Professional Documents

Culture Documents

Activity 1 Questin & Suggested Solution

Uploaded by

VOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 1 Questin & Suggested Solution

Uploaded by

VCopyright:

Available Formats

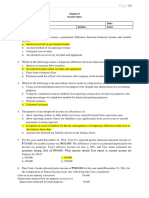

Learning Unit 4: Assignment Question and Suggested Solution.

Activity 1

The following information is given:

Date Information Rand

31 December 20.19 Provision for taxation 20.19 R100 000

Taxation paid – 20.19 100 000

(first and second payment)

28 February 20.20 Tax assessment for 20.19 received after the 93 900

financial statements were drafted

31 December 20.20 Provision for taxation 20.20 80 000

Taxation paid – 20.20 72 000

(first and second payment)

REQUIRED:

Prepare the ledger entries for all relevant accounts for the financial years ended 31

December 20.19 and 31 December 20.20

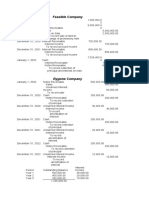

Income tax expense

Date Contra-Account Amount Date Contra-Account Amount

31 Dec Current tax payable: 31 Dec

20.19 Income tax 100 000 20.19 Profit or loss 100 000

31 Dec 28 Feb Current tax payable:

20.20 Current tax payable 80 000 20.20 Income tax 6 100

(over-provision 20.18)

31 Dec

20.20 Profit or loss 73 900

80 000 80 000

b)

Current tax payable / SARS: Income Tax

31 Dec 28 Feb

20.19 Bank 100 000 20.18 Income tax expense 100 000

28 Feb 31 Dec

20.18 Income tax expense 6 100 20.20 Income tax expense 80 000

31 Dec

20.20 Bank 72 000

31 Dec

20.20 Closing balance c/d 1 900

80 000 80 000

1 Jan

20.21 Opening balance b/d 1 900

You might also like

- Sol. Man. Chapter 18 Govt Grants Ia Part 1BDocument6 pagesSol. Man. Chapter 18 Govt Grants Ia Part 1BChrismae Monteverde Santos100% (1)

- 2a.notes PayableDocument8 pages2a.notes PayableDia rielNo ratings yet

- Notes PayableDocument10 pagesNotes PayableMia Casas100% (5)

- Profe03 Activity Chapter 7Document5 pagesProfe03 Activity Chapter 7eloisa celisNo ratings yet

- PAS 1 Presentation of FSDocument11 pagesPAS 1 Presentation of FSPatrickMendozaNo ratings yet

- Use The Following Information For The Next Seven Questions:: Total LiabilitiesDocument7 pagesUse The Following Information For The Next Seven Questions:: Total LiabilitiesRoss John JimenezNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian GaboroNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Purchase 66,000 Freight-In 1,400 Accounts Payable 67,400Document7 pagesPurchase 66,000 Freight-In 1,400 Accounts Payable 67,400Rhea OraaNo ratings yet

- Quarterly Value Added Tax Declaration - 1st QuarterDocument3 pagesQuarterly Value Added Tax Declaration - 1st QuarterJo HernandezNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Financial Reporting in Hyperinflationary Economies: AssetsDocument4 pagesFinancial Reporting in Hyperinflationary Economies: AssetsKian GaboroNo ratings yet

- Chapter 37 Financial StatementsDocument68 pagesChapter 37 Financial StatementsheyheyNo ratings yet

- Yes NoDocument3 pagesYes Noyrrej tadgolNo ratings yet

- Yes NoDocument3 pagesYes NoNia AtalinNo ratings yet

- AaaaDocument3 pagesAaaaFranz GaldonesNo ratings yet

- (A715df5e 0954 4777 A1Document1 page(A715df5e 0954 4777 A1John Aries Paz SarteNo ratings yet

- Yes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30Document1 pageYes No: Vat-On Business Services-In General VB010 2,108,277.52 252,993.30 2,108,277.52 252,993.30MJ TuliaoNo ratings yet

- Year Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes NoDocument5 pagesYear Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes Noarchell gabicaNo ratings yet

- ACCTG12 CSN PartnershipDocument5 pagesACCTG12 CSN PartnershipJhane XiNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- DoneDocument3 pagesDoneJam DiolazoNo ratings yet

- Intacc1A M5Assignment KeyDocument9 pagesIntacc1A M5Assignment KeyGabriel AfricaNo ratings yet

- CARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Document1 pageCARELIFT - BIR Form 2550Q VAT RETURN - 4Q 2021Jay Mark DimaanoNo ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- DEFERRED TAX - TUTORIAL SOLUTION - Part 2Document4 pagesDEFERRED TAX - TUTORIAL SOLUTION - Part 2SARASVATHYDEVI SUBRAMANIAMNo ratings yet

- Quiz 8Document2 pagesQuiz 8Wena Mae LavideNo ratings yet

- 0622 - 2550Q - Lola Tina NewDocument3 pages0622 - 2550Q - Lola Tina NewKaren RodriguezNo ratings yet

- 12 December 2550Q'19Document3 pages12 December 2550Q'19RóndoNo ratings yet

- Chapter 37-Presentation of FsDocument8 pagesChapter 37-Presentation of FsEmma Mariz GarciaNo ratings yet

- Mini Exercise Answer KeyDocument3 pagesMini Exercise Answer KeyKaren TumabiniNo ratings yet

- Solution:: Purchases, Cash Basis P 2,850,000Document2 pagesSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Marife 2550q Dec2022Document2 pagesMarife 2550q Dec2022cathzNo ratings yet

- Interest Bearing Non Interest Bearing Notes HandoutsDocument4 pagesInterest Bearing Non Interest Bearing Notes HandoutsAliezaNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- AC 41 Accounting Essentials PRACTICE DRILL Unit IIIDocument1 pageAC 41 Accounting Essentials PRACTICE DRILL Unit IIIAiahNo ratings yet

- AssignmentDocument1 pageAssignmentDarlington K. CooperNo ratings yet

- FA - Thanh TamDocument19 pagesFA - Thanh TamTâm Huỳnh ThanhNo ratings yet

- 2550Q - 4thQ 2021Document3 pages2550Q - 4thQ 2021rdecendario.upturnNo ratings yet

- Financial Accounting GauriDocument8 pagesFinancial Accounting GauriSanket Santosh RahadeNo ratings yet

- Co Accg 1 - Tut QN - Oct 2022Document10 pagesCo Accg 1 - Tut QN - Oct 2022Xuan Hui LohNo ratings yet

- Partnership LiquidationDocument10 pagesPartnership LiquidationAbc xyzNo ratings yet

- ACC101 Notes ReceivableDocument3 pagesACC101 Notes ReceivableJoan GujeldeNo ratings yet

- Activity 1 Man. Acct.Document2 pagesActivity 1 Man. Acct.Aia Sophia SindacNo ratings yet

- Name: - Yr. and SectionDocument4 pagesName: - Yr. and SectionClarisse AlimotNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- Bruno PPE Note - SolutionDocument4 pagesBruno PPE Note - SolutionizzyhowoNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- Exercise InvestmentsDocument1 pageExercise InvestmentsJane GavinoNo ratings yet

- 01 Homework - Urbino Bsa - 4aDocument8 pages01 Homework - Urbino Bsa - 4aVeralou UrbinoNo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- Chapter 7 Construction ContractsDocument10 pagesChapter 7 Construction Contractsleshz zynNo ratings yet

- VAT 3rd Quarter (September) 2550QDocument3 pagesVAT 3rd Quarter (September) 2550QVan Joshua NunezNo ratings yet

- Reviewer in Taxation Part III - Business Taxation (USC Fervid)Document11 pagesReviewer in Taxation Part III - Business Taxation (USC Fervid)Kim AranasNo ratings yet

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- Lect 11b Depreciation-Double Entry (Part 2)Document8 pagesLect 11b Depreciation-Double Entry (Part 2)11Co sarahNo ratings yet

- Problem 3 Accounts ReceivableDocument11 pagesProblem 3 Accounts ReceivableAngelie Bocala CatalanNo ratings yet

- Construction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEDocument25 pagesConstruction Contracts: 1. False 6. True 2. False 7. True 3. False 8. False 4. True 9. False 5. True 10. TRUEjuennaguecoNo ratings yet

- SI-Class 1 - Share Capital QuestionDocument7 pagesSI-Class 1 - Share Capital QuestionVNo ratings yet

- LU1 D CH 4 QuestionsDocument2 pagesLU1 D CH 4 QuestionsVNo ratings yet

- Fringe Benefits QuestionDocument1 pageFringe Benefits QuestionVNo ratings yet

- Learning Unit 2 - Chapter 1 - PowerPoint SlidesDocument7 pagesLearning Unit 2 - Chapter 1 - PowerPoint SlidesVNo ratings yet