020Ý Nhi NguyễnNo ratings yet

- Inco TermsDocument20 pagesInco TermsHarmanjit DhillonNo ratings yet

- Cost and Freight: (Insert Named Port of Destination) Incoterms 2020Document10 pagesCost and Freight: (Insert Named Port of Destination) Incoterms 2020Khang NguyễnNo ratings yet

- OTS IncoTermsDocument32 pagesOTS IncoTermsasasNo ratings yet

- CDCS Incoterms 2020 Updates To FiguresDocument13 pagesCDCS Incoterms 2020 Updates To FiguresSadia NazninNo ratings yet

- Incoterm 2020Document2 pagesIncoterm 2020Nabila BoujimNo ratings yet

- Incoterms: Incoterms, Promulgated by The International Chamber of Commerce, Is An Acronym For "InternationalDocument4 pagesIncoterms: Incoterms, Promulgated by The International Chamber of Commerce, Is An Acronym For "InternationalTeshaleNo ratings yet

- The Incoterms® RulesDocument2 pagesThe Incoterms® RulesVarthemaNo ratings yet

- INCOTERMSDocument11 pagesINCOTERMSRomero Mary JaneNo ratings yet

- Rules For Any Mode or Modes of TransportDocument2 pagesRules For Any Mode or Modes of TransportMădălina HohanNo ratings yet

- Incoterms 2016 Chart DetailedDocument3 pagesIncoterms 2016 Chart DetailedtamerNo ratings yet

- Shipping Education INCO TERMSDocument4 pagesShipping Education INCO TERMSGerardo Urdaneta100% (1)

- Module 5. Understanding IncotermsDocument14 pagesModule 5. Understanding IncotermsAreeba AmirNo ratings yet

- Incoterms 2010 Are Used Today by Practitioners and Traders, Anyone Involved in TheDocument3 pagesIncoterms 2010 Are Used Today by Practitioners and Traders, Anyone Involved in TheDeeksha GandheNo ratings yet

- QTXNKDocument5 pagesQTXNKThanh Lê GiaiNo ratings yet

- Int Sale of Goods - IncotermsDocument29 pagesInt Sale of Goods - IncotermsLaw KiajorkNo ratings yet

- Incoterms 2010Document21 pagesIncoterms 2010Aanchal ShankerNo ratings yet

- The Incoterms: Port of Destination)Document4 pagesThe Incoterms: Port of Destination)KlaudiaNo ratings yet

- Module 8 - Incoterms 2020Document46 pagesModule 8 - Incoterms 2020Trixie De LaraNo ratings yet

- INCOTERM - HillebrandDocument18 pagesINCOTERM - HillebrandjosecastillejocamposNo ratings yet

- FOB Price (Free On Board) - What Is FOB PriceDocument3 pagesFOB Price (Free On Board) - What Is FOB PriceFarooq BhuttaNo ratings yet

- Export Marketing: Prof. Zia-Ur-RehmanDocument11 pagesExport Marketing: Prof. Zia-Ur-RehmanBader NoorNo ratings yet

- INCOTERMSDocument2 pagesINCOTERMSrjaviersalNo ratings yet

- Shipping Incoterms: EXW (EX-Works)Document2 pagesShipping Incoterms: EXW (EX-Works)Rahul ShanbhogueNo ratings yet

- IncotermsDocument11 pagesIncotermsSky509No ratings yet

- International Payment: Edward G. HinkelmanDocument34 pagesInternational Payment: Edward G. HinkelmanNguyen Van KhanhNo ratings yet

- Exportaid: Incoterms - Definitions ' 2007Document2 pagesExportaid: Incoterms - Definitions ' 2007Marey MorsyNo ratings yet

- Nghiep Vu Ngoai ThuongDocument10 pagesNghiep Vu Ngoai ThuongKhoa Nguyễn XuânNo ratings yet

- ITOD3Document30 pagesITOD3sanyam20007No ratings yet

- Cost, Insurance, and Freight - CIF Definition byDocument5 pagesCost, Insurance, and Freight - CIF Definition byDanica BalinasNo ratings yet

- Smallpdf - 2022 06 19Document1 pageSmallpdf - 2022 06 19Nathaly TobarNo ratings yet

- INCOTERMSDocument2 pagesINCOTERMSsre.rwpNo ratings yet

- Tableau Incoterms 202000Document5 pagesTableau Incoterms 202000souleymane sow100% (6)

- Incoterms Chart of Responsibility 2020 1Document1 pageIncoterms Chart of Responsibility 2020 1Hiro Katsumoto100% (1)

- Learning Session On ImportsDocument36 pagesLearning Session On ImportsHaroon Ahmed MalikNo ratings yet

- Incoterms® 2010, Will Be Launched in September and Come Into Effect On 1 January 2011Document3 pagesIncoterms® 2010, Will Be Launched in September and Come Into Effect On 1 January 2011Neha SinghNo ratings yet

- IncotermsDocument4 pagesIncotermsRajat GoyalNo ratings yet

- Incoterms 2010Document58 pagesIncoterms 2010K.Inusha sanjeewani FernandoNo ratings yet

- Incoterms® Rules: EXW Ex WorksDocument3 pagesIncoterms® Rules: EXW Ex WorksDineshkumarNo ratings yet

- Incoterms CombinedDocument66 pagesIncoterms CombinedWasim AkramNo ratings yet

- Elements of Oral DefamationDocument2 pagesElements of Oral DefamationLesterNo ratings yet

- The Crime of Libel in The PhilippinesDocument4 pagesThe Crime of Libel in The PhilippinesLesterNo ratings yet

- Public SafetyDocument1 pagePublic SafetyLesterNo ratings yet

- Casual-Based Contract of Employment - SampleDocument2 pagesCasual-Based Contract of Employment - SampleLester100% (2)

- Forest TreesDocument164 pagesForest TreesLesterNo ratings yet

- H-3870-1 - Adverse Claims, Protests, Contests, and AppealsDocument67 pagesH-3870-1 - Adverse Claims, Protests, Contests, and AppealsLesterNo ratings yet

- Project-Based Contract of Employment - SampleDocument2 pagesProject-Based Contract of Employment - SampleLester100% (7)

- People OF THE Philippines, Crim, Case No. SB-17-CRM-0496Document17 pagesPeople OF THE Philippines, Crim, Case No. SB-17-CRM-0496LesterNo ratings yet

- Nurses, Negligence, Malpractice: An Analysis Based On More Than 250 Cases Against NursesDocument10 pagesNurses, Negligence, Malpractice: An Analysis Based On More Than 250 Cases Against NursesLesterNo ratings yet

- ResolutionDocument9 pagesResolutionLesterNo ratings yet

- Handbook On ASEAN Consumer Protection Laws and RegulationDocument94 pagesHandbook On ASEAN Consumer Protection Laws and RegulationLesterNo ratings yet

- DENR Rules and Regulations Governing Timber and Timber Products Planted On Private LandDocument6 pagesDENR Rules and Regulations Governing Timber and Timber Products Planted On Private LandLesterNo ratings yet

- Sandiganbayan CaseDocument11 pagesSandiganbayan CaseLesterNo ratings yet

- July 22 28 2019 Small PDFDocument12 pagesJuly 22 28 2019 Small PDFLesterNo ratings yet

- Thailand Synnex 2021Document1 pageThailand Synnex 2021Carlos SobralNo ratings yet

- 6int 2007 Dec QDocument7 pages6int 2007 Dec Qapi-19836745No ratings yet

- JioMart Invoice 16491756280302451A 1Document2 pagesJioMart Invoice 16491756280302451A 1new nameNo ratings yet

- Simulation of Negotiation-Based Data Dissemination Protocol in Wireless Sensor Networks With Omnet++Document13 pagesSimulation of Negotiation-Based Data Dissemination Protocol in Wireless Sensor Networks With Omnet++pigeonrainNo ratings yet

- Kelompok 8Document16 pagesKelompok 8dewi murniNo ratings yet

- The Nilson Report - Aug 2016 IssueDocument11 pagesThe Nilson Report - Aug 2016 IssueFidel100% (1)

- Simplex ES Net 1-2 Launch BulletinDocument7 pagesSimplex ES Net 1-2 Launch BulletinRodrigo Lima100% (1)

- Rini Mam NotesDocument15 pagesRini Mam NotesasbroadwayNo ratings yet

- PPA Notes Module 2Document22 pagesPPA Notes Module 2Community Institute of Management StudiesNo ratings yet

- MTM Link Trifold WebDocument2 pagesMTM Link Trifold WebRagnarr FergusonNo ratings yet

- General Ledger SampleDocument3 pagesGeneral Ledger SampleBusinessTips.Ph80% (15)

- Blue and White Illustrated Medical Healthcare in The 21st Century Education Presentation - 20230925 - 110030 - 0000Document8 pagesBlue and White Illustrated Medical Healthcare in The 21st Century Education Presentation - 20230925 - 110030 - 0000Janix MagbanuaNo ratings yet

- COURSE OUTLINE N LECTURE 1Document37 pagesCOURSE OUTLINE N LECTURE 1Judith OwitiNo ratings yet

- Period Close Exceptions Report (XML)Document6 pagesPeriod Close Exceptions Report (XML)Priya NimmagaddaNo ratings yet

- Business Flow Chart SampleDocument1 pageBusiness Flow Chart Samplekyle1991No ratings yet

- 220244-Data Communication and Computer Network - 22414 - 2023 - Summer Model AnswerDocument21 pages220244-Data Communication and Computer Network - 22414 - 2023 - Summer Model Answerommane312003100% (2)

- CHAPTER 10 Multiplexing and DemultiplexingDocument3 pagesCHAPTER 10 Multiplexing and DemultiplexingPatrick GarciaNo ratings yet

- Tax Invoice: TIN#: 1000145GST501Document1 pageTax Invoice: TIN#: 1000145GST501aishathNo ratings yet

- Community Health Nursing VocabDocument2 pagesCommunity Health Nursing VocabMaureen Beldorin0% (1)

- LIFE STAGE FINANCIAL PLANNING For PROTECTION, EDUCATIONDocument18 pagesLIFE STAGE FINANCIAL PLANNING For PROTECTION, EDUCATIONmgoyenecNo ratings yet

- DRAP New Rules On Ethical Marketing To HCPsDocument10 pagesDRAP New Rules On Ethical Marketing To HCPsRaheel KhanNo ratings yet

- Permit To ConstructDocument1 pagePermit To ConstructJirhana Lindagan Karon-KampangNo ratings yet

- Delhi Tourism - Citizen Charter: DTTDC Information Offices in DelhiDocument13 pagesDelhi Tourism - Citizen Charter: DTTDC Information Offices in Delhisakshi kathaitNo ratings yet

- VenmoDocument5 pagesVenmonasege9019100% (1)

- Computer NetworkDocument20 pagesComputer NetworkyjnNo ratings yet

- Account Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueDocument22 pagesAccount Summary Portfolio Allocation: Brokerage Cash Balance Deposit Sweep Balance Total Securities Portfolio ValueFerguson TchayaNo ratings yet

- Cooper EDI FlyerDocument2 pagesCooper EDI FlyerNguyen Anh TuNo ratings yet

- Perhitungan Pelunasan An PT SATU AMERTA 74403582219Document4 pagesPerhitungan Pelunasan An PT SATU AMERTA 74403582219Tia BessieNo ratings yet

- Annual Report 2021-22 MCQDocument14 pagesAnnual Report 2021-22 MCQEkknath JujareNo ratings yet

- Analisys of Three Publically Available INTER-AS MPLS L3 VPN ImplementationsDocument47 pagesAnalisys of Three Publically Available INTER-AS MPLS L3 VPN Implementationsdeltakio@gmail.comNo ratings yet

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseFrom EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseNo ratings yet

- How to Win Your Case In Traffic Court Without a LawyerFrom EverandHow to Win Your Case In Traffic Court Without a LawyerRating: 4 out of 5 stars4/5 (5)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterFrom EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterNo ratings yet

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowFrom EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowRating: 1 out of 5 stars1/5 (1)

- Law of Contract Made Simple for LaymenFrom EverandLaw of Contract Made Simple for LaymenRating: 4.5 out of 5 stars4.5/5 (9)

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersFrom EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersRating: 5 out of 5 stars5/5 (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- The Certified Master Contract AdministratorFrom EverandThe Certified Master Contract AdministratorRating: 5 out of 5 stars5/5 (1)

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreFrom EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreRating: 3.5 out of 5 stars3.5/5 (2)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Fundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignFrom EverandFundamentals of Theatrical Design: A Guide to the Basics of Scenic, Costume, and Lighting DesignRating: 3.5 out of 5 stars3.5/5 (3)

- Contracts: The Essential Business Desk ReferenceFrom EverandContracts: The Essential Business Desk ReferenceRating: 4 out of 5 stars4/5 (15)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetFrom EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetNo ratings yet

- How to Win Your Case in Small Claims Court Without a LawyerFrom EverandHow to Win Your Case in Small Claims Court Without a LawyerRating: 5 out of 5 stars5/5 (1)