Professional Documents

Culture Documents

Total Assets 5 500r

Total Assets 5 500r

Uploaded by

George HigginsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Total Assets 5 500r

Total Assets 5 500r

Uploaded by

George HigginsCopyright:

Available Formats

Authorized capital RUR thousand 9 000

Retained Profit RUR thousand 2 500

Long term Debts (Loans) RUR thousand 7 800

Average interest rate on long-term loans % 14,0

Sales RUR thousand 18 900

Total costs RUR thousand 14 800

Corporate income tax rate % 20,0

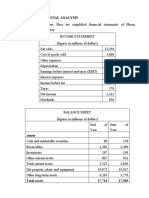

a) Total Assets = current assets – current liabilities

= Long term debts - Retained profit

Total Assets = 5 500r

Current assets = Long term debts

Liabilities = retained profit + Total costs

Current liabilities = Retained profit

Balance sheet snippet:

Current assets: Long term debts(loan) 7 800

Liabilities:

Retained profit 2 500

Total costs 14 800

Total assets 5 300

b)

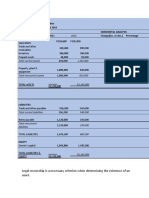

Financial leverage is when a company/individual borrows money for an investment that might produce

greater returns.

Financial leverage = short term debt/ shareholder debt.

Or

Financial leverage = Earnings before interest and tax / Earnings before Tax

Earnings before interest and tax = Sales – Total costs - interest

Earnings before interest and tax = 18 900 – 14 800

Earnings before interest and tax = 4 100r

Earnings before interest and tax - interest = 4 100 -1092

Earnings before Tax = 3 008r

Therefore

Financial leverage = Earnings before interest and tax / Earnings before interest and tax – Interest

Financial leverage = 4100/3008

Financial leverage = 1.36 times

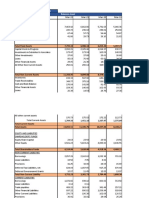

c)

Degree of financial leverage = % change in Net income/ % change in Earnings before interest and tax

OR

Degree of financial leverage = Earnings before interest and tax / Earnings before Tax

d) Determine which sources of financing are more profitable for the enterprise to use in the planning

period: own or borrowed?

- Business maintains complete control

- Enhances the planning process

- Lowers overall cost of the project.

- It will improve the reputation and value of the business.

However with External funding,

- There will be loss of ownership

- Accrued expenses like interest

Therefore, I conclude that internal (own) funding is more profitable for the enterprise.

You might also like

- American Home Products: Free Cash Flows, WACC, and Implicit GrowthDocument5 pagesAmerican Home Products: Free Cash Flows, WACC, and Implicit GrowthJeronimo CabreraNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Assigment EFADocument3 pagesAssigment EFAResty Arum100% (1)

- Financial Analysis and Reporting - Midterm ExamDocument4 pagesFinancial Analysis and Reporting - Midterm ExamElla Marie LopezNo ratings yet

- Chapter 14Document29 pagesChapter 14Baby Khor100% (1)

- Asian Paints - Financial Modeling (With Solutions) - CBADocument47 pagesAsian Paints - Financial Modeling (With Solutions) - CBAavinashtiwari201745No ratings yet

- Turorial 9: DepreciationDocument2 pagesTurorial 9: DepreciationFaezFarhatNo ratings yet

- Financial StatementsDocument25 pagesFinancial StatementsRaquel Sibal RodriguezNo ratings yet

- Financial Stament ReviewDocument8 pagesFinancial Stament Reviewロザリーロザレス ロザリー・マキルNo ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- (Company Name) : Balance SheetDocument6 pages(Company Name) : Balance SheetLemonade Ave. BeverageNo ratings yet

- 1.0 CFI - FS Primer PDFDocument10 pages1.0 CFI - FS Primer PDFSarthak NautiyalNo ratings yet

- Financial Stament Review PDFDocument8 pagesFinancial Stament Review PDFglenn dandyne montanoNo ratings yet

- FINANCIAL POSITON Week 1 or To Week 2 StudentDocument5 pagesFINANCIAL POSITON Week 1 or To Week 2 StudentStefhanie DiazNo ratings yet

- FINMAN1 Module3&4Document10 pagesFINMAN1 Module3&4Jayron NonguiNo ratings yet

- Long Term AssetsDocument18 pagesLong Term AssetsJähäñ ShërNo ratings yet

- Fam - 1Document20 pagesFam - 1shahidNo ratings yet

- Limited Company Format A2 (Repaired)Document7 pagesLimited Company Format A2 (Repaired)Sterling ArcherNo ratings yet

- Cash Flow ModuleDocument5 pagesCash Flow ModuleEmzNo ratings yet

- M2Document2 pagesM2sejal aroraNo ratings yet

- Investment Analysis and Portfolio Management 2012Document61 pagesInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- T4 - Cash Flow StatementDocument26 pagesT4 - Cash Flow StatementJhonatan Perez VillanuevaNo ratings yet

- Financial Management 02Document20 pagesFinancial Management 02Bby28No ratings yet

- Accounting Chapter 2. Financial Statements For Decision MakingDocument56 pagesAccounting Chapter 2. Financial Statements For Decision MakingMichenNo ratings yet

- Q Financial RatiosDocument5 pagesQ Financial RatiosUmmi KalthumNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Solution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysDocument6 pagesSolution:-Inventory Conversion Period $12 / ($60/365) 73.0 DaysKyla Ramos DiamsayNo ratings yet

- Review Materials Financial ManagementDocument9 pagesReview Materials Financial ManagementTOBIT JEHAZIEL SILVESTRENo ratings yet

- Analysis of Financial Statements: Made Gitanadya, Se., MSMDocument18 pagesAnalysis of Financial Statements: Made Gitanadya, Se., MSMLilia LiaNo ratings yet

- "Chapter 2: Companies": Universidad Nacional Del AltiplanoDocument19 pages"Chapter 2: Companies": Universidad Nacional Del AltiplanoYaneth Milagros Quispe SandovalNo ratings yet

- Tujuan Pembelajaran:: 1. Membaca Laporan Keuangan 2. Menghitung Pajak Perusahaan 3. Mengukur Arus Kas Bebas PerusahaanDocument17 pagesTujuan Pembelajaran:: 1. Membaca Laporan Keuangan 2. Menghitung Pajak Perusahaan 3. Mengukur Arus Kas Bebas PerusahaanSiti Roh ChayatunNo ratings yet

- Ratio Indosat 2016Document21 pagesRatio Indosat 2016rebeliousageNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- The Basic Financial Statement FinalDocument69 pagesThe Basic Financial Statement FinalKaren Annica Astrero MedinaNo ratings yet

- Topic 13 - Analysis 2022Document20 pagesTopic 13 - Analysis 2022Danyael millevoNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- CSEC Principles of Accounts SEC. 9-Company Accounting (Balance Sheet)Document23 pagesCSEC Principles of Accounts SEC. 9-Company Accounting (Balance Sheet)Ephraim PryceNo ratings yet

- Tarea Taller 1 FINA 503Document4 pagesTarea Taller 1 FINA 503Hugo LombardiNo ratings yet

- 2 Understanding Financial Information-1Document32 pages2 Understanding Financial Information-1Tijana DjurdjevicNo ratings yet

- CHP 10 - Long Term Financing DecisionsDocument15 pagesCHP 10 - Long Term Financing DecisionsHarvey AguilarNo ratings yet

- Mohd Azmezanshah Bin SezwanDocument4 pagesMohd Azmezanshah Bin SezwanMohd Azmezanshah Bin SezwanNo ratings yet

- 2018 - Session11 - 12 FSA - PGP - SentDocument40 pages2018 - Session11 - 12 FSA - PGP - SentArty DrillNo ratings yet

- Formula For Ratio AnalysisDocument8 pagesFormula For Ratio AnalysiszainNo ratings yet

- Bsa 2 - Finman - Group 8 - Lesson 2Document5 pagesBsa 2 - Finman - Group 8 - Lesson 2カイ みゆきNo ratings yet

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Blank FSDocument13 pagesBlank FSIndians Are RandiNo ratings yet

- Unit 3. Understanding Financial StatementsDocument21 pagesUnit 3. Understanding Financial StatementsWoodsville HouseNo ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- Consolidated Financial Statements - Acquistion DateDocument52 pagesConsolidated Financial Statements - Acquistion DateXavier AresNo ratings yet

- L03 - Accounting Classification and EquationsDocument29 pagesL03 - Accounting Classification and EquationsmardhiahNo ratings yet

- Adjusted Trial BalanceDocument4 pagesAdjusted Trial BalanceMonir HossainNo ratings yet

- Week 3 - ACCY111 NotesDocument4 pagesWeek 3 - ACCY111 NotesDarcieNo ratings yet

- Cash Flow Statements Notes and Practical ExercisesDocument9 pagesCash Flow Statements Notes and Practical ExercisesRNo ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- FIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4Document4 pagesFIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4the learners club5100% (1)

- Total Current Assets 1,345,000: Legal Ownership Is A Necessary Criterion When Determining The Existence of An AssetDocument7 pagesTotal Current Assets 1,345,000: Legal Ownership Is A Necessary Criterion When Determining The Existence of An Assetann abegail perezNo ratings yet

- Accruals and Prepayments: AlreadyDocument4 pagesAccruals and Prepayments: AlreadyLOW YAN QINNo ratings yet

- Lec 04Document14 pagesLec 04Ryan GroffNo ratings yet

- Acc 1Document7 pagesAcc 1Taskeen AliNo ratings yet

- Economics 101: Interactive BrokersDocument11 pagesEconomics 101: Interactive BrokersDennys FreireNo ratings yet

- Ramco Cements StandaloneDocument13 pagesRamco Cements StandaloneTao LoheNo ratings yet

- Icahn's Lawsuit Against Lions GateDocument32 pagesIcahn's Lawsuit Against Lions GateDealBookNo ratings yet

- 01 Laporan 1 Minggu Live TiktokDocument3 pages01 Laporan 1 Minggu Live Tiktokbagusazmi666No ratings yet

- نشاط الإنجليزيةDocument4 pagesنشاط الإنجليزيةsaleh.01chfNo ratings yet

- FU Wang FoodDocument91 pagesFU Wang FoodBiswas LitonNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsMaurice AgbayaniNo ratings yet

- FDGDFDocument3 pagesFDGDF1No ratings yet

- Module 5 - Understanding The Role of Financial Markets and InstitutionsDocument7 pagesModule 5 - Understanding The Role of Financial Markets and InstitutionsMarjon Dimafilis100% (1)

- Accounting Probs.Document3 pagesAccounting Probs.Aldrin Benitez Jumaquio0% (1)

- Eco Products Inc Final SCDocument13 pagesEco Products Inc Final SCRobert Mambo50% (2)

- DFIM Circular 04 26.07.2021 On Loan ClassificationDocument24 pagesDFIM Circular 04 26.07.2021 On Loan ClassificationM Rejwan AlamNo ratings yet

- Relevant Costing Quiz Answer KeyDocument8 pagesRelevant Costing Quiz Answer KeyDeniseNo ratings yet

- Wolfram Alpha AnnvssksvsgymbDocument4 pagesWolfram Alpha AnnvssksvsgymbenrokNo ratings yet

- Engineering Economy 8th Edition Blank Solutions ManualDocument38 pagesEngineering Economy 8th Edition Blank Solutions Manualleogreenetxig100% (19)

- Date Financial Assets Held For Trading: ILLUSTRATION 1: Initial MeasurementDocument2 pagesDate Financial Assets Held For Trading: ILLUSTRATION 1: Initial MeasurementALMA MORENANo ratings yet

- Fiscal Year Is January-December. All Values USD Millions.: AssetsDocument29 pagesFiscal Year Is January-December. All Values USD Millions.: AssetsHubert Luis Madariaga ManyaNo ratings yet

- Document 1514 9730Document67 pagesDocument 1514 9730rubyhien46tasNo ratings yet

- Capital Budgeting Practices by Corporates in India PPTDocument13 pagesCapital Budgeting Practices by Corporates in India PPTRVijaySai0% (1)

- CCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomeDocument26 pagesCCIL All Sovereign Bonds Index (CASBI) : Secondary Market OutcomegopalkpsahuNo ratings yet

- BitaiDocument20 pagesBitaiLarry WoodNo ratings yet

- Risk Reward Analysis in Risk ArbDocument11 pagesRisk Reward Analysis in Risk ArbWilliam EnszerNo ratings yet

- CH 10 RevisedDocument3 pagesCH 10 RevisedRestu AnggrainiNo ratings yet

- Order To CashDocument4 pagesOrder To CashAbhishekRanjanNo ratings yet

- Unit I: Accounting FOR A PartnershipDocument18 pagesUnit I: Accounting FOR A PartnershipAki GirmNo ratings yet

- Caselet 2Document2 pagesCaselet 2aparna mohanNo ratings yet