Professional Documents

Culture Documents

Untitled

Uploaded by

SCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

SCopyright:

Available Formats

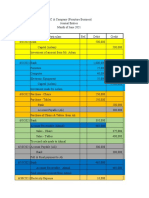

ACC 101

Q. No. 01 Debtors Account

Following information is related to the ABC & C0, for the year ended December 31, 2021.

Account Receivable 500,000

Allowance for Bad debts (Dr) 15,000

Sales 750,000

Sales Returns & allowances 25,500

Cash collected from Customers 875,000

Bad debts estimated 3% on Balance sheet method

Compute & record the estimated bad debts for the year ended December 31, 2021

Q. No. 02 Depreciation

On January 01, 2020. ABC & Co. purchased a machine at a cost of Rs. 61,875. The machine had

an estimated useful life of 15 years, 20,000 machine hours and 300,000 units. Its estimated

residual value is Rs. 1,875. The machine operated 7,000 hours and produced 27,000 units in

2020 and 4,000 hours and 21,600 units in 2021.

Calculate depreciation for year 2020 & 2021 on the basis of following Depreciation methods:

a. Straight Line Method

b. Units method

c. Diminishing method @ 15%

d. Machine hours method

Q. No. 03

Paid $22,500 for a Machine which cost $30,000 with the garage accepting $17,500 in part

exchange. The old Machine cost $32,000 and had depreciated by $10,000. Compute & record the

Journal entries?

Q. No. 04

What are the advantages of Accounts Receivable Aging Report?

The accountant of ABC & Co provided the following:

a. Account Receivable opening balance Rs. 10,000.

b. Allowance for Bad Debts opening balance Rs. 1,000

c. Cash sales Rs. 72,000

d. Credit Sales Rs. 78,000

e. Collection from customer Rs. 40,000

f. Sale Return & allowance Rs. 700

g. Customer account written off Rs. 1,500

h. Previously written off account recovered R. 700

Required:

Record bad debt expense estimating Allowance for Bad Debts @5% on ending balance of

Account Receivable

Record bad debt expense estimating Allowance for Bad Debts @2% on Credit sales

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- To Be Printed Part 1a and Part 1b Computations No AnswerDocument112 pagesTo Be Printed Part 1a and Part 1b Computations No Answerheyhey100% (1)

- Au Ia1 Midterm ExamDocument4 pagesAu Ia1 Midterm ExamCherrylane EdicaNo ratings yet

- 3 ReceivablesDocument13 pages3 Receivablesjoneth.duenasNo ratings yet

- Ia Long QuizDocument15 pagesIa Long QuizKennedy Malubay0% (1)

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- RISE ITA Model Paper SolutionDocument15 pagesRISE ITA Model Paper Solutionzaffiii.293No ratings yet

- Quiz ReceivablesDocument9 pagesQuiz ReceivablesJanella PatriziaNo ratings yet

- HW On Receivables CDocument5 pagesHW On Receivables CAmjad Rian MangondatoNo ratings yet

- ECO-2 - ENG-J18 - CompressedDocument6 pagesECO-2 - ENG-J18 - CompressedAmit AdhikariNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- AR Estimation of DADocument4 pagesAR Estimation of DAemman neriNo ratings yet

- Quiz Bee WordDocument7 pagesQuiz Bee WordVince De GuzmanNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- M2.2e Diy-Problems (Answer Key)Document13 pagesM2.2e Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- IntAcc-1 Accounting For ReceivablesDocument13 pagesIntAcc-1 Accounting For ReceivablesShekainah BNo ratings yet

- Week 03 - Accounts ReceivablesDocument4 pagesWeek 03 - Accounts ReceivablesPj ManezNo ratings yet

- Receivables ProblemsDocument13 pagesReceivables ProblemsIris Mnemosyne0% (1)

- CPA 1 Past Paper 1 - Financial AccountingDocument8 pagesCPA 1 Past Paper 1 - Financial AccountingInnocent Won Aber65% (34)

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- FABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityDocument10 pagesFABM 210 Fundamentals of Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- ReviewerDocument19 pagesReviewerLyca Jane OlamitNo ratings yet

- Diploma-Level-1 2017 DEC PDFDocument125 pagesDiploma-Level-1 2017 DEC PDFDixie CheeloNo ratings yet

- BA3 Special Revision MockDocument17 pagesBA3 Special Revision MockSanjeev JayaratnaNo ratings yet

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Cup 1 FA 1 and FA 2Document16 pagesCup 1 FA 1 and FA 2Thony Danielle LabradorNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- Anskey 1-1Document8 pagesAnskey 1-1De MarcusNo ratings yet

- Final Accounts - That's It BatchDocument16 pagesFinal Accounts - That's It BatchKunika PimparkarNo ratings yet

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- kALBARYONISHERLY 1Document8 pageskALBARYONISHERLY 1De MarcusNo ratings yet

- CH 6 Exhibit 12 Q 19-22Document4 pagesCH 6 Exhibit 12 Q 19-22ЭниЭ.No ratings yet

- Ar Problems HandoutsDocument18 pagesAr Problems Handoutsxjammer100% (1)

- Accounts Receivables: TheoriesDocument5 pagesAccounts Receivables: TheoriesshellacregenciaNo ratings yet

- Midterm Answer KeyDocument6 pagesMidterm Answer Keyazzenethfaye.delacruz.mnlNo ratings yet

- 6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages6 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman Mastura100% (1)

- 5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginDocument17 pages5 - Accounts Receivable & Estimation of Doubtful Accounts - Mastura, MauginMikhail Ayman MasturaNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- AccountDocument3 pagesAccountSk SinghNo ratings yet

- Account Receivable Quiz Acc124 PDFDocument25 pagesAccount Receivable Quiz Acc124 PDFPRINCESS DELOS REYESNo ratings yet

- Tls Cl-Xii Accountancy P.T 3 Q.P 2021-22Document13 pagesTls Cl-Xii Accountancy P.T 3 Q.P 2021-22Priyank DhadhiNo ratings yet

- IntAcc Reviewer - Module 2 (Problems)Document26 pagesIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNo ratings yet

- Assessment Part 1Document5 pagesAssessment Part 1RoNnie RonNieNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- Day 1A - Receivables - AM SeatworkDocument7 pagesDay 1A - Receivables - AM SeatworkdgdeguzmanNo ratings yet

- S4 Aceiteka 2017 AccountsDocument7 pagesS4 Aceiteka 2017 AccountsEremu ThomasNo ratings yet

- T1 Question and Answer June 2016Document18 pagesT1 Question and Answer June 2016Biplob K. SannyasiNo ratings yet

- AP Receivablesdocx PDF FreeDocument13 pagesAP Receivablesdocx PDF FreeAnn SaturayNo ratings yet

- AP ReceivablesDocument13 pagesAP ReceivablesRegina Rebulado40% (5)

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- Chapter 7Document19 pagesChapter 7nimnim85% (13)

- 5.1 - AUDIT ON RECEIVABLES (Problems)Document10 pages5.1 - AUDIT ON RECEIVABLES (Problems)LorraineMartinNo ratings yet

- Diy-Problems (Questionnaires)Document11 pagesDiy-Problems (Questionnaires)May Ramos100% (1)

- Financial AccountingDocument16 pagesFinancial AccountingSNo ratings yet

- UntitledDocument6 pagesUntitledSNo ratings yet

- What Are The Main Types of Depreciation Methods?: Depreciation Expense Book ValueDocument4 pagesWhat Are The Main Types of Depreciation Methods?: Depreciation Expense Book ValueSNo ratings yet

- Course Outline Introduction To Financial AccountingDocument8 pagesCourse Outline Introduction To Financial AccountingLuciferNo ratings yet