Professional Documents

Culture Documents

Rupay Platinum Credit Card

Uploaded by

Arbaz KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rupay Platinum Credit Card

Uploaded by

Arbaz KhanCopyright:

Available Formats

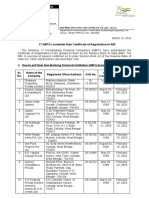

Manage your Credit Card with “Canara Saathi App – Canara Credit Card Self Service App”

Features of Card:

Credit Limit: Up to Rs. 25 Lakhs

Free Credit Period: 20 – 50 days

Revolving Facility: Card holder needs to pay a minimum of 5% of the due bill subject to minimum

amount Rs. 100. The unpaid portion will attract 2.5% p.m on the balance outstanding.

Cash withdrawal limit per billing cycle: 50% of the card limit subject to maximum Rs. 50000/-.

EMV CHIP PIN card for higher security

EMI Facility is available on purchases above Rs 5000*

Add on cards : Up to four add on cards to immediate family members

International ATM Access

Cash advance facility through any Canara Bank ATM.

Rewards Points: Two rewards points for every purchase transaction including E-commerce

transaction of Rs 100. One point is equal to Rs 0.25. Option for Encashment of Reward Points is

available.

Baggage Insurance: Rs. 25000/-

Purchase Protection cover: Rs. 25000/-

Card Fee

Charges* RuPay Platinum

Enrolment Fee Nil

Annual Fee Nil

Inactivity Fee Rs200/- per annum if the turnover is below Rs. 50,000 per year

3% of the transaction amount subject to a minimum of Rs. 30/-

Cash Withdrawal Fee

for every Rs. 1000 or part thereof.

Complimentary Accidental Insurance Cover:

Rs. 8.00 Lacs for Self

Air Accident Rs. 4.00 Lacs for Spouse

Rs. 4.00 Lacs for self

Other than Air Accident Rs. 2.00 Lacs for spouse

*T&C applied

You might also like

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- Mojo Platinum Credit Card: INR 1000 INR 1000Document4 pagesMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- Applicable Fees and Charges On Credit CardDocument3 pagesApplicable Fees and Charges On Credit CardAbbasNo ratings yet

- SBI Simply Click Feb21Document1 pageSBI Simply Click Feb21harveyNo ratings yet

- Key Fact Statement and MITCDocument23 pagesKey Fact Statement and MITCSumeet ShelarNo ratings yet

- English CCDocument6 pagesEnglish CCdsouzan071No ratings yet

- RBL BankDocument17 pagesRBL BankorekishNo ratings yet

- Schedule of Fees and ChargesDocument3 pagesSchedule of Fees and Chargesdeepakoneplus5No ratings yet

- SBI Simply Click Feb21Document1 pageSBI Simply Click Feb21vinod guptaNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document44 pagesSUPERCARD Most Important Terms and Conditions (MITC)Chouhan Akshay SinghNo ratings yet

- Most Important Terms and ConditionsDocument44 pagesMost Important Terms and Conditionssarang chawareNo ratings yet

- ShopriteDocument1 pageShopriteAlrexie pgNo ratings yet

- SBI BPCLPlatinum Rupay Card Jan 23Document2 pagesSBI BPCLPlatinum Rupay Card Jan 23Ankit WardhanNo ratings yet

- SBI BPCL Card Mar21Document2 pagesSBI BPCL Card Mar21Sachin MehrolNo ratings yet

- Important TNCDocument20 pagesImportant TNCsanthoshsk3072002No ratings yet

- Gild MITC Visa Platinum Doc Updated 13may2022 FinalDocument9 pagesGild MITC Visa Platinum Doc Updated 13may2022 FinalravindraiNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document44 pagesSUPERCARD Most Important Terms and Conditions (MITC)Aazad JiiNo ratings yet

- Imperia Platinum Debit Card E-Usage GuideDocument9 pagesImperia Platinum Debit Card E-Usage GuideKhirai HelpNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerSwapnil PankeNo ratings yet

- MITC Document CustomerDocument14 pagesMITC Document CustomerAnkur SarafNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Edelweiss Broking LTD.: V03/Feb/2020Document2 pagesEdelweiss Broking LTD.: V03/Feb/2020Shyam KukrejaNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document17 pagesSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgNo ratings yet

- Fees and Charges To DPDocument2 pagesFees and Charges To DPMohd FarhanNo ratings yet

- Tariff Sheet For HDFC Bank Individual Demat AccountDocument1 pageTariff Sheet For HDFC Bank Individual Demat Accountnirvana8791No ratings yet

- BFL MITC 02june21 - Final PDFDocument24 pagesBFL MITC 02june21 - Final PDFLokesh SriramNo ratings yet

- Axis Bank Service ChargesDocument4 pagesAxis Bank Service ChargesRanjith MeelaNo ratings yet

- Supercard Most Important Terms and ConditionsDocument26 pagesSupercard Most Important Terms and Conditionstauseef21scribdNo ratings yet

- RBL Mitc FinalDocument16 pagesRBL Mitc FinalVivekNo ratings yet

- Credit CardDocument6 pagesCredit CardAnup SrivastavaNo ratings yet

- SCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFDocument2 pagesSCHEDULE - OF - CHARGES - Combined - PoS - PGMarch - 14 PDFnits_chawlaNo ratings yet

- Key Fact DocumentDocument7 pagesKey Fact Documentdeepak799sgNo ratings yet

- English MITCDocument15 pagesEnglish MITCraman kumarNo ratings yet

- Ready Line SOC Jan June 2024Document1 pageReady Line SOC Jan June 2024umarNo ratings yet

- Fees and Charges W.E.F. 17th Mar, 2021Document3 pagesFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENo ratings yet

- SBI Simply Click Jan22-1Document1 pageSBI Simply Click Jan22-1Broke BondNo ratings yet

- DownloadDocument2 pagesDownloadSourav mNo ratings yet

- DownloadDocument2 pagesDownloadsatendraNo ratings yet

- Brochure - Doctor Plus Savings AccountDocument2 pagesBrochure - Doctor Plus Savings AccountBasil KNo ratings yet

- Final Product PPT - Aura EdgeDocument11 pagesFinal Product PPT - Aura EdgeNarendra KumarNo ratings yet

- SCB Supervalue Titanium.Document2 pagesSCB Supervalue Titanium.sanket shahNo ratings yet

- Jubilee Plus Savings Account: (January 01,2020)Document2 pagesJubilee Plus Savings Account: (January 01,2020)Ruthvik TMNo ratings yet

- Key Fact Statement CorporateDocument7 pagesKey Fact Statement CorporateRAM MAURYANo ratings yet

- Common Service ChargesDocument3 pagesCommon Service ChargesatharvxunoNo ratings yet

- Sbi BPCL Card Feb21Document2 pagesSbi BPCL Card Feb21vinod guptaNo ratings yet

- Changes in Upcoming Schedule of Charges (Jan-Jun-2019) : ADC ServicesDocument1 pageChanges in Upcoming Schedule of Charges (Jan-Jun-2019) : ADC ServicesAhsan IqbalNo ratings yet

- SBI Pulse Card Sep 22Document2 pagesSBI Pulse Card Sep 22yesindiacanngoNo ratings yet

- Core Bundled Savings AccountDocument2 pagesCore Bundled Savings AccountSweta MistryNo ratings yet

- DownloadDocument2 pagesDownloadsmitasahoo9609No ratings yet

- Savings Charges PDFDocument2 pagesSavings Charges PDFPramod NaikareNo ratings yet

- Broking Idirect Linked Savings AccountDocument7 pagesBroking Idirect Linked Savings Accounttrue chartNo ratings yet

- Gold CardDocument2 pagesGold CardjalajsinghNo ratings yet

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- SBI Club VistaraDocument1 pageSBI Club VistaraAwaken IndiansNo ratings yet

- Lending MITC EnglishDocument29 pagesLending MITC EnglishDhiren PatilNo ratings yet

- Credit Card Service and Price Guide: (Prices Are Exclusive of VAT)Document2 pagesCredit Card Service and Price Guide: (Prices Are Exclusive of VAT)Jismin JosephNo ratings yet

- How to Generate and Earn Royalty Income: From casual side income to a new investment categoryFrom EverandHow to Generate and Earn Royalty Income: From casual side income to a new investment categoryNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- SFL - Voucher - MOHAMMED IBRAHIM SARWAR SHAIKHDocument1 pageSFL - Voucher - MOHAMMED IBRAHIM SARWAR SHAIKHArbaz KhanNo ratings yet

- January Payslip 2023.pdf - 1-2Document1 pageJanuary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- March Payslip 2023.pdf - 1Document1 pageMarch Payslip 2023.pdf - 1Arbaz KhanNo ratings yet

- Ankit KumarDocument14 pagesAnkit KumarArbaz KhanNo ratings yet

- February Payslip 2023.pdf - 1-2Document1 pageFebruary Payslip 2023.pdf - 1-2Arbaz KhanNo ratings yet

- 12 BA LI Year Review 2015 Jan 2015Document1 page12 BA LI Year Review 2015 Jan 2015Arbaz KhanNo ratings yet

- INV0001Document1 pageINV0001Arbaz KhanNo ratings yet

- Flagship Health Top Up MonthlyDocument6 pagesFlagship Health Top Up MonthlyArbaz KhanNo ratings yet

- Halal FoodsDocument1 pageHalal FoodsArbaz KhanNo ratings yet

- Axis ASAP FlowDocument13 pagesAxis ASAP FlowArbaz KhanNo ratings yet

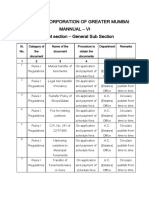

- RTI - Assistant Commissioner - Estate - E07Document15 pagesRTI - Assistant Commissioner - Estate - E07Arbaz KhanNo ratings yet

- PR1ECADocument2 pagesPR1ECAArbaz KhanNo ratings yet

- Health Pass BrochureDocument5 pagesHealth Pass BrochureArbaz KhanNo ratings yet

- Disbursal Request Form drf-0095749001552896143Document1 pageDisbursal Request Form drf-0095749001552896143Arbaz KhanNo ratings yet

- Declaration/VerificationDocument2 pagesDeclaration/VerificationArbaz KhanNo ratings yet

- Re Issue of Passport ChecklistDocument3 pagesRe Issue of Passport ChecklistArbaz KhanNo ratings yet

- Group Care 360 Insurance Policy TNCDocument83 pagesGroup Care 360 Insurance Policy TNCArbaz KhanNo ratings yet

- Edelman Copy FINAL Flipkart Pay Later Now Available On PhonePeDocument2 pagesEdelman Copy FINAL Flipkart Pay Later Now Available On PhonePeArbaz KhanNo ratings yet