Professional Documents

Culture Documents

Cloud Accounting Applications - Pea 2021-2022 Session - Case Studies

Uploaded by

Oladapo Oluwakayode AbiodunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cloud Accounting Applications - Pea 2021-2022 Session - Case Studies

Uploaded by

Oladapo Oluwakayode AbiodunCopyright:

Available Formats

CERTIFICATION COURSE

IN

DIGITAL ACCOUNTING

-CLOUD ACCOUNTING

APPLICATIONS

…

1|Page-Case Studies in Certification Course-NCA/WKC 2021/2022

MODULE 2: CLOUD ACCOUNTING APPLICATIONS

Case Study1

Cloud accounting is the practice of using an accounting system that's accessed through

the internet. ... Because cloud accounting systems are internet-based, you can access

your records anywhere and on any device that has an internet connection using an app

or web browser.

Required:

Use Sage Online (Cloud) to:

i. Access the Records of any sample company;

ii. View the Income statement;

iii. View the Balance sheet;

iv. View the VAT records;

v. Export the Income statement to PDF;

vi. Send the Income statement as attachment to your mailbox;

vii. Check your mailbox to download the Income statement.

Case study 2

The following transactions relates to the activities of Walmart Consulting for the year

2022:

$

i. Audit fees 5,000,000 Income

ii. Consultancy fees received 1,500,000 Income

iii. Electricity paid 500,000 Income

iv. Salaries paid 700,000 Expenses

v. Office Equipment bought 3,000,000 Fixed Asset

Note:

1. All the transactions were effected through Chase bank account.

2. Use codes 6001, 6002 for revenue items; codes 7001, etc for expenditure items

and code 8001 for asset items.

Required:

Use Wave (Cloud) to:

i. Create the Company.

ii. Create Chart of Accounts.

iii. Post the transactions for 2021 using General Journal.

iv. Generate the Income Statement.

v. Generate the Balance Sheet.

2|Page-Case Studies in Certification Course-NCA/WKC 2021/2022

Case study 3

The Internal Revenue Service (IRS) has been put to enquiry on the returns filed

by Super Cycles Wholesales in respect of VAT. The company utilize Sage Cloud

in preparing her accounts. The company presented the difference between

Output and input VAT as 25,000. The IRS engaged you as the Consultant to

verify and report the actual difference between the VATs.

Required:

How will you go about this assignment in the Cloud Accounting environment?

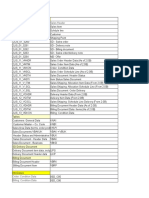

Case study 4

The following balances were extracted from the books of ACCSA Global in

2022

ITEMS AMOUNT

Motor Vehicles N500,000

Furniture N1,000,000

Zenith Bank N2,000,000

Capital N2,500,000

Loan N1,000,000

During the month/year the following transactions took place

ITEMS AMOUNT

Sales turnover N5,000,000

Donations received N2,000,000

Rent paid N500,000

Salaries N700,000

All transactions were done through bank:

Required

Use Sage50 online to create the chart of accounts, post the entries and

generate final accounts.

3|Page-Case Studies in Certification Course-NCA/WKC 2021/2022

Practice Question

Question

The accounts department of USAID has been using manual accounting system

in preparing and presenting their financial statements for the past three years.

However, effective from 2022, the agency decided to use Sage50 online in

preparing and presenting financial reports. Below are the closing balances of the

accounts of the agency as at 31st December, 2021:

Description $

Accumulated Fund 10,000,000

Fixtures 4,000,000

Loan 2,000,000

Motor Vehicles 6,000,000

Chase Bank 800,000

Cash 1,200,000

Transactions During the year 2022

i. Registration fees received by Cheque $1,500,000.

ii. Inspection fees received by Cheque $900,000.

iii. Annual returns received by Cash $1,400,000.

iv. Electricity paid by Cheque $50,000.

v. Telephone Charges paid by Cheque $10,000.

vi. Water rates paid by Cash $15,000.

vii. Salaries paid Cheque $200,000.

viii. Motor Vehicle bought by Cheque $1,000,000.

ix. Furniture purchased by Cheque $120,000.

Note:

All transactions for 2022 were done through Bank, except the telephone charges.

It was paid via cash.

Required:

Use Sage50 online to:

i. Create the Agency.

ii. Create Chart of Accounts.

iii. Prepare opening General Ledger Trial Balance.

iv. Post the transactions for 2022 using Journal.

v. Generate the Income Statement.

vi. Generate the Balance Sheet.

vii. Export your reports to Pdf.

viii. Send the report to ananwkc@gmail.com

4|Page-Case Studies in Certification Course-NCA/WKC 2021/2022

Thank you for your attention!!!

PROF. ADEBAYO PAUL ADEJOLA, FCNA, FCA, FCTI, FCCSA (USA).

Managing Consultant, White Knight Consulting, Nigeria;

Regional Rep., ACCSA Global.

Mobile: +234 803 680 2529

E-mail: padejole@yahoo.com

Website: www.profadebayopaul.com

5|Page-Case Studies in Certification Course-NCA/WKC 2021/2022

You might also like

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Audit of Liabilities Quiz 3Document3 pagesAudit of Liabilities Quiz 3Cattleya50% (2)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- FAR Midterm QuizDocument2 pagesFAR Midterm QuizAllyy DelacruzNo ratings yet

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- CPAR - 91 - AFAR First Preboard ExamDocument18 pagesCPAR - 91 - AFAR First Preboard ExamAllyson VillalobosNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Financial Accounting AssignmentDocument2 pagesFinancial Accounting AssignmentHu. A. Hussein'sNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Team PRTC Far-Finpb - 5.21Document19 pagesTeam PRTC Far-Finpb - 5.21NananananaNo ratings yet

- Far Reviewer Comprehensive Various Problems QuestionsDocument5 pagesFar Reviewer Comprehensive Various Problems QuestionsCharles Eli AlejandroNo ratings yet

- Domondon Acctg 3 Prelim ExamDocument3 pagesDomondon Acctg 3 Prelim ExamPrince Anton DomondonNo ratings yet

- Aec 102 Pre Final Exam 1 22 23 PsbaDocument10 pagesAec 102 Pre Final Exam 1 22 23 PsbaMikha Ella BasaNo ratings yet

- BANOShenieLynn IA3 CD1 Assignment5Document6 pagesBANOShenieLynn IA3 CD1 Assignment5Shenie Lynn BanoNo ratings yet

- IAS 12 Class Tutorial CCP CemenDocument4 pagesIAS 12 Class Tutorial CCP CemenJames MutarauswaNo ratings yet

- HaloCrypto Cumulative Case Tutorial QuestionsDocument6 pagesHaloCrypto Cumulative Case Tutorial QuestionsLim ShawnNo ratings yet

- 10 ICV-Scorecard - Tawteen - ICV-Scorecard-Submission-Template-Guidelines - Version-2-0Document62 pages10 ICV-Scorecard - Tawteen - ICV-Scorecard-Submission-Template-Guidelines - Version-2-0HARISHNo ratings yet

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- 92 Afar PW Selftest 2Document18 pages92 Afar PW Selftest 2Benedict CasueNo ratings yet

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Individual Assignment 1 ACTDocument4 pagesIndividual Assignment 1 ACTKalkidanNo ratings yet

- Quiz No. 2Document3 pagesQuiz No. 2abbyNo ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Income Taxes Batch 4 (Repaired)Document10 pagesIncome Taxes Batch 4 (Repaired)Lealyn Martin BaculoNo ratings yet

- Tax Accounting Set ADocument4 pagesTax Accounting Set AGopti EmmanuelNo ratings yet

- AccountingDocument6 pagesAccountingBlue HourNo ratings yet

- AFAR Preweek Lecture Part 2Document18 pagesAFAR Preweek Lecture Part 2Joris YapNo ratings yet

- Template - Accounting 108 - Final ExaminationDocument11 pagesTemplate - Accounting 108 - Final ExaminationRochelle BuensucesoNo ratings yet

- Rift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual AssignmentDocument7 pagesRift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual Assignmentgenemu fejoNo ratings yet

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- CAF 1 FAR1 Autumn 2022Document6 pagesCAF 1 FAR1 Autumn 2022QasimNo ratings yet

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- ReviewerDocument19 pagesReviewerLyca Jane OlamitNo ratings yet

- University of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Document3 pagesUniversity of Rizal System - Binangonan Campus College of Accountancy 2 Year Iac 3 Quiz #2Justine JaymaNo ratings yet

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- ACCE 112 DL Assessment 4 QPDocument4 pagesACCE 112 DL Assessment 4 QPnazmirakaderNo ratings yet

- Auditing Problems MidtermDocument20 pagesAuditing Problems MidtermjasfNo ratings yet

- Prelim CfasDocument6 pagesPrelim CfasdumpanonymouslyNo ratings yet

- Pilot TestDocument5 pagesPilot Testkhanhhung1112004No ratings yet

- Level 1 Mock Quali Q and AsDocument31 pagesLevel 1 Mock Quali Q and AsJ A M A I C ANo ratings yet

- Week 03 - Accounts ReceivablesDocument4 pagesWeek 03 - Accounts ReceivablesPj ManezNo ratings yet

- Fundamentals of Accounting Business and Management - II 2Document4 pagesFundamentals of Accounting Business and Management - II 2Kathlene JaoNo ratings yet

- Final Revision Part 2 Language (2st)Document21 pagesFinal Revision Part 2 Language (2st)Magdy KamelNo ratings yet

- Fac511s-Financial Accounting 101-2nd Opp-July 2022Document14 pagesFac511s-Financial Accounting 101-2nd Opp-July 2022nettebrandy8No ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- Basic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamDocument10 pagesBasic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamBai Dianne BagundangNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- Big Data Analytics in Health Care A Review PaperDocument12 pagesBig Data Analytics in Health Care A Review PaperOladapo Oluwakayode AbiodunNo ratings yet

- Big Data Analytics in Healthcare Challenges and PossibilitiesDocument9 pagesBig Data Analytics in Healthcare Challenges and PossibilitiesOladapo Oluwakayode AbiodunNo ratings yet

- Basic Computer Operations (Excel 2016 Essentials Course)Document2 pagesBasic Computer Operations (Excel 2016 Essentials Course)Oladapo Oluwakayode AbiodunNo ratings yet

- Advanced Level Ii - Fellow West African Internal AuditorDocument10 pagesAdvanced Level Ii - Fellow West African Internal AuditorOladapo Oluwakayode AbiodunNo ratings yet

- Application of Big Data Analytics - An Innovation in Health CareDocument14 pagesApplication of Big Data Analytics - An Innovation in Health CareOladapo Oluwakayode AbiodunNo ratings yet

- CSE545 sp23 (1) What Is Big Data 1-29Document88 pagesCSE545 sp23 (1) What Is Big Data 1-29Oladapo Oluwakayode AbiodunNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- Bank Reconciliation TemplateDocument3 pagesBank Reconciliation TemplateOladapo Oluwakayode AbiodunNo ratings yet

- S/No Date Journal Customer Account Credit DebitDocument5 pagesS/No Date Journal Customer Account Credit DebitOladapo Oluwakayode AbiodunNo ratings yet

- Ayomide PLC: Account ReceivableDocument4 pagesAyomide PLC: Account ReceivableOladapo Oluwakayode AbiodunNo ratings yet

- Shouldice Hospital LimitedDocument9 pagesShouldice Hospital Limitedborn2win_sattiNo ratings yet

- Level III NewDocument5 pagesLevel III NewElias TesfayeNo ratings yet

- Bacolod, Adinrane P. Bsba Finman IiiDocument25 pagesBacolod, Adinrane P. Bsba Finman IiichenlyNo ratings yet

- FAR-2 Mock September 2021 FinalDocument8 pagesFAR-2 Mock September 2021 FinalMuhammad RahimNo ratings yet

- Midterm Exam FADocument7 pagesMidterm Exam FARes GosanNo ratings yet

- SAPBIBW Scope Document 2020 - SD Data ExtractionDocument22 pagesSAPBIBW Scope Document 2020 - SD Data ExtractionRajeshNo ratings yet

- MCQ of Financial Statement AnalysisDocument8 pagesMCQ of Financial Statement AnalysisRahul Ghosale100% (11)

- Measuring Financial Performance of A PharmacyDocument12 pagesMeasuring Financial Performance of A PharmacyKhondoker ShidurNo ratings yet

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- Vimp Interview QuestionsDocument19 pagesVimp Interview Questionsppt85No ratings yet

- Financial Analysis (Chapter 3)Document18 pagesFinancial Analysis (Chapter 3)kazamNo ratings yet

- Financial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestDocument89 pagesFinancial Statement Analysis and Security Valuation: - September 28, 2022 Arnt VerriestfelipeNo ratings yet

- Chapter 7 SolutionsDocument64 pagesChapter 7 SolutionssevtenNo ratings yet

- Fin Man 1 FINANCIAL Ratio AnalysisDocument15 pagesFin Man 1 FINANCIAL Ratio AnalysisAnnie EinnaNo ratings yet

- INTERNSHIP REPORT UpDocument50 pagesINTERNSHIP REPORT UpFact BeamNo ratings yet

- BKSL PDFDocument4 pagesBKSL PDFyohannestampubolonNo ratings yet

- MIS ProjectDocument12 pagesMIS ProjectDuc Anh67% (3)

- Principles of Accounting: Weygandt Kieso KimmelDocument38 pagesPrinciples of Accounting: Weygandt Kieso KimmelAfsar AhmedNo ratings yet

- Sybcom Business Economics Sem Iv CH 13-Types of Budget & Concepts of DeficitDocument13 pagesSybcom Business Economics Sem Iv CH 13-Types of Budget & Concepts of DeficitPriPat GamingNo ratings yet

- Revenue CycleDocument50 pagesRevenue CycleCardoza Ryan100% (1)

- Financial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomDocument74 pagesFinancial Analysis of Public Company and Its Contribution To Nepalese Economy: A Case Study of Nepal TelecomUmesh KathariyaNo ratings yet

- RR 10-76Document4 pagesRR 10-76cheska_abigail950No ratings yet

- HSM 543 Health Services Finance Week 7 Course Project AnswerDocument64 pagesHSM 543 Health Services Finance Week 7 Course Project AnswerMike RussellNo ratings yet

- Week 2 - Chapter 2Document86 pagesWeek 2 - Chapter 2Dre ThathipNo ratings yet

- Cash Flow Statements PDFDocument101 pagesCash Flow Statements PDFSubbu ..100% (1)

- Introduction To Accounting (Etagenehu)Document114 pagesIntroduction To Accounting (Etagenehu)Nigussie BerhanuNo ratings yet

- 3 Carlos Superdrug Corp. vs. Department of Social Welfare and Development (DSWD), 526 SCRA 130, June 29, 2007Document22 pages3 Carlos Superdrug Corp. vs. Department of Social Welfare and Development (DSWD), 526 SCRA 130, June 29, 2007Ian Kenneth MangkitNo ratings yet

- Internship ReportDocument38 pagesInternship ReportSaran Khaliq0% (1)

- JobsAvenueManpowerAgency PDFDocument205 pagesJobsAvenueManpowerAgency PDFsnsdeanNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet