Professional Documents

Culture Documents

Trading Book1

Uploaded by

Yahya Salman96%(80)96% found this document useful (80 votes)

29K views25 pagesOriginal Title

Trading book1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

96%(80)96% found this document useful (80 votes)

29K views25 pagesTrading Book1

Uploaded by

Yahya SalmanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 25

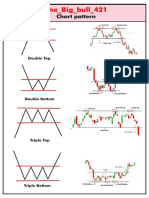

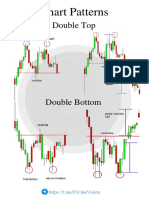

Double Top

What Is a Double Top? A double top is an

extremely bearish technical reversal

pattern that forms after an asset reaches a

high price two consecutive times with a

moderate decline between the two highs. It

is confirmed once the asset's price falls

below a support level equal to the low

between the two prior highs.

Double Bottom

The double bottom pattern is a bullish

reversal pattern that occurs at the bottom of

a downtrend and signals that the sellers, who

were in control of the price action so far, are

losing momentum. The pattern resembles

the letter “W” due to the two-touched low

and a change in the trend direction from a

downtrend to an uptrend.

Tripl Top

The triple top pattern occurs when

the price of an asset creates three

peaks at nearly the same price level.

The area of the peaks is resistance.

The pullbacks between the peaks are

called the swing lows.

Tripl Bottom

2 Bottom 3 Bottom

1Bottom

A triple bottom is a visual pattern that

shows the buyers (bulls) taking control

of the price action from the sellers

(bears). A triple bottom is generally

seen as three roughly equal lows

bouncing off support followed by the

price action breaching resistance.

You might also like

- Technical+and+Graphical+Analysis+eBook+ +copy+Document52 pagesTechnical+and+Graphical+Analysis+eBook+ +copy+Achraf Semlali (centent)87% (30)

- GoodCrypto Patterns PresentationDocument13 pagesGoodCrypto Patterns Presentationcoolboyulug100% (1)

- Big Bull Ghost TownDocument5 pagesBig Bull Ghost TownMAHEMOOD SHAH100% (10)

- Technical Graphical Analysis EbookDocument66 pagesTechnical Graphical Analysis EbookAngeli Pirvulescu100% (5)

- Important Chart PatternsDocument8 pagesImportant Chart Patternspradeephd100% (1)

- Charting SecretsDocument2 pagesCharting Secretsvaldyrheim100% (2)

- Trading BookDocument38 pagesTrading BookLola Eltoro100% (8)

- Technical Analysis: By: Rashmi BhandariDocument27 pagesTechnical Analysis: By: Rashmi Bhandarirashmibhandari24100% (1)

- Make Money Trading - Simple Technical Analysis BookDocument60 pagesMake Money Trading - Simple Technical Analysis Bookandres plazas sierra94% (69)

- Trading FaceDocument52 pagesTrading Facecryss savin91% (23)

- New Rich Text FormatDocument25 pagesNew Rich Text Formatpradeephd100% (1)

- Technical and Graphical AnalysisDocument66 pagesTechnical and Graphical AnalysisAhmet Selçuk ARSLAN100% (4)

- 2ND Chart Patterns For Price Action TradingDocument23 pages2ND Chart Patterns For Price Action TradingSandeep Reddy100% (2)

- Simple Trading BookDocument27 pagesSimple Trading BookYassin Malinoa100% (2)

- Forex Chart Patterns Part 3: Channels and RectanglesDocument10 pagesForex Chart Patterns Part 3: Channels and RectanglesJeremy NealNo ratings yet

- Bullish Engulfing Tutorial.Document8 pagesBullish Engulfing Tutorial.Mwnaje Hassan100% (2)

- Tradding ChartDocument22 pagesTradding ChartMR GG7100% (14)

- Trade CoinDocument96 pagesTrade CoinvienNo ratings yet

- Trading PatternsDocument8 pagesTrading PatternsJR 18067% (3)

- Continuation Chart PatternDocument25 pagesContinuation Chart PatternrgautomobilesstockNo ratings yet

- Major Market PatternsDocument30 pagesMajor Market PatternsTonderai Humanikwa100% (3)

- SIMPLE TRADING BookDocument25 pagesSIMPLE TRADING BookMostafa Sharaf93% (938)

- How To Trade Chart Patterns With Target and SL - Forex GDP - Trade With ConfidenDocument40 pagesHow To Trade Chart Patterns With Target and SL - Forex GDP - Trade With Confidenshashikant jambagi100% (4)

- Best Chart PatternsDocument17 pagesBest Chart PatternsrenkoNo ratings yet

- 07 KM Reversal PatternsDocument7 pages07 KM Reversal PatternsKumarenNo ratings yet

- Chart PatternsDocument32 pagesChart PatternsPraveen100% (2)

- Chart Pattern Guide for Reddit TradersDocument17 pagesChart Pattern Guide for Reddit TraderscorranNo ratings yet

- 5 Ways To Tell A Stock Is Headed UpDocument4 pages5 Ways To Tell A Stock Is Headed UpMurugesh MurthyNo ratings yet

- Stock Market Knowledge GuideDocument15 pagesStock Market Knowledge GuideMwnaje Hassan100% (1)

- Double Top: Chart PatternsDocument11 pagesDouble Top: Chart PatternsKrunal Jain100% (1)

- Reversal Trends-SAPMDocument26 pagesReversal Trends-SAPMHeavy Gunner50% (2)

- Technical Analysis OverviewDocument28 pagesTechnical Analysis Overviewpham terik86% (7)

- Chart PatternsDocument13 pagesChart PatternsVrutika Shah (207050592001)No ratings yet

- Reversal PatternsDocument25 pagesReversal PatternsMunyaradzi Alka Musarurwa100% (2)

- Candlestick Patterns PDF Free Guide DownloadDocument11 pagesCandlestick Patterns PDF Free Guide DownloadGreg Mavhunga88% (8)

- 5.4 - Technical Analysis - Chart Patterns - Trading Crypto CourseDocument22 pages5.4 - Technical Analysis - Chart Patterns - Trading Crypto Course2f9p4bykt8No ratings yet

- Simple Trading Book 2Document62 pagesSimple Trading Book 2Money Online100% (19)

- CRT PatternDocument10 pagesCRT PatternMD ASRAFUZZAMAN MAHTAF100% (1)

- Candlestick Pattern & Chart Pattern 1.0Document61 pagesCandlestick Pattern & Chart Pattern 1.0Akib khan90% (21)

- GuideToClassicChartPatterns PDFDocument1 pageGuideToClassicChartPatterns PDFRenato100% (1)

- Chart PatternsDocument10 pagesChart Patternsvvpvarun100% (2)

- Top 10 Chart Patterns SlidesDocument14 pagesTop 10 Chart Patterns Slidesashokfacebook100% (9)

- Price Action Patterns 2.0 Ebook Josh TradeDocument34 pagesPrice Action Patterns 2.0 Ebook Josh Trademarcocahuas90% (10)

- Chart Patterns Explained: 11 Common Stock Chart FormationsDocument6 pagesChart Patterns Explained: 11 Common Stock Chart FormationsAmit Wadekar100% (6)

- Symmetrical Triangles - Chart Formations That Consolidate Before BreakoutsDocument13 pagesSymmetrical Triangles - Chart Formations That Consolidate Before BreakoutsYin Shen Goh100% (4)

- Cover ChartsDocument5 pagesCover ChartsrahulNo ratings yet

- Chart PatternsDocument55 pagesChart Patternsnidukinduwara100100% (1)

- Investment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-ADocument10 pagesInvestment Analysis and Portfolio Management: G.Srianjaneyulu Rollno:18L31E0014 Mba-Analla maheshNo ratings yet

- Chart PatternsDocument17 pagesChart Patternsfxindia19100% (2)

- Presented by Zonaira SarfrazDocument19 pagesPresented by Zonaira SarfrazZunaira SarfrazNo ratings yet

- Chart Patterns Cheat Sheet - Stock Trading Visual GuideDocument1 pageChart Patterns Cheat Sheet - Stock Trading Visual GuideAbish Packya100% (1)

- 19 Chart-Patterns PDFDocument25 pages19 Chart-Patterns PDFMahid HasanNo ratings yet

- PDF 20221220 185518 0000 PDFDocument57 pagesPDF 20221220 185518 0000 PDFmarcocahuas93% (15)

- Patrones de VelasDocument2 pagesPatrones de Velasjact_1100% (1)

- Forexbee Co Candlestick Patterns Dictionary PDFDocument20 pagesForexbee Co Candlestick Patterns Dictionary PDFDaffy JackNo ratings yet

- Challan FormDocument1 pageChallan FormAsad Latif BhuttaNo ratings yet

- AdenDocument13 pagesAdenAhmed AdenNo ratings yet

- Simple_trading_book (2)Document25 pagesSimple_trading_book (2)YANESKANo ratings yet

- (ENG) SIMPLE TRADING Book v1 EditDocument25 pages(ENG) SIMPLE TRADING Book v1 EditBrahmantyo Wahyu BNo ratings yet

- Chart Patterns (Ahmer Waqas)Document23 pagesChart Patterns (Ahmer Waqas)ayubzulqarnain492No ratings yet