Professional Documents

Culture Documents

Annex B-2 RR 11-2018

Annex B-2 RR 11-2018

Uploaded by

Hershey Ramos SabinoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex B-2 RR 11-2018

Annex B-2 RR 11-2018

Uploaded by

Hershey Ramos SabinoCopyright:

Available Formats

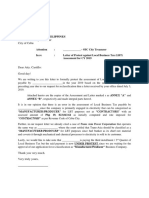

ANNEX “B-2”

INCOME PAYEE’S SWORN DECLARATION OF GROSS RECEIPTS/SALES

(For Self-Employed and/or Engaged in the Practice of Profession with Lone Income Payor)

I, _________________________________________________, ___________________________, of legal age, single/ married

(Name) (Citizenship)

to ___________________________________________permanently residing at _________________________________

(Name of Spouse)

___________________________________________________________________________________________________with

(Address)

Taxpayer Identification Number (TIN) _________________________, after having been duly sworn in accordance with law

hereby depose and state:

1. That I derived my professional income only from FILINVEST LAND, INC. with Taxpayer Identification Number

000-533-224-000 and business address at 79 EDSA BRGY. HIGHWAY HILLS, MANDALUYONG CITY;

2. That for the current year _____, my gross receipts will not exceed Two Hundred Fifty Thousand Pesos

(₱250,000.00) and that I am registered as a non-VAT taxpayer; that whatever is the amount of income received, I will

comply with the requirement to file my Income Tax Return on the prescribed due date. For this purpose, I opt to avail

of either one of the following:

Graduated Income Tax Rates under Section 24(A)(2)(a) of the Tax Code, as amended, based on the

taxable income. With this selection, I acknowledge that I am subject to 0% income tax, thus, not subject to

creditable withholding tax; subject to percentage tax, if applicable, and will file the required percentage tax

returns or subject to withholding percentage tax, in case of government money payments.

Eight Percent (8%) income tax rate under Section 24(A)(2)(b) of the Tax Code, as amended, based on

gross receipts/sales and other non-operating income - with this selection, I understand that this is in lieu of

the graduated income tax rates and the Percentage Tax under Section 116 of the Tax Code, as amended; thus,

no withholding tax shall be made;

3. That based on my selection above, if my gross sales/receipts and other non-operating income exceeds ₱250,000.00

but not over ₱3,000,000.00, my afore-stated lone income payor shall automatically withhold the prescribed rate of

withholding tax:

a. In case of Graduated Income Tax Rates, I acknowledge that aside from income tax, I am subject to

business tax (Percentage Tax, if applicable) and creditable withholding of income in excess of P250,000.00,

and business tax withholding, if any, are applicable on the entire income payment; OR

b. In case of Eight Percent (8%) income tax rate, I acknowledge that I am only subject to income tax and

thus, to the creditable withholding income tax in excess of P250,000.00;

4. That I duly execute this SWORN DECLARATION in compliance with the requirement prescribed under Section 3

of Revenue Regulations No. 11-2018;

5. That I declare, under the penalties of perjury, that this declaration has been made in good faith, and to the best of my

knowledge and belief to be true and correct.

IN WITNESS WHEREOF, I have hereunto set my hand this ___ day of ____________, 20___ at ___________, Philippines

_____________________________________________

Signature over Printed Name of Individual Taxpayer

SUBSCRIBED AND SWORN to before me this _____ day of ____________, 20___ in _______________________________.

Applicant exhibited to me his/her ___________________________issued at _______________________ on _______________.

Government Issued ID and No.)

NOTARY PUBLIC

Doc. No.: __________

Page No.: __________

Book No.: __________

Series of ___________

(To be filled-out by the withholding agent/lone payor)

Date Received: __________________ Received by:

(MM-DD-YYYY-00001)

______________________________________________

Signature over Printed Name of the Withholding Agent/Payor or Authorized Officer

______________________________________________

Designation/Position of Authorized Officer

______________________________________________

Name of Withholding Agent/Lone Payor

You might also like

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesTacloban Rebs100% (4)

- Sworn Declaration (Bir)Document1 pageSworn Declaration (Bir)Katherine Olidan75% (4)

- RevReg 13-77Document12 pagesRevReg 13-77dppascua100% (1)

- BIR - Affidavit of Preservation of Working PapersDocument1 pageBIR - Affidavit of Preservation of Working PapersLimuel Balestramon RazonalesNo ratings yet

- Quality Accreditation Checklist Form 4Document1 pageQuality Accreditation Checklist Form 4Joy Dimaano0% (1)

- Closure of Business With BirDocument2 pagesClosure of Business With Birjohn allen MarillaNo ratings yet

- Letter of Intent BIR-eFPSDocument1 pageLetter of Intent BIR-eFPSsheNo ratings yet

- Inventory of Unused ReceiptsDocument1 pageInventory of Unused ReceiptsAnna Sun100% (6)

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

- Letter of Intent To BIR For eFPS EnrolmentDocument1 pageLetter of Intent To BIR For eFPS EnrolmentFreann Sharisse Austria100% (2)

- BIR Sworn StatementDocument1 pageBIR Sworn StatementPFMPC Secretary100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Philhealth Online Access Form (Poaf)Document5 pagesPhilhealth Online Access Form (Poaf)pogirtNo ratings yet

- Affidavit of Correctness of EntriesDocument1 pageAffidavit of Correctness of EntriesPatrick Penachos100% (1)

- Special Power of Attorney BIRDocument1 pageSpecial Power of Attorney BIRJomielyn GaleraNo ratings yet

- Letter of EFPS For BIRDocument2 pagesLetter of EFPS For BIRLetty Tamayo100% (1)

- SEC Form Annex D Submission of Email Address and Mobile Numbers For CorporationDocument1 pageSEC Form Annex D Submission of Email Address and Mobile Numbers For CorporationJoy Nisolada100% (3)

- Secretary's CertificateDocument1 pageSecretary's CertificateJil MacasaetNo ratings yet

- eAccReg Sworn Statement - TaxpayerDocument1 pageeAccReg Sworn Statement - TaxpayerJayson Flaviano Panganiban100% (2)

- Philhealth ER1-Employer FormDocument1 pagePhilhealth ER1-Employer FormAimee F67% (3)

- RMO 12 2013 List of Unused Expired ORsSIsCIs Annex DDocument2 pagesRMO 12 2013 List of Unused Expired ORsSIsCIs Annex DMIS MijerssNo ratings yet

- Application-for-Business-Retirement in MuntinlupaDocument1 pageApplication-for-Business-Retirement in MuntinlupajoycegNo ratings yet

- EAccreg and ESales Enrollment FormDocument1 pageEAccreg and ESales Enrollment FormFrancis Chris100% (2)

- New Pagibig STLRF FormatDocument6 pagesNew Pagibig STLRF FormatNen Mar0% (2)

- Business Tax Protest Letter SampleDocument1 pageBusiness Tax Protest Letter SampleMaristela Regidor100% (1)

- Lessee Information StatementDocument4 pagesLessee Information StatementDarryl Jay Medina75% (4)

- Request For ReinvestigationDocument9 pagesRequest For Reinvestigationjoel raz94% (17)

- Letter of Request For DeactivationDocument1 pageLetter of Request For DeactivationRonald LeabresNo ratings yet

- 1906 January 2018 ENCS FinalDocument1 page1906 January 2018 ENCS FinalShane Shane100% (4)

- BIR Sample Letter of Intent For Efps (Individual)Document1 pageBIR Sample Letter of Intent For Efps (Individual)GraceKayCee50% (10)

- Loose LeafDocument1 pageLoose LeafMaricel Valerio Canlas67% (6)

- BIR Form No. 1900Document2 pagesBIR Form No. 1900Aldrin Laloma100% (1)

- ANNEX A Notarial Letter For EsalesDocument1 pageANNEX A Notarial Letter For EsalesBryan Co100% (5)

- Sworn Declaration Annex B-2Document4 pagesSworn Declaration Annex B-2Theresa Redler100% (1)

- Transfer Commitment FormDocument1 pageTransfer Commitment Formromarcambri100% (7)

- PESO RequirementsDocument2 pagesPESO RequirementsVher Christopher DucayNo ratings yet

- BIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionDocument3 pagesBIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionBobby LockNo ratings yet

- Notice of Death To Bir Estate SampleDocument2 pagesNotice of Death To Bir Estate SampleGlenda May100% (2)

- Sworn Declaration-2307 - 2020Document1 pageSworn Declaration-2307 - 2020JOHN JERALD P. MIRANDANo ratings yet

- No Rent Affidavit TemplateDocument2 pagesNo Rent Affidavit TemplateRyan Jude Lim100% (1)

- A. Gross Monthly Salary: Certificate of Employment and CompensationDocument1 pageA. Gross Monthly Salary: Certificate of Employment and CompensationMary Rose LlameraNo ratings yet

- Sworn DeclarationDocument1 pageSworn DeclarationGilden Joy CequenaNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Vincent AmomonponNo ratings yet

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDocument1 pageIncome Payee'S Sworn Declaration of Gross Receipts/SalesJan DoeNo ratings yet

- Annex B 2 RR 11 2018 PDFDocument1 pageAnnex B 2 RR 11 2018 PDFDnrxsNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Petrovich100% (1)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Alo Rio100% (3)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018JadeNo ratings yet

- AnnexDocument1 pageAnnexAHOUR PANGILAYANNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Annex B 1 RR 11 20181 2023Document1 pageAnnex B 1 RR 11 20181 2023danilotinio2No ratings yet

- Credit Risk AnalysisDocument1 pageCredit Risk AnalysisPhilip JosephNo ratings yet

- COR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorDocument2 pagesCOR and Income Payee's Sworn Declaration of Gross Receipts - Sales - Lone Income PayorKw1kS0T1kNo ratings yet

- Sworn Statement 1Document1 pageSworn Statement 1Eloisa MoniqueNo ratings yet

- Sworn Declaration - INCOME PAYEEDocument1 pageSworn Declaration - INCOME PAYEEkforteza.jtoNo ratings yet

- Annex B-1 RR 11-2018Document1 pageAnnex B-1 RR 11-2018Jose Marie De LeonNo ratings yet

- Please Attach Your COR On Page 1: (Trainer Name) (Trainer ID)Document2 pagesPlease Attach Your COR On Page 1: (Trainer Name) (Trainer ID)Jaymart de VillaNo ratings yet

- Joborder - Annex - A1 Lone Income PayorDocument1 pageJoborder - Annex - A1 Lone Income PayorNDP InfantaNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- Agrarian Land Reform (RA 6657)Document13 pagesAgrarian Land Reform (RA 6657)Eliza Corpuz GadonNo ratings yet

- Basic Real Estate ComputationsDocument4 pagesBasic Real Estate ComputationsEliza Corpuz GadonNo ratings yet

- Agrarian Land Reform (RA 6657)Document13 pagesAgrarian Land Reform (RA 6657)Eliza Corpuz GadonNo ratings yet

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Document39 pagesNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonNo ratings yet

- Additional Notes For CARL R.A 6657Document2 pagesAdditional Notes For CARL R.A 6657Eliza Corpuz GadonNo ratings yet

- DEED of SALE (Portion of Real Estate)Document1 pageDEED of SALE (Portion of Real Estate)Eliza Corpuz Gadon100% (7)

- Revenue Memorandum Circular No. 35-06: June 21, 2006Document18 pagesRevenue Memorandum Circular No. 35-06: June 21, 2006dom0202No ratings yet

- Win Telecom V CirDocument2 pagesWin Telecom V Circmv mendozaNo ratings yet

- FNSACC512 Assessment Student InstructionsDocument20 pagesFNSACC512 Assessment Student InstructionsHAMMADHRNo ratings yet

- Rmo 53 98Document25 pagesRmo 53 98Alvin AgullanaNo ratings yet

- Tabreed06 ProspectusDocument142 pagesTabreed06 ProspectusbontyonlineNo ratings yet

- Fin Otbi Sub Area Doc r13Document84 pagesFin Otbi Sub Area Doc r13Satya NNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument12 pagesChapter 2 - Taxes, Tax Laws, and Tax AdministrationAbraham Chin100% (3)

- Bank of America v. CA G.R. No. 103092Document6 pagesBank of America v. CA G.R. No. 103092Jopan SJNo ratings yet

- Employee's Withholding Certificate 2020Document4 pagesEmployee's Withholding Certificate 2020CNBC.comNo ratings yet

- SD - IMG-009 Aplicação Da SAP Note 747607 Ref MP 135 (ISS, PISDocument20 pagesSD - IMG-009 Aplicação Da SAP Note 747607 Ref MP 135 (ISS, PISLuiz O. Giordani100% (1)

- Petitioner Vs Vs Respondent: Third DivisionDocument12 pagesPetitioner Vs Vs Respondent: Third DivisionjackyNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- pf1 Chap 1 en CaDocument42 pagespf1 Chap 1 en CaSaira Fazal0% (1)

- Fringe Benefit Tax Train LawDocument27 pagesFringe Benefit Tax Train LawJoyce Leeann Manansala75% (4)

- SUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Document2 pagesSUITS THE C-SUITE by Saha P. Adlawan-Bulagsak Business World (10/31/2016 - p.S1/4)Bryce BihagNo ratings yet

- 2307 New PDFDocument2 pages2307 New PDFallan paolo neveidaNo ratings yet

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- 71 Ing Bank VSDocument2 pages71 Ing Bank VSManuel Villanueva100% (1)

- Sample Affidavit of UndertakingDocument2 pagesSample Affidavit of UndertakingKristine Coma100% (5)

- Annex C RR 11-2018Document2 pagesAnnex C RR 11-2018Ma. Cristy BroncateNo ratings yet

- G.R. No. 210641 - Domestic Petroleum Retailer Corp. v. Manila International Airport AuthorityDocument5 pagesG.R. No. 210641 - Domestic Petroleum Retailer Corp. v. Manila International Airport AuthorityMegan AglauaNo ratings yet

- TAX 2 Case DigestDocument6 pagesTAX 2 Case DigestGatan CawilanNo ratings yet

- RR 10-08Document30 pagesRR 10-08matinikki100% (1)

- Doing Business in Oman: A Tax and Legal GuideDocument16 pagesDoing Business in Oman: A Tax and Legal GuideAnand PrakashNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- PNOC v. CA (G.R. No. 109976. April 26, 2005.)Document2 pagesPNOC v. CA (G.R. No. 109976. April 26, 2005.)Emmanuel Yrreverre100% (1)

- Membership ApplicationDocument5 pagesMembership ApplicationAbhishek VijayNo ratings yet

- Dynamics AX Localization - PakistanDocument9 pagesDynamics AX Localization - PakistanAdeel EdhiNo ratings yet

- RMC No. 46-2008Document13 pagesRMC No. 46-2008Jourd MagbanuaNo ratings yet

- Can Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesDocument46 pagesCan Indonesia Reform Its Tax System? Problems and Options: Tulane Economics Working Paper SeriesSwastik GroverNo ratings yet