Professional Documents

Culture Documents

Capital Budgeting Techniques Part 2 PDF

Capital Budgeting Techniques Part 2 PDF

Uploaded by

mostafa0 ratings0% found this document useful (0 votes)

0 views7 pagesOriginal Title

Capital Budgeting Techniques part 2..pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

0 views7 pagesCapital Budgeting Techniques Part 2 PDF

Capital Budgeting Techniques Part 2 PDF

Uploaded by

mostafaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

Chapter 9

Capital

Budgeting

Techniques

Copyright © 2009 Pearson Prentice Hall. All rights reserved.

Learning Goals

1. Understand the role of capital budgeting

techniques in the capital budgeting process.

2. Calculate, interpret, and evaluate the payback

period.

3. Calculate, interpret, and evaluate the net

present value (NPV).

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-2

Net Present Value (NPV)

• Net Present Value (NPV): Net Present Value

is found by subtracting the present value of the

after-tax outflows from the present value of

the after-tax inflows.

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-3

Net Present Value (NPV) (cont.)

• Net Present Value (NPV): Net Present Value is

found by subtracting the present value of the

after-tax outflows from the present value of the

after-tax inflows.

Decision Criteria

If NPV > 0, accept the project

If NPV < 0, reject the project

If NPV = 0, technically indifferent

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-4

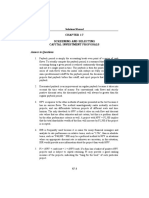

Net Present Value (NPV) (cont.)

Using the Bennett Company data from Table 9.1, assume

the firm has a 10% cost of capital. Based on the given

cash flows and cost of capital (required return), the NPV

can be calculated as shown in Figure 9.2

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-5

A company has two mutually exclusive projects available. The

cash flow details are in the table below. Which project should

the firm undertake given that the cost of capital is 11%?

A. both projects.

B. Project A only.

C. Project B only

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-6

NPV = 8000/1.1 +8500/1.21

+9000/1.33 + 9000/1.46 – 20000

=27910 – 20000 = 7910

NPV=20000/1.33 +20000/1.46 – 20000

=28736.22- 20000 = 8796.22

Answer C

Copyright © 2009 Pearson Prentice Hall. All rights reserved. 9-7

You might also like

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Handout # 1 Solutions (L)Document10 pagesHandout # 1 Solutions (L)Prabhawati prasadNo ratings yet

- Formula For The Net InvestmentDocument6 pagesFormula For The Net Investmentniqdelrosario100% (1)

- Earned Value Project Management (Fourth Edition)From EverandEarned Value Project Management (Fourth Edition)Rating: 1 out of 5 stars1/5 (2)

- Gitman - PPT - CH09 Capital Budgetting TechniquesDocument36 pagesGitman - PPT - CH09 Capital Budgetting Techniquesalmandouh.mustafa.khaledNo ratings yet

- CH 9Document59 pagesCH 9bbbhaha12No ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesMarium ShabbirNo ratings yet

- Chapter04 Capital BudgetingDocument34 pagesChapter04 Capital BudgetingJahirul Islam ShovonNo ratings yet

- Capital Budgeting TechniquesDocument32 pagesCapital Budgeting TechniquesYasser MaamounNo ratings yet

- FM CapitalBudgetingDocument35 pagesFM CapitalBudgetingvivekNo ratings yet

- Chapter 5 - Investment Rules-1Document32 pagesChapter 5 - Investment Rules-1Ibrahim ManshaNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Capital BudgetingDocument35 pagesCapital Budgetingmurarimishra1750% (2)

- 7e - Chapter 10Document39 pages7e - Chapter 10WaltherNo ratings yet

- Q Finman2 Capbudgtng 1920Document5 pagesQ Finman2 Capbudgtng 1920Deniece RonquilloNo ratings yet

- 308 CH 13 NotesDocument10 pages308 CH 13 NotesRayan LahlouNo ratings yet

- CF-PGPM-session 9.Document29 pagesCF-PGPM-session 9.Aman PratikNo ratings yet

- Capital Budgeting and Investment DecisionDocument12 pagesCapital Budgeting and Investment DecisionRakib Hasan NirobNo ratings yet

- Investment DecDocument29 pagesInvestment DecSajal BasuNo ratings yet

- 2 - INTRO TO Financial FSDocument19 pages2 - INTRO TO Financial FSmuhammad akbar bahmiNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Finance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1Document67 pagesFinance FIN2704/FIN2704X: Lecture 8: Capital Budgeting 1oehiohiwegNo ratings yet

- Capital Budgeting TechniquesDocument25 pagesCapital Budgeting TechniquesYoga EffendiNo ratings yet

- CHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)Document7 pagesCHAPTER 6: Some Alternative Investment Rules: 1. Internal Rate of Return (Irr)Aye M. PactoNo ratings yet

- Capital Budgeting TechniquesDocument26 pagesCapital Budgeting TechniquesNindytia Puspitasari, S.E.,M.Sc.No ratings yet

- Capital-Budgeting-Techniques 1. Gamestop Corporation Has Three Projects Under Consideration. The Cash Flows For Each of Them Are Shown in The Following Table. The Firm Has A 16% Cost of CapitalDocument6 pagesCapital-Budgeting-Techniques 1. Gamestop Corporation Has Three Projects Under Consideration. The Cash Flows For Each of Them Are Shown in The Following Table. The Firm Has A 16% Cost of CapitalEvangeline RemedilloNo ratings yet

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- Lockheed FinalDocument34 pagesLockheed FinalKshitij GuptaNo ratings yet

- Strategic Financial ManagementDocument3 pagesStrategic Financial Managementstk2796No ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- Net Present ValueDocument3 pagesNet Present ValueSheridanne GiloNo ratings yet

- Corporate Finance BasicsDocument15 pagesCorporate Finance Basicsakirocks71No ratings yet

- Chapter 10 SolutionsDocument9 pagesChapter 10 Solutionsaroddddd23No ratings yet

- Dba 302 Accounting Rate of Return, NPV and Irr PresentationsDocument12 pagesDba 302 Accounting Rate of Return, NPV and Irr Presentationsmulenga lubembaNo ratings yet

- Assignment: University of Central PunjabDocument5 pagesAssignment: University of Central PunjabAbdullah ghauriNo ratings yet

- Chapter 10Document22 pagesChapter 10danishamir086No ratings yet

- M08 Berk0821 04 Ism C08Document29 pagesM08 Berk0821 04 Ism C08Linda VoNo ratings yet

- Revision On ch12Document6 pagesRevision On ch12aml ellabanNo ratings yet

- Chapter 4 Investment Appraisal Methods 2Document62 pagesChapter 4 Investment Appraisal Methods 2JesterdanceNo ratings yet

- Financial Management I - Chapter 6Document34 pagesFinancial Management I - Chapter 6Mardi UmarNo ratings yet

- CHAPTER 17 - AnswerDocument7 pagesCHAPTER 17 - AnswerKlare HayeNo ratings yet

- Chapter 8 - Capital Budgeting Analysis - NPV and Other MethodsDocument71 pagesChapter 8 - Capital Budgeting Analysis - NPV and Other MethodsMadhav Chowdary TumpatiNo ratings yet

- Unit Iv: Capital BudgetingDocument35 pagesUnit Iv: Capital BudgetingDevyansh GuptaNo ratings yet

- Unit-2 Investment AppraisalDocument47 pagesUnit-2 Investment AppraisalPrà ShâñtNo ratings yet

- FINMAN2Document4 pagesFINMAN2Vince BesarioNo ratings yet

- Unit 5Document26 pagesUnit 5Vidhyamahaasree DNo ratings yet

- Chapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectDocument7 pagesChapter 6: Alternate Investment Tools I. Payback Period: Original Cost of The ProjectmajorkonigNo ratings yet

- FMTII Session 4&5 Capital BudgetingDocument56 pagesFMTII Session 4&5 Capital Budgetingbhushankankariya5No ratings yet

- FinMan Unit 8 Lecture-Capital Budgeting 2021 S1Document29 pagesFinMan Unit 8 Lecture-Capital Budgeting 2021 S1Debbie DebzNo ratings yet

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- Capital Budgeting Decision Models IIDocument30 pagesCapital Budgeting Decision Models IIDiannaNo ratings yet

- Capital BudgetingDocument39 pagesCapital BudgetingSiddhesh AsatkarNo ratings yet

- Capital.b (PGDMM)Document69 pagesCapital.b (PGDMM)Geethika NayanaprabhaNo ratings yet

- Lecture 5 - Capital BudgetingDocument26 pagesLecture 5 - Capital BudgetingJason LuximonNo ratings yet

- Qtouto 1492176702 1Document4 pagesQtouto 1492176702 1Christy AngkouwNo ratings yet

- Week 5 Lecture 2Document25 pagesWeek 5 Lecture 2john DoeNo ratings yet

- Investment Decision RulesDocument45 pagesInvestment Decision RulesLee ChiaNo ratings yet

- Risk and Refinements in Capital BudgetingDocument39 pagesRisk and Refinements in Capital BudgetingMelissa Cabigat Abdul KarimNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)