Professional Documents

Culture Documents

Firm Organization, Markets & Industry Structure

Uploaded by

mqdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Firm Organization, Markets & Industry Structure

Uploaded by

mqdCopyright:

Available Formats

⛪

Unit 3- The organisation of the

firm and industry

SPOT MARKET: Informal relationship between buyer and seller where none is

obligated to make an exchange

CONTRACT: Formal relationship between buyer and seller that obligates an

exchange in a legal document

PROCEDURE INPUTS INTERNALLY (VERTICAL INTEGRATION) : A firm

produces the inputs needed to the final product.

TRANSACTION COSTS: costs associated with acquiring an input a part from the

money paid to the supplier. (implicit)

a. Specialised investment

a. to allow thw two parties to exhcnge

b. Relationship specific exchange

a. when parties of a transaction have made a specialised investment

VERTICAL INTEGRATION

Use Advantages Disadvantages

skips middleman

when inputs require significant internal regulatory

reduced oportunism

transaction costs, complex mechanism cost of setting

mitigates transaction

contracting, specialised investment. up no longer specialised

costs

COMPENSATION AND THE PRINCIPAL-AGENT

PROBLEM

The principal problem for the lack of effort from labout inputs is the SEPARATION

OF OWNERSHIP AND CONTROL.

owners must incent managers

Unit 3- The organisation of the firm and industry 1

employees and managers

Managers face an economic trade off of leisure against labour.

INCENTIVES

1. Fixed salary

a. wages

2. Incentive contracts

a. performance related pay

b. absolute and relative

In order to align onwers and managers intrests: stock option.

In order to align manager workder interests: profit sharing, revenue sharing, price

rates, tima clocks.

EXTERNAL INCENTIVES

Reputation or take over threat can incentive managers .

MARKET STRUCTURE

factors:

number of firms

concentration (size)

technological and costs consitions

demand

Unit 3- The organisation of the firm and industry 2

barriers of entry

conduct

MEASURING INDUSTRY CONCENTRATION

C4 doesn´t take into account size and distribution, HHI gives more weigt to larger

businesses.

We muiltiply by 10000 beacuase the numbers are too small.

Legislation HHI values

Low concentration <1000

Moderate concentration between 1000 and 1800

Concentrated >1800

If the HHI in an indutry is larger than 1800 then the authorities will not allow for a

merger.

TECHNOLOGY AND COSTS

It depends of labour or capital intensive industries.

If the available technology is different, somw firms will have a cost advantage.

Unit 3- The organisation of the firm and industry 3

DEMAND AND MARKET CONDITIONS

Low demand may imply few firms

High demand may imply many firms

Elasticity varies:

ROTHSCHILD INDEX

POTENTIAL FOR ENTRY

factors:

capital requirements

patents

economies of scale …

CONDUCT

price markup over costs

integration or mergers

adventising expenditures

RD expenditures

1. PRICING BEHAVIOUR:

Unit 3- The organisation of the firm and industry 4

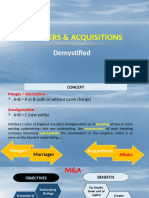

2. INTEGRATION AND MERGER ACTIVITIES

a. merger

i. reduce transaction costs

ii. economies of scale

iii. increase market power

iv. better access to capital markets

b. vertical integration

i. adding stages of the production function

c. horizontal integration

i. merging similar products into a firm

d. conglomerate mergers

i. two or more differnt product lines into a firm

The DANSBY-WILLIG PERFORMANCE INDEX measures how much social

welfare would increase if the output of an indusrty would increase by a small

amount

STRCUTURE- CONDUCT- PERFORMANCE

Structure Conduct Performance

Unit 3- The organisation of the firm and industry 5

Structure Conduct Performance

number of firms, profit and social

individual bahaviour: price, supply,

concentration, cost welfare,

RD, innovation, vertical integration

structure… employment

Dansby-Willig

Concentration ratio Lerner index

performance index

The SCP paradigm interprets that these three aspects are interrelated.

Unit 3- The organisation of the firm and industry 6

You might also like

- M-Power Assignment Sheet-1: Question-1Document4 pagesM-Power Assignment Sheet-1: Question-1kumar030290No ratings yet

- Full Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full ChapterDocument36 pagesFull Download Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manual PDF Full Chapteraortitismonist4y0aby100% (16)

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocument37 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions Manualcameradeaestivalnekwz7100% (26)

- Mib (PPT) PTDocument17 pagesMib (PPT) PTdeepali sharmaNo ratings yet

- Market Integration: Study Guide For Module No. 3Document8 pagesMarket Integration: Study Guide For Module No. 3Ma. Angelika MejiaNo ratings yet

- Solution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillDocument6 pagesSolution Manual Strategic Management An Integrated Approach 10th Edition by Charles W. L. HillJam PotutanNo ratings yet

- Strategy ManagementDocument6 pagesStrategy ManagementRuhi UppalNo ratings yet

- Making Utility M&a Succeed in 2008Document5 pagesMaking Utility M&a Succeed in 2008Marat SafarliNo ratings yet

- A New Approach To Accelerated Performance TransformationDocument9 pagesA New Approach To Accelerated Performance TransformationsofikhdyNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySan Yee Mon KyawNo ratings yet

- 1 - Strategic Management and Stategic CompetitivenessDocument3 pages1 - Strategic Management and Stategic CompetitivenessStephanie Nicole DiputadoNo ratings yet

- Accenture Constructions Engineering Procurement US v1Document12 pagesAccenture Constructions Engineering Procurement US v1Nilesh PatilNo ratings yet

- Diversification Motives and PerformanceDocument5 pagesDiversification Motives and PerformanceJam Aadil DharejoNo ratings yet

- Strategic Management and CompetitivenessDocument3 pagesStrategic Management and CompetitivenessStephanie Nicole DiputadoNo ratings yet

- Strategic Management Theory Cases Integrated Approach 12th Edition Hill Solutions ManualDocument50 pagesStrategic Management Theory Cases Integrated Approach 12th Edition Hill Solutions ManualAkhi Junior JMNo ratings yet

- Strategic Management/ Business PolicyDocument42 pagesStrategic Management/ Business PolicySuci Putri LNo ratings yet

- Corporate-Level Strategy: Creating Value Through DiversificationDocument43 pagesCorporate-Level Strategy: Creating Value Through DiversificationMaame Dufie CudjoeNo ratings yet

- M3 N001 DivE PDFDocument31 pagesM3 N001 DivE PDFsthahviNo ratings yet

- Article 3 Soegiarto Vania 20214863Document3 pagesArticle 3 Soegiarto Vania 20214863Vania EstrellitaNo ratings yet

- Meaning of Business EnvironmentDocument2 pagesMeaning of Business EnvironmentrajivrishiNo ratings yet

- The Ecosystems of OrganisationsDocument57 pagesThe Ecosystems of OrganisationsSANG HOANG THANHNo ratings yet

- Kimura 2000Document5 pagesKimura 2000LamssarbiNo ratings yet

- Profitability Analysis For A Mid-Sized Infrastructure Development CompanyDocument10 pagesProfitability Analysis For A Mid-Sized Infrastructure Development Companyakumar4uNo ratings yet

- Bus. Logic 6-8Document6 pagesBus. Logic 6-8Iya GarciaNo ratings yet

- SCM Module 2 NotesDocument7 pagesSCM Module 2 NotesRaveen MJNo ratings yet

- Company A Company B Company C: Share Holders' Benefit Market BenefitDocument6 pagesCompany A Company B Company C: Share Holders' Benefit Market BenefitMuhaiminul IslamNo ratings yet

- SM_Corp Level StratDocument21 pagesSM_Corp Level StratAkshat TiwariNo ratings yet

- M&ADocument151 pagesM&APallavi Prasad100% (1)

- Slide Set 04-2022Document23 pagesSlide Set 04-2022K59 KHUAT THI MINH ANHNo ratings yet

- Chapter 4Document5 pagesChapter 4erleen sumileNo ratings yet

- Manecon Module 1 NotesDocument6 pagesManecon Module 1 NotestygurNo ratings yet

- Lesson 20: Porter'S 5 Force Analysis: Learning ObjectiiveDocument5 pagesLesson 20: Porter'S 5 Force Analysis: Learning ObjectiiveSakshiNo ratings yet

- Industry analysis outlines competitive forcesDocument5 pagesIndustry analysis outlines competitive forcesJohn AlbateraNo ratings yet

- Management Information SystemDocument13 pagesManagement Information SystemVinay SainiNo ratings yet

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocument51 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDomingo Mckinney100% (31)

- Corporate StrategyDocument52 pagesCorporate Strategytomstor9No ratings yet

- IT & Corporate Strategy Presentation-MehnazDocument26 pagesIT & Corporate Strategy Presentation-MehnazYasanka Sandaruwan Samaraweera100% (1)

- Supply Chain Review With Mazars - Aug 2019Document3 pagesSupply Chain Review With Mazars - Aug 2019ShaileshNo ratings yet

- Supply Chains That Become Real Value Chains: A New Mandate For Industrial Supply-Chain Leaders EverywhereDocument15 pagesSupply Chains That Become Real Value Chains: A New Mandate For Industrial Supply-Chain Leaders EverywhereAbyan KemalNo ratings yet

- Tech-Enabled TransformationDocument67 pagesTech-Enabled TransformationjhlaravNo ratings yet

- Piramal Enterprises Limited Annual Report 2017 18 1 5Document20 pagesPiramal Enterprises Limited Annual Report 2017 18 1 5lokeshNo ratings yet

- General Aspect 2. Industry Specific AspectDocument8 pagesGeneral Aspect 2. Industry Specific AspectIrushiNo ratings yet

- Multi-National Corporation: Home Country and Operates in Several OtherDocument6 pagesMulti-National Corporation: Home Country and Operates in Several OtherApril Angel Mateo MaribbayNo ratings yet

- Chapter 02 - Industry AnalysisDocument6 pagesChapter 02 - Industry AnalysisOdette CostantinoNo ratings yet

- 003 03economicDocument5 pages003 03economiceyoboldairNo ratings yet

- SM CH 5 Business Level StrategiesDocument42 pagesSM CH 5 Business Level StrategiesVijeshNo ratings yet

- Chapter 10 Presentation - Beguina, Klarish Jay C. (BSA 2-4)Document19 pagesChapter 10 Presentation - Beguina, Klarish Jay C. (BSA 2-4)Klarish Jay BeguinaNo ratings yet

- Module 7 Corporate Level StrategiesDocument18 pagesModule 7 Corporate Level StrategiesAlberto LiNo ratings yet

- Porters Five Forces ModelDocument3 pagesPorters Five Forces ModelATUL ABNo ratings yet

- Swot Analysis For An It IndustryDocument7 pagesSwot Analysis For An It Industrymonika_ifimNo ratings yet

- External Environment EvaluaitonDocument56 pagesExternal Environment EvaluaitonPratyush JaiswalNo ratings yet

- 3C EuropeanRetailDigest Juli2006Document6 pages3C EuropeanRetailDigest Juli2006Peter van den HeuvelNo ratings yet

- Lecture 2.7. Technology and labour (2022)Document27 pagesLecture 2.7. Technology and labour (2022)nhiphuong0810No ratings yet

- Strategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualDocument51 pagesStrategic Management Theory and Cases An Integrated Approach 12th Edition Hill Solutions ManualRachelMorrisfpyjs100% (21)

- Success and Failure of IsDocument81 pagesSuccess and Failure of IsToto SubagyoNo ratings yet

- Market IntegrationDocument30 pagesMarket IntegrationSharmaineMirandaNo ratings yet

- Cbme 11 - C2Document15 pagesCbme 11 - C2Gemini LibraNo ratings yet

- Module 4 - Introduction Accounting in Economic DecisionsDocument34 pagesModule 4 - Introduction Accounting in Economic DecisionsMOHAMMED ALI MOHAMMED ZABBANINo ratings yet

- Strategic positioning and service strategyDocument10 pagesStrategic positioning and service strategyashulibraNo ratings yet

- The Economics of Immigration: A Story of Substitutes and ComplementsDocument10 pagesThe Economics of Immigration: A Story of Substitutes and ComplementsmqdNo ratings yet

- Assignments 5.1 and 5.2Document9 pagesAssignments 5.1 and 5.2mqdNo ratings yet

- UK Fiscal Effect of ImmigrationDocument4 pagesUK Fiscal Effect of ImmigrationmqdNo ratings yet

- Assignment 5.1Document3 pagesAssignment 5.1mqdNo ratings yet

- Haier Group CorporationDocument9 pagesHaier Group CorporationmqdNo ratings yet

- Unit 4 - Managing in Competitive Monopolistic and Monopolistically Competitive Markets.Document10 pagesUnit 4 - Managing in Competitive Monopolistic and Monopolistically Competitive Markets.mqdNo ratings yet

- CH8RDocument14 pagesCH8RApril ManaloNo ratings yet

- 4.determination of Exchange RateDocument20 pages4.determination of Exchange RateAjeng Putri NugrahaniNo ratings yet

- Dokumen2 Bisnis Coress SalinanDocument4 pagesDokumen2 Bisnis Coress SalinanRevi LizaNo ratings yet

- Airline Reservation System: Fare TariffsDocument2 pagesAirline Reservation System: Fare Tariffsoptimuz primeNo ratings yet

- Sammut BonnicipricingstrategyDocument4 pagesSammut BonnicipricingstrategyDurga Madhab PadhyNo ratings yet

- RELEVANT COSTING MULTIPLE CHOICEDocument20 pagesRELEVANT COSTING MULTIPLE CHOICEhobi stanNo ratings yet

- Participant Handbook (MS7 SM B2C CG)Document65 pagesParticipant Handbook (MS7 SM B2C CG)Dinesh kumarNo ratings yet

- AlintaEnergy-address ProofDocument2 pagesAlintaEnergy-address ProofruntabNo ratings yet

- BrazilDocument130 pagesBrazilLuc CardNo ratings yet

- Testbanks ch24Document12 pagesTestbanks ch24Hassan ArafatNo ratings yet

- Zydus Lifesciences LTDDocument7 pagesZydus Lifesciences LTDMahek SolankiNo ratings yet

- ABM-APPLIED ECONOMICS 12 - Q1 - W3 - Mod3Document20 pagesABM-APPLIED ECONOMICS 12 - Q1 - W3 - Mod3ely sanNo ratings yet

- 04 TAS Tender MDPL JaipurDocument349 pages04 TAS Tender MDPL JaipurJabar AlhakimNo ratings yet

- INVENTORIES2Document18 pagesINVENTORIES2Katherine MagpantayNo ratings yet

- Letter Writing and Passive VoiceDocument33 pagesLetter Writing and Passive Voicebiffin100% (1)

- Weighted Average Cost of CapitalDocument19 pagesWeighted Average Cost of CapitalShao BajamundeNo ratings yet

- Reference Notes - Accommodation StatisticsDocument2 pagesReference Notes - Accommodation StatisticsVedant HingeNo ratings yet

- Dollar Stationary IndustriesDocument34 pagesDollar Stationary IndustriesAsim Shakil Elias67% (3)

- View Duplicate Invoice - Apple Ipad ProDocument1 pageView Duplicate Invoice - Apple Ipad ProFabian Esteban Contreras SotoNo ratings yet

- Far410 Chapter 3 Equity EditedDocument32 pagesFar410 Chapter 3 Equity EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Test Paper InvestmentsDocument4 pagesTest Paper Investmentslagosjackie59No ratings yet

- Mestrado em População, Território e Estatísticas Públicas - Lista de ExercíciosDocument5 pagesMestrado em População, Território e Estatísticas Públicas - Lista de ExercíciosCauan BragaNo ratings yet

- Atty Jumrani Contract of Sale and LeaseDocument4 pagesAtty Jumrani Contract of Sale and LeaseArrianne ObiasNo ratings yet

- Depreciation Methods for Engineering AssetsDocument10 pagesDepreciation Methods for Engineering AssetsDiane Gutierrez100% (1)

- Credit and Inventory Management - NewDocument25 pagesCredit and Inventory Management - NewBidisha gogoiNo ratings yet

- CS, PS and EfficiencyDocument45 pagesCS, PS and EfficiencySubodh MohapatroNo ratings yet

- UoP Los Baños Economics Paper on Elasticity ConceptsDocument2 pagesUoP Los Baños Economics Paper on Elasticity ConceptsKenzie AlmajedaNo ratings yet

- Lacuesta - SWOT Analysis WorksheetDocument8 pagesLacuesta - SWOT Analysis WorksheetCrissa Mae LacuestaNo ratings yet

- FIN542 2019 Ch4Document56 pagesFIN542 2019 Ch4Cakap TanganNo ratings yet

- Week 10 TUTE Chapter 7 QuestionsDocument3 pagesWeek 10 TUTE Chapter 7 QuestionsEvelyn GladysNo ratings yet