Professional Documents

Culture Documents

BA3 Special Revision Mock

Uploaded by

Sanjeev JayaratnaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BA3 Special Revision Mock

Uploaded by

Sanjeev JayaratnaCopyright:

Available Formats

BA3 Special Revision Mock

Question 01

Calculate the capital balance of Graham from the following information.

$

Receivables 30,000

Motor vehicles 8,000

Payables 5,000

Fixtures 7,000

Stock of goods 12,000

Cash at bank (OD) 5,000

Question 02

Hans has an opening capital balance of $500,000(Cr) on 1st January 2016. During the year there was a

decrease in assets of $30,000 and an increase in liabilities of $10,000. His drawings amounted to $6,000.

What is the profit/(loss) for 2016?

Question 03

A sole trader is $8,000 overdrawn at her bank and receives $2,000 from a credit customer in respect of

its account.

Which elements of the accounting equation will change due to this transaction?

A Assets only

B Liabilities only

C Assets and Liabilities only

D Assets, liabilities and capital

Question 04

Bank Account

B/D 1,000

Sales 5,000 Salaries 2,000

Advertising 1,000

Electricity 3,000

What’s the movement in the account balance?

$ …………………………….Dr/ Cr

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 1

Question 05

State whether each of the following statements are true or false

True False

A debit entry will increase capital

A credit entry will decrease liabilities

A debit entry will increase expenses

Question 06

On 1 August 2018 PQ had a receivable from a customer $6,000. During the month of August, PQ:

• Sold goods for $9,000 and offered a 4% discount for payment within the month.

• Customer returned goods valued at $850 which had been purchased in July 2018

• Received a cheque for payment of the goods delivered in August.

The balance on the customer’s account at the end of August 2018 is

$ Dr Cr

Question 07

Your organization sold goods to PQ for $800 less trade discount of 20 per cent and cash discount of 5

per cent for payment within 14 days. The invoice was settled by cheque 5 days later. The entry to record

the payment is:

B

.

C

.

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 2

Question 08

CD operates the imprest system for petty cash. On 1 May was a float of $500. During May the cashier

received $50 from staff for using the photocopier and a cheque for $100 was cashed for an employee. In

May, cheques were drawn for $600 for petty cash. It was decided to increase the cash float to $700

from 1 June. How much cash was paid out by the cashier in May

$ ………………………

Question 09

The Non current asset register is an integral part of double entry. (True / False)

Question 10

N plc purchased a machine for $15,000. The transportation costs were $1,500 and installation costs

were $750. Testing charges amounted to $1,000. Staff training amounted to $2,000. The machine broke

down at the end of the first month in use and cost $400 to repair. N plc depreciates machinery at 10%

each year on cost, assuming no residual value.

What is the net book value of the machine after one year, to the nearest dollar?

A $13,500 B $18,225 C $15,525 D $16,425

Question 11

Drag and drop the correct options f rom the list below into the appropriate method of depreciation to f it the

asset type.

Straight-line depreciation Reducing-balance depreciation

A. Usef ul f or assets which provide equal benef it each year e.g. machinery.

B. Usef ul f or assets which provide more benef it in earlier years, e.g. cars, IT equipment.

Question 12

ABC bought machinery f or $300,000 on 1 July 2015, and has depreciated it at 10% per

annum by the reducing instalment method with a f ull year’s depreciation in the year of purchase and no

depreciation in the year of disposal.

What was the depreciation charge for the year ended 31 December 2017?

A $21,870

B $24,300

C $25,650

D $30,000

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 3

Question 13

According to IAS 38 Intangible assets, which of the f ollowing statements about intangible assets are

correct?

1 If certain criteria are met, research expenditure must be recognis ed as an intangible asset.

2 If certain criteria are met, development expenditure must be capitalised.

3 Intangible assets must be amortised if they have a def inite usef ul lif e.

A 2 and 3 only

B 1 and 3 only

C 1 and 2 only

D All three statements are correct

Question 14

At 31 December 2015, Latham had a non-current asset which had cost $20,000 and on which

accumulated depreciation was $10,000.

Inf ormation collated f or an impairment review at that date identif ied that its f air value was $8,000 and

costs to sell were $1,000. The value in use of the non-current asset was $9,000.

Required:

What was the extent of impairment recognised in Latham’s f inancial statements at 31 December

2015?

Question 15

ABC has several employees and provided the f ollowing information f rom its payroll for the months of

March and April:

March Gross Salary Tax Social security Net pay

$2,400 $500 $100 $1,800

April Gross Salary Tax Social security Net pay

$3,000 $600 $150 $2,250

Tax and social security are payable to the government one month af ter they are deducted f rom

employees' salaries.

Required:

What was the total cash paid in April by ABC in relation to payroll costs?

$ ...................

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 4

Question 16

$

Gross Salary 80,000

Employer’s NI 8,000

Employees NI 6,000

PAYE Tax 7,000

a) What is the wages expense?

b) What is the net salary?

Question 17

The sales account is:

A debited with the total of sales made, including sales tax

B debited with the total of sales made, excluding sales tax

C credited with the total of sales made, including sales tax

D credited with the total of sales made, excluding sales tax

Question 18

In the quarter ended 31 March 2002, X Ltd had VAT taxable outputs, net of VAT, of $200,000 and taxable

inputs, inclusive of VAT, of $92,000.

If the rate of VAT is 15%, how much VAT is due? …………………….Receivable / Payable

Question 19

A book of prime entry is one in which:

A the rules of double-entry bookkeeping do not apply

B ledger accounts are maintained

C transactions are entered prior to being recorded in the ledger accounts

D the personal accounts with customers and suppliers

Question 20

In which book of prime entry will a business record credit notes in respect of goods which have been s ent

back to suppliers?

A The cash book

B The purchase returns day book

C The purchase day book

D The sales returns day book

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 5

Question 21

A payment from a Trade Receivable of $500 was posted as $50.

What’s the correcting entry?

Dr Cr

Description

$ $

Question 22

What are the transactions that af f ect the Trial Balance?

a) Omission if a Purchase Invoice

b) Payments to Suppliers was not posted f rom the cash book

c) An electricity invoice was Credited to cash book and electricity account

d) Purchase of a Motor Car debited to Furniture

Question 23

A credit sale was correctly accounted but duplicated. What’s the impact on

a) Profits overstated understated

b) Current Assets overstated understated

Question 24

Your cash book at 31 December 2019 shows a bank balance of $600 overdrawn. On comparing

this with your bank statement at the same date, you discover that

• a cheque for $57 drawn by you on 29 December 2019 has not yet been presented for

payment;

• a cheque for $92 from a customer, which was paid into the bank on 24 December 2019,

has been dishonoured on 31 December 2019.

• Direct deposit from a customer for $150 is yet to be recorded in the cash book.

The correct bank balance to be shown in the statement of financial position at 31 December

2019 is:

$.............. Favorable / Overdrawn

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 6

Question 25

Adjusted Cash Book will include.

Standing Orders

Bank Charges

Dishonored Cheques

Unpresented Cheques

Unrealised desposits

Errors made by bank

Direct Debits

Question 26

Drag and drop words and values f rom the available list to complete the f ollowing two statements

regarding the disposal of a non-current asset as set out in IAS 16 Property, Plant and Equipment.

If the proceeds received on disposal are less than the c arrying amount at the date of sale,

the dif f erence is a _________________ which is treated as __________ when calculating the prof it

or loss f or the year.

If the proceeds received on disposal are more than the carrying about at the date of sale

the dif f erence is a ___________________ which is treated as _____________ when calculating the

prof it or loss f or the year.

Available words: prof it on disposal/loss on disposal/an expense/income

Question 27

JKL Co purchased a patent on 1 October 2013 f or $25,000. It expects to use the patent f or the next ten

years, af ter which it will have zero value. According to IAS 38 Intangible assets, what is the value of the

patent in JKL’s statement of f inancial position as at 31 December 2015?

$ ………………..

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 7

Question 28

Question 29

Your purchase ledger control account had a balance at 1 May 2018 of $100,000 credit. During May, credit

purchases where $240,000,cash purchases were $8,000, and payments made to suppliers, excluding

cash purchases and af ter deducting cash discounts of $4,000, were $206,000, purchase returns were

$15,000. Contra entries with Sales ledger were $5,000

Question 30

When reconciling control accounts to lists of balances, a casting error in a daybook will require

adjustments:

A To both the control account and the list of balances

B To neither the control account nor the list of balances

C To the control account, but not the list of balances

D To the list of balances, but not the control account

Question 31

The following data is available from Robin’s business for 2011.

$

Sales 200,000

Sales Returns 10,000

Purchases 118,000

Purchase Returns 10,000

Gross Profit 60,000

Closing Stock 3,000

What’s the value of the opening stock?

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 8

Question 32

Where is a discount received recognised?

A Statement of profit or loss

B Trading account

C Statement of financial position

D Trial balance

Question 33

An entity had a gross prof it for the year of $4,300, and also had the f ollowing items included in its trial

balance at the end of the year:

• Rent paid $1,000

• Interest paid $300

• Rent received $200

What was the entity's net prof it for the year?

A $3,000 prof it

B $3,200 prof it

C $5,600 prof it

D $5,800 prof it

Data for Question 34 & 35

ABC commenced business on 1 May 2010 and is charged rent at the rate of $15,000 per annum.

During the period to 31 December 2010 he actually paid $14,000.

Question 34

What should his charge in the statement of prof it or loss be in respect of rent?

Question 35

Prepare the relevant year end journal entry

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 9

Question 36

Barney Ltd has the following details.

Dr Cr

$ $

Trade Receivables 40,000

Allowance for Receivables 6,000

• Bad Debts to be written off $ 10,000

• Allowance for Receivables 10%

How the above transactions would be recorded in ledger accounts.

Dr Cr

$ $

Trade Receivables

Bad Debts

Allowance for Receivables

Question 37

Allowance for Receivables Working capital

(increase, Decrease , No impact)

Increase

Decrease

Question 38

The following information relates to M Ltd:

At 30 September 2000 1999

£000 £000

Stock of raw materials 75 45

Work-in-progress stock 60 70

Stock of finished goods 100 90

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 10

For the year ended 30 September 2000

£

Purchases of raw materials 300,000

Manufacturing wages 50,000

Factory overheads 40,000

The Factory cost of production in the manufacturing account for the year ended 30 September

2000 is £ ………………….

Question 39

List out the expenses should NOT be included in prime cost in a manufacturing account? (State all

items)

A Repairs to factory machinery.

B Direct production wages.

C Office salaries.

D Purchase of Raw Materials.

Question 40

Which of the f ollowing costs should be excluded from the cost of inv entory? Select all that apply.

A Purchase price

B Delivery costs

C Production overheads

D Non-production overheads

E Storage costs

F Selling costs

Question 41

CDE measures inventory using the f irst in, f irst out (FIFO) basis. Opening inventory comprised 10 units at

a cost of $4 per unit. During the accounting period, 30 units were purchased at a cost of $6, f ollowed by

issues of 12 units and a f urther 8 units.

What was the value of inventory at the end of the accounting period in accordance with IAS 2

Inventories?

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 11

Question 42

Tony’s business had net assets of $50,000 as at 1st January 2012. During the year he introduced new

capital of $30,000 and made a prof it of $20,000. He did not have any cash drawings but goods drawn

amounted to $5,000

You are required to calculate his closing net assets?

Question 43

Question 44

The following information is available from C Ltd

2008 2009 ($’000)

Operating Prof it 500

+ Investment Income 80

Finance costs (30)

PBT 550

Inventories 50 40

Receivables 70 75

Payables 28 30

Operating Prof it includes

• Depreciation charges of $20,000

• Loss on Disposal of Assets $10,000

Tax paid amounts to $20,000

You are required to calculate cash generated f rom operations

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 12

Question 45

A company has made a revaluation gain on one of its properties during the year.

Which THREE of the f ollowing statements are correct in relation to the revaluation gain?

1. It will be reported in the statement of prof it or loss.

2. It will be reported in other comprehensive income f or the year.

3. It will be shown as a cash inf low in the cash f low statement.

4. It will be reported in the statement of changes in equity

5. It will increase the value of non-current assets in the statement of f inancial position.

A. 1,3 and 5

B. 1 and 4

C. 2,3 and 4

D. 2, 4 and 5

Question 46

Which one of the f ollowing would you expect to f ind in the statement of changes in equity in a limited

company f or the current year?

A Ordinary dividend proposed during the current year, but paid in t he f ollowing year

B Ordinary dividend declared during the current year, but paid in the f ollowing year

C Directors' f ees

D Auditors' f ees

Question 47

Using the drop down lists available show the correct accounting entries for the following share issue.

An entity has issued 10,000 new ordinary shares with a nominal value of $0.50 each, at an issue price of

$2. The market price immediately bef ore issue was $2.50 each. The ledger entries to record this are as

f ollows:

Debit Bank/Share Capital/Share Premium $5,000/$15,000/$20,000/$25,000

Credit Bank/Share Capital/Share Premium $5,000/$15,000/$20,000/$25,000

Credit Bank/Share Capital/Share Premium $5,000/$15,000/$20,000/$25,000

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 13

Question 48

X Ltd has in issue $100,000 of ordinary shares at a par value of 20¢ each and 100,000 6% pref erence

shares at a par value of 50¢ each. The entity paid a dividend of 7% per ordinary share.

Required:

What was the total amount paid out in dividends?

$..........................

Question 49

A business has the f ollowing trading account f or the year ending 31 May 2018:

Its rate of inventory turnover f or the year is:

A 4.9 times

B 5.3 times

C 7.5 times

D 9 times

Question 50

BCD extracted the following information from its statement of financial position:

Calculate the current ratio : ………………: 1 State your answer to 1 decimal place.

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 14

Question 51

The f ollowing are extracts f rom the f inancial statements f or the year ended 31 January 2003 of M plc:

$000

Issued Ordinary shares of $1 200

Share premium account 50

Prof it and loss account 25

Debenture 80

Prof it bef ore interest f or the

year ended 31 January 2003 60

What is the return on total capital employed?

A 17%

B 22%

C 24%

D 30%

Question 52

A business entity accounted f or an upward revaluation of its land and buildings during the year.

As a result, what would be the impact on the Gearing Ratio? (Increase / Decrease / No change)

Question 53

The annual sales of CQR were $400,000. Half of the sales were made on credit terms, with the remainder

on a cash basis. The trade receivables in the statement of f inancial position were $25,000. ($10,000 at

the beginning of the year)

Required:

What was the trade receivables collection perio d (to the nearest day)?

................... days

Question 54

Which of the f ollowing transactions would result in an increase in capital employed?

A Selling inventories at prof it

B Writing of f an irrecoverable debt

C Paying a payable in cash

D Increasing the bank overdraf t to purchase a non-current asset

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 15

Question 55

The accounting concept to be considered when the owner of a business uses business f unds to pay

f or his private household expenses, is the:

A Separate entity concept

B Fair presentation concept

C Accruals concept

D Going concern concept

Question 56

According to the lASB's Conceptual Framework f or Financial Reporting, which TWO of the f ollowing are

part of f aithf ul representation?

1 It is neutral

2 It is relevant

3 It is presented f airly

4 It is f ree f rom material error

A 1 and 2

B 2 and 3

C 1 and 4

D 3 and 4

Question 57

Which one of the f ollowing statements is true in relation to integrated reports?

A. An integrated report should contain only historical f inancial inf ormation

B. An integrated report should contain a combination of financial and non-f inancial inf ormation which is

historical only

C. An integrated report should contain a combination of financial and non-f inancial inf ormation which is

f orward-looking only

D. An integrated report should contain a combination of financial and non-f inancial inf ormation, which is

both historical and f orward-looking

Question 58

What is the role of the IASB?

A. Oversee the standard setting and regulatory process

B. Formulate international financial reporting standards

C. Review defective accounts

D. Control the accountancy profession

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 16

Question 59

Financial accounts differ f rom management accounts in that they:

A are prepared monthly f or internal control purposes

B contain details of costs incurred in manuf acturing

C are summarised and prepared mainly f or external users of accounting inf ormation

D provide inf ormation to enable the trial balance to be prepared

Question 60

Which THREE of the f ollowing are necessary elements of the stewardship f unction?

A To maximise prof its

B To saf eguard assets

C To ensure adequate controls exist to prevent or detect f raud

D To prepare the f inancial accounts

E To attend meetings with the bank

F To prepare management accounts

BA3 Nov. 2020 – BA3 Special Revision Mock – Mallik De Silva 17

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2023: Your Complete Guide to Everything DeductibleNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Content Promotion ProcessDocument17 pagesContent Promotion ProcessAnca StanaselNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

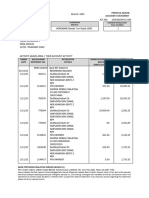

- Union Bank Statement FreshDocument7 pagesUnion Bank Statement Freshbindu mathaiNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Fa2 Mock Test 2Document7 pagesFa2 Mock Test 2Sayed Zain ShahNo ratings yet

- Accounting errors and adjustments explained in 17 stepsDocument7 pagesAccounting errors and adjustments explained in 17 stepsVinh Ngo NhuNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- FA2 TEST 1 REVIEWDocument15 pagesFA2 TEST 1 REVIEWVinh Ngo Nhu75% (4)

- The Practical Magic of The 5 Hour Workday by Trevor BlakeDocument29 pagesThe Practical Magic of The 5 Hour Workday by Trevor BlaketracyNo ratings yet

- Fa2 Mock Test 3Document14 pagesFa2 Mock Test 3Vinh Ngo Nhu57% (7)

- ACCA FA Progress Test PDFDocument21 pagesACCA FA Progress Test PDFNicat IsmayıloffNo ratings yet

- Nov 2023Document7 pagesNov 2023applybizzNo ratings yet

- Ffa Pilot PaperDocument21 pagesFfa Pilot PaperSyeda Saba BatoolNo ratings yet

- Polaroid - Process and Quality Control Case Study: Preparation by Presentation byDocument6 pagesPolaroid - Process and Quality Control Case Study: Preparation by Presentation byVinit Vijay SankheNo ratings yet

- Tugas 4 AKM - Kelompok 5 - 142200278Document13 pagesTugas 4 AKM - Kelompok 5 - 142200278muhammad alfariziNo ratings yet

- AWS Prescriptive Guidance: Migration Readiness GuideDocument17 pagesAWS Prescriptive Guidance: Migration Readiness Guidechandra100% (1)

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- C02-Fundamentals of Financial Accounting: Sample Exam PaperDocument15 pagesC02-Fundamentals of Financial Accounting: Sample Exam PaperIshak AnsarNo ratings yet

- Examiners Report 2013-2018 - Level BDocument13 pagesExaminers Report 2013-2018 - Level BZubair RafiqueNo ratings yet

- F3 - Mock A - QuestionsDocument15 pagesF3 - Mock A - QuestionsRana IbrahimliNo ratings yet

- F3 Mock Exam 2Document12 pagesF3 Mock Exam 2HiraNo ratings yet

- Financial Accounting Final AssessmentDocument17 pagesFinancial Accounting Final AssessmentroydkaswekaNo ratings yet

- F3 Mock Exam 1Document12 pagesF3 Mock Exam 1Smith TiwariNo ratings yet

- Financial Accounting Test One (01) James MejaDocument21 pagesFinancial Accounting Test One (01) James MejaroydkaswekaNo ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- FA Mock Exam 3-1Document12 pagesFA Mock Exam 3-1Annas SaeedNo ratings yet

- C02 Sample Questions Feb 2013Document20 pagesC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QMuhammad SaadNo ratings yet

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- ACCA Paper T3 Exam QuestionsDocument14 pagesACCA Paper T3 Exam QuestionschandoraNo ratings yet

- DL PT1Q F3 201301Document14 pagesDL PT1Q F3 201301MpuTitasNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/11Document12 pagesCambridge International AS & A Level: Accounting 9706/11Kristen NallanNo ratings yet

- F3 - Mock B - QuestionsDocument15 pagesF3 - Mock B - QuestionsabasNo ratings yet

- Accounting Paper 1Document12 pagesAccounting Paper 1Tenzin ChoekyNo ratings yet

- FA2 Mock 3 ExamDocument12 pagesFA2 Mock 3 ExamRameen ChNo ratings yet

- Mock Mid Term 1 Printed Questions OnlyDocument16 pagesMock Mid Term 1 Printed Questions OnlyVenkat ChamarthiNo ratings yet

- FA1 S20-A21 Examiner's ReportDocument6 pagesFA1 S20-A21 Examiner's ReportMuhammad DanishNo ratings yet

- BSc Accounting and Finance Mock Exam 1Document12 pagesBSc Accounting and Finance Mock Exam 1Suyash DixitNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/12Document12 pagesCambridge International AS & A Level: Accounting 9706/12Tauha JilaniNo ratings yet

- Madhrasathul Ahmadhiyya First Term Test 2002 Grade: 10 Principles of Accounting Paper One Page 1 of 5Document5 pagesMadhrasathul Ahmadhiyya First Term Test 2002 Grade: 10 Principles of Accounting Paper One Page 1 of 5afoo1234No ratings yet

- Practice Exam 4 - Chapters 8, 9, - Fall 2012Document6 pagesPractice Exam 4 - Chapters 8, 9, - Fall 2012Vincent ChinNo ratings yet

- 0452 w03 QP 1Document11 pages0452 w03 QP 1MahmozNo ratings yet

- Singapore Institute of Management: University of London Preliminary Exam 2020Document20 pagesSingapore Institute of Management: University of London Preliminary Exam 2020Kəmalə AslanzadəNo ratings yet

- CHAPTER-9-Principles of AccountingDocument39 pagesCHAPTER-9-Principles of AccountingNguyễn Ngọc AnhNo ratings yet

- T3int 2010 Jun QDocument9 pagesT3int 2010 Jun QlowchangsongNo ratings yet

- Fa2 Mock 2 Question - 1Document18 pagesFa2 Mock 2 Question - 1sameerjameel678No ratings yet

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocument17 pagesDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoNo ratings yet

- Đề ca 1 ngày 2/7/2022Document10 pagesĐề ca 1 ngày 2/7/2022Nguyễn Ngọc Hiền LinhNo ratings yet

- Pilot TestDocument5 pagesPilot Testkhanhhung1112004No ratings yet

- (123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFDocument4 pages(123doc) - Tai-Lieu-Accounting-Principles-Mid-Semester-Test PDFTrung HậuNo ratings yet

- 0452 w02 QP 1Document13 pages0452 w02 QP 1MahmozNo ratings yet

- ACCADocument12 pagesACCAanon-502587No ratings yet

- 3int 2005 Jun QDocument9 pages3int 2005 Jun QlowchangsongNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- 7110 w03 QP 1Document12 pages7110 w03 QP 1mstudy123456No ratings yet

- PILOT TEST 2023Document6 pagesPILOT TEST 2023bapeboiz1510No ratings yet

- Cambridge International AS & A Level: Accounting 9706/13Document12 pagesCambridge International AS & A Level: Accounting 9706/13Nadine JanganoNo ratings yet

- Accounting MCQsDocument7 pagesAccounting MCQssaeedqk100% (7)

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Chapter - 5 - Theoretical Framework & Hypothesis DevelopmentDocument10 pagesChapter - 5 - Theoretical Framework & Hypothesis DevelopmentSanjeev JayaratnaNo ratings yet

- Administering QuestionnairesDocument10 pagesAdministering QuestionnairesSanjeev JayaratnaNo ratings yet

- Administering QuestionnairesDocument10 pagesAdministering QuestionnairesSanjeev JayaratnaNo ratings yet

- Chapter - 11 - Measurement of VariablesDocument3 pagesChapter - 11 - Measurement of VariablesSanjeev JayaratnaNo ratings yet

- Interviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonDocument8 pagesInterviews: Personal Interview. Advantages and Disadvantages Business Is Largely A Social PhenomenonSanjeev JayaratnaNo ratings yet

- Chapter - 6 - Elements of Research DesignDocument7 pagesChapter - 6 - Elements of Research DesignSanjeev JayaratnaNo ratings yet

- Introduction to Research: Definitions and ApplicationsDocument5 pagesIntroduction to Research: Definitions and ApplicationsSanjeev JayaratnaNo ratings yet

- Defining and Refining The ProblemDocument13 pagesDefining and Refining The ProblemSanjeev JayaratnaNo ratings yet

- Data Collection Methods: ObservationDocument9 pagesData Collection Methods: ObservationSanjeev JayaratnaNo ratings yet

- Scientific Investigation: Hallmarks of Scientific Research Hypothetico-Deductive ResearchDocument3 pagesScientific Investigation: Hallmarks of Scientific Research Hypothetico-Deductive ResearchSanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 02Document8 pagesKotler, Bowen & Makens CH 02Sanjeev JayaratnaNo ratings yet

- Critical Literature Review The Critical ReviewDocument10 pagesCritical Literature Review The Critical ReviewSanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 18Document8 pagesKotler, Bowen & Makens CH 18Sanjeev JayaratnaNo ratings yet

- MHT CH 01Document9 pagesMHT CH 01Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 17Document8 pagesKotler, Bowen & Makens CH 17Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 13Document8 pagesKotler, Bowen & Makens CH 13Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 08Document8 pagesKotler, Bowen & Makens CH 08Sanjeev JayaratnaNo ratings yet

- MHT CH 03Document9 pagesMHT CH 03Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 16Document9 pagesKotler, Bowen & Makens CH 16Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 12Document9 pagesKotler, Bowen & Makens CH 12Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 19Document10 pagesKotler, Bowen & Makens CH 19Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 10Document6 pagesKotler, Bowen & Makens CH 10Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 14Document7 pagesKotler, Bowen & Makens CH 14Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 11Document8 pagesKotler, Bowen & Makens CH 11Sanjeev JayaratnaNo ratings yet

- MHT CH 01Document9 pagesMHT CH 01Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 06Document8 pagesKotler, Bowen & Makens CH 06Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 15Document8 pagesKotler, Bowen & Makens CH 15Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 09Document12 pagesKotler, Bowen & Makens CH 09Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 02Document8 pagesKotler, Bowen & Makens CH 02Sanjeev JayaratnaNo ratings yet

- Kotler, Bowen & Makens CH 04Document7 pagesKotler, Bowen & Makens CH 04Sanjeev JayaratnaNo ratings yet

- EPLC Annual Operational Analysis ChecklistDocument1 pageEPLC Annual Operational Analysis ChecklistTawfiq4444No ratings yet

- Entrepreneurship Style - MagicianDocument1 pageEntrepreneurship Style - MagicianhemanthreddyNo ratings yet

- Sexual Harassment, Grievances - Drug AbuseDocument49 pagesSexual Harassment, Grievances - Drug AbusefarizimranNo ratings yet

- WTO and Dispute Settlement MechanismDocument3 pagesWTO and Dispute Settlement Mechanismshruti mehtaNo ratings yet

- ApplyTerms PDFDocument10 pagesApplyTerms PDFKaren FlanaganNo ratings yet

- Group Case Study Report for Fibre Fashion Marketing and Sales IS PlanDocument11 pagesGroup Case Study Report for Fibre Fashion Marketing and Sales IS PlanWarisha KhanNo ratings yet

- How Contextual Factors Influenced Rapid Uptake of Mobile Money in KenyaDocument19 pagesHow Contextual Factors Influenced Rapid Uptake of Mobile Money in KenyafadelNo ratings yet

- Trading Agreement 2018 - SolidmarkDocument2 pagesTrading Agreement 2018 - SolidmarkPhillip James TabiqueNo ratings yet

- Texas General Abroad Careers Solutions CoDocument1 pageTexas General Abroad Careers Solutions CofoundationletitshineNo ratings yet

- ESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and AsiaDocument4 pagesESKIMI Ltd: Mobile Social Network and VAS Provider in Africa and Asiaish ishokNo ratings yet

- IMC Case 5 Ques PDFDocument2 pagesIMC Case 5 Ques PDFMrunal WaghchaureNo ratings yet

- Muhammad Khoirun Niam 20190410440 K GL1.Document3 pagesMuhammad Khoirun Niam 20190410440 K GL1.Khoir NiamNo ratings yet

- Digital Transformation 4.0: Integration of Artificial Intelligence & Metaverse in MarketingDocument7 pagesDigital Transformation 4.0: Integration of Artificial Intelligence & Metaverse in MarketingMohamed ChabaaneNo ratings yet

- Krishna Constructions: Work Order ToDocument2 pagesKrishna Constructions: Work Order ToNasim AktarNo ratings yet

- Research Literature ReviewDocument23 pagesResearch Literature ReviewChai BiscuitsNo ratings yet

- Test Bank For An Introduction To Management Science Quantitative Approaches To Decision Making 12th Edition Anderson SweeneyDocument16 pagesTest Bank For An Introduction To Management Science Quantitative Approaches To Decision Making 12th Edition Anderson Sweeneycodykellymqicepxagb100% (47)

- Fin Man - Module 3 ContinuitionDocument6 pagesFin Man - Module 3 ContinuitionFrancine PrietoNo ratings yet

- San Miguel Corp V InciongDocument7 pagesSan Miguel Corp V InciongReg AnasNo ratings yet

- Prototype Courier ChargesDocument16 pagesPrototype Courier ChargesDeepak BhanjiNo ratings yet

- Work-Share & Virtual Design Construction (VDC) ServicesDocument85 pagesWork-Share & Virtual Design Construction (VDC) ServicesmanojNo ratings yet

- Lean Information Management Toolkit TOCDocument12 pagesLean Information Management Toolkit TOCArk GroupNo ratings yet

- Improve Grammar and Build Vocabulary with TENSES PracticeDocument51 pagesImprove Grammar and Build Vocabulary with TENSES PracticeNguyen DreyNo ratings yet

- Lifting of Corporate VeilDocument8 pagesLifting of Corporate VeilmanjushreeNo ratings yet