Income State

Particulars

Mar-11

Mar-10

2,916.08

2,419.21

INCOME :

Sales Turnover

Net Sales

2,916.08

2,419.21

Other Income

1,243.91

801.22

Excise Duty

Stock Adjustments

Total Income

4,159.99

3,220.43

EXPENDITURE :

0

5.07

0.89

88.34

89.1

Other Manufacturing Expenses

888.44

924.86

Selling and Administration Expenses

131.66

165.07

73.57

130.51

Raw Materials

Power & Fuel Cost

Employee Cost

Miscellaneous Expenses

Less: Pre-operative Expenses

Capitalised

Total Expenditure

1,187.08

1,310.43

Operating Profit

2,972.91

1,910.00

Interest

1,286.70

847.24

Gross Profit

1,686.21

1,062.76

Depreciation

129.77

126.05

1,556.44

936.71

282.56

169.44

Profit Before Tax

Tax

Fringe Benefit tax

Deferred Tax

Reported Net Profit

Extraordinary Items

Adjusted Net Profit

Adjst. below Net Profit

P & L Balance brought forward

4.3

2.21

1,269.58

765.06

83.17

2.82

1,186.41

762.24

2,763.92

2,676.24

Appropriations

1,212.49

677.38

P & L Balance carried down

2,821.01

2,763.92

339.51

339.48

Statutory Appropriations

Dividend

Equity Dividend %

100

100

Earnings Per Share-Unit Curr

7.48

4.44

Earnings Per Share(Adj)-Unit Curr

7.48

4.44

81.36

75.59

Preference Dividend

Book Value-Unit Curr

�DLF

Income Statement

Standalone

Mar-09

Mar-08

Mar-07

Mar-06

2,835.36

5,532.84

1,133.47

984.4

2,835.36

5,532.84

1,133.47

984.4

1,004.61

529.01

297.49

161.02

3,839.97

6,061.85

1,430.96

1,145.42

profit margin

net sales

0.98

1.34

0.69

0.23

53.08

72.73

25.52

4.48

792.19

2,157.89

251.47

583.09

193.01

179.59

160.17

53.95

68.01

59.05

5.69

5.72

1,107.27

2,470.60

443.54

647.47

2,732.70

3,591.25

987.42

497.95

809.85

447.65

356.25

146.15

1,922.85

3,143.60

631.17

351.8

114.08

25.68

9.44

3.9

1,808.77

3,117.92

621.73

347.9

226

529.81

193.86

120

5.62

4.82

4.71

0.43

29.38

8.7

14.85

0.04

1,547.77

2,574.59

408.31

227.43

-0.52

0.22

0.8

-0.14

1,548.29

2,574.37

407.51

227.57

29.81

-215.38

1.08

1,734.96

269.27

523.76

317.02

636.3

1,108.90

447.42

21.77

2,676.24

1,734.96

269.27

523.76

339.44

681.94

340.97

1.55

100

200

100

40

8.95

14.42

2.29

60.16

8.95

14.42

NA

NA

72.91

66.1

4.27

170.75

book value

dividend payout

11

10

43.53721 31.62437

11-10

10-09

20.53852 -14.6771

81.36

75.59

26.74191 44.37299

�9

8

7

54.58813 46.53288 36.02301

09-08

08-07

07-06

-48.754 388.1329 15.14323

72.91

66.1

4.27

21.93091 26.48732 83.50763

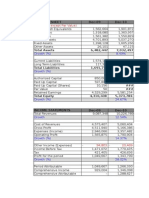

�Particulars

Mar-11

SOURCES OF FUNDS :

Share Capital

339.51

Reserves Total

13,470.98

Total Shareholders Funds

13,810.49

Secured Loans

14,700.70

Unsecured Loans

358.85

Total Debt

15,059.55

Total Liabilities

28,870.04

APPLICATION OF FUNDS :

Gross Block

Less : Accumulated Depreciation

Less:Impairment of Assets

Net Block

Lease Adjustment

2,143.36

400.26

0

1,743.10

0

Capital Work in Progress

2,199.25

Investments

7,037.24

Current Assets, Loans & Advances

Inventories

8,389.41

Sundry Debtors

270.21

Cash and Bank

176.27

Loans and Advances

15,393.61

Total Current Assets

24,229.50

Less : Current Liabilities and Provisions

Current Liabilities

Provisions

Total Current Liabilities

Net Current Assets

Miscellaneous Expenses not written off

5,306.94

967.27

6,274.21

17,955.29

0

Deferred Tax Assets

22.3

Deferred Tax Liability

87.14

Net Deferred Tax

Total Assets

Contingent Liabilities

-64.84

28,870.04

9,990.19

�Balance sheet

Mar-10

Mar-09

Mar-08

Mar-07

Mar-06

339.48

339.44

340.96

305.88

37.77

12,490.53

12,035.39

10,928.19

346.92

607.16

12,830.01

12,374.83

11,269.15

652.8

644.93

11,590.18

7,979.97

4,945.91

6,242.81

3,010.93

1,047.67

1,635.00

3,440.49

526.48

2.99

12,637.85

9,614.97

8,386.40

6,769.29

3,013.92

25,467.86

21,989.80

19,655.55

7,422.09

3,658.85

2,002.85

1,968.40

1,533.71

365.58

108.91

273.83

152.87

59.34

37.01

29.24

1,729.02

1,815.53

1,474.37

328.57

79.67

11

current ratio

capex

capex %

1,718.51

1,657.73

1,781.79

665.03

456.73

6,558.88

2,956.32

1,839.83

769.17

1,397.28

6,533.69

6,627.43

5,928.13

4,281.07

472.12

607.96

212.89

930.18

173.79

26.55

171.43

761.2

994.82

179.49

126.97

11,609.93

11,110.26

10,488.45

4,804.10

2,463.68

18,923.01

18,711.78

18,341.58

9,438.45

3,089.32

1,965.36

1,634.58

2,497.90

3,035.62

1,188.83

1,435.66

1,458.65

1,255.17

723.26

169.62

3,401.02

3,093.23

3,753.07

3,758.88

1,358.45

15,521.99

15,618.55

14,588.51

5,679.57

1,730.87

21.47

6.84

4.36

3.8

3.69

82.01

65.17

33.31

24.05

9.39

-60.54

-58.33

-28.95

-20.25

-5.7

25,467.86

21,989.80

19,655.55

7,422.09

3,658.85

8,908.62

6,370.28

4,294.27

4,561.19

1,611.30

386.1761082

489.59

11-10

539.65247

2,916.08

Asset turnover ratio

10.733135

3.8617611

1.6649689

�10

556.3922

604.926889

488.70871

251.097401

76.54

186.89

2,258.06

424.33

10-09

09-08

08-07

07-06

-59.0454 -91.7234 432.1471 728.9314

2,419.21

2,835.36

5,532.84

1,133.47

10.19524 13.61669 40.86649 20.45801

51.19

�Cash Flow

Particulars

Mar-11

Mar-10

Mar-09

Cash and Cash

Equivalents at Begining

of the year

169.6

759.4

982.25

Net Cash from Operating

Activities

1,515.13

Net Cash Used In

Investing Activities

-1949.99 -2416.41 -1151.17

Net Cash Used In

Financing Activities

391.66 1,365.86

419 1,434.95

-437.54

Net Inc/(Dec) In Cash

And Cash

-15.86

-589.8

-222.85

Cash And Cash

Equivalents At End Of

The Year

153.74

169.6

759.4

�h Flow

�Ratios

Years

Mar-11

Mar-10

Mar-09

Debt-Equity

Ratio

0.9

0.8

Long Term

Debt-Equity

Ratio

0.9

0.7

0.4

Current Ratio

3.4

3.1

2.3

Fixed Assets

1.4

1.2

1.6

Inventory

0.4

0.4

0.5

Debtors

6.6

5.9

Interest

Cover Ratio

2.2

2.1

3.2

PBIDTM (%)

102

79

96.4

PBITM (%)

97.5

73.7

92.4

PBDTM (%)

57.8

43.9

67.8

48

36.8

58.6

APATM (%)

43.5

31.6

54.6

ROCE (%)

10.5

7.5

12.6

RONW (%)

9.5

6.1

13.1

CPM (%)

PE

EBIDTA

DivYield

PBV

EPS

35.7

69.6

18.7

2,972.90 1,910.00 2,732.70

0.7

0.6

1.2

3.3

4.1

2.3

7.5

4.4

9

�Ratio Analysis

2011

Mar-08

Mar-07

1.3

7.5

Current ratio

3.51

0.7

6.5

Quick ratio

2.49

1.9

1.9

Cash Ratio

2.93

5.8

4.8

1.1

0.5

Current Cash Debt coverage ratio

financial slack

10

11.3

2.8

64.9

87.1

64.4

86.3

56.8

55.7

47

36.9

46.5

36

26.3

17.7

43.2

62.9

44.8

3,591.30

0.6

9.8

14.4

0

987.4

0

0

2.3

Debt equity ratio

�Ratio Analysis

2010

2009

2008

2007

5.03

2.96

2.34

1.75

3.56

3.83

3.28

1.36

7.3

4.6

1.64

0.9

0.8

1.3

7.5

�A

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

LIQUIDITY

Current ratio

Quick Ratio

SOLVENCY

Interest Cover

Total Debt to Owners

Debt Equity Ratio

TURNOVER RATIO

Inventory

Total Assets Turnover

Profit margin

Debtors Turnover R

RELATION TO INVESTMENT

ROE (%)

Price/Cash EPS (P/CE

Price Earning (P/E

ROA

ROE

net income/net sal

Net sales/Average Net

ROE(%)

ROE(%)

Net income/net sa

net sales/avg. total a

avg total assets/avg net

PBIDT/Sales(%)

Sales/Net Assets

PBDIT/Net Assets

PAT/PBIDT(%)

Net Assets/Net Worth

ROE(%)

7.00

9.00

6.00

8.00

�A

50

51

52

53

54

55

56

57

58

59

60

6.00

8.00

7.00

5.00

6.00

4.00

Current ratio

3.00

Quick ratio

2.00

5.00

4.00

3.00

2.00

1.00

1.00

0.00

2011

2010

2009

2008

2007

0.00

�I

1

2

3

4

5

6 LIQUIDITY

7

Current ratio

8

Quick Ratio

9 SOLVENCY

10

Interest Cover

11

Total Debt to Owners Fund

12

13

Debt Equity Ratio

14 TURNOVER RATIO

15

Inventory

16

Total Assets Turnover Ratio

17

Profit margin

18

Debtors Turnover Ratio

19 RELATION TO INVESTMENT

20

ROE (%)

21

Price/Cash EPS (P/CEPS)

22

Price Earning (P/E)

23

ROA

24

25

26 ROE

27

net income/net sales

28

Net sales/Average Net worth

29 ROE(%)

30

31 ROE(%)

32

Net income/net sales

33

net sales/avg. total assets

34

avg total assets/avg net worth

35

36

37

38 PBIDT/Sales(%)

39 Sales/Net Assets

40 PBDIT/Net Assets

41 PAT/PBIDT(%)

42 Net Assets/Net Worth

43 ROE(%)

44

45

46

47

48

9.00

49

8.00

2011

2010

2009

2008

3.86

2.52

5.56

3.64

6.05

3.91

4.89

3.31

2.40

1.09

2.45

0.99

3.52

0.78

8.38

0.74

1.00

0.90

0.80

1.30

0.39

0.12

0.44

6.64

0.37

0.11

0.32

5.62

0.45

0.21

0.55

4.95

1.08

0.28

0.47

9.96

9.53

6.07

32.41

59.60

35.72

69.57

0.04

0.03

Du pont analysis

13.09

17.38

18.68

0.06

43.19

44.36

44.83

0.15

Ratio analysis

0.44

0.22

9.53

0.32

0.19

6.07

0.55

0.24

13.09

0.47

0.93

43.19

0.44

0.09

2.41

9.53

0.32

0.09

2.15

6.07

0.55

0.12

2.05

13.09

0.47

0.32

2.91

43.19

101.95

0.10

0.10

42.70

2.09

9.53

78.95

0.09

0.08

40.06

1.99

6.07

96.38

0.13

0.12

56.64

1.78

13.09

64.91

0.28

0.18

71.69

1.74

43.19

�8.00

50

7.00

51

6.00

52

5.00

53

4.00

54

55

3.00

56

2.00

57

1.00

58

0.00

59

60

Interest cover

debt equity ratio

2011 2010 2009 2008 2007

�N

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

2007

2.51

1.37

3.22

10.37

7.50

0.48

0.15

0.36

11.00

62.93

0.00

0.00

0.05

0.36

1.75

62.93

0.36

0.14

12.50

62.93

87.11

0.15

0.13

41.35

11.37

62.93

0.89243

�Quick Ratio