Professional Documents

Culture Documents

Module 2 - Quiz To Give 03.06.23-1

Uploaded by

ZAIL JEFF ALDEA DALEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 2 - Quiz To Give 03.06.23-1

Uploaded by

ZAIL JEFF ALDEA DALECopyright:

Available Formats

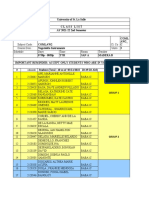

PROBLEM-SOLVING QUIZ 2

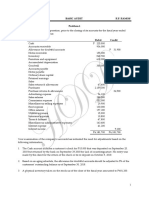

The trial balance of BABA Black Sheep Company as of December 31, 2022 is shown below.

DEBIT CREDIT

Cash 200,000

Trade Receivables 80,000

Allowance for doubtful accounts 5,000

Merchandise Inventory 50,000

Prepaid Insurance 8,000

Office Equipment 150,000

Accumulated Depreciation 2,500

Loans Payable 30,000

Accrued Expense Payable 5,000

Ryan, Capital 143,000

Jing, Capital 144,000

Sales 367,800.00

Sales Discounts 2,800.00

Sales Returns 3,600.00

Purchases 65,000.00

Purchase Discounts 1,000.00

Purchase Returns 1,500.00

Marketing Expense 28,500.00

Salaries and Wages 80,000.00

Utilities Expense 25,500.00

Taxes and Licenses 5,000.00

Other Miscellaneous Expenses 1,400.00

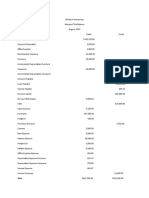

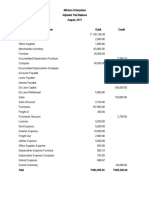

DATA FOR ADJUSTMENTS AS OF DEC 31, 2022 ARE AS FOLLOWS:

a. Allowance for doubtful accounts is at 10% of Trade Receivables.

b. Merchandise Inventory ending balance, P35,000

c. Expired portion of prepaid insurance, P2,000

d. Unpaid interest on loans, 10% of loans payable

e. Unpaid utilities, P5,000

f. Unrecorded depreciation on office equipment, P4,500

The partners agreed to the following division of profit and loss:

1. Monthly salaries to Ryan - P5,000

2. Bonus to Jing based on profit before income tax but after salary to partner - 10%

3. The remainder is divided to Ryan and Jing based on ratio of 1:2.

Assume 30% income tax rate.

REQUIRED:

1. Prepare the adjusting entries for items (a.) to (f.) (6 points x 2)

2. Compute for profit after income tax. (5 points)

3. Prepare the distribution of profit (loss) to Ryan and Jing. (10 points)

You might also like

- Harold King Trading Unadjusted Trial BalanceDocument4 pagesHarold King Trading Unadjusted Trial BalanceENIDNo ratings yet

- Adjusting entries for merchandising businessDocument3 pagesAdjusting entries for merchandising businessJekoe25% (4)

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Accounting 1 - Part 2Document18 pagesAccounting 1 - Part 2Jessica ManuelNo ratings yet

- Quiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditDocument2 pagesQuiz in Financial Statements Preparation: Adjusted Trial Balance Debit CreditEzra Mikah G. CaalimNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

- Cielo Corp accounting adjustmentsDocument3 pagesCielo Corp accounting adjustmentsCarina Mae Valdez ValenciaNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Income StatementDocument13 pagesIncome StatementShakir IsmailNo ratings yet

- Q No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditDocument4 pagesQ No.1 Saleem Provided Following Trial Balance On December 31, 2015. Title of Accounts Debit CreditNAFEES NASRUDDIN PATEL0% (1)

- MZM Grocery Income StatementDocument7 pagesMZM Grocery Income StatementIphegenia DipoNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- 3 Exam Part IDocument6 pages3 Exam Part IRJ DAVE DURUHANo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceANDREA OLIVASNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- FABM 2 Practice Problems SCIDocument3 pagesFABM 2 Practice Problems SCIMounicha Ambayec100% (4)

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Problem 1: Journal EntryDocument11 pagesProblem 1: Journal EntrySarah Nelle PasaoNo ratings yet

- Final Exam Key and Marking Scheme for Financial AccountingDocument3 pagesFinal Exam Key and Marking Scheme for Financial AccountingMinh ThưNo ratings yet

- Particulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRDocument9 pagesParticulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRasdfNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Financial Statement Preparation from Adjusted Trial BalanceDocument1 pageFinancial Statement Preparation from Adjusted Trial BalanceJohn Michael Gaoiran GajotanNo ratings yet

- Preparing WorksheetDocument4 pagesPreparing Worksheet6z5qstn8wsNo ratings yet

- Quiz 1.01 Financial Statements To Interim ReportingDocument22 pagesQuiz 1.01 Financial Statements To Interim ReportingJohn Lexter MacalberNo ratings yet

- Love Merchandising Co. Year-End WorksheetDocument6 pagesLove Merchandising Co. Year-End Worksheetvomawew647No ratings yet

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- 4 5Document7 pages4 5Jyan GayNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Merchandising - Completing The Cycle 1 - Christine Santos BagsDocument12 pagesMerchandising - Completing The Cycle 1 - Christine Santos BagsJowelyn Casignia100% (3)

- Trial Balance SampleDocument5 pagesTrial Balance SampleayeerahcaliNo ratings yet

- Jawaban Mid Test Praktik Dagang 2022Document14 pagesJawaban Mid Test Praktik Dagang 2022Rahmal SimarangkirNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- WE NEVER KNOW Inc. trial balance audit issuesDocument1 pageWE NEVER KNOW Inc. trial balance audit issuesJastine Rose CañeteNo ratings yet

- Cost of Goods Sold WorksheetDocument4 pagesCost of Goods Sold Worksheetbutch listangco100% (1)

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- Vidya Consumer Co-op Society AccountsDocument7 pagesVidya Consumer Co-op Society Accountsswati100% (3)

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceANDREA OLIVASNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- Journal Entries Problem 1Document4 pagesJournal Entries Problem 1Sarah Nelle PasaoNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- M4 Prac Exer. 2Document10 pagesM4 Prac Exer. 2Jasmine ActaNo ratings yet

- PT 2 and PT 3Document4 pagesPT 2 and PT 3Mariz Timario0% (2)

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- WE NEVER KNOW audit issuesDocument1 pageWE NEVER KNOW audit issuesNana CatNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytNo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Special Lecture On Defective ContractsDocument31 pagesSpecial Lecture On Defective ContractsMCM EnterpriseNo ratings yet

- PED2 Midterm Accomplishment Report for BABA 1ADocument3 pagesPED2 Midterm Accomplishment Report for BABA 1AZAIL JEFF ALDEA DALENo ratings yet

- Mod 1 FullDocument42 pagesMod 1 FullZAIL JEFF ALDEA DALENo ratings yet

- Law 3 - Negotiable Instruments GuideDocument9 pagesLaw 3 - Negotiable Instruments GuideZAIL JEFF ALDEA DALENo ratings yet

- PCOM Manual (Mid)Document50 pagesPCOM Manual (Mid)ZAIL JEFF ALDEA DALENo ratings yet

- Negotiable Instruments Law ReviewDocument7 pagesNegotiable Instruments Law ReviewZAIL JEFF ALDEA DALENo ratings yet

- 03 Lesson 3 - Partnership DissolutionDocument18 pages03 Lesson 3 - Partnership DissolutionZAIL JEFF ALDEA DALENo ratings yet

- Module 3 - Quiz 03.22.23 SolutionsDocument2 pagesModule 3 - Quiz 03.22.23 SolutionsZAIL JEFF ALDEA DALENo ratings yet

- University of St. La Salle Class ListDocument2 pagesUniversity of St. La Salle Class ListZAIL JEFF ALDEA DALENo ratings yet

- Nicor Final Merit and Cover Application2Document11 pagesNicor Final Merit and Cover Application2ZAIL JEFF ALDEA DALENo ratings yet

- Exercises On Partnership Dissolution 03.20.23Document4 pagesExercises On Partnership Dissolution 03.20.23ZAIL JEFF ALDEA DALENo ratings yet

- 02 Lesson 2 - Partnership Operations and Financial ReportingDocument12 pages02 Lesson 2 - Partnership Operations and Financial ReportingZAIL JEFF ALDEA DALENo ratings yet

- Conversion StoryDocument1 pageConversion StoryZAIL JEFF ALDEA DALENo ratings yet

- ACCTG. 101 End - Term ExaminationDocument9 pagesACCTG. 101 End - Term ExaminationZAIL JEFF ALDEA DALENo ratings yet

- Reed QuizDocument2 pagesReed QuizZAIL JEFF ALDEA DALENo ratings yet

- Tocap 986Document6 pagesTocap 986ZAIL JEFF ALDEA DALENo ratings yet

- The History of My NameDocument1 pageThe History of My NameZAIL JEFF ALDEA DALENo ratings yet

- Learning Task#2-Myths or TruthsDocument1 pageLearning Task#2-Myths or TruthsZAIL JEFF ALDEA DALENo ratings yet

- Albert EinsteinDocument21 pagesAlbert EinsteinZAIL JEFF ALDEA DALENo ratings yet

- TRUE OR FALSE ACCOUNTING QUIZDocument7 pagesTRUE OR FALSE ACCOUNTING QUIZZAIL JEFF ALDEA DALENo ratings yet

- Albert EinsteinDocument1 pageAlbert EinsteinZAIL JEFF ALDEA DALENo ratings yet

- 4.3.1 Lesson. Globalization and MediaDocument25 pages4.3.1 Lesson. Globalization and MediaZAIL JEFF ALDEA DALENo ratings yet

- Statement of Cash Flows (Problem)Document2 pagesStatement of Cash Flows (Problem)ZAIL JEFF ALDEA DALENo ratings yet

- What is History: Interpretation, Sources and CriticismDocument6 pagesWhat is History: Interpretation, Sources and CriticismZAIL JEFF ALDEA DALENo ratings yet

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument50 pages© The Institute of Chartered Accountants of Indiaprabhawagarwalla9690No ratings yet

- 01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 FormationDocument5 pages01-28-2022 CRC-ACE - AFAR - Week 01 - Accounting For Partnership - Part 1 Formationjohn francisNo ratings yet

- Factoring Accounts ReceivableDocument4 pagesFactoring Accounts ReceivableJohn MaynardNo ratings yet

- Mary Buffett, David Clark - Buffettology 51 PDFDocument1 pageMary Buffett, David Clark - Buffettology 51 PDFAsok KumarNo ratings yet

- AAOIFI - Chapter-1 - Trading in CurrenciesDocument10 pagesAAOIFI - Chapter-1 - Trading in Currencieslegendery_pppNo ratings yet

- 2309195408policy Initiatives - NABARD-2020-21Document41 pages2309195408policy Initiatives - NABARD-2020-21Bhupinder SawhneyNo ratings yet

- Pitchbook - Trading Business: BSE LTDDocument34 pagesPitchbook - Trading Business: BSE LTDVenu MadhavNo ratings yet

- 2018 - 11 - 07 GR 190800Document4 pages2018 - 11 - 07 GR 190800SabNo ratings yet

- Inclusions and Exclusions From Gross Income Sample CasesDocument27 pagesInclusions and Exclusions From Gross Income Sample Casesraslopez03020No ratings yet

- Cash Handling FEDocument109 pagesCash Handling FEAsfar KhanNo ratings yet

- Kotak Mahindra Life Insurance ReportDocument72 pagesKotak Mahindra Life Insurance ReportGanesh D Panda100% (3)

- Fee Revision Letter - Engineering - 0001Document2 pagesFee Revision Letter - Engineering - 0001Prem KumarNo ratings yet

- GSIS Mutual Fund, Inc. (GMFI) : Historical PerformanceDocument1 pageGSIS Mutual Fund, Inc. (GMFI) : Historical Performanceapi-25886697No ratings yet

- QUIZ 1 Donors Taxation 2 PDFDocument5 pagesQUIZ 1 Donors Taxation 2 PDFMary DenizeNo ratings yet

- Axis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)Document2 pagesAxis Bank - Transaction Banking Schedule of Charges - Current Accounts (Value Based Schemes) (W.E.F. April 1, 2018)venkatesh19701100% (1)

- Sabrina SultanaDocument64 pagesSabrina SultanaMohib Ullah YousafzaiNo ratings yet

- IFRS PresentationDocument49 pagesIFRS Presentationunni Krishnan100% (9)

- VCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Document4 pagesVCE Summer Internship Program 2021: Ruchira Parwanda 3 Financial Modelling (Infra)Ruchira ParwandaNo ratings yet

- Audit of CBS EnvironmentDocument28 pagesAudit of CBS EnvironmentPatricia UkemNo ratings yet

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpNo ratings yet

- Introduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSDocument8 pagesIntroduction To Assurance and Non Assurance - MULTIPLE CHOICES QUESTIONSReynan E. BolisayNo ratings yet

- Cash Flow and Financial Planning Chapter SolutionsDocument3 pagesCash Flow and Financial Planning Chapter SolutionsSaifur R. SabbirNo ratings yet

- Ciq Financials MethodologyDocument25 pagesCiq Financials Methodologysanti_hago50% (2)

- Ebullient Services invoice for 400kg gold shipment to ItalyDocument1 pageEbullient Services invoice for 400kg gold shipment to ItalyYimbi King Dénis-PârisNo ratings yet

- WS - Submarine Cable 1 - Neilson-Watts - BruceDocument7 pagesWS - Submarine Cable 1 - Neilson-Watts - BruceJason GuthrieNo ratings yet

- NYC HDC M2 Mixed Middle-Income Housing TermsheetDocument6 pagesNYC HDC M2 Mixed Middle-Income Housing TermsheetNorman OderNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesMaximuzNo ratings yet

- Basic Accounting ConceptsDocument32 pagesBasic Accounting ConceptsenuNo ratings yet

- Financial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Document4 pagesFinancial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Diamante GomezNo ratings yet